2025 MIRA Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: MIRA's Market Position and Investment Value

Mira (MIRA) serves as a decentralized verification network designed to enable truly autonomous AI by addressing the challenges of AI hallucinations and unreliable outputs through consensus-based verification mechanisms. As of December 20, 2025, MIRA has achieved a market capitalization of $126.3 million with a circulating supply of approximately 191.2 million tokens, trading at around $0.1263 per token. This innovative infrastructure asset is playing an increasingly critical role in healthcare, finance, legal services, and other high-stakes domains where accuracy is non-negotiable.

This article will provide a comprehensive analysis of MIRA's price trends and market dynamics, combining historical patterns, market supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for the coming years.

MIRA Market Analysis Report

I. MIRA Price History Review and Current Market Status

MIRA Historical Price Evolution Trajectory

Based on available data, MIRA experienced significant volatility since its launch on December 20, 2025:

- September 26, 2025: MIRA reached its all-time high of $2.6662, representing the peak of early market enthusiasm for the decentralized verification network.

- December 18, 2025: MIRA hit its all-time low of $0.1122, marking a substantial correction from its historical peak, reflecting market repricing following the initial launch phase.

- Current Period (December 20, 2025): Price stabilized at $0.1263, showing a 1-year decline of -91.22% from launch levels, with the token trading near recent bottom levels.

MIRA Current Market Status

Price Performance:

- Current Price: $0.1263

- 24-Hour Change: +8.13% ($0.009496 increase)

- 1-Hour Change: +1.04%

- 7-Day Change: -10.17%

- 30-Day Change: -26.22%

- 1-Year Change: -91.22%

Market Metrics:

- Market Capitalization: $24,148,560

- Fully Diluted Valuation: $126,300,000

- 24-Hour Trading Volume: $231,695.69

- Total Supply: 1,000,000,000 MIRA

- Circulating Supply: 191,200,000 MIRA (19.12% circulating ratio)

- Current Holders: 12,912 addresses

- Listed on 26 exchanges

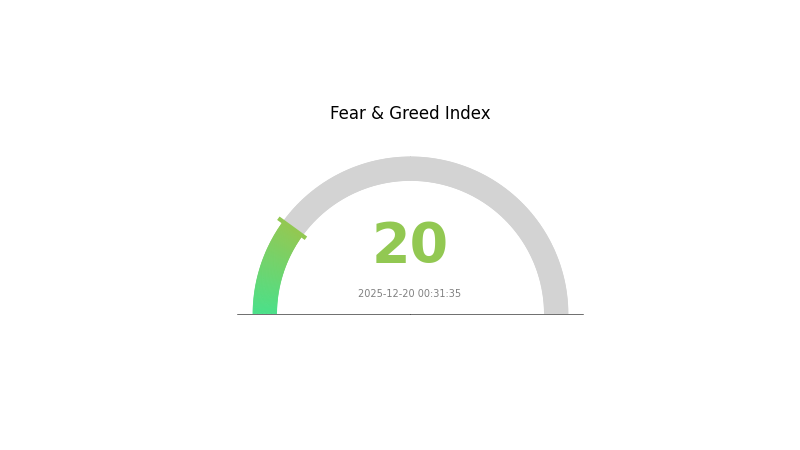

Market Sentiment: The current market sentiment indicates "Extreme Fear" with a VIX reading of 20, suggesting heightened market anxiety and risk aversion affecting MIRA's price action.

Price Range:

- 24-Hour High: $0.1266

- 24-Hour Low: $0.1161

Click to view current MIRA market price

MIRA Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index hitting 20. This indicates severe market pessimism and panic selling pressure among investors. During such periods, assets typically face downward pressure as uncertainty dominates sentiment. However, historically, extreme fear has often presented contrarian opportunities for long-term investors. Risk-averse traders should maintain caution and avoid making emotional decisions. Consider using this volatility as a potential entry point if your investment strategy and risk tolerance permit. Monitor market developments closely on Gate.com for real-time data and analysis.

