2025 UOS Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: Market Position and Investment Value of UOS

Ultra (UOS) is a blockchain protocol and platform designed to disrupt the $140 billion gaming industry by enabling anyone to establish and operate their own game distribution platforms or virtual commodity trading services. Since its inception in 2019, Ultra has challenged the monopoly held by industry giants such as Steam, Google, and Apple. As of 2025, UOS has achieved a market capitalization of approximately $4.05 million with a circulating supply of around 488 million tokens, currently trading at $0.008297. This innovative asset, recognized for its utility-driven ecosystem approach, is playing an increasingly important role in democratizing game distribution and enabling decentralized virtual commerce.

This article will provide a comprehensive analysis of UOS price trends from 2025 to 2030, integrating historical performance patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to deliver professional price forecasts and practical investment strategies for stakeholders.

Ultra (UOS) Market Analysis Report

I. UOS Price History Review and Current Market Status

UOS Historical Price Evolution

-

2021: Peak Performance, UOS reached its all-time high (ATH) of $2.49 on November 25, 2021, representing the apex of market enthusiasm during the broader cryptocurrency bull cycle.

-

2021-2025: Extended Downtrend, UOS experienced a prolonged bearish period, declining from its historical peak, with cumulative losses reflecting challenging market conditions and shifting investor sentiment toward gaming blockchain projects.

-

December 2025: New Low Territory, UOS hit its all-time low (ATL) of $0.00773489 on December 17, 2025, marking a significant 90.79% depreciation over the past year.

UOS Current Market Dynamics

As of December 24, 2025, UOS is trading at $0.008297, reflecting a marginal recovery of 1.86% over the past 24 hours after touching the ATL just days earlier. The token demonstrates modest short-term strength with a 1-hour gain of 0.72% and a 7-day advance of 1.72%, though the 30-day performance remains decidedly negative at -28.34%.

The trading volume over the past 24 hours stands at approximately $21,480.74, indicating relatively subdued market activity. UOS maintains a market capitalization of approximately $4.05 million against a fully diluted valuation of $8.30 million, representing 48.80% market cap to FDV ratio. With a circulating supply of 488,003,473 tokens out of a maximum supply of 1 billion, the token ranks 1,665th by market capitalization.

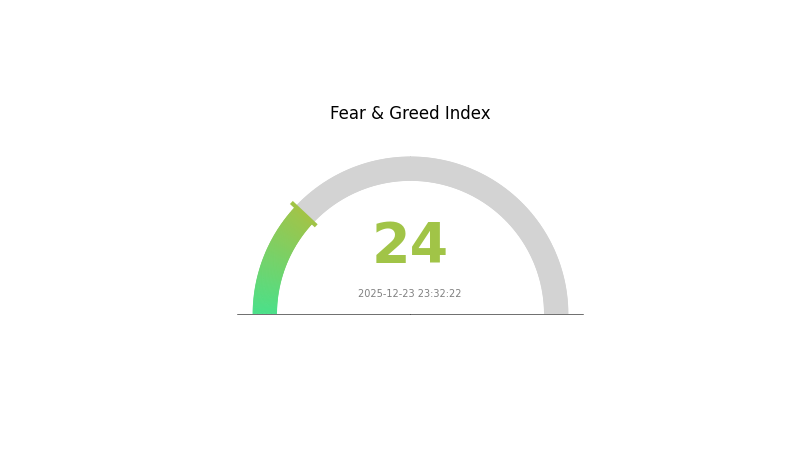

The current market sentiment remains pessimistic, with the Fear and Greed Index registering at 24, signifying "Extreme Fear" among market participants. The token is available for trading across six major exchange platforms and currently held by approximately 23,841 unique addresses.

Click to view current UOS market price

UOS Market Sentiment Indicator

2025-12-23 Fear & Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear & Greed Index dropping to 24. This signals significant market pessimism and potential panic selling pressure. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors, as markets tend to be oversold. However, caution remains essential as volatility may persist. Monitor key support levels closely and consider dollar-cost averaging strategies. On Gate.com, you can track real-time market sentiment indicators to make informed trading decisions during these volatile periods.

