2026 LRDS Price Prediction: Analyzing Future Market Trends and Investment Opportunities

Introduction: LRDS Market Position and Investment Value

BLOCKLORDS (LRDS), as a player-driven medieval grand strategy MMO game token, has been developing since its launch in July 2024. As of February 2026, LRDS has a market capitalization of approximately $256,420, with a circulating supply of about 12.29 million tokens, and the price maintains around $0.02087. This asset, known as a "gaming economy governance token," is playing an increasingly important role in the blockchain gaming and GameFi sectors.

This article will comprehensively analyze the price trends of LRDS from 2026 to 2031, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment to provide professional price forecasts and practical investment strategies for investors.

I. LRDS Price History Review and Current Market Status

LRDS Historical Price Evolution Trajectory

- 2024: BLOCKLORDS token launched on Gate.com in July with an initial offering price of $0.6, reaching a peak of $2.625 on July 24, 2024, representing substantial early-stage volatility in the gaming token sector.

- 2024-2025: Following its launch peak, LRDS experienced significant market correction as the broader crypto gaming sector underwent consolidation, with price declining substantially from its all-time high.

- 2026: Market conditions remained challenging in early 2026, with the token reaching its lowest recorded level of $0.01698 on February 6, 2026, reflecting ongoing pressure in the play-to-earn and blockchain gaming markets.

LRDS Current Market Status

As of February 8, 2026, LRDS is trading at $0.02087, showing a 3.98% increase over the past 24 hours with a trading volume of approximately $177,010. The token has demonstrated mixed short-term momentum, gaining 1.60% in the past hour while experiencing a 21.09% decline over the past week.

The circulating supply stands at 12,286,545 LRDS tokens, representing 12.29% of the maximum supply of 100 million tokens. The current market capitalization is approximately $256,420, with a fully diluted valuation of $2.087 million. The token ranks #3665 in the cryptocurrency market, holding a 0.000084% market share.

LRDS has recorded a 24-hour trading range between $0.01925 and $0.03109, indicating significant intraday volatility. The token maintains an ERC20 standard implementation on the Ethereum blockchain, with 4,936 holders according to available data. Trading activity is available across 6 exchanges, with Gate.com serving as a primary trading venue.

The 30-day performance shows a 46.03% decline, while the one-year trajectory reflects a 94.21% decrease from previous levels, positioning the token substantially below its July 2024 launch price and all-time high. Current market sentiment indicators suggest a fear environment with a volatility index reading of 6, classified as "Extreme Fear" conditions in the cryptocurrency market.

