2026 HAPPY Price Prediction: Expert Analysis, Market Trends, and Investment Outlook for the Next Year

Introduction: HAPPY's Market Position and Investment Value

HappyCat (HAPPY), as a meme-inspired digital asset built on the Solana blockchain, has garnered attention since its inception in 2024. As of February 2026, HAPPY maintains a market capitalization of approximately $986,623 USD, with a circulating supply of around 3.33 billion tokens, and a current price hovering near $0.000296. This asset, originating from a viral video featuring a joyful cat, has attracted over 105,000 holders and established a presence across 6 cryptocurrency exchanges.

This article will comprehensively analyze HAPPY's price trajectory from 2026 to 2031, examining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasting and practical investment strategies. Given HAPPY's recent volatility, with a 21.31% decline over the past week and a 38.06% drop over the past month, understanding the underlying market forces becomes particularly relevant for potential investors navigating this emerging digital asset.

I. HAPPY Price History Review and Market Overview

HAPPY Historical Price Evolution

- 2024: Token launched in November with an initial price of $0.02718, reaching its historical peak of $0.04723 on November 16, 2024

- 2025: Market experienced correction phase with sustained downward pressure

- 2026: Price declined to historical low of $0.000288 on February 2, 2026, representing a significant decrease from peak levels

HAPPY Current Market Status

As of February 3, 2026, HAPPY is trading at $0.000296, showing a 1.32% increase over the past 24 hours. The token has recorded a 24-hour trading volume of $15,243.39, with intraday price fluctuations between $0.000288 and $0.0003148.

The market capitalization stands at $986,623.28, with a fully diluted valuation matching this figure at 100% circulation ratio. All 3.33 billion tokens are currently in circulation, with the maximum supply capped at the same amount. The token maintains a market dominance of 0.000035%.

Short-term price movements show a 0.47% gain over the past hour, while broader timeframes reveal more substantial declines: 21.31% over the past 7 days, 38.06% over the past 30 days, and 89.74% over the past year. The token is currently listed on 6 exchanges and has attracted 105,589 holders.

Click to view current HAPPY market price

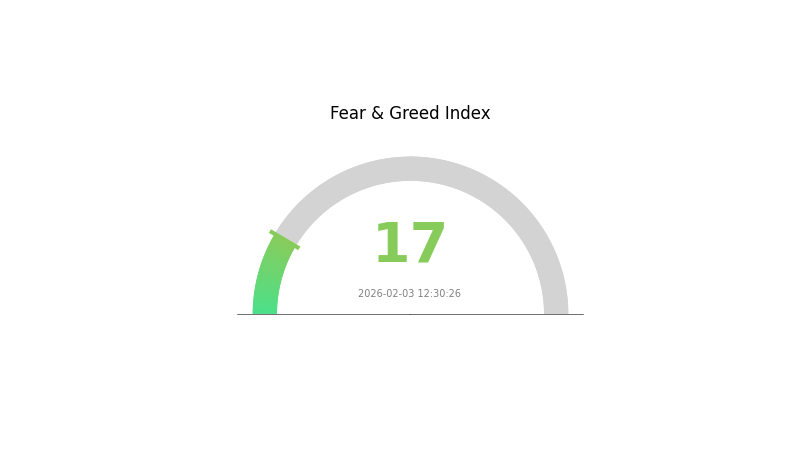

HAPPY Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index standing at 17. This indicates a significant pullback in investor confidence and heightened market anxiety. During such periods of extreme fear, opportunities often emerge for long-term investors. Market volatility tends to be elevated, and prices may experience sharp fluctuations. Traders should exercise caution and maintain disciplined risk management strategies. Consider diversifying your portfolio and avoiding emotional decision-making during these uncertain times. Historical data suggests that extreme fear phases often precede market recoveries, making this a critical moment for strategic positioning.

