2026 EGG Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: EGG's Market Position and Investment Value

Goose Finance (EGG), as a decentralized exchange operating on Binance Smart Chain and integrated with PancakeSwap, has been serving the DeFi ecosystem since its launch in 2021. As of 2026, EGG maintains a market capitalization of approximately $241,501, with a circulating supply of around 56.7 million tokens, and the price hovering at $0.004259. This yield-generating asset continues to play a role in the decentralized trading landscape, offering token-earning opportunities for participants.

This article will comprehensively analyze EGG's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. EGG Price History Review and Market Status

EGG Historical Price Evolution Trajectory

- 2021: Project launch in February, price reached historical peak of $172.51 on February 20, demonstrating strong initial market interest in this BSC-based decentralized exchange protocol

- 2024: Price experienced significant correction, touching historical low of $0.000000991998 on July 14, reflecting broader market pressures and competitive landscape shifts in the DeFi sector

- 2026: Price continues to consolidate in lower ranges, with current valuation representing substantial decline from peak levels

EGG Current Market Status

As of February 8, 2026, EGG is trading at $0.004259, showing mixed short-term momentum. The token recorded a 1.14% increase over the past hour, suggesting some immediate buying interest, while experiencing a 2.8% decline over the 24-hour period with trading volume of approximately $19,693.58.

The broader timeframe reveals persistent downward pressure, with the token declining 9.71% over the past week, 23.11% over the past month, and 55.14% over the past year. The 24-hour price range has fluctuated between $0.004209 and $0.004392.

The project maintains a circulating supply of approximately 56.70 million EGG tokens against a total supply of 49.85 million tokens, with market capitalization standing at around $241,501. The fully diluted market cap aligns closely at approximately $212,300. EGG currently holds approximately 12,299 token holders and is available for trading on 2 exchanges, including Gate.com.

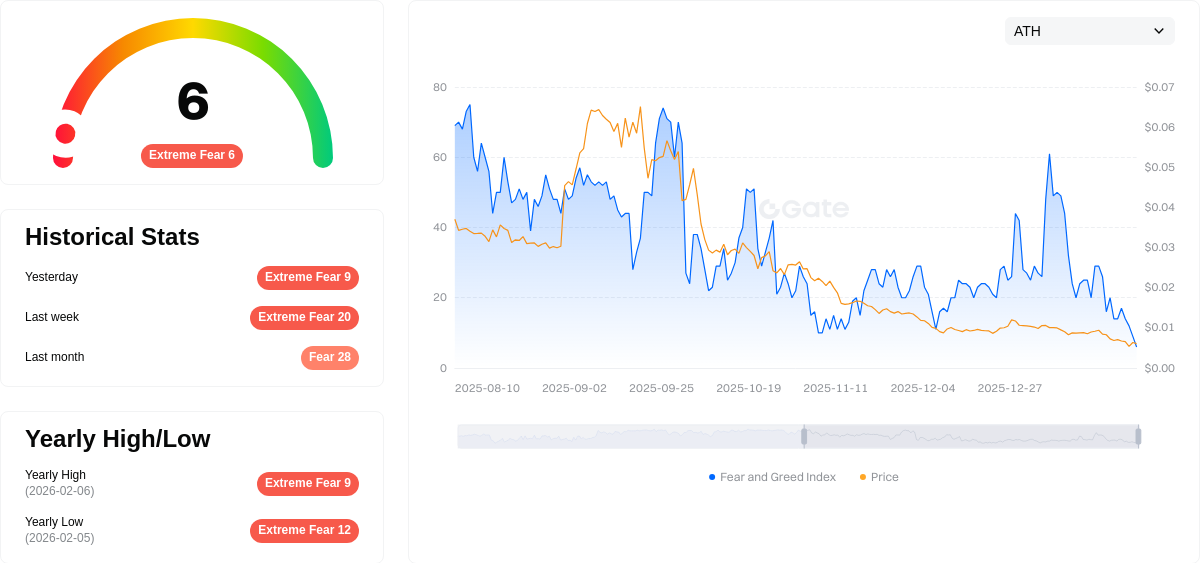

Market sentiment indicators suggest an environment of extreme fear with a volatility index reading of 6, potentially influencing investor behavior and trading patterns across the cryptocurrency sector.

Click to view current EGG market price

EGG Market Sentiment Indicator

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the index dropping to 6. This indicates strong bearish sentiment among investors, characterized by widespread panic selling and risk aversion. Such extreme readings often signal capitulation phases where market bottoms may form. Seasoned traders view this as a potential buying opportunity, though caution is advised until sentiment stabilizes. Monitor market developments closely as extreme fear conditions can lead to rapid reversals.

