2025 LCAT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: LCAT's Market Position and Investment Value

LCAT (Lion Cat) is a groundbreaking meme token on the Binance Smart Chain (BSC) that combines advanced AI-powered tools, compelling storytelling, and strong community-driven development. As of December 2025, LCAT has achieved a market capitalization of $6,658,800 with a circulating supply of approximately 540.75 million tokens, currently trading at $0.011098 per token. This innovative asset, which represents ambition, creativity, and innovation, is establishing itself in the crypto market through its distinctive AI-powered ecosystem featuring cryptocurrency price prediction tools, meme generation capabilities, and interactive chatbots designed for investors and crypto enthusiasts.

This article will provide a comprehensive analysis of LCAT's price trends and market dynamics, examining historical price performance, market supply and demand factors, ecosystem development, and broader market conditions to deliver professional price forecasts and practical investment strategies for the period through 2030.

I. LCAT Price History Review and Market Status

LCAT Historical Price Trajectory

- February 21, 2025: LCAT reached its all-time high of $0.12806, marking the peak of the token's performance since launch.

- December 7, 2025: LCAT hit its all-time low of $0.005945, representing a significant decline from historical highs.

- December 23, 2025: Current trading price stands at $0.011098, reflecting a recovery from the recent low but still substantially below the all-time high, representing a -66.86% decline over the past year.

LCAT Current Market Status

As of December 23, 2025, LCAT is trading at $0.011098 with a 24-hour trading volume of $11,801.85. The token has demonstrated modest positive momentum in the medium term, gaining 5.42% over the past 7 days and 17.32% over the past 30 days, though it remains down -0.0031% in the last hour.

The total market capitalization stands at $6,001,243.50, with a fully diluted valuation of $6,658,800. LCAT has a circulating supply of 540,750,000 tokens out of a maximum supply of 600,000,000, representing a circulation ratio of 90.125%. The token maintains a market dominance of 0.00020% in the broader cryptocurrency market.

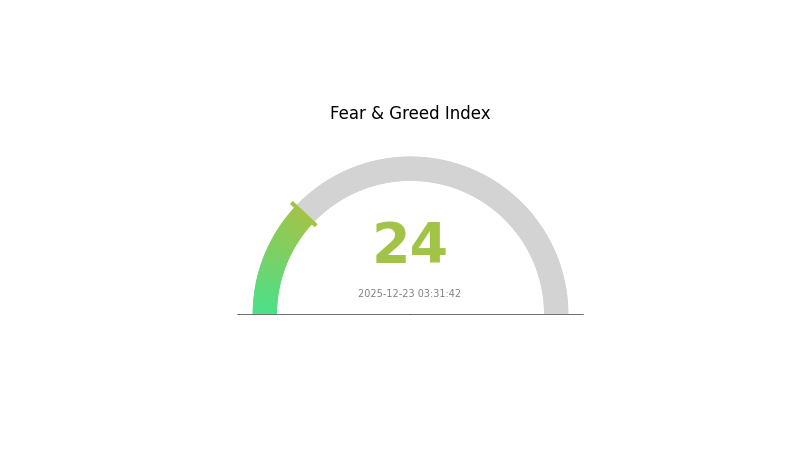

With 127,053 token holders and a presence on 2 exchanges, LCAT continues to build its holder base. The current market sentiment reflects extreme fear, with a VIX reading of 24, indicating heightened market volatility and investor caution in the broader cryptocurrency landscape.

View the current LCAT market price

LCAT Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an index reading of 24. This exceptionally low sentiment indicates widespread investor anxiety and pessimistic market conditions. When fear reaches such extreme levels, it often signals potential buying opportunities for long-term investors, as assets may be undervalued. However, caution is warranted as market volatility typically increases during periods of intense fear. Traders should carefully assess their risk tolerance and investment strategies. Monitoring sentiment shifts on Gate.com can help investors make more informed decisions during turbulent market periods.

