2026 HEU Price Prediction: Expert Analysis of High Enriched Uranium Market Trends and Future Valuations

Introduction: HEU's Market Position and Investment Value

Heurist (HEU), positioned as a decentralized AI-as-a-Service cloud platform, has emerged as an innovative solution aggregating GPU resources from individual holders and data centers since its launch in December 2024. As of February 2026, HEU maintains a market capitalization of approximately $1.44 million, with a circulating supply of around 196.09 million tokens, and the price hovering around $0.00732. This asset, characterized as a "censorship-free AI infrastructure enabler," is playing an increasingly significant role in providing serverless AI services to developers through its API-first infrastructure.

This article will comprehensively analyze HEU's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. HEU Price History Review and Market Status

HEU Historical Price Evolution Trajectory

- December 2024: HEU was officially listed on Gate.com on December 6, 2024, with an initial offering price of $0.07

- December 2024: On December 28, 2024, the token reached a peak value of $0.462

- January 2026: The price experienced a significant adjustment, dropping to a recorded low of $0.00613 on January 31, 2026

HEU Current Market Situation

As of February 2, 2026, HEU is trading at $0.00732, reflecting short-term price fluctuations across multiple timeframes. Over the past hour, the price decreased by 3.56%, while the 24-hour period shows a decline of 4.68%. The token's 7-day performance indicates a decrease of 32.029%, and the 30-day trend demonstrates a drop of 36.29%.

The current 24-hour trading volume stands at $38,033.68, with prices fluctuating between a high of $0.00872 and a low of $0.00657 during this period. The circulating supply is 196,088,747 HEU tokens, representing 19.61% of the maximum supply of 1,000,000,000 tokens. The current market capitalization is approximately $1,435,369.63, while the fully diluted market cap is valued at $7,320,000.

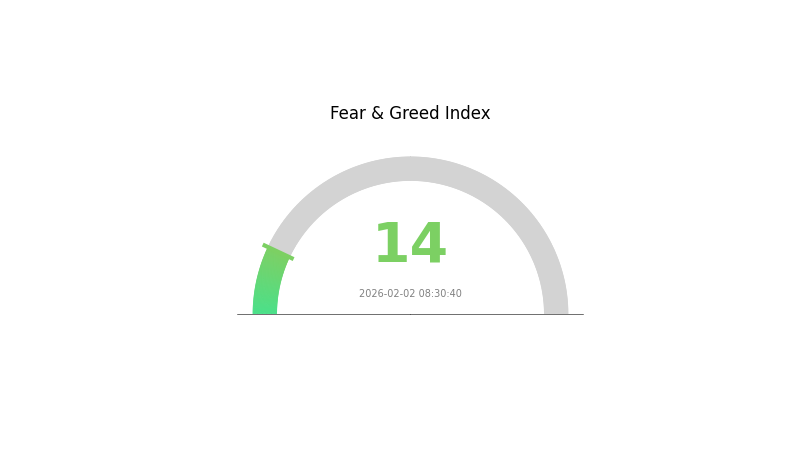

HEU ranks #2272 in the overall cryptocurrency market, with a market share of 0.00027%. The token is available for trading on 4 exchanges and has attracted 47,505 holders. Built on the ERC-20 standard, HEU operates with contract deployments on Base and zkSync Era networks. The current market sentiment index indicates extreme fear at level 14.

Click to view the current HEU market price

HEU Market Sentiment Indicator

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 14. This exceptionally low reading indicates heightened market anxiety and pessimistic sentiment among investors. During such periods, risk-averse traders typically reduce exposure, while contrarian investors may view this as a potential accumulation opportunity. Market participants should remain cautious and conduct thorough risk assessment before making trading decisions.

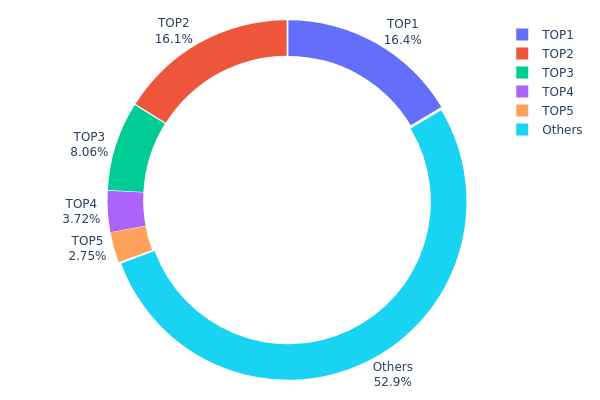

HEU Holdings Distribution

The holdings distribution chart reveals the allocation of HEU tokens across different wallet addresses, providing crucial insights into the degree of decentralization and concentration risk within the token's ecosystem. As of February 2, 2026, the on-chain data demonstrates a moderately concentrated distribution pattern that warrants careful examination from both investment and market structure perspectives.

