2026 MTRG Price Prediction: Expert Analysis and Market Forecast for Matrixport Token

Introduction: MTRG's Market Position and Investment Value

Meter (MTRG), as a governance token of a high-performance EVM-compatible public blockchain based on HotStuff2 consensus, has been serving the crypto ecosystem since its launch in 2020. As of February 2026, MTRG has a market capitalization of approximately $929,234, with a circulating supply of around 32.28 million tokens, and the price hovers around $0.02879. This asset, recognized as a "dual-token governance solution," plays an increasingly critical role in securing network operations through Proof-of-Stake mechanisms while utilizing Bitcoin miner PoW-generated MTR as the network's gas payment medium.

This article will comprehensively analyze MTRG's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. MTRG Price History Review and Market Status

MTRG Historical Price Evolution Trajectory

- 2021: MTRG reached a notable price level of $16.47 on November 3, marking a significant milestone in its trading history

- 2026: The token experienced substantial price movement, with prices declining to a low of $0.02804947 on February 3

MTRG Current Market Situation

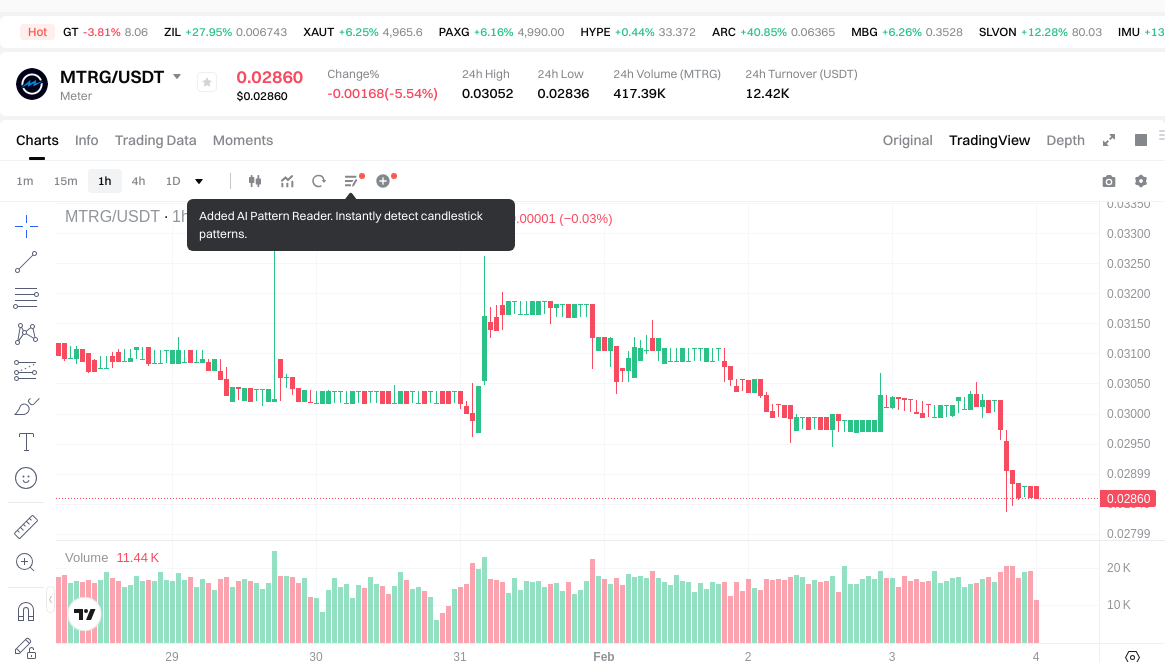

As of February 4, 2026, MTRG is trading at $0.02879, reflecting a market capitalization of approximately $929,234.96. The 24-hour trading volume stands at $12,393.28, indicating moderate trading activity in the market.

The token has experienced price fluctuations across different timeframes. Over the past hour, the price showed minimal movement at -0.03%. The 24-hour period saw a decrease of 4.92%, with the price ranging between $0.02836 and $0.03052. Weekly performance indicates a decline of 7.48%, while the monthly trend shows a reduction of 13.54%. Over the past year, the token has decreased by 77.01%.

MTRG currently holds a market ranking of 2558, with a circulating supply of 32,276,310 tokens out of a total supply of 48,890,067 tokens, representing a circulation ratio of approximately 73.5%. The fully diluted market cap stands at $1,407,545.03. The token's market dominance is recorded at 0.000051%.

