2026 AIBOT Price Prediction: Expert Analysis and Market Forecast for the Next Generation AI Token

Introduction: AIBOT's Market Position and Investment Value

Cherry AI (AIBOT) serves as a full-stack crypto ecosystem integrating AI-powered trading bots, web trading platforms, and community growth tools. Since its launch in 2025, the project has achieved notable milestones including over 10 million game users, 1 million+ raid executions, and $150 million+ in simulated trading volume. As of February 2026, AIBOT maintains a market capitalization of approximately $994,978, with around 221.5 million tokens in circulation, and the price hovering around $0.004492. This asset, recognized for its automated trading and AI-driven solutions, is playing an increasingly important role in the crypto trading automation and community engagement sectors.

This article will comprehensively analyze AIBOT's price trajectory from 2026 to 2031, incorporating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. AIBOT Price History Review and Market Status

AIBOT Historical Price Evolution Trajectory

- October 2025: AIBOT reached a price peak of $0.0442, marking a significant milestone in its early trading period

- September 2025: The token experienced its lowest recorded price of $0.0032, representing a notable consolidation phase

- 2025-2026: Following its initial launch, AIBOT underwent substantial price corrections, declining by approximately 98.93% from its historical high to current levels

AIBOT Current Market Status

As of February 03, 2026, AIBOT is trading at $0.004492, with a 24-hour trading volume of $12,152.62. The token has experienced a decline of 2.34% over the past 24 hours, with intraday fluctuations ranging between $0.004491 and $0.004714.

The market capitalization stands at approximately $994,978, with 221.5 million tokens in circulation, representing 22.15% of the total supply of 1 billion tokens. The fully diluted market cap is calculated at $4.492 million. Over the past week, AIBOT has declined by 5.85%, while the 30-day performance shows a decrease of 37.29%.

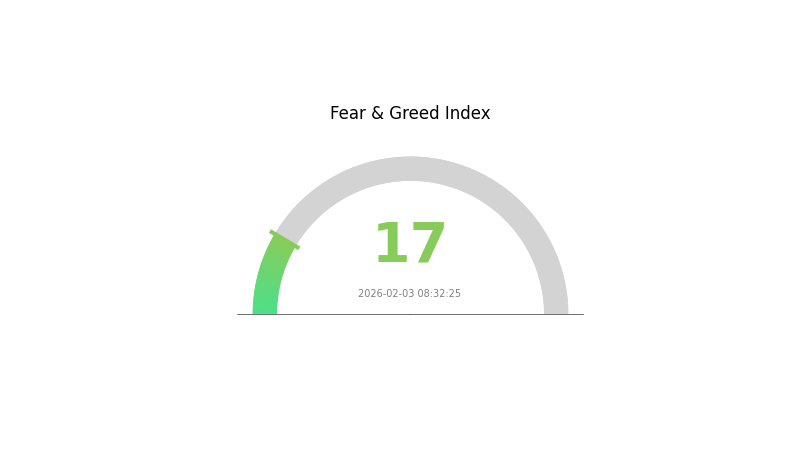

The token maintains a market dominance of 0.00016% and is held by approximately 3,509 addresses. AIBOT is currently listed on 5 exchanges, with Gate.com among the trading platforms. The crypto market sentiment index registers at 17, indicating extreme fear conditions in the broader market environment.

Click to view current AIBOT market price

AIBOT Market Sentiment Index

02-03-2026 Fear & Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear & Greed Index at 17. This indicates significant market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often signals potential buying opportunities for contrarian investors. However, caution is advised as market downturns may continue. Monitor key support levels closely and consider dollar-cost averaging strategies. On Gate.com, you can track real-time market sentiment and make informed trading decisions based on these critical indicators.

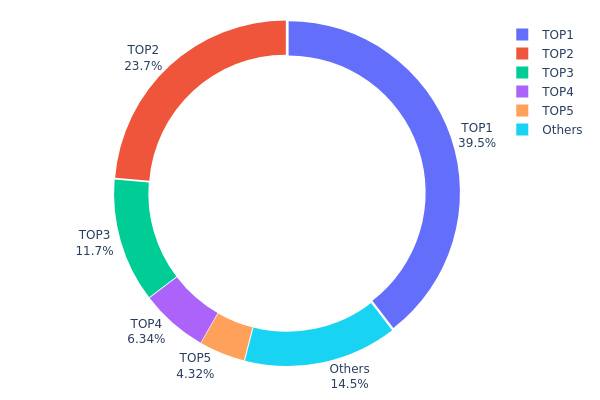

AIBOT Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, serving as a crucial indicator of decentralization and potential market manipulation risks. For AIBOT, the current distribution data reveals a highly concentrated ownership structure that warrants careful consideration from both investors and market participants.

