2025 KCT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: Market Position and Investment Value of KCT

Konnect (KCT), positioned as a travel token economy ecosystem that seamlessly integrates Web3 utilities with Web2-based membership utilities, has been building its presence since its launch in 2022. As of 2025, KCT has achieved a market capitalization of approximately $6.34 million, with a circulating supply of around 7.375 billion tokens, currently trading at $0.0008593. This innovative asset, hailed as a "bridge between Web2 and Web3 infrastructures," is increasingly playing a pivotal role in the tourism, membership services, and digital loyalty economy sectors.

This article will provide a comprehensive analysis of KCT's price trajectories through 2030, integrating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for investors interested in this emerging token.

I. KCT Price History Review and Current Market Status

KCT Historical Price Evolution

-

2023: KCT reached its all-time high (ATH) of $0.04 on December 13, 2023, marking a significant peak in the token's price history.

-

2024-2025: The token experienced a substantial decline from its peak, with prices contracting significantly through 2024 and into 2025.

-

December 2024: KCT touched its all-time low (ATL) of $0.000088 on December 30, 2024, representing a dramatic 99.78% decrease from the all-time high.

KCT Current Market Status

As of December 23, 2025, KCT is trading at $0.0008593, reflecting a modest 24-hour price increase of 1.47%. The token demonstrates limited market capitalization of approximately $6.34 million with a fully diluted valuation of $8.59 million. The current circulating supply stands at 7.375 billion KCT out of a maximum supply of 10 billion KCT, indicating a circulation ratio of 73.75%.

Trading volume over the past 24 hours totals $248,968.82, indicating relatively light trading activity. KCT is ranked 1,404th by market capitalization within the broader cryptocurrency market, with a market dominance of 0.00026%. The token maintains a presence on 3 exchanges and is held by 774 unique addresses.

Over longer time horizons, KCT has demonstrated volatile price action, with a 7-day change of +2.31% and a 30-day decline of -19.23%. However, on a 1-year basis, the token has appreciated significantly by 616.32%, recovering substantially from its December 2024 lows.

Click to view current KCT market price

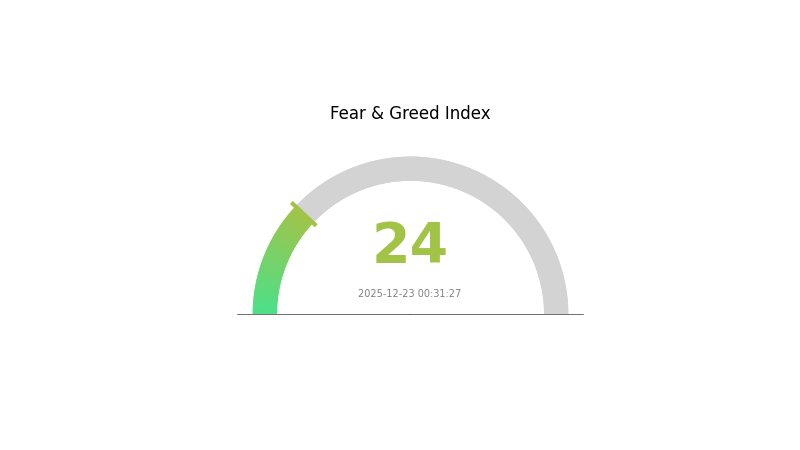

KCT 市场情绪指标

2025-12-23 恐惧与贪婪指数:24(Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with a Fear & Greed Index reading of 24. This indicates heightened market anxiety and pessimism among investors. When the index reaches such low levels, it often signals potential capitulation and panic selling. However, historically, extreme fear periods can present contrarian opportunities for disciplined investors. Market participants should exercise caution and avoid emotional decision-making. Consider your risk tolerance and long-term strategy before making any trading moves. Monitor key support levels and fundamental developments closely during this volatile period.