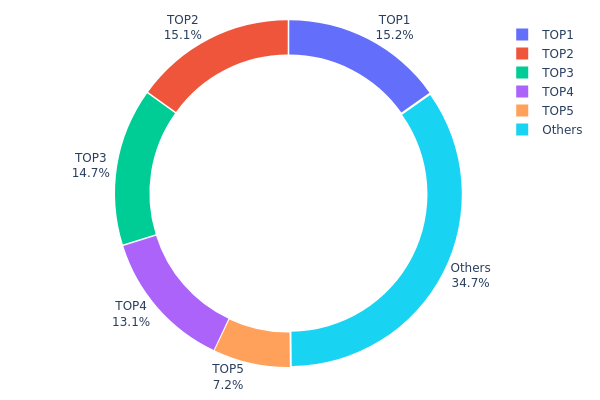

UOS Holdings Distribution

The address holdings distribution chart illustrates the concentration of UOS tokens across blockchain addresses, providing critical insight into the token's ownership structure and potential market dynamics. By analyzing the top holders and their proportional stakes, we can assess the degree of decentralization and evaluate risks associated with token concentration.

Current data reveals a moderately concentrated holder structure, with the top four addresses collectively controlling approximately 58.14% of total UOS supply. The leading address (0xca5f...fbbc26) holds 15.18%, followed closely by three other major holders each representing between 13.13% and 15.10% of circulating tokens. While this concentration level is not extreme by industry standards, it remains significant enough to warrant attention regarding potential market influence. The fifth-largest holder maintains a notably smaller position at 7.19%, indicating a considerable gap between the top tier and secondary holders. The remaining 34.67% distributed among other addresses suggests a degree of decentralization in the secondary tier.

The current distribution pattern presents both structural considerations and market implications. The presence of four similarly-sized major holders rather than a single dominant wallet may reduce acute manipulation risks compared to more extreme concentration scenarios. However, coordinated actions among these top four addresses could theoretically influence market sentiment and price movements due to their combined majority stake. The gap between the top five holders and remaining addresses indicates that UOS ownership follows a typical power-law distribution common in cryptocurrency markets. This structure reflects a moderately decentralized ecosystem with sufficient smaller holders to provide baseline liquidity support, yet concentrated enough that major holder activities warrant monitoring for potential volatility.

Access current UOS holdings distribution data

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xca5f...fbbc26 | 151859.75K | 15.18% |

| 2 | 0xa353...e1ecf1 | 151036.66K | 15.10% |

| 3 | 0x7b5d...2cf8b1 | 147300.00K | 14.73% |

| 4 | 0xd13c...ab5c8c | 131301.19K | 13.13% |

| 5 | 0xc9e8...5e87ca | 71978.11K | 7.19% |

| - | Others | 346524.29K | 34.67% |

II. Core Factors Affecting UOS Future Price

Supply Mechanism

- Halving Events: UOS price movements are influenced by periodic supply reductions similar to Bitcoin's halving cycle. These events create cyclical patterns in the cryptocurrency market by constraining token supply during specific periods.

- Historical Patterns: Halving events have historically demonstrated their ability to influence price dynamics across cryptocurrency markets. The periodic reduction in supply typically correlates with market sentiment shifts and investor positioning.

- Current Supply Impact: Market demand dynamics and the constrained supply environment are expected to continue shaping UOS price trajectories as investors closely monitor supply-side developments.

Macroeconomic Environment

- Monetary Policy Impact: Global central bank policies play a significant role in cryptocurrency valuation. Current monetary conditions and policy expectations influence capital flows into digital assets and affect overall market liquidity for tokens like UOS.

- Inflation Hedge Characteristics: Cryptocurrencies are increasingly viewed as potential inflation hedges. As macroeconomic conditions evolve, investors reassess their portfolio allocations toward assets that may provide protection against currency debasement.

- Geopolitical Factors: International geopolitical developments and trade dynamics create market uncertainty that can influence capital flows into cryptocurrency markets, including UOS trading activity and valuation.

Technology Development and Ecosystem Building

- Market Acceptance: Technological progress and growing market adoption serve as key drivers for long-term price appreciation. Investor attention to technological advancements and ecosystem development remains critical for sustaining growth momentum.

- Ecosystem Applications: The expansion of blockchain ecosystem applications and use cases directly impacts token utility and market demand. Development of DApps and ecosystem projects strengthens the fundamental value proposition of blockchain networks.

III. 2025-2030 UOS Price Prediction

2025 Outlook

- Conservative Forecast: $0.00704-$0.00828

- Neutral Forecast: $0.00828

- Optimistic Forecast: $0.01159 (requires sustained platform adoption and positive market sentiment)

2026-2028 Medium-term Outlook

- Market Phase Expectation: Gradual recovery with volatility, characterized by incremental growth as the ecosystem matures and user adoption expands.

