2026 FRONTIERS Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Next Generation of Frontier Technologies

Introduction: FRONTIERS Market Position and Investment Value

Dark Frontiers (FRONTIERS), positioned as a player-governed DAO virtual world and blockchain gaming platform, has been developing its ecosystem since its launch in 2021. As of 2026, FRONTIERS maintains a market capitalization of approximately $235,186, with a circulating supply of around 215.17 million tokens, and the price hovering around $0.001093. This GameFi asset, recognized as an innovative NFT and yield farming integrated gaming project, is playing an increasingly significant role in the blockchain gaming sector.

This article will comprehensively analyze FRONTIERS price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. FRONTIERS Price History Review and Market Status

FRONTIERS Historical Price Evolution Trajectory

- 2021: Project launched in October with an initial price of $0.5352, reaching an all-time high of $1.82 in November during the early NFT gaming boom.

- 2022-2025: Market entered a prolonged correction phase, with price experiencing significant volatility alongside broader crypto market cycles.

- 2026: Price reached historical low of $0.00108181 in early February, reflecting a decline from peak levels.

FRONTIERS Current Market Landscape

As of February 8, 2026, FRONTIERS is trading at $0.001093, with 24-hour trading volume standing at $20,669.41. The token has exhibited short-term weakness, declining 2.54% over the past 24 hours and 2.71% in the last hour. Over the past week, the price has dropped 2.58%, while the 30-day performance shows a more pronounced decline of 17.88%.

The project maintains a circulating supply of 215,174,900 FRONTIERS tokens, representing 86.07% of the maximum supply of 250,000,000 tokens. The current market capitalization stands at $235,186.17, with a fully diluted valuation of $273,167.92. The token's market dominance is minimal at 0.000010%.

Dark Frontiers operates as a DAO-managed virtual world focused on GameFi mechanics, incorporating NFT utility and yield farming mechanisms. The project is deployed on the BSC blockchain with the contract address 0x12fc07081fab7de60987cad8e8dc407b606fb2f8. The token holder base comprises approximately 7,815 addresses.

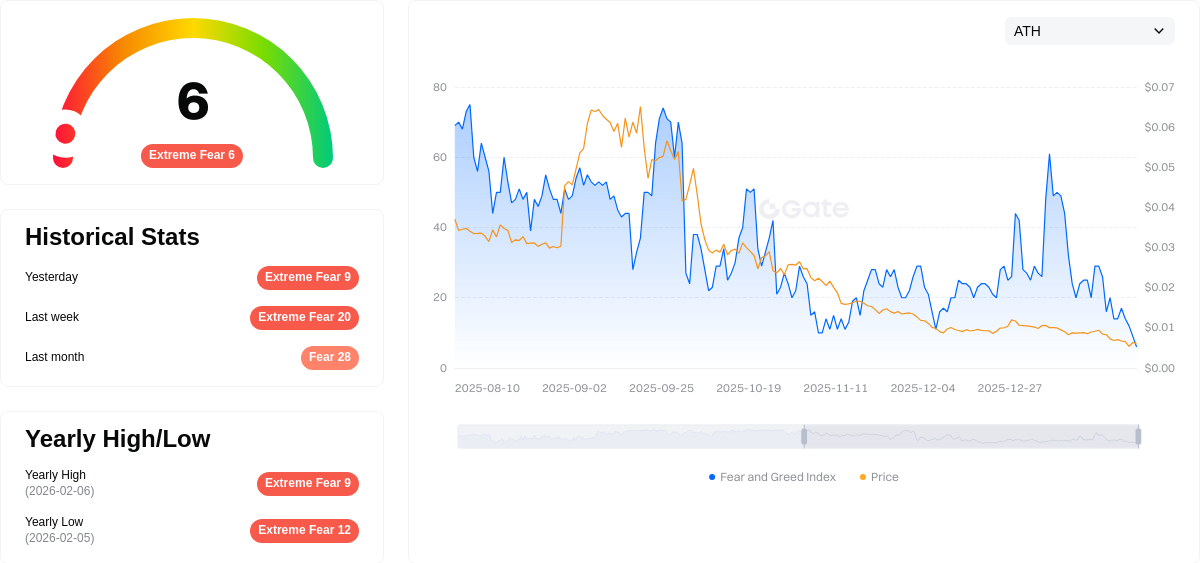

The broader crypto market sentiment, as indicated by the Fear & Greed Index, currently registers at 6, reflecting extreme fear conditions that may influence short-term price action across digital assets.