Based on the latest on-chain data, the top five addresses collectively control approximately 85.51% of the total AIBOT supply, indicating significant centralization. The largest holder alone possesses 395,263.21K tokens (39.52%), while the second-largest address holds 237,089.42K tokens (23.70%). The third through fifth positions control 11.65%, 6.33%, and 4.31% respectively. Meanwhile, all remaining addresses combined account for merely 14.49% of the circulating supply. This extreme concentration creates an asymmetric market structure where a small number of entities exert disproportionate influence over price movements and liquidity dynamics.

Such concentration levels present multiple implications for market stability. Large holders possess sufficient holdings to trigger substantial price volatility through coordinated selling or strategic accumulation. The limited distribution among retail participants restricts organic price discovery mechanisms and may amplify susceptibility to sudden liquidity shocks. Furthermore, this structure raises concerns about potential coordinated market activities, as the top holders could theoretically influence trading patterns through their dominant positions. From a decentralization perspective, AIBOT's current distribution reflects an early-stage or heavily institutionalized allocation model, which contrasts with the broader cryptocurrency ethos of distributed ownership and may impact long-term community governance and project resilience.

Click to view current AIBOT Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x73d8...4946db | 395263.21K | 39.52% |

| 2 | 0xd7b5...61eb33 | 237089.42K | 23.70% |

| 3 | 0x4982...6e89cb | 116556.31K | 11.65% |

| 4 | 0x9ba0...3c4556 | 63349.51K | 6.33% |

| 5 | 0xd377...b0d255 | 43186.17K | 4.31% |

| - | Others | 144545.43K | 14.49% |

II. Core Factors Influencing AIBOT's Future Price

Supply Mechanism

- Fixed Supply: AIBOT maintains a constant total supply, creating scarcity attributes that influence price performance as demand fluctuates.

- Historical Pattern: The fixed supply model has historically correlated with price appreciation during periods of increased adoption and market demand.

- Current Impact: The permanent supply cap continues to support potential upward price pressure as enterprise adoption expands and trading volume grows.

Institutional and Major Holder Dynamics

- Institutional Holdings: Multiple AI technology enterprises have expressed interest in integrating AIBOT into their operational frameworks, signaling growing institutional confidence.

- Enterprise Adoption: Several AI-focused companies are exploring AIBOT integration for trading solutions and automated services.

- Tokenomics Execution: The actual implementation of token economics and distribution mechanisms remains a key factor in determining long-term value trajectory.

Macroeconomic Environment

- Market Sentiment: Investor confidence and sentiment directly impact AIBOT/USD movement, with positive news regarding widespread adoption or technological breakthroughs driving price momentum.

- Broader Economic Factors: General cryptocurrency market conditions and economic indicators influence AIBOT's price prospects alongside sector-specific developments.

- Demand Trends: Adoption patterns and market acceptance rates play crucial roles in shaping price direction.

Technology Development and Ecosystem Building

- AI Trading Tool Effectiveness: The performance and reliability of AIBOT's AI-powered trading solutions in real market environments significantly impact value perception.

- Smart Contract Security: Despite audit results indicating low risk levels, ongoing security monitoring and contract performance remain essential considerations.

- Ecosystem Applications: The expansion of use cases and integration opportunities within AI-driven financial services continues to develop.

III. 2026-2031 AIBOT Price Forecast

2026 Outlook

- Conservative forecast: $0.00287 - $0.00449

- Neutral forecast: $0.00449 average trading range

- Optimistic forecast: Up to $0.00665 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: The token is anticipated to enter a gradual growth phase, with year-over-year price changes ranging from 24% to 38%, reflecting steady market maturation and potential ecosystem expansion.