Click to view the current LRDS market price

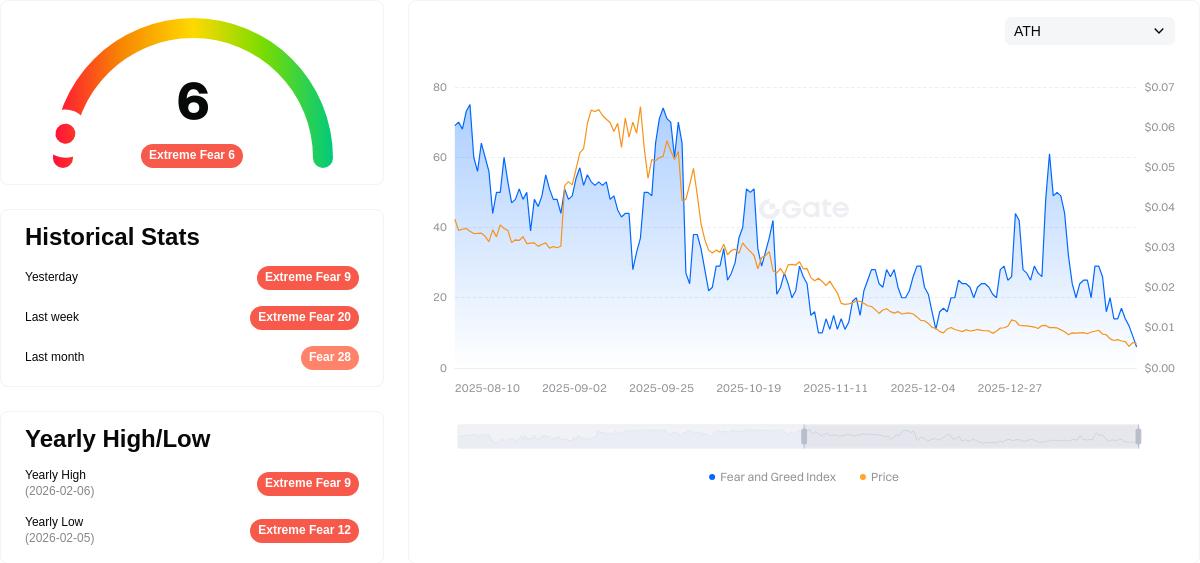

LRDS Market Sentiment Index

02-07-2026 Fear and Greed Index: 6 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear conditions, with the index hitting a critical low of 6. This sentiment reflects significant market pessimism and panic among investors. Such extreme fear levels historically present contrarian opportunities, as markets often stabilize or recover when sentiment reaches these depths. Traders should exercise caution while considering strategic positioning. Monitor market developments closely and stay informed through Gate.com's comprehensive market data tools to navigate these volatile conditions effectively.

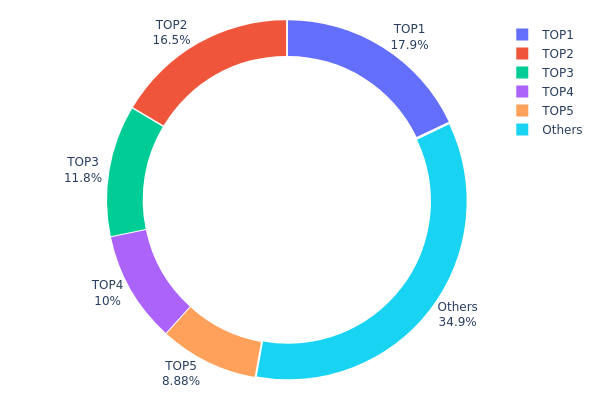

LRDS Holdings Distribution

The holdings distribution chart provides a comprehensive view of how LRDS tokens are allocated across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. By analyzing the concentration of tokens among top holders, investors can assess the health of the token's distribution structure and its implications for price stability.

Based on the current data, LRDS exhibits a moderately concentrated holdings pattern. The top five addresses collectively control approximately 65.04% of the total token supply, with the largest holder possessing 17.90% (17.91 million tokens) and the second-largest holding 16.45% (16.46 million tokens). Notably, the remaining category labeled "Others" accounts for 34.96% of the supply, suggesting that a significant portion of tokens is distributed among smaller holders. This distribution pattern indicates that while there is notable concentration among major stakeholders, the token has not reached extreme centralization levels that would raise immediate red flags.

The current holdings structure presents both opportunities and risks for market participants. The presence of several large holders with double-digit percentage stakes introduces potential volatility, as significant sell-offs from any of these addresses could trigger rapid price movements. However, the fact that no single entity controls more than 18% of the supply provides some protection against unilateral market manipulation. The relatively substantial "Others" category suggests a growing retail participation base, which typically contributes to improved liquidity and more organic price discovery mechanisms. From an on-chain structural perspective, LRDS demonstrates a transitional state between early-stage concentration and broader distribution, indicating ongoing community development and increasing market maturity.

Click to view current LRDS Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xa9d1...1d3e43 | 17907.73K | 17.90% |

| 2 | 0x804d...e6982e | 16457.40K | 16.45% |

| 3 | 0x3154...0f2c35 | 11823.95K | 11.82% |

| 4 | 0xebb2...76482a | 10000.00K | 10.00% |

| 5 | 0x8a59...88ba8b | 8878.76K | 8.87% |

| - | Others | 34932.16K | 34.96% |

II. Core Factors Influencing LRDS Future Price

Macroeconomic Environment

- Global Economic Trends: Macroeconomic factors such as inflation concerns, geopolitical tensions, and central bank interest rate changes may drive investors toward digital assets as a store of value. During periods of uncertainty, demand for LRDS could potentially increase.

- Market Sentiment: Understanding LRDS tokenomics, historical price movements, and overall market sentiment can help investors better assess the token's future price trajectory.

Company-Specific ESG Performance

- Information Asymmetry Reduction: ESG (Environmental, Social, and Corporate Governance) performance serves as an information intermediary, reducing market friction by providing incremental information about corporate social responsibility and sustainable development capabilities. This helps alleviate information asymmetry and improves stock pricing efficiency.

- Reputation Capital Accumulation: Strong ESG performance enables companies to build market confidence and a positive public image. By accumulating corporate reputation capital, ESG practices constrain operational management and prevent asset operating efficiency decline due to opportunistic behavior, thereby positively influencing market pricing.

