2026 GMRT Price Prediction: Expert Analysis and Market Forecast for Next Generation Token Value

Introduction: GMRT's Market Position and Investment Value

The Game Company (GMRT), as a next-generation cloud gaming platform integrated with Web3 technology, has been making significant strides in bridging traditional gaming with blockchain-based earning mechanisms since its launch in 2025. As of 2026, GMRT maintains a market capitalization of approximately $1.38 million, with a circulating supply of around 29.28 million tokens, and its price hovering near $0.047. This asset, recognized as an innovative player in the "Play-to-Earn cloud gaming" sector, is playing an increasingly important role in democratizing high-quality gaming access while introducing tournament-based earning opportunities through strategic partnerships with major technology providers.

This article will comprehensively analyze GMRT's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. GMRT Price History Review and Market Status

GMRT Historical Price Evolution Trajectory

- 2025: Platform launch in February with initial trading price of $0.12, price experienced significant volatility throughout the year

- 2025: Reached peak price of $0.52 in February 2025, demonstrating strong initial market interest in the cloud gaming platform

- 2025: Market correction phase saw price decline to historical low of $0.004814 in November 2025, reflecting broader market conditions

GMRT Current Market Situation

As of February 2, 2026, GMRT is trading at $0.046998, representing a decrease of 2.26% over the past 24 hours. The token has demonstrated recent volatility with a 1.87% increase in the past hour, while experiencing a 36.67% decline over the past 7 days. On a monthly basis, GMRT has shown recovery with a 9.99% increase over the past 30 days.

The token currently maintains a market capitalization of approximately $1.38 million, with a circulating supply of 29,283,333 tokens out of a maximum supply of 1 billion tokens, representing a circulation ratio of approximately 2.93%. The fully diluted market cap stands at $47 million. Within the past 24 hours, GMRT has traded within a range of $0.046815 to $0.048085, with total trading volume reaching $11,774.63.

The Game Company platform has established a user base of 67,080 token holders. The token is deployed on the BASE network and is available for trading on 2 exchanges. Market sentiment indicators suggest a cautious environment, with current conditions reflecting careful investor positioning in the cloud gaming and Web3 gaming sectors.

Click to view current GMRT market price

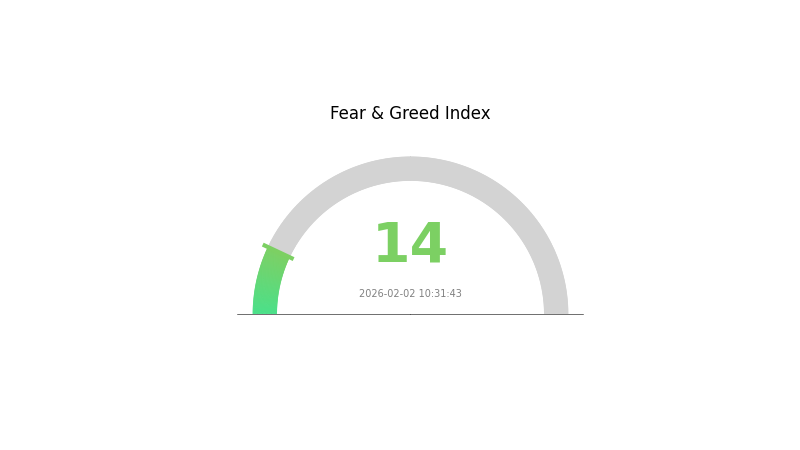

GMRT Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the GMRT index at 14. This exceptionally low reading indicates severe market pessimism and heightened risk aversion among investors. During such periods, market volatility tends to increase significantly, and asset prices often face considerable downward pressure. Traders and investors should exercise caution and consider implementing risk management strategies. However, extreme fear can also present contrarian opportunities for long-term investors who are willing to accumulate quality assets at depressed valuations. Monitor market developments closely and adjust your investment strategy accordingly.

