2026 AIR Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: AIR's Market Position and Investment Value

AIRian (AIR) operates as a web3 community project integrating DePIN and Sport AI technologies to enhance user health globally through gamified experiences. Since its launch in 2024, the project has established a presence in the health-focused blockchain ecosystem. As of 2026, AIR maintains a market capitalization of approximately $1.40 million, with a circulating supply of about 157.33 million tokens and a current price around $0.0089. This asset, positioned at the intersection of decentralized physical infrastructure and health data sharing, is gaining recognition within the web3 health and wellness sector.

This article will comprehensively analyze AIR's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic factors to provide professional price forecasts and practical investment strategies for investors.

I. AIR Price Historical Review and Current Market Status

AIR Historical Price Evolution Trajectory

- 2024: AIRian token was launched in July, reaching its highest recorded price of $0.15 on July 16, demonstrating strong initial market reception during its early trading phase.

- 2025: The token experienced significant downward pressure throughout the year, with price declining to its lowest point of $0.00022 on November 4, reflecting broader market corrections.

- 2026: As of early February, AIR is trading at $0.008894, showing a recovery trend with a 24.77% increase over the past 30 days, though still substantially below its historical peak.

AIR Current Market Status

As of February 2, 2026, AIR is trading at $0.008894, representing a notable decline from its all-time high but showing signs of recent stabilization. The token has experienced a 0.2% increase over the past hour, though it has declined by 10.21% in the last 24 hours. Over the weekly timeframe, AIR has decreased by 13.43%, while the monthly performance shows a positive trend with a 24.77% gain.

The current market capitalization stands at approximately $1.40 million, with a 24-hour trading volume of $12,954.63. The circulating supply represents 157.33 million tokens, which accounts for 15.73% of the total supply of 1 billion tokens. The fully diluted market cap is valued at $8.89 million.

AIR maintains a market dominance of 0.00032%, ranking at position 2290 in the cryptocurrency market. The token is currently available on 2 exchanges and has approximately 557 holders. The current trading range over the past 24 hours shows a high of $0.010175 and a low of $0.00887.

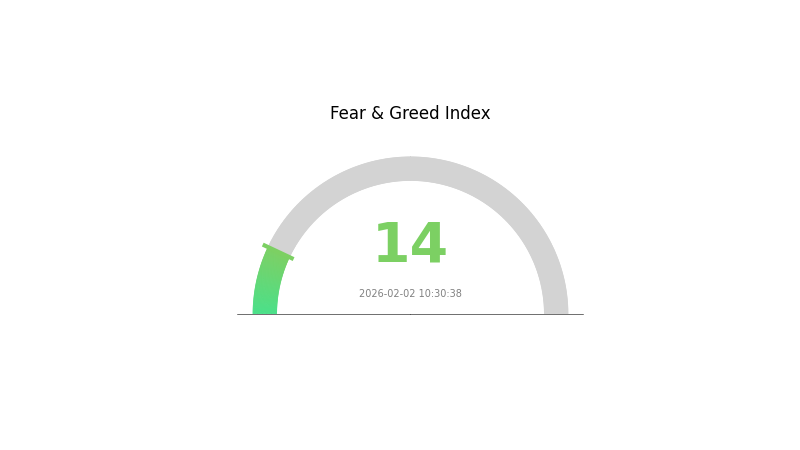

The market sentiment index indicates an "Extreme Fear" reading of 14, suggesting cautious investor positioning in the broader cryptocurrency market environment.

Click to view current AIR market price

AIR Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the index at 14, indicating significant pessimism among investors. This level typically reflects heightened market anxiety and risk aversion. When fear reaches such extremes, it often presents contrarian opportunities for long-term investors, as panic-driven selling may create attractive entry points. However, caution is advised, as extreme fear can also signal continued downside pressure. Monitor key support levels and market fundamentals closely before making investment decisions.

