2025 XSWAP Price Prediction: Expert Analysis and Market Forecast for the Decentralized Exchange Token

Introduction: Market Position and Investment Value of XSWAP

XSwap (XSWAP), a decentralized application built on Chainlink CCIP for cross-chain token swaps and smart contract execution, has emerged as a notable player in the blockchain interoperability space. Since its launch in May 2024, the project has established itself with a current market capitalization of approximately $5.71 million USD. As of December 23, 2025, XSWAP is trading at $0.01631, with a circulating supply of approximately 311.37 million tokens out of a total supply of 350 million tokens. This innovative asset, which specializes in "cross-chain interoperability solutions," is playing an increasingly critical role in facilitating seamless asset transfers and smart contract execution across multiple blockchain networks.

This article will conduct a comprehensive analysis of XSwap's price dynamics and market performance, combining historical price patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and practical investment strategies for the period from 2025 to 2030.

XSWAP Price Analysis Report

I. XSWAP Price History Review and Current Market Status

XSWAP Historical Price Evolution

- May 2024: XSWAP reached its all-time high of $0.24, marking the peak valuation since project launch.

- December 2025: XSWAP declined to its all-time low of $0.0157, reflecting significant downward pressure over the year.

XSWAP Current Market Position

As of December 23, 2025, XSWAP is trading at $0.01631 with a 24-hour trading volume of $90,612.71. The token exhibits mixed short-term sentiment with a marginal 24-hour gain of 0.49%, yet substantial declines persist across extended timeframes:

- 1-hour change: -0.18%

- 7-day change: -11.52%

- 30-day change: -26.83%

- 1-year change: -87.42%

The circulating supply stands at 311,371,958.87 XSWAP tokens out of a maximum supply of 350,000,000, with a circulating ratio of 88.96%. The current market capitalization is $5,078,476.65, while the fully diluted valuation reaches $5,708,500. XSWAP maintains a global market dominance of 0.00017%, currently ranking 1518th by market cap among all cryptocurrencies.

The token trades on 3 exchanges with 1,720 unique holders, demonstrating limited but active market participation. Market sentiment indicators reflect "Extreme Fear" conditions in the broader cryptocurrency market environment.

Visit XSWAP market price on Gate.com for real-time data.

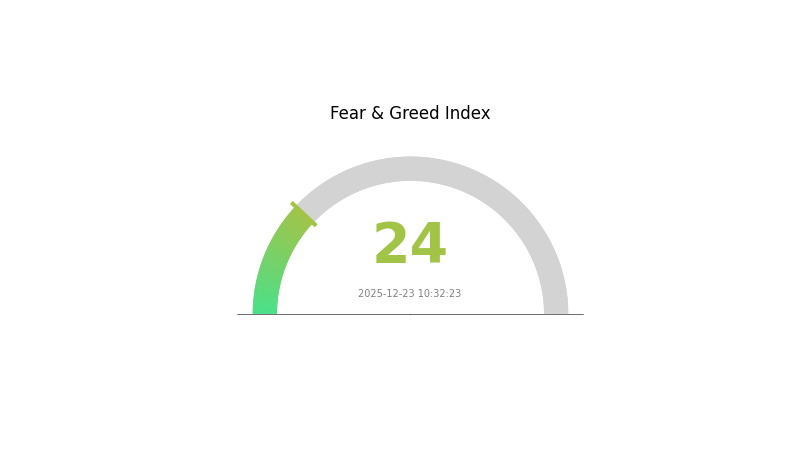

XSWAP Market Sentiment Indicator

2025-12-23 Fear and Greed Index: 24 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear, with the Fear and Greed Index plummeting to 24. This level typically indicates significant market pessimism and heightened risk aversion among investors. During such periods, volatility tends to spike as traders reassess their positions. However, contrarian investors often view extreme fear as a potential buying opportunity, as markets historically tend to recover from such lows. It's crucial to maintain a diversified portfolio and avoid panic-driven decisions during these turbulent conditions.

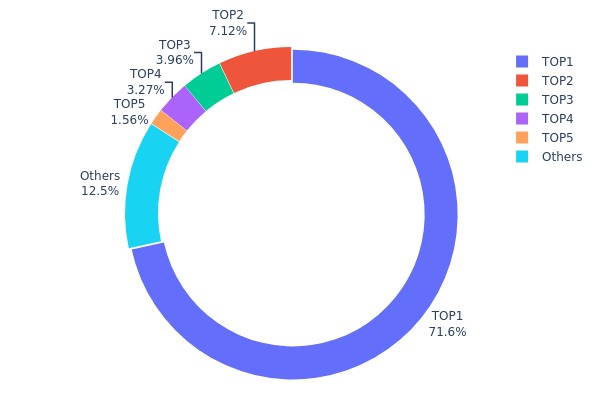

XSWAP Holdings Distribution

The address holdings distribution map illustrates the concentration of token ownership across the network by tracking the top holders and their proportional stake in total circulating supply. This metric serves as a critical indicator of tokenomics health, decentralization degree, and potential systemic risks related to wealth concentration.

