2025 NEXO Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: NEXO's Market Position and Investment Value

NEXO (NEXO), as a leading provider of advanced real-time encrypted credit lines, has made significant strides since its inception in 2018. As of 2025, NEXO's market capitalization has reached $915,400,000, with a circulating supply of approximately 1,000,000,000 tokens, and a price hovering around $0.9154. This asset, often dubbed the "crypto-backed lending pioneer," is playing an increasingly crucial role in the field of decentralized finance (DeFi) and crypto-backed loans.

This article will comprehensively analyze NEXO's price trends from 2025 to 2030, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic factors to provide investors with professional price predictions and practical investment strategies.

I. NEXO Price History Review and Current Market Status

NEXO Historical Price Evolution

- 2018: Initial launch, price started at $0.1 and reached an all-time low of $0.04515276 on September 13

- 2021: Bull market peak, NEXO hit its all-time high of $4.07 on May 12

- 2022-2025: Market cycle fluctuations, price declined from the peak to current levels

NEXO Current Market Situation

As of December 16, 2025, NEXO is trading at $0.9154, ranking 91st in the crypto market with a market capitalization of $915,400,000. The token has experienced a 2.48% decrease in the last 24 hours, with a trading volume of $346,467.98. NEXO's current price is significantly below its all-time high, reflecting the broader market conditions. The circulating supply matches the total and maximum supply at 1,000,000,000 NEXO tokens, indicating full distribution. Despite recent price declines, NEXO maintains a substantial market presence with a market dominance of 0.029%.

Click to view the current NEXO market price

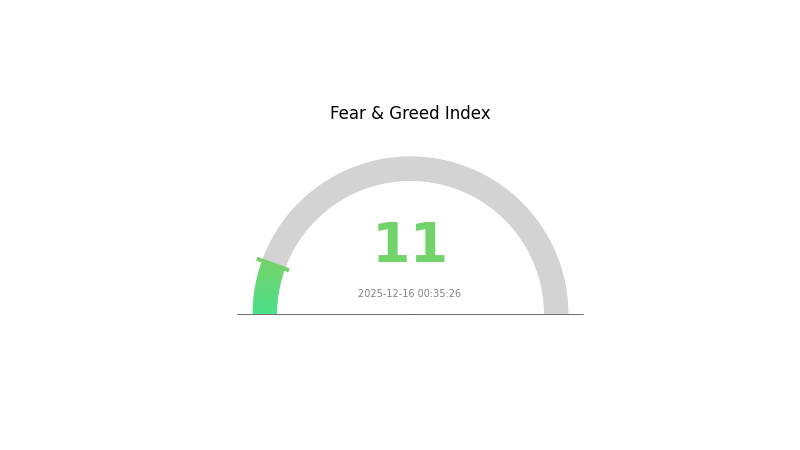

NEXO Market Sentiment Indicator

2025-12-16 Fear and Greed Index: 11 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently gripped by extreme fear, with the sentiment indicator plummeting to a mere 11. This level of pessimism often signals a potential buying opportunity for contrarian investors. However, it's crucial to approach with caution and conduct thorough research. Remember, market sentiment can shift rapidly. Stay informed and consider diversifying your portfolio to mitigate risks in these uncertain times. Gate.com offers a range of tools to help navigate such market conditions.

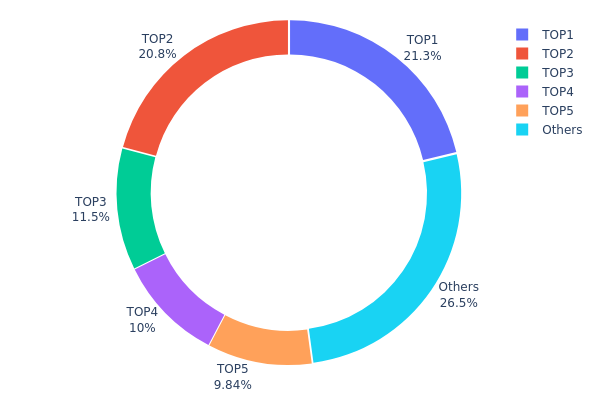

NEXO Holdings Distribution

The address holdings distribution data for NEXO reveals a significant concentration of tokens among a few top addresses. The top five addresses collectively hold 73.47% of the total NEXO supply, with the remaining 26.53% distributed among other addresses. This high level of concentration raises concerns about the token's decentralization and potential market manipulation risks.

