2026 MLP Price Prediction: Expert Analysis and Market Forecast for Midstream Energy Infrastructure

Introduction: MLP's Market Position and Investment Value

Matrix Layer Protocol (MLP), as an AI-driven communication and infrastructure protocol for decentralized networks, has been advancing the development of multi-dimensional data transmission solutions since its launch in 2024. As of 2026, MLP has achieved a market capitalization of approximately $314,686, with a circulating supply of around 618 million tokens, and the price is maintained at around $0.0005092. This asset, known as a "next-generation infrastructure protocol", is playing an increasingly critical role in areas such as the Internet of Things (IoT), Web3, and the Metaverse.

This article will comprehensively analyze the price trends of MLP from 2026 to 2031, combining historical patterns, market supply and demand, ecosystem development, and macroeconomic environment, to provide investors with professional price predictions and practical investment strategies.

I. MLP Price History Review and Market Status

MLP Historical Price Evolution Trajectory

- November 2024: MLP launched on Gate.com at an initial offering price of $0.01, marking its entry into the cryptocurrency trading market.

- December 2024: The token experienced significant volatility, reaching its all-time high of $0.077 on December 31, 2024, representing a 670% increase from its launch price.

- October 2025: Market sentiment shifted negatively, with MLP declining to its all-time low of $0.00024 on October 22, 2025, reflecting a substantial correction from peak levels.

MLP Current Market Situation

As of February 7, 2026, Matrix Layer Protocol (MLP) is trading at $0.0005092, with a 24-hour trading volume of $38,626.37. The token has demonstrated positive short-term momentum, gaining 27.34% over the past 24 hours, though it has declined 0.51% in the last hour. The intraday price range spans from $0.0003908 to $0.0005267.

From a broader perspective, MLP has experienced downward pressure across longer timeframes, declining 5.42% over the past week and 26.20% over the past month. The annual performance shows a substantial decrease of 98.9% from the previous year's levels.

The token's market capitalization stands at $314,685.60, with a circulating supply of 618 million MLP tokens out of a maximum supply of 5 billion tokens, representing a circulation ratio of 12.36%. The fully diluted market cap is calculated at $2,546,000. MLP currently ranks #3487 in the cryptocurrency market, with a market dominance of 0.00010%. The token has attracted a holder base of 15,621 addresses.

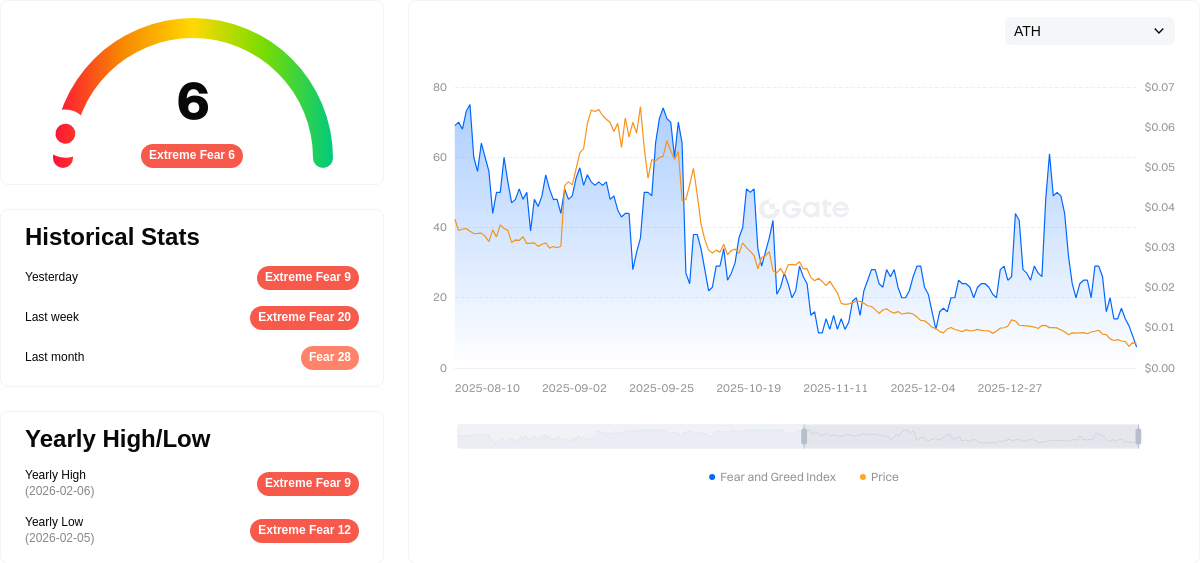

The current market sentiment indicator reflects a Crypto Fear & Greed Index reading of 6, categorized as "Extreme Fear," suggesting heightened caution among market participants. MLP is exclusively traded on Gate.com, with one active trading venue.