Click to view current FRONTIERS market price

FRONTIERS Market Sentiment Index

2026-02-07 Fear and Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

The FRONTIERS market is experiencing extreme fear with an index reading of 6. This represents one of the most bearish sentiment levels, indicating heightened investor anxiety and risk aversion across emerging blockchain projects. Such extreme fear conditions often create significant buying opportunities for contrarian investors, as assets are typically heavily discounted. Market participants should monitor upcoming catalysts and fundamental developments, as sentiment extremes frequently precede substantial market reversals. Risk management remains essential during periods of maximum pessimism.

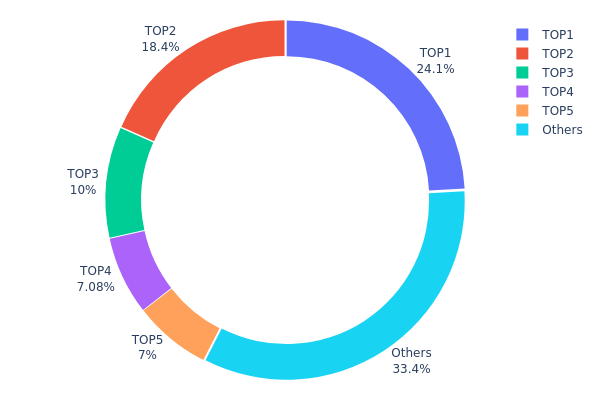

FRONTIERS Token Holder Distribution

According to the on-chain holder distribution data, FRONTIERS token exhibits a moderately concentrated ownership structure. The top 5 addresses collectively hold approximately 66.56% of the total supply, with the largest holder controlling 24.08% (60.21 million tokens) and the second-largest address holding 18.40% (46.02 million tokens). This concentration level falls within a typical range for emerging crypto projects, though it warrants careful monitoring. The remaining 33.44% distributed among other holders provides a reasonable degree of decentralization, suggesting some level of community participation beyond major stakeholders.

From a market structure perspective, this distribution pattern presents both opportunities and risks. The presence of several large holders (addresses ranked 3-5 each holding between 7% to 10%) creates potential price stability through their long-term holding commitment, but simultaneously introduces vulnerability to coordinated selling pressure. The relatively limited circulation among smaller holders may result in reduced liquidity during periods of market stress. Additionally, such concentration increases the theoretical possibility of price manipulation, though actual market behavior would depend on the identity and intentions of these major holders—whether they represent project reserves, institutional investors, or strategic partners.

The current holder distribution reveals FRONTIERS maintains a balanced chain structure characteristic of projects in their growth phase. While the 33.44% held by smaller addresses indicates healthy grassroots adoption, the dominance of top-tier holders suggests the project has yet to achieve broad retail distribution. This structure typically stabilizes price action by limiting extreme volatility from retail panic selling, but may also constrain upside momentum during bullish market conditions due to concentrated supply control.

Click to view current FRONTIERS holder distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xcda2...bbccf1 | 60205.47K | 24.08% |

| 2 | 0x0d07...b492fe | 46020.75K | 18.40% |

| 3 | 0xabc3...60a71c | 25000.00K | 10.00% |

| 4 | 0x8e1a...fcc28b | 17708.10K | 7.08% |

| 5 | 0xe210...288dc6 | 17500.00K | 7.00% |

| - | Others | 83565.68K | 33.44% |

II. Core Factors Influencing FRONTIERS' Future Price

Supply Mechanism

-

Market Supply-Demand Dynamics: Based on available data, gold supply growth has been limited while demand continues to rise. From 2021 to 2024, global gold demand (excluding OTC transactions) increased from 4,026 tons to 4,606 tons, while mine production grew modestly from 3,573 tons to 3,673 tons. This supply-demand imbalance creates upward pressure on prices.