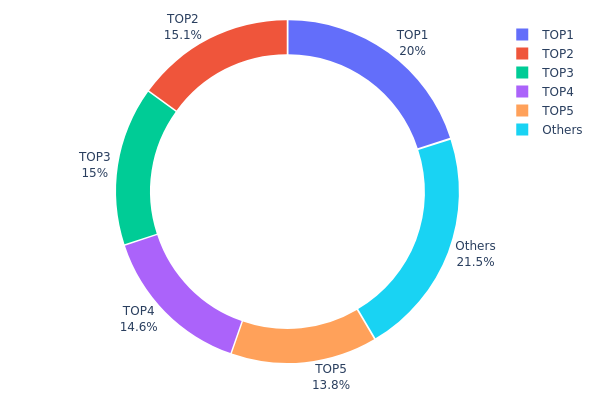

MIRA Holdings Distribution

The holdings distribution map illustrates the concentration of MIRA tokens across blockchain addresses, providing critical insights into the token's decentralization status and potential market dynamics. By analyzing the top holders and their proportional stakes, we can assess the level of ownership concentration and identify structural vulnerabilities that may influence price volatility and market stability.

MIRA exhibits moderate to elevated concentration characteristics. The top five addresses collectively control 78.49% of the circulating supply, with the largest holder commanding 20.00% and the second-largest accounting for 15.05%. This concentration level suggests that significant decision-making power is distributed among a limited number of stakeholders. While the remaining 21.51% held by other addresses indicates some degree of decentralization, the substantial stakes held by the top five entities create a potential imbalance in market structure. Such concentration patterns typically increase the risk of coordinated actions and price manipulation, as large holders possess the capacity to influence market sentiment through significant trading activities or strategic position adjustments.

The current distribution reflects a market structure with notable centralization risks. The presence of five addresses controlling approximately four-fifths of total supply indicates limited decentralization and heightened vulnerability to sudden large-scale liquidations or accumulation events. This configuration suggests reduced market resilience and increased price volatility potential. Investors should monitor the on-chain behavior of these major holders, as their transactions could substantially impact short-term price dynamics. The structural stability of MIRA's ecosystem remains dependent on maintaining the commitment and passive stance of these significant stakeholders.

Click to view current MIRA Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x157d...e91cb2 | 200000.00K | 20.00% |

| 2 | 0x8b78...84977f | 150505.13K | 15.05% |

| 3 | 0xf688...528cf1 | 150000.00K | 15.00% |

| 4 | 0x231d...f67d81 | 146162.50K | 14.61% |

| 5 | 0x5fc7...de4006 | 138311.62K | 13.83% |

| - | Others | 215020.75K | 21.51% |

II. Core Factors Influencing MIRA's Future Price

Supply Mechanism

-

Economic Incentive Model: MIRA tokens are used for payment and node rewards, with penalty mechanisms to ensure accountability and proper network participation.

-

Consensus Security: The network implements a hybrid Proof-of-Work/Proof-of-Stake (PoW/PoS) mechanism combined with random sharding to prevent collusion and maintain security, which affects token utility and long-term value proposition.

Macroeconomic Environment

-

Global Economic Trends: MIRA's future price is influenced by broader global economic trends, particularly fluctuations in international financial markets and interest rate volatility, which impact market sentiment across cryptocurrency assets.

-

Regulatory Changes: The cryptocurrency market regulatory landscape plays a crucial role in determining adoption rates and market demand, directly affecting MIRA's price trajectory and investor confidence.

Technology Development and Ecosystem Building

-

Blockchain Technological Advancements: Progress in blockchain infrastructure and innovations in distributed systems directly influence MIRA's utility and competitive positioning within the broader cryptocurrency ecosystem.

-

Ecosystem Adoption: Market demand and adoption rates of MIRA within its network ecosystem are key drivers of future price movements, determined by the practical applications and network growth.