XSWAP exhibits pronounced concentration characteristics, with the top holder commanding 71.59% of total supply—a significant concentration level that substantially exceeds optimal decentralization benchmarks. The top five addresses collectively control 87.48% of tokens, leaving only 12.52% distributed among remaining holders. This extreme concentration in the first address, combined with the steep decline in holdings among subsequent top holders, reveals a highly skewed distribution pattern typical of projects in early developmental stages or those with substantial pre-allocation structures.

Such elevated concentration levels present notable market structure implications. The dominant position of the leading address creates pronounced vulnerability to potential large-scale liquidation events or coordinated selling pressure, which could exert downward price pressure on the asset. Furthermore, the concentration dynamic raises considerations regarding governance participation and decision-making influence, as token-weighted voting mechanisms would heavily favor top holders. While this structure may reflect legitimate allocations to development teams, early investors, or treasury reserves, the magnitude of concentration warrants continued monitoring of address activity patterns and potential redistribution through trading or staking mechanisms to assess whether decentralization naturally improves over time.

Click to view current XSWAP Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x71b4...203ddd | 192562.69K | 71.59% |

| 2 | 0xc397...990d0f | 19157.93K | 7.12% |

| 3 | 0x54db...965c62 | 10646.55K | 3.95% |

| 4 | 0xa161...f57e3a | 8800.13K | 3.27% |

| 5 | 0x3cc9...aecf18 | 4183.15K | 1.55% |

| - | Others | 33598.61K | 12.52% |

II. Core Factors Affecting XSWAP's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Recent industry dynamics show that the Bank of Japan's rate hike has triggered a rebound in the crypto market, with some altcoins gaining strength. Additionally, the European Central Bank has completed preparations for a digital euro, with expected rollout in the second half of 2026, which may influence the broader digital asset landscape.

-

Market Sentiment: The crypto fear index currently stands at 20, indicating the market remains in an "extreme fear" state. This sentiment significantly impacts XSWAP's price movements, as market psychology drives trading behavior and investment decisions in the cryptocurrency sector.

Note: The provided context materials contain limited specific information about XSWAP Protocol's supply mechanisms, institutional holdings, enterprise adoption, national policies, and technical development roadmap. Sections addressing these topics have been excluded from this analysis as they cannot be accurately filled with available data. For comprehensive investment analysis, additional detailed information about XSWAP's tokenomics, ecosystem partnerships, and technical upgrades would be required.

III. 2025-2030 XSWAP Price Forecast

2025 Outlook

- Conservative Forecast: $0.01058 - $0.01628

- Base Case Forecast: $0.01628

- Optimistic Forecast: $0.02328 (requires sustained market sentiment and increased adoption)

2026-2028 Medium-term Outlook

- Market Stage Expectation: Gradual recovery and consolidation phase with incremental growth trajectory

- Price Range Forecast:

- 2026: $0.01681 - $0.02512 (+21% potential appreciation)

- 2027: $0.01369 - $0.02604 (+37% cumulative growth)

- 2028: $0.01261 - $0.03273 (+48% cumulative growth)

- Key Catalysts: Ecosystem development expansion, institutional adoption initiatives, technological upgrades, and overall market cycle recovery

2029-2030 Long-term Outlook

- Base Case Scenario: $0.02593 - $0.04188 (+74% by 2029, driven by mainstream market acceptance and protocol maturation)

- Optimistic Scenario: $0.03026 - $0.04926 (+115% by 2030, assuming accelerated DeFi adoption and cross-chain integration success)

- Transformational Scenario: $0.04926+ (contingent upon major ecosystem breakthroughs, regulatory clarity, and significant capital influx into the asset class)

Key Observations: The forecast indicates a consistent upward trajectory across the six-year period, with cumulative gains of approximately 115% by 2030 under base case assumptions. Price volatility is expected to moderate as market maturation progresses. Trading on Gate.com provides real-time price discovery for monitoring these predictions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.02328 | 0.01628 | 0.01058 | 0 |

| 2026 | 0.02512 | 0.01978 | 0.01681 | 21 |

| 2027 | 0.02604 | 0.02245 | 0.01369 | 37 |

| 2028 | 0.03273 | 0.02425 | 0.01261 | 48 |

| 2029 | 0.04188 | 0.02849 | 0.02593 | 74 |

| 2030 | 0.04926 | 0.03518 | 0.03026 | 115 |

XSwap (XSWAP) Professional Investment Analysis Report

I. Executive Summary

XSwap is a decentralized application (dApp) built on Chainlink CCIP, a decentralized interoperability protocol designed to transfer messages and funds between blockchains. XSwap provides a service layer on top of CCIP infrastructure to enable cross-chain token swaps and flexible smart contract execution on destination chains.

