2025 PROPS Price Prediction: Expert Analysis and Market Forecast for Digital Property Tokens

Introduction: PROPS Market Position and Investment Value

Propbase (PROPS) serves as a tokenized real estate investment marketplace in Southeast Asia, enabling fractional ownership of high-quality real estate assets with investments starting as low as $100. Since its launch in November 2023, PROPS has established itself as a utility token powering the platform's ecosystem. As of December 2025, PROPS maintains a market capitalization of approximately $9.64 million with a circulating supply of around 456.65 million tokens, currently trading at $0.008037 per unit. This innovative asset is playing an increasingly important role in democratizing real estate investment and enabling rental yield opportunities across the region.

This article will provide a comprehensive analysis of PROPS price trends and market dynamics, combining historical performance patterns, supply and demand factors, ecosystem development, and macroeconomic conditions to deliver professional price forecasting and actionable investment strategies for investors seeking exposure to this emerging tokenized real estate sector.

Propbase (PROPS) Market Analysis Report

I. PROPS Price History Review and Current Market Status

PROPS Historical Price Trajectory

- April 2024: Reached all-time high (ATH) of $0.1873, marking the peak of market enthusiasm for the tokenized real estate investment platform.

- December 2024: Entered a significant downtrend, with price declining substantially from previous highs.

- December 24, 2025: Hit all-time low (ATL) of $0.00803, representing a severe contraction of approximately 91.23% from its peak value.

PROPS Current Market Performance

As of December 24, 2025, Propbase (PROPS) is trading at $0.008037, experiencing pronounced weakness across multiple timeframes. The 24-hour price change stands at -2.99%, while the past week has seen a -4.52% decline. Over the 30-day period, PROPS has depreciated by -3.32%, and the one-year performance reflects a devastating -91.23% loss from the initial listing price of $0.0032.

The 24-hour trading volume reaches $68,978.93, with a market capitalization of approximately $3,670,106.33. The circulating supply comprises 456.65 million tokens out of a total supply of 1.2 billion PROPS, representing a circulation ratio of 38.05%. The fully diluted valuation (FDV) stands at $9,644,400, with PROPS maintaining a market dominance of 0.0003% in the broader cryptocurrency ecosystem.

Currently, PROPS is listed on 7 exchanges with 6,332 token holders. The token operates on the Aptos blockchain and retains its ranking at position 1,729 among all cryptocurrencies by market capitalization.

View current PROPS market price

PROPS Market Sentiment Index

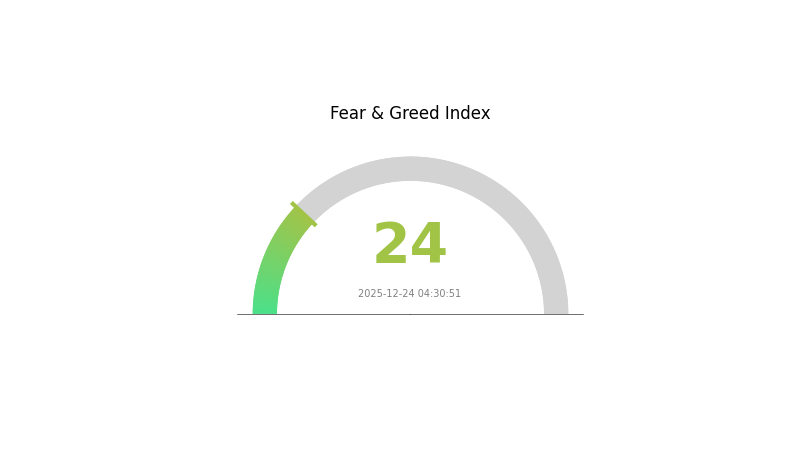

2025-12-24 Fear and Greed Index: 24 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plummeting to 24. This reading indicates severe market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often presents contrarian opportunities for patient investors. Historical data shows that such capitulation periods frequently mark market bottoms. However, caution remains warranted as negative sentiment can persist. Traders should consider their risk tolerance and investment horizon carefully before making decisions. Monitor key support levels and volume indicators for potential reversal signals.

