2026 ISP Price Prediction: What to Expect as Internet Service Costs Rise Across the Globe

Introduction: ISP's Market Position and Investment Value

Ispolink (ISP), as a cutting-edge blockchain-based recruitment platform powered by Binance Smart Chain and AI technology, has been connecting blockchain companies with leading technical talent since its launch in 2021. As of 2026, ISP maintains a market capitalization of approximately $1.02 million, with a circulating supply of around 9.46 billion tokens, and the price stabilizing at about $0.00010835. This asset, recognized as an innovative solution in the decentralized talent acquisition sector, is playing an increasingly important role in bridging the gap between Web3 enterprises and skilled professionals.

This article will comprehensively analyze ISP's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. ISP Price History Review and Market Status

ISP Historical Price Evolution Trajectory

- 2021: ISP reached its all-time high on November 8, with price touching $0.01830029

- 2025: The token experienced significant downward pressure, hitting its all-time low of $0.00008478 on December 26

- Recent Period: The token has shown recovery signs with a 24-hour increase of 9.62%

ISP Current Market Status

As of February 3, 2026, ISP is trading at $0.00010835, demonstrating a positive short-term momentum with a 9.62% gain over the past 24 hours. The 24-hour trading range spans from $0.0000971 to $0.00013331, with total trading volume reaching $31,251.11.

The token's market capitalization stands at approximately $1.02 million, with a circulating supply of 9.46 billion ISP tokens, representing 94.56% of the total supply of 9.79 billion tokens. The maximum supply is capped at 10 billion tokens. The market cap to fully diluted valuation ratio sits at 94.56%, indicating minimal dilution risk from future token releases.

From a longer-term perspective, ISP has experienced notable volatility, with a 7-day decline of 7.08% and a 30-day decrease of 14.21%. The annual performance shows an 81.73% decline, reflecting challenging market conditions over the past year. The token maintains a market dominance of 0.000038%.

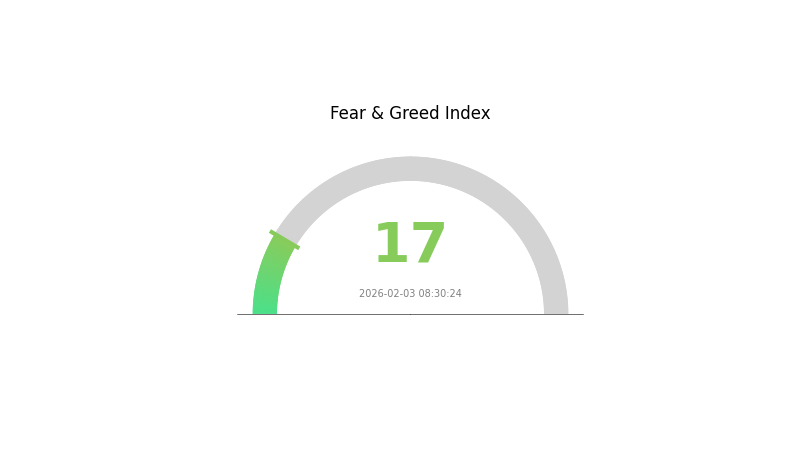

The current market sentiment index registers at 17, indicating an "Extreme Fear" level in the broader cryptocurrency market, which may be influencing ISP's price action.

Click to view current ISP market price

ISP Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 17. This indicates significant market pessimism and heightened risk aversion among investors. During periods of extreme fear, markets often present contrarian opportunities for long-term investors, as assets may be undervalued. However, caution is advised as volatility remains elevated. Monitor key support levels and market developments closely before making investment decisions. Consider your risk tolerance and investment strategy accordingly.

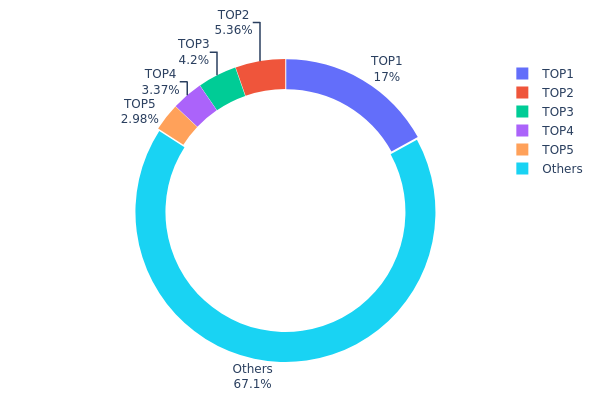

ISP Holding Distribution

The holding distribution chart reflects the token allocation across different wallet addresses in the ISP ecosystem, serving as a crucial indicator of decentralization levels and potential concentration risks. By analyzing the proportion of tokens held by top addresses, we can assess the degree of power centralization and evaluate potential market manipulation risks.