The top three addresses collectively control 40.57% of the total HEU supply, with the largest holder commanding 16.42% (30,654.71K tokens), followed closely by the second-largest at 16.10% (30,055.30K tokens), and the third at 8.05% (15,031.80K tokens). The top five addresses account for 47.04% of circulating supply, while the remaining 52.96% is distributed among other market participants. This configuration indicates a dual-tier structure where major stakeholders maintain significant influence alongside a relatively diverse base of smaller holders.

From a market dynamics standpoint, this concentration level presents both stability and vulnerability factors. The substantial holdings by top addresses could facilitate price support during market downturns, as these entities typically possess stronger conviction and longer investment horizons. However, the combined control of over 40% by the top three addresses also introduces potential liquidity risks and price volatility concerns should any large holder decide to redistribute or liquidate their positions. The relatively healthy 52.96% held by others suggests adequate market depth for routine trading activities, though traders should remain cognizant of the influence major addresses may exert during significant market movements or protocol governance decisions.

Click to view current HEU Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xfa13...95761c | 30654.71K | 16.42% |

| 2 | 0xa9c1...7c1bb2 | 30055.30K | 16.10% |

| 3 | 0x0d07...b492fe | 15031.80K | 8.05% |

| 4 | 0xbeb7...4b3d31 | 6945.52K | 3.72% |

| 5 | 0x4e3a...a31b60 | 5140.99K | 2.75% |

| - | Others | 98786.06K | 52.96% |

II. Core Factors Influencing HEU's Future Price

Supply Mechanism

-

Nuclear Policy and Disarmament Concerns: The market has shown sensitivity to potential nuclear disarmament discussions. Recent concerns emerged when speculation arose about a possible repeat of the 1993 "Megatons to Megawatts" program, which involved converting weapons-grade highly enriched uranium (HEU) into low-enriched uranium (LEU) for nuclear power plants. However, analysts suggest the current geopolitical landscape differs significantly from 1993, making large-scale nuclear disarmament unlikely.

-

Historical Patterns: Between 1993 and 2013, Russia and the United States implemented an agreement to dilute 500 tons of weapons-grade HEU into LEU suitable for nuclear fuel. This government program concluded in 2013. Such historical supply releases have demonstrated the potential for significant market impacts.

-

Current Impact: While recent speculation about renewed disarmament talks between major powers has created short-term price pressure, industry analysts believe the market reaction may be excessive. The fundamental supply-demand dynamics for natural uranium remain unchanged, with medium to long-term shortages still anticipated.

Institutional and Major Holder Dynamics

-

Institutional Holdings: Financial institutions and specialized funds have become increasingly active in the uranium market. Entities like Sprott Physical Uranium Trust and Yellow Cake plc continue to accumulate physical uranium inventory, which has contributed to market tightness. Centrus Energy (LEU) holds a unique position as one of only two companies authorized to produce commercial LEU, and the sole holder of HALEU (high-assay low-enriched uranium) production licenses.

-

Corporate Adoption: Major technology companies are exploring nuclear power for data center applications. Microsoft has announced plans to restart Three Mile Island Unit 1 to power data centers, signaling growing interest from tech giants in securing dedicated nuclear power sources for AI infrastructure.

-

National Policies: The United States enacted legislation in May 2024 prohibiting imports of enriched uranium from certain countries, with exemptions limited until January 1, 2028. Russia responded in November 2024 with export restrictions on enriched uranium, though supplies under specific one-time permits remain exempt. These policy developments have created supply chain restructuring pressures.

Macroeconomic Environment

-

Monetary Policy Impact: Global nuclear energy development has gained momentum as countries seek energy security and carbon reduction. Central banks' focus on inflation control and energy price stability has indirectly supported nuclear power investment as a long-term inflation hedge strategy.

-

Inflation Hedging Attributes: Uranium exhibits characteristics of a strategic commodity with limited substitutability. During periods of energy price volatility and inflationary pressure, nuclear fuel's relatively stable long-term cost structure has attracted attention as a potential inflation hedge.

-

Geopolitical Factors: Regional instabilities continue to affect supply. In 2023, sanctions by the Economic Community of West African States (ECOWAS) led to the suspension of uranium production at Orano's Somair facility in Niger, which accounted for approximately 4% of global natural uranium supply in 2022. Kazakhstan, the world's largest uranium producer, faces sulfuric acid supply constraints affecting production capacity utilization.

