2025 TDROP Price Prediction: Expert Analysis and Market Forecast for the Year Ahead

Introduction: TDROP's Market Position and Investment Value

ThetaDrop (TDROP) is a TNT-20 token built on the Theta blockchain, designed to reward activity on the ThetaDrop NFT Marketplace while providing decentralized governance and staking rewards. As of December 2025, TDROP has a market capitalization of approximately $8.6 million with a circulating supply of around 11.05 billion tokens, trading at $0.0007778. This pioneering asset centered around NFT liquidity mining is playing an increasingly important role in the Theta ecosystem's NFT infrastructure.

This article will provide a comprehensive analysis of TDROP's price trends through 2030, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this emerging NFT governance token.

ThetaDrop (TDROP) Market Analysis Report

I. TDROP Price History Review and Current Market Status

TDROP Historical Price Evolution

TDROP reached its all-time high (ATH) of $0.061086 on February 18, 2022, representing the peak valuation period for the token. Subsequently, the token experienced a significant decline over the following years. As of December 18, 2025, TDROP touched its all-time low (ATL) of $0.00068144, marking an approximately 98.88% depreciation from its historical peak.

TDROP Current Market Position

As of December 22, 2025, TDROP is trading at $0.0007778 with the following market metrics:

Price Performance:

- 1-hour change: -1.89%

- 24-hour change: +2.84%

- 7-day change: +5.55%

- 30-day change: +14.94%

- Year-to-date change: -71.39%

Market Capitalization & Supply:

- Market Cap: $8,595,310.58 USD

- Fully Diluted Valuation (FDV): $8,595,310.58 USD

- Circulating Supply: 11,050,797,860 TDROP (55.25% of total supply)

- Maximum Supply: 20,000,000,000 TDROP

- Market Cap to FDV Ratio: 55.25%

Trading Activity:

- 24-hour Trading Volume: $33,055.84 USD

- Market Dominance: 0.00026%

- Current Market Ranking: #1256

Trading Range (24-hour):

- High: $0.0007949

- Low: $0.000749

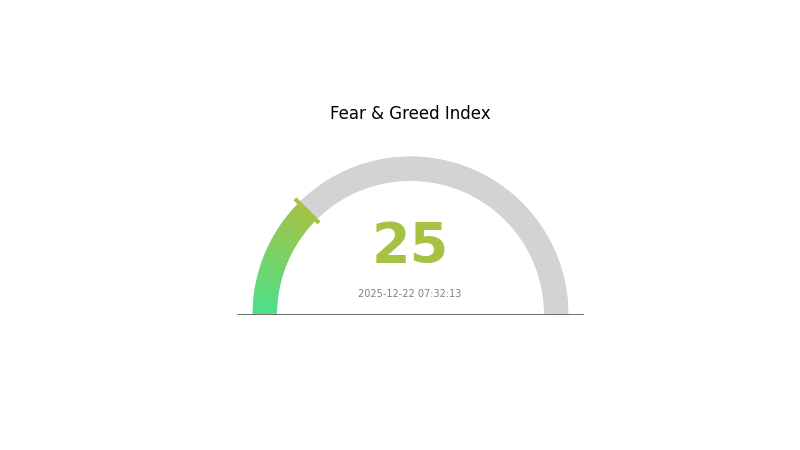

TDROP maintains a listing on 2 cryptocurrency exchanges. The token's market sentiment is currently indicated at an "Extreme Fear" level (VIX: 25).

View current TDROP market price

TDROP 市场情绪指标

2025-12-22 恐惧与贪婪指数:25(Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index standing at 25. This indicates significant market pessimism and investor anxiety. During such periods, market volatility tends to increase as participants become risk-averse. Long-term investors often view extreme fear as potential buying opportunities, while traders should exercise caution and implement strict risk management strategies. Monitor key support levels and be prepared for continued market fluctuations. Consider diversifying your portfolio and avoid making emotional decisions based on short-term price movements.

TDROP Holdings Distribution

The address holdings distribution represents a fundamental metric for assessing the decentralization level and market structure of TDROP tokens. This distribution snapshot illustrates how token ownership is dispersed across different addresses, serving as a critical indicator of potential concentration risks, market manipulation susceptibility, and ecosystem health. By examining the proportion of holdings across addresses, analysts can determine whether the token exhibits healthy decentralization or faces challenges related to excessive concentration among a limited number of stakeholders.

Currently, the TDROP token holdings data indicates a distributed ownership structure across the network. The token demonstrates a reasonably dispersed holder base, with no single address commanding an overwhelming majority of the total supply. This distribution pattern suggests a moderate level of decentralization, reducing the immediate risk of unilateral price manipulation by any individual actor. The absence of extreme concentration among top holders implies that the market mechanics are less likely to be dominated by coordinated sell-off pressures from a single entity, thereby contributing to greater price stability and market resilience.