Based on current data, ISP exhibits a relatively high concentration pattern. The top address holds 1,428,103.16K tokens, accounting for 17.01% of total supply, while the top five addresses collectively control approximately 32.9% of circulating supply. Notably, the third-ranked address (0x0000...00dead) represents a burn address holding 4.19% of tokens, indicating some deflationary mechanism in the project's tokenomics. The remaining 67.1% is distributed among other addresses, suggesting a certain degree of token dispersal, though top-tier concentration remains significant.

This concentration level presents a dual-edged impact on market structure. On one hand, major holders possess substantial influence over price movements, potentially triggering significant volatility during large-scale sell-offs. On the other hand, if these addresses belong to project teams, foundations, or long-term institutional investors, they may provide price stability during market downturns. The current distribution pattern suggests ISP maintains moderate decentralization, though investors should remain vigilant regarding potential selling pressure from top addresses and monitor their on-chain activities closely to assess market sentiment shifts.

Click to view current ISP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2677...ccb975 | 1428103.16K | 17.01% |

| 2 | 0x9642...2f5d4e | 450014.20K | 5.36% |

| 3 | 0x0000...00dead | 352500.00K | 4.19% |

| 4 | 0x1c4b...bb558c | 283048.63K | 3.37% |

| 5 | 0x446b...d027ba | 250093.01K | 2.97% |

| - | Others | 5631134.45K | 67.1% |

II. Core Factors Influencing ISP Future Prices

Supply Mechanism

- Market Growth and Maturity Transition: The global ISP chip industry is transitioning from growth stage to maturity stage, maintaining an annual compound growth rate above 18%. The Chinese market is experiencing even faster growth at 24%, significantly higher than the global average.

- Historical Patterns: Past supply dynamics show that cost reduction effectively lowers end-product prices, which helps capture market share. The integration of ISP with application processors has reduced implementation costs.

- Current Impact: Market expansion is driven by increased penetration of multi-camera smartphones, which continues to boost demand for ISP chips. Production scale expansion and technology optimization are expected to contribute to gradual cost reductions.

Institutional and Major Player Dynamics

- Industry Applications: ISP technology is being adopted across various sectors beyond smartphones, including outdoor night vision products with price ranges from $100 to $3,000 depending on performance and materials. AI-ISP products are disrupting the mid-to-high-end market in North America.

- Manufacturing Trends: Smartphone manufacturers are increasingly investing in proprietary ISP chip development as part of broader strategies to secure supply chains and enhance product differentiation in imaging capabilities.

Macroeconomic Environment

- Market Demand Dynamics: Consumer purchasing decisions heavily factor in price considerations, making cost management a critical competitive advantage in the ISP market.

- Regional Market Variations: China's telecommunications market represents the world's largest, with the information industry serving as an economic growth engine. This infrastructure development supports continued demand for ISP technology.

Technology Development and Ecosystem Building

- AI Integration: AI-ISP technology is emerging as a significant innovation direction, with potential future integration with large language models to enhance image processing capabilities.

- Application Diversification: ISP technology is expanding beyond traditional mobile imaging into specialized applications such as advanced night vision systems and cloud data center infrastructure.

- Industry Lifecycle Evolution: The market is progressing through its growth phase with barriers to entry including technical expertise, scale requirements, and integration capabilities with application processors.

III. 2026-2031 ISP Price Forecast

2026 Outlook

- Conservative estimate: $0.00008 - $0.00011

- Neutral estimate: $0.00011

- Optimistic estimate: $0.00015 (requires favorable market conditions)

2027-2029 Mid-term Outlook

- Market phase expectations: ISP may experience gradual growth as the cryptocurrency market matures, with potential consolidation periods followed by moderate upward movements.