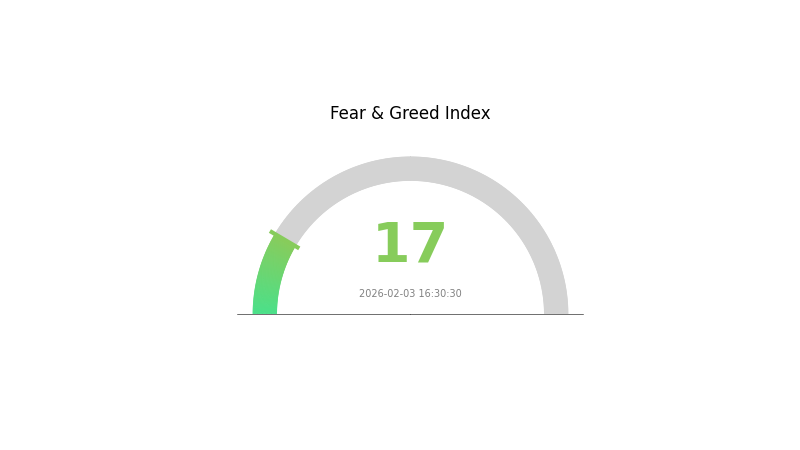

The cryptocurrency fear and greed index for February 3, 2026, registered at 17, indicating an "Extreme Fear" sentiment in the broader market.

Click to view current MTRG market price

MTRG Market Sentiment Index

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the index at 17. This exceptionally low reading suggests investors are highly pessimistic and risk-averse. Such extreme sentiment levels historically present contrarian opportunities, as markets often reach capitulation points before recovery. However, caution remains warranted as further downside risks may persist. Traders should exercise prudent risk management and avoid panic-driven decisions during volatile periods. Consider dollar-cost averaging strategies and maintaining diversified portfolios to navigate through this fearful sentiment phase effectively.

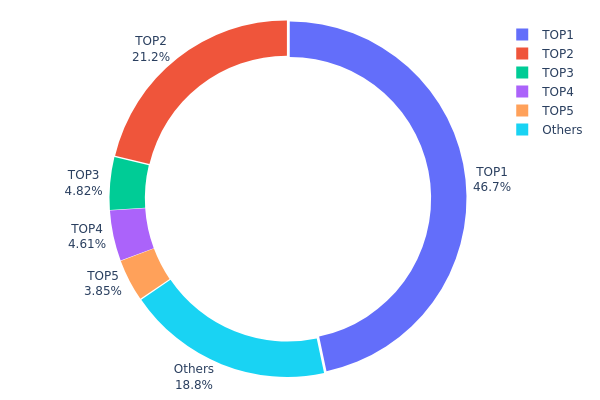

MTRG Holding Distribution

The holding distribution chart reflects the concentration of token holdings across different addresses in the blockchain network, serving as a key indicator of decentralization and potential market manipulation risk. According to the current data, the top address holds 1.4 million MTRG tokens, accounting for 46.66% of the total supply, while the second-largest address holds 637,100 tokens (21.23%). The top two addresses alone control nearly 68% of the circulating supply, indicating a highly concentrated holding structure. The remaining top five addresses collectively hold an additional 12.26%, while other addresses only account for 18.85% of the total supply.

This extreme concentration poses significant concerns for market stability and price manipulation risk. When a small number of addresses control the majority of tokens, large holders can exert substantial influence on market prices through coordinated buying or selling activities. The dominance of the top address at nearly 47% is particularly noteworthy, as any significant movement from this whale address could trigger sharp price volatility and affect market sentiment. Such centralized distribution also suggests that the project may still be in its early stages of development or that tokens are predominantly held by team members, early investors, or institutional partners.

From a decentralization perspective, MTRG's current holding structure indicates relatively weak on-chain governance distribution. A healthy token economy typically features broader token distribution to ensure network resilience and reduce single-point failure risks. The limited number of individual holders outside the top addresses suggests that retail participation remains relatively low, which could impact long-term community building and ecosystem development. Investors should closely monitor any significant transfer activities from major holding addresses, as these movements could serve as early warning signals for potential market changes.

Click to view current MTRG Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x62e3...92daf1 | 1400.00K | 46.66% |

| 2 | 0xea31...11c0c0 | 637.10K | 21.23% |

| 3 | 0x0d07...b492fe | 144.51K | 4.81% |

| 4 | 0x837f...f2bcfb | 138.30K | 4.60% |

| 5 | 0x8caf...ae696d | 115.63K | 3.85% |

| - | Others | 564.46K | 18.85% |

II. Core Factors Influencing MTRG's Future Price

Market Sentiment

- Sentiment-Driven Volatility: The cryptocurrency market demonstrates high sensitivity to sentiment shifts. News events, social media trends, and market narratives can trigger significant price movements in MTRG.

- Historical Patterns: Price fluctuations in related assets have historically reflected changes in market sentiment and user adoption patterns.

