2026 BMB Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: BMB's Market Position and Investment Value

Beamable Network (BMB), as a decentralized compute infrastructure platform building Compute Capital Markets on Solana, has been transforming how computational resources are accessed and traded since its launch in November 2025. As of February 2026, BMB maintains a market capitalization of approximately 1.06 million USD, with a circulating supply of around 196.67 million tokens, and its price hovering near 0.005399 USD. This asset, recognized as a pioneer in tokenized compute resource infrastructure, is playing an increasingly critical role in providing cost-effective alternatives to centralized cloud computing services, particularly for AI applications and infrastructure workloads.

This article will comprehensively analyze BMB's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. BMB Price History Review and Market Status

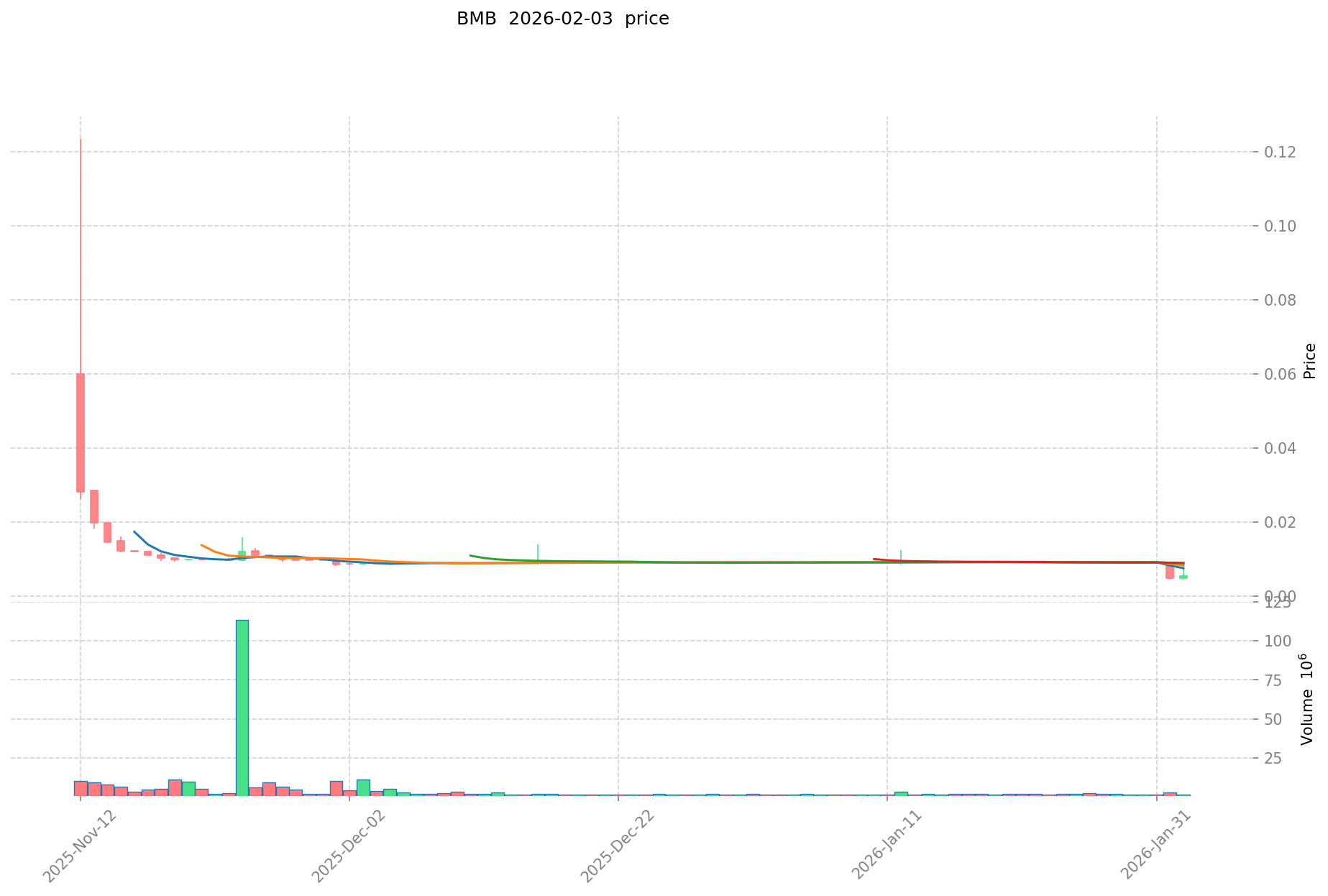

BMB Historical Price Evolution Trajectory

- November 2025: Token launched on Gate.com, reaching a peak price of $0.12349 on November 12, 2025

- January-February 2026: Market experienced significant correction, with price declining from previous highs

- February 2026: Price reached a low point of $0.004363 on February 2, 2026, representing substantial volatility from peak levels

BMB Current Market Status

As of February 3, 2026, BMB is trading at $0.005399, showing a 24-hour increase of 15.88%. The token has experienced notable price fluctuations in recent periods, with a 7-day decline of 40.18% and a 30-day decrease of 40.47%. The 24-hour trading volume stands at $9,099.08, while the market capitalization has reached $1,061,802.11.