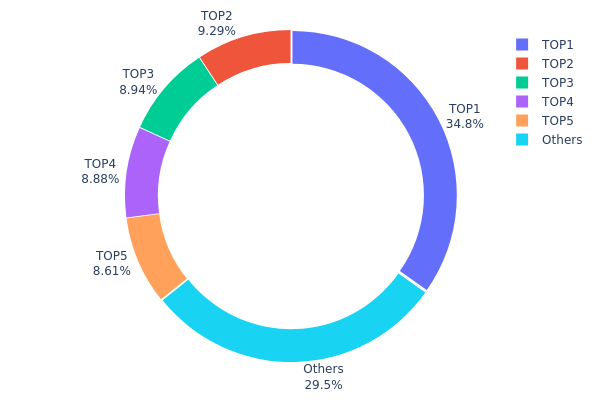

EGG Holding Distribution

The holding distribution chart illustrates how EGG tokens are allocated across different wallet addresses on the blockchain, providing insights into the concentration of token ownership and the degree of decentralization within the ecosystem. This metric serves as a crucial indicator of market structure, as it reflects whether token control is dispersed among numerous participants or concentrated within a limited number of major holders.

According to the current data, the top holder (0xe70e...7f2e57) controls 19,777.84K EGG tokens, representing 34.77% of the total supply. The top five addresses collectively hold 40,093.74K tokens, accounting for 70.48% of the total circulation. This concentration level indicates a relatively centralized distribution pattern, where a small number of addresses maintain substantial control over the token supply. Such distribution characteristics may expose the market to heightened volatility risks, as significant movements by any of these major holders could trigger substantial price fluctuations.

From a market structure perspective, this concentration level presents both opportunities and challenges. The "Others" category, comprising all remaining addresses, holds only 29.52% of the supply, suggesting limited token dispersion among retail participants. This structure may increase susceptibility to price manipulation and create liquidity concerns during periods of market stress. However, it's worth noting that some concentrated holdings may belong to project treasury wallets, liquidity pools, or long-term institutional investors, which could provide stability rather than instability. The current distribution pattern reflects a market structure that requires careful monitoring, particularly regarding the activities of top holders, as their trading decisions could significantly influence price discovery and overall market sentiment.

Click to view current EGG Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xe70e...7f2e57 | 19777.84K | 34.77% |

| 2 | 0xb815...b90a16 | 5284.89K | 9.29% |

| 3 | 0x3378...6cd804 | 5083.23K | 8.93% |

| 4 | 0xd1b5...d8d8d3 | 5051.05K | 8.88% |

| 5 | 0x19e7...e03019 | 4896.73K | 8.61% |

| - | Others | 16776.59K | 29.52% |

II. Core Factors Influencing EGG's Future Price

Supply Mechanism

-

Laying Hen Inventory Dynamics: The inventory level of laying hens serves as the fundamental indicator of egg supply. Breeding decisions made 4-5 months prior directly determine current supply volumes, creating inherent lag effects. When breeding profits are favorable, farmers increase restocking, though new production capacity requires several months to materialize. Conversely, during loss-making periods, accelerated culling of older hens occurs, though inventory reductions also take time to translate into decreased egg output.

-

Historical Patterns: Seasonal factors significantly impact supply patterns. Summer high temperatures and humidity naturally reduce laying rates while increasing storage and transportation costs, typically creating seasonal supply tightness. Spring and autumn seasons see improved climate conditions, enhanced laying rates, and relatively ample supply.

-

Current Impact Expectations: As of early 2026, capacity reduction trends are gradually emerging. Following May 2025, deteriorating breeding profits have prompted adjustments in farming strategies, with restocking enthusiasm notably declining. Data indicates chick restocking volumes from July-November 2025 decreased substantially year-on-year, sitting at near six-year average levels for the same period. This trend is expected to significantly impact the 2026 egg market supply landscape, with pressure from newly laying hens easing during January-May 2026, establishing foundations for capacity reduction.

Institutional and Major Holder Dynamics

-

Institutional Positions: Futures market data shows holding volumes continued expanding during price fluctuations, indicating intensified divergence between long and short positions, with market competition entering a heated stage. The top 20 members' net long positions increased, though short position increases were equally significant, maintaining a tight balance ratio.

-

Industry Adoption: Food processing enterprises and catering sectors constitute major demand sources, with collective purchasing demand releases from concentrated group meal needs during school openings and factory resumptions bringing phased procurement increases.

-

Policy Environment: At the national level, reserve meat release and other regulatory measures may impact the overall protein market, indirectly affecting egg price trends.

Macroeconomic Environment

-

Monetary Policy Impact: During liquidity easing periods, capital may flow into commodity markets including eggs seeking preservation or speculation, amplifying price fluctuation ranges.

