2026 OWN Price Prediction: Expert Analysis and Market Forecast for the Upcoming Year

Introduction: OWN's Market Position and Investment Value

Otherworld (OWN), positioned as a Web3 social protocol that bridges traditional social media features with digital asset ownership, has been developing its decentralized content ecosystem since its launch in 2024. As of 2026, OWN maintains a market capitalization of approximately $1.06 million, with a circulating supply of around 35.34 million tokens, and the price hovering near $0.02986. This asset, which integrates entertainment intellectual property rights with social engagement through immersive experiences like webcomics and interactive NFT collections, is establishing its presence in the Web3 social infrastructure space.

This article will comprehensively analyze OWN's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. OWN Price History Review and Current Market Status

OWN Historical Price Evolution Trajectory

- June 2024: OWN launched on Gate.com with an initial offering price of $0.1, establishing its entry point in the Web3 social protocol market

- June 27, 2024: Price reached an all-time low of $0.01, representing a significant decline from the launch price during the early trading period

- January 16, 2025: OWN achieved its all-time high of $2.33244, marking a substantial appreciation from its historical low and demonstrating strong market momentum during this period

- 2025-2026: Following the all-time high, the token entered a correction phase, with price declining as market conditions adjusted

OWN Current Market Performance

As of February 3, 2026, OWN is trading at $0.02986, reflecting relatively stable short-term price action. Over the past hour, the token has shown a modest increase of 0.028%, with the price ranging between $0.02975 and $0.03004 in the 24-hour period. The 24-hour trading volume stands at approximately $20,360, indicating moderate market activity for this Web3 social protocol token.

Looking at broader timeframes, OWN has experienced notable volatility. The 7-day performance shows a decline of 43.4%, suggesting recent selling pressure or market repositioning. However, the 30-day trend presents a contrasting picture with an 18.3% gain, indicating some recovery momentum in the medium term. The 1-year performance reflects an 89.42% decrease from price levels a year ago, which aligns with the token's journey from its all-time high in January 2025.

OWN's market capitalization currently stands at approximately $1.06 million, with 35.34 million tokens in circulation out of a maximum supply of 1 billion tokens. This represents a circulation ratio of 3.53%. The fully diluted market cap is calculated at $29.86 million. The token holds a market dominance of 0.0010%, positioning it as a relatively small-cap asset within the broader cryptocurrency ecosystem. The current market cap to fully diluted valuation ratio of 3.53% suggests significant potential token supply yet to enter circulation.

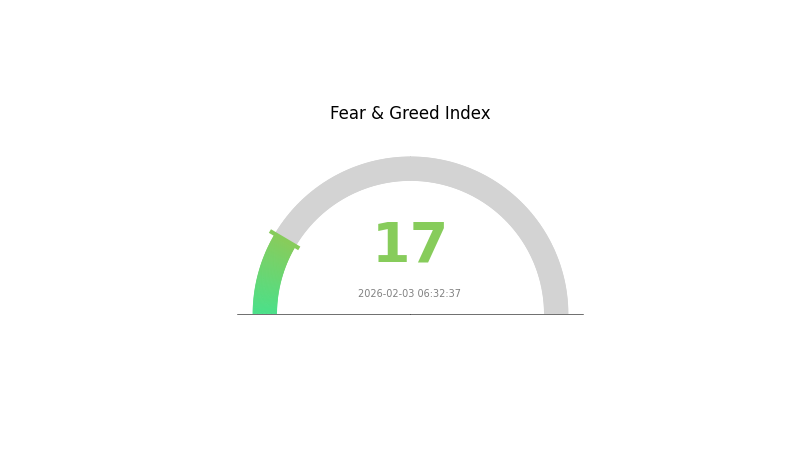

The crypto market sentiment index currently registers at 17, indicating an "Extreme Fear" environment, which typically characterizes periods of heightened caution among market participants. OWN has established 119 token holders and maintains trading availability on Gate.com, providing liquidity for market participants interested in this Web3 social protocol project.

Click to view the current OWN market price

OWN Market Sentiment Indicator

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 17. This exceptionally low sentiment suggests investors are highly pessimistic about market conditions. Extreme fear periods typically present contrarian opportunities for long-term investors, as panic selling often creates entry points. However, caution is warranted as further downside risk remains possible. Monitor key support levels and macroeconomic indicators closely. Such extreme readings historically precede significant market reversals, making risk management essential during this volatile period.