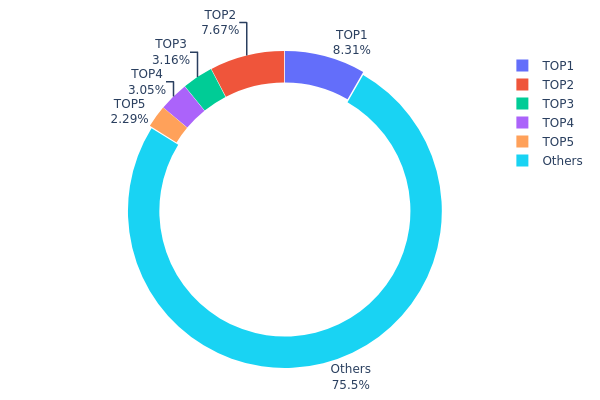

HAPPY Holding Distribution

The holding distribution chart illustrates the concentration of tokens across different wallet addresses, revealing the degree of decentralization and potential market control. Based on the current data, HAPPY demonstrates a relatively moderate concentration pattern. The top holder controls 8.31% of the total supply (276,993.83K tokens), while the second-largest address holds 7.66% (255,518.20K tokens). The top five addresses collectively hold 24.45% of the total supply, with the remaining 75.55% distributed among other addresses.

This distribution structure indicates a relatively balanced ecosystem without extreme concentration risks. While the top two addresses each hold significant portions exceeding 7%, neither single entity controls a dominant market share. The fact that over three-quarters of the supply remains distributed among smaller holders suggests reasonable decentralization and reduces the likelihood of single-party market manipulation.

From a market stability perspective, this holding pattern presents both opportunities and considerations. The moderate concentration among top holders provides a degree of price stability, as these large stakeholders typically have long-term interests in maintaining project value. However, the combined 15.97% held by the top two addresses means that coordinated large-scale selling could generate notable price pressure. The substantial 75.55% held by other addresses indicates active community participation and suggests that HAPPY has achieved meaningful token distribution across its user base, which typically contributes to healthier long-term market dynamics and resilience against sudden volatility.

Click to view current HAPPY Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 276993.83K | 8.31% |

| 2 | 2Ejnns...z2Ps3e | 255518.20K | 7.66% |

| 3 | u6PJ8D...ynXq2w | 105291.46K | 3.15% |

| 4 | CXejtJ...zoEVtH | 101656.06K | 3.05% |

| 5 | 4QXXp1...zGaYB3 | 76266.96K | 2.28% |

| - | Others | 2516964.79K | 75.55% |

II. Core Factors Influencing HAPPY's Future Price

Market Demand and Trading Activity

- Market Sentiment: Cryptocurrency assets like HAPPY are particularly sensitive to overall market sentiment and risk appetite among investors.

- Trading Volume Dynamics: Changes in trading activity and liquidity conditions can significantly impact price movements and volatility patterns.

- Investor Behavior: The token's price trajectory is closely tied to shifts in market participant confidence and trading strategies.

Regulatory Environment

- Policy Developments: Regulatory changes at both national and international levels can materially affect cryptocurrency valuations.

- Compliance Framework: Evolving regulatory standards and compliance requirements may influence market accessibility and institutional participation.

- Cross-border Regulations: International regulatory coordination efforts continue to shape the broader operating environment for digital assets.

Macroeconomic Factors

- Risk Asset Correlation: As a relatively high-risk asset class, cryptocurrencies including HAPPY are influenced by broader macroeconomic conditions.

- Economic Policy Impact: Central bank monetary policies and economic stimulus measures can affect capital flows into cryptocurrency markets.

- Global Economic Trends: Macroeconomic indicators such as inflation rates, interest rate expectations, and economic growth projections play roles in shaping investment decisions.

Technological Advancements

- Innovation Trajectory: Ongoing technological developments within the blockchain ecosystem may enhance functionality and use cases.