Click to view current MLP market price

MLP Market Sentiment Index

2026-02-07 Fear & Greed Index: 6 (Extreme Fear)

Click to view current Fear & Greed Index

Market Analysis:

The crypto market is experiencing extreme fear with an index reading of just 6. This indicates panic selling and significant risk aversion among investors. Such an extremely low reading suggests potential capitulation, where market participants abandon positions due to pessimism. These conditions often mark oversold territories where opportunistic investors may consider accumulating assets, though caution remains essential. Traders should monitor market developments closely and manage positions accordingly during this heightened volatility period.

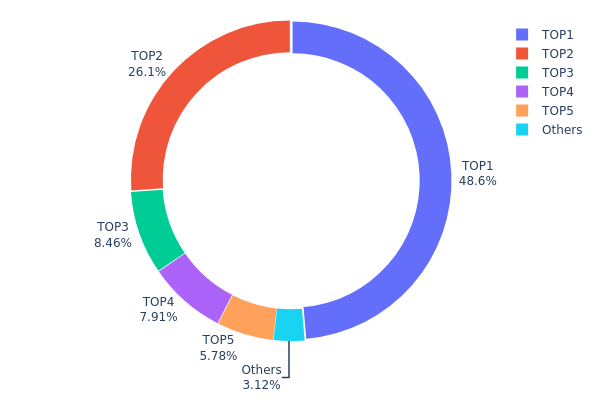

MLP Holding Distribution

According to the latest on-chain data, MLP tokens exhibit a highly concentrated holding pattern. The top five addresses collectively control 96.85% of the total token supply, with the largest holder alone accounting for 48.62% (2.43 billion tokens). The second-ranked address holds 26.10%, while addresses ranked third through fifth hold 8.45%, 7.90%, and 5.78% respectively. The remaining addresses outside the top five collectively hold only 3.15% of the supply.

This extreme concentration reflects the characteristics of liquidity provider (LP) tokens, where major addresses typically represent protocol treasury contracts, liquidity pools, or institutional market makers. Such distribution patterns are common in DeFi ecosystem tokens, particularly for assets designed to provide liquidity infrastructure rather than broad retail participation. However, this concentration level does create structural dependencies, as the behavior of any single top-tier holder could significantly impact market liquidity and price stability.

From a market structure perspective, the current holding distribution suggests limited decentralization in token ownership. While this may not necessarily indicate manipulation risks if the major holders are protocol-related smart contracts, it does imply reduced trading depth and potential vulnerability to large-scale position adjustments. Investors should monitor whether these concentrated holdings remain stable or show signs of redistribution, as changes in this pattern could signal shifts in the protocol's liquidity provision strategy or institutional participation levels.

Click to view current MLP Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x1434...79475c | 2431382.71K | 48.62% |

| 2 | 0x0d07...b492fe | 1305262.34K | 26.10% |

| 3 | 0x3c5d...f59647 | 422917.96K | 8.45% |

| 4 | 0x456f...5ccf09 | 395467.63K | 7.90% |

| 5 | 0x782d...7d7128 | 289115.61K | 5.78% |

| - | Others | 155853.75K | 3.15% |

II. Core Factors Influencing MLP's Future Price

Market Sentiment and Technical Analysis

- Price Prediction Models: Research demonstrates that Multi-Layer Perceptron (MLP) models show significant capability in forecasting price movements. Studies utilizing MLP algorithms for futures price prediction, combined with optimization techniques like Genetic Algorithms (GA), have achieved R² values exceeding 0.98, indicating strong predictive accuracy.

- Historical Patterns: Technical indicators derived from historical price data, including momentum indicators and volatility measures, serve as key inputs for price prediction models. These indicators help identify potential trend reversals and continuation patterns.

- Current Impact: Advanced machine learning models incorporating 16 distinct features—covering momentum, volatility levels, price-volume correlations, and volatility surface characteristics—demonstrate approximately 60% accuracy in predicting volatility changes over 20-day periods.

Institutional and Market Dynamics

- Market Microstructure: Options market activity, particularly from sophisticated participants, may exhibit "smart money" effects. Institutional trading patterns in derivatives markets can provide leading indicators for underlying asset price movements.

- Volatility Trading: The relationship between implied volatility and historical volatility creates opportunities for strategic positioning. Market makers and institutional investors actively trade volatility spreads, influencing short-term price dynamics.

- Position Concentration: Open interest and trading volume patterns in related futures and options contracts reflect institutional sentiment and can signal potential price inflections.

Macroeconomic Environment

- Economic Indicators: Medium to long-term price trends correlate with broader economic factors, though specific monetary policy impacts depend on asset classification and regulatory framework.

