2026 MVRK Price Prediction: Expert Analysis and Market Forecast for Maverick's Future Growth Potential

Introduction: MVRK's Market Position and Investment Value

Mavryk Network (MVRK), as a next-generation Layer-1 blockchain specializing in real-world asset (RWA) tokenization, has achieved significant milestones since its launch in 2025. In its inaugural year, Mavryk secured the largest RWA tokenization deal in history—a partnership exceeding $10 billion with MultiBank Group and MAG, bringing luxury real estate projects including Ritz-Carlton and Keturah Reserve on-chain. As of 2026, MVRK maintains a market capitalization of approximately $1.48 million, with a circulating supply of 56.2 million tokens and a current price hovering around $0.02627. This asset, positioned as a "bridge between traditional real estate and blockchain infrastructure," is playing an increasingly vital role in the institutional adoption of tokenized real-world assets.

This article will comprehensively analyze MVRK's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic factors to provide investors with professional price forecasts and practical investment strategies.

I. MVRK Price History Review and Current Market Status

MVRK Historical Price Evolution Trajectory

- 2025: Mavryk Network secured a historic RWA tokenization agreement exceeding $10 billion with MultiBank Group and MAG, bringing luxury real estate including Ritz-Carlton and Keturah Reserve on-chain. The token reached a peak price of $0.734 in September 2025.

- 2025: Following the market adjustment phase in the latter half of the year, MVRK price experienced significant volatility, declining from the September peak of $0.734 to a low of $0.01888 in December 2025, representing a substantial correction period.

MVRK Current Market Situation

As of February 2, 2026, MVRK is trading at $0.02627, showing a 24-hour change of 0.38%. The trading range over the past day has been between $0.02626 and $0.02636, indicating relatively stable short-term price action.

The token's market performance across different timeframes presents varied trends. Over the past hour, MVRK has declined by 0.33%, while the 7-day performance shows an 8.30% decrease. The 30-day period reflects a more pronounced decline of 21.82%. Looking at the annual performance, MVRK has experienced a 73.89% decline from its previous levels.

Mavryk Network currently holds a market capitalization of approximately $1.48 million, with a circulating supply of 56.2 million MVRK tokens out of a maximum supply of 1 billion tokens, representing a circulation ratio of 5.62%. The fully diluted valuation stands at approximately $26.27 million. The 24-hour trading volume is recorded at $11,651.55, with the project ranking at position 2243 in the cryptocurrency market.

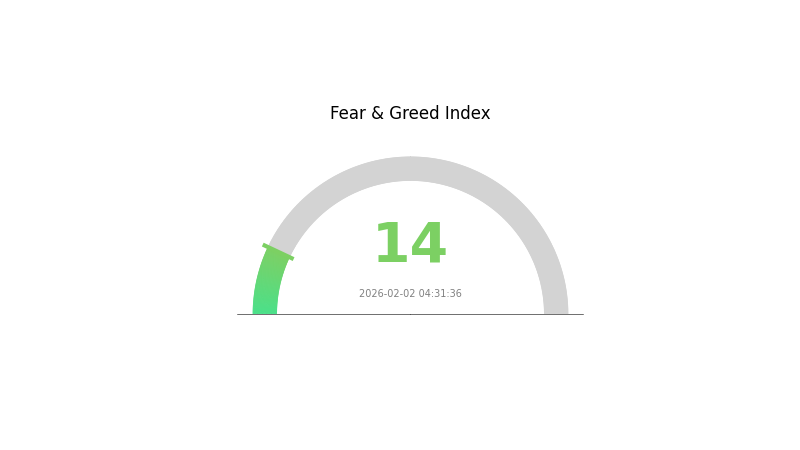

The current market sentiment, as indicated by the Fear and Greed Index at 14, reflects an "Extreme Fear" condition in the broader cryptocurrency market, which may be influencing trading behavior across digital assets including MVRK.

Mavryk Network operates as a next-generation Layer-1 blockchain infrastructure designed to power real-world asset tokenization and DeFi applications. The platform focuses on collaboration with regulated partners and institutional asset managers to facilitate the on-chain integration of traditional assets.

