2026 KP3R Price Prediction: Expert Analysis and Market Outlook for Keep3r Network Token

Introduction: KP3R's Market Position and Investment Value

Keep3rV1 (KP3R), as a decentralized work matching platform connecting external developers with project teams requiring specialized services, has been operating since 2020. As of February 2026, KP3R maintains a market capitalization of approximately $766,542, with a circulating supply of around 476,113 tokens and a current price hovering near $1.61. This asset, recognized for its role in facilitating decentralized keeper networks and job execution, continues to serve important functions within the DeFi infrastructure ecosystem.

This article will comprehensively analyze KP3R's price trends from 2026 through 2031, examining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. KP3R Price History Review and Market Status

KP3R Historical Price Evolution Trajectory

- 2021: Launched on October 29, 2020, the token reached a significant milestone on November 13, 2021, when the price climbed to 1995.53, marking a notable period of market activity.

- 2026: On February 4, 2026, the price recorded 1.72, representing a substantial decline from previous levels, reflecting broader market dynamics and evolving project developments.

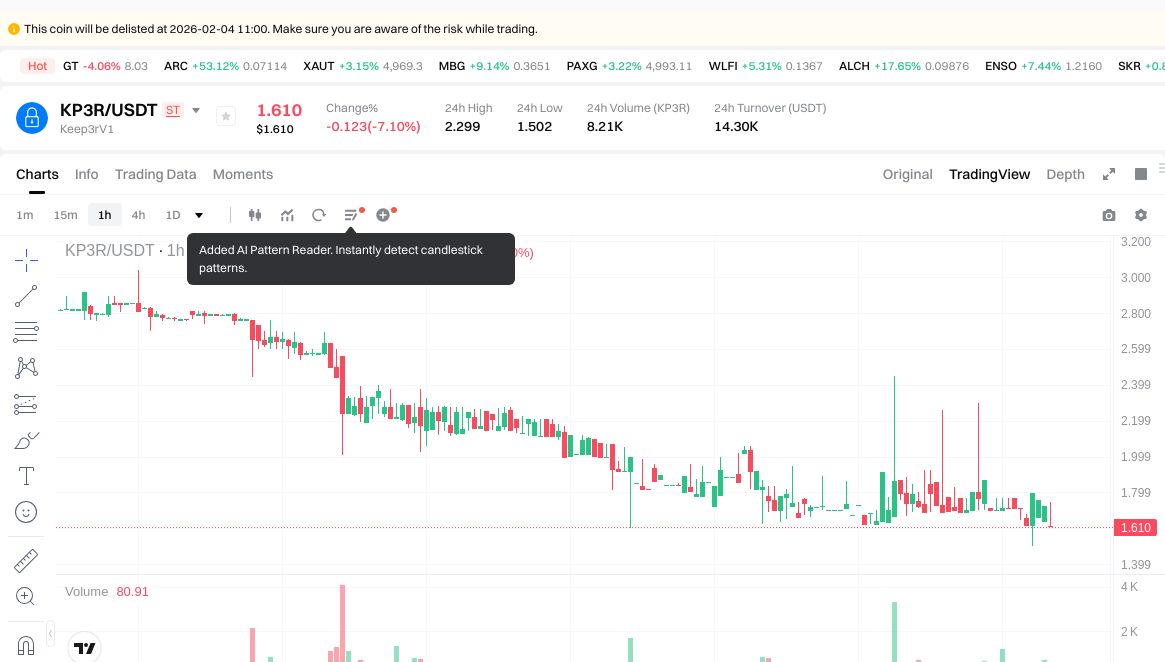

KP3R Current Market Status

As of February 4, 2026, KP3R is trading at 1.61, with a 24-hour trading volume of 14,445.70. The token has experienced notable volatility across different timeframes. In the past hour, the price decreased by 1.95 percent, while the 24-hour performance shows a decline of 4.9 percent. Over the past week, KP3R has declined by 43.03 percent, and the 30-day performance indicates a decrease of 46.03 percent. The one-year trend shows a decline of 91.69 percent.

