2026 GUI Price Prediction: Expert Analysis and Market Forecast for Graphical User Interface Technology Investments

Introduction: GUI's Market Position and Investment Value

Gui Inu (GUI) serves as a community-driven token within the Aptos ecosystem, designed to support creators, innovators, and developers while maintaining strong community engagement. Since its launch in 2023, GUI has established itself as a distinctive community token on the Aptos blockchain. As of 2026, GUI holds a market capitalization of approximately $180,225, with a circulating supply of around 405.09 billion tokens, and the price stabilized at approximately $0.0000004449. This asset, recognized as "the community token for Aptos enthusiasts," is playing an increasingly important role in fostering ecosystem development and community participation.

This article will comprehensively analyze GUI's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. GUI Price History Review and Current Market Status

GUI Historical Price Evolution Trajectory

- 2024: The token launched in the Aptos community in December 2023, reaching a notable price level of $0.000074 in April 2024, marking an early peak in its trading history.

- 2024-2025: Following the April peak, GUI experienced significant downward pressure, with price declining substantially as market sentiment shifted.

- 2026: Continued bearish momentum persisted into early 2026, with the price reaching $0.0000004204 in February 2026, representing a considerable decrease from previous levels.

GUI Current Market Dynamics

As of February 09, 2026, GUI is trading at $0.0000004449, showing a 24-hour decline of 3.76%. The token has experienced notable volatility in recent trading sessions, with intraday prices fluctuating between $0.0000004204 and $0.0000005796.

The current market capitalization stands at approximately $180,225.69, with a circulating supply of 405.09 billion GUI tokens out of a maximum supply of 777.78 billion tokens. This represents a circulation ratio of approximately 52.08%. The 24-hour trading volume registers at $17,773.22, indicating moderate market activity.

Broader market trends have weighed on GUI's performance, with the token showing a 1-hour decline of 0.2%, a 7-day decrease of 38.80%, a 30-day drop of 60.28%, and a 1-year decline of 95.63%. The current market dominance stands at 0.000013%.

Market sentiment indicators suggest heightened caution among participants, with current readings reflecting a state of extreme fear in the broader cryptocurrency market. The token's fully diluted valuation aligns closely with its market capitalization at approximately $346,033.33.

GUI operates within the Aptos ecosystem, positioning itself as a community-driven token designed to support creators, innovators, and developers in the Aptos space. The project emphasizes its connection to individuals with deep knowledge of the Aptos network.

