2026 DFYN Price Prediction: Expert Analysis and Market Forecast for the Decentralized Finance Token

Introduction: DFYN's Market Position and Investment Value

Dfyn Network (DFYN), positioned as a multi-chain AMM DEX operating on the Polygon network and expanding to other blockchain networks, has been developing its cross-chain liquidity infrastructure since its launch in 2021. As of February 2026, DFYN maintains a market capitalization of approximately $217,511, with a circulating supply of around 192.49 million tokens, and the price hovering near $0.00113. This asset, designed to serve as a liquidity gateway within the cross-chain DeFi ecosystem, is playing an increasingly significant role in facilitating decentralized exchange across multiple Layer-1 and Layer-2 blockchains.

This article will comprehensively analyze DFYN's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. DFYN Price History Review and Market Status

DFYN Historical Price Evolution Trajectory

- 2021: Project launched in May with token debut, price reached $8.38 during initial trading period

- 2021-2025: Extended market correction phase, price experienced sustained downward pressure across multiple cycles

- 2026: Price declined to $0.00107014 in early February, marking a significant low point in trading history

DFYN Current Market Situation

As of February 08, 2026, DFYN is trading at $0.00113, showing a 2.35% increase over the past hour. The 24-hour trading volume stands at $15,192.28, with the price fluctuating between $0.001096 and $0.001153 during this period. The token has experienced a 0.72% decline over the past 24 hours.

The circulating supply is 192,488,455 DFYN tokens, representing approximately 77% of the total supply of 198,284,007 tokens. The current market capitalization is $217,511.95, with a fully diluted market cap of $224,060.93. The maximum supply is capped at 250,000,000 tokens.

Recent price trends indicate varied performance across different timeframes: a 12.09% decrease over the past 7 days, a 36.29% decline over 30 days, and a 79.55% reduction over the past year. The token's market dominance stands at 0.0000088%, with approximately 4,052 holders. Market sentiment indicators currently reflect cautious positioning among participants.

Click to view current DFYN market price

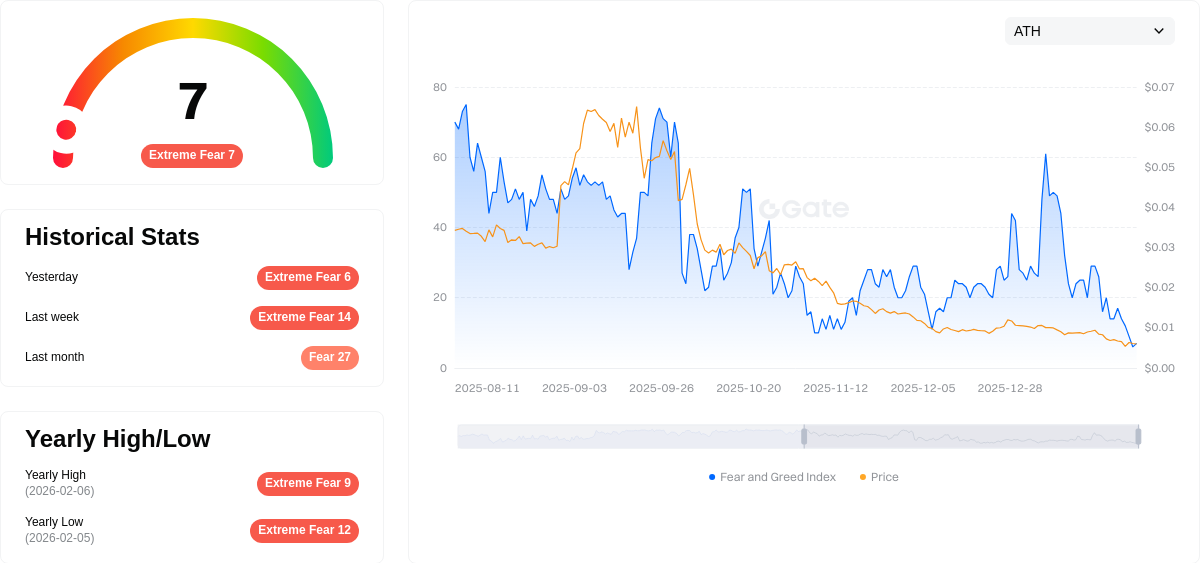

Market Sentiment Indicator

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index at 7. This exceptionally low reading indicates widespread investor anxiety and pessimism in the market. Such extreme fear conditions typically suggest that asset prices may be significantly undervalued. Historically, these periods have presented buying opportunities for contrarian investors. However, it is crucial to conduct thorough research and implement proper risk management strategies before making investment decisions during volatile market conditions.