The top address holds 21.32% of the total supply, followed closely by the second-largest holder with 20.83%. Such a concentrated distribution suggests that a small number of entities or individuals have substantial control over the NEXO token supply. This concentration could lead to increased volatility in the token's price, as large holders have the potential to significantly impact the market through their trading activities.

From a market structure perspective, this concentration presents both opportunities and risks. While it may provide stability if large holders maintain their positions, it also increases the vulnerability to sudden price movements if these major holders decide to liquidate their holdings. Investors and traders should be aware of this concentration when considering NEXO tokens, as it may affect the token's long-term stability and market dynamics.

Click to view the current NEXO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x9bdb...e14447 | 213231.99K | 21.32% |

| 2 | 0x1111...111111 | 208333.33K | 20.83% |

| 3 | 0x1c43...76b497 | 114800.95K | 11.48% |

| 4 | 0x9099...cccd07 | 100000.00K | 10.00% |

| 5 | 0x2222...222222 | 98437.50K | 9.84% |

| - | Others | 265196.23K | 26.53% |

II. Core Factors Affecting NEXO's Future Price

Supply Mechanism

- Limited Supply: NEXO has a limited supply, which can potentially drive up prices as demand increases.

- Historical Pattern: In the past, when supply remained limited and demand increased, it tended to push NEXO prices higher.

- Current Impact: The current supply dynamics are expected to continue influencing NEXO's price, with potential upward pressure if demand grows.

Macroeconomic Environment

- Monetary Policy Impact: Decisions by major central banks, particularly the US Federal Reserve, are likely to significantly influence NEXO's price in 2025 and beyond.

- Inflation Hedging Properties: In high-inflation environments, NEXO may be viewed as a potential hedge, which could affect its price performance.

- Geopolitical Factors: Global cryptocurrency capital deployment, especially from the US, can have far-reaching effects on NEXO's price trends.

Technological Development and Ecosystem Building

- Protocol Updates: NEXO's price is influenced by protocol updates, which can enhance functionality and attract more users.

- Ecosystem Applications: The development of DApps and ecosystem projects within the NEXO network can drive demand and affect price.

III. NEXO Price Prediction for 2025-2030

2025 Outlook

- Conservative prediction: $0.86048 - $0.9154

- Neutral prediction: $0.9154 - $1.00

- Optimistic prediction: $1.00 - $1.1351 (requires favorable market conditions)

2027-2028 Outlook

- Market phase expectation: Potential growth phase with increased volatility

- Price range forecast:

- 2027: $0.81179 - $1.20672

- 2028: $0.61049 - $1.42831

- Key catalysts: Broader crypto market recovery, NEXO platform adoption, regulatory clarity

2029-2030 Long-term Outlook

- Base scenario: $1.29009 - $1.31589 (assuming steady market growth)

- Optimistic scenario: $1.34169 - $1.90804 (assuming strong NEXO ecosystem expansion)

- Transformative scenario: Above $1.90804 (extreme favorable conditions in crypto lending sector)

- 2030-12-31: NEXO $1.31589 (potential year-end price based on average prediction)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.1351 | 0.9154 | 0.86048 | 0 |

| 2026 | 1.16878 | 1.02525 | 0.61515 | 12 |

| 2027 | 1.20672 | 1.09702 | 0.81179 | 19 |

| 2028 | 1.42831 | 1.15187 | 0.61049 | 25 |

| 2029 | 1.34169 | 1.29009 | 0.69665 | 41 |

| 2030 | 1.90804 | 1.31589 | 1.17114 | 43 |

IV. NEXO Professional Investment Strategies and Risk Management

NEXO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Conservative investors seeking stable growth