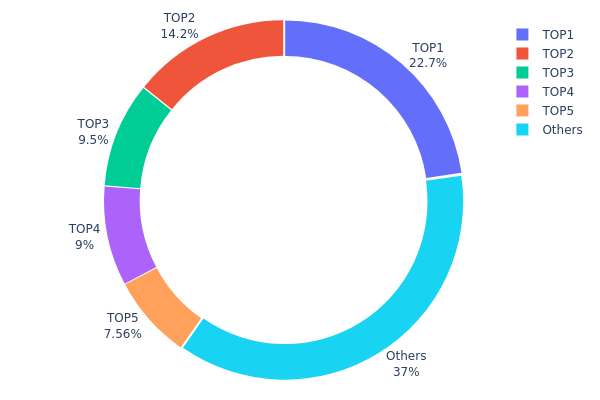

AIR 持仓分布

The address holding distribution chart illustrates the concentration of AIR tokens across different wallet addresses, revealing the degree of decentralization within the token's ownership structure. Based on current on-chain data, the top 5 addresses collectively hold 62.99% of the total AIR supply, indicating a relatively high concentration level. The largest holder controls 22.68% (226.8M tokens), followed by the second-largest at 14.25% (142.5M tokens), while the remaining addresses outside the top 5 account for 37.01% of total supply.

This concentration pattern suggests that AIR's ownership structure exhibits moderate centralization characteristics. While not reaching extreme concentration levels seen in some newly launched projects, the fact that over 60% of tokens are controlled by the top 5 addresses creates potential concerns regarding market manipulation risks and price volatility. Large holders possess significant influence over trading dynamics, and coordinated sell-offs could trigger substantial price fluctuations. Additionally, such distribution may impact governance mechanisms if AIR implements token-based voting systems, as major stakeholders could dominate decision-making processes.

From a market structure perspective, the current holding distribution reflects a typical pattern observed during early development phases or following significant token distribution events. The 37.01% held by other addresses indicates some level of retail participation and organic distribution, which provides a foundation for gradual decentralization. However, monitoring changes in this distribution over time remains crucial for assessing the project's long-term stability and its transition toward a more balanced ownership ecosystem.

Click to view current AIR holding distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xd3ae...73367e | 226800.00K | 22.68% |

| 2 | 0x822c...52c380 | 142500.00K | 14.25% |

| 3 | 0x7593...617a48 | 95000.00K | 9.50% |

| 4 | 0xe118...839acc | 90000.00K | 9.00% |

| 5 | 0x0a04...7752d5 | 75600.00K | 7.56% |

| - | Others | 370100.00K | 37.01% |

II. Core Factors Influencing AIR's Future Price Trends

Supply Mechanism

- Memory Component Supply Constraints: Apple faces supply limitations in advanced memory chips and system-on-chip (SoC) processors using cutting-edge 3nm technology. This constraint directly impacts production capacity and pricing flexibility.

- Historical Pattern: Previous supply chain disruptions have typically led to temporary price adjustments or margin compression as manufacturers balance supply costs with market competitiveness.

- Current Impact: Memory price increases had minimal effect on Q1 2026 gross margins but are expected to create greater pressure in Q2 2026, potentially influencing product pricing strategies or margin targets in subsequent quarters.

Institutional and Major Player Dynamics

- Institutional Positioning: Apple reported record quarterly revenue of $143.8 billion with iPhone revenue growing 23% year-over-year. The company maintains strong channel inventory management despite unprecedented demand levels.

- Enterprise Adoption: Apple's active installed base exceeded 2.5 billion devices globally, with services revenue reaching $30 billion (up 14% year-over-year), indicating sustained enterprise and consumer engagement across product categories.

- National Policy: Global memory chip shortages driven by AI infrastructure demand have created industry-wide supply challenges. Apple's procurement capabilities position it favorably compared to competitors facing similar constraints.

Macroeconomic Environment

- Monetary Policy Impact: Rising component costs and memory price volatility create potential pressure on profit margins, though Apple's diversified product mix and pricing power provide buffering mechanisms.

- Inflation Hedge Attributes: Apple's premium positioning and loyal customer base have historically enabled selective price adjustments during inflationary periods, though the company has shown reluctance to pass full cost increases to consumers.

- Geopolitical Factors: Strong performance in Greater China (38% year-over-year growth) demonstrates resilience despite regional competitive pressures, while supply chain diversification efforts continue across multiple geographies.

Technology Development and Ecosystem Building

- Apple Intelligence Integration: The company is advancing AI capabilities through partnerships with Google's Gemini models to power next-generation personalized Siri functionality, creating potential differentiation opportunities.

- Apple Silicon Evolution: Continued investment in proprietary chip development (including advanced 3nm SoCs and custom modems) strengthens product differentiation and potentially improves long-term margin structures.