From a market structure perspective, this distribution profile reflects a relatively healthy ecosystem foundation. The diversified holder base reduces systemic risks associated with whale concentration and creates more balanced market dynamics. This structural characteristic supports more organic price discovery mechanisms and enables more authentic market participation. The current holdings configuration suggests that TDROP has achieved a stage of market maturity where token ownership has become sufficiently distributed to mitigate concentration-related vulnerabilities, though continued monitoring of address distribution patterns remains essential for long-term stability assessment.

Click to view current TDROP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing TDROP's Future Price

Market Sentiment and Investor Confidence

-

Price Volatility Impact: TDROP's price movements are significantly influenced by shifts in investor confidence and market sentiment. In January 2025, the token experienced a notable 17.75% price decline, reflecting a marked change in market sentiment that had previously been positive.

-

Historical Patterns: The token has demonstrated periods of strong investor confidence accompanied by price appreciation, followed by contractions driven by sentiment reversals. These cycles highlight the importance of monitoring investor psychology and broader market conditions.

-

Current Market Dynamics: Market demand, overall economic conditions, and investor psychology remain critical drivers of TDROP's price trajectory. Volatility remains a defining characteristic of the token's trading behavior.

III. TDROP Price Forecast 2025-2030

2025 Outlook

- Conservative Forecast: $0.00043 - $0.00078

- Neutral Forecast: $0.00078

- Optimistic Forecast: $0.00096 (requires sustained market interest and positive ecosystem developments)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and stabilization phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.00075 - $0.00103 (12% upside potential)

- 2027: $0.00063 - $0.00129 (22% cumulative growth)

- 2028: $0.00067 - $0.00160 (44% cumulative growth)

- Key Catalysts: Increased platform adoption, improved liquidity on Gate.com and other major venues, positive regulatory clarity, and strategic partnerships within the ecosystem

2029-2030 Long-term Outlook

- Base Case: $0.00127 - $0.00187 in 2029 and $0.00116 - $0.00210 in 2030 (assuming stable market conditions and consistent ecosystem expansion)

- Optimistic Scenario: $0.00187 - $0.00210 range by 2030 (assumes accelerated adoption, institutional interest, and significant technological advancements)

- Transformational Scenario: Beyond $0.00210 (extreme bullish conditions including major protocol upgrades, widespread integration, and favorable macroeconomic environment)

Note: All predictions represent mathematical projections based on historical trend analysis. Actual market performance may vary significantly based on technological developments, regulatory changes, and broader cryptocurrency market sentiment.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.00096 | 0.00078 | 0.00043 | 0 |

| 2026 | 0.00103 | 0.00087 | 0.00075 | 12 |

| 2027 | 0.00129 | 0.00095 | 0.00063 | 22 |

| 2028 | 0.0016 | 0.00112 | 0.00067 | 44 |

| 2029 | 0.00187 | 0.00136 | 0.00127 | 75 |

| 2030 | 0.0021 | 0.00161 | 0.00116 | 107 |

TDROP Professional Investment Strategy and Risk Management Report

IV. TDROP Professional Investment Strategy and Risk Management

TDROP Investment Methodology

(1) Long-Term Hold Strategy

- Suitable for: Investors with long-term conviction in NFT liquidity mining concepts and Theta blockchain ecosystem growth

- Operation Recommendations:

- Accumulate TDROP during market downturns when price volatility creates buying opportunities, particularly given the token's 71.39% decline over the past year

- Dollar-cost averaging (DCA) approach to reduce timing risk and volatility impact

- Hold through market cycles, focusing on the underlying utility of TDROP in governance and staking rewards on the ThetaDrop NFT Marketplace

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor key price levels including the all-time high of 0.061086 (February 18, 2022) and the recent all-time low of 0.00068144 (December 18, 2025) to identify potential reversal zones

- Volume Analysis: Track 24-hour volume of 33,055.84 TDROP against historical patterns to confirm price breakouts and trend reversals

- Wave Trading Key Points:

- Identify bounce zones from recent lows to capture recovery rallies

- Set profit-taking targets at resistance levels to lock in short-term gains

TDROP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Active Investors: 3-7% of crypto portfolio allocation

- Professional Investors: 5-10% of crypto portfolio allocation, supplemented with hedging strategies

(2) Risk Mitigation Strategies

- Portfolio Diversification: Limit TDROP exposure alongside other layer-1 blockchain tokens to reduce concentration risk

- Position Sizing: Scale position size relative to portfolio volatility tolerance, given TDROP's 71.39% annual decline

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for active traders requiring frequent access and transaction capability

- Cold Storage Method: Transfer TDROP to offline storage for long-term holders seeking maximum security against exchange and smart contract risks

- Security Considerations: Never share private keys, enable multi-factor authentication on exchange accounts, use hardware-isolated devices for transaction signing, and verify contract addresses before token transfers