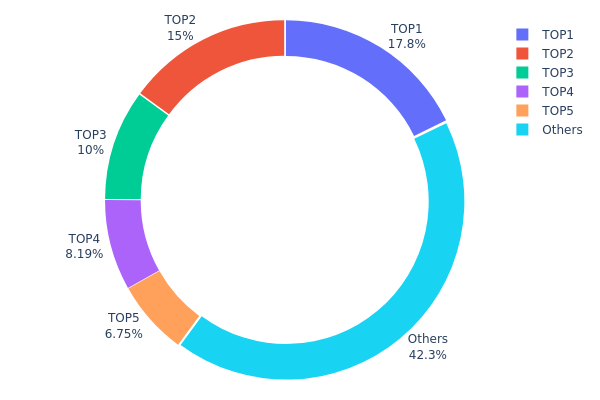

KCT Holdings Distribution

The address holdings distribution represents the concentration of KCT tokens across the blockchain network, measured by the proportion of total token supply held by individual addresses. This metric serves as a critical indicator of token decentralization, liquidity fragmentation, and potential market structure risks. By analyzing the top holders and their respective stakes, we can assess the vulnerability of the asset to price manipulation and evaluate the overall health of its on-chain ecosystem.

Current data reveals a moderate concentration pattern in KCT's holder distribution. The top five addresses collectively control 57.67% of the total token supply, with the largest holder commanding 17.77% of all circulating tokens. This concentration level indicates that while KCT maintains a reasonably distributed structure, significant influence remains concentrated among a limited number of wallets. The remaining 42.33% dispersed among other addresses suggests a degree of decentralization, though the top-tier holders retain substantial control over the asset's liquidity and price direction.

The existing distribution pattern presents both opportunities and risks for market participants. The concentration among top five holders could facilitate coordinated market movements or create liquidity bottlenecks during periods of elevated trading activity. However, the fact that more than 40% of tokens are distributed across numerous smaller holders demonstrates sufficient market decentralization to prevent absolute monopolistic control. This bifurcated structure—combining large institutional or founding holders with a broad retail base—reflects a relatively mature on-chain ecosystem typical of established digital assets, though continued monitoring of top holder activities remains advisable for assessing long-term market stability.

View current KCT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xbbf3...646aa9 | 1777251.57K | 17.77% |

| 2 | 0x4fb3...a83128 | 1496620.00K | 14.96% |

| 3 | 0xcc46...d77236 | 1000000.05K | 10.00% |

| 4 | 0xc882...84f071 | 819406.37K | 8.19% |

| 5 | 0x0b12...59f924 | 675083.32K | 6.75% |

| - | Others | 4231638.68K | 42.33% |

Core Factors Influencing KCT's Future Price

Technology Development and Ecosystem Construction

Wi-Fi Evolution and Product Innovation

-

Wi-Fi 7 Technology Leadership: KCT has achieved early market entry with Wi-Fi 7 Front-End Module (FEM) products, positioning itself ahead of global competitors. The company's Wi-Fi 7 products are undergoing technical validation and integration into reference designs from major international SoC manufacturers including Qualcomm and MediaTek. Market penetration of Wi-Fi 7 is projected to reach 2.35% in 2024 and 7.89% by 2026, creating sustained demand growth for advanced RF front-end solutions.

-

Complete Product Line Coverage: The company has developed a comprehensive Wi-Fi FEM product portfolio spanning Wi-Fi 5, Wi-Fi 6, Wi-Fi 6E, and Wi-Fi 7 standards. This breadth enables the company to capture market opportunities across different technology generations and customer segments, including home routers, enterprise-grade access points, and IoT applications.

-

IoT and Sub-GHz Solutions: KCT's Sub-GHz frequency band KCT810xL series products achieve optimal balance between high power output, high linearity, and low power consumption. These products support multiple mainstream IoT communication protocols including LP-WAN (LoRa, Sigfox), Wi-Fi HaLow, and Wi-SUN, significantly enhancing competitive positioning in the IoT market.

Star Flash Ecosystem Participation

-

Industry Recognition: KCT was formally recognized as a governing board member of the International Star Flash Wireless Short-Distance Communication Alliance in March 2025, validating the company's development achievements and industry contributions in wireless short-distance communication.

-

Next-Generation Short-Distance Technology: As a leading domestic enterprise in Wi-Fi 7 RF front-end chips, KCT has integrated Star Flash RF front-end solutions into major SoC manufacturer reference designs and achieved successful commercial applications across IoT sectors. The company continues driving technical standardization and ecosystem development through active participation in industry alliances.

R&D Infrastructure and Talent Foundation

-

Advanced Research Center: KCT's wireless network RF front-end chip research center was officially recognized as a Shanghai Enterprise Technology Center in October 2022. The center maintains professional expertise and high automation standards, supported by a research team predominantly graduated from leading international institutions including Lehigh University, University of Surrey, and domestic universities such as Shanghai Jiao Tong University and University of Electronic Science and Technology of China.