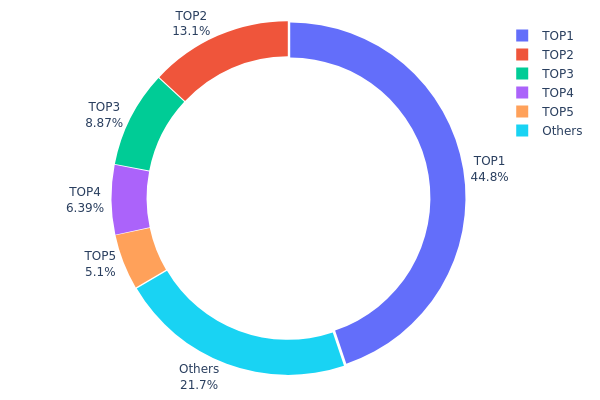

DFYN Holding Distribution

The holding distribution chart reflects the allocation of token holdings across different wallet addresses, serving as a key indicator of decentralization and market structure. By analyzing the concentration of tokens among top holders, we can assess the project's vulnerability to price manipulation and the overall health of its on-chain ecosystem.

Based on current data, DFYN exhibits a relatively high concentration among its top holders. The largest address controls approximately 44.81% of the total supply (86.75 million tokens), while the top five addresses collectively hold 78.25% of all tokens. This level of concentration suggests that a small number of entities maintain significant influence over the token's market dynamics. The remaining 21.75% is distributed among other addresses, indicating limited dispersion beyond the major holders.

This concentrated holding structure presents both risks and considerations for market participants. The dominance of top addresses could lead to heightened volatility, as large-scale selling from any major holder would significantly impact market liquidity and price stability. Additionally, such concentration raises concerns about potential coordinated market activities and reduces the token's decentralization characteristics. However, it's worth noting that some of these addresses may represent legitimate protocol-controlled wallets, exchange reserves, or long-term institutional investors, which could provide a degree of structural stability if these entities maintain consistent holding strategies.

Click to view the current DFYN Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x40ec...5bbbdf | 86749.27K | 44.81% |

| 2 | 0x58ed...a36a51 | 25341.56K | 13.09% |

| 3 | 0x9642...2f5d4e | 17164.96K | 8.86% |

| 4 | 0xcab3...3f8fb2 | 12375.84K | 6.39% |

| 5 | 0x0000...44c6df | 9878.25K | 5.10% |

| - | Others | 42068.31K | 21.75% |

II. Core Factors Influencing DFYN's Future Price

Supply Mechanism

- Market Demand Dynamics: The price trajectory of DFYN is fundamentally influenced by the supply-demand ratio, which fluctuates with market activities and investor sentiment. Token scarcity and limited availability play a significant role in determining value.

- Historical Patterns: Historical data suggests that cryptocurrency prices tend to respond positively to increased market demand and ecosystem activity. Projects with active development and growing user bases typically experience upward price pressure.

- Current Impact: DFYN's price movement remains closely tied to overall blockchain technology advancement and the broader cryptocurrency market trends. Enhanced ecosystem activity and project innovation could potentially support price appreciation.

Institutional and Major Holder Dynamics

- Institutional Positioning: Market analysts continue to monitor DFYN's institutional interest as a key indicator of long-term value potential. The token's market capitalization serves as an important metric for assessing its competitive position.

- Adoption Trends: The cryptocurrency market's overall direction, including regulatory developments and market sentiment, significantly influences DFYN's perceived value among investors.

- Policy Environment: Broader support for blockchain technology development at national levels could create favorable conditions for projects operating within the decentralized finance space.

Macroeconomic Environment

- Monetary Policy Impact: Cryptocurrency markets remain sensitive to global monetary policy shifts, with major central bank decisions potentially affecting digital asset valuations across the board.

- Market Sentiment: The overall direction of cryptocurrency markets, influenced by investor confidence and risk appetite, plays a crucial role in shaping individual token performance.

- Geopolitical Considerations: International regulatory changes and policy developments continue to impact the cryptocurrency sector, with market participants closely monitoring potential implications for project valuations.

Technological Development and Ecosystem Building

- Blockchain Technology Evolution: Ongoing advancements in blockchain infrastructure and decentralized applications contribute to the long-term development potential of tokens within the ecosystem.

