2025 TUT Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: TUT's Market Position and Investment Value

Tutorial (TUT) is an AI-driven educational platform designed to help users understand blockchain and cryptocurrency, particularly within the BNB Chain ecosystem. Since its launch, TUT has established itself as an innovative tool in the crypto education space through its flagship product, "Tutorial Agent," an intelligent tutor that breaks down complex blockchain concepts into accessible lessons. As of December 21, 2025, TUT has achieved a market capitalization of $12.66 million with a circulating supply of 1 billion tokens, currently trading at $0.01266 per token.

This emerging educational asset is playing an increasingly important role in democratizing blockchain knowledge and lowering barriers to entry for newcomers in the cryptocurrency ecosystem. The TUT token serves multiple functions within the platform, including user rewards, feature unlocking, and platform governance.

This article provides a comprehensive analysis of TUT's price dynamics and market trends through 2025-2030, incorporating historical price patterns, market supply and demand fundamentals, ecosystem development, and macroeconomic factors. We aim to deliver professional price forecasts and practical investment strategies for investors seeking exposure to this innovative educational platform.

Tutorial (TUT) Market Analysis Report

I. TUT Price History Review and Current Market Status

TUT Historical Price Evolution Trajectory

- September 20, 2025: TUT reached its all-time high of $0.18675, representing the peak of the token's price performance since launch.

- October 10, 2025: TUT hit its all-time low of $0.00844, marking a significant correction from its previous highs.

- December 21, 2025: Following the volatile period from September to October, TUT stabilized around $0.01266, reflecting ongoing market consolidation.

TUT Current Market Dynamics

As of December 21, 2025, TUT is trading at $0.01266 with a 24-hour trading volume of 106,169.58 tokens. The token shows modest resilience with a positive 24-hour price change of +0.07%, though it has experienced notable declines over longer timeframes with a -7.33% pullback over the past 7 days and -14.00% over the past 30 days. Notably, TUT demonstrates impressive year-to-date performance with a +4,878.17% gain since its inception.

The current market capitalization stands at $12.66 million with a fully diluted valuation matching this figure, as the circulating supply equals the total supply of 1 billion tokens (100% circulation ratio). TUT maintains a market dominance of 0.00039%, ranking 1,064th among all cryptocurrencies.

The token operates on the BNB Chain as a BEP-20 standard asset with contract address 0xcaae2a2f939f51d97cdfa9a86e79e3f085b799f3. With 17,447 token holders and availability on 21 exchanges, TUT demonstrates reasonable market distribution and accessibility. The 24-hour trading range spans from $0.01255 to $0.01315, indicating relatively tight price action in the short term.

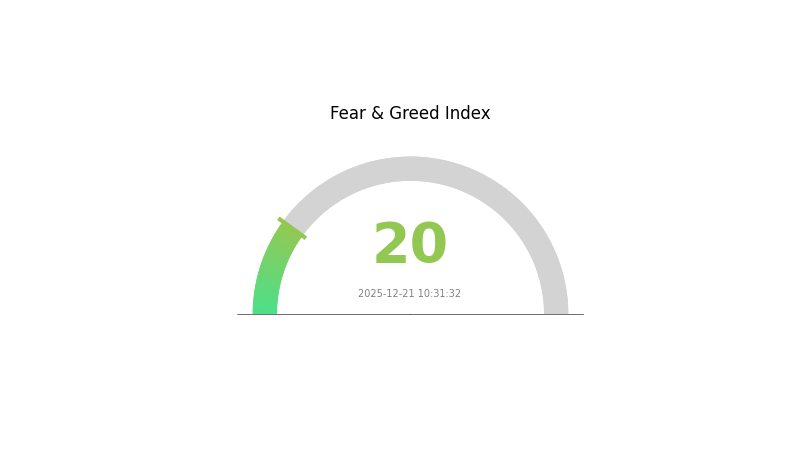

Current market sentiment reflects extreme fear with a VIX reading of 20, which may present both challenges and opportunities for market participants navigating the broader cryptocurrency landscape.