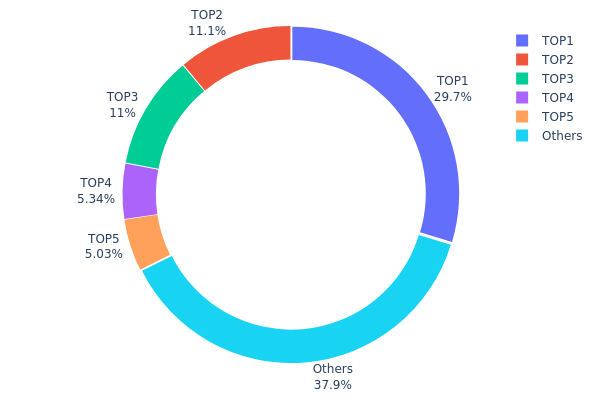

PROPS Holdings Distribution

An address holdings distribution map illustrates the concentration of token ownership across the blockchain by ranking addresses by their PROPS holdings and displaying both absolute quantities and percentage allocations. This metric serves as a critical indicator for assessing token decentralization, identifying potential whale concentration risks, and understanding the overall market structure.

The current PROPS holdings distribution reveals a moderately concentrated ownership pattern. The top address commands 29.69% of total supply, while the combined top five addresses control 61.09% of circulating tokens. This concentration level indicates significant influence concentrated among a limited number of holders. However, the remaining 37.91% distributed across other addresses demonstrates that nearly four in ten tokens remain dispersed throughout the broader holder base, suggesting incomplete monopolization of supply. The distribution gap between the top holder and secondary holders—approximately 2.7x difference between the first and second addresses—reflects notable disparities in wealth concentration within the ecosystem.

The current address concentration presents moderate structural implications for the PROPS market. While the substantial holdings of top addresses create potential for significant price impact through coordinated movements or large liquidations, the non-negligible portion held by other addresses provides some resilience against extreme manipulation scenarios. The market maintains a balance between centralized influence and distributed participation, though the 61.09% concentration among top five addresses warrants monitoring for governance alignment and stakeholder coordination.

Click to view current PROPS holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x785d...e41b41 | 354154.18K | 29.69% |

| 2 | 0x3e16...a47e01 | 131871.09K | 11.06% |

| 3 | 0xe8ca...49b9ea | 130789.94K | 10.97% |

| 4 | 0x430f...ed2426 | 63650.00K | 5.34% |

| 5 | 0x82d8...07059a | 60000.00K | 5.03% |

| - | Others | 452239.54K | 37.91% |

II. Core Factors Affecting PROPS Future Price

Supply Mechanism

-

Token Distribution Structure: PROPS tokens are allocated across multiple segments: approximately 40% for ecosystem development and user rewards to incentivize early adopters and active users; 25% allocated to team and advisors with a 2-4 year lock-up period to ensure long-term commitment; 20% reserved for private and seed round financing; and 15% maintained as reserves for market volatility and future development needs.

-

Phased Release Strategy: PROPS adopts a staged release mechanism where users can earn token rewards through participating in real estate investments, referring new users, and completing platform tasks. Team tokens are subject to strict lock-up periods, typically beginning 6 months after project launch with subsequent monthly or quarterly unlocking to prevent premature selling by team members.

-

Current Impact: The structured release schedule helps maintain price stability by preventing sudden market flooding with tokens. The incentive mechanism encourages ecosystem participation and community engagement, potentially supporting long-term price appreciation through increased platform adoption.

Institutional and Whale Dynamics

- Enterprise Adoption: Propbase has accumulated a user base across multiple real estate projects in Southeast Asia. The platform actively seeks partnerships with real estate developers and investment institutions to expand the pool of investable real estate assets, which could attract institutional capital flows.