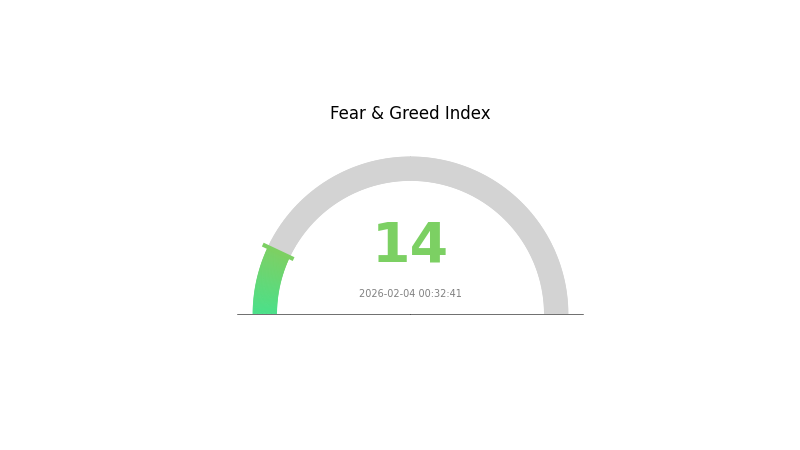

The current market capitalization stands at 766,542.27, with a circulating supply of 476,113.21 tokens, representing 100.14 percent of the total supply. The fully diluted market cap matches the current market capitalization at 766,542.27. KP3R ranks 2694 in the overall cryptocurrency market, with a market dominance of 0.000028 percent. The token has 8,460 holders and is available on 3 exchanges. The current market sentiment index indicates 14, reflecting extreme fear in the broader crypto market.

Click to view the current KP3R market price

KP3R Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index dropping to 14. This exceptionally low reading indicates severe market pessimism and heightened investor anxiety. During such periods, panic selling often dominates trading behavior, creating significant volatility. Market participants are adopting highly cautious stances, with risk aversion at peak levels. This extreme fear environment typically presents contrarian opportunities for long-term investors, as assets may become oversold. However, traders should remain vigilant about potential further downside movements before sentiment stabilizes.

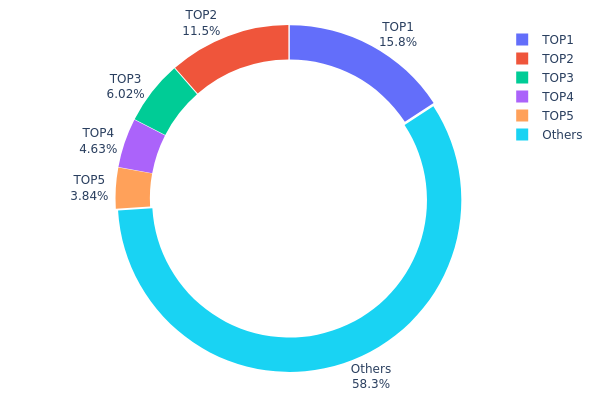

KP3R Holder Distribution

The holder distribution chart visualizes the concentration of token holdings across different wallet addresses, serving as a crucial indicator of market decentralization and potential price manipulation risks. A more dispersed distribution typically suggests healthier market structure, while excessive concentration in a few addresses may indicate elevated centralization risks.

According to the current data, the top five addresses collectively hold approximately 41.71% of KP3R's total supply, demonstrating a moderate level of concentration. The largest holder controls 15.78% (75.17K tokens), followed by the second-largest at 11.46% (54.59K tokens). The remaining 58.29% is distributed among other addresses, indicating that while major holders maintain significant influence, the token distribution has not reached extreme centralization levels.

From a market structure perspective, this concentration ratio presents both opportunities and risks. The substantial holdings by top addresses could provide price stability during market downturns, as these holders typically have longer-term investment horizons. However, any large-scale selling activity from these major holders could trigger significant price volatility. Currently, the distribution pattern reflects a relatively mature on-chain structure, where the balance between major holders and retail participants maintains reasonable equilibrium, supporting the token's long-term development while preserving adequate liquidity for market transactions.

Click to view current KP3R Holder Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x2141...1a9fa9 | 75.17K | 15.78% |

| 2 | 0x2fc5...3dc1a2 | 54.59K | 11.46% |

| 3 | 0x11b7...167bf5 | 28.66K | 6.01% |

| 4 | 0x9642...2f5d4e | 22.02K | 4.62% |

| 5 | 0xedb6...fae8e9 | 18.28K | 3.84% |

| - | Others | 277.39K | 58.29% |

II. Core Factors Affecting KP3R's Future Price

Supply Mechanism

- Halving Events: Keep3rV1 implements periodic halving mechanisms that reduce token issuance rates. Historical data suggests that halving events have triggered significant price volatility, with potential for both sharp increases and corrections depending on market conditions.

- Historical Pattern: Previous supply adjustments in the KP3R ecosystem have demonstrated notable impact on price movements, with instances of price fluctuations ranging from $80 to $200 during periods of supply-side pressure.

- Current Impact: Future halving events may continue to influence price dynamics, though the actual effect will depend on broader market sentiment and DeFi sector recovery momentum.