Three、2025-2030 MIRA Price Forecast

2025 Outlook

- Conservative forecast: $0.0750 - $0.1272

- Neutral forecast: $0.1272 - $0.1463

- Bullish forecast: $0.1463 (requires sustained market sentiment and ecosystem development)

2026-2028 Medium-term Outlook

- Market phase expectation: Consolidation and gradual recovery phase with incremental growth potential

- Price range forecast:

- 2026: $0.0697 - $0.1983 (8% upside potential)

- 2027: $0.0854 - $0.1809 (32% upside potential)

- 2028: $0.1429 - $0.2212 (37% upside potential)

- Key catalysts: Increased ecosystem adoption, strategic partnerships, improved market liquidity on platforms such as Gate.com, and broader cryptocurrency market recovery

2029-2030 Long-term Outlook

- Base case scenario: $0.1661 - $0.2076 (assuming moderate adoption and stable macro conditions)

- Bullish scenario: $0.1885 - $0.2351 (assuming accelerated protocol development and institutional interest)

- Transformative scenario: $0.2351+ (extreme favorable conditions including widespread adoption, regulatory clarity, and significant capital inflows)

- 2030-12-31: MIRA reaching $0.2351 (60% cumulative upside from 2025 baseline, representing strong long-term value appreciation)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.14628 | 0.1272 | 0.07505 | 0 |

| 2026 | 0.19827 | 0.13674 | 0.06974 | 8 |

| 2027 | 0.18091 | 0.16751 | 0.08543 | 32 |

| 2028 | 0.22124 | 0.17421 | 0.14285 | 37 |

| 2029 | 0.20761 | 0.19772 | 0.16609 | 56 |

| 2030 | 0.23509 | 0.20267 | 0.18848 | 60 |

MIRA Professional Investment Strategy and Risk Management Report

IV. MIRA Professional Investment Strategy and Risk Management

MIRA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with 1-3 year investment horizons who believe in Mira's core technology for decentralized AI verification

- Operational Recommendations:

- Accumulate positions during price corrections, particularly when 24-hour volatility spikes exceed 10%

- Set target accumulation zones based on historical support levels and dollar-cost averaging over 6-12 months

- Secure holdings in institutional-grade custody solutions to minimize counterparty risk exposure

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support/Resistance Levels: Monitor the historical low of $0.1122 and recent trading ranges between $0.1161-$0.1266 to identify breakout opportunities

- Moving Averages: Use 7-day and 30-day MAs to identify trend direction given the -10.17% weekly decline and -26.22% monthly decline

- Wave Trading Key Points:

- Trade around documented resistance at $0.1266 (24-hour high) with strict stop-loss orders

- Execute positions when price stabilizes above $0.1200 support level with volume confirmation

MIRA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of portfolio allocation

- Active Investors: 3-7% of portfolio allocation

- Professional/Institutional Investors: Up to 10% of diversified crypto holdings

(2) Risk Hedging Strategies

- Position Sizing Discipline: Never allocate more than 5% of liquid net worth to any single position; use strict 20% stop-loss orders

- Portfolio Diversification: Combine MIRA positions with established Layer 1 and Layer 2 blockchain assets to reduce single-protocol dependency risk

(3) Secure Storage Solutions

- Hardware Wallet Recommendations: Store the majority of long-term holdings in institutional-grade hardware solutions with multi-signature security protocols

- Exchange Custody: For active trading, maintain only 10-20% of holdings on Gate.com with 2FA authentication and withdrawal whitelisting enabled

- Security Precautions: Never share private keys, use dedicated hardware for wallet access, and conduct regular security audits of storage infrastructure

V. MIRA Potential Risks and Challenges

MIRA Market Risk

- Extreme Volatility: MIRA has declined 91.22% over one year and lost 26.22% in the past month, indicating severe price instability unsuitable for conservative portfolios

- Liquidity Risk: With 24-hour trading volume of $231,695.69 and only 26 trading pairs, large position exits could face significant slippage and market impact

- Market Cap Concentration: Fully diluted valuation of $126.3M with only 19.12% circulating supply suggests potential significant dilution upon full token unlock

MIRA Regulatory Risk

- Emerging Technology Classification: AI verification networks lack established regulatory frameworks in most jurisdictions, creating uncertainty around compliance requirements

- Jurisdiction-Specific Constraints: Different regulatory bodies may classify MIRA as securities, derivatives, or utility tokens, resulting in inconsistent treatment across markets

- Policy Evolution Risk: Governments may implement restrictions on AI infrastructure tokens or decentralized verification systems as regulatory frameworks develop