Check out TUT's current market price

TUT Market Sentiment Indicator

2025-12-21 Fear and Greed Index: 20 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 20. This indicates significant market pessimism and heightened investor anxiety. During such periods, market volatility typically increases as traders adopt defensive positions. This extreme fear phase often presents contrarian opportunities for long-term investors, as excessive pessimism may have priced in worst-case scenarios. However, caution remains warranted until stabilization signals emerge. Monitor key support levels and market fundamentals closely on Gate.com to make informed trading decisions.

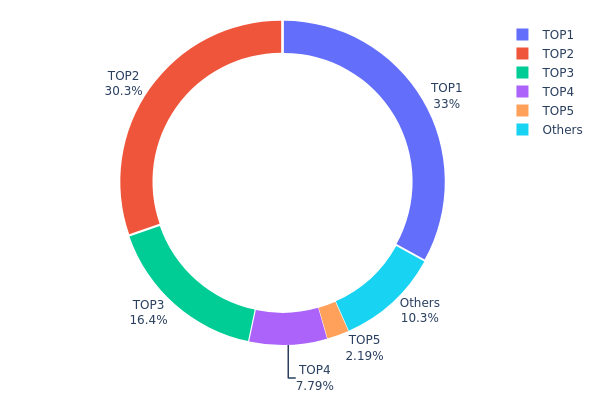

TUT Holding Distribution

The address holding distribution map illustrates the concentration of token ownership across the blockchain network by tracking the allocation percentages held by major addresses. This metric serves as a critical indicator of market decentralization, liquidity dynamics, and potential vulnerability to large-scale sell-offs or price manipulation. By analyzing the top holders' positions relative to total supply, analysts can assess the overall health and stability of the token's on-chain ecosystem.

TUT demonstrates notable concentration characteristics in its current holding structure. The top two addresses command 63.35% of the total supply, with the largest holder maintaining 33.04% and the second-largest holding 30.31% respectively. The third address, categorized as a burn or dead wallet, accounts for 16.35%, effectively removing this portion from active circulation. Together, the top five addresses control 89.66% of all TUT tokens, while the remaining holders collectively represent only 10.34% of the supply. This distribution pattern reveals significant centralization, with the token's ownership heavily concentrated among a limited number of addresses rather than being widely dispersed across the community.

The concentration observed in TUT's holding distribution carries substantial implications for market dynamics and structural stability. High concentration levels increase the potential for dramatic price volatility, as strategic moves by major holders could substantially impact market conditions. The dominance of the top two addresses suggests that price action and market liquidity may be disproportionately influenced by their trading decisions, potentially constraining the token's ability to establish organic price discovery mechanisms. While the substantial dead wallet holdings do reduce the effective circulating supply, the remaining active concentration levels warrant attention regarding market resilience and decentralization objectives.

Click to view current TUT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x5a52...70efcb | 330415.25K | 33.04% |

| 2 | 0xf977...41acec | 303146.96K | 30.31% |

| 3 | 0x0000...00dead | 163581.97K | 16.35% |

| 4 | 0x6daf...8a8d1f | 77884.26K | 7.78% |

| 5 | 0xffa8...44cd54 | 21887.81K | 2.18% |

| - | Others | 103083.75K | 10.34% |

II. Core Factors Influencing TUT's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: TUT's price movements are influenced by major central bank policy expectations and monetary cycles. Changes in global interest rates and liquidity conditions directly affect cryptocurrency market sentiment and capital flows into digital assets.

-

Investor Sentiment and Policy Changes: Market psychology plays a significant role in TUT's price trajectory. Policy shifts at both national and international levels can trigger substantial price volatility, as investors reassess risk-reward dynamics in the broader crypto market ecosystem.

Note: The provided research materials contain limited specific information about TUT's supply mechanisms, institutional holdings, enterprise adoption, geopolitical factors, technological upgrades, and ecosystem applications. To provide comprehensive analysis across all template sections, more detailed project-specific documentation would be required.

Three、2025-2030 TUT Price Forecast

2025 Outlook

- Conservative Forecast: $0.00999 - $0.01264

- Neutral Forecast: $0.01264

- Optimistic Forecast: $0.01605 (requires sustained market interest and positive ecosystem developments)

2026-2027 Mid-term Outlook

- Market Stage Expectation: Consolidation phase with gradual recovery, characterized by moderate volatility and potential accumulation opportunities.