The current circulating supply is 196,666,441 BMB tokens, representing 19.67% of the total supply of 1 billion tokens. The fully diluted market cap is calculated at $5,399,000. BMB ranks #2,466 in overall market capitalization, with a market dominance of 0.00019%. The token is held by 1,844 addresses and is currently listed on 2 exchanges.

Within the past 24 hours, BMB has traded between a high of $0.008985 and a low of $0.004659, demonstrating significant intraday volatility. The current price represents a substantial decline from the peak price recorded in November 2025.

Click to view current BMB market price

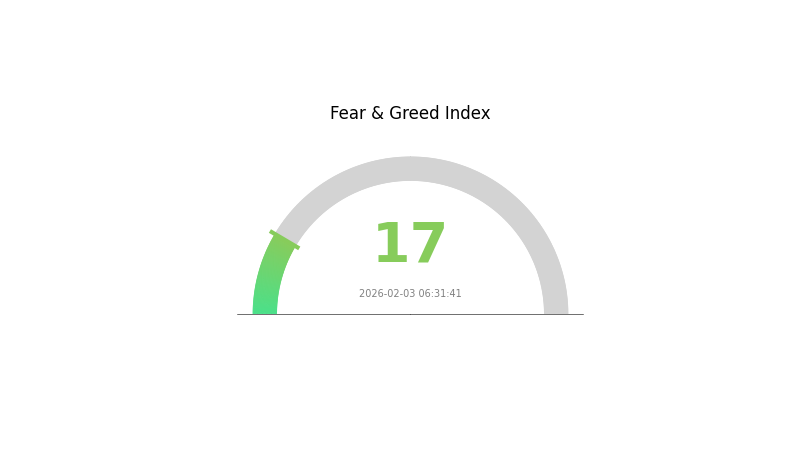

BMB Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 17. This indicates significant market pessimism and heightened risk aversion among investors. When fear reaches such extreme levels, it often signals potential oversold conditions and may present buying opportunities for long-term investors with strong conviction. However, caution remains warranted as market volatility could persist. Traders should implement strict risk management strategies and monitor key support levels closely during such uncertain periods.

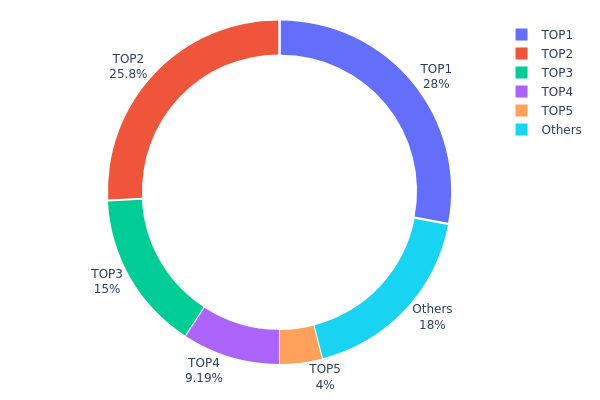

BMB Holding Distribution

The holding distribution chart reflects the concentration of BMB tokens across different wallet addresses, providing insights into the decentralization level and potential market manipulation risks. By analyzing the proportion of tokens held by top addresses versus smaller holders, we can assess the market structure and stability of the token's on-chain ecosystem.

According to the current data, BMB exhibits a highly concentrated holding pattern. The top address controls 280,000K tokens (28.00%), while the second and third largest holders possess 258,000K (25.80%) and 150,000K (15.00%) respectively. Combined, the top three addresses account for 68.80% of the total supply, with the top five addresses collectively holding 81.98%. This concentration level significantly exceeds the healthy decentralization threshold typically observed in mature cryptocurrency projects, indicating that a small number of entities maintain dominant control over the token's circulation.

Such extreme concentration presents notable risks to market stability. Large holders, or "whales," possess substantial influence over price movements through their trading activities. When these addresses execute significant buy or sell orders, they can trigger sharp price fluctuations, increasing volatility and creating opportunities for potential market manipulation. Furthermore, the remaining 18.02% held by "Others" suggests limited distribution among retail investors and smaller participants, which may constrain organic market growth and reduce liquidity resilience. This holding structure reflects a relatively centralized on-chain ecosystem that could benefit from broader token distribution to enhance long-term stability and community-driven governance.

