2025 QKC Price Prediction: Expert Analysis and Market Outlook for QuarkChain Token's Future Performance

Introduction: Market Position and Investment Value of QKC

QuarkChain (QKC), a blockchain underlying technology solution based on sharding technology, has been advancing since its inception in 2018. As of December 2025, QKC has achieved a market capitalization of approximately $27.74 million, with a circulating supply of about 7.19 billion tokens, currently trading at $0.003858. This asset, characterized by its security, decentralization, high throughput capability and scalability, is playing an increasingly important role in advancing next-generation blockchain infrastructure, with the capacity to achieve over 100,000 transactions per second (TPS).

This article provides a comprehensive analysis of QKC's price trajectory from 2025 through 2030, combining historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors.

I. QKC Price History Review and Current Market Status

QKC Historical Price Trajectory

-

2018: Project launch with initial price of $0.0198. Following the ICO, QKC reached its all-time high of $0.338765 on June 5, 2018, during the peak of the cryptocurrency market cycle.

-

2020: Market downturn phase. QKC declined to its all-time low of $0.00137714 on March 13, 2020, during the broader crypto market correction.

-

2024-2025: Extended bear market period. The asset experienced a cumulative decline of 60.54% over the past year, reflecting prolonged market weakness and decreased investor interest in the project.

QKC Current Market Status

As of December 20, 2025, QKC is trading at $0.003858, reflecting a 24-hour price increase of 3.59%. The token shows mixed short-term momentum with a 1-hour gain of 0.1%, while facing headwinds over longer timeframes with a 7-day decline of 5.89% and a 30-day loss of 11.35%.

The circulating supply stands at approximately 7.19 billion QKC tokens out of a total supply of 10 billion, representing a circulation ratio of 71.92%. The current market capitalization is $27.74 million with a fully diluted valuation of $38.58 million. Trading volume over the past 24 hours totaled $128,191.29, indicating relatively modest liquidity. QKC maintains a market dominance of 0.0012% with a global market ranking of 732.

The token is available for trading on 14 exchanges, with an active holder base of 10,061 addresses. Current market sentiment remains cautious, reflected in the extreme fear market condition index (VIX reading of 16).

Click to view current QKC market price

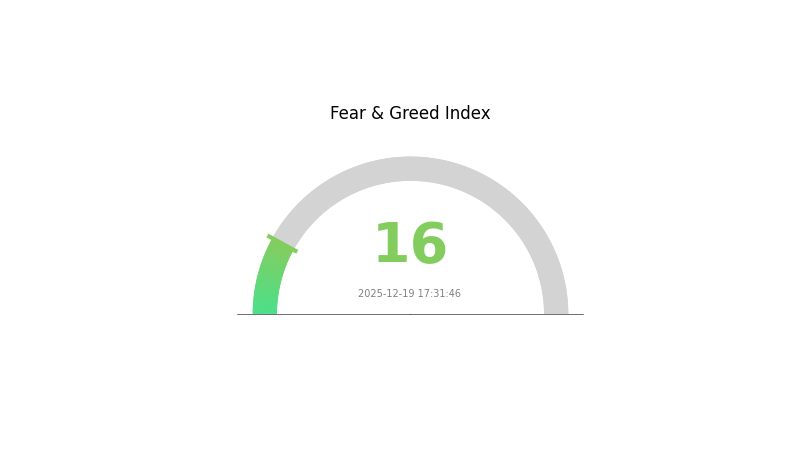

QKC Market Sentiment Indicator

2025-12-19 Fear and Greed Index: 16 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 16. This indicates strong negative sentiment among investors, reflecting significant market anxiety and pessimism. During extreme fear periods, prices often hit bottom levels, presenting potential buying opportunities for long-term investors. However, traders should remain cautious and conduct thorough research before making investment decisions. Monitor market developments closely on Gate.com to stay informed about the latest trends and opportunities in this volatile environment.

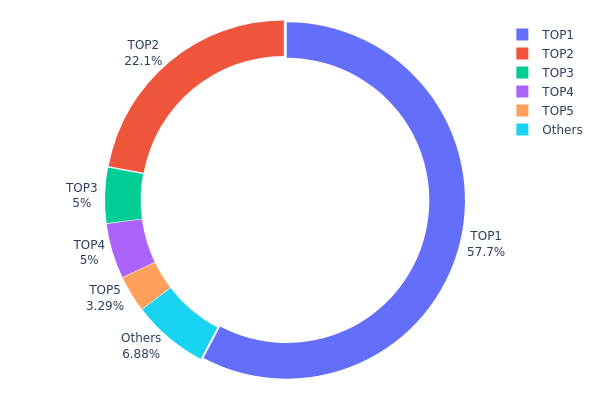

QKC Holdings Distribution

The address holdings distribution represents the concentration of QKC tokens across the blockchain network, revealing the ownership structure and token centralization level. This metric is essential for understanding the decentralization status, potential market manipulation risks, and the stability of the on-chain ecosystem.