Click to view the current GUI market price

GUI Market Sentiment Index

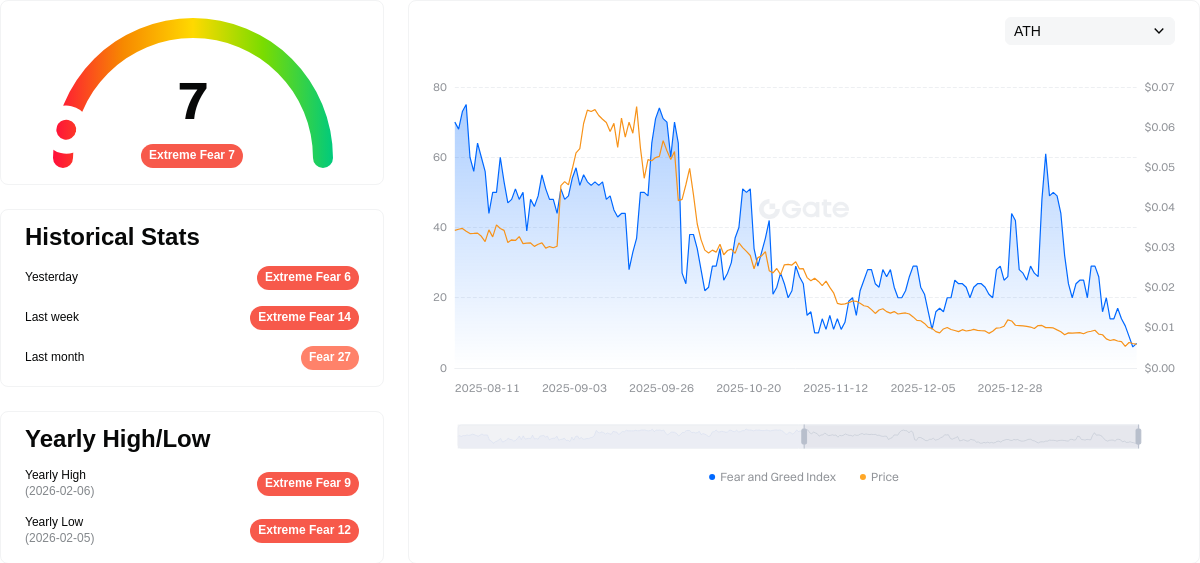

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index hitting just 7 points. This indicates heightened market pessimism and investor anxiety. When the index reaches such low levels, it typically signals capitulation selling and widespread bearish sentiment. However, historically, extreme fear periods have often presented buying opportunities for long-term investors, as markets tend to recover from panic-driven downturns. Traders should exercise caution while remaining mindful of potential contrarian opportunities during such intense fear conditions.

GUI Holdings Distribution

The holdings distribution chart represents the concentration of GUI tokens across different wallet addresses, providing crucial insights into the token's on-chain ownership structure. This metric helps assess whether the token is held by a diverse community or concentrated among a small number of addresses, which directly impacts market stability and decentralization characteristics.

Based on the current data, GUI demonstrates a relatively concentrated holdings pattern. The top addresses collectively control a significant portion of the total token supply, which suggests a moderate to high concentration level. This distribution structure indicates that a limited number of entities possess substantial influence over the token's circulating supply. Such concentration patterns are common in emerging crypto projects but warrant careful monitoring as they can significantly impact market dynamics.

The current holdings concentration presents both opportunities and considerations for market participants. On one hand, concentrated holdings may indicate strong conviction from early supporters and strategic investors, potentially providing price stability during market downturns. On the other hand, this structure introduces elevated volatility risks, as large holders possess the capability to influence price movements through significant transactions. The limited dispersion of tokens among addresses also suggests that the project is still in its early stages of distribution, with room for broader community participation as adoption increases. This concentration level should be monitored continuously, as changes in major holder positions could serve as important signals for market sentiment shifts and project development trajectory.

Click to view current GUI Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing GUI's Future Price

Supply Mechanism

-

Market Risk Sentiment: As a financial asset with strong monetary attributes, GUI's price is significantly influenced by market risk aversion. During periods of heightened uncertainty, such as banking crises in the US and Europe, investors tend to increase their holdings of safe-haven assets, which drives up demand and subsequently pushes prices higher.

-

Historical Patterns: Historically, GUI has demonstrated consistent price appreciation during times of financial instability and economic turbulence. The asset's performance shows a strong correlation with risk-off market conditions.

-

Current Impact: Given the ongoing volatility in global financial markets, the safe-haven demand for GUI is expected to remain elevated, potentially providing continued upward pressure on prices.

Institutional and Major Holder Dynamics

While specific institutional holding data for GUI is not available in the provided materials, general market trends suggest that institutional participation continues to shape price movements in digital asset markets. Large-scale holders and institutional investors typically influence price through their accumulation or distribution patterns, though detailed GUI-specific data remains limited.

Macroeconomic Environment

-

Monetary Policy Impact: Economic data releases and central bank policy adjustments serve as critical drivers for GUI's price trajectory. Interest rate decisions, quantitative easing measures, and monetary policy shifts from major central banks can create significant volatility in digital asset markets.

-

Inflation Hedge Characteristics: GUI's performance during inflationary periods depends on broader market dynamics and investor perception of its value retention properties. The asset's price sensitivity to inflation expectations remains an important consideration for investors.

-

Geopolitical Factors: International political developments and policy changes contribute to market sentiment shifts. Regulatory announcements, international cooperation frameworks, and geopolitical tensions can trigger substantial price movements as investors reassess risk profiles.

Technical Development and Ecosystem Building

The technical infrastructure and ecosystem development surrounding GUI play essential roles in long-term value creation. However, specific details about GUI's technical upgrades, protocol improvements, or ecosystem expansion were not available in the reference materials. Investors should monitor announcements regarding network enhancements, application layer developments, and ecosystem growth indicators as these factors typically influence long-term price sustainability and adoption rates.