-

International Technical Experience: Core team members bring extensive RF front-end chip development experience from internationally recognized companies including RFaxis (acquired by Skyworks in 2016), RFMD (merged into Qorvo), and Anadigics, providing robust technical foundation and global technological vision.

III. 2025-2030 KCT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00045 - $0.00086

- Neutral Forecast: $0.00086

- Bullish Forecast: $0.00112 (requiring sustained market momentum)

2026-2028 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and accumulation phase with progressive price appreciation driven by ecosystem development and adoption expansion.

- Price Range Forecast:

- 2026: $0.00096 - $0.00125

- 2027: $0.00099 - $0.00160

- 2028: $0.00078 - $0.00189

- Key Catalysts: Enhanced protocol functionality, increased institutional participation, ecosystem partnerships, and positive regulatory developments.

2029-2030 Long-term Outlook

- Base Case: $0.00135 - $0.00187 (assuming steady adoption and market stabilization)

- Bullish Case: $0.00163 - $0.00229 (contingent on accelerated ecosystem growth and mainstream adoption)

- Transformative Case: $0.00229+ (under conditions of breakthrough technological innovation, major institutional inflows, and market leadership establishment)

- 2030-12-23: KCT projected at $0.00229, representing approximately 103% cumulative gains from 2025 baseline levels.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00112 | 0.00086 | 0.00045 | 0 |

| 2026 | 0.00125 | 0.00099 | 0.00096 | 14 |

| 2027 | 0.0016 | 0.00112 | 0.00099 | 30 |

| 2028 | 0.00189 | 0.00136 | 0.00078 | 58 |

| 2029 | 0.00187 | 0.00163 | 0.00135 | 89 |

| 2030 | 0.00229 | 0.00175 | 0.00138 | 103 |

Konnect (KCT) Professional Investment Strategy and Risk Management Report

IV. KCT Professional Investment Strategy and Risk Management

KCT Investment Methodology

(1) Long-Term Hold Strategy

-

Target Investors: Believers in Web3 integration and travel token economy ecosystem development; investors with 1-3 year investment horizons

-

Operational Recommendations:

- Accumulate during market downturns, particularly when prices fall below recent support levels

- Maintain positions through market volatility, focusing on fundamental development rather than short-term price fluctuations

- Monitor project milestones including ecosystem expansion across duty-free shops, K-pop, medical services, tourism, and communication infrastructure

-

Storage Solutions:

- For significant holdings, utilize Gate.com's Web3 wallet for secure long-term storage with easy access to ecosystem integrations

- Enable multi-signature security protocols for enhanced protection

- Maintain backup seed phrases in secure, offline locations

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Volatility indicators: Monitor KCT's 24H trading volume ($248,968.82) and price range movements to identify breakout opportunities

- Trend analysis: Utilize 7-day (+2.31%) and 30-day (-19.23%) price movements to identify short-term trend reversals

-

Range Trading Key Points:

- Identify support at recent lows and resistance at previous highs for swing trading opportunities

- Monitor volume patterns around membership utility announcements and partnership developments

- Execute trades on Gate.com with appropriate stop-loss orders set 5-10% below entry positions

KCT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total crypto portfolio allocation

- Active Investors: 3-5% of total crypto portfolio allocation

- Professional Investors: Up to 10% with corresponding hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance KCT holdings with established cryptoassets to mitigate project-specific risks

- Position Sizing: Implement maximum position limits per investor risk profile to prevent catastrophic losses from individual asset volatility

(3) Secure Storage Solutions

- Hot Wallet Approach: Gate.com's Web3 wallet for active trading and regular ecosystem participation

- Cold Storage Method: Transfer majority holdings to hardware-secured solutions for long-term preservation

- Security Precautions: Never share private keys; enable all available security features; verify contract addresses before transactions; use only official project websites and Gate.com for accurate information

V. KCT Potential Risks and Challenges

KCT Market Risk

- Liquidity Risk: With only 3 exchanges listed and $248,968.82 daily volume, KCT faces liquidity constraints that could result in significant price slippage during large transactions

- Price Volatility: 24-hour price fluctuations of 1.47% and 30-day decline of -19.23% indicate high volatility unsuitable for risk-averse investors

- Market Capitalization Concerns: Current market cap of $6.34M represents early-stage project status with significant dilution risks as circulating supply represents only 73.75% of total supply

