2026 1DOLLAR Price Prediction: Will the Digital Currency Reach New Heights in the Next Bull Market?

Introduction: 1DOLLAR's Market Position and Investment Value

1DOLLAR ($1DOLLAR), as a MEME coin launched on the Solana blockchain, has captured attention in the decentralized digital asset space. As of February 2026, 1DOLLAR maintains a market capitalization of approximately $1.47 million, with a circulating supply of 1 billion tokens and a current price hovering around $0.001466. With over 72,000 holders, this Solana-based token demonstrates notable community engagement within the meme coin sector.

This article will comprehensively analyze 1DOLLAR's price trajectory from 2026 through 2031, incorporating historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies. We will examine technical indicators, on-chain metrics, and broader market conditions to offer actionable insights for navigating this emerging digital asset.

I. 1DOLLAR Price History Review and Current Market Status

Historical Price Evolution Trajectory of 1DOLLAR

- 2025: Token launched on Solana blockchain in January, price reached a peak of $0.0859809 on January 19, 2025, followed by significant volatility.

- 2025: Market correction occurred, price declined from the peak to a low of $0.00128 on January 9, 2025.

- 2026: Continued downward pressure observed, with price standing at $0.0014655 as of February 2, 2026.

Current Market Status of 1DOLLAR

As of February 2, 2026, 1DOLLAR is trading at $0.0014655, reflecting a decrease of 1.67% over the past 24 hours. The token has experienced a price range between $0.0014239 and $0.0015989 within the last day.

Over the past week, 1DOLLAR has declined by 13.70%, while the 30-day performance shows a decrease of 35.67%. The yearly performance indicates a decline of 73.95% from previous levels.

The token maintains a market capitalization of approximately $1.47 million, with a fully diluted valuation matching this figure at $1.47 million, indicating a 100% market cap to FDV ratio. The circulating supply stands at 1 billion tokens, which represents the total and maximum supply, resulting in a 100% circulation ratio.

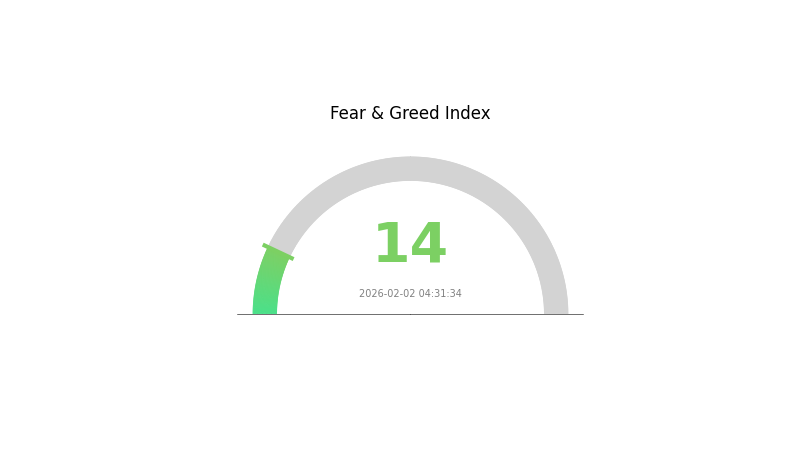

1DOLLAR has recorded a 24-hour trading volume of approximately $24,031. The token holds 72,116 holders and maintains a market dominance of 0.000054%. The cryptocurrency market sentiment index currently registers at 14, indicating an extreme fear sentiment among market participants.

Click to view the current 1DOLLAR market price

1DOLLAR Market Sentiment Indicator

02-02-2026 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reading at 14. This exceptionally low reading indicates severe market pessimism and risk aversion among investors. Such extreme fear conditions historically present potential opportunities for contrarian traders, as panic selling often creates oversold conditions. However, extreme caution is advised, as markets may continue experiencing downward pressure. Investors should carefully assess their risk tolerance and investment strategy before making trading decisions during periods of extreme market fear.