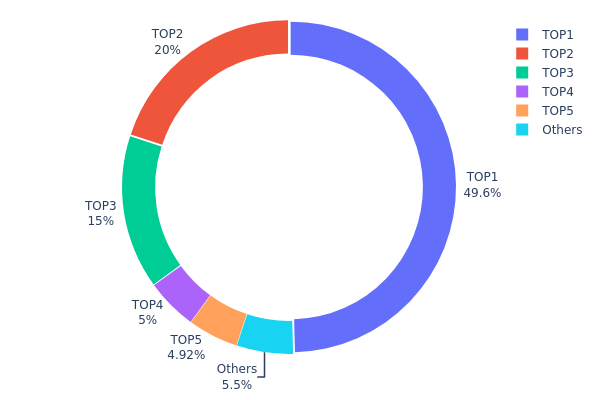

OWN Holding Distribution

The holding distribution chart illustrates the concentration of token ownership across different wallet addresses, serving as a critical indicator of decentralization and market structure. By analyzing the percentage of total supply held by top addresses, investors can assess potential risks related to price manipulation, liquidity constraints, and overall ecosystem health.

According to the current data, OWN exhibits a highly concentrated holding pattern. The top address controls 495,833.33K tokens, representing 49.58% of the total supply, while the second-largest holder possesses 20.00% (200,000.00K tokens). The top five addresses collectively hold 94.49% of the circulating supply, leaving only 5.51% distributed among all other market participants. This extreme concentration suggests that OWN's token distribution is significantly centralized, potentially exposing the market to substantial volatility risks.

Such a concentrated holding structure presents several implications for market dynamics. The dominant position of the largest holders grants them considerable influence over price movements, as large-scale transactions from these addresses could trigger significant market fluctuations. This concentration may deter institutional investors who prioritize liquidity and decentralization, while simultaneously creating vulnerability to coordinated selling pressure. The limited token distribution among smaller holders indicates that the project has not achieved broad-based adoption, which could impact long-term price stability and organic growth potential.

Click to view the current OWN Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xbe86...e4c934 | 495833.33K | 49.58% |

| 2 | 0xedd1...a5683a | 200000.00K | 20.00% |

| 3 | 0x46d6...51c7a6 | 150000.00K | 15.00% |

| 4 | 0x6b51...dfc567 | 50000.00K | 5.00% |

| 5 | 0x6a2d...d7482e | 49156.67K | 4.91% |

| - | Others | 55010.00K | 5.51% |

II. Core Factors Influencing OWN's Future Price

Macroeconomic Environment

-

Monetary Policy Impact: Economic indicators and central bank policies play a significant role in shaping market conditions. Changes in monetary stance can affect liquidity flows into digital assets, potentially influencing OWN's price trajectory.

-

Market Liquidity Dynamics: Market liquidity conditions remain a critical factor. During periods of tightening liquidity or shifts in investment preferences, high-growth assets may experience price adjustments as capital reallocates across different market segments.

-

Geopolitical Factors: Geopolitical events contribute to market volatility and investor sentiment. International developments can create uncertainty that affects risk appetite across digital asset markets, including OWN.

Market Valuation and Capital Flows

-

Valuation Considerations: Growth-oriented projects may accumulate elevated valuations during bullish phases. Market participants should remain aware that valuation levels can influence price movements, particularly during periods of style rotation or capital reallocation.

-

US Dollar Dynamics: The US Dollar Index serves as a reference point for global market conditions. Currency strength variations can indirectly affect digital asset pricing through their impact on international capital flows and investment positioning.