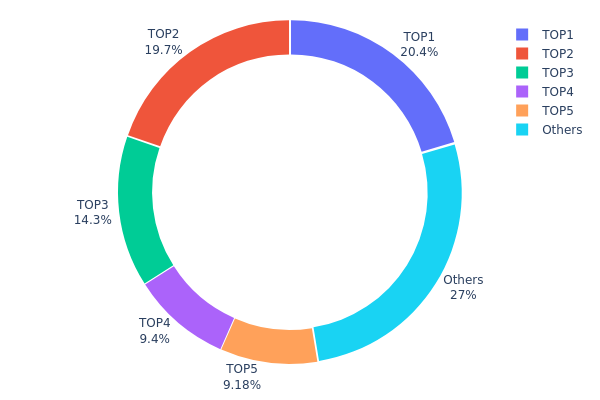

GMRT Holdings Distribution

According to the on-chain data, GMRT's holdings distribution exhibits significant concentration characteristics. The "Holdings Distribution Chart" reflects the distribution of token holdings across different addresses on the blockchain, serving as a crucial indicator for assessing token decentralization and market structure stability. By analyzing the holdings proportion of top addresses, we can evaluate potential centralization risks and market manipulation possibilities.

From the current data, the top five addresses collectively hold 72.98% of GMRT's total supply, indicating a highly concentrated holdings structure. Specifically, the largest address holds 204 million tokens (20.40%), while the second-largest holds 193.4 million tokens (19.72%). The third through fifth addresses hold 14.28%, 9.40%, and 9.18% respectively. This concentration pattern suggests that a small number of major holders control the majority of circulating supply, which may include project teams, institutional investors, or early participants. Such high concentration could potentially amplify price volatility, as large holders' trading decisions may significantly impact market trends.

This holdings distribution structure presents dual implications for market participants. On one hand, excessive concentration may weaken decentralization, increasing the risk of price manipulation and potentially triggering sharp price fluctuations during large-scale sell-offs. On the other hand, if major holders are long-term strategic investors or project teams, their stable holdings could provide support for price stability. Currently, with only 27.02% held by other addresses, GMRT's on-chain structure demonstrates relatively weak decentralization, warranting close attention to major holders' on-chain activities and transfer behaviors.

Click to view current GMRT Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf382...231892 | 200000.00K | 20.40% |

| 2 | 0x859c...6b9dc9 | 193403.62K | 19.72% |

| 3 | 0xae1f...2043c7 | 140000.00K | 14.28% |

| 4 | 0xbe75...f28358 | 92166.77K | 9.40% |

| 5 | 0x3f11...1f4f0f | 90000.00K | 9.18% |

| - | Others | 264776.51K | 27.02% |

II. Core Factors Influencing GMRT's Future Price

Supply Mechanism

- Token Distribution and Unlock Schedule: GMRT has a total supply of 1 billion tokens with an initial market cap of approximately $3.381 million at Token Generation Event (TGE). The first round sale price was set at 0.06 USDC per GMRT. The current release includes 15% of total supply with no lock-up period, and full unlock is expected within 7 months.

- Historical Pattern: The absence of a lock-up period and relatively short unlock timeline may create selling pressure in the market, historically affecting short-term price stability for similar token launches.

- Current Impact: The 7-month complete unlock schedule suggests potential downward pressure on price as early investors may seek to realize profits, particularly during market volatility periods.

Institutional and Major Holder Dynamics

Insufficient data available in the provided materials regarding institutional holdings, major corporate adoption, or specific national policies related to GMRT.

Macroeconomic Environment

- Market Sentiment Impact: GMRT price performance remains sensitive to broader cryptocurrency market sentiment fluctuations, which can amplify volatility regardless of project fundamentals.

- Regulatory Policy Changes: The token's valuation may experience significant swings due to evolving regulatory frameworks across different jurisdictions, requiring investors to maintain vigilant awareness of policy developments.

Technology Development and Ecosystem Building

- Web3 Cloud Gaming Platform: GMRT serves as the utility token powering Game Company's Web3 cloud gaming infrastructure, representing an innovative intersection of blockchain technology and gaming services.