MIRA Technology Risk

- Protocol Unproven at Scale: As a consensus-based AI verification network, Mira's ability to maintain performance and security with thousands of concurrent AI models remains largely untested

- Model Coordination Complexity: Ensuring consistent agreement between multiple independent AI models introduces technical risks related to Byzantine fault tolerance and network latency

- Dependency on AI Model Quality: The entire verification system relies on quality external AI models; malicious or corrupted model inputs could compromise network security

VI. Conclusions and Action Recommendations

MIRA Investment Value Assessment

Mira presents a compelling but high-risk opportunity in the emerging decentralized AI infrastructure space. The project addresses a genuine problem—AI hallucinations and the need for trustless verification in critical domains like healthcare and finance. However, the token faces significant headwinds: a 91.22% one-year decline, limited trading liquidity, and an unproven technology at scale. The project is fundamentally speculative, suitable only for investors with high risk tolerance and deep understanding of both AI and blockchain technologies.

MIRA Investment Recommendations

✅ Beginners: Start with 1-2% portfolio allocation through dollar-cost averaging on Gate.com over 3-6 months; prioritize education on AI verification mechanisms before increasing exposure

✅ Experienced Investors: Consider 3-5% allocation with active rebalancing; use technical support/resistance levels to optimize entry points during consolidation phases

✅ Institutional Investors: Conduct comprehensive due diligence on Mira's consensus mechanism, token economics, and competitive positioning; establish direct relationships with project stakeholders before committing capital

MIRA Trading Participation Methods

- Gate.com Spot Trading: Purchase MIRA against USDT or ETH trading pairs with immediate settlement; ideal for establishing baseline positions

- Dollar-Cost Averaging: Execute fixed-amount purchases at regular intervals (weekly/monthly) to reduce timing risk and volatility impact

- Limit Order Strategy: Set buy orders at predefined support levels and sell orders at resistance levels to automate trading without emotional bias

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their own risk tolerance and financial circumstances. Consult a qualified financial advisor before investing. Never invest more than you can afford to lose completely.

FAQ

Is Mira a good stock to buy right now?

MIRA shows promising potential with strong technical indicators and growing market interest. Current price levels present attractive entry opportunities for investors seeking exposure to this emerging asset. Market momentum suggests upside potential in the near term.

What is the future prediction for Mira coin?

Mira coin is predicted to reach $0.3384 by 2030, representing a potential 176.45% increase. Forecasts suggest trading range between $0.08423 and $0.3384 based on market analysis trends.

Is Mira a good investment?

Mira presents solid investment potential with strong fundamentals and growing adoption in the Web3 ecosystem. Its innovative technology and active community support position it favorably for long-term value appreciation and market expansion.

Is Mira Coin a good investment?

Mira Coin presents promising investment potential with positive price forecasts. Based on current market analysis and predictions, Mira is positioned as a profitable investment opportunity for those conducting thorough research in the crypto market.

2025 HOLO Price Prediction: Analyzing Market Trends and Growth Potential in the Post-Halving Crypto Landscape

2025 COOKIE Price Prediction: Market Analysis and Future Outlook for Digital Cookie Economy

2025 SIREN Price Prediction: Future Outlook, Market Analysis, and Key Factors Driving This Emerging Crypto Asset

2025 AVAAIPrice Prediction: Analyzing Market Trends and Growth Potential for AVAAI in the Expanding AI Sector

2025 XNY Price Prediction: Analyzing Market Trends, Technical Indicators and Future Outlook for Cryptocurrency Investors

2025 ACTPrice Prediction: Analyzing Market Trends and Future Valuation of ACT Tokens in the Evolving Crypto Ecosystem

What is ALLO: A Comprehensive Guide to Understanding the Revolutionary Blockchain Token and Its Impact on Decentralized Finance

Guide to Purchasing Virtual Property in the Metaverse

Current TFG Coin Value in USD: Live Price & Chart

2025 HYPER Price Prediction: Will the Token Reach $1 by Year-End?

2025 DOGS Price Prediction: Expert Analysis and Market Forecast for the Coming Year