Technological Development and Ecosystem Building

-

Nuclear Power Renaissance: Global nuclear power is experiencing renewed interest. The International Atomic Energy Agency (IAEA) projects global nuclear capacity to reach 543 GW by 2035, representing a CAGR of 2.9% from 2024-2035. China continues aggressive development, approving 11 new reactors in August 2024, while developed nations are restarting previously idled facilities.

-

AI and Data Center Demand: The emergence of artificial intelligence as a power-intensive application has created a new demand driver. AI data centers require approximately seven times more electricity than traditional data centers. The U.S. data center electricity consumption is projected to increase from 126 TWh in 2022 to 390 TWh by 2030, rising from 2.5% to 7.5% of national consumption.

-

Enrichment Capacity Constraints: Global uranium enrichment capacity has shifted from surplus to shortage. Separative Work Unit (SWU) prices have tripled since early 2022, reaching $176. This tightness reduces the economic viability of re-enriching depleted uranium tails and underfeeding, effectively constraining secondary supply sources and increasing dependence on primary uranium mine production.

-

Production Challenges: Major uranium producers face operational headwinds. Cameco reported equipment issues at Cigar Lake and labor challenges at McArthur River, leading to downward production guidance revisions in 2023. Kazakhstan's Kazatomprom reduced its 2025 production guidance from 30.5-31.5 million pounds to 25.0-26.5 million pounds due to sulfuric acid shortages, a critical input for in-situ leaching operations.

III. 2026-2031 HEU Price Forecast

2026 Outlook

- Conservative Forecast: $0.00693 - $0.00729

- Neutral Forecast: Around $0.00729

- Optimistic Forecast: Up to $0.00846 (requires favorable market conditions)

Based on current market dynamics, HEU is projected to experience a slight correction in 2026, with price change estimates around -3%. The token may consolidate within a relatively narrow range as the market adjusts to prevailing conditions. Traders on Gate.com should monitor key support levels around $0.00693 to identify potential entry points during this consolidation phase.

2027-2029 Mid-term Outlook

- Market Stage Expectation: Recovery and gradual growth phase with increasing momentum

- Price Range Forecast:

- 2027: $0.00622 - $0.00835 (approximately 4% growth)

- 2028: $0.00511 - $0.00884 (approximately 7% growth)

- 2029: $0.00441 - $0.01034 (approximately 12% growth)

- Key Catalysts: Market recovery trends, broader cryptocurrency adoption, and potential technological developments within the HEU ecosystem

The mid-term period suggests a progressive recovery trajectory, with price volatility potentially widening as the market matures. Each successive year shows expanding price ranges, indicating increasing market participation and liquidity. The accelerating growth rate from 4% to 12% reflects strengthening market confidence.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00564 - $0.00941 in 2030 (assuming steady market development and sustained adoption rates)

- Optimistic Scenario: $0.01058 - $0.01503 by 2031 (contingent on accelerated ecosystem expansion and favorable regulatory environment)

- Transformative Scenario: Potential to reach upper bounds of $0.01176 in 2030 and $0.01503 in 2031 (requires exceptional market conditions, mainstream adoption breakthroughs, and sustained bullish cryptocurrency market trends)

The long-term projection indicates substantial growth potential, with 2030 showing approximately 24% price appreciation and 2031 demonstrating a robust 40% increase. These forecasts suggest HEU could experience significant value appreciation over the five-year horizon, though investors should remain aware of inherent market volatility and conduct thorough research before making investment decisions on platforms like Gate.com.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00846 | 0.00729 | 0.00693 | -3 |

| 2027 | 0.00835 | 0.00787 | 0.00622 | 4 |

| 2028 | 0.00884 | 0.00811 | 0.00511 | 7 |

| 2029 | 0.01034 | 0.00847 | 0.00441 | 12 |

| 2030 | 0.01176 | 0.00941 | 0.00564 | 24 |

| 2031 | 0.01503 | 0.01058 | 0.00899 | 40 |

IV. HEU Professional Investment Strategy and Risk Management

HEU Investment Methodology

(1) Long-term Holding Strategy

- Target investors: Investors who believe in the long-term development potential of decentralized AI infrastructure and are willing to bear short-term price fluctuations

- Operation suggestions:

- Consider building positions in batches when market sentiment is stable to avoid concentrated purchases at high points

- Set reasonable profit-taking targets and stop-loss points, and adjust dynamically according to project development progress

- Use Gate Web3 Wallet for secure storage to ensure private key security and facilitate long-term holding

(2) Active Trading Strategy

- Technical analysis tools:

- Moving averages: Use 20-day and 50-day moving averages to identify short-term trends and potential support/resistance levels

- Trading volume analysis: Pay attention to the correlation between price and volume changes to identify potential trend reversals

- Swing trading points:

- Monitor key support levels around $0.00613 (historical low) and resistance levels