Key Metrics (As of December 23, 2025):

- Current Price: $0.01631

- Market Capitalization: $5,078,476.65

- Fully Diluted Valuation: $5,708,500.00

- Circulating Supply: 311,371,958.87 XSWAP

- Total Supply: 350,000,000 XSWAP

- 24-Hour Volume: $90,612.71

- Market Ranking: #1,518

II. XSwap Market Analysis

Market Position and Performance

XSwap has demonstrated significant price volatility since its launch on May 6, 2024, at an initial price of $0.05. The token reached its all-time high of $0.24 on May 6, 2024, representing a 380% gain from launch price. As of the latest update, XSWAP trades at $0.01631, down 87.42% over the past year.

Price Trends:

- 1-Hour Change: -0.18%

- 24-Hour Change: +0.49%

- 7-Day Change: -11.52%

- 30-Day Change: -26.83%

- 1-Year Change: -87.42%

24-Hour Trading Range:

- High: $0.01708

- Low: $0.01602

Market Structure

- Market Share: 0.00017%

- Circulation Ratio: 88.96%

- Token Holders: 1,720

- Listed Exchanges: 3 (including Gate.com)

- Dominance: 0.00017%

III. XSwap Project Analysis

Core Technology and Use Cases

XSwap leverages Chainlink CCIP as its foundational infrastructure for cross-chain interoperability. The platform's primary functions include:

- Cross-Chain Token Swaps: Enables users to exchange tokens across different blockchain networks seamlessly

- Smart Contract Execution: Facilitates flexible smart contract execution on destination chains

- Interoperability Layer: Provides a service layer that simplifies cross-chain communication and transaction execution

Token Distribution and Economics

- Total Supply: 350,000,000 XSWAP

- Circulating Supply: 311,371,958.87 XSWAP (88.96% of total)

- Fully Diluted Valuation: $5,708,500.00

- Launch Price (May 6, 2024): $0.05

- Current Market Cap: $5,078,476.65

The circulating supply represents 88.96% of the total supply, indicating a significant portion of tokens are already in circulation with approximately 38.6 million tokens remaining to be released.

Network Coverage

XSWAP token is deployed on multiple blockchain networks:

- Ethereum (ETH): Contract address 0x8fe815417913a93ea99049fc0718ee1647a2a07c

- Base (BASEEVM): Contract address 0x8Fe815417913a93Ea99049FC0718ee1647A2a07c

IV. XSwap Professional Investment Strategy and Risk Management

XSwap Investment Methodology

(1) Long-Term Holding Strategy

- Target Investors: Cross-chain infrastructure enthusiasts and long-term cryptocurrency holders

- Operational Guidelines:

- Dollar-cost averaging (DCA) over extended periods to mitigate price volatility exposure

- Accumulation during market downturns when sentiment is bearish

- Secure storage in non-custodial solutions with periodic security audits

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor price action around historical levels ($0.0157 ATL, $0.01602-$0.01708 current range)

- Volume Analysis: Assess trading strength with 24-hour volume at $90,612.71

- Wave Trading Considerations:

- Track momentum during 7-day and 30-day volatility cycles

- Monitor correlation with Chainlink (LINK) and broader DeFi market sentiment

XSwap Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% allocation

- Aggressive Investors: 3-5% allocation

- Professional Investors: 5-10% allocation (with hedging strategies)

(2) Risk Mitigation Strategies

- Portfolio Diversification: Balance XSWAP holdings with established cryptocurrencies and stablecoins

- Position Sizing: Maintain positions well below personal risk tolerance thresholds

- Stop-Loss Discipline: Establish predefined exit points based on technical analysis

(3) Secure Storage Solutions

- Custodial Trading: Gate.com offers secure trading and holding options for active traders

- Self-Custody: Transfer tokens to secure wallets for long-term holders

- Security Best Practices: Enable two-factor authentication, use unique passwords, keep seed phrases offline in secure locations

V. XSwap Potential Risks and Challenges

Market Risks

- Extreme Volatility: XSWAP has experienced 87.42% decline over 12 months, indicating significant price instability and potential for further downside

- Low Liquidity: With only 3 exchange listings and 24-hour volume of $90,612.71, the token faces liquidity constraints that may result in slippage during large transactions

- Market Capitalization Risk: At $5.07 million market cap, XSWAP is susceptible to manipulation and market concentration among early holders

Regulatory Risks

- Cross-Chain Compliance Uncertainty: Regulatory frameworks for cross-chain protocols remain underdeveloped globally, creating potential compliance challenges

