2025 REP Price Prediction: Expert Analysis and Market Forecast for Augur's Native Token

Introduction: REP's Market Position and Investment Value

Augur (REP) is a decentralized prediction market platform built on the Ethereum blockchain, which has been developing since 2014. As a pioneering project in the prediction market sector, Augur has established itself as a unique asset enabling users to predict and trade on real-world events using cryptocurrency. As of December 2025, REP has achieved a market capitalization of approximately $7.61 million with a circulating supply of around 8.15 million tokens, currently trading at $0.9337 per token.

This innovative protocol, often referred to as a "decentralized forecasting infrastructure," plays an increasingly critical role in democratizing prediction markets and eliminating centralized intermediaries. By leveraging crowd wisdom and blockchain technology, Augur enables global participants to create markets, share insights, and trade on any event imaginable without geographic restrictions or traditional institutional gatekeeping.

This article will provide a comprehensive analysis of REP's price trajectory from 2025 through 2030, synthesizing historical market patterns, supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and actionable investment strategies for crypto asset investors.

Augur (REP) Market Analysis Report

I. REP Price History Review and Market Status

REP Historical Price Movement Trajectory

-

2016 (Launch Period): Augur project launched on Ethereum blockchain with initial public price of $0.5795. The token experienced rapid price appreciation during the early adoption phase, reaching an all-time high of $341.85 on February 10, 2016, driven by strong community interest in decentralized prediction markets.

-

Early 2016 (Peak and Correction): Following the all-time high in February, REP experienced significant correction, dropping to an all-time low of $0.2075552978020019 on January 22, 2016, reflecting typical market volatility during early cryptocurrency projects.

-

Long-term Performance: From the 2016 launch to the present (December 22, 2025), REP has demonstrated notable long-term appreciation, with a 1-year return of 76.49%, indicating sustained investor interest in the decentralized prediction market concept.

REP Current Market Stance

As of December 22, 2025, REP is trading at $0.9337, representing an 11.6% increase over the past 24 hours. The token is currently ranked at #1,319 by market capitalization, with a total market cap of approximately $7.61 million and 24-hour trading volume of $16,194.39.

The current price sits between a 24-hour high of $0.967 and a 24-hour low of $0.8101. Over longer timeframes, REP has shown mixed performance: a 7-day gain of 3.57%, a 30-day decline of -28.43%, and a 1-year gain of 76.49.

The circulating supply stands at 8,151,709.06 REP tokens with a circulating ratio of 74.11%. The token maintains active holder engagement with 12,637 token holders currently participating in the ecosystem. The 1-hour price movement shows a slight decline of -0.21%, indicating relatively stable trading conditions in the short term.

View current REP market price

REP Market Sentiment Indicator

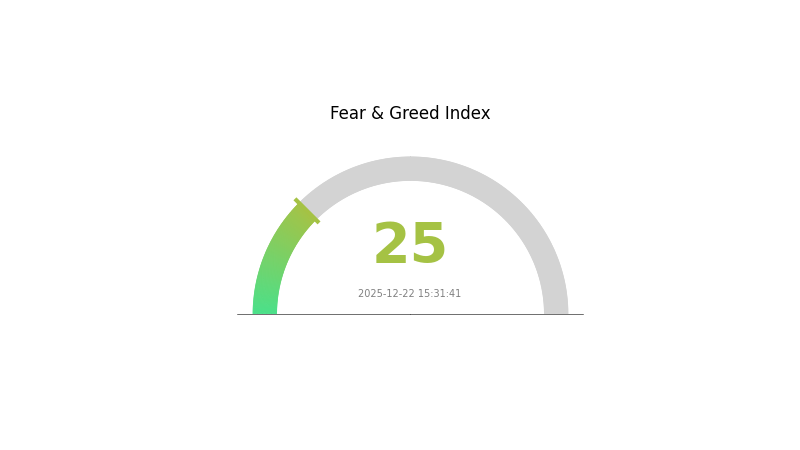

2025-12-22 Fear and Greed Index: 25 (Extreme Fear)

Click to view current Fear & Greed Index

The REP market is currently experiencing extreme fear, with the Fear and Greed Index standing at 25. This indicates significant market pessimism and heightened risk aversion among investors. During such periods, market volatility tends to increase substantially, and asset prices may face considerable downward pressure. However, extreme fear conditions often present contrarian opportunities for long-term investors with strong conviction. It's crucial to exercise caution, conduct thorough research, and only invest capital you can afford to lose. Monitor Gate.com's real-time market data to stay informed about sentiment shifts and make informed trading decisions.