- Ecosystem Activity: The vitality of DFYN's ecosystem, including user engagement and development progress, represents a key factor in determining future value. Projects demonstrating sustained innovation and partnership development may experience enhanced market positioning.

- DeFi Integration: The broader DeFi landscape continues to evolve, with project success often linked to the ability to create utility and foster meaningful partnerships within the decentralized finance space.

III. 2026-2031 DFYN Price Prediction

2026 Outlook

- Conservative Prediction: $0.001 - $0.00112

- Neutral Prediction: $0.00112

- Optimistic Prediction: $0.00162 (contingent on favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: DFYN may experience gradual growth momentum as the DeFi sector continues to evolve, with potential volatility reflecting broader cryptocurrency market cycles.

- Price Range Predictions:

- 2027: $0.001 - $0.00158

- 2028: $0.00087 - $0.00174

- 2029: $0.00141 - $0.00235

- Key Catalysts: Platform adoption expansion, technological upgrades, and increased liquidity within decentralized exchange ecosystems could serve as primary price drivers during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00192 - $0.00255 (assuming steady protocol development and moderate market growth)

- Optimistic Scenario: $0.00198 - $0.00247 (with enhanced user engagement and strategic partnerships)

- Transformational Scenario: Up to $0.00255 (under exceptionally favorable conditions including widespread DeFi adoption and breakthrough protocol innovations)

- 2026-02-08: DFYN trading within predicted range as market participants assess long-term value proposition

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00162 | 0.00112 | 0.001 | 0 |

| 2027 | 0.00158 | 0.00137 | 0.001 | 21 |

| 2028 | 0.00174 | 0.00147 | 0.00087 | 30 |

| 2029 | 0.00235 | 0.00161 | 0.00141 | 42 |

| 2030 | 0.00255 | 0.00198 | 0.00192 | 74 |

| 2031 | 0.00247 | 0.00226 | 0.00163 | 100 |

IV. DFYN Professional Investment Strategy and Risk Management

DFYN Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to multi-chain DEX infrastructure with a medium to long-term horizon

- Operational Recommendations:

- Consider accumulating positions during market corrections, given the current price level represents significant decline from historical peaks

- Monitor developments in Dfyn's expansion to additional blockchain networks including BSC, HECO, Algorand, Solana and Avalanche

- Storage Solution: Utilize Gate Web3 Wallet for secure storage of DFYN tokens, supporting Ethereum network integration

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: With 24-hour trading volume of approximately $15,192, monitor liquidity patterns before executing larger positions

- Support and Resistance Levels: Track the 24-hour range between $0.001096 (low) and $0.001153 (high) for short-term trading opportunities

- Swing Trading Key Points:

- Recent 7-day decline of 12.09% may present opportunities for mean reversion trades

- Consider the significant 30-day decline of 36.29% when assessing oversold conditions

DFYN Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% of crypto portfolio allocation with active monitoring

(2) Risk Hedging Solutions

- Position Sizing: Given the current market cap of approximately $217,511, implement strict position limits relative to portfolio size

- Stop-Loss Management: Set stop-loss orders below recent support levels to manage downside risk

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading access and secure storage

- Cold Storage Option: For long-term holdings, consider transferring significant amounts to hardware wallet solutions

- Security Considerations: Always verify contract address (0x9695e0114e12c0d3a3636fab5a18e6b737529023) before transactions; enable two-factor authentication; never share private keys

V. DFYN Potential Risks and Challenges

DFYN Market Risks

- Low Liquidity: With a market cap of approximately $217,511 and ranking of 3,842, DFYN exhibits limited liquidity which may result in significant price volatility and potential difficulty executing large trades

- Price Volatility: The token has experienced substantial decline of 79.55% over the past year, indicating elevated market risk and potential for continued volatility

- Limited Exchange Availability: Currently available on limited number of exchanges, which constrains accessibility and may impact price discovery

DFYN Regulatory Risks

- DEX Regulatory Uncertainty: As decentralized exchanges face evolving regulatory frameworks across jurisdictions, Dfyn's multi-chain DEX model may encounter compliance challenges

- Cross-Chain Protocol Oversight: The integration with Router Protocol and expansion across multiple Layer-1 and Layer-2 networks may face regulatory scrutiny regarding cross-border transactions

- Token Classification: Potential regulatory developments regarding token classification could impact DFYN's trading status and availability

DFYN Technical Risks

- Smart Contract Vulnerabilities: As with all DeFi protocols, smart contract risks exist including potential bugs or exploits in the AMM mechanism