- Price Range Forecast:

- 2026: $0.00990 - $0.01506

- 2027: $0.00926 - $0.01838

- Key Catalysts: Project milestone achievements, ecosystem expansion, increased institutional adoption, and broader market sentiment shifts.

2028-2030 Long-term Outlook

- Base Case Scenario: $0.01654 - $0.02316 (assumes steady ecosystem development and moderate market growth)

- Optimistic Scenario: $0.01985 - $0.02523 (assumes accelerated adoption, strategic partnerships, and favorable regulatory environment)

- Transformative Scenario: $0.02523+ (requires breakthrough technological innovation, mainstream institutional involvement, and significant market capitalization expansion)

- 2030-12-21: TUT approaches $0.02523 as potential annual peak (reflecting cumulative 60% upside potential from current levels)

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01605 | 0.01264 | 0.00999 | 0 |

| 2026 | 0.01506 | 0.01435 | 0.0099 | 13 |

| 2027 | 0.01838 | 0.01471 | 0.00926 | 16 |

| 2028 | 0.02316 | 0.01654 | 0.00993 | 30 |

| 2029 | 0.02084 | 0.01985 | 0.0133 | 56 |

| 2030 | 0.02523 | 0.02035 | 0.01831 | 60 |

TUT Token Professional Investment Strategy and Risk Management Report

IV. TUT Professional Investment Strategy and Risk Management

TUT Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Investors seeking exposure to AI-driven educational platforms within the BNB Chain ecosystem; users interested in blockchain education adoption

- Operational Recommendations:

- Accumulate TUT tokens during market downturns, taking advantage of the -14% monthly decline to build a diversified position aligned with your investment timeline

- Participate in the platform's governance and utility functions as $TUT rewards users for engagement and learning activities

- Monitor the development progress of Tutorial Agent features and ecosystem expansion on BNB Chain

(2) Active Trading Strategy

- Technical Analysis Considerations:

- 24-hour Price Action: Currently trading at $0.01266 with a 24-hour range between $0.01255 and $0.01315; monitor this volatility band for entry and exit signals

- 7-day and 30-day Trends: The asset shows weakness with -7.33% and -14% declines respectively, suggesting potential consolidation before potential recovery

- Wave Trading Key Points:

- Support Level Recognition: The 24-hour low of $0.01255 and historical low of $0.00844 represent key support zones

- Resistance Level Analysis: The all-time high of $0.18675 (reached September 20, 2025) provides long-term resistance; nearer-term resistance exists around $0.01315

TUT Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-8% of total portfolio allocation

- Professional Investors: Up to 10-15% of alternative asset allocation, depending on research-driven conviction

(2) Risk Hedging Strategies

- Position Sizing: Implement strict position limits based on your risk tolerance; given TUT's -14% monthly performance, consider dollar-cost averaging over time rather than lump-sum purchases

- Diversification: Balance TUT holdings with other blockchain education and infrastructure projects to reduce single-asset concentration risk

(3) Secure Storage Solutions

- Hot wallet for Trading: Use Gate.com's integrated wallet for active trading and frequent transactions, enabling quick access to liquidity

- Cold Storage for Long-term Holdings: Consider secure storage methods for long-term positions to protect against exchange risk

- Security Best Practices: Enable two-factor authentication on all exchange accounts; use strong, unique passwords; regularly audit wallet permissions and connected dApps

V. TUT Potential Risks and Challenges

TUT Market Risks

- Liquidity Risk: With 24-hour trading volume of $106,169.58 and 1 billion circulating tokens, TUT faces potential liquidity constraints during market stress; large position exits could result in significant slippage

- Price Volatility: TUT demonstrates extreme volatility, with a -14% monthly decline and all-time high 4878% annual return, indicating speculative market dynamics and potential sharp drawdowns

- Market Adoption Risk: As an early-stage educational platform, Tutorial Agent's success depends on achieving sufficient user adoption and retention within the competitive blockchain education space

TUT Regulatory Risks

- Token Classification Uncertainty: Regulatory bodies may classify $TUT as a security, potentially triggering compliance requirements or trading restrictions across jurisdictions

- Geographic Restrictions: Certain countries may restrict or prohibit trading in educational tokens or decentralized governance tokens, limiting market accessibility

- Evolving Compliance Framework: The regulatory landscape for crypto-educational platforms remains nascent; future regulations could impact platform operations and token utility

