2026 BC Price Prediction: Expert Analysis and Market Forecast for Bitcoin's Future Valuation

Introduction: BC's Market Position and Investment Value

Blood Crystal (BC), positioned as an innovative blockchain game token that combines the classic Wizardry RPG legacy with modern Web3 gaming mechanics, has been navigating the crypto gaming sector since its launch in March 2024. As of February 2026, BC maintains a market capitalization of approximately $697,180, with a circulating supply of about 844 million tokens, and the price hovering around $0.000826. This asset, recognized as a bridge between traditional dungeon-crawling RPG elements and blockchain gaming innovation, is playing an evolving role in the GameFi ecosystem.

This article will comprehensively analyze BC's price trajectory from 2026 to 2031, integrating historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. BC Price History Review and Market Status

BC Historical Price Evolution Trajectory

- 2024: Project launched on March 7, 2024, with an initial offering price of $0.025, experiencing significant market fluctuations throughout the year

- 2024: On December 18, 2024, BC reached a notable price level of $0.095102, representing a substantial increase from its launch price

- 2026: Experienced considerable market volatility, with the price declining from previous levels to $0.000424 on February 4, 2026

BC Current Market Status

As of February 4, 2026, Blood Crystal (BC) is trading at $0.000826, showing a 24-hour price decline of 52.22%. The token has experienced significant short-term volatility, with a 1-hour decrease of 9.81% and a 7-day decline of 56.98%. Over the past 30 days, BC has decreased by 52.80%, while the 1-year performance shows a decline of 96.33%.

The current 24-hour trading volume stands at $3,631.69, with the total market capitalization at $697,180.13. BC holds a market ranking of 2,772 and represents 0.000025% of the total cryptocurrency market share. The circulating supply is 844,043,746 BC tokens, accounting for 84.40% of the total supply of 844,043,746 tokens, with a maximum supply cap set at 1,000,000,000 tokens.

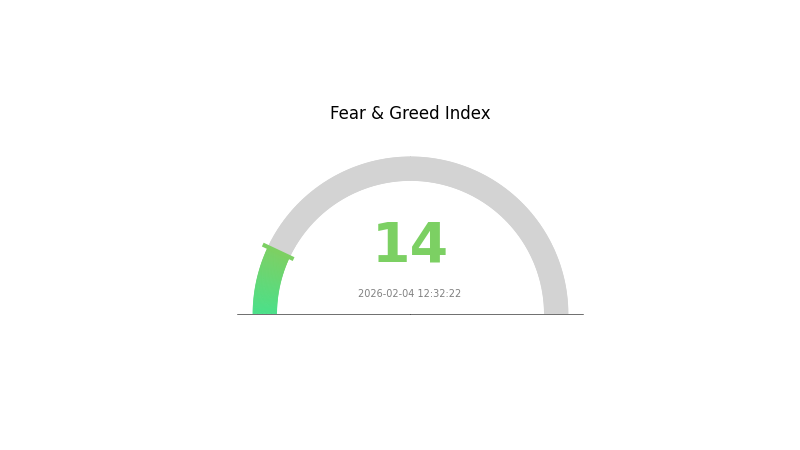

The token's 24-hour trading range has been between $0.000424 and $0.001729. The current market cap to fully diluted valuation ratio stands at 84.4%. According to market sentiment indicators, the current Fear and Greed Index is at 14, indicating "Extreme Fear" in the broader cryptocurrency market.

BC is an ERC-20 token deployed on the Ethereum blockchain, with the contract address 0x4b6d036d0bc62a633acca6d10956e9dbbb16748f. The token currently has 189 holders and is listed on 2 cryptocurrency exchanges, including Gate.com.

Click to view the current BC market price

BC Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 14. This historically low reading suggests panic-driven selling and significant market pessimism. When sentiment reaches extreme fear levels, it often presents contrarian opportunities for long-term investors, as assets become oversold and prices may diverge substantially from fundamental value. Market participants should exercise caution and consider whether current valuations align with their investment strategy. Monitor market developments closely for potential trend reversals as extreme sentiment conditions typically precede significant movements.