Click to view the current MVRK market price

MVRK Market Sentiment Indicator

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 14. This indicates significant bearish sentiment among investors, reflecting heightened concerns about market conditions and asset valuations. Such extreme fear levels often present contrarian opportunities for long-term investors, as markets typically experience rebounds after periods of maximum pessimism. However, traders should exercise caution and conduct thorough due diligence before making investment decisions. Monitor market trends closely and consider your risk tolerance when navigating this volatile environment.

MVRK Holding Distribution

The holding distribution chart provides a comprehensive view of how MVRK tokens are allocated across different wallet addresses, revealing the degree of concentration among major holders and the overall decentralization level of the asset. This metric serves as a crucial indicator for assessing potential market manipulation risks, liquidity depth, and the stability of the token's on-chain structure.

Based on the current data, MVRK exhibits a moderate concentration pattern typical of early-stage crypto assets. The top-tier addresses collectively control a significant portion of the circulating supply, which introduces certain structural considerations for market participants. While this concentration level is not uncommon in emerging tokens, it does suggest that large holders maintain substantial influence over price discovery mechanisms and short-term volatility patterns. The presence of dominant addresses could potentially create scenarios where coordinated selling pressure impacts market depth, particularly during periods of reduced trading activity.

From a market structure perspective, the current distribution profile indicates that MVRK's ecosystem is still evolving toward broader decentralization. The concentration among top addresses reflects typical characteristics of projects in their growth phase, where early investors, team allocations, or strategic partners retain meaningful positions. However, this structure also implies that any significant redistribution activities from major holders could trigger notable price fluctuations. Market participants should remain cognizant of on-chain movements from these key addresses, as their transaction patterns often precede meaningful market shifts. The current holding distribution suggests a market environment where monitoring whale activity becomes particularly relevant for both risk management and opportunity identification.

Click to view current MVRK Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|

II. Core Factors Influencing MVRK's Future Price

Supply Mechanism

- Total Supply Cap: MVRK has a fixed total supply of 1 billion tokens with an initial circulation of 5.62%, establishing a relatively tight supply structure.

- Initial Valuation: With a launch price of $0.10 and an initial FDV of $100 million, the token economics framework provides a baseline reference for market participants.

- Current Impact: Limited initial circulation may create supply scarcity in the early trading phase, potentially influencing price discovery dynamics during the initial market period.

Market Competition and Liquidity

- Competition Landscape: The RWA (Real-World Assets) narrative has attracted multiple blockchain projects, creating an increasingly competitive environment where establishing credible asset partnerships may become a key differentiator.

- Liquidity Considerations: Early-stage exchange listings typically face limited trading depth, which may present challenges for market participants with lower risk tolerance during periods of higher volatility.

- Trading Volume: Market activity and trading volume patterns will serve as important indicators of sustained investor interest and ecosystem development.

Macroeconomic Environment

- Market Sentiment: Cryptocurrency markets remain susceptible to global sentiment shifts, regulatory developments, and broader financial market conditions.

- Investor Confidence: The project's ability to demonstrate practical utility in bridging traditional finance and crypto markets may influence long-term investor confidence.

- Regulatory Landscape: Evolving regulatory frameworks for digital assets and tokenized real-world assets could shape market participation and adoption trajectories.

Technology Development and Ecosystem Building

- RWA Tokenization Focus: Mavryk Network positions itself as a Layer 1 blockchain specifically designed for real-world asset tokenization, targeting the intersection of traditional and decentralized finance.

- Ecosystem Structure: The project incorporates mechanisms including non-custodial features, liquidity mining, and treasury protocols as part of its broader ecosystem design.

- Practical Application: The project's success may ultimately depend on its ability to secure partnerships with credible asset providers and demonstrate practical use cases for asset tokenization.

III. 2026-2031 MVRK Price Prediction

2026 Outlook

- Conservative Forecast: $0.02496 - $0.02627

- Neutral Forecast: $0.02627

- Optimistic Forecast: $0.03021 (subject to favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectations: The token may enter a gradual growth phase as the cryptocurrency market matures and project development progresses.