- Network Development: Improvements in transaction efficiency, security protocols, and scalability solutions can contribute to long-term value proposition.

- Ecosystem Evolution: The continued development of supporting infrastructure and applications may influence adoption rates and utility.

III. 2026-2031 HAPPY Price Prediction

2026 Outlook

- Conservative Prediction: $0.0002 - $0.0003

- Neutral Prediction: $0.0003 (average forecast)

- Optimistic Prediction: Up to $0.00044 (requires favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: Gradual growth phase with increasing token adoption and ecosystem development

- Price Range Forecast:

- 2027: $0.00024 - $0.00043

- 2028: $0.00025 - $0.00056

- 2029: $0.00028 - $0.00065

- Key Catalysts: Market expansion, technological improvements, and broader community engagement driving upward momentum

2030-2031 Long-term Outlook

- Base Scenario: $0.00032 - $0.00072 (assuming steady market growth and consistent project development)

- Optimistic Scenario: $0.00056 - $0.00072 (contingent on accelerated adoption and positive regulatory environment)

- Transformative Scenario: Potential to reach $0.0007+ by 2031 (requires exceptional market conditions and breakthrough developments)

- 2026-02-03: HAPPY trading within early-stage valuation range of $0.0002 - $0.00044 (establishing baseline price discovery)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00044 | 0.0003 | 0.0002 | 0 |

| 2027 | 0.00043 | 0.00037 | 0.00024 | 24 |

| 2028 | 0.00056 | 0.0004 | 0.00025 | 34 |

| 2029 | 0.00065 | 0.00048 | 0.00028 | 61 |

| 2030 | 0.00072 | 0.00056 | 0.00032 | 90 |

| 2031 | 0.0007 | 0.00064 | 0.00061 | 116 |

IV. HAPPY Professional Investment Strategy and Risk Management

HAPPY Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to meme coin trends with medium to high risk tolerance

- Operational Recommendations:

- Conduct thorough research on community engagement metrics and social media sentiment before entering positions

- Consider dollar-cost averaging (DCA) approach to mitigate entry timing risks

- Storage Solution: Use Gate Web3 Wallet for secure self-custody with built-in security features

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume patterns; current volume of $15,243 indicates moderate liquidity conditions

- Support/Resistance Levels: Track key price levels between the 24-hour low ($0.000288) and high ($0.0003148)

- Swing Trading Key Points:

- Set stop-loss orders below recent support levels to manage downside risk

- Monitor social media sentiment shifts that may precede price movements in meme coin assets

HAPPY Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 10% with active risk monitoring systems

(II) Risk Hedging Solutions

- Portfolio Diversification: Balance HAPPY exposure with blue-chip cryptocurrencies and stablecoins

- Position Sizing: Limit individual position size to prevent concentrated risk exposure

(III) Secure Storage Solutions

- Self-custody Recommendation: Gate Web3 Wallet offers multi-layer security protocols for SOL-based tokens

- Multi-signature Option: Consider implementing multi-signature wallets for larger holdings

- Security Considerations: Never share private keys or seed phrases; enable two-factor authentication on all exchange accounts

V. HAPPY Potential Risks and Challenges

HAPPY Market Risks

- High Volatility: HAPPY has experienced a 1-year decline of 89.74%, demonstrating significant price volatility typical of meme coins

- Liquidity Risk: With a market cap of approximately $986,623 and relatively modest 24-hour volume, large trades may experience slippage

- Meme Coin Lifecycle: Trend-driven assets may face sustained downward pressure if community interest declines

HAPPY Regulatory Risks

- Regulatory Uncertainty: Evolving cryptocurrency regulations may impact trading access or tax treatment

- Compliance Evolution: Future regulatory frameworks may impose restrictions on meme coin trading or marketing

- Jurisdictional Variations: Different regions may adopt varying approaches to cryptocurrency asset classification

HAPPY Technical Risks

- Smart Contract Dependency: As a Solana-based token, HAPPY relies on the underlying blockchain's security and performance