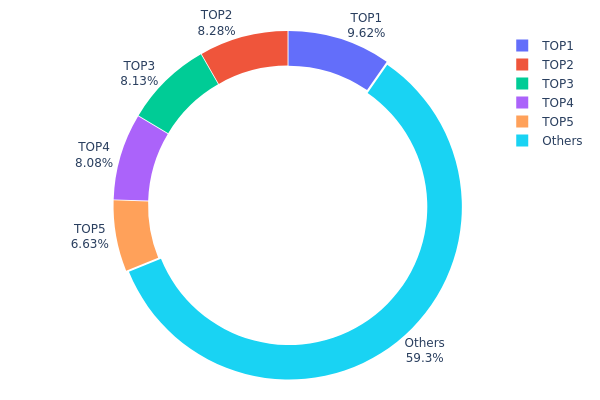

REP Holdings Distribution

The address holdings distribution map illustrates the concentration of REP tokens across blockchain addresses, revealing the degree of decentralization and potential market structure vulnerabilities. By analyzing the top holders and their aggregate holdings, this metric provides critical insights into whether token distribution remains sufficiently dispersed or exhibits concerning concentration patterns that could impact market stability and price dynamics.

REP's current holdings distribution demonstrates moderate concentration characteristics. The top five addresses collectively control approximately 40.72% of the total token supply, with the largest holder accounting for 9.61% and the second-largest at 8.28%. While these figures indicate some level of accumulation among major stakeholders, the distribution does not present extreme concentration. The remaining 59.28% of tokens held by dispersed addresses suggests a reasonably healthy level of decentralization, preventing any single entity from wielding overwhelming influence over the token's market movements or governance decisions.

The current address distribution pattern reflects a market structure with balanced risk considerations. The absence of extreme whale dominance mitigates the likelihood of coordinated price manipulation or sudden large-scale liquidations that could trigger severe volatility. However, the presence of five substantial holders controlling over 40% of the supply warrants monitoring for potential collective action scenarios. This distribution framework indicates a moderately decentralized token ecosystem that maintains sufficient stakeholder diversity to support organic market price discovery, while the concentrated holdings among top addresses suggest ongoing institutional or early-stage investor participation that provides network stability and reduced risk of rapid token dilution events.

Click to view current REP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x98ed...eadad8 | 784.13K | 9.61% |

| 2 | 0xd2dd...e6869f | 675.11K | 8.28% |

| 3 | 0x981f...2f030e | 662.48K | 8.12% |

| 4 | 0x7daf...706f83 | 659.01K | 8.08% |

| 5 | 0x5d65...22d918 | 540.59K | 6.63% |

| - | Others | 4830.39K | 59.28% |

II. Core Factors Influencing REP's Future Price

Macroeconomic Environment

-

Inflation Hedge Properties: REP's primary connection is to prediction market activity, which means its inflation hedge attributes are limited. Unlike assets that provide cross-chain liquidity or store-of-value characteristics, REP's value is more directly tied to the usage and adoption of prediction market platforms rather than serving as a traditional inflation hedge.

-

Monetary Policy Impact: REP, like other cryptocurrencies in the market, follows the broader cryptocurrency market dynamics influenced by monetary policy decisions. Market sentiment and regulatory clarity around cryptocurrency will play important roles in determining price trajectories.

-

Market Sentiment and Regulatory Environment: The price of REP is significantly influenced by market demand, supply dynamics, institutional adoption patterns, and regulatory changes. Regulatory clarity and increased institutional participation can drive more bullish trends, while regulatory uncertainty may create downward pressure on the token's valuation.

III. 2025-2030 REP Price Forecast

2025 Outlook

- Conservative Forecast: $0.57 - $0.93

- Base Case Forecast: $0.93 - $1.27

- Optimistic Forecast: $1.27+ (requires sustained market recovery and increased institutional adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery phase with consolidation patterns, characterized by increasing institutional interest and ecosystem development maturation

- Price Range Predictions:

- 2026: $0.72 - $1.63

- 2027: $1.19 - $1.61

- 2028: $0.80 - $1.58

- Key Catalysts: Enhanced platform functionality, regulatory clarity, growing decentralized application adoption on the REP network, and improving market sentiment cycles

2029-2030 Long-term Outlook

- Base Case Scenario: $0.94 - $2.32 (assumes steady technological advancement and moderate market expansion)

- Optimistic Scenario: $1.10 - $2.12 (assumes accelerated enterprise adoption and significant DeFi market growth)

- Transformational Scenario: $1.53+ (assumes breakthrough use cases, mainstream institutional participation, and REP becoming a core infrastructure asset)