QKC exhibits pronounced concentration characteristics, with the top address holding 57.73% of total supply, creating a highly centralized structure. The second-largest holder controls an additional 22.09%, meaning the top two addresses command approximately 79.82% of all circulating QKC tokens. This extreme concentration in the upper tier represents a significant risk factor. The subsequent holders—ranked third through fifth—each maintain relatively substantial positions of 5.00%, 5.00%, and 3.29% respectively, which individually appear moderate but collectively reinforce the concentrated nature of the distribution.

The dispersion analysis reveals that only 6.89% of QKC tokens are distributed among all remaining addresses, indicating severely limited retail participation and decentralization. This structure suggests QKC exhibits characteristics typically associated with early-stage projects or those with significant institutional concentration. The heavy concentration poses notable risks to market stability: whale holders possess considerable influence over price movements, and coordinated actions could trigger substantial volatility. Furthermore, the limited diffusion among smaller holders reduces organic trading depth and potentially constrains the token's utility and adoption across the broader ecosystem.

Click to view current QKC holdings distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0000...514b43 | 5773253.15K | 57.73% |

| 2 | 0xbb3d...8fc34b | 2209496.93K | 22.09% |

| 3 | 0xb4c9...897ee1 | 500000.00K | 5.00% |

| 4 | 0x9539...2d4cd0 | 500000.00K | 5.00% |

| 5 | 0xf977...41acec | 329426.57K | 3.29% |

| - | Others | 687823.35K | 6.89% |

II. Core Factors Affecting QKC's Future Price

Technology Development and Ecosystem Building

-

Multi-chain Hybrid Architecture: QuarkChain operates on a core multi-chain hybrid architecture that integrates with Ethereum and Arbitrum, enabling enhanced scalability and interoperability across different blockchain networks.

-

Ecosystem Development: As QKC serves as the core token of the QuarkChain ecosystem, the expansion of application scenarios and user adoption are critical drivers for future development prospects. The growth of the ecosystem and increased user participation directly influence the token's long-term value trajectory.

Market Sentiment and Trading Dynamics

-

Market Sentiment Impact: QKC price movements are significantly influenced by overall market sentiment within the cryptocurrency sector. Positive or negative sentiment shifts can lead to substantial price volatility.

-

Trading Volume: The trading volume of QKC plays a crucial role in determining price trends. Higher trading volumes typically indicate stronger market interest and can facilitate price discovery mechanisms.

-

User Adoption Trends: The adoption rate and growth of users within the QuarkChain ecosystem directly correlate with demand for QKC tokens, making user growth a key price influence factor.

III. QKC Price Forecast for 2025-2030

2025 Outlook

- Conservative Prediction: $0.00204 - $0.00386

- Neutral Prediction: $0.00386

- Optimistic Prediction: $0.00521 (contingent on sustained market momentum and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental gains as the cryptocurrency market stabilizes and QKC strengthens its market position.

- Price Range Predictions:

- 2026: $0.00435 - $0.00635 (17% upside potential)

- 2027: $0.00397 - $0.00734 (41% upside potential)

- 2028: $0.00486 - $0.00946 (65% upside potential)

- Key Catalysts: Network adoption acceleration, technological upgrades, expanded partnerships, increasing institutional interest in layer-2 solutions, and improved market sentiment toward mid-cap blockchain projects.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00618 - $0.00935 (105% cumulative growth by 2029; assumes steady ecosystem expansion and moderate market growth)

- Optimistic Scenario: $0.00829 - $0.01227 (123% cumulative growth by 2030; assumes strong adoption of QuarkChain's scaling solutions and favorable regulatory environment)

- Transformative Scenario: Sustained above $0.01227 (assumes breakthrough in mainstream blockchain adoption, successful protocol innovations, and significant increase in transaction volume on the QuarkChain network)

Note: These forecasts are based on historical trends and market analysis. Investors should conduct independent research and consult with financial advisors on Gate.com or other platforms before making investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00521 | 0.00386 | 0.00204 | 0 |

| 2026 | 0.00635 | 0.00453 | 0.00435 | 17 |

| 2027 | 0.00734 | 0.00544 | 0.00397 | 41 |

| 2028 | 0.00946 | 0.00639 | 0.00486 | 65 |

| 2029 | 0.00935 | 0.00793 | 0.00618 | 105 |

| 2030 | 0.01227 | 0.00864 | 0.00829 | 123 |

QuarkChain (QKC) Professional Investment Strategy and Risk Management Report

IV. QKC Professional Investment Strategy and Risk Management

QKC Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Core believers in sharding technology scalability, long-term blockchain infrastructure investors, and those with high risk tolerance seeking 3-5 year horizons.

