2025 MUBARAK Price Prediction: Expert Analysis and Future Market Outlook for the Emerging Digital Asset

Introduction: MUBARAK's Market Position and Investment Value

MUBARAK (MUBARAK), representing the meaning of "celebration" or "auspiciousness" in the Middle East, has established itself as an emerging digital asset in the cryptocurrency market. As of December 2025, MUBARAK has achieved a market capitalization of $15,930,000 with a circulating supply of 1,000,000,000 tokens, maintaining a price point of approximately $0.01593. This asset has garnered attention from 25,682 token holders across the blockchain ecosystem.

This article will provide a comprehensive analysis of MUBARAK's price trends through 2025-2030, incorporating historical performance patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to deliver professional price forecasts and practical investment strategies for investors.

I. MUBARAK Price History Review and Current Market Status

MUBARAK Historical Price Evolution Trajectory

- March 18, 2025: MUBARAK reached its all-time high of $0.22078, marking a significant peak in the token's trading history.

- October 10, 2025: The token hit its all-time low of $0.00669, representing a substantial correction from previous highs.

- December 21, 2025: MUBARAK is trading at $0.01593, having recovered from its lowest point while remaining significantly below its historical peak.

MUBARAK Current Market Dynamics

MUBARAK, a BEP-20 token built on the Binance Smart Chain, currently ranks 953st by market capitalization with a total market cap of $15,930,000. The token features a total supply of 1,000,000,000 MUBARAK with full circulation (100% circulating ratio), resulting in a fully diluted valuation of $15,930,000.

Price Performance Analysis:

In the short term, MUBARAK demonstrates positive momentum with a 1-hour gain of 1.21% and a 24-hour increase of 3.16%, indicating recent buying pressure. However, medium to longer-term performance reveals consolidation challenges, with the token declining 3.45% over the past 7 days and 7.92% over the past 30 days. Over the 1-year timeframe, MUBARAK has surged approximately 5,746.43%, demonstrating exceptional long-term appreciation from its launch at $0.079 on January 16, 2025.

Trading Activity:

The 24-hour trading volume stands at approximately $76,635.45, with MUBARAK listed on 24 active exchanges globally. The token maintains a holder base of 25,682 addresses, indicating a modest but growing community. Current market sentiment reflects extreme fear with a VIX reading of 20, suggesting conservative market conditions.

Visit MUBARAK Current Market Price on Gate.com

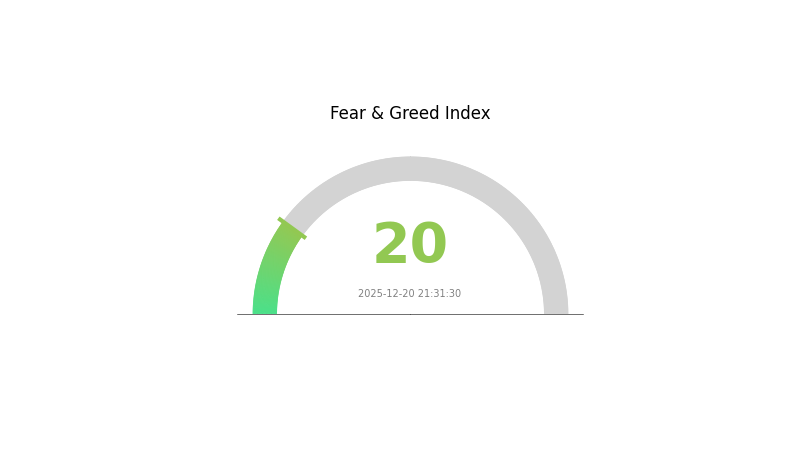

MUBARAK Market Sentiment Index

2025-12-20 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reaching 20. This indicates significant market pessimism and investor anxiety. Such extreme readings often signal potential buying opportunities for contrarian investors, as markets tend to revert to normal conditions. However, traders should exercise caution and conduct thorough risk assessment before entering positions. Monitor market developments closely and consider dollar-cost averaging strategies during periods of heightened fear to manage downside risks effectively.

