2026 MAK Price Prediction: Expert Analysis and Market Forecast for Makiblox Token

Introduction: MAK's Market Position and Investment Value

MetaCene (MAK), as a pioneering meta-MMO platform token for gamers to entertain, govern, and create, has been developing its blockchain MMORPG ecosystem since its launch in 2024. As of February 2026, MAK maintains a market capitalization of approximately $180,174, with a circulating supply of around 102.43 million tokens, and the price hovering near $0.001759. This asset, regarded as an emerging player in the blockchain gaming sector, is playing an increasingly significant role in the metaverse entertainment and Web3 gaming infrastructure.

Despite experiencing notable volatility since its all-time high of $0.16316 in September 2024, MAK has shown recent positive momentum with a 7-day gain of 5.08% and a 30-day increase of 11.89%. Backed by a development team featuring veterans from renowned gaming companies such as Blizzard and Tencent, and supported by influential investors including Kaifu Lee and David Brevik, the project continues to advance its vision of becoming a next-generation blockchain MMORPG homeland for mass players.

This article will comprehensively analyze MAK's price trajectory from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. MAK Price History Review and Market Status

MAK Historical Price Evolution Trajectory

- September 2024: MAK launched on Gate.com at $0.06, subsequently experiencing significant volatility with an all-time high of $0.16316 recorded on September 5, 2024.

- Late 2024 to Early 2025: The token underwent a substantial correction phase, declining from its peak levels as market conditions shifted.

- November 2025: MAK reached its all-time low of $0.001267 on November 26, 2025, representing a decline from its historical high.

MAK Current Market Status

As of February 9, 2026, MAK is trading at $0.001759, showing a slight recovery of 5.08% over the past 7 days and 11.89% over the past 30 days. However, the token has declined by 1.18% in the last 24 hours, with intraday trading ranging between $0.001746 and $0.0018.

The current market capitalization stands at approximately $180,174.37, with a circulating supply of 102.43 million MAK tokens out of a maximum supply of 1 billion tokens, representing a circulation ratio of approximately 10.24%. The fully diluted market cap is calculated at $1,759,000. Daily trading volume has reached $9,670.11, indicating relatively modest market activity. The token's market dominance is measured at 0.000069%.

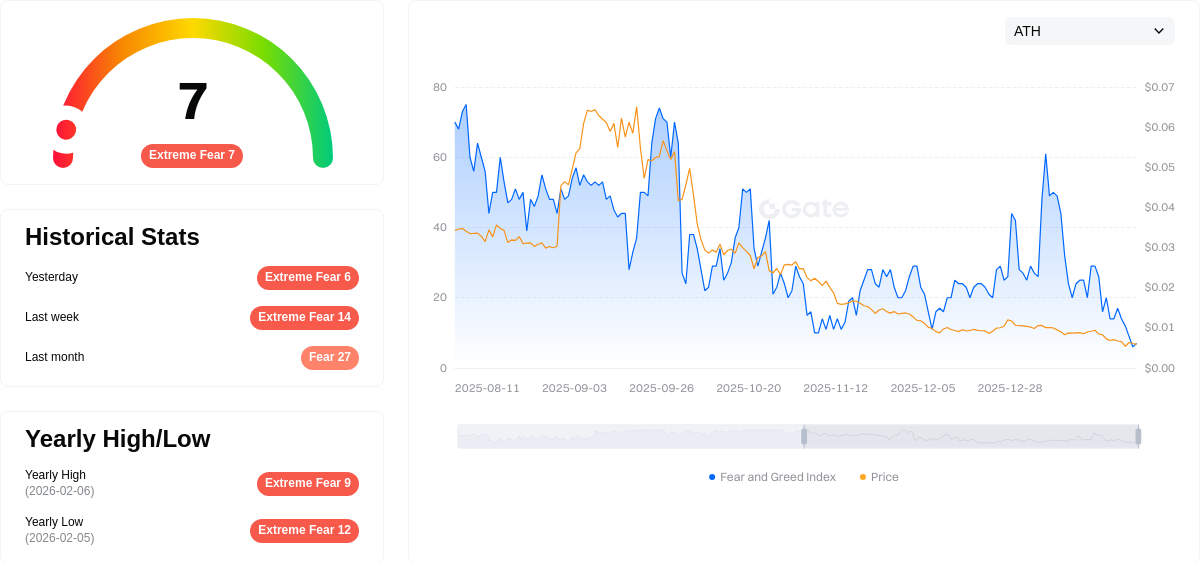

MetaCene maintains a holder base of 458 addresses, with the token listed on 2 exchanges. The current price reflects a 97% decline from its launch price of $0.06 and a 93.93% decrease over the past year. The market emotion index currently registers at 7, indicating an "Extreme Fear" sentiment among cryptocurrency market participants.