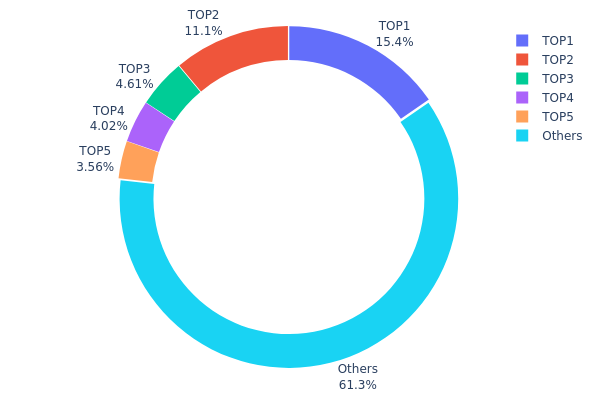

1DOLLAR 持仓分布

The holdings distribution chart represents the allocation of token supply across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. By analyzing the concentration of tokens among top holders versus the broader community, investors can assess the structural stability and health of a cryptocurrency's on-chain ecosystem.

Based on the current data, 1DOLLAR exhibits a moderately concentrated distribution pattern. The top holder controls approximately 15.41% of the total supply (154,090.90K tokens), while the second-largest address holds 11.08% (110,807.13K tokens). Combined, the top five addresses account for 38.65% of the circulating supply, with the remaining 61.35% distributed among other market participants. This concentration level suggests a semi-centralized structure where major holders possess significant influence over price movements and liquidity dynamics.

This distribution pattern presents both opportunities and risks for market participants. The substantial holdings of top addresses could enable coordinated selling pressure during volatile periods, potentially triggering sharp price corrections. However, the fact that over 60% of tokens remain distributed among other holders indicates reasonable community participation and reduces the likelihood of complete price manipulation by a single entity. The current structure reflects a transitional phase common in emerging tokens, where early investors and project-affiliated wallets maintain considerable positions while broader market adoption gradually increases decentralization levels.

Click to view current 1DOLLAR Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 154090.90K | 15.41% |

| 2 | u6PJ8D...ynXq2w | 110807.13K | 11.08% |

| 3 | 4gXs8o...Dat8tH | 46037.77K | 4.60% |

| 4 | 5B61Yt...wrv63n | 40152.34K | 4.01% |

| 5 | ASTyfS...g7iaJZ | 35584.10K | 3.55% |

| - | Others | 613008.73K | 61.35% |

II. Core Factors Influencing 1DOLLAR's Future Price

Supply Mechanism

- Token Supply Dynamics: The supply volume of 1DOLLAR plays a crucial role in determining its price trajectory. Generally, tokens with lower circulating supply tend to experience stronger price appreciation when demand remains consistent, compared to high-supply alternatives.

- Historical Pattern: Historical data suggests that supply constraints can create upward price pressure during periods of increased market demand and adoption.

- Current Impact: The current supply structure of 1DOLLAR may influence its ability to respond to market demand fluctuations, with projected annual growth rates potentially affecting long-term valuation.

Institutional and Whale Activity

- Market Participation: The future price of 1DOLLAR may be influenced by the level of institutional participation and engagement from major holders in the cryptocurrency market.

- Exchange Listings: The availability of 1DOLLAR on cryptocurrency trading platforms can significantly impact its accessibility and liquidity, which are key factors in price discovery.

- Market Adoption Rate: The speed at which the community adopts 1DOLLAR and the broader acceptance within the crypto ecosystem remain important considerations for price development.

Macroeconomic Environment

- Economic Factors: Broader macroeconomic conditions, including monetary policy trends and economic indicators, can influence the overall cryptocurrency market sentiment and indirectly affect 1DOLLAR's price performance.

- Market Sentiment: Overall cryptocurrency market sentiment remains a significant driver of price movements. Positive market conditions typically support upward price trends, while negative sentiment can exert downward pressure.