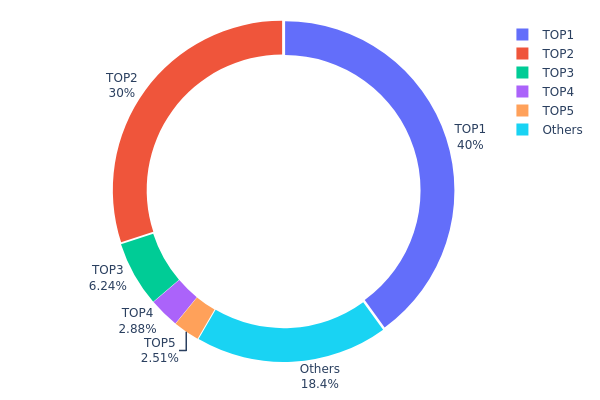

MUBARAK Holdings Distribution

The holdings distribution chart illustrates how MUBARAK tokens are allocated across different blockchain addresses, serving as a critical indicator of token concentration risk and market structure health. By analyzing the top token holders and their proportional ownership, investors and analysts can assess the degree of decentralization, identify potential whale concentration, and evaluate market stability and vulnerability to coordinated selling pressure.

MUBARAK exhibits pronounced concentration risk, with the top two addresses controlling approximately 69.99% of the total token supply. The largest holder (0x5a52...70efcb) commands 39.99% of all tokens, while the second-largest (0xf977...41acec) holds 30.00%, creating a highly polarized distribution structure. This extreme concentration suggests significant centralization, as a combined decision by these two entities could substantially impact market dynamics. The third-largest position (0x90a5...513491) accounts for 6.24%, followed by gradually diminishing holdings, with addresses beyond the top five collectively representing only 18.39% of circulating supply.

Such concentrated distribution patterns typically indicate elevated manipulation risks and reduced market resilience. The dominance of a few addresses restricts genuine price discovery mechanisms and amplifies vulnerability to sudden liquidations or coordinated exits. The presence of what appears to be institutional or treasury wallets among top holders, combined with the significant tail-off after the second position, suggests MUBARAK's on-chain structure remains relatively immature from a decentralization perspective. The modest 18.39% distribution among remaining addresses indicates limited retail participation and organic token dispersion, potentially constraining the asset's long-term market stability and organic adoption trajectory.

For current MUBARAK holdings distribution data, please visit Gate.com

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5a52...70efcb | 399977.04K | 39.99% |

| 2 | 0xf977...41acec | 300000.00K | 30.00% |

| 3 | 0x90a5...513491 | 62406.69K | 6.24% |

| 4 | 0x0d07...b492fe | 28807.77K | 2.88% |

| 5 | 0x0000...00dead | 25094.05K | 2.50% |

| - | Others | 183714.46K | 18.39% |

II. Core Factors Affecting MUBARAK's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Federal Reserve policy shifts are expected to influence the broader cryptocurrency market. If the Federal Reserve implements interest rate cuts in the second half of 2025, this could provide supportive conditions for cryptocurrency market expansion, potentially benefiting MUBARAK alongside the broader market.

-

Market Sentiment and Narrative Support: MUBARAK currently faces headwinds from overall market weakness and insufficient narrative support. The project experienced price declines following its platform listing despite significant pre-launch attention, indicating that market enthusiasm has not translated into sustained price appreciation. Market sentiment improvements and the development of stronger value propositions will be critical for future price recovery.

-

Regulatory Environment: Global cryptocurrency regulatory frameworks continue to evolve. The advancement of legislation such as the U.S. CLARITY Act and GENIUS Act will provide clearer legal status and regulatory frameworks. Enhanced regulatory clarity may attract institutional capital into the cryptocurrency market, potentially creating a more favorable environment for token valuations, including MUBARAK.

Market Dynamics and Trading Activity

-

Trading Volume Performance: MUBARAK demonstrated robust trading volume growth following its launch, particularly during periods of market catalysts. Strong trading volume indicates market demand and can support price momentum when combined with positive market conditions.

-

Liquidity Considerations: Market depth and trading liquidity remain important factors for price stability. Adequate liquidity is essential for price discovery and reducing trading slippage, particularly during periods of market volatility.

Three、2025-2030 MUBARAK Price Forecast

2025 Outlook

- Conservative Forecast: $0.01132 - $0.01350

- Neutral Forecast: $0.01595

- Optimistic Forecast: $0.01707 (requires sustained market momentum and positive sentiment)

2026-2028 Midterm Outlook

- Market Stage Expectation: Potential recovery and accumulation phase with gradual upward pressure as market conditions stabilize and adoption expands

- Price Range Forecast:

- 2026: $0.01420 - $0.02097

- 2027: $0.01461 - $0.02455

- 2028: $0.01320 - $0.02965

- Key Catalysts: Increased institutional interest, platform ecosystem development, improved market liquidity on major exchanges such as Gate.com, and positive macroeconomic sentiment toward digital assets