TUT Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, TUT depends on the security of its underlying smart contract; code audits are essential to verify security standards

- Blockchain Network Risk: BSC network disruptions or congestion could impact TUT's liquidity and trading functionality

- Platform Development Risk: The Tutorial Agent's educational effectiveness and feature rollout timelines are critical to long-term value proposition; development delays could undermine token utility and user adoption

VI. Conclusion and Action Recommendations

TUT Investment Value Assessment

Tutorial (TUT) represents a speculative play on AI-driven blockchain education within the BNB Chain ecosystem. The project's utility centers on rewarding users, unlocking platform features, and governance participation. However, at a $12.66M market cap, TUT faces significant execution risk in achieving mainstream adoption. The token's extreme volatility—ranging from $0.00844 to $0.18675 historically—reflects market uncertainty and speculative positioning. Long-term value depends on Tutorial Agent's development progress, user acquisition metrics, and sustained engagement within the educational platform. Current weakness (-14% monthly performance) may present accumulation opportunities for conviction-based investors, though downside risks remain substantial given the early-stage nature of the project.

TUT Investment Recommendations

✅ Beginners: Start with small pilot positions (1-3% of alternative asset budget); use dollar-cost averaging over 3-6 months to reduce timing risk; focus on understanding the Tutorial Agent roadmap before committing capital

✅ Experienced Investors: Consider 3-8% portfolio allocation if technical fundamentals align; implement disciplined stop-loss orders at 15-20% below entry prices; actively monitor user adoption metrics and platform development announcements

✅ Institutional Investors: Conduct thorough smart contract audits and legal review before significant allocation; structure positions through multiple tranches; maintain quarterly reviews of platform adoption data and regulatory developments

TUT Trading Participation Methods

- Gate.com Direct Trading: Access TUT trading pairs on Gate.com with competitive spreads and integrated wallet functionality; leverage Gate.com's advanced charting tools for technical analysis

- Spot Market Accumulation: Execute market or limit orders based on your predetermined entry prices; utilize Gate.com's order types for precise execution

- Portfolio Monitoring: Use Gate.com's portfolio tracking features to monitor TUT holdings in real-time and set price alerts for key support and resistance levels

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must carefully evaluate their personal risk tolerance and conduct independent research. Consult professional financial advisors before making investment decisions. Never invest capital you cannot afford to lose.

FAQ

Is tut coin a good investment?

TUT coin shows promising fundamentals with growing adoption and strong community support. Market analysis suggests potential for significant growth in 2025-2026. However, conduct thorough research before investing, as crypto markets remain volatile and unpredictable.

What is TUT coin and what is its use case?

TUT coin is a blockchain-based token designed for the online education ecosystem. It rewards students and educators for their participation and contributions, creating incentives within decentralized learning platforms.

What factors could influence TUT coin price in the future?

TUT price is influenced by project announcements, technological developments, market sentiment, trading volume, regulatory changes, and broader cryptocurrency market trends. Ecosystem growth and adoption also play key roles in determining future price movements.

What is the current market cap and trading volume of TUT coin?

As of 2025-12-21, TUT coin has a market cap of $10.62 million with 24-hour trading volume of $2.69 million, reflecting steady market activity and investor interest in this blockchain-based tutorial platform token.

Is Tutorial (TUT) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential in 2024

CTP vs BNB: Comparing Two Leading Crypto Exchanges for Optimal Trading Experience

BUZZ vs BNB: The Battle for Crypto Dominance in Social Media Platforms

AIL vs BNB: Comparing Two Popular Crypto Assets for Long-Term Investment

Is Tutorial (TUT) a good investment?: Analyzing the Potential Returns and Risks of this Blockchain-Based Learning Platform

AIX9 vs BNB: Which Cryptocurrency Will Dominate the Market in 2024?

What is PROPC: A Comprehensive Guide to Process-Oriented Programming and Control Structures

What is KRL: A Comprehensive Guide to the KUKA Robot Language and Its Applications in Industrial Automation

What is ALU: Understanding the Arithmetic Logic Unit and Its Role in Computer Processing

What is HEMI: A Comprehensive Guide to Chrysler's Revolutionary Engine Technology

What is GALFAN: A Revolutionary Coating Technology for Enhanced Corrosion Protection and Durability