- DeFi Regulation Expansion: Increased government scrutiny of decentralized finance platforms could impact project viability

- Jurisdictional Variations: Different countries may impose conflicting regulatory requirements affecting cross-chain functionality

Technology Risks

- Chainlink CCIP Dependency: XSwap's reliance on Chainlink CCIP means platform stability is directly affected by CCIP's operational status and security

- Smart Contract Vulnerabilities: Cross-chain smart contract execution introduces potential attack vectors and exploitation risks

- Bridge Security Concerns: Cross-chain bridges remain a major attack surface in cryptocurrency, with historical incidents resulting in substantial fund losses

VI. Conclusion and Action Recommendations

XSwap Investment Value Assessment

XSwap presents a speculative investment opportunity within the cross-chain interoperability sector. The platform addresses a genuine need for seamless cross-chain communication and token swaps. However, the extreme price decline (-87.42% over 12 months), low market capitalization ($5.07 million), limited exchange listings, and heavy reliance on Chainlink CCIP infrastructure present substantial risks that outweigh current growth opportunities.

The token's utility is directly tied to adoption of cross-chain transactions and smart contract execution services. Market viability remains uncertain given competition from established cross-chain protocols and the nascent state of the interoperability market.

XSwap Investment Recommendations

✅ Beginners: Avoid direct exposure; educate yourself on cross-chain technology before considering this asset. If interested in the sector, start with established protocols and only allocate minimal capital (<1% of portfolio).

✅ Experienced Investors: Consider small speculative positions (2-5% of risk capital) only if you have high risk tolerance and deep understanding of cross-chain protocols. Implement strict stop-losses and risk management discipline.

✅ Institutional Investors: Conduct comprehensive due diligence on technology partnerships, development roadmap, and tokenomics before allocation. Typically unsuitable for conservative institutional portfolios due to extreme volatility and execution risks.

XSwap Trading Participation Methods

- Gate.com Trading: Access XSWAP trading pairs on Gate.com, the recommended platform for secure trading with comprehensive market data and analysis tools

- Direct Blockchain Interaction: Interact directly with XSwap smart contracts on Ethereum and Base networks for advanced users

- Dollar-Cost Averaging: Implement systematic purchasing schedules to reduce timing risk and average acquisition costs over extended periods

Cryptocurrency investment carries extreme risk. This report does not constitute investment advice. Investors must make decisions based on personal risk tolerance and financial situation. Consult with professional financial advisors before investing. Never invest capital you cannot afford to lose completely.

FAQ

What is the future of $XSwap?

XSwap is projected to reach $0.120348 by 2027 with a 10.25% growth rate, driven by increasing adoption and strong market fundamentals in the DeFi ecosystem.

What factors influence XSWAP price movements?

XSWAP price is primarily driven by supply and demand dynamics, market sentiment, trading volume, cryptocurrency market trends, and fundamental developments within the project ecosystem.

How much could XSWAP be worth in 2025/2030?

Based on current price predictions, XSWAP could reach $0.01739 to $0.03498 by 2030. The exact value depends on market adoption, ecosystem development, and overall crypto market conditions during this period.

What is XSWAP's current market cap and trading volume?

XSWAP's current market cap is $4.91 million, with a 24-hour trading amount of $3.32 thousand as of December 23, 2025.

How does XSWAP compare to other DeFi tokens in terms of potential?

XSWAP offers superior cross-chain capabilities and innovative features positioning it ahead of many DeFi tokens. Its unique protocol design and growing ecosystem suggest strong long-term appreciation potential compared to traditional alternatives.

2025 KAVA Price Prediction: Analyzing Market Trends, Technical Indicators, and Growth Potential in the DeFi Landscape

2025 LONPrice Prediction: Analyzing Market Trends and Potential Growth Factors for Tokenlon Network Token

2025 IDEX Price Prediction: Analyzing Market Trends and Future Growth Potential for the Decentralized Exchange Token

RADAR vs DYDX: Comparing Two Leading Decentralized Trading Platforms

Is BitShares (BTS) a good investment?: Analyzing the Potential and Risks of this Decentralized Exchange Token

Is Synthetix (SNX) a good investment?: Analyzing the potential and risks of this DeFi protocol

Is CEEK Smart VR Token (CEEK) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects

Is Crown by Third Time Games (CRWN) a good investment?: A Comprehensive Analysis of Tokenomics, Market Potential, and Risk Factors

Is XDB CHAIN (XDB) a good investment?: A Comprehensive Analysis of Price Potential, Technology, and Market Viability in 2024

Is Clore.ai (CLORE) a good investment?: A Comprehensive Analysis of the GPU Computing Platform's Market Potential and Risk Factors

MicroStrategy Bitcoin Strategy: How Corporate Reserve Strategies Impact Crypto Markets