Institutional and Whale Activity

- Whale Position Changes: Large holder movements have historically shown direct correlation with KP3R price action. Significant capital flows from major holders can trigger substantial price swings in both directions.

- Market Liquidity: Concentration of holdings among major participants creates price sensitivity to their trading activities, potentially amplifying volatility during periods of position adjustments.

Macroeconomic Environment

- Market Sentiment: Overall cryptocurrency market sentiment plays a significant role in KP3R's price trajectory. Broader market cycles and risk appetite in the DeFi sector directly influence token valuation.

- DeFi Market Recovery: KP3R's future value potential is closely tied to the overall recovery and growth of the decentralized finance sector, as the token operates within this ecosystem.

Technical Development and Ecosystem Building

- Ethereum Upgrades: Network improvements on Ethereum, the underlying blockchain infrastructure, have direct implications for KP3R operations and can affect token price through enhanced functionality and reduced transaction costs.

- New Product Launches: The introduction of new products and features within the Keep3r ecosystem represents a key driver for potential value appreciation, as expanded utility may attract increased user adoption and demand.

- Exchange Listings: Token listings on major trading platforms have historically served as catalysts for price movements, improving accessibility and trading volume for KP3R.

III. 2026-2031 KP3R Price Forecast

2026 Outlook

- Conservative estimate: $1.48-$1.61

- Neutral estimate: $1.61

- Optimistic estimate: $1.61-$1.72 (requires sustained market momentum)

2027-2029 Outlook

- Market phase expectation: Transitioning into a growth phase with increasing adoption and ecosystem development

- Price range forecast:

- 2027: $0.88-$2.47

- 2028: $2.00-$3.08

- 2029: $2.42-$3.52

- Key catalysts: Enhanced protocol utility, expanding DeFi integration, and broader market recovery

2030-2031 Long-term Outlook

- Baseline scenario: $2.80-$3.66 (assuming steady ecosystem growth and stable market conditions)

- Optimistic scenario: $3.05-$3.66 (driven by significant protocol upgrades and increased adoption)

- Transformative scenario: Above $3.66 (requires exceptional market conditions and widespread mainstream adoption)

- 2026-02-04: KP3R $1.48-$1.72 (early consolidation phase with potential for gradual appreciation)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 1.7227 | 1.61 | 1.4812 | 0 |

| 2027 | 2.4662 | 1.66635 | 0.88317 | 3 |

| 2028 | 3.07875 | 2.06627 | 2.00429 | 28 |

| 2029 | 3.52434 | 2.57251 | 2.41816 | 59 |

| 2030 | 3.65811 | 3.04843 | 2.80455 | 89 |

| 2031 | 3.55446 | 3.35327 | 2.64908 | 108 |

IV. KP3R Professional Investment Strategies and Risk Management

KP3R Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in decentralized infrastructure and oracle solutions

- Operational Recommendations:

- Consider accumulating during market downturns when KP3R trades closer to support levels

- Monitor keeper network activity and job completion rates as indicators of platform health

- Store assets in Gate Web3 Wallet for secure long-term custody with multi-signature protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of approximately $14,445.70 to identify liquidity trends and potential breakout opportunities

- Moving Averages: Track price action relative to key moving averages, noting the recent 43.03% decline over 7 days suggests bearish momentum

- Swing Trading Considerations:

- Set strict stop-loss orders given the high volatility, as evidenced by the 24-hour range between $1.502 and $2.299

- Consider the limited exchange availability (3 exchanges) which may impact liquidity during volatile periods

KP3R Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 10% with active hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance KP3R exposure with stablecoin positions to manage volatility

- Position Sizing: Limit individual trade size to account for the token's relatively low market capitalization of approximately $766,542

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and easy access to DeFi integrations

- Cold Storage Solution: Hardware wallet storage for long-term holdings with multi-signature setup

- Security Precautions: Enable two-factor authentication, verify contract addresses (0x1ceb5cb57c4d4e2b2433641b95dd330a33185a44 on Ethereum), and never share private keys

V. KP3R Potential Risks and Challenges

KP3R Market Risks

- High Volatility: The token has experienced a 91.69% decline over one year and a 46.03% drop in 30 days, indicating significant price instability

- Limited Liquidity: With only 3 exchanges listing KP3R and relatively low 24-hour trading volume, large trades may face slippage challenges

- Market Share: The token holds only 0.000028% market dominance, suggesting limited mainstream adoption and potential for extreme price movements

KP3R Regulatory Risks

- DeFi Uncertainty: As a decentralized work coordination platform, Keep3rV1 operates in an evolving regulatory environment where guidance on DeFi protocols remains unclear