- Regulatory Environment: Policy regulations and governmental approaches to cryptocurrency oversight may impact market confidence and trading activity.

Technical Development and Ecosystem Growth

- Adoption Trends: The rate at which 1DOLLAR gains traction among users and developers within the crypto space can contribute to its long-term value proposition.

- Market Demand: Sustained market demand driven by use cases and utility within the broader blockchain ecosystem remains fundamental to price appreciation.

- Growth Projections: Some market analyses suggest potential annual growth rates, such as the projected 5% annual increase, though actual performance may vary based on multiple market variables and adoption dynamics.

III. 2026-2031 1DOLLAR Price Prediction

2026 Outlook

- Conservative Forecast: $0.00129 - $0.00147

- Neutral Forecast: $0.00147 average price level

- Optimistic Forecast: $0.00184 (requires favorable market conditions and increased trading volume)

2027-2029 Outlook

- Market Stage Expectation: Gradual accumulation phase with potential volatility as the token seeks to establish stronger market positioning

- Price Range Forecast:

- 2027: $0.00101 - $0.00185, representing approximately 12% year-over-year growth

- 2028: $0.00098 - $0.00261, with 19% projected annual increase

- 2029: $0.00148 - $0.00249, showing 48% potential growth momentum

- Key Catalysts: Enhanced liquidity, broader exchange listings, ecosystem development initiatives, and improved market sentiment in the digital asset sector

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00182 - $0.00233 (assuming steady adoption and stable market conditions)

- Optimistic Scenario: $0.00287 - $0.00341 (contingent on significant ecosystem expansion and sustained positive market trends)

- Transformative Scenario: approaching $0.00341 levels (requires exceptional market conditions, substantial technological breakthroughs, and widespread adoption)

- February 2, 2026: 1DOLLAR trading within $0.00129 - $0.00184 range (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00184 | 0.00147 | 0.00129 | 0 |

| 2027 | 0.00185 | 0.00165 | 0.00101 | 12 |

| 2028 | 0.00261 | 0.00175 | 0.00098 | 19 |

| 2029 | 0.00249 | 0.00218 | 0.00148 | 48 |

| 2030 | 0.00341 | 0.00233 | 0.00182 | 59 |

| 2031 | 0.00304 | 0.00287 | 0.00184 | 95 |

IV. 1DOLLAR Professional Investment Strategy and Risk Management

1DOLLAR Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Investors with high risk tolerance and understanding of MEME token characteristics

- Operational Recommendations:

- Consider the high volatility nature of MEME tokens when planning holding periods

- Monitor community engagement and social media trends on platforms like Twitter

- Storage Solution: Use Gate Web3 Wallet for secure asset management with multi-layer security features

(II) Active Trading Strategy

- Technical Analysis Tools:

- Price Action Analysis: Monitor the 24H price range between $0.0014239 and $0.0015989 to identify support and resistance levels

- Volume Analysis: Track the 24H trading volume of $24,031 to gauge market interest and liquidity

- Swing Trading Key Points:

- Pay attention to short-term price movements, as 1H change shows 0.47% volatility

- Set reasonable stop-loss levels considering the token's price fluctuations

1DOLLAR Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: Tailored allocation based on risk appetite and portfolio strategy

(II) Risk Hedging Solutions

- Diversification: Avoid concentration in single MEME tokens

- Position Sizing: Limit exposure relative to total portfolio value

(III) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet offers user-friendly interface and security features for SOL-based tokens

- Security Considerations: Enable two-factor authentication, keep private keys confidential, and verify contract addresses (GHichsGq8aPnqJyz6Jp1ASTK4PNLpB5KrD6XrfDjpump) before transactions

V. 1DOLLAR Potential Risks and Challenges

1DOLLAR Market Risks

- High Volatility: The token experienced a 73.95% decline over 1 year, indicating significant price instability