- Price range forecasts:

- 2027: $0.0001 - $0.00018

- 2028: $0.00012 - $0.00019

- 2029: $0.00011 - $0.00018

- Key catalysts: Broader cryptocurrency market adoption, potential technical developments within the ISP ecosystem, and overall market sentiment could serve as primary drivers for price movements during this period.

2030-2031 Long-term Outlook

- Baseline scenario: $0.00016 - $0.00018 (assuming steady market conditions and consistent project development)

- Optimistic scenario: $0.00018 - $0.00022 (assuming enhanced ecosystem adoption and positive market sentiment)

- Transformational scenario: $0.00017 - $0.00025 (under exceptionally favorable conditions including significant platform upgrades and widespread adoption)

- February 3, 2026: ISP trading within the $0.00008 - $0.00015 range (initial forecast period baseline)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00015 | 0.00011 | 0.00008 | 0 |

| 2027 | 0.00018 | 0.00013 | 0.0001 | 19 |

| 2028 | 0.00019 | 0.00016 | 0.00012 | 43 |

| 2029 | 0.00018 | 0.00017 | 0.00011 | 61 |

| 2030 | 0.00022 | 0.00018 | 0.00016 | 65 |

| 2031 | 0.00025 | 0.0002 | 0.00017 | 84 |

IV. ISP Professional Investment Strategies and Risk Management

ISP Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors seeking exposure to blockchain recruitment technology platforms with moderate risk tolerance

- Operational Recommendations:

- Consider accumulating ISP tokens during market dips, targeting entry points below the current price range

- Monitor platform development progress and user adoption metrics before increasing position size

- Store ISP tokens securely using Gate Web3 Wallet, which supports both ETH and BSC networks where ISP is deployed

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Use 20-day and 50-day moving averages to identify potential trend reversals, given ISP's recent 24-hour increase of 9.62% following a 7-day decline of 7.08%

- Volume Analysis: Monitor trading volume patterns, noting that current 24-hour volume stands at approximately $31,251, which can indicate momentum shifts

- Swing Trading Considerations:

- Set stop-loss orders below key support levels to manage downside risk in this volatile micro-cap token

- Consider taking partial profits during short-term rallies, particularly given the 30-day decline of 14.21%

ISP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio allocation

- Aggressive Investors: 2-3% of crypto portfolio allocation

- Professional Investors: Up to 5% with active monitoring and hedging strategies

(2) Risk Hedging Approaches

- Portfolio Diversification: Balance ISP exposure with established cryptocurrencies and stablecoins to mitigate volatility

- Position Sizing: Implement scaled entry and exit strategies rather than single large transactions

(3) Secure Storage Solutions

- Multi-chain Wallet Recommendation: Gate Web3 Wallet supports both Ethereum and BSC networks, enabling secure storage of ISP tokens on either chain

- Hardware Wallet Option: For larger holdings, consider transferring ISP tokens to hardware wallets compatible with ERC-20 and BEP-20 standards

- Security Precautions: Enable two-factor authentication, never share private keys, and verify contract addresses (ETH: 0xc8807f0f5ba3fa45ffbdc66928d71c5289249014, BSC: 0xd2e7b964770fcf51df088a5f0bb2d33a3c60cccf) before transactions

V. ISP Potential Risks and Challenges

ISP Market Risks

- High Volatility: ISP has experienced an 81.73% decline over the past year, reflecting significant price volatility typical of low market cap tokens

- Limited Liquidity: With only one exchange listing and relatively low 24-hour trading volume, ISP faces potential liquidity constraints that could impact price execution

- Market Cap Vulnerability: With a market capitalization of approximately $1.02 million and ranking at 2487, ISP remains susceptible to market manipulation and extreme price swings

ISP Regulatory Risks

- Employment Platform Compliance: Blockchain-based recruitment platforms may face evolving regulatory scrutiny regarding labor laws and data protection requirements

- Token Utility Classification: Regulatory authorities may scrutinize ISP's token utility features, including staking rewards and governance functions, which could impact operational models

- Cross-border Employment Regulations: As a global talent platform, Ispolink may encounter compliance challenges across different jurisdictions with varying employment regulations