- Market Correlation: Price movements often exhibit correlations with related financial instruments, suggesting sensitivity to systematic risk factors affecting multiple asset classes.

- Event-Driven Factors: News and significant announcements can materially impact short to medium-term price trajectories, with positive or negative information flows creating measurable price responses.

Technical Development and Model Innovation

- Ensemble Learning Methods: Research indicates that combining multiple prediction models—including Random Forest, XGBoost, and MLP architectures—through ensemble learning techniques can enhance forecast accuracy and robustness.

- Feature Engineering Advances: The integration of diverse data sources, including standardized volatility metrics, momentum indicators, and volatility surface characteristics, enables more comprehensive price modeling approaches.

- Optimization Algorithms: Implementation of genetic algorithms and other optimization techniques to fine-tune model parameters (including neuron count, layer depth, and learning rates) has demonstrated capacity to improve prediction performance, particularly during periods of elevated market volatility.

III. 2026-2031 MLP Price Prediction

2026 Outlook

- Conservative prediction: $0.00048 - $0.00051

- Neutral prediction: $0.00051

- Optimistic prediction: $0.00059

2027-2029 Outlook

- Market stage expectation: MLP is anticipated to enter a gradual growth phase, with price movements reflecting moderate market expansion and increasing adoption

- Price range predictions:

- 2027: $0.00045 - $0.00065 (approximately 7% growth)

- 2028: $0.00037 - $0.00075 (approximately 17% growth)

- 2029: $0.00065 - $0.00089 (approximately 32% growth)

- Key catalysts: Market maturation, ecosystem development, and broader cryptocurrency market trends may serve as primary drivers for price appreciation during this period

2030-2031 Long-term Outlook

- Baseline scenario: $0.00071 - $0.00078 (assuming steady market conditions and consistent project development)

- Optimistic scenario: $0.00088 - $0.00098 (contingent on favorable market sentiment and enhanced utility)

- Transformational scenario: $0.00128 (requiring exceptional market conditions, significant technological breakthroughs, or widespread mainstream adoption)

- 2026-02-07: MLP trading within the predicted range of $0.00048 - $0.00059, establishing baseline for future growth trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00059 | 0.00051 | 0.00048 | 0 |

| 2027 | 0.00065 | 0.00055 | 0.00045 | 7 |

| 2028 | 0.00075 | 0.0006 | 0.00037 | 17 |

| 2029 | 0.00089 | 0.00067 | 0.00065 | 32 |

| 2030 | 0.00098 | 0.00078 | 0.00071 | 53 |

| 2031 | 0.00128 | 0.00088 | 0.00055 | 72 |

IV. MLP Professional Investment Strategy and Risk Management

MLP Investment Methodology

(1) Long-term Holding Strategy

- Target Audience: Investors who believe in decentralized communication infrastructure and AI-driven network solutions, with moderate to high risk tolerance and long-term investment horizons

- Operational Recommendations:

- Consider gradually accumulating positions during market downturns, as MLP has experienced significant volatility with a 98.9% decline over the past year

- Monitor project development milestones, particularly advancements in IoT, Web3, and Metaverse integration capabilities

- Storage Solution: Use Gate Web3 Wallet or hardware wallets compatible with BEP-20 tokens for secure long-term storage

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($38,626) relative to market cap ($314,686) to identify liquidity patterns and potential breakout opportunities

- Support and Resistance Levels: Track the 24-hour range ($0.0003908 - $0.0005267) to establish entry and exit points

- Swing Trading Essentials:

- Be aware of high volatility, as evidenced by the 27.34% increase in 24 hours, which presents both opportunities and risks

- Consider the limited exchange availability (currently listed on 1 exchange), which may impact liquidity and price discovery

MLP Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation, given the high-risk nature and low market cap

- Aggressive Investors: 3-5% allocation for those seeking higher risk-reward opportunities in infrastructure protocols

- Professional Investors: Up to 10% allocation with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance MLP exposure with established infrastructure tokens and stablecoins to mitigate concentration risk

- Stop-Loss Implementation: Set strict stop-loss orders given the token's history of sharp declines

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and convenient access to BSC-based tokens

- Cold Storage Solution: Hardware wallets supporting BEP-20 standard for long-term holdings exceeding short-term trading needs

- Security Considerations: Verify the contract address (0xdbe3ea3639077a837e767c5d82730254fc933e41) on BscScan before any transactions; never share private keys or seed phrases

V. MLP Potential Risks and Challenges

MLP Market Risks

- Extreme Volatility: MLP has demonstrated significant price fluctuations, declining 98.9% from its all-time high of $0.077 (December 31, 2024) to near its all-time low of $0.00024 (October 22, 2025)