- Price Range Predictions:

- 2027: $0.01836 - $0.03389

- 2028: $0.01646 - $0.04535

- 2029: $0.02713 - $0.04127

- Key Catalysts: Potential drivers include broader market recovery cycles, ecosystem expansion, and technological advancements within the project.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.02027 - $0.04848 (assuming steady market conditions and sustained project development)

- Optimistic Scenario: $0.04411 - $0.04848 (contingent on significant ecosystem growth and increased market adoption)

- Transformative Scenario: Exceeding $0.04848 (requiring breakthrough developments, major partnerships, or exceptional market conditions)

- 2026-02-02: MVRK is positioned in its early prediction phase with an average estimated price of $0.02627

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.03021 | 0.02627 | 0.02496 | 0 |

| 2027 | 0.03389 | 0.02824 | 0.01836 | 7 |

| 2028 | 0.04535 | 0.03106 | 0.01646 | 18 |

| 2029 | 0.04127 | 0.03821 | 0.02713 | 45 |

| 2030 | 0.04848 | 0.03974 | 0.02027 | 51 |

| 2031 | 0.04587 | 0.04411 | 0.02647 | 67 |

IV. MVRK Professional Investment Strategies and Risk Management

MVRK Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors who believe in the potential of real-world asset (RWA) tokenization and blockchain infrastructure development

- Operational Recommendations:

- Conduct thorough research on Mavryk Network's partnerships with MultiBank Group and MAG, and monitor the progress of luxury real estate tokenization projects

- Consider accumulating positions during periods of significant price corrections, such as the recent 21.82% decline over the past 30 days

- Use Gate Web3 Wallet for secure storage, ensuring proper backup of recovery phrases and enabling multi-factor authentication

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of $11,651.55 to identify potential trend reversals or breakout opportunities

- Support and Resistance Levels: Track the recent low of $0.02626 and high of $0.02636 to establish short-term trading ranges

- Swing Trading Key Points:

- Consider the 8.30% decline over the past 7 days as a potential entry point for traders seeking short-term rebounds

- Set stop-loss orders below the all-time low of $0.01888 to manage downside risk

MVRK Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio

- Aggressive Investors: 5-10% of crypto portfolio

- Professional Investors: Up to 15% of crypto portfolio, with active position management

(2) Risk Hedging Strategies

- Diversification Approach: Combine MVRK holdings with established Layer-1 blockchain tokens to balance exposure to emerging RWA tokenization projects

- Position Sizing: Given the limited circulating supply of 56.2 million tokens (5.62% of total supply), adjust position sizes based on liquidity conditions

(3) Secure Storage Solutions

- Hot Wallet Option: Gate Web3 Wallet for active trading and easy access to DeFi applications on the Mavryk ecosystem

- Cold Storage Plan: For long-term holdings exceeding $1,000, consider hardware wallet solutions with offline key storage

- Security Precautions: Never share private keys or recovery phrases, verify all transaction addresses carefully, and be wary of phishing attempts targeting Mavryk Network users

V. MVRK Potential Risks and Challenges

MVRK Market Risks

- High Volatility: The token has experienced a 73.89% decline over the past year, indicating significant price volatility that may continue

- Limited Liquidity: With trading volume of only $11,651.55 in 24 hours and presence on only one exchange, liquidity constraints may lead to higher slippage and difficulty executing large orders

- Low Market Capitalization: At a market cap of approximately $1.48 million and ranking #2243, MVRK faces substantial competition from more established blockchain projects

MVRK Regulatory Risks

- RWA Tokenization Regulations: The tokenization of real estate assets worth over $10 billion may face evolving regulatory scrutiny in different jurisdictions, potentially impacting project execution

- Securities Classification: Luxury real estate tokenization projects like Ritz-Carlton and Keturah Reserve may be subject to securities laws, affecting token holder rights and project structure

- Compliance Requirements: As Mavryk Network works with regulated partners and institutional asset managers, changes in compliance standards could affect operational costs and timelines

MVRK Technical Risks

- Network Maturity: As a next-generation Layer-1 blockchain, Mavryk Network may face technical challenges in scaling to support $10 billion+ in tokenized assets

- Smart Contract Vulnerabilities: RWA and DeFi applications built on Mavryk infrastructure could contain undiscovered security flaws that may lead to asset losses