- Cloud Gaming Market Demand: The token's value proposition connects directly to the expanding cloud gaming sector, where technological innovations and increasing user adoption could drive fundamental demand for GMRT.

- Ecosystem Applications: The token facilitates various functions within the cloud gaming ecosystem, though specific details about decentralized applications or partner projects were not provided in the reference materials.

Risk Notice: The cryptocurrency market experiences significant volatility. GMRT's price may be influenced by market sentiment, regulatory policy changes, and other factors. Investment requires caution and thorough due diligence.

III. 2026-2031 GMRT Price Prediction

2026 Outlook

- Conservative Forecast: $0.03854 - $0.047

- Neutral Forecast: $0.047

- Optimistic Forecast: $0.06298 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: The token is anticipated to enter a gradual growth phase, with average annual price increases ranging from 17% to 33% compared to 2026 baseline levels.

- Price Range Predictions:

- 2027: $0.05004 - $0.06324

- 2028: $0.03369 - $0.0668

- 2029: $0.05918 - $0.07869

- Key Catalysts: Sustained market momentum, potential ecosystem developments, and broader cryptocurrency market recovery may serve as primary drivers for price appreciation during this period.

2030-2031 Long-Term Outlook

- Baseline Scenario: $0.04887 - $0.10411 (assuming steady market conditions and moderate adoption growth)

- Optimistic Scenario: $0.07082 - $0.10409 (contingent on accelerated ecosystem expansion and favorable regulatory environment)

- Transformative Scenario: Approaching $0.10411 (requires exceptional market conditions, significant technological breakthroughs, or widespread institutional adoption)

- 2026-02-02: GMRT demonstrates early-stage price discovery with projected average trading around $0.047

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.06298 | 0.047 | 0.03854 | 0 |

| 2027 | 0.06324 | 0.05499 | 0.05004 | 17 |

| 2028 | 0.0668 | 0.05911 | 0.03369 | 25 |

| 2029 | 0.07869 | 0.06295 | 0.05918 | 33 |

| 2030 | 0.10411 | 0.07082 | 0.04887 | 50 |

| 2031 | 0.10409 | 0.08747 | 0.06735 | 86 |

IV. GMRT Professional Investment Strategy and Risk Management

GMRT Investment Methodology

(I) Long-Term Holding Strategy

- Target Investors: Investors seeking exposure to the cloud gaming and Web3 gaming sectors with a tolerance for emerging market volatility

- Operational Recommendations:

- Consider accumulating positions during market corrections when price retraces below moving averages

- Monitor key partnership announcements and platform development milestones that may impact long-term value

- Utilize Gate Web3 Wallet for secure token storage with proper backup of seed phrases and private keys

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 7-day and 30-day moving averages to identify short-term trends; current 7-day decline of 36.67% suggests bearish momentum

- Volume Analysis: Monitor 24-hour trading volume ($11,774.63) relative to market cap ($1.38M) to assess liquidity conditions

- Key Points for Swing Trading:

- Establish clear support levels based on recent low of $0.046815 and resistance near $0.048085

- Set stop-loss orders to manage downside risk given the token's demonstrated volatility range

GMRT Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: Up to 10-15% based on conviction and risk tolerance

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance GMRT exposure with established crypto assets and stablecoins

- Position Sizing: Scale entries across multiple price points to reduce timing risk

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking accessibility

- Cold Storage Solution: Hardware wallet integration for long-term holdings exceeding comfortable risk threshold

- Security Precautions: Never share private keys, verify contract addresses on BaseScan (0x6967f0974d76d34e140cae27efea32cdf546b58e), and enable two-factor authentication on all accounts

V. GMRT Potential Risks and Challenges

GMRT Market Risks

- High Volatility: Token has experienced significant price swings from ATH of $0.52 (February 2025) to ATL of $0.004814 (November 2025), demonstrating extreme volatility

- Limited Liquidity: With only 2.93% of tokens currently circulating (29.28M of 1B total supply), liquidity constraints may impact price discovery