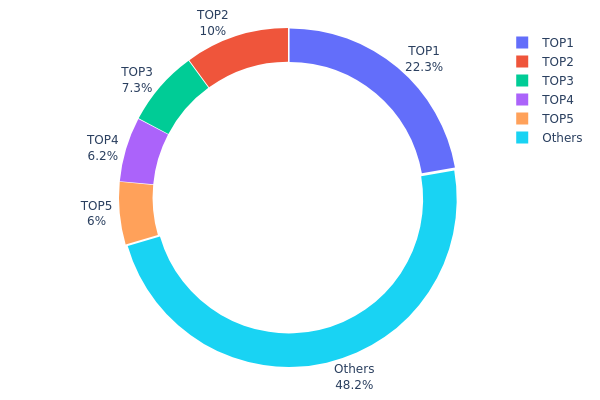

LCAT Holdings Distribution

The address holdings distribution map illustrates the concentration of LCAT tokens across blockchain addresses, providing critical insights into token ownership structure and potential market dynamics. This metric tracks the percentage of total token supply held by individual addresses, ranking them from largest to smallest holders. Understanding this distribution is essential for assessing decentralization levels, identifying key stakeholders, and evaluating concentration risks within the LCAT ecosystem.

Current LCAT holdings data reveals moderate concentration characteristics. The top five addresses collectively control approximately 51.75% of the total token supply, with the largest holder commanding 22.26% of all tokens. While this concentration level indicates some degree of centralization, it remains relatively distributed when compared to highly concentrated token structures. Notably, the remaining 48.25% of tokens are dispersed among numerous other addresses, suggesting that nearly half of the circulating supply is held across a fragmented base of smaller stakeholders. This bifurcated structure—dominated by several substantial holders but balanced by significant distributed ownership—reflects a typical pattern for established digital assets seeking to maintain both institutional participation and retail engagement.

The current address distribution presents meaningful implications for market structure and price stability. The presence of multiple large holders, rather than a single dominant entity, reduces the risk of coordinated market manipulation through concentrated selling pressure. However, the top five addresses collectively represent a significant voting bloc that could theoretically influence protocol decisions or market sentiment during periods of volatility. The substantial proportion of tokens held outside the top addresses indicates growing decentralization and suggests that LCAT's market movements are increasingly influenced by broader stakeholder participation rather than individual whale actions, contributing to a more resilient and balanced market microstructure.

Click to view current LCAT holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe27d...825cfc | 133619.92K | 22.26% |

| 2 | 0xd277...545833 | 60000.00K | 10.00% |

| 3 | 0x8457...0666bc | 43800.00K | 7.30% |

| 4 | 0x0d07...b492fe | 37179.84K | 6.19% |

| 5 | 0xd135...34cab3 | 36000.00K | 6.00% |

| - | Others | 289400.23K | 48.25% |

II. Core Factors Impacting LCAT's Future Price

Supply Mechanism

- Market Competition Impact: Low-end production capacity competition has intensified, resulting in notable price declines and overcapacity phenomena.

- Current Impact: High-end products rely on imports, with the progress of domestic substitution directly affecting price movements. Import dependency on premium products creates vulnerability to supply chain disruptions and trade policy changes.

Macroeconomic Environment

- Monetary Policy Influence: Overall economic trends significantly influence LCAT's exchange rate fluctuations against fiat currencies. Central bank policy decisions and interest rate adjustments have direct implications for cryptocurrency valuations.

- Geopolitical Factors: International trade levels and forecasts from institutions such as the United Nations and IMF impact LCAT's value. Trade tensions, tariff policies, and cross-border capital flows create additional price pressure on emerging cryptocurrencies.

III. 2025-2030 LCAT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00855 - $0.01643

- Base Case Forecast: $0.0111

- Bullish Forecast: $0.01643 (requires sustained market recovery and increased adoption momentum)

2026-2027 Mid-Term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, transitioning from bear market lows toward renewed growth trajectory

- Price Range Predictions:

- 2026: $0.0095 - $0.01803 (24% potential upside)

- 2027: $0.01462 - $0.01637 (43% cumulative gains)

- Key Catalysts: Ecosystem expansion, institutional interest revival, broader cryptocurrency market recovery, and technological upgrades within the LCAT protocol