Investor Attention Levels

- Institutional Investor Focus: Institutional investors possess professional expertise and superior social resources, enabling them to conduct continuous information tracking through analyst teams. Higher institutional investor attention strengthens the positive impact of ESG performance on pricing efficiency by incorporating more company-specific information into stock price movements.

- Individual Investor Dynamics: Individual investors tend to collect information independently to support decision-making. Due to limited attention and resources, they may exhibit herd mentality and irrational emotions. Increased individual investor attention may weaken the positive influence of ESG performance on pricing efficiency, as noise information could be introduced during stock price volatility analysis.

Information Transmission Mechanisms

- Multi-Level Capital Market System: In China's multi-tier capital market structure, pricing efficiency shows greater sensitivity to ESG performance of upper-tier peer companies compared to same-tier peers, indicating a demonstration and leadership effect from mainboard companies on investment strategy adjustments.

- Industry Competition and Environmental Sensitivity: For companies in highly competitive industries or those with higher environmental sensitivity, the positive impact of ESG performance on stock pricing efficiency becomes more pronounced.

III. 2026-2031 LRDS Price Prediction

2026 Outlook

- Conservative prediction: $0.01855 - $0.02108

- Neutral prediction: $0.02108

- Optimistic prediction: $0.02509 (requires favorable market conditions)

2027-2029 Outlook

- Market stage expectation: The token may enter a gradual growth phase with increased volatility, potentially driven by broader market recovery and ecosystem development

- Price range prediction:

- 2027: $0.01847 - $0.03208

- 2028: $0.01627 - $0.02841

- 2029: $0.02548 - $0.04144

- Key catalysts: Market adoption expansion, technological upgrades, and potential partnerships could serve as primary drivers for price movement

2030-2031 Long-term Outlook

- Baseline scenario: $0.02673 - $0.03472 (assuming steady market conditions and moderate adoption)

- Optimistic scenario: $0.03472 - $0.05103 (assuming accelerated ecosystem growth and increased utility)

- Transformational scenario: $0.04288 - $0.05745 (requires significant market breakthrough and widespread adoption)

- 2026-02-08: LRDS is currently in early development stage with potential for gradual appreciation over the forecasted period

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.02509 | 0.02108 | 0.01855 | 1 |

| 2027 | 0.03208 | 0.02308 | 0.01847 | 10 |

| 2028 | 0.02841 | 0.02758 | 0.01627 | 32 |

| 2029 | 0.04144 | 0.028 | 0.02548 | 34 |

| 2030 | 0.05103 | 0.03472 | 0.02673 | 66 |

| 2031 | 0.05745 | 0.04288 | 0.02958 | 105 |

IV. LRDS Professional Investment Strategy and Risk Management

LRDS Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term development potential of blockchain gaming and are willing to hold through market volatility

- Operational Recommendations:

- Consider accumulating positions during market dips, particularly when LRDS trades near support levels

- Monitor project development milestones, including game updates and ecosystem expansion

- Utilize Gate Web3 Wallet for secure storage, enabling self-custody of assets while maintaining flexibility for future transactions

(II) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track 50-day and 200-day moving averages to identify potential trend reversals and momentum shifts

- Volume Analysis: Monitor trading volume patterns on Gate.com to gauge market interest and validate price movements

- Swing Trading Considerations:

- Be aware of the current high volatility, as evidenced by the 24-hour price range between $0.01925 and $0.03109

- Set clear stop-loss levels to manage downside risk given the token's -94.21% performance over the past year

LRDS Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: Up to 10% with active risk monitoring

(II) Risk Hedging Approaches

- Position Sizing: Limit individual position size to minimize exposure to single-asset volatility

- Diversification: Maintain exposure across multiple gaming tokens and broader crypto assets to reduce concentration risk

(III) Secure Storage Solutions

- Software Wallet Recommendation: Gate Web3 Wallet, offering user-friendly interface with robust security features for ERC20 tokens

- Multi-signature Approach: For larger holdings, consider implementing multi-signature wallet solutions for enhanced security

- Security Precautions: Never share private keys, enable two-factor authentication, and regularly verify wallet addresses before transactions

V. LRDS Potential Risks and Challenges

LRDS Market Risks

- Price Volatility: LRDS has experienced significant price fluctuations, declining approximately 94.21% from its peak, indicating substantial market volatility

- Liquidity Concerns: With a 24-hour trading volume of approximately $177,000 and circulation of only 12.29% of total supply, limited liquidity may impact execution of larger trades

- Market Capitalization: The relatively modest market cap of approximately $256,000 suggests higher vulnerability to market manipulation and sudden price swings