- Current Impact: Market sentiment remains a primary driver of short-term price volatility, with news cycles and community engagement playing substantial roles in valuation changes.

Regulatory Environment

- Government Oversight: The regulatory landscape in major cryptocurrency markets significantly influences MTRG's price trajectory. Policy clarity and legal frameworks in key jurisdictions shape investor confidence and market participation.

- Policy Evolution: Regulatory developments continue to evolve across different regions, creating both opportunities and challenges for market participants.

- Compliance Framework: The degree of regulatory clarity affects institutional adoption and mainstream integration of cryptocurrency assets.

Technological Innovation

- Technical Advancements: Ongoing technological improvements and innovations within the broader ecosystem contribute to price dynamics.

- Development Activity: Continuous technical development and protocol enhancements play a role in long-term value proposition.

- Innovation Ecosystem: Progress in underlying technology and related infrastructure development influences market positioning and competitive advantages.

III. 2026-2031 MTRG Price Forecast

2026 Outlook

- Conservative forecast: $0.01687 - $0.0286

- Neutral forecast: Around $0.0286

- Optimistic forecast: Up to $0.03747 (requires favorable market conditions and strong ecosystem development)

2027-2029 Outlook

- Market stage expectation: Entry into gradual growth phase with increasing adoption and ecosystem expansion

- Price range forecast:

- 2027: $0.01883 - $0.04459 (14% year-over-year change)

- 2028: $0.03765 - $0.04347 (34% cumulative change from 2026)

- 2029: $0.02469 - $0.0576 (42% cumulative change from 2026)

- Key catalysts: Technology upgrades, strategic partnerships, broader market acceptance, and potential regulatory clarity in the blockchain sector

2030-2031 Long-term Outlook

- Baseline scenario: $0.04394 - $0.06566 (assuming steady market growth and continued project development)

- Optimistic scenario: $0.05752 - $0.06672 (assuming accelerated adoption, significant ecosystem expansion, and favorable macroeconomic conditions)

- Transformative scenario: Exceeding $0.06672 (requires breakthrough technological innovations, mass adoption, and exceptional market conditions)

- February 4, 2026: MTRG trading within established range as the project continues its development trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.03747 | 0.0286 | 0.01687 | 0 |

| 2027 | 0.04459 | 0.03303 | 0.01883 | 14 |

| 2028 | 0.04347 | 0.03881 | 0.03765 | 34 |

| 2029 | 0.0576 | 0.04114 | 0.02469 | 42 |

| 2030 | 0.06566 | 0.04937 | 0.04394 | 71 |

| 2031 | 0.06672 | 0.05752 | 0.03106 | 99 |

IV. MTRG Professional Investment Strategies and Risk Management

MTRG Investment Methodology

(I) Long-Term Holding Strategy

- Target Investors: Investors with a long-term perspective on blockchain infrastructure and governance token ecosystems

- Operational Recommendations:

- Consider building positions during market corrections, given MTRG's recent price decline of approximately 77% over the past year

- Monitor Meter network development progress and governance participation metrics before establishing positions

- Gate Web3 Wallet provides secure storage solutions for MTRG tokens across multiple chains including MTR, BSC, and ETH

(II) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Current price near $0.02879 is close to the all-time low of $0.02805, which may serve as a technical support level

- Volume Analysis: Daily trading volume of approximately $12,393 should be monitored for liquidity assessment

- Swing Trading Considerations:

- Recent 24-hour volatility shows a range between $0.02836 and $0.03052, providing potential trading opportunities

- The 7-day decline of 7.48% and 30-day decline of 13.54% suggest caution in establishing new positions

MTRG Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Moderate Investors: 3-5% of crypto portfolio allocation

- Professional Investors: Up to 10% of crypto portfolio allocation, with active monitoring

(II) Risk Hedging Approaches

- Portfolio Diversification: Balance MTRG holdings with established cryptocurrencies and stablecoins

- Position Sizing: Implement dollar-cost averaging to manage entry point risks during volatile periods

(III) Secure Storage Solutions

- Multi-Chain Wallet Recommendation: Gate Web3 Wallet supports MTRG across MTR, BSC, and ETH networks

- Hardware Wallet Alternative: Consider cold storage solutions for long-term holdings

- Security Precautions: Enable two-factor authentication, verify contract addresses before transactions, and never share private keys

V. MTRG Potential Risks and Challenges

MTRG Market Risks

- Price Volatility: MTRG has experienced significant price decline of 77% over the past year, indicating high volatility

- Liquidity Concerns: Daily trading volume of approximately $12,393 suggests relatively low market liquidity compared to major cryptocurrencies

