2025 PIXEL Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: PIXEL's Market Position and Investment Value

Pixels (PIXEL) is a social casual Web3 game powered by the Ronin Network, featuring an open-world experience centered around farming, exploration, and creation. Since its launch in February 2024, PIXEL has established itself as an innovative gaming token in the Web3 ecosystem. As of December 2025, PIXEL's market capitalization has reached approximately $6.06 million, with a circulating supply of around 771 million tokens trading at approximately $0.007855 per token. This gaming-focused asset is playing an increasingly important role in the blockchain gaming and metaverse sectors.

This article will provide a comprehensive analysis of PIXEL's price trends and market outlook for 2025-2030, combining historical price patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

PIXEL (PixelVerse) Market Analysis Report

I. PIXEL Price History Review and Current Market Status

PIXEL Historical Price Evolution

- February 2024: PIXEL reached its all-time high of $2.2908 on February 19, 2024, marking the peak of the token's market performance since its launch.

- October 2025: PIXEL hit its all-time low of $0.00637 on October 10, 2025, representing a significant decline from historical peaks.

- December 2025: The token has recovered slightly from its low point, currently trading at $0.007855 as of December 23, 2025.

PIXEL Current Market Position

PIXEL is currently ranked 1,428 by market capitalization with a fully diluted valuation of $39,275,000. The token shows a circulating supply of 771,041,667 PIXEL out of a total supply of 5,000,000,000, representing approximately 15.42% circulation ratio.

24-Hour Performance: The token demonstrates modest upward momentum with a 24-hour gain of +0.73%, trading within a narrow range between $0.007691 (24h low) and $0.007982 (24h high). The 24-hour trading volume stands at $129,104.10.

Medium-Term Trends: Over the past 7 days, PIXEL has declined 11.55%, while the 30-day performance shows a steeper decline of 39.1%. The 1-year performance reflects a dramatic downturn of 94.97%, indicating significant value erosion since the token's earlier peaks.

Market Distribution: PIXEL maintains a market dominance of 0.0012% within the broader cryptocurrency market. The token is supported by 6,283 holders and is available on 31 exchanges, including Gate.com.

Technical Specification: PIXEL operates on multiple blockchain networks, with contract addresses on both Ethereum (ERC20) and Ronin Chain (RON) networks, enabling cross-chain functionality.

Click to view current PIXEL market price

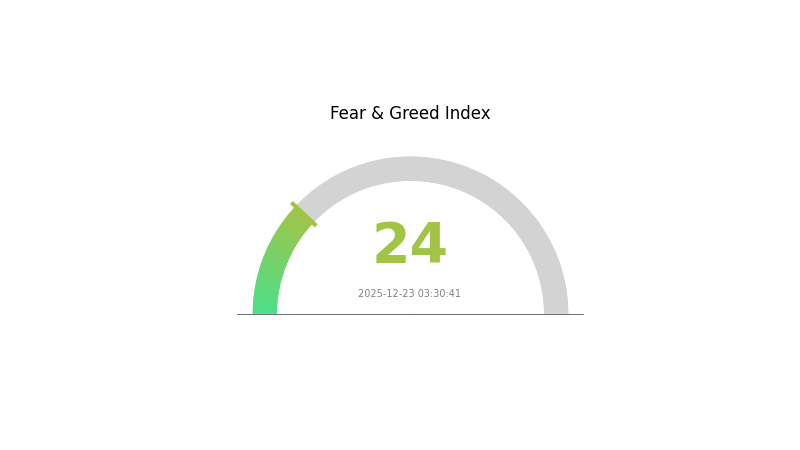

PIXEL Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The PIXEL market is currently experiencing extreme fear sentiment, with the index standing at 24. This exceptionally low reading indicates that investors are deeply pessimistic about near-term market conditions. Such extreme fear often presents contrarian opportunities for long-term investors, as markets tend to recover from oversold conditions. However, caution remains warranted as underlying bearish pressures may persist. Monitor key support levels and wait for stabilization signals before increasing exposure. Consider dollar-cost averaging strategies to build positions during periods of extreme fear on Gate.com.