-

Inflation Hedging Attributes: Feed costs, particularly corn and soybean meal prices, directly influence breeding profits, subsequently affecting farmer decisions and industry capacity adjustment pace. When feed prices remain elevated while egg prices stay low, sustained losses accelerate capacity culling, laying groundwork for subsequent price increases.

-

Geopolitical Factors: Major events such as significant animal disease outbreaks, extreme weather disasters, and public health incidents can all impact production, circulation, or consumption segments, triggering short-term sharp price fluctuations.

Technical Development and Ecosystem Construction

-

Industry Standardization Progress: The egg industry is gradually improving in scale, with constant temperature storage and cold storage inventory regulation mechanisms becoming increasingly mature, which will effectively smooth seasonal fluctuations, with expected price volatility ranges narrowing compared to previous years.

-

Supply Chain Optimization: Regional price differentials between production areas reflect structural imbalances in transportation logistics. Recent heavy rainfall in major production areas like Henan and Shandong has disrupted transportation links, with regional price differentials expanding beyond 200 yuan/ton. Such structural imbalances are rapidly priced through futures markets.

-

Ecosystem Applications: The middle-tier trading segment exhibits "low inventory, fast turnover" characteristics, with dealers generally adopting cautious stocking strategies, which paradoxically intensifies price fluctuation frequency. Downstream consumption markets show obvious holiday-driven characteristics, with processing demand for products like mooncakes having higher quality requirements, creating prominent premium phenomena for quality egg sources.

III. 2026-2031 EGG Price Forecast

2026 Outlook

- Conservative Forecast: $0.00393 - $0.00427

- Neutral Forecast: $0.00427

- Optimistic Forecast: $0.00474 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Phase Expectation: Gradual growth phase with potential volatility as the project develops its ecosystem

- Price Range Forecast:

- 2027: $0.0041 - $0.0054

- 2028: $0.00372 - $0.00684

- 2029: $0.00507 - $0.00849

- Key Catalysts: Technology development progress, community expansion, and broader cryptocurrency market trends

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00554 - $0.00978 (assuming steady market development)

- Optimistic Scenario: $0.00719 - $0.01239 (assuming strong ecosystem growth and increased user adoption)

- Transformative Scenario: Up to $0.01239 (under exceptionally favorable conditions including significant partnerships and mainstream adoption)

- 2026-02-08: EGG trading within the early forecast range, establishing foundation for potential growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00474 | 0.00427 | 0.00393 | 0 |

| 2027 | 0.0054 | 0.0045 | 0.0041 | 5 |

| 2028 | 0.00684 | 0.00495 | 0.00372 | 16 |

| 2029 | 0.00849 | 0.0059 | 0.00507 | 38 |

| 2030 | 0.00978 | 0.00719 | 0.00554 | 68 |

| 2031 | 0.01239 | 0.00849 | 0.00509 | 99 |

IV. EGG Professional Investment Strategy and Risk Management

EGG Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Cryptocurrency enthusiasts interested in decentralized exchange (DEX) protocols and BSC ecosystem participants

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) to mitigate price volatility impact

- Monitor Goose Finance protocol developments and community updates through official channels

- Store assets securely using Gate Web3 Wallet for convenient access and management

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Profile: Analyze the 24-hour trading volume of approximately $19,693 to identify liquidity zones and potential support/resistance levels

- Moving Averages: Track short-term (7-day: -9.71%) and medium-term (30-day: -23.11%) trends to identify potential entry and exit points

- Swing Trading Key Points:

- Monitor the current trading range between $0.004209 (24h low) and $0.004392 (24h high) for tactical opportunities

- Set stop-loss orders to manage downside risk, particularly given the 1-year decline of -55.14%

EGG Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of cryptocurrency portfolio allocation

- Aggressive Investors: 5-8% of cryptocurrency portfolio allocation

- Professional Investors: Up to 10% with active monitoring and hedging strategies

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance EGG holdings with established cryptocurrencies and stablecoins to reduce volatility exposure

- Position Sizing: Limit individual position size based on the token's relatively low market capitalization of approximately $241,501

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking participation

- Cold Storage Option: Hardware wallet solutions for long-term holdings exceeding investment thresholds

- Security Precautions: Enable two-factor authentication, verify contract addresses (BSC: 0xF952Fc3ca7325Cc27D15885d37117676d25BfdA6), and never share private keys

V. EGG Potential Risks and Challenges

EGG Market Risks

- High Volatility: The token has experienced significant price fluctuations, declining from an all-time high of $172.51 to the current price of $0.004259, representing a substantial drawdown