- Market Cap Positioning: Current market capitalization of approximately $929,235 places MTRG at rank 2558, indicating limited market recognition

MTRG Regulatory Risks

- Compliance Uncertainty: Evolving regulatory frameworks for governance tokens and blockchain infrastructure may impact MTRG's operations

- Cross-Chain Regulatory Challenges: MTRG's deployment across multiple chains (MTR, BSC, ETH) may face varying regulatory requirements in different jurisdictions

- Governance Token Classification: Potential regulatory scrutiny regarding the classification and treatment of governance tokens

MTRG Technical Risks

- Network Security: As a governance token for the Meter network, MTRG's value depends on the continued security and performance of the underlying blockchain

- Smart Contract Risks: Multi-chain deployment increases exposure to potential smart contract vulnerabilities across different platforms

- Adoption Challenges: The project's relatively low holder count of 1,785 addresses suggests limited network adoption

VI. Conclusion and Action Recommendations

MTRG Investment Value Assessment

MTRG presents a high-risk opportunity within the blockchain infrastructure sector. As the governance token for the Meter network, which utilizes HotStuff2 consensus and combines PoS security with PoW-generated gas payments, the project offers technical innovation. However, the significant price decline of 77% over the past year, limited liquidity with daily volume around $12,393, and market cap ranking of 2558 indicate substantial challenges. The current price near all-time lows may attract contrarian investors, but the limited holder base of 1,785 addresses suggests cautious market sentiment. Long-term value depends on successful network adoption and ecosystem development.

MTRG Investment Recommendations

✅ Beginners: Avoid MTRG until gaining more experience with cryptocurrency markets and thoroughly understanding blockchain governance mechanisms. Focus on established cryptocurrencies first. ✅ Experienced Investors: Consider small speculative positions (1-2% of portfolio) only after comprehensive due diligence on Meter network developments. Monitor network growth metrics and governance participation. ✅ Institutional Investors: Conduct detailed technical and fundamental analysis of Meter's consensus mechanism and ecosystem potential before considering allocation. Assess project team credentials and development roadmap.

MTRG Trading Participation Methods

- Spot Trading: Available on Gate.com with trading pairs, allowing direct purchase and sale of MTRG

- Secure Storage: Utilize Gate Web3 Wallet for multi-chain MTRG storage across MTR, BSC, and ETH networks

- Network Participation: Consider participating in Meter network governance activities to understand token utility and ecosystem dynamics

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MTRG token and what are its uses?

MTRG is the governance token of the Meter blockchain ecosystem. It serves as the utility token for network security, transaction fee calculation, and decentralized governance participation.

What are the main factors affecting MTRG price?

MTRG price is primarily influenced by network adoption rate, governance participation level, and market demand. Increased DeFi infrastructure usage and active voting activities enhance token value and utility.

How to analyze MTRG's historical price trends?

Analyze MTRG's historical price trends by examining candlestick charts, trading volume patterns, and support/resistance levels. Track price movements across different timeframes, identify trend reversals, and compare with market cycles. Monitor key metrics like market cap and on-chain activity to understand price drivers and predict future movements.

What are the advantages and disadvantages of MTRG compared to other governance tokens?

MTRG excels with high throughput, EVM compatibility, and innovative gas design. Its on-chain governance is robust. However, it faces stiff competition from more established governance tokens with larger ecosystems and longer track records in the market.

What are the price predictions and risk factors for MTRG in 2024-2025?

MTRG price predictions for 2024-2025 depend on market trends and investor sentiment. Key risk factors include market volatility, regulatory changes, and fluctuations in transaction volume. Expert analysis suggests potential growth driven by platform adoption and ecosystem development.

Where can I buy MTRG and how to trade safely?

MTRG is available on major crypto exchanges. Enable two-factor authentication, use secure wallets, and verify addresses before transactions. Trade on reputable platforms with high trading volume to ensure liquidity and security.

What is MTRG's development roadmap and future prospects?

MTRG powers Meter's PoW-based stablecoin system with DeFi infrastructure and cross-chain technology. The project demonstrates strong long-term market potential through sustainable tokenomics and expanding ecosystem adoption.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Survey Note: Detailed Analysis of the Best AI in 2025

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Kaspa’s Journey: From BlockDAG Innovation to Market Buzz

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

Popular GameFi Games in 2025

Top 3 Cryptocurrency Exchanges for Buying Bitcoin in the UK

Cryptocurrency Airdrops: A Comprehensive Guide to Participation and Profit

Best Graphics Card for Mining: Top Next-Generation GPUs

Who Is Vitalik Buterin? An In-Depth Look at the Co-Founder of Ethereum

What is Demand Supply Zone and How to Use It in Trading