Click to view current BMB Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | GkqBta...BbgPKH | 280000.00K | 28.00% |

| 2 | NzHcrC...C13LSr | 258000.00K | 25.80% |

| 3 | 7xQVXz...vXHixT | 150000.00K | 15.00% |

| 4 | 88Qish...kiHk8y | 91873.70K | 9.18% |

| 5 | 2cxoaT...FVsjEs | 40000.00K | 4.00% |

| - | Others | 180125.69K | 18.02% |

II. Core Factors Influencing BMB's Future Price

Supply Mechanism

- Node Network Expansion: As the distributed node operator network expands, network utility increases, potentially creating upward pressure on token demand.

- Historical Pattern: Network growth has historically correlated with enhanced utility and value appreciation in similar decentralized infrastructure projects.

- Current Impact: Expansion of the node network is expected to strengthen the token's fundamental value proposition by increasing network security and functionality.

Institutional and Major Player Dynamics

- Game Developer Adoption: More game developers are adopting the Beamable infrastructure, which drives organic demand for the token through practical use cases.

- Ecosystem Expansion: The growth of the developer community and increased integration of Beamable's infrastructure in gaming applications represents a positive catalyst for token adoption.

Macroeconomic Environment

- Market Sentiment: External market conditions and overall cryptocurrency market sentiment play a crucial role in price movements, particularly for tokens in the gaming and infrastructure sectors.

- External Factors: Broader market dynamics, including regulatory developments and shifts in investor risk appetite, continue to influence price trends.

Technology Development and Ecosystem Building

- Infrastructure Development: The project's ongoing development of its core infrastructure for game developers represents a key technical foundation for long-term value.

- Ecosystem Applications: The adoption of Beamable's technology by game developers creates practical use cases that support token utility and demand.

- Network Utility Growth: As the distributed node network expands and more developers integrate the platform, network effects may positively impact token value over time.

III. 2026-2031 BMB Price Prediction

2026 Outlook

- Conservative Prediction: $0.00513 - $0.0054

- Neutral Prediction: Around $0.0054

- Optimistic Prediction: Up to $0.00788 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: Gradual growth phase with increasing market recognition and ecosystem development

- Price Range Predictions:

- 2027: $0.00505 - $0.0077 (approximately 23% potential growth)

- 2028: $0.00602 - $0.00911 (approximately 32% potential growth)

- 2029: $0.00513 - $0.0114 (approximately 50% potential growth)

- Key Catalysts: Enhanced platform utility, expanding user base, potential partnerships, and broader cryptocurrency market trends

2030-2031 Long-term Outlook

- Baseline Scenario: $0.0086 - $0.01202 (assuming steady ecosystem growth and sustained market interest)

- Optimistic Scenario: $0.00977 - $0.01459 (assuming accelerated adoption and favorable regulatory environment)

- Transformative Scenario: Above $0.01459 (requires breakthrough developments, significant institutional adoption, or major platform innovations)

- February 3, 2026: BMB trading at baseline levels within the predicted range of $0.00513 - $0.00788

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00788 | 0.0054 | 0.00513 | 0 |

| 2027 | 0.0077 | 0.00664 | 0.00505 | 23 |

| 2028 | 0.00911 | 0.00717 | 0.00602 | 32 |

| 2029 | 0.0114 | 0.00814 | 0.00513 | 50 |

| 2030 | 0.01202 | 0.00977 | 0.0086 | 80 |

| 2031 | 0.01459 | 0.01089 | 0.00926 | 101 |

IV. BMB Professional Investment Strategy and Risk Management

BMB Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors seeking exposure to decentralized computing infrastructure with a tolerance for emerging technology volatility

- Operational Recommendations:

- Consider accumulating positions during network development phases when workload adoption is growing

- Monitor monthly API call volumes and on-chain revenue generation as indicators of network utilization

- Storage Solution: Gate Web3 Wallet offers secure storage for SPL tokens on Solana, supporting multi-signature functionality and hardware wallet integration

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track the correlation between 24-hour trading volume ($9,099) and price movements to identify liquidity patterns

- Support/Resistance Levels: Monitor the recent low of $0.004363 as a potential support zone and evaluate resistance near previous trading ranges

- Swing Trading Considerations:

- Given the 40.18% decline over 7 days, wait for price stabilization signals before entering positions

- Monitor broader Solana ecosystem developments that may impact network computing demand

BMB Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 10% with active monitoring of network metrics