Click to view current MAK market price

MAK Market Sentiment Index

2026-02-08 Fear & Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear, with the Fear & Greed Index plummeting to 7. This indicates severe market pessimism and investor panic. During such periods, risk assets typically face intense selling pressure as traders rush to exit positions. However, extreme fear often precedes market reversals, presenting potential opportunities for contrarian investors. Monitor key support levels and market catalysts closely. On Gate.com, you can track real-time sentiment data and adjust your trading strategy accordingly.

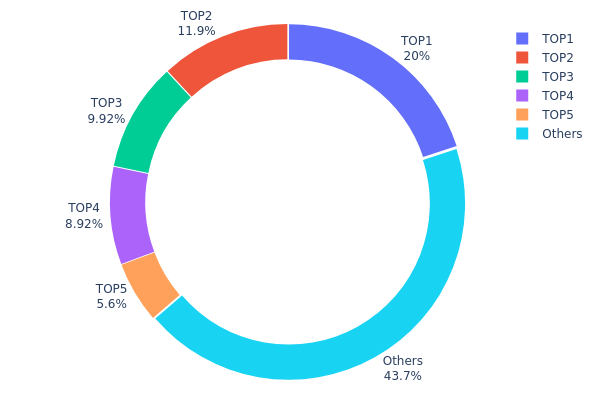

MAK Holding Distribution

According to on-chain data, MAK's holding distribution exhibits a moderate concentration pattern. The top holder controls 200,000K tokens (20.00%), while the second and third largest holders possess 118,750K (11.87%) and 99,184.14K (9.91%) respectively. The top five addresses collectively hold approximately 56.29% of the total supply, with the remaining 43.71% distributed among other addresses. This concentration level falls within a relatively balanced range, neither excessively centralized nor overly dispersed.

From a market structure perspective, this holding distribution presents both stability factors and potential risks. The top address's 20% holding represents significant control but remains below the threshold typically associated with extreme centralization risk. The gradual decline in holdings from the top five addresses suggests a relatively healthy distribution curve. However, the combined influence of the top three holders (41.78%) could still exert considerable impact on market liquidity and price movements during significant sell-offs or coordinated actions.

The current holding structure reflects a moderate level of decentralization. While not achieving an ideal broad distribution, it avoids the extreme concentration seen in some emerging tokens where single addresses control over 30-40% of supply. The 43.71% held by other addresses provides a foundation for market depth and trading activity, though monitoring the top holders' behavioral patterns remains crucial for assessing potential market manipulation risks and overall ecosystem stability.

Click to view current MAK Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7101...4abd9c | 200000.00K | 20.00% |

| 2 | 0xe64f...735d9f | 118750.00K | 11.87% |

| 3 | 0x1ab4...8f8f23 | 99184.14K | 9.91% |

| 4 | 0x7e8b...0b148b | 89243.75K | 8.92% |

| 5 | 0xd073...64a92d | 55999.98K | 5.59% |

| - | Others | 436822.13K | 43.71% |

II. Core Factors Influencing MAK's Future Price

Supply Mechanisms

While specific supply mechanism details for MAK are limited in available materials, cryptocurrency prices are generally influenced by token economics and distribution models. Understanding the token release schedule and circulation dynamics remains important for price assessment.

Market Trends and Economic Dynamics

- Supply and Demand Balance: MAK's price trajectory is shaped by the fundamental interaction between market supply and demand forces. Changes in trading volumes and market participation can create price volatility.

- Market Sentiment: Investor confidence and market psychology play significant roles in determining price movements, particularly in emerging crypto assets.

Macroeconomic Environment

- Global Economic Conditions: Broader economic trends, including monetary policies of major central banks and inflation dynamics, create the backdrop for cryptocurrency market performance. Economic uncertainty can influence investor allocation decisions across asset classes.

- Geopolitical Factors: International political developments and regulatory changes in different jurisdictions can impact market sentiment and trading activity. Cross-border investment flows may be affected by geopolitical considerations.