- Price Range Predictions:

- 2026: $0.00507-$0.01103 (19% upside potential)

- 2027: $0.00954-$0.01321 (26% projected gain)

- 2028: $0.00746-$0.01279 (42% cumulative appreciation)

- Key Catalysts: Enhanced platform functionality, increased enterprise adoption, improvements in transaction efficiency, and broader blockchain market recovery.

2029-2030 Long-term Outlook

- Base Case Scenario: $0.00862-$0.01774 for 2029 and $0.00947-$0.01924 for 2030 (assumes moderate ecosystem growth and stable macroeconomic conditions)

- Optimistic Scenario: $0.01774-$0.01924 range (assumes strong institutional adoption and significant platform expansion)

- Transformative Scenario: Extended growth trajectory with 48-81% appreciation through 2030 (assumes breakthrough protocol upgrades, major partnership announcements, and sustained industry momentum)

- 2025-12-24: UOS remains in early recovery phase with 0% change, establishing foundation for projected multi-year appreciation.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.01159 | 0.00828 | 0.00704 | 0 |

| 2026 | 0.01103 | 0.00994 | 0.00507 | 19 |

| 2027 | 0.01321 | 0.01048 | 0.00954 | 26 |

| 2028 | 0.01279 | 0.01185 | 0.00746 | 42 |

| 2029 | 0.01774 | 0.01232 | 0.00862 | 48 |

| 2030 | 0.01924 | 0.01503 | 0.00947 | 81 |

Ultra (UOS) Professional Investment Strategy and Risk Management Report

IV. UOS Professional Investment Strategy and Risk Management

UOS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of blockchain-based gaming platforms and are willing to tolerate short-term volatility

- Operational recommendations:

- Dollar-cost averaging (DCA) approach: accumulate UOS tokens gradually over time to reduce the impact of price volatility

- Focus on the Ultra platform's development progress and ecosystem expansion announcements

- Store tokens in secure wallets and avoid frequent trading during market downturns

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Identify key price levels where buying or selling pressure emerges (current support near $0.00773, resistance near $0.009537)

- Moving Averages: Use 20-day and 50-day moving averages to identify trend direction and potential breakout opportunities

- Wave Trading Key Points:

- Monitor the 24-hour trading volume of 21,480.74 UOS to gauge market sentiment and entry/exit opportunities

- Pay attention to price movements within the 52-week range ($0.00773 - $2.49) to identify potential reversal points

UOS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of total portfolio allocation

- Active Investors: 3-5% of total portfolio allocation

- Professional Investors: 5-10% of total portfolio allocation (with hedging strategies)

(2) Risk Hedging Solutions

- Position Sizing: Limit single position size to prevent catastrophic losses during market downturns

- Portfolio Diversification: Combine UOS holdings with other cryptocurrency and traditional assets to reduce concentration risk

(3) Secure Storage Solutions

- Hot Wallet Solution: Use Gate.com's Web3 wallet for frequent trading and liquidity needs

- Cold Storage Approach: Transfer long-term holdings to self-custody solutions with strong security protocols

- Security Precautions: Enable two-factor authentication, use strong passwords, never share private keys, and regularly verify wallet addresses before transactions

V. UOS Potential Risks and Challenges

UOS Market Risk

- Extreme Volatility: UOS has experienced an 88% decline from its all-time high of $2.49 (November 25, 2021) to current levels, indicating significant price instability and speculative market dynamics

- Low Trading Liquidity: With 24-hour volume of only 21,480.74 UOS and listed on only 6 exchanges, limited liquidity could amplify price movements and create slippage risks

- Market Sentiment Dependency: The token's value remains highly dependent on investor sentiment regarding the Ultra platform's development and gaming industry adoption potential

UOS Regulatory Risk

- Gaming Industry Regulation: Increased regulatory scrutiny on blockchain-based gaming platforms and virtual asset transactions could impact the Ultra ecosystem

- Jurisdictional Restrictions: Different countries may impose varying restrictions on token usage and trading, affecting the platform's global expansion plans

- Compliance Requirements: Future regulatory changes could require the Ultra platform to implement additional compliance measures, potentially affecting token utility and value

UOS Technology Risk

- Platform Execution Risk: The success of UOS depends on Ultra's ability to successfully compete against established gaming distribution platforms and attract game developers