ISP Technical Risks

- Smart Contract Vulnerabilities: Despite deployment on established networks, smart contracts remain susceptible to potential bugs or security exploits

- Platform Adoption Uncertainty: The success of ISP token depends heavily on the platform's ability to attract both blockchain companies and technical talent to its ecosystem

- Competitive Landscape: The blockchain recruitment sector faces competition from both traditional platforms and emerging Web3 alternatives, which may impact ISP's long-term value proposition

VI. Conclusion and Action Recommendations

ISP Investment Value Assessment

Ispolink (ISP) represents a specialized play on the intersection of blockchain technology and recruitment services, targeting the growing demand for technical talent in the crypto industry. The platform's dual-chain deployment on Ethereum and BSC networks provides operational flexibility, while features including staking rewards and governance participation offer multiple utility vectors. However, ISP faces significant challenges, including substantial year-over-year price decline, limited exchange listings, and relatively low market capitalization. The token's recent 24-hour performance increase suggests potential short-term momentum, but investors should carefully weigh this against longer-term downward trends and structural liquidity concerns. The success of ISP depends heavily on the platform's ability to capture meaningful market share in the competitive blockchain recruitment space.

ISP Investment Recommendations

✅ Beginners: Limit exposure to no more than 1% of total crypto portfolio, focus on understanding platform fundamentals before investing, and use only funds you can afford to lose completely ✅ Experienced Investors: Consider small speculative positions during favorable technical setups, implement strict stop-loss discipline, and actively monitor platform development milestones and user growth metrics ✅ Institutional Investors: Conduct thorough due diligence on platform traction and competitive positioning, consider direct engagement with project team for detailed roadmap assessment, and evaluate ISP within a diversified portfolio of crypto infrastructure projects

ISP Trading Participation Methods

- Spot Trading: Purchase ISP tokens through Gate.com's spot market, where ISP is currently listed for trading

- Long-term Accumulation: Implement dollar-cost averaging strategy to build position gradually while mitigating timing risk

- Portfolio Integration: Include ISP as a small allocation within a broader crypto recruitment and human resources technology theme

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

Will ISP broadband prices rise or fall in the future?

ISP broadband prices are likely to decline in the coming months, driven by technological advancement and increased market competition. However, price trends remain subject to various factors and require continuous monitoring.

What are the main factors affecting ISP network service prices?

ISP network service prices are primarily influenced by routing protocols(such as CN2 GT vs GIA), bandwidth demand, regional market competition, and network infrastructure quality. These factors collectively determine pricing variations across different service providers.

How to predict price change trends across different ISP operators?

Analyze market demand, competitive landscape, and technological developments. Historical data analysis and market research are essential. Current trends suggest prices may rise with increasing demand and network expansion needs.

What is the relationship between ISP price and network speed?

ISP price typically correlates with network speed; faster speeds command higher prices. High-speed broadband costs more than slower alternatives. Pricing and speeds vary by region and provider, influencing market dynamics and user adoption rates.

Do ISP prices vary significantly across different regions?

Yes, ISP prices differ notably by region due to varying infrastructure development and market competition. Developed regions like the US typically have higher prices, while developing countries offer lower rates. These differences reflect local market conditions and technological advancement levels.

How does ISP price prediction help consumers make better choices?

ISP price prediction helps consumers identify optimal timing for service upgrades, budget planning, and value comparison. By forecasting price trends, users can avoid overpaying and select services that best match their needs and financial capacity, maximizing network performance value.

What are the expected changes in ISP broadband prices in 2024?

ISP broadband prices in 2024 are expected to remain relatively stable with slight increases due to infrastructure upgrades and rising operational costs. Growing market demand will continue to support the broadband services sector throughout the year.

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Newbie Must Read: How to Formulate Investment Strategies When Nasdaq Turns Positive in 2025

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

How to Mine Ethereum in 2025: A Complete Guide for Beginners

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

TapSwap Listing Date: What Investors Need to Know in 2025

What Is an Airdrop? Which Airdrop Opportunities Should You Target?

How to Get Free NFTs (5 Simple Methods)

7 Essential Indicators for Beginner Traders

FOMC and Bitcoin Prices: How U.S. Monetary Policy Influences BTC

Best Graphics Card for Mining: Top Next-Generation GPUs