- Regional Market Development: Market maturity levels and regulatory frameworks in different regions influence accessibility and adoption patterns. Areas with higher openness and market orientation tend to show different investment characteristics.

Technology and Regulatory Landscape

- Technological Advancements: Innovation in blockchain technology and related infrastructure can affect the utility and adoption potential of crypto assets. Technical improvements may enhance transaction efficiency and use cases.

- Regulatory Evolution: Changes in regulatory approaches across different markets impact operational frameworks and investor participation. Regulatory clarity tends to influence institutional involvement and market confidence.

- Market Infrastructure: The development of trading platforms, custody solutions, and supporting financial services affects market accessibility and liquidity conditions.

III. 2026-2031 MAK Price Prediction

2026 Outlook

- Conservative prediction: $0.00135 - $0.00176

- Neutral prediction: $0.00176 (average scenario)

- Optimistic prediction: $0.00246 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with potential volatility as the project develops its ecosystem and expands user base

- Price range predictions:

- 2027: $0.0016 - $0.00297 (approximately 19% increase from 2026)

- 2028: $0.00239 - $0.00363 (approximately 44% increase from 2026)

- 2029: $0.0029 - $0.00352 (approximately 75% increase from 2026)

- Key catalysts: Technology upgrades, partnership expansions, market sentiment shifts, and broader cryptocurrency market trends

2030-2031 Long-term Outlook

- Baseline scenario: $0.00297 - $0.0033 (assuming steady market development and consistent project progress)

- Optimistic scenario: $0.00346 - $0.00422 (assuming enhanced market adoption and favorable regulatory environment)

- Transformative scenario: Potential to reach $0.00496 by 2031 (requires exceptional market conditions, significant technological breakthroughs, and widespread mainstream adoption)

- 2026-02-09: MAK trading within the predicted range, positioning for potential multi-year growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00246 | 0.00176 | 0.00135 | 0 |

| 2027 | 0.00297 | 0.00211 | 0.0016 | 19 |

| 2028 | 0.00363 | 0.00254 | 0.00239 | 44 |

| 2029 | 0.00352 | 0.00308 | 0.0029 | 75 |

| 2030 | 0.00422 | 0.0033 | 0.00297 | 87 |

| 2031 | 0.00496 | 0.00376 | 0.00346 | 113 |

IV. MAK Professional Investment Strategies and Risk Management

MAK Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of blockchain gaming and metaverse platforms, with tolerance for high volatility

- Operational Recommendations:

- Consider accumulating MAK positions during market downturns, given the token's significant decline from its all-time high

- Monitor MetaCene's platform development milestones and user growth metrics as indicators of fundamental value

- Storage Solution: Gate Web3 Wallet offers secure storage for ERC-20 tokens like MAK, providing convenience and security for long-term holders

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the relatively low 24-hour trading volume ($9,670) which may indicate liquidity challenges and wider spreads

- Price Action Analysis: Track the token's recent 30-day performance (+11.89%) against broader market trends to identify momentum shifts

- Swing Trading Key Points:

- The current low circulating supply (10.24% of total supply) may create volatility opportunities as more tokens enter circulation

- Set strict stop-loss orders given the token's historical price range between $0.001267 and $0.16316

MAK Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio allocation

- Aggressive Investors: 2-3% of crypto portfolio allocation

- Professional Investors: Up to 5% with active monitoring and hedging strategies

(II) Risk Hedging Solutions

- Position Sizing: Never allocate more than a small percentage of total portfolio to early-stage gaming tokens

- Diversification: Balance MAK holdings with established cryptocurrencies and other blockchain gaming assets

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking participation

- Cold Storage Solution: For long-term holdings, consider transferring significant amounts to hardware wallets after accumulation

- Security Precautions: Always verify contract address (0xd073e6341a3aa6c4d94c4f8f20fbd1ede572b0da) before transactions, enable two-factor authentication, and never share private keys

V. MAK Potential Risks and Challenges

MAK Market Risks

- Extreme Volatility: The token has experienced a 93.93% decline over the past year, demonstrating significant downside risk

- Low Liquidity: With only $9,670 in 24-hour trading volume and listing on just 2 exchanges, MAK faces liquidity constraints that may impact execution and pricing

- Limited Distribution: Only 10.24% of total supply is currently circulating, creating potential dilution risk as more tokens are released

MAK Regulatory Risks

- Gaming Token Classification: Evolving regulations around blockchain gaming tokens could impact MAK's utility and trading availability