2029-2030 Long-term Outlook

- Base Case: $0.02000 - $0.03129 (assuming moderate adoption growth and stable regulatory environment)

- Optimistic Case: $0.02564 - $0.03330 (assuming accelerated utility adoption and strengthened market infrastructure)

- Transformative Case: Above $0.03330 (extreme favorable conditions including mainstream institutional adoption, breakthrough technological developments, and significant expansion of use cases)

- 2030-12-21: MUBARAK approaching $0.03330 (representing 78% cumulative growth from current levels, reflecting enhanced market maturity and ecosystem expansion)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01707 | 0.01595 | 0.01132 | 0 |

| 2026 | 0.02097 | 0.01651 | 0.0142 | 3 |

| 2027 | 0.02455 | 0.01874 | 0.01461 | 17 |

| 2028 | 0.02965 | 0.02164 | 0.0132 | 35 |

| 2029 | 0.03129 | 0.02564 | 0.02 | 60 |

| 2030 | 0.0333 | 0.02847 | 0.01679 | 78 |

MUBARAK Investment Analysis Report

IV. MUBARAK Professional Investment Strategy and Risk Management

MUBARAK Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Retail investors with medium to long-term investment horizons seeking exposure to emerging tokens with growth potential.

-

Operational Recommendations:

- Dollar-cost averaging (DCA) approach: Allocate fixed amounts at regular intervals to reduce timing risk and average entry prices over time.

- Set clear entry and exit targets based on technical levels and personal risk tolerance thresholds.

- Store tokens in secure wallets during holding periods to maintain asset security and reduce exchange counterparty risk.

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price action patterns: Monitor 24-hour trading range ($0.01532 - $0.01596) and key support/resistance levels relative to historical highs ($0.22078) and lows ($0.00669).

- Volume analysis: Track 24-hour trading volume ($76,635.45) relative to average to identify liquidity conditions and potential breakout scenarios.

-

Wave Trading Key Points:

- Current 24-hour price momentum shows +3.16% positive movement, suggesting near-term bullish sentiment.

- Exercise caution given -3.45% 7-day and -7.92% 30-day declines, indicating potential consolidation or downward pressure periods.

- Trading activity is distributed across 24 exchanges, providing multiple liquidity venues for entry and exit optimization.

MUBARAK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% portfolio allocation - Focus on minimal exposure with emphasis on capital preservation.

- Active Investors: 3-8% portfolio allocation - Moderate exposure aligned with risk capacity for higher growth potential.

- Professional Investors: 5-15% portfolio allocation - Larger positions with sophisticated hedging and rebalancing strategies.

(2) Risk Mitigation Strategies

- Position sizing discipline: Limit single trade risk to 2% of total portfolio value to contain potential losses from adverse price movements.

- Rebalancing protocols: Review allocation quarterly or when price movements exceed 20% to maintain target exposure levels.

(3) Secure Storage Solution

- Hardware security approach: Utilize cold storage solutions that support BEP-20 tokens on the BSC (Binance Smart Chain) network for maximum security against online threats.

- Exchange custody consideration: For active traders, maintain trading positions on Gate.com with proper account security (two-factor authentication, IP whitelisting).

- Security best practices: Never share private keys, use hardware-based solutions for large holdings, implement multi-signature protocols where possible, and maintain regular security audits of wallet addresses.

V. MUBARAK Potential Risks and Challenges

MUBARAK Market Risk

- High volatility exposure: Token has experienced extreme price swings from $0.00669 (all-time low on October 10, 2025) to $0.22078 (all-time high on March 18, 2025), representing a 3,198% volatility range that can result in substantial investor losses.

- Liquidity concentration risk: With 25,682 token holders and trading activity across only 24 exchanges, liquidity may be insufficient for large position exits without significant price slippage.

- Downward price pressure: Recent 7-day (-3.45%) and 30-day (-7.92%) declines suggest potential loss of investor confidence or market momentum deterioration requiring careful monitoring.

MUBARAK Regulatory Risk

- Emerging market classification: Limited regulatory clarity regarding token classification and compliance requirements across different jurisdictions where trading occurs.

- Exchange listing volatility: Token availability across 24 different platforms creates exposure to varying compliance standards and potential delisting risks if regulatory environments tighten.

- Geographic enforcement uncertainty: Regulatory actions in major markets could impact token accessibility or trading conditions for international investors.

MUBARAK Technical Risk

- Smart contract dependency: Token operates on BSC via BEP-20 standard (contract address: 0x5c85d6c6825ab4032337f11ee92a72df936b46f6), creating vulnerability to network issues or smart contract exploits.