-

Operational Recommendations:

- Establish a core position during market downturns when QKC trades significantly below all-time highs (currently trading 98.6% below ATH of $0.338765).

- Implement dollar-cost averaging (DCA) strategy over 6-12 months to reduce timing risk, given the highly volatile nature of the token.

- Hold tokens through development cycles of sharding technology implementation and network upgrades to capture potential value appreciation.

-

Storage Solution:

- For long-term holders: Gate Web3 wallet offers secure self-custody options with multi-chain support for ERC-20 positioned QKC tokens.

- Hardware wallet integration: Consider using hardware security for positions exceeding $10,000 in value to mitigate exchange counterparty risk.

(2) Active Trading Strategy

-

Technical Analysis Tools:

- Moving Averages (MA): Use 50-day and 200-day moving average crossovers to identify trend reversals. Current price of $0.003858 requires confirmation of uptrend structure above key resistance levels.

- Relative Strength Index (RSI): Monitor oversold conditions (RSI < 30) as potential entry signals, particularly relevant given the -60.54% one-year decline indicating potential capitulation.

- Trading Volume Analysis: Watch for volume expansion on upside breakouts, with current 24-hour volume of $128,191 suggesting moderate liquidity on Gate.com and 13 other exchanges.

-

Swing Trading Key Points:

- Capitalize on the token's 24-hour volatility range: recent high of $0.003871 and low of $0.003686 provide tactical entry/exit points.

- Execute trades on fundamental announcements regarding network upgrades, ecosystem partnerships, or sharding technology breakthroughs.

- Set strict stop-loss orders at 5-8% below entry prices given the -11.35% monthly and -5.89% weekly declines.

QKC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum. QKC's speculative nature and current market cap of $27.7M make it unsuitable for risk-averse portfolios.

- Active Investors: 3-5% portfolio allocation. Appropriate for those with 5+ year investment horizons and belief in infrastructure scalability solutions.

- Professional Investors: 5-10% allocation as a high-risk/high-reward infrastructure technology bet, with clear thesis documentation and quarterly rebalancing.

(2) Risk Hedging Strategies

- Portfolio Diversification: Combine QKC holdings with established layer-1 blockchain tokens and stablecoins to reduce concentration risk. QKC's 0.0012% market dominance means it lacks the stability of larger-cap alternatives.

- Position Sizing: Divide total QKC allocation into 4-5 tranches with staggered entry points, enabling tactical averaging and reducing emotional decision-making.

- Profit-Taking Framework: Establish predetermined exit targets at 50%, 100%, and 200% gains to lock in profits while maintaining upside exposure.

(3) Secure Storage Solutions

- Web3 Self-Custody: Gate Web3 Wallet provides secure custody for ERC-20 QKC tokens on Ethereum network with private key management and DeFi integration capabilities.

- Exchange Storage: Short-term trading positions (< 7 days) can remain on Gate.com's institutional-grade security infrastructure, which maintains insurance coverage for digital assets.

- Security Considerations:

- Never share private keys or seed phrases with any third party.

- Enable two-factor authentication (2FA) on all exchange and wallet accounts.

- Maintain regular backups of wallet recovery phrases in geographically distributed secure locations.

- Verify all transaction addresses independently before confirming transfers.

V. QKC Potential Risks and Challenges

QKC Market Risks

- Extreme Volatility and Drawdown Risk: QKC has declined 60.54% over the past year and 98.6% from its all-time high. Future volatility could result in additional 50%+ drawdowns, requiring strong psychological resilience from investors.

- Low Liquidity Concentration: With only $128,191 in 24-hour volume across 14 exchanges, large buy or sell orders can cause significant price slippage and execution challenges.

- Limited Market Adoption: Current holder base of only 10,061 addresses and fully diluted market cap of $38.6M (ranked #732) suggests limited mainstream adoption and network effects maturity.

QKC Regulatory Risks

- Blockchain Classification Uncertainty: Regulatory authorities worldwide continue debating whether blockchain infrastructure tokens constitute securities, potentially subjecting QKC to compliance requirements affecting trading and custody.