- Operation suggestions:

- Accumulate NEXO tokens during market dips

- Stake NEXO tokens on the platform for additional rewards

- Store tokens in a secure non-custodial wallet

(2) Active Trading Strategy

- Technical analysis tools:

- Moving Averages: Identify trend directions and potential reversals

- RSI (Relative Strength Index): Gauge overbought or oversold conditions

- Key points for swing trading:

- Monitor market sentiment and news related to Nexo platform

- Set stop-loss orders to limit potential losses

NEXO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Up to 15% of crypto portfolio

(2) Risk Hedging Solutions

- Diversification: Spread investments across various crypto assets

- Use of stable coins: Allocate a portion to stable coins during market volatility

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet

- Cold storage solution: Hardware wallet for long-term holdings

- Security precautions: Enable two-factor authentication, use strong passwords

V. Potential Risks and Challenges for NEXO

NEXO Market Risks

- Volatility: Cryptocurrency market's inherent price fluctuations

- Competition: Increasing number of crypto lending platforms

- Market sentiment: Susceptibility to broader crypto market trends

NEXO Regulatory Risks

- Regulatory uncertainty: Evolving global regulations on crypto lending

- Compliance challenges: Meeting varied regulatory requirements across jurisdictions

- Potential restrictions: Risk of limitations on crypto lending activities

NEXO Technical Risks

- Smart contract vulnerabilities: Potential flaws in the token's underlying code

- Platform security: Risk of hacks or breaches on the Nexo platform

- Scalability issues: Potential limitations in handling increased user demand

VI. Conclusion and Action Recommendations

NEXO Investment Value Assessment

NEXO presents a unique value proposition in the crypto lending space, with potential for long-term growth. However, investors should be aware of short-term volatility and regulatory uncertainties.

NEXO Investment Recommendations

✅ Beginners: Start with small, regular investments to understand the platform ✅ Experienced investors: Consider a balanced approach, combining staking and trading ✅ Institutional investors: Conduct thorough due diligence and consider larger positions

NEXO Participation Methods

- Direct purchase: Buy NEXO tokens on Gate.com

- Staking: Participate in Nexo's loyalty program for additional benefits

- Lending: Use NEXO as collateral for crypto-backed loans on the Nexo platform

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make decisions carefully based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Which coin price prediction 2030?

Based on current trends, NEXO's price could reach $5-$10 by 2030. This projection considers potential market growth and adoption rates in the crypto space.

Is NEXO a good crypto exchange?

Yes, NEXO is a reputable crypto exchange offering competitive interest rates, low fees, and a user-friendly interface. It's generally considered safe and effective for managing and growing crypto assets.

Is neo coin a good investment?

Neo coin shows promise in the Web3 space. Its innovative blockchain technology and growing ecosystem make it an attractive option for investors seeking high-growth potential in the crypto market.

Is my crypto safe on NEXO?

NEXO employs robust security measures and conservative lending practices to protect user assets. However, as with any crypto platform, some risks remain due to market volatility and potential cybersecurity threats.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Helium (HNT) a good investment? A comprehensive analysis of risks, rewards, and market prospects in 2024

Is Sandbox (SAND) a good investment?: Analyzing Market Performance, Risk Factors, and Future Potential in the Metaverse Gaming Sector

Is Chiliz (CHZ) a good investment?: A Comprehensive Analysis of Price Potential, Market Trends, and Risk Factors in 2024

Is Decred (DCR) a good investment?: A Comprehensive Analysis of Price Potential, Governance Features, and Market Outlook for 2024

Is crvUSD (CRVUSD) a good investment?: A Comprehensive Analysis of Risks, Benefits, and Market Potential in 2024