- Price range forecast:

- 2027: $0.00351 - $0.00624, with an average price around $0.00557

- 2028: $0.00502 - $0.00649, averaging approximately $0.00590

- 2029: $0.00446 - $0.00800, with a mid-point estimate of $0.00620

- Key catalysts: Sustained market interest, potential technological developments within the AIBOT ecosystem, and broader cryptocurrency market recovery could serve as primary drivers for price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00582 - $0.0071 in 2030 (assuming continued moderate growth trajectory with approximately 58% cumulative price change)

- Optimistic scenario: $0.0082 - $0.0093 by 2030-2031 (contingent upon accelerated adoption, significant platform upgrades, or favorable regulatory developments)

- Transformative scenario: Reaching $0.01197 by 2031 (requires exceptional market conditions, breakthrough partnerships, or widespread mainstream integration, representing an 82% cumulative increase from 2026 baseline)

- February 3, 2026: AIBOT trading within the $0.00287 - $0.00665 range (current early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00665 | 0.00449 | 0.00287 | 0 |

| 2027 | 0.00624 | 0.00557 | 0.00351 | 24 |

| 2028 | 0.00649 | 0.0059 | 0.00502 | 31 |

| 2029 | 0.008 | 0.0062 | 0.00446 | 38 |

| 2030 | 0.0093 | 0.0071 | 0.00582 | 58 |

| 2031 | 0.01197 | 0.0082 | 0.00541 | 82 |

IV. AIBOT Professional Investment Strategy and Risk Management

AIBOT Investment Methodology

(I) Long-Term Holding Strategy

- Target Investors: Individuals seeking exposure to AI-driven trading solutions and automated crypto tools with a multi-year investment horizon

- Operational Recommendations:

- Consider accumulating positions during market corrections when the price approaches support levels

- Monitor the project's milestone achievements, including expansion of user base beyond the current 10M+ game users and growth in executed raids beyond 1M+

- Implement a secure storage solution using Gate Web3 Wallet for cold storage of long-term holdings

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track 50-day and 200-day moving averages to identify potential trend reversals and momentum shifts

- Volume Analysis: Monitor daily trading volume relative to the 24-hour volume of approximately $12,152 to assess market participation

- Swing Trading Key Points:

- Establish entry positions near identified support zones and exit near resistance levels

- Set stop-loss orders to manage downside risk, particularly given the recent 30-day decline of 37.29%

AIBOT Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of cryptocurrency portfolio

- Aggressive Investors: 5-8% of cryptocurrency portfolio

- Professional Investors: 8-12% of cryptocurrency portfolio, with appropriate hedging strategies

(II) Risk Hedging Solutions

- Position Sizing: Limit initial exposure and scale positions based on market confirmation and project development progress

- Portfolio Diversification: Balance AIBOT holdings with established cryptocurrencies and other AI-sector tokens to reduce concentration risk

(III) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet for convenient access and regular trading activities

- Security Best Practices Solution: Enable two-factor authentication, regularly update security settings, and never share private keys or seed phrases

- Key Security Considerations: Be aware of phishing attempts, verify contract addresses (0x96adaa33e175f4a7f20c099730bc78dd0b45745b on BSC), and conduct transactions only through verified platforms

V. AIBOT Potential Risks and Challenges

AIBOT Market Risks

- Volatility Exposure: The token has experienced a 98.93% decline over the past year and a 37.29% decline in the past 30 days, indicating elevated volatility that may continue

- Liquidity Concerns: With a 24-hour trading volume of approximately $12,152 and a market cap of approximately $994,978, liquidity may be limited during periods of market stress

- Market Sentiment Shifts: Changes in investor appetite for AI-focused crypto projects could impact price action and trading volume

AIBOT Regulatory Risks

- Trading Bot Regulation: Potential regulatory scrutiny of automated trading tools and AI-driven trading solutions may impact the project's operational framework

- Cross-Border Compliance: As the project operates across multiple jurisdictions through partnerships with Meteora, LDA/QuickSWAP, and Bitcoin OS, regulatory requirements may vary

- Token Classification: Evolving regulatory definitions of utility tokens versus securities could affect AIBOT's legal status in different markets

AIBOT Technical Risks

- Smart Contract Vulnerabilities: As a BEP-20 token on BSC, the project is subject to potential smart contract exploits or coding errors