Technology Development and Ecosystem Building

-

Smart Contract Infrastructure: Propbase utilizes smart contracts to automatically execute investment agreements and distribute returns. When real estate generates rental income or capital appreciation, the smart contracts automatically allocate returns proportional to token holders' positions, ensuring transparency and reducing administrative overhead.

-

Tokenized Real Estate Market: The platform converts physical real estate assets into digital tokens, allowing investors to purchase fractional ownership starting from as low as $100. This democratization of real estate investment significantly lowers entry barriers and expands the potential investor base, directly supporting ecosystem expansion and token utility.

-

Ecosystem Applications: Propbase operates a tokenized real estate investment platform where PROPS token holders can participate in investment decisions, receive rental income distributions, and engage in platform governance. The secondary market liquidity for PROPS tokens enables investors to trade their real estate investment stakes at any time, addressing the traditional illiquidity problem in real estate.

III. PROPS Price Forecast for 2025-2030

2025-2026 Outlook

- Conservative Forecast: $0.00545 - $0.00638

- Neutral Forecast: $0.00802 - $0.00966

- Optimistic Forecast: $0.01131 - $0.01092 (requiring sustained ecosystem development and increased adoption)

2027-2028 Medium-term Outlook

- Market Stage Expectation: Potential consolidation phase with gradual recovery, transitioning toward growth acceleration as utility-driven demand increases

- Price Range Forecast:

- 2027: $0.00947 - $0.01482

- 2028: $0.00791 - $0.01343

- Key Catalysts: Platform ecosystem expansion, strategic partnerships, increased institutional participation, and improvements in underlying protocol infrastructure

2029-2030 Long-term Outlook

- Base Case Scenario: $0.01299 - $0.01702 (assuming moderate adoption growth and stable market conditions)

- Optimistic Scenario: $0.01501 - $0.01891 (contingent on significant ecosystem development and mainstream integration)

- Transformation Scenario: $0.01891+ (requiring breakthrough innovations, major enterprise adoption, or transformative use case emergence)

Market participants are recommended to monitor PROPS token developments through Gate.com and conduct thorough due diligence before making investment decisions, as cryptocurrency markets remain highly volatile and subject to regulatory changes.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01131 | 0.00802 | 0.00545 | 0 |

| 2026 | 0.01092 | 0.00966 | 0.00638 | 20 |

| 2027 | 0.01482 | 0.01029 | 0.00947 | 28 |

| 2028 | 0.01343 | 0.01255 | 0.00791 | 56 |

| 2029 | 0.01702 | 0.01299 | 0.00987 | 61 |

| 2030 | 0.01891 | 0.01501 | 0.0105 | 86 |

Propbase (PROPS) Professional Investment Strategy and Risk Analysis Report

IV. PROPS Professional Investment Strategy and Risk Management

PROPS Investment Methodology

(1) Long-term Holding Strategy

Target Investors: Real estate investment enthusiasts, passive income seekers, and long-term cryptocurrency believers who view Propbase as an alternative asset class for portfolio diversification.

Operation Recommendations:

- Accumulate PROPS tokens during market downturns to benefit from fractional ownership in tokenized real estate assets across Southeast Asia, which historically provide rental yield income.

- Implement dollar-cost averaging (DCA) by investing fixed amounts monthly or quarterly to reduce timing risk, given the current -91.23% year-over-year decline indicating substantial volatility.

- Hold tokens long-term (2+ years) in secure storage to capture potential appreciation as the tokenized real estate market matures and adoption increases in Southeast Asian markets.

Storage Solutions:

- Use Gate Web3 Wallet for convenient staking and liquidity access while maintaining security standards for PROPS holdings on the Aptos blockchain.

- For enhanced security, consider hardware wallet solutions with Aptos compatibility for storing larger PROPS positions offline.

(2) Active Trading Strategy

Technical Analysis Tools:

- Support and Resistance Levels: Monitor historical price points at $0.1873 (all-time high from April 30, 2024) and current lows around $0.00803 to identify key reversal zones for entry and exit timing.