- Smart Contract Interaction: The platform's reliance on external keepers executing transactions may face scrutiny under developing regulations governing automated financial services

- Cross-border Compliance: The decentralized nature of keeper networks may present challenges in jurisdictions requiring clear service provider identification

KP3R Technical Risks

- Smart Contract Vulnerabilities: The platform's reliance on keeper execution of jobs introduces potential attack vectors if contracts are not properly audited

- Network Dependency: KP3R operates on Ethereum, exposing holders to network congestion, high gas fees, and potential blockchain-level risks

- Competition Risk: The oracle and automation space faces competition from established players, potentially limiting Keep3r's growth trajectory

VI. Conclusion and Action Recommendations

KP3R Investment Value Assessment

Keep3rV1 presents an innovative approach to decentralized work coordination and oracle functionality within the DeFi ecosystem. While the platform addresses real infrastructure needs through its keeper network model, investors should carefully weigh the significant price decline (over 90% from all-time high of $1,995.53) and limited market presence. The token's utility in governance and keeper compensation provides fundamental value, but the current market conditions and low liquidity present substantial short-term risks.

KP3R Investment Recommendations

✅ Beginners: Consider starting with small allocations (1-2% of crypto portfolio) only after thoroughly understanding the keeper network model and DeFi infrastructure space ✅ Experienced Investors: May explore swing trading opportunities given recent volatility, while maintaining strict risk management protocols and diversification across multiple DeFi infrastructure tokens ✅ Institutional Investors: Evaluate KP3R as part of a broader DeFi infrastructure thesis, with emphasis on platform development metrics, keeper participation rates, and job completion statistics

KP3R Trading Participation Methods

- Spot Trading: Purchase KP3R directly on Gate.com with competitive fees and secure custody options

- DeFi Integration: Participate in the Keep3r ecosystem by becoming a keeper or creating jobs, earning KP3R rewards through platform activity

- Portfolio Strategy: Combine KP3R holdings with complementary DeFi infrastructure tokens to diversify oracle and automation exposure

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make careful decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is KP3R? What are the use cases and value proposition of Keep3r Network?

KP3R is Keep3r Network's governance token. Keep3r Network provides decentralized automation infrastructure for DeFi protocols, enabling keeper jobs and smart contract automation to ensure reliable protocol operations and security.

What is KP3R's historical price performance? What are the price fluctuation trends over the past year?

KP3R reached an all-time high of $2,056 and a low of $2.57. Over the past year, the price declined approximately 11.72%. Currently, KP3R continues to experience market volatility with dynamic price movements.

What are the main factors affecting KP3R price?

KP3R price is primarily influenced by market demand, trading volume, DeFi ecosystem health, overall market trends, and network adoption. These factors collectively determine price movements and investor sentiment.

What is the price prediction for KP3R in 2024-2025?

KP3R price predictions for 2024-2025 show gradual growth trajectory. January 2024 starts at $0.045, with steady monthly increases through May 2024 reaching approximately $0.049. Full 2025 forecasts remain limited based on available data.

What are the advantages and disadvantages of KP3R compared to other DeFi tokens such as UNI and AAVE?

KP3R offers limited maximum supply and unique tokenomics with governance potential. However, it has lower liquidity and higher price volatility compared to UNI and AAVE due to smaller market capitalization.

What are the main risks of investing in KP3R?

KP3R faces market volatility, regulatory uncertainty, and technical risks. Price fluctuations can be significant, policy changes may impact prospects, and smart contract vulnerabilities could pose security threats to the ecosystem.

How is the liquidity and trading volume of KP3R? On which exchanges can it be traded?

KP3R maintains strong liquidity and substantial trading volume across major platforms. The token is actively traded on multiple decentralized and centralized exchanges, providing users with diverse trading options and competitive spreads for seamless transactions.

What is Keep3r Network's development roadmap and future plans?

Keep3r Network plans to transition governance to existing teams and DeFi Wonderland. Future focus includes expanding decentralized job market infrastructure, enhancing protocol security, and improving keeper incentive mechanisms to strengthen ecosystem adoption and competitiveness.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What is Worldcoin (WLD) and how does its iris biometric verification technology work for digital identity authentication?

How Does Token Economic Model Balance Community, Team, and Investor Interests Through Deflationary Mechanisms?

What is Litecoin's fundamental analysis and why will LTC reach $250-$300 by 2030

What are the major security risks and vulnerabilities in cryptocurrency exchanges and smart contracts in 2026?

How does macroeconomic policy uncertainty affect UNI crypto price in 2026: Fed policy, inflation data, and stock market correlation analysis