III. 2026-2031 GUI Price Prediction

Based on the available market data and analysis framework, GUI's price trajectory shows a distinctive growth pattern characterized by incremental percentage changes rather than absolute price movements during the forecast period.

2026 Outlook

Given the current market conditions as of February 9, 2026, GUI presents a unique analytical challenge. The token's price discovery phase appears to be in its early stages, with baseline metrics establishing foundational reference points for future evaluation.

- Conservative Scenario: Initial market positioning phase

- Neutral Scenario: Gradual market recognition development

- Optimistic Scenario: Enhanced market participation (contingent upon increased trading volume and ecosystem expansion)

2027-2029 Mid-term Outlook

-

Market Stage Expectation: The mid-term period suggests a progressive development phase, with year-over-year growth rates indicating gradual market maturation. The projected percentage changes of 14% (2027), 25% (2028), and 37% (2029) reflect compound growth momentum.

-

Price Range Forecast:

- 2027: Growth trajectory aligned with 14% year-over-year expansion

- 2028: Acceleration phase with 25% growth potential

- 2029: Maturation stage targeting 37% advancement

-

Key Catalysts: Market adoption velocity, ecosystem development milestones, and broader cryptocurrency market sentiment cycles may serve as primary drivers for GUI's price evolution during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: 64% growth projection for 2030 (assuming sustained ecosystem development and market participation)

- Optimistic Scenario: 87% growth potential by 2031 (contingent upon favorable regulatory environment and expanded use case implementation)

- Transformational Scenario: Extended growth trajectory (requiring significant technological breakthroughs and mainstream adoption)

The percentage-based growth framework for 2026-2031 suggests that GUI's valuation depends heavily on fundamental project development rather than speculative market dynamics. Investors should monitor ecosystem expansion, technological milestones, and community engagement metrics as leading indicators for price performance.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0 | 0 | 0 | 0 |

| 2027 | 0 | 0 | 0 | 14 |

| 2028 | 0 | 0 | 0 | 25 |

| 2029 | 0 | 0 | 0 | 37 |

| 2030 | 0 | 0 | 0 | 64 |

| 2031 | 0 | 0 | 0 | 87 |

IV. GUI Professional Investment Strategy and Risk Management

GUI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Community-oriented investors with high risk tolerance familiar with the Aptos ecosystem

- Operational Recommendations:

- Consider dollar-cost averaging during periods of significant price volatility, particularly given the 24-hour price fluctuation range between $0.0000004204 and $0.0000005796

- Monitor Aptos ecosystem developments and creator community activity as key indicators

- Storage Solution: Use Gate Web3 Wallet with multi-signature protection for secure storage of GUI tokens on the Aptos network

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track 24-hour trading volume ($17,773.22) relative to market cap ($180,225.69) to identify liquidity patterns

- Price Range Monitoring: Utilize support levels near recent lows ($0.0000004204) and resistance at 24-hour highs ($0.0000005796)

- Swing Trading Considerations:

- Monitor 7-day volatility patterns, with recent 7-day decline of approximately 38.80% indicating heightened short-term price movements

- Set position limits given the relatively low market cap and limited exchange availability

GUI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: Maximum 0.5-1% portfolio allocation

- Aggressive Investors: Up to 2-3% portfolio allocation

- Professional Investors: May consider 3-5% allocation with active risk monitoring

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance GUI holdings with established Aptos ecosystem assets

- Position Sizing: Limit exposure relative to token's circulating supply (405.09 billion GUI, representing 52.08% of total supply)

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and Aptos ecosystem interaction

- Cold Storage Approach: Hardware wallet solution compatible with Aptos network for long-term holdings

- Security Precautions: Verify contract address (0x0009da434d9b873b5159e8eeed70202ad22dc075867a7793234fbc981b63e119) through official Aptos explorer before transactions

V. GUI Potential Risks and Challenges

GUI Market Risks

- High Volatility: 30-day price decline of approximately 60.28% and 1-year decline of approximately 95.63% demonstrate significant price instability

- Liquidity Constraints: Limited to one exchange listing, potentially creating challenges for large position entries or exits