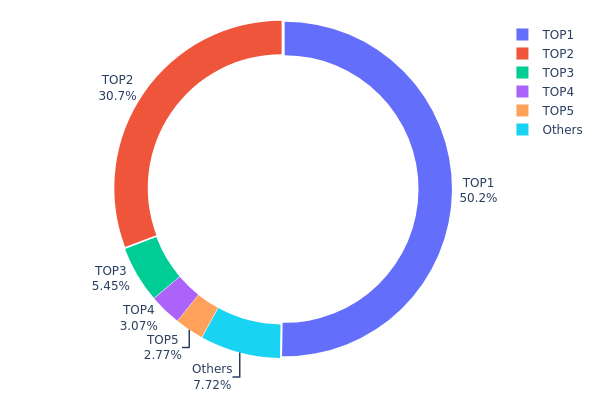

PIXEL Holdings Distribution

Address holding distribution refers to the concentration of token ownership across blockchain addresses, serving as a key indicator of the tokenomics structure and market maturity. This metric reveals the degree of decentralization and potential concentration risks within a project's ecosystem by mapping the proportion of total supply held by different addresses.

Current analysis of PIXEL's holding distribution reveals a significant concentration pattern. The top two addresses alone control 80.98% of the total token supply, with the largest holder commanding 50.24% and the second-largest holding 30.74%. This extreme concentration among a small number of addresses indicates substantial centralization risk. The third through fifth addresses further hold an additional 11.27% collectively, leaving only 7.75% distributed among all remaining addresses. Such a skewed distribution raises concerns about governance autonomy and market stability.

This pronounced concentration structure carries notable implications for market dynamics and price formation. The dominant position of the top two addresses suggests limited liquidity dispersion in the open market, which could amplify price volatility during significant trading activity or redemption events. The potential for coordinated action by major holders, whether intentional or otherwise, presents risks of market manipulation or sudden supply shocks. The concentration predominantly reflects typical patterns in early-stage projects where institutional allocations, team reserves, or major investor positions remain largely illiquid, though the absence of corresponding distribution events limits the decentralization trajectory in the near term.

Click to view current PIXEL Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe26d...51f73c | 2512318.82K | 50.24% |

| 2 | 0xfb94...24d825 | 1537083.34K | 30.74% |

| 3 | 0xd107...6d6e04 | 272344.33K | 5.44% |

| 4 | 0xf977...41acec | 153497.15K | 3.06% |

| 5 | 0x5a52...70efcb | 138564.08K | 2.77% |

| - | Others | 386192.28K | 7.75% |

II. Core Factors Affecting PIXEL's Future Price

Supply Mechanism

-

Token Release and Circulation Growth: Following mainnet launch, early miners accumulated over several years gained the ability to freely trade their tokens, resulting in massive sell-offs. Circulating supply rapidly expanded to 5.56 billion tokens, but actual market demand failed to keep pace, creating severe supply-demand imbalance that directly triggered price correction (from $1.97 high to $0.7).

-

Historical Patterns: Previous cycles demonstrate that periods of rapid supply increase without corresponding demand growth typically result in significant price pressure and volatility.

-

Current Impact: The ongoing token unlocking and circulation dynamics continue to exert downward pressure on PIXEL's price until market demand stabilizes and absorbs available supply.

Machine Institutional and Major Holder Dynamics

-

Exchange Support: Initial mainnet launch lacked support from major exchanges, limiting liquidity and restricting new investor entry, which exacerbated price fluctuations. Support from exchanges like Gate.com could potentially attract more capital inflow and stabilize pricing.

-

User Adoption: While the project boasts over 60 million registered users, only approximately 15% have actually migrated to mainnet and completed KYC verification, indicating limited active participation and reducing effective token utility.

Macroeconomic Environment

- Broader Cryptocurrency Market Trends: PIXEL's price performance is significantly influenced by overall cryptocurrency market conditions. During bull markets (such as Bitcoin rallies), PIXEL may experience positive momentum, while bear market conditions could amplify downward pressure.

Technology Development and Ecosystem Construction

- Ecosystem Application Expansion: The project plans to extend application scenarios through merchant integration and cross-chain cooperation. If ecosystem development materializes with functional decentralized applications and payment scenarios, demand pressure could be alleviated and token utility could increase substantially.