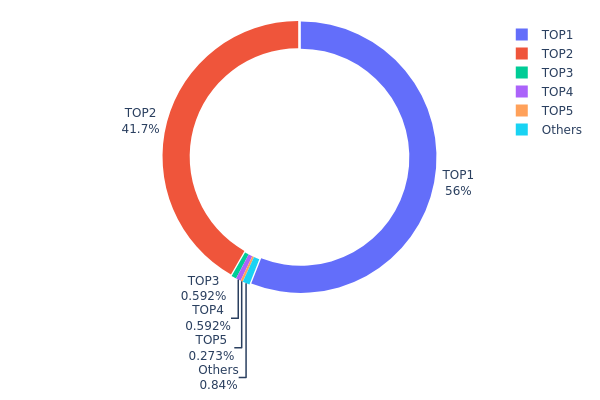

BC Holdings Distribution

The holdings distribution chart illustrates the concentration of token ownership across different wallet addresses, providing insights into the decentralization level and potential market manipulation risks. By analyzing the proportion of tokens held by top addresses versus smaller holders, investors can assess the health of token distribution and its implications for price stability.

Based on the current data, BC exhibits an extremely high concentration pattern. The top address holds 472,292.03K tokens (55.95%), while the second-largest address contains 352,354.37K tokens (41.74%). Combined, these two addresses control approximately 97.69% of the total supply. The third and fourth positions each hold 5,000K tokens (0.59%), with the fifth address holding 2,307.22K tokens (0.27%). All remaining addresses collectively account for only 0.86% of the total supply.

This extraordinarily centralized distribution structure poses significant risks to market stability. With nearly 98% of tokens controlled by just two addresses, the potential for price manipulation is substantial. Any selling pressure from these major holders could trigger dramatic price movements, while the lack of broad-based distribution suggests limited organic trading activity. The presence of a burn address (0x0000...00dead) holding 41.74% indicates a deflationary mechanism, though the dominant position of the top address remains a critical concern. This concentration level falls far below healthy decentralization standards, potentially deterring institutional investors and exposing retail participants to elevated volatility risks.

Click to view current BC Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x40ec...5bbbdf | 472292.03K | 55.95% |

| 2 | 0x0000...00dead | 352354.37K | 41.74% |

| 3 | 0xa60d...5ae096 | 5000.00K | 0.59% |

| 4 | 0x568f...7b56f0 | 5000.00K | 0.59% |

| 5 | 0x8ded...16e375 | 2307.22K | 0.27% |

| - | Others | 7090.12K | 0.86% |

II. Core Factors Influencing BC's Future Price Trends

Supply Mechanisms

-

Housing Supply Constraints: BC's housing market, particularly in Vancouver, faces significant supply limitations. The scarcity of new housing inventory continues to be a primary driver of long-term price appreciation, even during periods of market stagnation.

-

Historical Patterns: Past cycles demonstrate that BC's real estate market exhibits remarkable resilience compared to other regions. During market downturns, BC tends to experience plateaus rather than sharp declines, reflecting structural supply-demand imbalances.

-

Current Impact: Limited new housing development pipelines suggest continued upward pressure on prices. Vancouver's median home price, currently around CAD 2.5 million, may reach CAD 2.8 million within the next decade, driven primarily by insufficient supply growth relative to demand.

Institutional and Policy Dynamics

-

Government Policy Framework: BC's 2020 Budget allocated historic capital investments of CAD 22.9 billion over three years for infrastructure development, including hospitals, highways, schools, and housing projects. These investments create over 100,000 direct and indirect jobs during construction phases, supporting economic stability.

-

Immigration Policy: Federal and provincial immigration policies represent a dual-edged influence. While short-term policy adjustments may temporarily moderate price growth, long-term immigration-driven population increases continue to fuel housing demand. BC's population is projected to grow by approximately 346,000 by 2024, with over 1 million additional residents expected within 15 years.

-

Economic Development Initiatives: The province's focus on sustainable economic growth includes investments in clean technology through CleanBC programs, workforce development via the BC Access Grant supporting over 40,000 students, and support for diversified industries including forestry innovation and LNG development.

Macroeconomic Environment

-

Regional Economic Leadership: BC maintains one of Canada's fastest GDP growth rates, with projections of 2.0% for 2020 and 1.9% for 2021. The province's low unemployment rate and leading job creation position it favorably among Canadian provinces.

-

Trade Relationships: Stable and reaffirmed trade relationships, along with major domestic economic development projects, constitute core factors for improving market activity. However, global trade policy uncertainties and geopolitical tensions present ongoing risks.