- Low Liquidity: With a market cap of approximately $314,686 and limited exchange listings, the token faces liquidity constraints that may result in high slippage during larger trades

- Low Circulation Rate: Only 12.36% of the total supply is currently circulating (618 million out of 5 billion tokens), creating potential dilution risk as more tokens enter circulation

MLP Regulatory Risks

- Infrastructure Protocol Classification: Uncertainty surrounding regulatory treatment of AI-driven communication protocols may impact project operations and token utility

- Cross-jurisdictional Compliance: As MLP targets global IoT and Web3 applications, varying international regulatory approaches to decentralized infrastructure could affect adoption

- Token Distribution Scrutiny: The significant difference between circulating supply and total supply may attract regulatory attention regarding token distribution practices

MLP Technical Risks

- Protocol Development Risk: As an emerging infrastructure protocol for IoT, Web3, and Metaverse applications, technical implementation challenges may delay promised functionality

- Network Security Vulnerabilities: Operating on BSC (BEP-20 standard) exposes the protocol to potential smart contract vulnerabilities and chain-level security issues

- Competitive Landscape: Numerous established projects are developing decentralized communication infrastructure, creating intense competition for adoption and market share

VI. Conclusion and Action Recommendations

MLP Investment Value Assessment

Matrix Layer Protocol presents an interesting case in the decentralized infrastructure space, focusing on AI-driven communication solutions for emerging technologies like IoT, Web3, and the Metaverse. The project's long-term value proposition centers on addressing future communication needs with low-latency, high-security services across various network environments.

However, short-term risks are substantial. The token has experienced a 98.9% decline from its all-time high, reflecting either initial overvaluation or significant market challenges. With only 12.36% of tokens in circulation and limited exchange availability, investors face considerable liquidity and dilution risks. The market cap of approximately $314,686 indicates an early-stage project with high uncertainty.

MLP Investment Recommendations

✅ Beginners: Exercise extreme caution or avoid this investment. If interested in infrastructure protocols, start with minimal allocation (less than 1% of crypto portfolio) and thoroughly research the project's technical documentation and development progress. Focus on learning about token economics and market dynamics before investing.

✅ Experienced Investors: Consider a small speculative position (2-3% of crypto portfolio) only if you have conviction in the AI-driven communication infrastructure thesis and can tolerate potential total loss. Implement strict risk management with predefined exit strategies and regular portfolio rebalancing.

✅ Institutional Investors: Conduct comprehensive due diligence on the protocol's technical architecture, team capabilities, and competitive positioning. If pursuing investment, structure allocation with appropriate hedging mechanisms and milestone-based position adjustments tied to development progress and adoption metrics.

MLP Trading Participation Methods

- Spot Trading: Purchase MLP through Gate.com with appropriate position sizing based on your risk tolerance and investment strategy

- Dollar-Cost Averaging: Systematically accumulate positions over time to mitigate timing risk, particularly suitable given the token's high volatility

- Portfolio Rebalancing: Regularly review and adjust MLP allocation in relation to your overall crypto portfolio to maintain target risk exposure

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is an MLP (Master Limited Partnership) and how does it work?

An MLP is a business structure traded on exchanges combining features of corporations and partnerships. It distributes income to investors without entity-level taxation, offering tax advantages and regular profit distributions directly to shareholders.

What factors influence MLP price movements and predictions?

MLP price movements are driven by historical price data, trading volume, market sentiment, economic indicators, and liquidity conditions. AI models analyze these factors to forecast future price trends.

What are the risks and benefits of investing in MLPs?

MLPs offer tax-advantaged distributions and passive income potential. However, they carry risks including complex tax reporting, energy sector volatility, and potential tax law changes. Investors can access MLPs directly or through ETFs and mutual funds for diversified exposure.

How do I predict or forecast MLP prices?

Monitor market trends, trading volume, and technical indicators. Analysts predict MLP could reach 10.33 EUR by 2027, ranging from 9.00 EUR to 12.50 EUR based on current data analysis and market sentiment.

What is the historical performance and dividend yield of MLPs?

MLPs have delivered approximately 7.75% average annual dividend yield since inception. The 5-year return reached 24.06%, while 1-year performance was 5.15%. These infrastructure assets offer consistent income distributions to investors.

How do MLP prices compare to other energy sector investments?

MLP prices typically offer steadier returns and lower volatility compared to traditional energy sector investments. They provide more predictable cash flows and reliable income streams, making them generally more stable than other energy assets.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Comprehensive Guide to Understanding and Managing FUD in Cryptocurrency Markets

What Is DID (Decentralized Identity)? Latest Updates and Use Cases

Comprehensive Guide to Bull Flag Patterns for Trading

Everything About the Cryptocurrency Fear and Greed Index

Top 11 Golden Cross Trading Strategies for Investors and Traders