KCT Regulatory Risk

- Geographic Restrictions: Different jurisdictions may impose restrictions on token trading, staking, or membership utility access

- Compliance Uncertainty: As a project bridging Web2 and Web3, regulatory treatment of membership utilities combined with token economics remains undefined in many markets

- Partnership Vulnerability: Regulatory changes affecting duty-free shops, K-pop licensing, or medical service provisions could disrupt core ecosystem categories

KCT Technology Risk

- Smart Contract Risk: ERC-20 implementation on Ethereum remains subject to potential vulnerabilities; audit reports should be verified before significant investment

- Ecosystem Integration Complexity: Successfully integrating multiple real-world services (duty-free, K-pop, medical, tourism, communications) presents technical execution risks

- Scalability Concerns: Current infrastructure may face challenges supporting mass adoption across membership categories without significant technological upgrades

VI. Conclusion and Action Recommendations

KCT Investment Value Assessment

Konnect presents an innovative approach to bridging Web2 and Web3 through a travel token economy ecosystem with practical membership utilities. The project's integration of real-world services across five categories demonstrates differentiation from pure-play crypto projects. However, investors should recognize that KCT remains in early development stages with significant execution risks. The 616.32% year-over-year price gain reflects speculative interest, while the recent 19.23% monthly decline and 73.75% circulating supply ratio warrant cautious entry strategies. Success depends entirely on ecosystem execution and adoption across its membership categories.

KCT Investment Recommendations

✅ Beginners: Allocate only 1-2% of crypto portfolio after thorough research; use Gate.com's intuitive platform for small accumulation during market weakness; prioritize security over frequent trading

✅ Experienced Investors: Implement 3-5% portfolio allocation with technical analysis of entry points around support levels; consider range trading between $0.0008-$0.0009 resistance; monitor project announcements for catalyst trading opportunities

✅ Institutional Investors: Conduct comprehensive due diligence on ecosystem partnership agreements and regulatory compliance; establish position limits with corresponding hedging strategies; engage directly with project team regarding roadmap execution timelines

KCT Participation Methods

- Gate.com Trading: Access KCT trading with competitive fee structures and deep liquidity across spot trading pairs

- Membership Utility Engagement: Participate in project ecosystem features upon launch, including duty-free distributions and tourism benefits

- Community Participation: Monitor official Twitter (@KONNECT_KCT), Kakao forum, and Naver blog for project updates and partnership announcements

Cryptocurrency investment carries extreme risk and volatility. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and financial situation. It is strongly recommended to consult with professional financial advisors before making any investment decisions. Never invest more capital than you can afford to lose completely.

FAQ

What is the KCT price prediction for 2025?

Based on current market analysis, KCT is predicted to reach approximately $0.001123 by end of 2025. This forecast reflects short-term technical indicators and market trends. Actual prices may vary based on market conditions.

Can KCT reach $1 in the next 5 years?

KCT reaching $1 within 5 years is highly unlikely based on current market conditions and price projections. The token would need massive adoption and significant volume growth to achieve this target.

What factors will influence KCT price movements?

KCT price is influenced by market demand, trading volume, overall crypto market sentiment, technological developments, regulatory news, macroeconomic factors, and adoption rates. Major events and institutional interest also significantly impact price movements.

Is KCT a good investment based on current fundamentals?

KCT appears undervalued with positive fundamentals supporting growth potential. Strong market indicators suggest favorable investment opportunity for long-term holders seeking exposure to the crypto sector.

What is the historical price performance of KCT?

KCT launched at $0.0542 with an 83.57% gain in its first year. 2025 has been the strongest year for KCT price performance, demonstrating significant growth momentum throughout the period.

2025 RLC Price Prediction: Will RLC Reach $10 in the Next Bull Run?

2025 STOS Price Prediction: Analyzing Market Trends and Potential Growth Factors for the Digital Asset

2025 PPrice Prediction: Analyzing Market Trends and Future Valuation Prospects for Investors

2025 SQR Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 LIY Price Prediction: Navigating Market Trends and Potential Growth Factors

2025 CHAPZ Price Prediction: Analyzing Market Trends and Potential Growth Factors

Leading Incubation Platform Launches Season 4 Program with 14 Blockchain Projects

What is DeFi, and how is it different from traditional finance?

Mobile Mining: A Guide and Overview

Futures Là Gì? Hướng Dẫn Giao Dịch Futures Cho Người Mới

Is Web3 Dead?