-

Fiscal Prudence: The provincial government maintains balanced budgets with projected surpluses (CAD 227 million for 2020-21, CAD 179 million for 2021-22, and CAD 374 million for 2022-23), providing economic stability. Contingency reserves of CAD 600 million for 2020-21 and CAD 400 million annually for subsequent years offer buffers against unforeseen circumstances.

Market Segmentation and Consumer Dynamics

-

Affordability Measures: Government initiatives to improve affordability include the BC Child Opportunity Benefit supporting 290,000 families, the Affordable Child Care Benefit, ICBC insurance premium reductions averaging CAD 400 annually, and the elimination of MSP premiums—representing the largest middle-class tax reduction in a generation.

-

Differentiated Price Movements: Different property types exhibit varying price trajectories. Market segmentation reflects diverse buyer profiles and economic conditions across regions, with major urban centers like Vancouver demonstrating greater resilience compared to smaller communities.

-

Demographic Shifts: Over 75% of BC's projected 860,000 new jobs over the next decade will require post-secondary education or training. Educational investments and workforce development programs aim to ensure residents can capitalize on emerging opportunities in the evolving economy.

Infrastructure and Long-term Development

-

Capital Investment Programs: Historic infrastructure spending supports healthcare improvements (13 communities receiving new or renovated hospitals, 12 new urgent and primary care centers operational), educational enhancements (4,200 new teachers, school renovations, additional CAD 339 million for K-12 system), and transportation networks.

-

Clean Economy Transition: CleanBC initiatives include CAD 419 million in additional funding over three years for electric vehicle incentives, charging infrastructure, industrial transition to low-carbon solutions, and energy efficiency projects in educational and healthcare facilities, building upon CAD 900 million invested in 2019.

-

Economic Diversification: Support for forestry sector workers through training programs, equipment purchase loans, and community assistance demonstrates commitment to transitioning traditional industries. Investments in bio-economy development, converting wood into biofuels, bioplastics, and textiles, represent innovation-driven economic transformation strategies.

III. 2026-2031 BC Price Prediction

2026 Outlook

- Conservative prediction: $0.00057 - $0.00108

- Neutral prediction: Around $0.00108

- Optimistic prediction: Up to $0.00146 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with potential consolidation periods

- Price range prediction:

- 2027: $0.00081 - $0.00147

- 2028: $0.00099 - $0.00189

- 2029: $0.00124 - $0.00219

- Key catalysts: Market maturation, potential technological developments, and broader cryptocurrency market trends

2030-2031 Long-term Outlook

- Baseline scenario: $0.00139 - $0.00208 (assuming steady market development)

- Optimistic scenario: $0.00191 - $0.00213 (with enhanced ecosystem growth and sustained adoption)

- Transformative scenario: Potential to reach $0.00213 or higher (under exceptionally favorable market conditions with significant network expansion)

- 2026-02-04: BC trading within projected ranges as the token continues its market evolution

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00146 | 0.00108 | 0.00057 | 30 |

| 2027 | 0.00147 | 0.00127 | 0.00081 | 53 |

| 2028 | 0.00189 | 0.00137 | 0.00099 | 65 |

| 2029 | 0.00219 | 0.00163 | 0.00124 | 97 |

| 2030 | 0.00208 | 0.00191 | 0.00139 | 131 |

| 2031 | 0.00213 | 0.00199 | 0.0014 | 141 |

IV. BC Professional Investment Strategy and Risk Management

BC Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors interested in blockchain gaming ecosystems with high risk tolerance

- Operational Recommendations:

- Consider dollar-cost averaging during market downturns to reduce entry cost volatility

- Monitor game development progress and community engagement metrics

- Utilize Gate Web3 Wallet for secure storage with multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the relatively low 24h trading volume ($3,631.69) which may indicate limited liquidity and higher slippage risk

- Support and Resistance Levels: Track the recent low at $0.000424 and resistance near $0.001729

- Swing Trading Considerations:

- Exercise extreme caution given the high volatility (52.22% decline in 24h)

- Set strict stop-loss orders to manage downside risk

BC Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0-1% of crypto portfolio

- Aggressive Investors: 1-3% of crypto portfolio

- Professional Investors: Maximum 5% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine BC with established gaming tokens to reduce concentration risk

- Position Sizing: Limit single trade exposure to no more than 2% of total portfolio value

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading needs with enhanced security features

- Cold Storage Option: Transfer majority holdings to hardware wallets for long-term storage