- Blockchain network risk: Reliance on BSC network stability means token trading and transfers are subject to network congestion, transaction failures, or security breaches affecting the underlying blockchain.

- Limited project documentation: Absence of detailed white paper, GitHub repository, or comprehensive technical documentation increases uncertainty regarding token development roadmap and technical competence.

VI. Conclusion and Action Recommendations

MUBARAK Investment Value Assessment

MUBARAK represents a highly speculative token with significant volatility and risk characteristics. The token's recent 1-year return of 5,746.43% reflects extreme historical volatility rather than stable value creation. Current market capitalization of $15.93 million with 100% circulating supply indicates full dilution with limited scarcity mechanisms. The positive 24-hour momentum (+3.16%) contrasts with concerning 7-day and 30-day declines, suggesting near-term uncertainty. Investment suitability depends entirely on individual risk tolerance and speculative capacity rather than fundamental value assessment.

MUBARAK Investment Recommendations

✅ Beginners: Start with minimal allocation (0.5-1% of total crypto portfolio) using dollar-cost averaging over extended periods. Avoid market timing and limit to trading hours with established price discovery. Prioritize learning about BEP-20 token mechanics and BSC network operations before expanding exposure.

✅ Experienced Traders: Execute tactical positions around identified support/resistance levels based on technical analysis of the $0.01532-$0.01596 trading range. Implement stop-loss orders at 15-20% below entry prices and profit-taking targets at 25-35% above entry. Actively monitor volume changes across 24 trading venues for liquidity optimization.

✅ Institutional Investors: Conduct comprehensive due diligence on project fundamentals, development team credibility, and use case viability before consideration. If proceeding, establish positions through staged accumulation while implementing systematic hedging strategies. Require detailed legal analysis of regulatory compliance across target markets before commitment.

MUBARAK Trading Participation Methods

- Direct spot trading: Purchase MUBARAK tokens directly on Gate.com against major trading pairs (USDT, BUSD, or other stablecoins) with real-time price execution and immediate settlement.

- Decentralized alternatives: Access token through decentralized exchange interfaces on BSC network, accepting higher technical complexity but avoiding centralized exchange counterparty risk.

- Liquidation and rebalancing: Execute periodic profit-taking at predetermined price targets and portfolio rebalancing intervals to systematically manage risk exposure.

Cryptocurrency investments carry extreme risk of total capital loss. This report is educational analysis only and does not constitute investment advice. Investors must evaluate their personal risk tolerance, financial situation, and investment objectives independently. Always consult qualified financial professionals before making investment decisions. Never invest funds you cannot afford to lose completely.

FAQ

What is the future of Mubarak coin?

Mubarak coin is projected to reach $0.002315 by 2028 with a 15.76% growth rate, driven by increasing market adoption and growing transaction volume in the Web3 ecosystem.

Can Mubarak reach 1 dollar?

Yes, Mubarak has potential to reach $1 in bullish market conditions. Based on community engagement and meme coin trends, it could potentially reach $1.20 or higher with sustained momentum and favorable market conditions.

Why is the Mubarak coin falling?

Mubarak coin price declined due to significant selling pressure from crypto whales and large investors. The 40% price drop to $0.08652 was primarily triggered by Binance listing effects and subsequent profit-taking activity in the market.

How much is the Mubarak meme coin worth?

As of December 20, 2025, Mubarak meme coin is worth approximately ₹1.31. Built on Binance Smart Chain, it focuses on community engagement and cultural entertainment value within the Web3 ecosystem.

2025 TURBO Price Prediction: Analyzing Market Trends and Future Valuation Prospects in the Evolving Cryptocurrency Ecosystem

2025 WOJAK Price Prediction: Analyzing Market Trends and Future Valuation Prospects for the Popular Meme Token

2025 WHYPrice Prediction: Market Analysis and Growth Potential for Investors

2025 DON Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 QUACK Price Prediction: Will This Meme Coin Soar or Crash in the Crypto Market?

2025 COQ Price Prediction: Expert Analysis and Market Outlook for the Coming Year

What is PROPC: A Comprehensive Guide to Process-Oriented Programming and Control Structures

What is KRL: A Comprehensive Guide to the KUKA Robot Language and Its Applications in Industrial Automation

What is ALU: Understanding the Arithmetic Logic Unit and Its Role in Computer Processing

What is HEMI: A Comprehensive Guide to Chrysler's Revolutionary Engine Technology

What is GALFAN: A Revolutionary Coating Technology for Enhanced Corrosion Protection and Durability