- Volume Analysis: Track the 24-hour volume of approximately $68,978.93 to identify periods of strong buying or selling pressure, with higher volume suggesting stronger trend confirmation.

Wave Trading Key Points:

- Identify short-term price movements within the 24-hour range ($0.00808 to $0.008447) to capitalize on intraday volatility during market-active periods.

- Execute take-profit orders at 10-15% gains and set stop-losses at -8% to manage downside risk given PROPS' significant price volatility and market maturity status.

PROPS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 2-3% of portfolio allocation to PROPS, treating it as a speculative, high-risk exposure to emerging tokenized real estate markets.

- Active Investors: 5-8% allocation for investors with moderate risk tolerance who believe in Southeast Asian real estate tokenization thesis and can withstand 90%+ drawdowns.

- Professional Investors: 10-15% allocation for sophisticated investors with significant cryptocurrency experience, conducting deep due diligence on Propbase's real estate fundamentals and smart contract security.

(2) Risk Hedging Solutions

- Diversification Strategy: Balance PROPS holdings with uncorrelated assets (stablecoins, established layer-1 blockchains) to reduce portfolio concentration risk from single-project dependency.

- Position Sizing: Limit individual PROPS position size to no more than 5% of total crypto holdings, ensuring that adverse price movements do not disproportionately impact overall portfolio value.

(3) Secure Storage Solutions

- Self-Custody Recommendation: Gate Web3 Wallet for active traders maintaining regular PROPS transactions while retaining full control of private keys.

- Cold Storage Method: Store majority holdings on hardware-compatible solutions with Aptos support for long-term security and protection against exchange counterparty risk.

- Security Considerations: Never share private keys or seed phrases; enable multi-signature verification for large transactions; regularly verify contract addresses against official Propbase channels (https://www.propbase.app/) to prevent phishing attacks; monitor wallet activity for unauthorized access.

V. PROPS Potential Risks and Challenges

PROPS Market Risk

-

Extreme Price Volatility: PROPS has experienced a -91.23% decline over one year, with an all-time high of $0.1873 in April 2024, indicating extreme market instability and susceptibility to speculative trading. Current price of $0.008037 represents a 95.7% decline from peak valuations.

-

Liquidity Constraints: Daily volume of approximately $68,978.93 is relatively low for a token with 1,200,000,000 total supply, creating potential slippage risks for larger orders and limiting exit opportunities during market stress.

-

Market Dependency on Real Estate Cycles: Propbase's business model is directly exposed to Southeast Asian real estate market conditions, economic downturns, and property valuation fluctuations, which could negatively impact token utility and demand.

PROPS Regulatory Risk

-

Emerging Market Jurisdiction Uncertainty: Propbase operates in Southeast Asia where tokenized real estate and cryptocurrency regulations remain underdeveloped and subject to rapid policy changes, creating compliance uncertainty and potential operational restrictions.

-

Real Estate Regulation Ambiguity: Regulators may impose new restrictions on tokenized property ownership, fractional ownership structures, or cross-border real estate transactions, fundamentally altering Propbase's business model feasibility.

-

Securities Classification Risk: Depending on regulatory interpretation, PROPS tokens or Propbase's real estate offerings could be classified as unregistered securities, exposing the project to legal enforcement actions and trading restrictions.

PROPS Technology Risk

-

Aptos Blockchain Dependency: PROPS operates exclusively on the Aptos blockchain; any technical vulnerabilities, network congestion, or protocol failures could directly impact token functionality and market accessibility.

-

Smart Contract Vulnerabilities: Given PROPS's reliance on smart contracts for property transactions, settlement, and access control, unaudited code or zero-day exploits could result in fund loss or fraudulent transactions.

-

Low Exchange Presence: With only 7 cryptocurrency exchange listings, PROPS faces limited trading pairs and venues, reducing price discovery efficiency and increasing exposure to exchange-specific risks or delisting scenarios.

