2026 1DOLLAR Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for Digital Currency Growth

Introduction: 1DOLLAR's Market Position and Investment Value

1DOLLAR ($1DOLLAR), positioned as a meme token on the Solana blockchain, has experienced significant market volatility since its launch in early 2025. As of February 2, 2026, 1DOLLAR maintains a market capitalization of approximately $1.46 million, with a total circulating supply of 1 billion tokens and a current price hovering around $0.0014604. This asset, characterized by its meme-driven community engagement, has attracted over 72,000 holders within its first year of existence.

This article will comprehensively analyze 1DOLLAR's price trends from 2026 to 2031, examining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. 1DOLLAR Price History Review and Market Status

1DOLLAR Historical Price Evolution Trajectory

- January 2025: Token launched on Solana blockchain, price reached peak of $0.0859809 on January 19

- January 2025: Price experienced significant volatility, dropping to lowest point of $0.00128 on January 9

- February 2026: Token entered downward trend, declining 74.03% from its peak

1DOLLAR Current Market Status

As of February 2, 2026, 1DOLLAR is trading at $0.0014604, showing a 24-hour decline of 2.93%. The token's 24-hour trading range spans from $0.0014239 to $0.0015989, with a total trading volume of $24,458.78.

The market capitalization stands at $1,460,400, with a fully diluted valuation matching this figure as all 1 billion tokens are in circulation. The circulating supply represents 100% of the maximum supply, with 72,116 holders currently participating in the token ecosystem.

Over different time periods, 1DOLLAR has demonstrated varied performance patterns. The token showed a modest 1% gain in the past hour, while experiencing a 14.14% decline over the past week and a 36.54% decrease over the past 30 days. The yearly performance reflects a substantial 74.03% decline from previous levels.

The token maintains a market dominance of 0.000054% within the broader cryptocurrency ecosystem. The current market sentiment index stands at 14, indicating an "Extreme Fear" sentiment among market participants. 1DOLLAR is accessible on one exchange platform and operates on the Solana blockchain infrastructure.

Click to view current 1DOLLAR market price

1DOLLAR Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at just 14 points. This exceptionally low reading indicates that investors are highly pessimistic about market conditions and risk assets. During periods of extreme fear, experienced traders often view this as a potential accumulation opportunity, as excessive selling may create attractive entry points. However, new investors should exercise caution and conduct thorough research before making investment decisions. Market sentiment can shift rapidly, so monitoring the index regularly on Gate.com can help you stay informed about prevailing market conditions and make more strategic trading decisions.

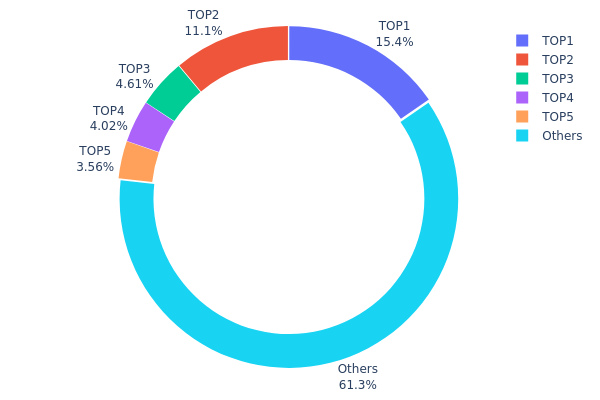

1DOLLAR Holding Distribution

The holding distribution chart provides a visual representation of how tokens are allocated across different wallet addresses, serving as a critical indicator for assessing the degree of decentralization and potential concentration risks within a cryptocurrency ecosystem. By examining the proportion of tokens held by top addresses versus the broader holder base, analysts can gauge whether the market structure exhibits healthy distribution or shows signs of centralization that could impact price stability and market manipulation susceptibility.

Based on the current data, 1DOLLAR exhibits a moderate concentration pattern with the top five addresses collectively controlling approximately 38.65% of the total token supply. The largest holder (5Q544f...pge4j1) possesses 15.41% of the supply, followed by the second-largest address (u6PJ8D...ynXq2w) holding 11.08%. While the combined holdings of the top two addresses exceed 26%, this concentration level remains within acceptable parameters compared to highly centralized projects. The remaining 61.35% distributed among other addresses suggests a relatively broad holder base, which provides a certain degree of decentralization and liquidity depth.

From a market structure perspective, this distribution pattern presents both opportunities and risks. The significant holdings by top addresses could potentially create price volatility during large-scale transactions, as movements from these whale addresses might trigger market reactions. However, the fact that over 60% of tokens remain distributed among numerous smaller holders indicates reasonable community participation and reduces the likelihood of coordinated manipulation. This balance between concentrated large holders and dispersed retail participation typically contributes to more stable on-chain activity while maintaining adequate liquidity for normal trading operations.