Three、2025-2030 PIXEL Price Forecast

2025 Outlook

- Conservative Forecast: $0.00463 - $0.00785

- Neutral Forecast: $0.00785

- Bullish Forecast: $0.00903 (requires sustained market momentum and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Gradual recovery phase with incremental growth as the project strengthens its market positioning and adoption metrics improve

- Price Range Forecast:

- 2026: $0.00642 - $0.01081

- 2027: $0.00905 - $0.01116

- Key Catalysts: Project milestone achievements, ecosystem expansion, increased institutional interest, and overall market sentiment improvement toward mid-cap assets

2028-2030 Long-term Outlook

- Base Case: $0.00873 - $0.01549 (assumes continued steady development and moderate market adoption)

- Bullish Case: $0.01231 - $0.01704 (assumes accelerated platform usage, strategic partnerships, and favorable macroeconomic conditions)

- Transformative Case: $0.01704+ (assumes breakthrough in use cases, significant user base expansion, and major market recognition)

- 2025-12-23: PIXEL trading volume and price action remain within anticipated parameters on platforms such as Gate.com

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00903 | 0.00785 | 0.00463 | 0 |

| 2026 | 0.01081 | 0.00844 | 0.00642 | 7 |

| 2027 | 0.01116 | 0.00962 | 0.00905 | 22 |

| 2028 | 0.01549 | 0.01039 | 0.00873 | 32 |

| 2029 | 0.0141 | 0.01294 | 0.00932 | 64 |

| 2030 | 0.01704 | 0.01352 | 0.01231 | 72 |

PIXEL Investment Analysis Report

IV. PIXEL Professional Investment Strategy and Risk Management

PIXEL Investment Methodology

(1) Long-term Hold Strategy

- Suitable For: Web3 gaming enthusiasts and casual investors with medium to long-term investment horizons

- Operational Recommendations:

- Accumulate PIXEL tokens during market downturns, taking advantage of the current 94.97% year-over-year decline to dollar-cost average into positions

- Participate in the Pixels game ecosystem to generate in-game rewards and additional token earnings through farming, exploration, and creation activities

- Secure tokens in a reliable storage solution to maintain long-term holdings without active trading pressure

(2) Active Trading Strategy

- Market Analysis Tools:

- Price Action Analysis: Monitor the 24-hour trading range ($0.007691 - $0.007982) to identify support and resistance levels for short-term entry and exit points

- Volume Analysis: Observe the 24-hour volume of approximately 129,104 tokens to assess market liquidity and potential breakout opportunities

- Wave Trading Key Points:

- Execute buy orders during negative price periods (current 7-day decline of -11.55%) and sell during recovery rallies

- Monitor the token's circulation rate (15.42% of total supply) to understand token release schedules that may impact price movements

PIXEL Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: 5-10% of crypto portfolio allocation with active hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Implement strict position limits to prevent overexposure to PIXEL's high volatility, particularly given the -94.97% annual decline

- Portfolio Diversification: Balance PIXEL holdings with established blockchain assets and stablecoins to mitigate project-specific risks

(3) Secure Storage Solution

- Hot Wallet Option: Gate.com Web3 Wallet for frequent trading and gaming interaction within the Pixels ecosystem

- Cold Storage Approach: For long-term holdings exceeding 6 months, consider offline storage solutions that support both ETH and RON chains

- Security Precautions: Never share private keys, enable two-factor authentication on all exchange accounts, and verify contract addresses (ETH: 0x3429d03c6F7521AeC737a0BBF2E5ddcef2C3Ae31; RON: 0x7eae20d11ef8c779433eb24503def900b9d28ad7) before transactions

V. PIXEL Potential Risks and Challenges

PIXEL Market Risks

- Extreme Price Volatility: PIXEL has declined 94.97% year-over-year, dropping from an all-time high of $2.2908 (February 19, 2024) to current levels around $0.007855, indicating severe market sentiment deterioration

- Low Trading Liquidity: With only 129,104 tokens traded in 24 hours across 31 exchanges, the relatively thin order books create slippage risks for large position movements

- Weak Market Capitalization: At approximately $6.06 million circulating market cap and $39.27 million fully diluted valuation, PIXEL remains susceptible to significant price swings from minor buy or sell pressure

PIXEL Regulatory Risks

- Evolving Gaming Regulation: Web3 gaming projects face increasing regulatory scrutiny in multiple jurisdictions regarding token utility classifications and gambling implications

- Blockchain Network Dependency: Reliance on both Ethereum and Ronin networks exposes PIXEL to regulatory actions targeting these underlying protocols

- Token Classification Uncertainty: Potential regulatory reclassification of PIXEL as a security could restrict trading and significantly impact market dynamics