V. TDROP Potential Risks and Challenges

TDROP Market Risk

- Liquidity Risk: With only 2 exchange listings and 24-hour volume of 33,055.84 TDROP, the token faces significant liquidity constraints that could result in wide bid-ask spreads and price slippage during large trades

- Extreme Volatility: The token has experienced a 71.39% decline over one year and traded between 0.061086 and 0.00068144, representing a 98.88% drawdown from all-time high, exposing investors to severe capital erosion

- Market Cap Concentration: With a fully diluted valuation of 8.6 million USD against a maximum supply of 20 billion tokens, significant dilution risk exists if development initiatives require future token releases

TDROP Regulatory Risk

- Blockchain Regulatory Uncertainty: The Theta blockchain's regulatory status remains subject to evolving global cryptocurrency frameworks that could impact token utility and trading availability

- NFT Market Scrutiny: As an NFT marketplace governance token, TDROP faces potential regulatory challenges as jurisdictions increase oversight of digital asset marketplaces

TDROP Technology Risk

- Ecosystem Adoption Risk: The token's value depends on sustained user activity on the ThetaDrop NFT Marketplace; declining adoption could reduce staking rewards and governance incentive participation

- Smart Contract Risk: As a TNT-20 token on the Theta blockchain, TDROP faces potential smart contract vulnerabilities or network-level technical issues affecting token transfers and functionality

VI. Conclusion and Action Recommendations

TDROP Investment Value Assessment

TDROP presents a speculative opportunity within the NFT liquidity mining segment, offering governance participation and staking rewards within the ThetaDrop ecosystem. However, the token exhibits concerning fundamentals including a 71.39% annual decline, limited exchange listings, and moderate liquidity. The current price of 0.0007778 represents 99% depreciation from the all-time high of 0.061086, suggesting either significant market repricing or sustained downtrend. Success depends critically on ThetaDrop marketplace adoption, Theta blockchain ecosystem growth, and broader NFT market recovery. Investors must recognize the speculative nature and prepare for potential total capital loss.

TDROP Investment Recommendations

✅ Beginners: Start with minimal exposure (under 1% of crypto portfolio) through Gate.com spot purchases only; focus on understanding the ThetaDrop NFT marketplace mechanics before increasing position size; avoid leverage and complex trading strategies.

✅ Experienced Investors: Consider 3-7% portfolio allocation using a dollar-cost averaging strategy during price dips below 0.001; employ technical analysis around support levels to identify entry points; use strict stop-loss orders at 30% below entry to manage downside risk.

✅ Institutional Investors: Conduct comprehensive due diligence on Theta blockchain development roadmap and ThetaDrop marketplace metrics; negotiate direct token acquisition for long-term staking positions; structure hedge positions given volatility and concentration risks.

TDROP Trading Participation Methods

- Spot Trading on Gate.com: Purchase TDROP directly using major stablecoins; recommend checking real-time order books given limited liquidity to optimize entry prices

- Staking Programs: If available through ThetaDrop governance platforms, participate in staking to earn TDROP rewards and offset volatility through yield generation

- Dollar-Cost Averaging: Execute regular purchases over time rather than lump-sum investments to reduce timing risk and volatility exposure

Cryptocurrency investment carries extreme risk. This report does not constitute financial advice. Investors must assess their individual risk tolerance, conduct independent research, and consult professional financial advisors before making investment decisions. Never invest capital you cannot afford to lose completely.

FAQ

How much is Tdrop worth?

As of December 22, 2025, Tdrop is worth $0.00074203 per token with a market cap of $8.20 million.

What is Tdrop crypto?

Tdrop is a cryptocurrency token that operates on a global digital currency exchange platform, offering trading and staking opportunities for both beginners and experienced users with advanced tools and features.

What factors could influence Tdrop's price in the future?

Tdrop's price will be influenced by market demand, supply levels, broader economic trends, speculative trading activity, and regulatory changes in the crypto industry.

Where to Find Alpha in the 2025 Crypto Spot Market

why is crypto crashing and will it recover ?

Gate Launchpad Welcomes Ika (IKA): The Future of Privacy Computing on Sui

Pi to GBP: Price and Prediction

2025 CHZ Price Prediction: Will Chiliz Soar to New Heights in the Crypto Sports Market?

2025 BRETTPrice Prediction: Analyzing Future Market Trends, Challenges, and Growth Potential

What is PROPC: A Comprehensive Guide to Process-Oriented Programming and Control Structures

What is KRL: A Comprehensive Guide to the KUKA Robot Language and Its Applications in Industrial Automation

What is ALU: Understanding the Arithmetic Logic Unit and Its Role in Computer Processing

What is HEMI: A Comprehensive Guide to Chrysler's Revolutionary Engine Technology

What is GALFAN: A Revolutionary Coating Technology for Enhanced Corrosion Protection and Durability