-

Historical Patterns: The supply-demand relationship has historically influenced price movements. When demand substantially exceeds supply growth, prices tend to experience sustained appreciation. The current market exhibits similar characteristics to previous periods of price increases.

-

Current Impact: The ongoing supply constraints coupled with robust investment demand suggest continued support for price levels. Central bank purchases and investment flows are contributing to sustained demand pressure.

Institutional and Major Holder Dynamics

-

Institutional Holdings: Developing country central banks have emerged as significant buyers. China's central bank holdings increased from approximately 64 million ounces in 2022 to about 74 million ounces (approximately 2,300 tons) currently, representing an addition of 10 million ounces over three years.

-

Central Bank Sentiment: According to the World Gold Council's June survey, 95% of surveyed central banks expect global official gold reserves to increase further over the next 12 months, up substantially from 81% the previous year. Additionally, 43% indicated plans to continue increasing holdings in the coming year, reaching a historical high.

-

Investment Vehicles: Gold ETF investment demand has shifted from negative contribution in 2021 to positive territory in 2024, reflecting growing market recognition of gold's investment value.

Macroeconomic Environment

-

Monetary Policy Impact: Major economies have entered low interest rate cycles, including the United States and China. In September, the Federal Reserve implemented a 25 basis point rate cut. Market expectations suggest continued monetary easing, which tends to compress real interest rates and enhance gold's relative investment appeal.

-

Inflation Hedge Attributes: Gold has historically served as a hedge against inflation and currency devaluation. In periods of rising commodity prices driven by supply disruptions, gold typically experiences price appreciation alongside other assets.

-

Geopolitical Factors: The evolution of geopolitical tensions represents a primary driver of gold's safe-haven demand. Military conflicts and international tensions typically amplify supply constraints for resource commodities, elevating inflation expectations and strengthening gold's appeal as a protective asset. Historical episodes including 1970s Middle East conflicts and the 2022 situation demonstrate this relationship.

Currency Market Dynamics

-

Dollar Index Relationship: Historical data reveals an inverse correlation between the U.S. dollar index and gold prices. Through August, the dollar index declined from 108.6 in January to 98.2, while gold prices increased 23.9% over the same period. The dollar's continued weakness provides fundamental support for gold appreciation.

-

Reserve Currency Diversification: U.S. dollar share of global foreign exchange reserves has declined from a peak of 72% in 2001 to 57.74% in the first quarter of this year. Survey data indicates 70% of central banks expect further reduction in dollar reserve shares over the next five years, potentially benefiting alternative reserve assets.

-

U.S. Debt Dynamics: The U.S. total debt-to-GDP ratio reached 124% in 2024, requiring approximately $1.1 trillion in annual interest payments. This debt sustainability concern contrasts with gold's independent credit characteristics, highlighting gold's advantage as a financial stability anchor.

The future price trajectory depends primarily on two critical variables: the evolution of geopolitical circumstances and the resolution path for U.S. debt challenges. If tensions ease and debt concerns are appropriately managed, prices may stabilize or face correction pressure. Conversely, if conflicts intensify and debt issues escalate, safe-haven attributes would likely drive continued appreciation. Market conditions remain highly uncertain, with both "black swan" events and "gray rhino" risks creating challenges for precise forecasting.