VI. Conclusion and Action Recommendations

PROPS Investment Value Assessment

Propbase represents a highly speculative investment in the emerging tokenized real estate sector within Southeast Asia. While the core concept of fractional ownership in real estate assets and rental yield generation through blockchain technology presents long-term strategic merit, the extreme price decline (-91.23% annually), minimal trading liquidity ($68,978.93 daily volume), and uncertain regulatory environment create substantial near-term risks.

The project's current market capitalization of $3.67 million with only 6,332 token holders suggests limited mainstream adoption and institutional support. The massive gap between circulating supply ($3.67M) and fully diluted valuation ($9.64M) indicates potential significant dilution risks if new listings activate. For risk-averse investors, PROPS remains unsuitable. For experienced cryptocurrency investors with conviction in Southeast Asian property tokenization, PROPS may warrant a small, speculative allocation with realistic expectations of total loss.

PROPS Investment Recommendations

✅ Beginners: Avoid PROPS entirely until the project demonstrates sustained profitability, regulatory clarity, or significantly increased trading liquidity. Focus learning on more established cryptocurrencies before exploring micro-cap speculative projects.

✅ Experienced Investors: Consider a 2-3% portfolio allocation only if you possess deep knowledge of Southeast Asian real estate markets, understand Aptos blockchain mechanics, and can withstand 90%+ drawdowns without emotional decision-making. Implement strict dollar-cost averaging and set clear exit criteria.

✅ Institutional Investors: Conduct comprehensive due diligence on Propbase's real estate asset valuations, smart contract security audits, regulatory compliance status across Southeast Asian jurisdictions, and token economics before considering any allocation. Engage directly with project management on revenue-sharing mechanisms and property portfolio transparency.

PROPS Trading Participation Methods

-

Gate.com Trading: Access PROPS trading on Gate.com, which lists PROPS with verified contract address (0x6dba1728c73363be1bdd4d504844c40fbb893e368ccbeff1d1bd83497dbc756d on Aptos), providing regulated trading infrastructure and user protection policies.

-

Direct Wallet Accumulation: Acquire PROPS through Gate.com and transfer directly to Gate Web3 Wallet or compatible Aptos wallets for long-term holding, staking, or direct platform interaction with real estate assets on Propbase.app.

-

Propbase Platform Access: Use PROPS tokens to invest directly in tokenized real estate assets listed on https://www.propbase.app/ with fractional ownership starting at $100 minimum investments, with earned rental yields distributed to token holders.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult qualified financial advisors before committing capital. Never invest more than you can afford to lose completely.

FAQ

Does propy crypto have a future?

Yes, Propy has a promising future. Its focus on blockchain-based real estate solutions positions it well for adoption. With growing utility and market support, PROPS is positioned for significant potential growth in the emerging Web3 real estate sector.

What factors could influence PROPS token price in the coming years?

PROPS token price will be influenced by institutional adoption rates, platform user growth, regulatory developments, overall crypto market sentiment, and increased token utility within the ecosystem.

What is the current use case and adoption rate of PROPS in the Propy ecosystem?

PROPS tokens enable real estate investments within the Propy ecosystem, allowing users to participate in property transactions and investment opportunities. The adoption rate has shown steady growth, with increasing user participation in Propbase's investment platform throughout 2025.

What are AliExpress Coin

RWA on Avalanche (AVAX): How Real-World Assets Come On-Chain

Is Ondo Finance (ONDO) a good investment?: Analyzing the potential and risks of this innovative DeFi protocol

2025 WHITEPrice Prediction: Analysis of Market Trends and Future Value Potential

2025 QNT Price Prediction: Analyzing Potential Growth and Market Trends for Quant Network's Token

SIX vs QNT: Analyzing Performance Metrics of Two Leading Blockchain Technology Platforms

Leading Incubation Platform Launches Season 4 Program with 14 Blockchain Projects

What is DeFi, and how is it different from traditional finance?

Mobile Mining: A Guide and Overview

Futures Là Gì? Hướng Dẫn Giao Dịch Futures Cho Người Mới

Is Web3 Dead?