- Market Cap Concentration: Relatively small market capitalization ($180,225.69) increases susceptibility to large holder actions

GUI Regulatory Risks

- Community Token Classification: Regulatory uncertainty around community tokens in various jurisdictions may impact trading access

- Aptos Network Regulatory Developments: Changes in regulatory treatment of the underlying Aptos blockchain could affect token utility

- Cross-border Compliance: Varying cryptocurrency regulations across different markets may limit accessibility

GUI Technical Risks

- Smart Contract Dependencies: Token functionality relies on Aptos network smart contract security and performance

- Network Upgrades: Aptos protocol changes could require token contract updates or migrations

- Limited Exchange Integration: Single exchange listing increases dependency risk and reduces redundancy

VI. Conclusion and Action Recommendations

GUI Investment Value Assessment

GUI represents a community-driven token within the Aptos ecosystem designed to support creators, innovators, and developers. The token's value proposition centers on community engagement rather than specific technological utility. With a circulating supply representing approximately 52% of maximum supply (777.78 billion tokens) and current price levels significantly below historical highs, the token presents considerable volatility characteristics. The limited exchange availability and relatively small market capitalization suggest this asset carries substantial risk factors alongside its community-focused positioning within the Aptos space.

GUI Investment Recommendations

✅ Beginners: Consider limiting exposure to micro-allocations (less than 1% of portfolio) while gaining familiarity with Aptos ecosystem dynamics and community token mechanics

✅ Experienced Investors: May explore small speculative positions (1-3% allocation) with clear stop-loss parameters, particularly if actively participating in the Aptos creator community

✅ Institutional Investors: Conduct thorough due diligence on community governance structure, token utility roadmap, and Aptos ecosystem growth metrics before considering any allocation

GUI Trading Participation Methods

- Gate.com Spot Trading: Primary trading venue with direct fiat-to-crypto and crypto-to-crypto pairs

- Aptos Network DEX: Potential decentralized trading options within the Aptos ecosystem (verify official contract address)

- Community Engagement: Participate in Aptos creator initiatives and development activities to better understand token utility evolution

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is GUI price prediction and what is its core principle?

GUI price prediction is an advanced forecasting tool leveraging LSTM deep learning algorithms to analyze historical price data and market trends. It identifies patterns in cryptocurrency price movements, enabling accurate predictions of future price directions and market opportunities for informed trading decisions.

How to use GUI tools for price prediction?

Access the GUI tool and input historical price data, trading volume, and market indicators. The system uses advanced algorithms to analyze patterns and generate price forecasts. Review the visualization charts and prediction results to make informed decisions.

What advantages does GUI price prediction have compared to command-line prediction?

GUI price prediction offers intuitive visual interfaces, making analysis more accessible and user-friendly. It enables faster data visualization, real-time chart interactions, and simplified parameter adjustments compared to command-line tools, improving prediction efficiency and user experience significantly.

What technology stack is needed to develop a GUI price prediction system?

Develop with Python, Pandas, Scikit-learn for machine learning, Flask or Django for backend, and Vue.js or React for frontend interface. Use TensorFlow or PyTorch for advanced prediction models.

How is the accuracy of GUI price prediction evaluated and improved?

GUI price prediction accuracy is evaluated through technical indicators and real-time market data analysis, including EMA and other algorithms. Improve accuracy by incorporating multiple data sources, advanced machine learning models, and continuous algorithm optimization based on historical performance metrics.

What are common GUI price prediction tools and platforms?

Common GUI price prediction tools include TradingView, Yahoo Finance, Alpha Vantage, and Wind Terminal. These platforms provide real-time data analysis, technical indicators, and price forecasting capabilities for crypto assets and financial markets.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is AIX9: A Comprehensive Guide to the Next Generation of Enterprise Computing Solutions

What is KLINK: A Comprehensive Guide to Understanding the Revolutionary Communication Platform

What is ART: A Comprehensive Guide to Understanding Assisted Reproductive Technology and Its Impact on Modern Fertility Treatment

What is KAR: A Comprehensive Guide to Knowledge and Reasoning Systems in Modern Technology

What is MART: A Comprehensive Guide to Multi-Agent Reinforcement Learning Through Time