- Cross-border Compliance: As a metaverse platform token, MAK may face varying regulatory treatment across different jurisdictions

- Securities Considerations: Regulatory authorities may scrutinize gaming tokens for securities characteristics, potentially affecting trading and distribution

MAK Technical Risks

- Platform Dependency: MAK's value is heavily dependent on MetaCene platform's successful development and user adoption

- Smart Contract Risk: As an ERC-20 token, MAK is subject to potential vulnerabilities in its smart contract code

- Competition Risk: The blockchain gaming sector is highly competitive, with numerous projects competing for user attention and capital

VI. Conclusion and Action Recommendations

MAK Investment Value Assessment

MAK presents a high-risk, high-potential opportunity within the blockchain gaming sector. While backed by experienced teams from major gaming companies like Blizzard and Tencent, and supported by notable investors, the token faces significant challenges including low liquidity, limited market presence, and substantial price depreciation from its launch. The 11.89% gain over 30 days suggests some recovery momentum, but the year-over-year performance indicates substantial market skepticism. Long-term value depends heavily on MetaCene's ability to deliver a compelling gaming experience and attract sustainable user engagement.

MAK Investment Recommendations

✅ Beginners: Avoid or allocate only minimal amounts for learning purposes. The combination of low liquidity, high volatility, and early-stage project risk makes MAK unsuitable for those new to cryptocurrency investing

✅ Experienced Investors: Consider small speculative positions (1-2% of crypto portfolio) with strict risk management. Monitor platform development updates and user metrics before increasing exposure

✅ Institutional Investors: Conduct thorough due diligence on MetaCene's development roadmap, team execution capability, and competitive positioning. Consider strategic partnerships or direct project involvement rather than passive token holding

MAK Trading Participation Methods

- Spot Trading: Available on Gate.com with MAK/USDT pairs, allowing direct purchase and sale of tokens

- Dollar-Cost Averaging: Systematic small purchases over time to reduce timing risk in this volatile asset

- Wait-and-See Approach: Monitor project milestones, user growth, and market conditions before committing capital

Cryptocurrency investment carries extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

MAK代币的历史价格走势如何?

MAK代币历史价格波动明显。截至2026年2月8日,当前价格为0.012223美元。代币曾波动至0.010494韩元水平。整体呈现较大波幅特征,投资者可查看详细K线图表了解完整走势。

What are the main factors affecting MAK price?

MAK price is primarily influenced by market supply and demand dynamics, trading volume, investor sentiment, and broader cryptocurrency market trends. Regulatory developments and technological updates to the MAK network also significantly impact price movements.

How to predict MAK price? What analysis methods are available?

Predict MAK price using technical and fundamental analysis. Monitor moving averages, trading volume, market trends, and community activity. Track on-chain metrics and development updates for comprehensive price forecasting.

What are the differences between MAK and other mainstream cryptocurrencies?

MAK distinguishes itself through focus on stablecoin integration and flexible salary solutions. Unlike traditional cryptocurrencies relying on mining, MAK streamlines payroll management with stable value, offering practical utility for workforce compensation beyond speculative trading.

What are the risks of investing in MAK?

MAK investments carry market volatility risk and potential capital loss. Cryptocurrency markets are highly unpredictable, influenced by regulatory changes, technology developments, and market sentiment. Electronic trading systems also pose operational risks. All crypto investments require careful consideration of individual risk tolerance.

XRP Price Analysis 2025: Market Trends and Investment Outlook

Treasure NFT Marketplace: A 2025 Guide for Web3 Gamers and Investors

Mastering the Crypto Fear and Greed Index: 2025 Trading Strategies

What Is the Best Crypto ETF in 2025: Top Performers and Beginner's Guide

What is SwissCheese (SWCH) and How Does It Democratize Investment?

What Is the Best AI Crypto in 2025?

What is AIX9: A Comprehensive Guide to the Next Generation of Enterprise Computing Solutions

What is KLINK: A Comprehensive Guide to Understanding the Revolutionary Communication Platform

What is ART: A Comprehensive Guide to Understanding Assisted Reproductive Technology and Its Impact on Modern Fertility Treatment

What is KAR: A Comprehensive Guide to Knowledge and Reasoning Systems in Modern Technology

What is MART: A Comprehensive Guide to Multi-Agent Reinforcement Learning Through Time