- Exchange Availability: Currently listed on limited number of exchanges (2), which may restrict trading volume and price stability

GMRT Regulatory Risks

- Gaming Token Classification: Evolving regulatory frameworks around Play-to-Earn mechanics may impact token utility

- Cross-Border Compliance: Global gaming platform operations may face varying jurisdictional requirements

- Token Economics Scrutiny: Large proportion of uncirculated supply (97.07%) may attract regulatory attention regarding distribution mechanisms

GMRT Technical Risks

- Platform Dependency: Token value closely tied to adoption and performance of TGC cloud gaming platform

- Competition Risk: Cloud gaming sector includes established players with significant resources

- Smart Contract Risk: Token deployed on Base network requires ongoing security audits and monitoring

VI. Conclusion and Action Recommendations

GMRT Investment Value Assessment

The Game Company represents an innovative convergence of cloud gaming technology and Web3 tokenomics, targeting the growing market for accessible, device-agnostic gaming experiences. The platform's partnerships with established entities and integration of over 1,300 gaming titles provide foundational utility. However, the token faces significant headwinds including dramatic price decline from launch (99.74% from initial levels), limited circulating supply creating potential overhang concerns, and early-stage market positioning. The 36.67% seven-day decline reflects broader market skepticism that investors must weigh against long-term sector potential.

GMRT Investment Recommendations

✅ Beginners: Avoid allocation until clear trend reversal and increased market stability; prioritize education on gaming token fundamentals before considering entry ✅ Experienced Investors: Consider small speculative position (1-3% of portfolio) with strict stop-loss parameters; wait for technical confirmation of support levels ✅ Institutional Investors: Monitor platform development metrics and user acquisition data; evaluate partnership execution before establishing meaningful position

GMRT Trading Participation Methods

- Spot Trading: Direct purchase on Gate.com with appropriate position sizing relative to portfolio risk tolerance

- Dollar-Cost Averaging: Systematic accumulation strategy to mitigate timing risk during volatile market conditions

- Limit Orders: Utilize limit orders to capture potential price rebounds at predetermined technical levels

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is GMRT? What are its uses and value?

GMRT is a utility token in the Web3 ecosystem designed for decentralized applications and governance. Its primary value lies in enabling transaction efficiency, community participation, and network security. The token serves as a medium of exchange within its protocol, with growing adoption driving long-term appreciation potential.

What are the main factors affecting GMRT price prediction?

GMRT price prediction is primarily influenced by market demand, trading volume, technological developments, macroeconomic conditions, and community sentiment. These factors collectively determine price trends and future movements in the cryptocurrency market.

How to conduct technical and fundamental analysis of GMRT to predict prices?

Analyze GMRT's historical price and trading volume patterns using technical indicators like moving averages and support/resistance levels. For fundamentals, evaluate tokenomics, development progress, market adoption, and ecosystem growth. Combine both analyses to forecast price trends and identify potential trading opportunities.

What risks exist in GMRT price prediction? How should I mitigate them?

GMRT price prediction risks include market volatility and information asymmetry. Mitigate by diversifying data sources, consulting expert analysis, and monitoring on-chain metrics. Stay informed on project fundamentals and market sentiment.

What are GMRT's advantages and disadvantages compared to similar tokens?

GMRT offers innovative utility and community-driven features within its ecosystem. Advantages include strong governance mechanisms and emerging adoption. Disadvantages include lower market liquidity and limited institutional recognition compared to major cryptocurrencies.

What is GMRT's historical price trend? Are there any patterns to follow?

GMRT exhibits a fluctuating upward trend influenced by USD strength and real interest rates. It shows negative correlation with the dollar and real rates, reflecting its store-of-value characteristics in macroeconomic cycles.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Comprehensive Guide to NFT Gaming: Opportunities, Strategies, and Top Games

What Is SocialFi? Is This Emerging as a New Trend in the Crypto Market?

Best Crypto Wallets for 2025: A Review of Leading Options

Everything About Automated Market Makers

Are NFTs Dead? A Guide to NFT Applications