- Geographic Trading Restrictions: Certain jurisdictions may impose restrictions on trading infrastructure tokens, potentially limiting QKC's market accessibility and reducing liquidity.

- Environmental Compliance: Mining or validation mechanisms associated with blockchain networks face increasing regulatory scrutiny regarding energy consumption and environmental impact.

QKC Technology Risks

- Sharding Implementation Complexity: Sharding technology remains one of blockchain's most challenging technical problems. Failure to successfully implement sharding at scale could fundamentally undermine QKC's core value proposition.

- Network Security Vulnerabilities: Fragmentation across shards creates new attack vectors not present in single-chain architectures, potentially exposing the network to novel security threats.

- Developer Activity and Ecosystem Growth: GitHub activity and ecosystem development are critical success metrics. Any slowdown in development or loss of core developer team members could threaten long-term viability.

VI. Conclusion and Action Recommendations

QKC Investment Value Assessment

QuarkChain represents a high-risk, high-reward infrastructure technology bet centered on sharding-based blockchain scalability. The 98.6% decline from all-time highs suggests either significant overvaluation in 2018 or substantial undervaluation at current levels depending on technological execution success.

Positive factors: Addresses critical blockchain scalability challenge targeting 100,000+ TPS; active GitHub development; presence across 14 trading venues.

Negative factors: Limited adoption (10,061 holders), minimal market cap relative to tier-1 blockchain platforms, 60.54% one-year decline, execution risk on unproven sharding technology.

Current positioning reflects market skepticism regarding infrastructure token viability and competitive pressure from established layer-1 blockchains and other scalability solutions.

QKC Investment Recommendations

✅ Beginners: Do not participate in QKC trading. Focus on learning blockchain fundamentals through more established, higher-liquidity cryptocurrency assets before considering infrastructure tokens.

✅ Experienced Investors: Consider micro-cap allocation (1-2% of portfolio) only if you have deep technical understanding of sharding mechanisms and strong conviction in QuarkChain's technological differentiation. Require 3-5 year time horizon.

✅ Institutional Investors: Conduct comprehensive technical due diligence on sharding implementation roadmap before considering infrastructure fund allocations. Establish relationships with QuarkChain development team to monitor progress on key technological milestones.

QKC Trading Participation Methods

- Gate.com Spot Trading: Direct QKC/USDT or QKC/ETH trading pairs with professional institutional infrastructure and multi-layer security protocols.

- Gate Web3 Wallet Integration: Purchase QKC via Gate.com and transfer to self-custody wallets for long-term holding, enabling full ownership and elimination of exchange counterparty risk.

- Dollar-Cost Averaging Plan: Implement systematic monthly purchases through Gate.com's recurring order functionality to reduce timing risk and emotional decision-making impacts.

Cryptocurrency investment carries extreme risk. This report does not constitute financial advice. Investors must make decisions based on personal risk tolerance and financial circumstances. Consult professional financial advisors before investing. Never invest funds you cannot afford to lose completely.

FAQ

What is QKC crypto?

QKC is a cryptocurrency token from the QuarkChain platform, founded in 2017. It operates within the QuarkChain ecosystem as a utility token for network transactions and governance purposes.

Is QKC a good coin?

Yes, QKC shows promising potential with strong technical fundamentals and growing adoption in the blockchain ecosystem. Analysts project positive price movements through 2028, making it an attractive option for long-term investors seeking exposure to innovative layer-2 scaling solutions.

What is the price prediction for QuarkChain in 2030?

Based on current market analysis, QuarkChain (QKC) could potentially reach price levels around $0.03-$0.04 by 2030. This projection depends on network adoption, technological developments, and overall crypto market conditions. Long-term growth depends on QuarkChain's scaling solutions and ecosystem expansion.

2025 CORE Price Prediction: Analyzing Potential Growth Factors and Market Trends in the Cryptocurrency Ecosystem

2025 CORE Price Prediction: Analyzing Growth Potential and Market Factors for Widespread Adoption

2025 CKBPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Nervos Network's Native Token

2025 LOOM Price Prediction: Analyzing Market Trends and Growth Potential for the Blockchain Platform

2025 CKB Price Prediction: Bullish Outlook as Adoption and Development Accelerate

2025 HEI Price Prediction: Analyzing Market Trends and Potential Growth Factors for HEI Token

The Ultimate Guide to Algorithmic Trading in Cryptocurrencies and Web3

Understanding the Difference Between Crypto Exchanges and Wallets

Claiming Your Share of the ZK Sync Airdrop: A Guide

Exploring the Benefits and Use Cases of USD Coin Stablecoin

Guide to Launching TRUST with Token-Curated Knowledge Graphs