Click to view current 1DOLLAR Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 154090.90K | 15.41% |

| 2 | u6PJ8D...ynXq2w | 110807.13K | 11.08% |

| 3 | 4gXs8o...Dat8tH | 46037.77K | 4.60% |

| 4 | 5B61Yt...wrv63n | 40152.34K | 4.01% |

| 5 | ASTyfS...g7iaJZ | 35584.10K | 3.55% |

| - | Others | 613008.73K | 61.35% |

II. Core Factors Influencing 1DOLLAR's Future Price

Supply Mechanism

- Token Supply Dynamics: The supply volume of 1DOLLAR plays a significant role in determining its price trajectory. Generally, tokens with lower circulating supply tend to experience more pronounced price movements compared to high-supply alternatives, assuming similar demand levels.

- Historical Patterns: Supply-related factors have historically influenced price volatility in the cryptocurrency market. Tokens with controlled or limited supply mechanisms often demonstrate stronger price resilience during market fluctuations.

- Current Impact: The relationship between supply constraints and market demand continues to shape 1DOLLAR's price behavior. As adoption rates increase and circulation patterns evolve, supply dynamics may create upward or downward pressure on valuation.

Institutional and Major Holder Dynamics

- Institutional Participation: Institutional involvement remains a potential catalyst for 1DOLLAR's price development. The entry of institutional investors into the cryptocurrency space has historically contributed to market maturation and price stability.

- Exchange Listings: The availability of 1DOLLAR on cryptocurrency trading platforms, including its listing on Gate.com, influences accessibility and trading volume. Broader exchange coverage typically correlates with enhanced liquidity and market depth.

Macroeconomic Environment

- Market Sentiment: Overall cryptocurrency market sentiment significantly impacts 1DOLLAR's price movements. Positive sentiment driven by broader market trends, technological advancements, or favorable regulatory developments can support price appreciation.

- Economic Trends: Macroeconomic conditions, including monetary policy shifts and global economic indicators, affect investor risk appetite and capital flows into digital assets. These broader economic factors create the backdrop against which 1DOLLAR's price operates.

- Regulatory Landscape: Policy frameworks and regulatory clarity surrounding cryptocurrencies influence market confidence and adoption rates. Evolving regulatory environments across different jurisdictions may impact 1DOLLAR's accessibility and legitimacy in various markets.

Technology Development and Ecosystem Building

- Technical Innovation: Technological improvements within the cryptocurrency infrastructure continue to influence token utility and adoption. Enhanced transaction efficiency, security protocols, and scalability solutions contribute to the overall value proposition of digital assets.

- Adoption Trends: The rate at which users, developers, and businesses integrate 1DOLLAR into their operations affects long-term price sustainability. Growing adoption across payment systems, decentralized applications, or other use cases may support fundamental value growth.

- Community Development: The strength and engagement of the user community surrounding 1DOLLAR play a role in driving awareness and utilization. Active community participation in governance, development, or promotional activities can contribute to ecosystem vitality.

III. 2026-2031 1DOLLAR Price Prediction

2026 Outlook

- Conservative Forecast: $0.0013 - $0.0014

- Neutral Forecast: $0.00146

- Optimistic Forecast: $0.00157 (requires favorable market conditions and sustained trading volume)

2027-2029 Outlook

- Market Stage Expectation: Gradual growth phase with moderate volatility, potential accumulation period for long-term holders

- Price Range Forecast:

- 2027: $0.00097 - $0.00199

- 2028: $0.00095 - $0.00215

- 2029: $0.00178 - $0.00271

- Key Catalysts: Market adoption expansion, technological development progress, and broader cryptocurrency market sentiment

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00224 - $0.00289 (assuming steady market development and sustained interest)

- Optimistic Scenario: $0.00261 - $0.00369 (contingent on significant ecosystem expansion and increased utility)

- Transformative Scenario: Potential to reach upper ranges if major partnerships materialize and regulatory environment becomes more favorable

- 2026-02-02: 1DOLLAR trading within projected range, monitoring market dynamics for validation of forecast trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00157 | 0.00146 | 0.0013 | 0 |

| 2027 | 0.00199 | 0.00152 | 0.00097 | 3 |

| 2028 | 0.00215 | 0.00175 | 0.00095 | 19 |

| 2029 | 0.00271 | 0.00195 | 0.00178 | 33 |

| 2030 | 0.00289 | 0.00233 | 0.00224 | 59 |

| 2031 | 0.00369 | 0.00261 | 0.00167 | 78 |

IV. 1DOLLAR Professional Investment Strategy and Risk Management

1DOLLAR Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Risk-tolerant investors with understanding of meme coin market volatility

- Operational Recommendations:

- Consider dollar-cost averaging approach to mitigate entry timing risk

- Monitor Solana network developments and ecosystem growth

- Utilize Gate Web3 Wallet for secure storage with multi-signature features

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $24,458 to assess market liquidity

- Price Action Analysis: Track support level around $0.001424 and resistance near $0.001599