- Ecosystem Applications: Services ecosystem expansion includes new advertising placements in App Store, digital ID functionality in Apple Wallet, and growing developer platform generating over $550 billion in cumulative payouts, reinforcing platform stickiness and recurring revenue streams.

III. 2026-2031 AIR Price Prediction

2026 Outlook

- Conservative prediction: $0.00809 - $0.00889

- Neutral prediction: Around $0.00889

- Optimistic prediction: Up to $0.01281 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: AIR may enter a gradual growth phase, with price volatility expected as the project ecosystem develops and market sentiment shifts

- Price range predictions:

- 2027: $0.00911 - $0.01487, with an average around $0.01085

- 2028: $0.00669 - $0.01466, with an average around $0.01286

- 2029: $0.00784 - $0.01995, with an average around $0.01376

- Key catalysts: Technology upgrades, expanded user adoption, market sentiment improvements, and overall crypto market trends could drive price appreciation

2030-2031 Long-term Outlook

- Baseline scenario: $0.01331 - $0.02191 (assuming steady project development and stable market conditions)

- Optimistic scenario: Potential to reach $0.0221 (with accelerated ecosystem growth and increased market demand)

- Transformative scenario: Could approach or exceed the upper range if AIR achieves significant technological breakthroughs or widespread adoption

- 2026-02-02: AIR trading within the initial predicted range as the token enters a multi-year growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01281 | 0.00889 | 0.00809 | 0 |

| 2027 | 0.01487 | 0.01085 | 0.00911 | 22 |

| 2028 | 0.01466 | 0.01286 | 0.00669 | 44 |

| 2029 | 0.01995 | 0.01376 | 0.00784 | 54 |

| 2030 | 0.02191 | 0.01685 | 0.01331 | 89 |

| 2031 | 0.0221 | 0.01938 | 0.01337 | 117 |

IV. AIR Professional Investment Strategy and Risk Management

AIR Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors interested in DePIN and Sport AI ecosystem development, willing to hold through market cycles

- Operation suggestions:

- Consider accumulating AIR tokens during market pullbacks, given the current price of $0.008894 showing significant distance from its ATH of $0.15

- Monitor the project's ecosystem expansion and user growth metrics as key indicators for long-term value

- Storage solution: Use Gate Web3 Wallet for secure ERC-20 token storage with private key control

(2) Active Trading Strategy

- Technical analysis tools:

- Volume analysis: Monitor the 24-hour trading volume of $12,954.63 to identify liquidity trends and potential price movements

- Price range observation: Track the 24-hour price range between $0.00887 and $0.010175 to identify support and resistance levels

- Swing trading considerations:

- Consider the recent 24-hour decline of 10.21% and 7-day decline of 13.43% when planning entry points

- Note the 30-day positive performance of 24.77%, which may indicate potential short-term recovery opportunities

AIR Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-2% of crypto portfolio

- Moderate investors: 3-5% of crypto portfolio

- Experienced investors: 5-10% of crypto portfolio, depending on risk appetite and market conditions

(2) Risk Hedging Approaches

- Position sizing: Limit AIR holdings to avoid overexposure to a single low-cap asset with current market cap of approximately $1.4 million

- Diversification: Balance AIR holdings with established cryptocurrencies and other DePIN projects to reduce sector-specific risks

(3) Security Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for convenient trading and ecosystem participation

- Cold storage option: Hardware wallet solutions for long-term holding of significant AIR positions

- Security considerations: Always verify contract address (0x294b9da569c0d694870239813bbe7b5824fd2339) before transactions, enable two-factor authentication, and never share private keys

V. AIR Potential Risks and Challenges

AIR Market Risks

- Limited liquidity: With only 557 holders and trading on 2 exchanges, the token faces liquidity constraints that may result in high volatility and slippage

- Price volatility: The 1-year decline of 71.25% demonstrates significant price instability and market uncertainty

- Low circulation ratio: Only 15.73% of total supply is currently circulating, with potential pressure from future token unlocks

AIR Regulatory Risks

- DePIN sector uncertainty: As decentralized physical infrastructure networks face evolving regulatory frameworks, changes in data privacy and health information regulations could impact AIRian's operations

- Token classification: Regulatory developments regarding utility tokens and health data platforms may affect AIR's legal status in different jurisdictions