2028-2030 Long-Term Outlook

- Base Scenario: $0.01291 - $0.02146 (45% growth by 2028), with gradual appreciation to $0.01461 - $0.02242 by 2030 (80% total upside)

- Bullish Scenario: $0.02146 - $0.02242 (assumes accelerated mainstream adoption, successful partnerships, and positive regulatory developments)

- Transformative Scenario: $0.02242+ (extreme favorable conditions including widespread institutional adoption, major protocol innovations, and significant market capitalization expansion)

- 2030-12-31: LCAT projected at $0.02002 (base case average), representing substantial long-term value appreciation from 2025 levels

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01643 | 0.0111 | 0.00855 | 0 |

| 2026 | 0.01803 | 0.01376 | 0.0095 | 24 |

| 2027 | 0.01637 | 0.01589 | 0.01462 | 43 |

| 2028 | 0.02146 | 0.01613 | 0.01291 | 45 |

| 2029 | 0.02124 | 0.01879 | 0.01804 | 69 |

| 2030 | 0.02242 | 0.02002 | 0.01461 | 80 |

LCAT (Lion Cat) Professional Investment Strategy and Risk Management Report

IV. LCAT Professional Investment Strategy and Risk Management

LCAT Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Community-focused investors and meme token enthusiasts who believe in LCAT's AI-powered utility and long-term vision

- Operational Recommendations:

- Establish a core position during price dips and accumulate gradually over time, leveraging the token's utility tools (cryptocurrency price prediction, meme generation, and interactive chatbots)

- Hold through market volatility cycles, as the project's renounced smart contract and Chainlink Automation-based vesting mechanism provide structural safety advantages

- Participate actively in community governance and development initiatives to align with the project's community-driven growth model

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Candlestick Patterns: Monitor 1-hour to 4-hour timeframes on Gate.com to identify support and resistance levels, particularly noting the 24-hour price stability at $0.011098

- Volume Analysis: Track the 24-hour trading volume of $11,801.85 to identify breakout opportunities and validate trend reversals

-

Wave Trading Key Points:

- Capitalize on the 7-day uptrend (+5.42%) and 30-day growth (+17.32%) by identifying entry points during minor pullbacks within the broader upward trend

- Establish stop-loss orders below recent support levels and take profits at historical resistance zones, considering the historical high of $0.12806 (February 21, 2025) and the recent low of $0.005945 (December 7, 2025)

LCAT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5%-1% of portfolio allocation

- Active Investors: 1%-3% of portfolio allocation

- Professional Investors: 3%-5% of portfolio allocation

(2) Risk Hedging Solutions

- Diversification Strategy: Balance LCAT holdings with other established digital assets to mitigate concentration risk inherent in meme tokens

- Position Sizing: Use strict position sizing based on portfolio risk tolerance, never exceeding more than 5% of total crypto holdings for any single meme token

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate.com Web3 wallet for active trading and frequent access to LCAT on the Binance Smart Chain

- Cold Storage Approach: Transfer LCAT to a personal BSC-compatible wallet address for long-term storage, maintaining private key custody independently

- Security Considerations: Enable two-factor authentication on Gate.com trading accounts, never share private keys or seed phrases, verify contract addresses (0x3917d6bdffe43105a74e6f9c09b5206f0f3f5fc0) before transactions, and regularly audit wallet activity on BSCScan

V. LCAT Potential Risks and Challenges

LCAT Market Risk

- Extreme Volatility: LCAT exhibits significant price swings, with a -66.86% decline over one year, indicating exposure to substantial downside risk and rapid value erosion

- Meme Token Dependency: As a meme token, LCAT's value is heavily influenced by social sentiment and community momentum rather than fundamental cash flows, making it susceptible to rapid trend reversals

- Liquidity Constraints: With a 24-hour trading volume of $11,801.85 against a market cap of $6.00M, the token faces liquidity challenges that could amplify slippage on large trades

LCAT Regulatory Risk

- Evolving Regulatory Environment: Meme tokens operate in regulatory gray zones across multiple jurisdictions; changes in cryptocurrency regulation, particularly regarding utility claims and token classification, could impact LCAT's operations