- 2030-12-22: REP targeting $1.83 average valuation (anticipated consolidation at higher price levels with substantial 95% cumulative gains from 2025 baseline)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.26983 | 0.9337 | 0.56956 | 0 |

| 2026 | 1.63061 | 1.10177 | 0.71615 | 18 |

| 2027 | 1.6121 | 1.36619 | 1.18859 | 46 |

| 2028 | 1.5785 | 1.48915 | 0.80414 | 59 |

| 2029 | 2.11667 | 1.53382 | 1.10435 | 64 |

| 2030 | 2.31806 | 1.82525 | 0.94913 | 95 |

Augur (REP) Professional Investment Strategy and Risk Management Report

IV. REP Professional Investment Strategy and Risk Management

REP Investment Methodology

(1) Long-term Holding Strategy

-

Target Investors: Belief-driven investors who support decentralized prediction market infrastructure, institutional investors seeking exposure to blockchain-based forecasting platforms, and diversified crypto portfolio allocators.

-

Operational Recommendations:

- Accumulate REP during market downturns when prices fall below historical support levels, leveraging dollar-cost averaging to reduce average entry costs over extended periods.

- Maintain a 2-3 year minimum holding horizon to allow the Augur ecosystem to mature and demonstrate sustained adoption in prediction market activities.

- Monitor quarterly updates on prediction market activity, trading volumes, and community engagement metrics as key performance indicators.

(2) Active Trading Strategy

-

Technical Analysis Considerations:

- Price Action Analysis: REP exhibited significant volatility with a 24-hour range of $0.8101 to $0.967, demonstrating liquidity swings suitable for swing trading within established support and resistance levels.

- Volume Analysis: Current 24-hour trading volume of $16,194.39 provides reference points for entry/exit liquidity; monitor for volume spikes accompanying price movements to confirm trend validity.

-

Swing Trading Considerations:

- Trade REP around identified resistance zones based on historical price movements; 2025 performance shows a 76.49% yearly gain suggesting potential consolidation phases.

- Exercise caution during low-volume periods given REP's relatively modest trading volume compared to major cryptocurrencies; prioritize entries during elevated market activity windows.

REP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% portfolio allocation maximum, treating REP as a speculative alternative asset within a primarily traditional investment portfolio.

- Active Investors: 3-5% portfolio allocation, positioning REP as a minor tactical allocation within a diversified cryptocurrency holdings structure.

- Specialized Investors: 5-10% portfolio allocation, for those with demonstrated expertise in decentralized finance and prediction market mechanics.

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance REP holdings against uncorrelated assets including traditional equities, bonds, and other blockchain assets with different risk profiles to reduce concentration risk.

- Position Sizing Discipline: Establish maximum loss thresholds per trade (typically 1-2% of portfolio value) and use predetermined stop-loss levels to contain downside exposure.

(3) Secure Storage Solutions

-

Hardware Wallet Approach: For holdings exceeding $5,000 USD equivalent, consider storing REP on secure Ethereum-compatible hardware wallets; verify the contract address (0x221657776846890989a759ba2973e427dff5c9bb) before transferring assets.

-

Exchange Account Management: For active trading purposes, maintain REP holdings on Gate.com, which provides direct trading pairs, integrated security features, and regulatory compliance frameworks for cryptocurrency trading.

-

Security Best Practices: Enable two-factor authentication on all exchange accounts; use unique, strong passwords; never share private keys or seed phrases; regularly verify contract addresses before any token transfers.

V. Potential Risks and Challenges for REP

Market Risks

-

Liquidity Risk: REP's daily trading volume of approximately $16,194 is substantially lower than major cryptocurrencies, potentially limiting the ability to execute large position trades without significant price slippage.

-

Price Volatility Risk: Historical price movements from all-time high of $341.85 (February 2016) to current levels represent extreme volatility; investors face substantial drawdown potential during bear market cycles.

-

Adoption Risk: Prediction market utility depends on sustained user participation and market creation; insufficient market adoption or migration to competing platforms could materially impair REP token utility and demand.

Regulatory Risks

-

Prediction Market Classification: Regulatory uncertainty regarding whether prediction markets constitute gambling, securities, or derivatives affects jurisdictional availability and operational legality across different regions.

-

Financial Services Regulation: Evolution of global regulatory frameworks governing decentralized finance and cryptocurrency-based prediction mechanisms could impose compliance requirements on platform operations.

-

Geographic Restrictions: Certain jurisdictions may restrict or prohibit participation in decentralized prediction platforms, limiting addressable market and token utility.