- Cross-border compliance: Operating a global health data sharing platform requires compliance with varying regional healthcare and data protection regulations

AIR Technical Risks

- Smart contract vulnerabilities: As an ERC-20 token, AIR is subject to potential bugs or exploits in its contract code

- Ecosystem dependency: The project's reliance on Sport AI and DePIN infrastructure means technical issues in underlying systems could impact token utility

- Scaling challenges: Expanding a health data sharing ecosystem while maintaining security and performance may present technical obstacles

VI. Conclusion and Action Recommendations

AIR Investment Value Assessment

AIRian presents an interesting proposition in the intersection of DePIN, health data, and community engagement. The project's focus on user health improvement through gamification and data sharing addresses a growing market interest. However, investors should carefully weigh the long-term potential against current market indicators: a relatively small market cap of $1.4 million, limited exchange listings, and significant price depreciation from ATH. The 30-day positive trend of 24.77% may suggest emerging interest, but the broader 1-year decline of 71.25% indicates substantial risk. The project's success will largely depend on ecosystem adoption, user growth, and the broader acceptance of health-data-focused Web3 applications.

AIR Investment Recommendations

✅ Beginners: Consider starting with minimal exposure (under 1% of crypto portfolio) only after thoroughly researching the DePIN and Sport AI sectors. Focus on understanding the project's fundamentals and whitepaper before any investment.

✅ Experienced investors: May allocate 2-5% of crypto portfolio to AIR as a speculative position, with careful monitoring of ecosystem development, partnership announcements, and user adoption metrics. Consider dollar-cost averaging during market dips.

✅ Institutional investors: Should conduct comprehensive due diligence on the project's technology, team, and competitive landscape. Consider engaging directly with the project team and evaluating the scalability of the health data ecosystem before significant capital deployment.

AIR Trading Participation Methods

- Spot trading: Purchase AIR directly on Gate.com with USDT or other supported pairs for straightforward exposure

- Portfolio integration: Add AIR to a diversified DePIN-focused portfolio alongside other decentralized infrastructure projects

- Ecosystem participation: Engage with AIRian's health data sharing platform and products to gain firsthand experience with token utility

Cryptocurrency investment carries extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is AIR token? What is its purpose?

AIR token is a cryptocurrency designed for peer-to-peer trading platforms. It enhances efficiency and accessibility in digital asset transactions by facilitating seamless trading between users, reducing friction in the crypto market.

What are the main factors affecting AIR price?

AIR price is primarily influenced by market demand, trading volume, tokenomics, ecosystem development, macroeconomic conditions, and sentiment in the crypto market. Network adoption and technological updates also play significant roles in price movements.

How to conduct AIR price prediction? What are the common analysis methods?

AIR price prediction commonly uses technical analysis(examining price charts and trading volume trends), fundamental analysis(evaluating project developments and market conditions), and on-chain metrics analysis. Combining multiple methods provides more reliable forecasts for price movements.

What is the historical price trend of AIR?

AIR reached its historical peak in December 2025, then experienced a notable decline thereafter. The token has shown significant volatility throughout 2025, with trading volume fluctuating accordingly during market movements.

What are the risks of investing in AIR for price prediction?

AIR price prediction involves market volatility and liquidity risks. Price fluctuations can be significant due to market sentiment and trading volume changes. Investors should assess their risk tolerance before participating in price prediction activities.

What are the differences between AIR and other mainstream cryptocurrencies?

AIR distinguishes itself through unique tokenomics and specialized use cases compared to Bitcoin and Ethereum. It offers lower transaction costs, faster settlement times, and innovative features tailored for specific applications. AIR's growing ecosystem and developer community position it as an emerging alternative with distinct technological advantages.

Top 10 DePIN Crypto Projects to Invest in 2025

How to Participate in a DePIN Project

What is DePIN?How Does DePIN Work?

What Does Onyxcoin's DApp Ecosystem Look Like in 2025?

How to Earn with The RWA DePin Protocol in 2025

TrendX (XTTA): An Innovative Investment Platform Integrating AI and DePIN

Top 12 DeFi Protocols

How to Create an NFT and Maximize Profits in Today’s Market Conditions

GetAgent: Advanced AI Trading Assistant vs Traditional Trading Bots

Is NFT Dead? A Guide to NFT Use Cases

What Is an Airdrop in Cryptocurrency?