- Set reasonable position sizes and avoid over-concentration in single trades

HEU Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: 1-3% of crypto portfolio

- Aggressive investors: 5-10% of crypto portfolio

- Professional investors: Adjust flexibly based on risk assessment and market conditions

(2) Risk Hedging Solutions

- Portfolio diversification: Combine with mainstream cryptocurrencies and stablecoins to reduce single-asset risk

- Position management: Use stop-loss orders to limit potential losses and avoid emotional decision-making

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for convenient trading and management

- Cold storage solution: For large holdings, consider using hardware wallets with offline private key storage

- Security considerations: Never share private keys or seed phrases, enable two-factor authentication, and regularly update wallet software

V. HEU Potential Risks and Challenges

HEU Market Risks

- High volatility: HEU has experienced significant price fluctuations, with a 32.029% decline over the past 7 days and 36.29% over 30 days

- Limited liquidity: With a 24-hour trading volume of approximately $38,033 and trading on only 4 exchanges, liquidity constraints may lead to slippage during large transactions

- Market sentiment impact: As an emerging project, HEU is susceptible to overall crypto market sentiment and may face additional downward pressure during market downturns

HEU Regulatory Risks

- AI technology regulation: Global regulatory frameworks for AI technology are evolving, which may affect the operational model of decentralized AI platforms

- Cryptocurrency compliance: Different jurisdictions have varying regulatory requirements for crypto assets, potentially impacting HEU's trading and usage

- Data privacy concerns: AI services involving data processing may face stricter data protection regulations

HEU Technical Risks

- Network security: As a decentralized platform aggregating GPU resources, system security and node reliability are critical

- Smart contract risks: Potential vulnerabilities in smart contracts deployed on Base and zkSync Era chains could lead to fund losses

- Competition pressure: The decentralized AI computing market is highly competitive, and the project faces challenges from other similar platforms

VI. Conclusion and Action Recommendations

HEU Investment Value Assessment

Heurist aims to provide decentralized AI services through a serverless infrastructure that aggregates GPU computing resources. The project addresses the growing demand for AI computing power with an innovative model. However, HEU currently faces significant challenges including substantial price declines, limited liquidity, and low market capitalization. While the long-term potential of decentralized AI infrastructure is noteworthy, investors should be aware of the project's early-stage nature and associated risks.

HEU Investment Recommendations

✅ Beginners: Start with small positions to understand project fundamentals and market dynamics; avoid large investments until gaining sufficient knowledge ✅ Experienced investors: Conduct thorough research on the project's technical architecture and competitive landscape; consider dollar-cost averaging and maintain strict risk management ✅ Institutional investors: Evaluate the project's long-term viability in the decentralized AI ecosystem; assess liquidity constraints and implement appropriate hedging strategies

HEU Trading Participation Methods

- Spot trading: Trade HEU on Gate.com and other supported exchanges with transparent pricing and order execution

- Secure storage: Use Gate Web3 Wallet for convenient management and secure storage of HEU tokens

- Market monitoring: Follow official channels and community updates to stay informed about project developments and market dynamics

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is HEU and how is its price determined?

HEU is a cryptocurrency whose price is calculated using volume-weighted average pricing across global exchanges. The price updates in real-time, reflecting market supply and demand dynamics through trading activity data aggregation.

What are the main factors affecting HEU price?

HEU price is influenced by market sentiment, trading volume, macroeconomic factors, interest rate changes, regulatory signals, technological developments, and user adoption trends.

How to predict the future price trend of HEU?

HEU price prediction depends on analyzing market demand, trading volume, adoption growth, and overall market sentiment. Monitor project developments, technological improvements, and macroeconomic factors. Use technical analysis combined with fundamental metrics for informed forecasting.

What are the common analysis methods used in HEU price prediction?

HEU price prediction commonly uses technical analysis and fundamental analysis, relying on trading volume, price trends, and market news to forecast price movements.

What is the correlation between HEU price and other related assets?

HEU price is correlated with overall cryptocurrency market trends and trading volume. Primarily traded on Uniswap V3, HEU price fluctuates against USDC. Market performance reflects the health of the broader crypto ecosystem and demand dynamics.

What has been HEU's price trend over the past 5 years?

Over the past 5 years, HEU's price has risen from €15.97 to €21.00, with an average daily trading volume of 2585 shares. The upward trajectory demonstrates steady growth, reflecting positive market sentiment and investor confidence in the asset.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Three Leading Japanese Web3 Tokens

Understanding PoS in Cryptocurrency: A Beginner’s Guide to Proof-of-Stake

Top Crypto Exchanges for Beginners: A Review of Leading Platforms

Top 6 Best Decentralized Exchanges — A Review of Leading DEX Platforms

How Will Bitcoin Change the World in the Next 10 Years?