III. 2026-2031 FRONTIERS Price Prediction

2026 Outlook

- Conservative prediction: $0.00057 - $0.00138

- Neutral prediction: $0.0011

- Optimistic prediction: $0.00138 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with moderate volatility as the project establishes its market position

- Price range prediction:

- 2027: $0.00063 - $0.00156 (13% increase year-over-year)

- 2028: $0.00095 - $0.00191 (28% increase year-over-year)

- 2029: $0.00159 - $0.00188 (51% increase year-over-year)

- Key catalysts: Market maturation, potential technological developments, and broader ecosystem expansion

2030-2031 Long-term Outlook

- Baseline scenario: $0.0015 - $0.00248 (assuming steady market development and sustained community engagement)

- Optimistic scenario: $0.00177 - $0.00263 (assuming accelerated adoption and favorable regulatory environment)

- Transformative scenario: Above $0.00263 (requires exceptional market conditions, major partnerships, or breakthrough technological implementations)

- 2026-02-08: FRONTIERS trading within the established range with potential for gradual appreciation over the forecast period

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00138 | 0.0011 | 0.00057 | 0 |

| 2027 | 0.00156 | 0.00124 | 0.00063 | 13 |

| 2028 | 0.00191 | 0.0014 | 0.00095 | 28 |

| 2029 | 0.00188 | 0.00165 | 0.00159 | 51 |

| 2030 | 0.00248 | 0.00177 | 0.0015 | 61 |

| 2031 | 0.00263 | 0.00212 | 0.0018 | 94 |

IV. FRONTIERS Professional Investment Strategy and Risk Management

FRONTIERS Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: GameFi enthusiasts and blockchain gaming believers who understand the DAO governance model and virtual world ecosystem

- Operational Recommendations:

- Consider accumulating positions during market corrections when the token trades near its support levels

- Monitor project development milestones and community governance proposals that may impact token utility

- Utilize secure storage solutions like Gate Web3 Wallet for long-term holdings to maintain control of private keys

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track 50-day and 200-day moving averages to identify potential trend reversals in this highly volatile asset

- Volume Analysis: Monitor trading volume fluctuations as FRONTIERS currently shows daily volume of approximately $20,669, which can signal liquidity conditions

- Swing Trading Considerations:

- Set clear entry and exit points based on support and resistance levels given the token's recent price volatility

- Implement stop-loss orders to protect capital, particularly important given the 92.36% decline over the past year

FRONTIERS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 5-8% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Position Sizing: Limit exposure to micro-cap gaming tokens to prevent overconcentration risk

- Portfolio Diversification: Balance FRONTIERS holdings with established cryptocurrencies and other gaming sector tokens

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for active traders requiring frequent access and transaction flexibility

- Cold Storage Approach: Hardware wallet solutions for long-term holders to minimize online exposure risks

- Security Precautions: Enable two-factor authentication, regularly update wallet software, and never share private keys or seed phrases

V. FRONTIERS Potential Risks and Challenges

FRONTIERS Market Risks

- Extreme Volatility: The token has declined 92.36% over the past year, demonstrating significant price instability

- Limited Liquidity: With daily trading volume around $20,669 and market cap of approximately $235,186, the token faces potential liquidity constraints

- Market Cap Risk: Ranked #3763 with dominance of 0.000010%, indicating minimal market presence and higher susceptibility to price manipulation

FRONTIERS Regulatory Risks

- Gaming Token Classification: Evolving regulatory frameworks may impact blockchain gaming tokens and their classification as securities or utilities

- DAO Governance Concerns: Player-managed DAO structures may face scrutiny under emerging decentralized organization regulations

- Cross-border Compliance: Global regulatory divergence may affect the project's ability to operate in certain jurisdictions

FRONTIERS Technical Risks

- Smart Contract Vulnerabilities: BSC-based token contract at 0x12fc07081fab7de60987cad8e8dc407b606fb2f8 may contain undiscovered vulnerabilities

- Platform Dependency: Reliance on BSC infrastructure creates single-point-of-failure risks

- NFT Integration Complexity: The project's NFT and yield farming mechanisms add technical layers that could introduce unforeseen bugs or exploits

VI. Conclusion and Action Recommendations

FRONTIERS Investment Value Assessment

Dark Frontiers represents a high-risk, high-reward opportunity in the GameFi sector. The project's player-managed DAO model and NFT integration approach offer innovative concepts for blockchain gaming adoption. However, the token's performance shows concerning trends, with a 92.36% annual decline and minimal market capitalization of approximately $235,186. The circulating supply represents 86.07% of total supply, indicating limited future dilution risk. While the project aims to bridge traditional gaming with blockchain technology, its current market position suggests significant uncertainty. Long-term value depends heavily on successful execution of gaming platform development and user adoption, neither of which can be confirmed from current market metrics.