Technology Risks

-

Smart Contract Security: As an Ethereum-based protocol, Augur faces ongoing smart contract vulnerability risks; identified security flaws or exploits could undermine market integrity and token value.

-

Ethereum Dependency: REP token functionality and platform operations are entirely dependent on Ethereum network availability, security, and fee structures; Ethereum-level technical issues or congestion directly impact Augur usability.

-

Oracle Risk: Prediction market resolution depends on reliable data feeds to determine event outcomes; oracle manipulation, data inaccuracy, or source unavailability could trigger incorrect market settlements and disputes.

VI. Conclusions and Action Recommendations

REP Investment Value Assessment

Augur (REP) represents a technically innovative approach to decentralized prediction markets with established on-chain infrastructure. However, the token operates in a specialized niche with limited mainstream adoption compared to major blockchain applications. The significant historical volatility and moderate trading liquidity present both opportunities for active traders and challenges for passive investors. Long-term value realization depends on sustained ecosystem growth, broader market acceptance of prediction market mechanics, and regulatory clarity supporting platform operations. Current market conditions suggest REP appeals primarily to investors with specific conviction regarding decentralized forecasting infrastructure rather than general cryptocurrency exposure.

REP Investment Recommendations

✅ Beginners: Allocate 1-2% of cryptocurrency portfolio to REP as an experimental position; conduct thorough research on prediction market mechanisms before trading; start with small positions on Gate.com to understand platform mechanics.

✅ Experienced Investors: Utilize 3-5% allocation within diversified cryptocurrency holdings; employ swing trading strategies around identified technical levels; maintain positions through market cycles while monitoring ecosystem developments.

✅ Institutional Investors: Evaluate REP as part of specialized digital asset or blockchain infrastructure strategies; conduct thorough due diligence on prediction market adoption metrics and regulatory environment; execute positions through established on-ramp platforms like Gate.com.

REP Trading Participation Methods

-

Gate.com Trading: Access REP/USDT and other pairs directly on Gate.com, utilizing advanced order types (limit orders, stop-losses) for disciplined trade execution and risk management.

-

Spot Market Purchase: For investors seeking direct REP ownership, execute spot purchases during identified technical support levels when market conditions support favorable entry pricing.

-

Portfolio Allocation: Incorporate REP as part of broader cryptocurrency allocation strategies; rebalance holdings periodically to maintain target portfolio weights and discipline around profit-taking.

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and conduct thorough due diligence. Consultation with qualified financial advisors is strongly recommended. Never invest capital you cannot afford to lose completely.

FAQ

What is the price prediction for REP (Augur) in 2025?

Based on market analysis, REP is projected to reach a maximum of $19.29 in 2025, with a potential minimum around $0.02511. The price trajectory depends on market adoption and network development.

Will REP reach $100 by 2030?

REP reaching $100 by 2030 is possible with increased adoption and market growth, though uncertain. Institutional interest and platform expansion could drive price appreciation, but market conditions remain highly speculative and unpredictable.

What factors influence REP token price movements?

REP token price is influenced by market liquidity, supply and demand dynamics, and investor sentiment. Automated Market Makers set prices based on token supply in liquidity pools. Trading volume and overall market conditions also impact price movements significantly.

How has REP price performed historically?

REP price has experienced significant volatility throughout its history, with fluctuations driven by market sentiment, network adoption, and broader crypto market cycles. The token has shown both substantial gains during bull markets and notable corrections during downturns, reflecting typical cryptocurrency market dynamics.

What is the current market cap and circulating supply of REP?

As of 2025-12-22, REP has a market cap of $6.71 million with a circulating supply of 8.15 million coins. This reflects the current valuation in the cryptocurrency market.

MYX Token Price and Market Analysis on Gate.com in 2025

2025 VVSPrice Prediction: Market Analysis and Future Outlook for Crypto Investors

2025 PNG Price Prediction: Forecasting Digital Asset Value Trends in the Evolving NFT Marketplace

2025 DODOPrice Prediction: Analyzing Growth Potential and Market Factors for the DeFi Token's Future Value

BMEX vs UNI: Comparing the Leading Trading Platforms for Crypto Derivatives and Decentralized Exchange

SUPE vs SNX: Comparing Performance and Potential in the Synthetic Asset Space

A Beginner's Guide to Digital Web3 Wallets

What is SCOR: A Comprehensive Guide to Supply Chain Operations Reference Model

What is ACM: A Comprehensive Guide to the Association for Computing Machinery and Its Global Impact on Computer Science

What is PIPE: A Comprehensive Guide to Process Inter-Process Communication in Modern Software Development

Convert Solana to USDT: A Step-by-Step Guide