- Trading Considerations:

- Set stop-loss orders to manage downside risk given high volatility

- Consider the -2.93% 24-hour change as part of broader market sentiment analysis

1DOLLAR Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Moderate Investors: 3-5% of crypto portfolio allocation

- Aggressive Investors: Up to 10% of crypto portfolio allocation

(II) Risk Mitigation Approaches

- Portfolio Diversification: Allocate across multiple asset classes beyond meme coins

- Position Sizing: Limit exposure based on market capitalization of $1.46 million

(III) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet with Solana chain support

- Security Best Practices: Enable two-factor authentication and regularly backup private keys

- Safety Considerations: Never share private keys or seed phrases with any third party

V. 1DOLLAR Potential Risks and Challenges

1DOLLAR Market Risks

- High Volatility: Price declined 14.14% over 7 days and 36.54% over 30 days, indicating significant price fluctuations

- Limited Liquidity: Daily trading volume of approximately $24,458 may result in slippage during large transactions

- Market Cap Concentration: Total market cap of $1.46 million represents relatively small market presence

1DOLLAR Regulatory Risks

- Meme Coin Classification: Regulatory treatment of meme tokens remains uncertain across different jurisdictions

- Compliance Evolution: Potential regulatory changes could impact trading availability or token classification

- Platform Risk: Trading availability may be affected by regulatory developments in cryptocurrency exchanges

1DOLLAR Technical Risks

- Smart Contract Dependency: Token operates on Solana blockchain with contract address GHichsGq8aPnqJyz6Jp1ASTK4PNLpB5KrD6XrfDjpump

- Network Congestion: Solana network performance issues could affect transaction processing

- Total Supply Circulation: 100% of 1 billion tokens already in circulation eliminates inflation risk but removes scarcity mechanism

VI. Conclusion and Action Recommendations

1DOLLAR Investment Value Assessment

1DOLLAR represents a meme coin with community-driven characteristics on the Solana blockchain. With 72,116 holders and full token circulation, the project demonstrates established community participation. However, the significant price decline of 74.03% over one year and market capitalization of $1.46 million indicate substantial risk factors. The token's value proposition relies primarily on community sentiment rather than fundamental utility, requiring investors to carefully evaluate risk tolerance against speculative potential.

1DOLLAR Investment Recommendations

✅ Beginners: Allocate no more than 1% of crypto portfolio; prioritize education on meme coin dynamics before investing ✅ Experienced Investors: Consider tactical allocation up to 5% with strict stop-loss discipline and regular portfolio rebalancing ✅ Institutional Investors: Approach with extreme caution due to limited liquidity and high volatility profile; suitable only for specialized high-risk mandates

1DOLLAR Trading Participation Methods

- Spot Trading: Access 1DOLLAR trading pairs on Gate.com with real-time market data

- Wallet Storage: Utilize Gate Web3 Wallet for secure Solana-based token management

- Community Engagement: Follow official Twitter channel @1DollarSol for project updates and community developments

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is 1DOLLAR token, and what are its main use cases and value sources?

1DOLLAR is a meme cryptocurrency designed for accessible crypto market participation with minimal investment. Its primary utility lies in community engagement and trading, with value derived from community support and market demand dynamics.

What is the historical price performance of 1DOLLAR, and what is the price fluctuation over the past year?

1DOLLAR reached its peak of $0.07784 on November 27, 2024. As of February 2, 2026, the price has declined 86.66% from its historical high. The token experienced significant volatility over this period.

What is the price prediction for 1DOLLAR by professional analysts?

Professional analysts predict 1DOLLAR will trade between $0.001754 and $0.002451 in 2025, with some technical indicators suggesting downward pressure. Year-end returns remain uncertain based on current market conditions.

What risk factors should I be aware of when investing in 1DOLLAR?

1DOLLAR faces high volatility typical of meme coins, with prices subject to significant fluctuations. Liquidity risks exist for large trades, potentially causing sharp price movements. Market sentiment shifts can trigger dramatic price swings. Consider these factors before investing.

What are the advantages and disadvantages of 1DOLLAR compared to other stablecoins or mainstream tokens?

1DOLLAR offers price stability and reduced volatility as a stablecoin pegged to fiat currency, making it reliable for transactions. However, it lacks the growth potential of mainstream cryptocurrencies and may have lower trading volume compared to established stablecoins.

What are the main factors affecting 1DOLLAR price fluctuations?

1DOLLAR price is primarily influenced by US economic fundamentals including GDP growth and inflation, Federal Reserve monetary policy and interest rate decisions, market trading volume, and geopolitical developments affecting global risk sentiment.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

Trading Patterns—A Beginner’s Guide

Top 12 DeFi Protocols

How to Create an NFT and Maximize Profits in Today’s Market Conditions

GetAgent: Advanced AI Trading Assistant vs Traditional Trading Bots

Is NFT Dead? A Guide to NFT Use Cases