- Network Congestion: Solana network issues could temporarily affect transaction processing and token transfers

- Token Contract Risks: Limited information about contract audits or security assessments increases technical uncertainty

VI. Conclusion and Action Recommendations

HAPPY Investment Value Assessment

HAPPY represents a high-risk, high-volatility meme coin asset derived from viral internet content. With a current market cap ranking of 2520 and 100% circulating supply, the token exhibits complete liquidity but faces significant price pressure, having declined 89.74% over the past year. The project's value proposition centers on community engagement and social media virality rather than fundamental utility. Short-term risks include continued price volatility, limited liquidity depth, and dependence on sustained community interest. Long-term value remains highly speculative and contingent on maintaining relevance in the competitive meme coin landscape.

HAPPY Investment Recommendations

✅ Beginners: Start with minimal allocation (under 1% of portfolio); focus on learning crypto market dynamics rather than expecting returns; only invest amounts you can afford to lose entirely

✅ Experienced Investors: Consider HAPPY as a speculative position within a diversified meme coin basket; implement strict stop-loss disciplines; monitor on-chain metrics and social sentiment indicators

✅ Institutional Investors: Assess HAPPY within broader trend-based trading strategies; evaluate liquidity profiles before position sizing; implement comprehensive risk management protocols

HAPPY Trading Participation Methods

- Spot Trading: Purchase HAPPY directly on Gate.com with competitive trading fees and instant settlement

- Limit Orders: Set specific price targets to optimize entry and exit points during volatile market conditions

- Portfolio Integration: Use Gate.com's portfolio management tools to track HAPPY performance alongside other holdings

Cryptocurrency investment carries extreme risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is HAPPY token? What are its practical use cases?

HAPPY is a blockchain-based digital token designed to support fan economy and creator communities. Its applications include rewarding content creators, enabling community governance participation, and facilitating fan engagement through token incentives and voting mechanisms.

How to predict the future price of HAPPY tokens? What analysis methods are available?

Predict HAPPY price using technical analysis(tracking chart patterns and market trends)and fundamental analysis(monitoring project developments and trading volume). Combine on-chain metrics with market sentiment to assess potential price movements.

What are the main factors affecting HAPPY token price?

HAPPY token price is primarily influenced by market demand, liquidity levels, and platform dependency. Additionally, Federal Reserve policies and overall cryptocurrency market trends significantly impact its price movements.

What risks should I be aware of when investing in HAPPY tokens?

HAPPY token investments carry market volatility risks and regulatory uncertainty. Token holders typically lack voting rights compared to direct ownership. Conduct thorough risk assessment before investing.

What are the advantages and disadvantages of HAPPY token compared to similar tokens?

HAPPY token offers unique application scenarios and higher growth potential in specific use cases. Compared to established tokens, it features greater price volatility and market mobility, positioning it as an emerging asset with distinct market differentiation and investment opportunities.

What is the historical price trend of HAPPY token and what stage is it currently at?

HAPPY token has experienced significant price volatility with unstable historical trends. Currently positioned at a low point, presenting potential rebound opportunities for investors seeking entry positions in this market cycle.

What is the long-term price outlook for HAPPY tokens according to experts?

Experts view HAPPY's long-term prospects positively, with many believing digital assets offer value preservation against currency dilution. The token's fundamentals and market adoption suggest strong growth potential, though market volatility remains a natural characteristic of crypto assets.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

Dusting Attack: How Hackers Steal Your Information with Tiny Crypto Amounts and How to Protect Yourself

Who Is Will Clemente? A Guide to the Popular On-Chain Analyst

Best Crypto Wallets: An In-Depth Review of Leading Choices

Best Crypto Wallets in Russia: Top 3 Reliable Solutions for Secure Digital Asset Storage

What Are Nodes? Types of Nodes and How They Work in Blockchain