- Classification Uncertainty: Regulatory bodies may reclassify LCAT from a utility token to a security token, potentially requiring compliance with securities laws and registration requirements

LCAT Technology Risk

- Smart Contract Dependency: While LCAT features a renounced smart contract, this immutability also means bugs or vulnerabilities cannot be rectified, creating permanent code-level risks

- Chainlink Automation Reliance: The decentralized token vesting mechanism depends on Chainlink Automation infrastructure; any disruption to Chainlink services could affect token distribution mechanisms

VI. Conclusion and Action Recommendations

LCAT Investment Value Assessment

LCAT represents a speculative opportunity within the meme token sector, combining narrative appeal with claimed AI utility features. However, the -66.86% one-year decline, extreme volatility, and modest trading liquidity present substantial risks that outweigh potential gains for risk-averse investors. The project's long-term viability depends critically on execution of its AI-powered tools roadmap and sustained community engagement. Current valuation at $0.011098 reflects significant depreciation from historical highs, potentially offering entry opportunities for high-risk-tolerance investors, but the path to recovery remains uncertain.

LCAT Investment Recommendations

✅ Beginners: Allocate minimal capital (0.5%-1% of crypto portfolio) as a speculative position only if you can afford total loss; prioritize education on meme token risks and use Gate.com's trading interface with strict stop-loss orders set at 20%-30% below entry price

✅ Experienced Investors: Consider 1%-3% portfolio allocation with active monitoring; implement wave trading strategies around support/resistance levels identified on BSCScan; participate in community channels to stay informed on development updates and sentiment shifts

✅ Institutional Investors: Typically avoid exposure due to meme token classification and limited institutional infrastructure; if pursuing exposure, maintain 0.5%-1% allocation within alternative/speculative crypto buckets and conduct enhanced due diligence on token distribution and holder concentration

LCAT Trading Participation Methods

- Direct Purchase on Gate.com: Access LCAT trading pairs on Gate.com platform, the recommended regulated exchange for institutional-grade trading infrastructure and security standards

- Decentralized Trading: Interact with LCAT smart contract directly on Binance Smart Chain using custom wallet addresses; note this approach requires technical expertise and exposes users to smart contract risks

- Community Integration: Engage with LCAT ecosystem through the platform's AI tools and community-driven development initiatives at https://lioncat.meme to evaluate project fundamentals firsthand

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more capital than you can afford to lose completely.

FAQ

Will cat coin reach $1?

Based on current prediction algorithms, LCAT is not expected to reach $1. The highest projected price is approximately $0.000019 by 2050. However, market conditions and project developments could significantly impact future price movements.

Is Simon's cat coin a good investment?

Yes, Simon's Cat coin is a good investment. With strong Binance backing and positive market momentum in 2025, CAT demonstrates solid potential for growth and profitability.

What is the price prediction for cat in a dogs world in 2030?

Based on current market trends, LCAT is predicted to range between $0.0008618 and $0.001733 by 2030. This forecast reflects potential growth trajectory considering market developments and adoption trends.

2025 TURBO Price Prediction: Analyzing Market Trends and Future Valuation Prospects in the Evolving Cryptocurrency Ecosystem

2025 WOJAK Price Prediction: Analyzing Market Trends and Future Valuation Prospects for the Popular Meme Token

2025 WHYPrice Prediction: Market Analysis and Growth Potential for Investors

2025 DON Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 QUACK Price Prediction: Will This Meme Coin Soar or Crash in the Crypto Market?

2025 COQ Price Prediction: Expert Analysis and Market Outlook for the Coming Year

Is My Lovely Coin (MLC) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Investment Prospects

Is Boson (BOSON) a good investment? A Comprehensive Analysis of the Protocol's Potential and Market Performance

KOMA vs BAT: A Comprehensive Comparison of Two Leading Chinese Tech Giants in the Mobile and AI Industry

ALKIMI vs XLM: A Comprehensive Comparison of Two Blockchain Tokens and Their Market Position

Web3 Transformation of Global Remittance Giant Western Union Launches US Dollar Stablecoin USDPT