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance BMB exposure with established Layer 1 tokens and stablecoins

- Position Sizing: Scale into positions gradually rather than committing capital in a single transaction

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet provides convenient access for active traders with built-in security features

- Cold Storage Option: Hardware wallets supporting Solana SPL tokens for long-term holdings

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (BMBtwz6LFDJVJd2aZvL5F64fdvWP3RPn4NP5q9Xe15UD) before transactions

V. BMB Potential Risks and Challenges

BMB Market Risks

- Price Volatility: The token has experienced significant fluctuations, with a 40.47% decline over 30 days, reflecting high market volatility

- Liquidity Concerns: With a 24-hour trading volume of approximately $9,099 and availability on 2 exchanges, liquidity may be limited during market stress

- Market Cap Position: Ranked #2466 with a market capitalization of approximately $1.06 million, the token faces competition from established computing projects

BMB Regulatory Risks

- Decentralized Computing Oversight: Evolving regulations around decentralized infrastructure services may impact network operations

- Token Classification Uncertainty: Regulatory frameworks for utility tokens tied to computing resources remain in development across jurisdictions

- Cross-border Compliance: Operating a global decentralized computing network may require navigating multiple regulatory environments

BMB Technical Risks

- Network Adoption Uncertainty: Success depends on attracting sufficient computing workload demand to generate sustainable on-chain revenue

- Competition from Established Providers: Competing against AWS and other hyperscalers requires significant technological differentiation and cost advantages

- Solana Network Dependencies: BMB relies on Solana's infrastructure, exposing it to potential network congestion or technical issues

VI. Conclusion and Action Recommendations

BMB Investment Value Assessment

Beamable Network presents an innovative approach to decentralizing computing infrastructure, targeting a substantial market opportunity. The token's connection to network activity through on-chain revenue sharing creates a direct link between usage and value. However, early-stage metrics including limited exchange availability, a circulating supply of only 19.67% of total supply, and recent price declines suggest the project is in an early development phase. Investors should weigh the long-term potential of disrupting centralized computing against near-term execution risks and market volatility.

BMB Investment Recommendations

✅ Beginners: Consider waiting for clearer network adoption metrics and increased liquidity before investing. If proceeding, allocate only a minimal portion of your portfolio. ✅ Experienced Investors: Monitor network growth indicators such as monthly API call volumes and on-chain revenue generation. Consider small exploratory positions with strict risk management. ✅ Institutional Investors: Conduct thorough due diligence on technology infrastructure, team credentials, and competitive positioning. Evaluate partnership developments and workload migration timelines.

BMB Trading Participation Methods

- Spot Trading: Purchase BMB on Gate.com with support for multiple trading pairs

- Decentralized Exchange Access: Trade directly on Solana-based DEXs using the verified contract address

- Research Phase: Review project documentation at docs.beamable.network and monitor community discussions on Discord and X (Twitter) before committing capital

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is BMB? What are its uses and value?

BMB is a digital currency developed by Coinxin Blockchain, enabling decentralized transactions through distributed ledger technology. It features immutability, trustless verification, and serves as a utility token in the blockchain ecosystem with growing adoption value.

What is the historical price trend of BMB tokens?

BMB token has shown relatively stable price movements, currently trading at $0.009045. The token reached its recent high of $0.009045 with a low of $0.062368. Recent 24-hour trading volume indicates moderate market activity and liquidity in the BMB market.

What will be the BMB price prediction trend in 2024?

Based on predictive models analyzing BMB's historical performance, the price is projected to reach $460.39 by 2026. Future movements depend on market conditions and adoption trends.

What are the main factors affecting BMB price?

BMB price is influenced by project development progress, market demand, overall crypto market trends, investor sentiment, and regulatory policies. Trading volume and ecosystem adoption also play significant roles.

What are the risks to be aware of when investing in BMB?

BMB price may fluctuate significantly, potentially leading to capital loss. Investors face market volatility risk and must bear full responsibility for investment decisions. Past performance does not guarantee future results.

What Is a Phantom Wallet: A Guide for Solana Users in 2025

Solana Price in 2025: SOL Token Analysis and Market Outlook

How Does Solana's Proof of History Work?

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Is Solana a Good Investment?

Solana in 2025: Ecosystem Growth and DeFi Dominance

What Are LP Tokens and How to Earn From Them: A Comprehensive Overview

Comprehensive Guide to Bitcoin and Cryptocurrency Investment

How to Create an NFT for Free with Picsart

Dusting Attack: How Hackers Steal Your Information with Tiny Crypto Amounts and How to Protect Yourself

Who Is Will Clemente? A Guide to the Popular On-Chain Analyst