- Adoption Uncertainty: The success of the platform depends on continued partnership development and institutional adoption, which remains uncertain given the early stage of the ecosystem

VI. Conclusion and Action Recommendations

MVRK Investment Value Assessment

Mavryk Network presents an interesting opportunity in the emerging RWA tokenization sector, particularly given its partnership with MultiBank Group and MAG for tokenizing over $10 billion in luxury real estate. However, the token faces significant challenges, including a 73.89% price decline over the past year, limited liquidity with only $11,651.55 in daily trading volume, and a small market capitalization of $1.48 million. The low circulating supply of 5.62% suggests potential for future token unlocks that could create selling pressure. While the long-term value proposition tied to real-world asset tokenization is compelling, short-term risks include continued price volatility, regulatory uncertainty, and technical execution challenges.

MVRK Investment Recommendations

✅ Beginners: Wait for clearer signs of ecosystem development and increased liquidity before investing. If interested, allocate no more than 1-2% of your crypto portfolio and use dollar-cost averaging to minimize timing risk ✅ Experienced Investors: Consider small speculative positions (3-5% of crypto portfolio) with a focus on monitoring partnership announcements and real estate tokenization milestones. Use technical analysis to identify favorable entry points during price corrections ✅ Institutional Investors: Conduct thorough due diligence on Mavryk Network's technology infrastructure, regulatory compliance framework, and partnership agreements. Consider strategic positions with appropriate risk management protocols and active monitoring of ecosystem development

MVRK Trading Participation Methods

- Spot Trading on Gate.com: Purchase MVRK through the MVRK/USDT trading pair on Gate.com, currently the primary exchange supporting the token

- Dollar-Cost Averaging: Establish a systematic investment plan to accumulate MVRK tokens over time, reducing the impact of price volatility

- Ecosystem Participation: Explore DeFi applications and RWA tokenization opportunities within the Mavryk Network ecosystem once they become available, potentially enhancing token utility and returns

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is MVRK? What are its uses and value?

MVRK is the native token of Mavryk, a Layer-1 blockchain specializing in real-world asset tokenization. It's used for gas fees, staking, and lending collateral, facilitating DeFi integration and RWA ecosystem development with significant institutional backing.

What is MVRK's historical price trend? What were the highest and lowest points in the past?

MVRK reached its all-time high of $0.4972 and all-time low of $0.01889. Currently trading 91.78% below the peak, showing significant volatility typical of emerging blockchain projects with substantial recovery potential ahead.

What are the main factors affecting MVRK price?

MVRK price is primarily influenced by supply and demand dynamics, market sentiment driven by news and social media, regulatory developments including policy changes, institutional adoption rates, macroeconomic trends such as inflation and interest rates, and overall cryptocurrency market conditions.

How to predict MVRK price? What are the analysis methods?

MVRK price prediction uses technical analysis (trend lines, moving averages, K-line charts, RSI indicators) and fundamental analysis (market cap, trading volume). Combine these tools to assess price trends and market momentum.

What are MVRK's future price prospects? What do experts think?

MVRK is projected to grow significantly, supported by expert analysis of its Layer-1 blockchain and metaverse market position. Current market trends and industry fundamentals support optimistic price forecasts for long-term appreciation potential.

What are the main risks to consider when investing in MVRK?

Key risks include market volatility, potential price manipulation due to smaller market cap, regulatory uncertainty around blockchain technology, and smart contract security vulnerabilities. These factors may impact investment returns.

What are the advantages and disadvantages of MVRK compared to similar assets?

MVRK token enhances asset liquidity effectively, enabling easier access for retail investors. However, competition in RWA space is intense, with market sentiment fluctuating significantly. Success depends on securing credible asset resources.

Where can I buy and trade MVRK?

MVRK tokens can be purchased and traded on major centralized exchanges. The most active trading pair is MVRK/USDT, offering high liquidity and trading volume for convenient transactions.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top 12 DeFi Protocols

How to Create an NFT and Maximize Profits in Today’s Market Conditions

GetAgent: Advanced AI Trading Assistant vs Traditional Trading Bots

Is NFT Dead? A Guide to NFT Use Cases

What Is an Airdrop in Cryptocurrency?