LRDS Regulatory Risks

- Gaming Token Classification: Evolving regulatory frameworks for gaming-related tokens may impact how LRDS is classified and traded across different jurisdictions

- Securities Compliance: Regulatory authorities may scrutinize gaming tokens for securities characteristics, potentially affecting trading availability

- Cross-border Operations: As a gaming platform token, LRDS may face varying regulatory requirements across different geographic markets

LRDS Technical Risks

- Smart Contract Dependencies: As an ERC20 token deployed on Ethereum, LRDS inherits potential vulnerabilities associated with smart contract functionality

- Network Congestion: Ethereum network congestion may impact transaction speeds and costs for LRDS transfers and trading activities

- Integration Challenges: The success of LRDS depends on seamless integration with the BLOCKLORDS gaming ecosystem and potential technical issues could affect token utility

VI. Conclusion and Action Recommendations

LRDS Investment Value Assessment

BLOCKLORDS (LRDS) represents a gaming-focused token operating within the medieval strategy gaming sector, with connections to established gaming franchises. However, the token currently faces significant headwinds, including substantial price depreciation from historical highs, limited circulating supply (12.29%), and relatively low trading volume. The long-term value proposition depends heavily on the project's ability to drive user adoption, enhance gameplay utility, and expand its ecosystem. Short-term risks remain elevated due to market volatility and the broader challenges facing gaming tokens in the current crypto environment.

LRDS Investment Recommendations

✅ Beginners: Consider waiting for clearer market signals and project development milestones before entering positions; if interested, start with minimal allocation (1-2% of crypto portfolio) and focus on understanding the gaming ecosystem ✅ Experienced Investors: May consider small speculative positions during favorable technical setups, but maintain strict risk management protocols and avoid over-allocation given current volatility patterns ✅ Institutional Investors: Conduct thorough due diligence on project fundamentals, team background, and gaming ecosystem metrics before considering any meaningful allocation; evaluate token utility within the broader gaming sector

LRDS Trading Participation Methods

- Spot Trading: Purchase LRDS directly on Gate.com through spot markets, offering straightforward exposure with clear ownership

- Dollar-Cost Averaging: For longer-term perspectives, consider systematic purchases at regular intervals to mitigate timing risk

- Educational Approach: Begin with small positions while learning about the BLOCKLORDS gaming ecosystem and monitoring project development updates

Cryptocurrency investment carries extreme risk, and this article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is LRDS? What are its practical use cases?

LRDS is the native token of the BLOCKLORDS ecosystem, enabling in-game transactions, asset purchases, and governance participation. Players use LRDS to trade game items, vote on decisions, and earn rewards within the platform.

What is the price prediction for LRDS in 2024? What are the main factors affecting the price?

LRDS is predicted to reach $0.03-0.05 by end of 2024, driven by increased gaming adoption, ecosystem development, and market sentiment. Key factors include community engagement, platform partnerships, overall crypto market trends, and token utility expansion in the gaming sector.

What are the risks of investing in LRDS? How should I evaluate its investment value?

LRDS investment involves market and credit risks. Evaluate value by analyzing macroeconomic trends, industry dynamics, and market demand. Balance risk-reward through diversification and position sizing for optimal returns.

What are the differences and advantages of LRDS compared to other mainstream cryptocurrencies?

LRDS distinguishes itself through its community-driven mechanism and decentralized governance model, offering higher user engagement and transparency. Its advantages include more flexible upgrades and stronger community control, providing superior scalability and transaction efficiency compared to traditional cryptocurrencies.

What is the historical price trend of LRDS? What do technical and fundamental analysis indicate?

LRDS reached an all-time high of $2.6 in July 2024, currently trading at $0.02058, representing a 99.21% decline. Technical analysis across multiple timeframes shows strong sell signals, indicating downward momentum and bearish sentiment in the market.

Where can I buy LRDS? How is the trading liquidity?

LRDS can be purchased on major cryptocurrency exchanges with strong trading volume and liquidity. The token maintains robust market depth, enabling smooth transactions for both small and large orders with competitive spreads.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

Is Muse (MUSE) a good investment? Analyzing Price Trends, Tokenomics, and Future Prospects in the Crypto Market

IOTA: Understanding the IoT-Focused Cryptocurrency and Its Market Potential

Is Crown Coin (CWS) a Good Investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects

Comprehensive Guide to Decentralized Applications (dApps)

Is Goose Finance (EGG) a good investment?: A comprehensive analysis of risks, rewards, and market potential in 2024