- Limited Market Cap: With a market capitalization of $1,465,500 and market share of 0.000054%, liquidity may be constrained

- Price Decline Trend: Recent performance shows negative returns across multiple timeframes (7D: -13.70%, 30D: -35.67%)

1DOLLAR Regulatory Risks

- MEME Token Classification: Regulatory treatment of MEME tokens remains uncertain in various jurisdictions

- Compliance Evolution: Changes in cryptocurrency regulations may impact trading availability and market access

1DOLLAR Technical Risks

- Smart Contract Dependency: Token operates on Solana blockchain with specific contract address, subject to network risks

- Network Performance: Reliance on Solana network stability and transaction processing capabilities

- Limited Exchange Availability: Currently available on 1 exchange, which may affect liquidity and trading options

VI. Conclusion and Action Recommendations

1DOLLAR Investment Value Assessment

As a MEME token on Solana, 1DOLLAR presents characteristics typical of speculative digital assets. With 72,116 holders and 100% circulation ratio, the token shows community participation. However, the recent downward price trends across multiple timeframes and significant decline from its historical high suggest substantial market challenges. The token's small market cap and limited exchange presence indicate higher volatility and liquidity risks compared to established cryptocurrencies.

1DOLLAR Investment Recommendations

✅ Beginners: Exercise extreme caution; consider educational exposure only with minimal capital you can afford to lose completely ✅ Experienced Investors: If participating, maintain strict position limits and active risk management with predetermined exit strategies ✅ Institutional Investors: Evaluate alignment with investment mandates regarding speculative assets and volatility tolerance

1DOLLAR Trading Participation Methods

- Spot Trading: Access 1DOLLAR through available trading pairs on Gate.com

- Wallet Storage: Transfer tokens to Gate Web3 Wallet for self-custody after purchase

- Market Monitoring: Track price movements and community developments through official channels including Twitter and project website

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is 1DOLLAR token? What is its practical application value?

1DOLLAR is a cryptocurrency enabling direct spot trading at current market prices. Its practical value includes serving as a payment method and investment instrument for crypto market participants.

What is the current price of 1DOLLAR? What are the all-time high and low prices?

1DOLLAR is currently trading at $0.009908. The all-time high price reached $0.07784, while the all-time low was $0.008879.

What are expert price predictions for 1DOLLAR? How much will it rise within the next year?

Experts predict 1DOLLAR may appreciate approximately 5% over the next year, with potential price targets reaching ₹0.560023. This forecast is based on current market trends and technical analysis indicators.

What are the main risks of investing in 1DOLLAR? What should I pay attention to?

Main risks include extreme price volatility, limited liquidity, and low trading volume. The token is susceptible to market manipulation. Investors should conduct thorough research and only invest capital they can afford to lose.

What is the technical foundation and team background of 1DOLLAR? What is the project's roadmap?

1Dollar leverages the XPL staking mechanism with a team of experienced blockchain developers. The 2026 roadmap highlights XPL delegation staking launch in Q3 and network performance optimization to enhance scalability and user experience.

What are the advantages and disadvantages of 1DOLLAR compared to other similar tokens?

1DOLLAR offers lower transaction fees and faster transaction speeds compared to competitors. However, it faces challenges from more established coins and maintains a smaller market capitalization, which may limit liquidity and adoption.

How to predict 1DOLLAR price trends through fundamental and technical analysis?

Analyze fundamentals by tracking market cap and trading volume. For technical analysis, examine K-line chart trends and support/resistance levels. Current market cap is 10,448,840 USD, ranked 1734 on CoinGecko. Combine both methods for comprehensive price prediction.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

Trading Patterns—A Beginner’s Guide

Top 12 DeFi Protocols

How to Create an NFT and Maximize Profits in Today’s Market Conditions

GetAgent: Advanced AI Trading Assistant vs Traditional Trading Bots

Is NFT Dead? A Guide to NFT Use Cases