PIXEL Technical Risks

- Ronin Network Dependency: The project's primary integration with Ronin Network creates technical risk if the network experiences congestion, security issues, or adoption challenges

- Smart Contract Risk: While deployed on established chains (ETH and RON), any undiscovered vulnerabilities in the Pixels smart contracts could threaten token value and user assets

- Scaling Challenges: As the game ecosystem grows, technical infrastructure must scale seamlessly; failure to do so could degrade user experience and reduce token utility

VI. Conclusion and Action Recommendations

PIXEL Investment Value Assessment

PIXEL presents a high-risk, speculative investment opportunity within the Web3 gaming sector. The token's fundamental utility derives from the Pixels game ecosystem, which emphasizes farming, exploration, and creation mechanics powered by the Ronin Network. However, the severe 94.97% annual decline, thin market liquidity, and modest trading volumes suggest significant market headwinds and waning investor confidence. The project's success depends critically on driving mainstream adoption of the Pixels game, increasing daily active users, and creating sustainable token demand beyond speculative trading. Current price levels may appeal to risk-tolerant investors viewing this as a recovery opportunity, yet the recovery path remains uncertain and will depend on tangible ecosystem milestones.

PIXEL Investment Recommendations

✅ Beginners: Start with micro-positions (0.5-1% of crypto portfolio) only after thoroughly understanding the Pixels game mechanics and the Web3 gaming sector; use this as an educational investment rather than a core holding.

✅ Experienced Investors: Consider accumulating small amounts during extreme weakness while simultaneously monitoring on-chain metrics and user engagement data; maintain strict stop-losses at 30-40% below entry to protect against further decline.

✅ Institutional Investors: Conduct deep due diligence on the development team's track record, game engagement metrics, and competitive positioning within Web3 gaming before considering allocation; treat any allocation as a venture-stage investment requiring 2-3 year holding horizon.

PIXEL Trading Participation Methods

- Gate.com Spot Trading: Purchase PIXEL directly using fiat or stablecoin pairs with real-time price discovery and immediate settlement

- Ronin Chain Direct: Bridge ETH to Ronin Network and trade PIXEL on the native chain for lower fees and faster transaction confirmation

- In-Game Earning: Participate in the Pixels ecosystem directly to earn PIXEL tokens through farming and exploration activities, reducing required capital outlay while gaining firsthand experience with token utility

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will PIXEL Coin reach $1?

Based on current market trends and expert analysis, PIXEL Coin is projected to potentially reach $1 by 2029. However, cryptocurrency prices are highly volatile and subject to market conditions, so actual results may vary significantly.

What is the PIXEL price prediction for 2025?

PIXEL is predicted to trade at an average of $1.2 and reach a maximum of $1.4 in 2025, based on market analysis and technical forecasts.

What is the PIXEL price forecast?

According to analytical models, PIXEL price is predicted to reach $0.0167 by end of 2026 and $0.0471 by end of 2029, based on current market trends and technical analysis.

What is the PIXEL coin price prediction for 2050?

PIXEL coin is projected to trade between $1.32 and $5.08 by 2050, reflecting a positive long-term outlook for the asset based on current market fundamentals and adoption trends.

2025 GEMS Price Prediction: Will This Gaming Token Surge to New Heights?

2025 MBXPrice Prediction: Analyzing Market Trends and Future Valuation Prospects for MBX Token

2025 WNCGPrice Prediction: Analyzing Market Trends, Technical Indicators, and Growth Potential for Wrapped NCG Token

2025 GMEE Price Prediction: Analyzing Market Trends and Potential Growth Factors

2025 SPS Price Prediction: Analyzing Market Trends and Future Potential for Splinterlands' Native Token

2025 DIO Price Prediction: Analyzing Potential Growth and Market Trends for the Digital Asset

Is Boson (BOSON) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Outlook

What Is NVDA Stock? An In-Depth Analysis from NVIDIA’s Business to Its Price Dynamics

Is SUKU (SUKU) a good investment?: A Comprehensive Analysis of Price Predictions, Risk Factors, and Market Potential for 2024

Is Camino Network (CAM) a good investment? A Comprehensive Analysis of Tokenomics, Use Cases, and Market Potential

Is Allo (RWA) a good investment?: A Comprehensive Analysis of Real-World Asset Tokenization and Market Potential