FRONTIERS Investment Recommendations

✅ Beginners: Exercise extreme caution with FRONTIERS investment. If interested in GameFi exposure, consider allocating no more than 1% of crypto portfolio and thoroughly research the project's gaming platform and roadmap before investing

✅ Experienced Investors: May consider speculative position sizing of 2-3% of crypto allocation, with strict stop-loss protocols given the token's volatility history. Focus on monitoring development updates and community engagement metrics

✅ Institutional Investors: Conduct comprehensive due diligence on project team, technology architecture, and competitive positioning within the GameFi sector. Consider FRONTIERS only as a small-cap speculative component within a broader blockchain gaming thesis

FRONTIERS Trading Participation Methods

- Spot Trading: Purchase FRONTIERS on Gate.com with USDT or other trading pairs, utilizing limit orders to optimize entry prices

- DCA Strategy: Implement dollar-cost averaging to mitigate timing risk in this volatile micro-cap token

- Community Engagement: Participate in the project's DAO governance to understand development direction and potentially influence token utility decisions

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make careful decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is the current price of FRONTIERS token, and what are its historical high/low prices?

FRONTIERS historical high price reached US$6.71 and low price was US$0.0157. For current real-time price data, please check CoinGecko for the latest market information.

What are the main factors affecting FRONTIERS price?

FRONTIERS price is primarily influenced by supply and demand dynamics, market sentiment driven by news and social media, regulatory developments, trading volume, and overall cryptocurrency market trends.

How to conduct FRONTIERS price technical analysis and trend prediction?

Analyze FRONTIERS price using multiple timeframes(4-hour, daily, weekly)technical indicators. Monitor trading volume trends, support/resistance levels, and RSI/MACD signals. Current technical analysis shows sell signals across timeframes, suggesting potential downward pressure near $0.01455.

What is the fundamental outlook of FRONTIERS, and what are the team background and development roadmap?

FRONTIERS focuses on building composite AI systems. The team comprises top ML systems engineers with expertise in advanced artificial intelligence. The roadmap includes implementing comprehensive AI integration over the coming years, with near-term priorities(1-3 years)on establishing foundational composite AI infrastructure.

What are the main risks of investing in FRONTIERS tokens?

Main risks include market volatility, regulatory uncertainty, liquidity challenges, and smart contract vulnerabilities. Gaming token performance depends on player adoption and platform development progress.

What are the advantages and disadvantages of FRONTIERS compared to similar projects?

FRONTIERS integrates perception, prediction, and planning into a unified model for streamlined efficiency and simplified training. However, it may lack specialized optimization of traditional systems and could be less robust against specific failure modes compared to modular alternatives.

How are professional institutions rating and predicting the price of FRONTIERS?

Currently, FRONTIERS demonstrates strong market potential with institutional valuations reflecting bullish sentiment. Analyst ratings suggest upside opportunities, with price targets indicating substantial growth potential in the coming quarters as the ecosystem expands and adoption increases.

FRONTIERS在哪些交易所上市,流动性如何?

FRONTIERS在多个主流交易所上市,流动性充足,交易额稳定。用户可通过主要加密交易平台便捷交易,市场认可度高,价格发现机制完善。

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

Everything About Non-Fungible Tokens (NFTs)

What is the Metaverse? The Virtual World of the Future and Its Core Technologies

Benefits and Drawbacks of Coincheck IEO and Getting Started

Web2 vs Web3: What Are the Key Differences?

What Is Spatial Computing and How Is It Transforming the World?