- Smart Contract Vulnerability: Potential security vulnerabilities in the Ethereum-based token contract could expose users to losses

- Adoption Uncertainty: The platform's success relies on achieving significant adoption from game developers and users, which remains uncertain given the entrenched position of competitors like Steam

VI. Conclusion and Action Recommendations

UOS Investment Value Assessment

Ultra's vision of disrupting the $140 billion gaming industry through blockchain technology presents an ambitious long-term value proposition. However, the project faces significant headwinds, as evidenced by the 90.79% annual decline and extremely low current trading volume. The token's utility is directly tied to the Ultra platform's ability to achieve meaningful adoption and compete against dominant market players. Current market conditions suggest substantial downside risk, though early-stage believers in decentralized gaming platforms may view this as a contrarian opportunity. The 48.80% circulation ratio indicates that token supply dynamics could create additional sell pressure in the medium term.

UOS Investment Recommendations

✅ Beginners: Start with minimal allocations (under 1% of portfolio) through Gate.com only after thoroughly researching the Ultra platform's development progress. Avoid attempting active trading given the low liquidity.

✅ Experienced Investors: Consider dollar-cost averaging into small positions only if you have a strong conviction in blockchain-based gaming adoption timelines. Use strict stop-losses at 20-30% below entry price to manage downside risk.

✅ Institutional Investors: Evaluate UOS only as a speculative position within a diversified cryptocurrency portfolio, with position sizing limited to 2-5% maximum due to market cap concentration risk and execution uncertainty.

UOS Trading Participation Methods

- Gate.com Spot Trading: Purchase UOS directly through Gate.com's spot market for immediate ownership and flexible holding periods

- Limit Orders: Set predetermined buy levels during price weakness to improve entry prices and reduce emotional decision-making

- Portfolio Rebalancing: Periodically review UOS holdings as part of broader portfolio management to maintain target allocation percentages

Cryptocurrency investments carry extremely high risk. This report does not constitute investment advice. Investors must make decisions based on their individual risk tolerance and should consult professional financial advisors. Never invest more than you can afford to lose completely.

FAQ

What is UOS and what is its use case?

UOS is a decentralized operating system platform in the blockchain field. Its primary use case is enabling secure, decentralized applications and services, providing infrastructure for Web3 ecosystem development and innovation.

What is the price prediction for UOS in 2025?

Ultra (UOS) is forecasted to reach approximately $0.0085 by the end of 2025. Based on current market trends and technical analysis, the price may experience modest fluctuations throughout the year, but is expected to maintain stability around this level.

How high can UOS price potentially go?

Based on technical analysis, UOS price is projected to potentially reach $0.088705 by 2034, with intermediate peaks of $0.031211 in 2027 and $0.080491 as institutional investment drives the market forward.

What are the risks and challenges for UOS investment?

UOS investment faces market volatility, regulatory uncertainty, and adoption challenges. Limited liquidity, competition from other platforms, and technological risks also exist. Thorough research and risk assessment are recommended before investing.

How does UOS compare to other similar blockchain projects?

UOS specializes in gaming industry adoption with niche market focus, while competitors like ICP target broader blockchain and cloud computing markets. UOS offers distinct gaming-specific features and has different market sensitivities, making it uniquely positioned within its sector.

Is Vanar (VANRY) a good investment?: A Comprehensive Analysis of Risk and Potential Returns

UOS vs ICP: A Comparative Analysis of Operating Systems for Enterprise Security and Compliance

PIXEL vs ZIL: The Battle of Emerging Digital Asset Protocols

Is Gunz (GUN) a good investment?: Analyzing Market Potential and Risk Factors for Crypto Investors

2025 UOS Price Prediction: Analyzing Growth Potential and Market Dynamics in the Evolving Blockchain Ecosystem

2025 GUNPrice Prediction: Market Analysis and Investment Outlook for Firearms Industry

What is CVC crypto coin price and market overview in December 2025?

# What are the Top Crypto Security Risks: Smart Contract Vulnerabilities, Network Attacks, and Exchange Custody Threats in 2025?

Is XL1 (XL1) a good investment? Analyzing Market Performance, Risk Factors, and Future Potential for 2024

How to Use On-Chain Data Analysis Tools to Track Active Addresses, Transaction Volume, and Whale Movements in 2025?

Is Social Master & Branch (SMB) a good investment?: A Comprehensive Analysis of Growth Potential, Market Position, and Financial Performance