- Platform Dependencies: Reliance on the Binance Smart Chain infrastructure exposes the project to network congestion, gas fee fluctuations, and potential chain-level issues

- Integration Complexity: The multi-component ecosystem (Buy Bot, Raid Bot, Sniper Bot, and web trading terminal) creates technical complexity that may result in operational challenges

VI. Conclusion and Action Recommendations

AIBOT Investment Value Assessment

Cherry AI presents an integrated approach to AI-driven trading automation within the crypto ecosystem, having achieved measurable traction with 10M+ game users, 1M+ raids executed, and $150M+ in simulated trading volume. However, the token's market performance shows considerable volatility, with a market cap of approximately $994,978 and a circulating supply representing 22.15% of total supply. The project's partnerships with established platforms and its comprehensive product suite demonstrate operational progress, though investors should weigh these developments against the token's price decline and relatively modest market capitalization.

AIBOT Investment Recommendations

✅ Beginners: Start with a minimal allocation (no more than 1-2% of total cryptocurrency holdings), focus on understanding the project's fundamentals through the whitepaper at docs.cherrybot.co, and consider dollar-cost averaging to mitigate entry timing risk ✅ Experienced Investors: Evaluate AIBOT within the broader context of AI and trading automation sectors, monitor developments in user growth and partnership expansion, and consider strategic position sizing based on technical analysis and project milestones ✅ Institutional Investors: Conduct comprehensive due diligence on the project's technology stack, partnership agreements, and competitive positioning, assess liquidity constraints relative to position sizing requirements, and implement risk management protocols appropriate for early-stage crypto assets

AIBOT Trading Participation Methods

- Spot Trading on Gate.com: Access AIBOT trading pairs on Gate.com for direct token purchases and sales with transparent pricing

- Utilize Gate Web3 Wallet: Store and manage AIBOT tokens securely through Gate Web3 Wallet, maintaining control of private keys

- Monitor Project Development: Follow official channels at x.com/cherrytgbot and review documentation at docs.cherrybot.co to stay informed about platform updates and new feature releases

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What are the main factors affecting AIBOT's price?

AIBOT's price is primarily influenced by market demand, investor sentiment, technology development progress, regulatory policies, and overall trading volume in the crypto market.

How to predict AIBOT price? What are the analysis methods?

AIBOT price prediction uses technical and fundamental analysis. Key indicators include market demand, trading volume, and technology development. Historical data and trend analysis are essential tools for forecasting price movements.

AIBOT的历史价格走势如何?

AIBOT Token reached its all-time high exceeding $10.71 USD in March 2023. The token experienced significant volatility throughout 2023, with notable price fluctuations reflecting market dynamics. Current momentum shows growing interest in the project's fundamentals and ecosystem development.

What are the risks and limitations of AIBOT price prediction?

AIBOT price prediction faces market volatility and multiple influencing factors. AI model accuracy has inherent limitations, and predictions cannot guarantee market outcomes. Past performance does not indicate future results.

How does AIBOT's price performance compare to other AI-related tokens?

AIBOT is priced at US$0.005157, positioning it as an attractive entry point compared to many other AI tokens. With 24-hour trading volume of US$1,103,053 and a 4.71% price increase in the past 24 hours, AIBOT demonstrates strong market momentum and growing investor interest in the AI token sector.

What are professional analysts' views on AIBOT's future price?

Professional analysts predict AIBOT could reach $0.15 by end of 2025, with continued growth potential into 2026. Market trends and AI analysis indicate strong upside momentum for the token.

Newbie Guide: Easily Profit from Automated Trading on Gate.com

xStocks on Gate: A 2025 Guide to Buying TSLAx and NVDAx

What is a Liquidity Sweep

Mastering Tranchess (CHESS) Price Prediction: MACD & RSI Technical Analysis Guide

SKYAI Price Analysis: MACD and RSI Signals Reveal Bearish Short-Term Trend

What Is Sentiment in Trading? How It Shapes Market Moves

The easiest way to buy Bitcoin: How to buy cryptocurrencies using P2P?

Who Is Coffeezilla, the YouTube Detective Exposing Crypto Scams?

How to Use and Calculate RSI in Cryptocurrency Trading

The typical crypto investor: Who chooses to invest in cryptocurrency

What is SMURFCAT: A Complete Guide to Understanding This Emerging Technology and Its Applications