- Cross-Chain Integration Complexity: The multi-chain architecture spanning Polygon, BSC, HECO, Algorand, Solana and Avalanche introduces technical complexity and potential points of failure

- Network Dependency: Heavy reliance on Polygon network performance and security, with planned expansion to other chains still in development stages

VI. Conclusion and Action Recommendations

DFYN Investment Value Assessment

Dfyn Network presents as a multi-chain DEX infrastructure project with ambitious cross-chain liquidity aggregation goals. The project's positioning in the Layer-2 AMM space and integration with Router Protocol offers potential long-term value in addressing cross-chain liquidity challenges. However, the current market conditions reflect significant challenges: the token has declined substantially from its all-time high, liquidity remains limited, and the project ranks relatively low in market capitalization. The circulating supply of 192,488,455 tokens represents approximately 77% of maximum supply, suggesting limited additional supply pressure. Short-term risks include continued price volatility, low trading volume, and execution challenges for substantial positions.

DFYN Investment Recommendations

✅ Beginners: Exercise extreme caution; only allocate small exploratory positions (less than 1% of crypto portfolio) after thorough research; prioritize understanding DEX mechanics and multi-chain infrastructure before investing ✅ Experienced Investors: Consider DFYN as a speculative allocation (2-3% of crypto portfolio) with focus on long-term multi-chain DEX thesis; implement strict stop-loss orders; monitor development progress on planned blockchain integrations ✅ Institutional Investors: Conduct comprehensive due diligence on smart contract security, team background, and competitive positioning; consider pilot allocation with active monitoring of technical development milestones; assess liquidity constraints before significant capital deployment

DFYN Trading Participation Methods

- Spot Trading: Access DFYN through Gate.com for direct spot trading with current market price around $0.00113

- Secure Storage: Utilize Gate Web3 Wallet for convenient management of DFYN holdings on Ethereum network

- Portfolio Integration: Incorporate DFYN as part of diversified DeFi infrastructure holdings, maintaining strict allocation limits given current market conditions

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is DFYN? What are its main functions and uses?

DFYN is a decentralized exchange built on Ethereum network. It provides efficient, low-cost trading services for cryptocurrency transactions, enabling users to swap tokens directly with minimal fees and fast settlement speeds.

How has DFYN token performed historically in price, and what are the main factors affecting its price fluctuations?

DFYN has experienced significant volatility, reaching an all-time high of $8.35 and low of $0.001186. Price movements are primarily driven by market demand, trading volume, and industry news sentiment.

What is the price prediction for DFYN in 2024? How do experts view it?

Expert price predictions for DFYN in 2024 vary widely. Based on market analysis, DFYN could potentially reach $0.15-$0.25 range, driven by ecosystem growth and increased adoption. However, market conditions remain volatile and subject to broader crypto trends.

What are the advantages and disadvantages of DFYN compared to other DeFi tokens such as Uniswap and SushiSwap?

DFYN features lower trading fees and flexible liquidity incentives through hybrid token models. However, it lacks the extensive user base and transaction volume of Uniswap and SushiSwap. DFYN offers competitive yields for liquidity providers but faces challenges in market adoption and brand recognition compared to established alternatives.

What risks should I be aware of when investing in DFYN? How is the market liquidity?

DFYN faces market volatility and price fluctuation risks typical of crypto assets. Liquidity varies across different trading venues and market conditions. Monitor trading volume and price spreads to assess liquidity depth before trading.

What is DFYN's project team and development roadmap? What are the future plans?

DFYN's team is dedicated to building a multi-chain DEX network. The roadmap focuses on expanding to multiple Layer 1 and Layer 2 blockchains, aiming to become a leading cross-chain liquidity provider and decentralized trading platform.

Where can I buy DFYN? How to safely store and trade?

You can acquire DFYN on decentralized exchanges and major platforms. Use a secure Web3 wallet like MetaMask or Trust Wallet for storage. Always enable two-factor authentication, verify contract addresses, and trade on verified platforms to ensure safety and asset protection.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What is AIX9: A Comprehensive Guide to the Next Generation of Enterprise Computing Solutions

What is KLINK: A Comprehensive Guide to Understanding the Revolutionary Communication Platform

What is ART: A Comprehensive Guide to Understanding Assisted Reproductive Technology and Its Impact on Modern Fertility Treatment

What is KAR: A Comprehensive Guide to Knowledge and Reasoning Systems in Modern Technology

What is MART: A Comprehensive Guide to Multi-Agent Reinforcement Learning Through Time