- Limited Liquidity: With 24-hour trading volume of approximately $19,693 across 2 exchanges, liquidity constraints may result in slippage during large transactions

- Market Sentiment: The recent negative price trends (-2.8% in 24h, -9.71% in 7d, -23.11% in 30d) indicate bearish market sentiment that may persist

EGG Regulatory Risks

- DeFi Regulatory Uncertainty: Decentralized finance platforms face evolving regulatory frameworks globally that may impact operations and token utility

- Cross-border Compliance: Operating across multiple jurisdictions may subject the project to varying regulatory requirements and potential restrictions

- Smart Contract Jurisdiction: Legal treatment of smart contract-based transactions remains unclear in many regions, potentially affecting user protection and dispute resolution

EGG Technical Risks

- Smart Contract Vulnerabilities: As a BSC-based protocol, EGG is subject to potential smart contract bugs or exploits that could affect token value and user funds

- Blockchain Dependency: The project's reliance on Binance Smart Chain means that any network issues, congestion, or security incidents could impact functionality

- Protocol Competition: The decentralized exchange space is highly competitive, with numerous alternatives potentially drawing liquidity and users away from Goose Finance

VI. Conclusion and Action Recommendations

EGG Investment Value Assessment

Goose Finance (EGG) represents a decentralized exchange protocol within the BSC ecosystem, offering token earning opportunities through its platform. The project's long-term value proposition depends on sustained protocol adoption, liquidity growth, and competitive differentiation within the crowded DEX landscape. However, investors should note the significant short-term risks, including substantial price decline over the past year (-55.14%), limited trading volume, and uncertain market recovery trajectory. The token's current low price relative to its all-time high may present speculative opportunities for risk-tolerant investors, but fundamental uncertainty warrants cautious evaluation.

EGG Investment Recommendations

✅ Beginners: Start with minimal allocation (1-2% of crypto portfolio) and focus on understanding DeFi mechanics before increasing exposure; use Gate Web3 Wallet for secure storage and platform interaction

✅ Experienced Investors: Consider tactical positions within a diversified DeFi portfolio, implementing strict stop-loss parameters; monitor protocol metrics and community developments for signs of ecosystem growth

✅ Institutional Investors: Conduct thorough due diligence on protocol fundamentals, smart contract audits, and liquidity dynamics; evaluate risk-adjusted returns within broader BSC ecosystem exposure strategies

EGG Trading Participation Methods

- Spot Trading: Purchase EGG through supported exchanges with attention to liquidity conditions and order book depth

- Yield Farming: Participate in Goose Finance protocol staking and liquidity provision programs to earn additional tokens (subject to platform availability and smart contract risks)

- Portfolio Integration: Include EGG as part of a diversified DeFi allocation strategy, balancing with established protocols and risk management tools

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is EGG token? What is its project background and use case?

EGG is the native token of Nestree, launched in 2019 with a total supply of 3 billion tokens. It powers Nestree's reward mechanism and enables blockchain-integrated chat functionality, creating a decentralized communication platform with economic incentives.

What is the current EGG price? What are the historical high and low prices?

EGG's current price data is not available. Historical high: 4.210 AUD (January 4, 2022). Historical low: 0.305 AUD (February 12, 2013).

How to predict the future price of EGG token? What are the analysis methods?

Predict EGG price using technical analysis with indicators like MACD, RSI, and Bollinger Bands for short-term trends. Use fundamental analysis to assess intrinsic value, network adoption, and market sentiment for long-term predictions.

What are the main factors affecting EGG price fluctuations?

EGG price fluctuations are primarily driven by market demand and supply dynamics, trading volume, community sentiment, overall crypto market conditions, and regulatory developments in the blockchain sector.

What are the differences between EGG token and mainstream cryptocurrencies like BTC and ETH?

EGG token differs from BTC and ETH in supply mechanics. BTC has a fixed cap of 21 million coins with deflationary design, while ETH has inflationary characteristics. EGG offers flexible tokenomics tailored for its ecosystem utility and governance purposes.

What are the risks to pay attention to when investing in EGG tokens?

EGG token investment carries high security risks due to low trading volume, insufficient reserves, and early-stage platform development. Users should exercise caution and only invest amounts they can afford to lose.

What is the future outlook of EGG token? How do experts view its development potential?

EGG token shows promising potential driven by growing community adoption and innovative ecosystem development. Experts anticipate significant growth as the project expands its utility and market presence in the Web3 space.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Comprehensive Guide to Parabolic SAR Trading Strategies for Bitcoin

Cardano (ADA) Price Forecast 2025/2026/2035

Comprehensive Guide to Bitcoin Holders

Pump and Dump: Definition and Mechanism

Hot Wallet vs Cold Wallet: Understanding the Key Differences