- Security Precautions: Never share private keys; enable two-factor authentication; verify all transaction addresses carefully

V. BC Potential Risks and Challenges

BC Market Risks

- Extreme Price Volatility: BC has declined 96.33% from its all-time high of $0.095102 in December 2024, indicating significant downside potential

- Low Liquidity: Limited trading volume and presence on only 2 exchanges may result in difficulty executing large orders

- Market Cap Vulnerability: With a market cap of only $697,180 and 189 holders, the token is susceptible to manipulation

BC Regulatory Risks

- Gaming Token Classification: Evolving regulations regarding blockchain gaming assets may impact BC's legal status in different jurisdictions

- Securities Law Compliance: Potential scrutiny from regulators regarding token economics and distribution mechanisms

- Geographic Restrictions: Possible trading limitations in regions with strict gaming or cryptocurrency regulations

BC Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token on Ethereum, BC is exposed to potential bugs or exploits in its contract code

- Game Development Risk: The project's success heavily depends on continuous development and user adoption of Eternal Crypt - Wizardry BC

- Network Congestion: Ethereum gas fees during peak times may make small transactions economically unviable

VI. Conclusion and Action Recommendations

BC Investment Value Assessment

Blood Crystal (BC) represents a highly speculative investment in the blockchain gaming sector. While the project combines the classic Wizardry franchise with modern blockchain mechanics, the token has experienced severe price depreciation and faces significant liquidity challenges. The small holder base (189) and limited exchange listings suggest early-stage adoption risks. Long-term value proposition depends entirely on successful game development and user retention, while short-term risks include continued price volatility and potential further declines.

BC Investment Recommendations

✅ Beginners: Avoid BC until gaining experience with more established cryptocurrencies; if interested in blockchain gaming, allocate no more than 0.5% of portfolio ✅ Experienced Investors: Consider small speculative position (1-2%) only if thoroughly researching game mechanics and development roadmap; implement strict stop-loss orders ✅ Institutional Investors: BC's low liquidity and market cap make it unsuitable for institutional-scale investments; monitor for potential future opportunities if project demonstrates sustainable growth

BC Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale with lower fees for established users

- Dollar-Cost Averaging: Systematic periodic purchases to mitigate timing risk in volatile market conditions

- Limit Orders: Use limit orders instead of market orders to avoid slippage given low liquidity environment

Cryptocurrency investment carries extreme risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What are the main methods for BC price prediction?

BC price prediction employs multiple approaches: ARIMA and regression for statistical analysis, LSTM and Transformer networks for deep learning, machine learning models like XGBoost for pattern recognition, sentiment analysis from social media, on-chain data tracking, and ensemble consensus methods combining multiple models for robust forecasting.

What are the key factors affecting BC price?

BC price is influenced by market sentiment, regulatory policies, trading volume, technological developments, and global economic conditions. Supply scarcity and halving events also drive significant price movements. Investor psychology and adoption rates further impact valuation.

How to use technical analysis for BC price prediction?

Use technical analysis by examining trading volume and price charts with moving averages and RSI indicators. Analyze support/resistance levels and trend patterns to identify potential BC price movements and market opportunities.

What is the historical price trend of BC and what patterns can be identified?

BC exhibits cyclical volatility with alternating trend and consolidation phases. Price movements reflect market sentiment and trading volume changes. Long-term observation reveals patterns in support/resistance levels and cycle timing, enabling traders to identify potential entry and exit opportunities based on historical behavior.

What are some reliable BC price prediction tools or platforms?

Reliable BC price prediction tools include CoinMarketCap, CryptoCompare, and TradingView. These platforms offer real-time data, technical analysis, and market insights to help forecast price movements accurately.

What are the risks and limitations of BC price predictions?

BC price predictions face credit rating limitations, liquidity risks, valuation risks, and market volatility. These factors may impact prediction accuracy and market performance.

What is the professional analyst's price prediction for BC in the future?

Professional analysts project BC's future price target at $70.0, according to B.Riley Securities analyst Eric Wold. This forecast reflects bullish sentiment on BC's medium to long-term growth potential.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

Free Money for App Registration: Crypto Rewards Guide

Top 4 Cryptocurrency Exchanges for Free Registration Bonuses

What is Slippage? How Can We Avoid It While Trading Crypto?

Revolut Quiz Answers

Top 5 Best Bitcoin Wallets | Updated Edition