III. 2026-2031 OWN Price Forecast

2026 Outlook

- Conservative estimate: $0.01785 - $0.02975

- Neutral estimate: Around $0.02975

- Optimistic estimate: Up to $0.04106 (contingent on favorable market conditions and project development milestones)

2027-2029 Mid-term Outlook

- Market stage expectation: The token may enter a gradual growth phase as the project matures and broader crypto market conditions potentially improve

- Price range forecast:

- 2027: $0.03328 - $0.05275 (approximately 18% increase from 2026 average)

- 2028: $0.04187 - $0.06303 (approximately 47% increase from 2026 average)

- 2029: $0.03106 - $0.07122 (approximately 79% increase from 2026 average)

- Key catalysts: Project ecosystem expansion, technological upgrades, strategic partnerships, and overall cryptocurrency market sentiment

2030-2031 Long-term Outlook

- Baseline scenario: $0.04617 - $0.07424 (assuming steady project development and stable market conditions)

- Optimistic scenario: $0.06239 - $0.07424 in 2030 (approximately 108% increase from 2026 average, driven by significant adoption growth)

- Extended growth scenario: $0.0485 - $0.07105 in 2031 (approximately 128% increase from 2026 average, subject to sustained ecosystem development and favorable regulatory environment)

- February 3, 2026: OWN trading within the early-stage price range as the project continues its development trajectory

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.04106 | 0.02975 | 0.01785 | 0 |

| 2027 | 0.05275 | 0.0354 | 0.03328 | 18 |

| 2028 | 0.06303 | 0.04408 | 0.04187 | 47 |

| 2029 | 0.07122 | 0.05355 | 0.03106 | 79 |

| 2030 | 0.07424 | 0.06239 | 0.04617 | 108 |

| 2031 | 0.07105 | 0.06832 | 0.0485 | 128 |

IV. OWN Professional Investment Strategy and Risk Management

OWN Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Investors who believe in Web3 social protocol development and digital asset ownership models

- Operational Suggestions:

- Consider accumulating positions during market corrections, given the 43.4% decline over the past 7 days

- Monitor project development milestones related to IP partnerships and content releases

- Utilize secure storage solutions like Gate Web3 Wallet for asset custody

(II) Active Trading Strategy

- Technical Analysis Tools:

- Price Trend Monitoring: Track 24-hour price movements (current range: 0.02975-0.03004) to identify entry and exit points

- Volume Analysis: Monitor 24-hour trading volume of approximately 20,360 USD to assess market liquidity

- Swing Trading Key Points:

- Consider the high volatility evidenced by the 89.42% decline from its historical high of 2.33244

- Note the 18.3% monthly gain as potential momentum indicator for short-term opportunities

OWN Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: Up to 7-10% of crypto portfolio with active monitoring

(II) Risk Hedging Solutions

- Portfolio Diversification: Allocate across multiple Web3 and social protocol tokens to reduce single-asset exposure

- Position Sizing: Given the low market cap of approximately 1.05 million USD, limit individual position size to manage liquidity risk

(III) Secure Storage Solutions

- Web3 Wallet Recommendation: Gate Web3 Wallet for convenient trading and secure asset management

- Cold Storage Option: For long-term holdings, consider hardware wallet solutions with proper backup procedures

- Security Considerations: Be aware of smart contract risks associated with the ERC20 token standard on Ethereum, and verify the contract address (0x2d81f9460bd21e8578350a4f06e62848ed4bb27e) before transactions

V. OWN Potential Risks and Challenges

OWN Market Risks

- High Volatility: The token has experienced an 89.42% decline from its historical high, indicating substantial price volatility

- Low Liquidity: With a 24-hour trading volume of approximately 20,360 USD and ranking at 2472, liquidity may be limited during market stress

- Low Circulation Ratio: Only 3.53% of total supply is currently circulating, creating potential for significant dilution

OWN Regulatory Risks

- Social Protocol Regulations: Web3 social platforms may face evolving regulatory scrutiny regarding content moderation and user data management

- Digital Asset Classification: Potential regulatory changes regarding NFTs and digital collectibles could impact the project's core offerings

- IP Licensing Compliance: The project's reliance on entertainment industry IP rights may face legal and regulatory challenges across different jurisdictions

OWN Technical Risks

- Smart Contract Vulnerabilities: As an ERC20 token, exposure to potential smart contract exploits or bugs on the Ethereum network

- Platform Development Risk: The success of "Solo Leveling: Unlimited" and future content offerings depends on technical execution and user adoption

- Network Dependency: Reliance on Ethereum network performance and gas fees may impact user experience and adoption rates

VI. Conclusion and Action Recommendations

OWN Investment Value Assessment

Otherworld (OWN) represents an innovative approach to combining Web3 social protocols with entertainment IP, targeting the intersection of social engagement and digital asset ownership. While the project demonstrates potential in the content-driven social ecosystem space, investors should carefully consider the significant price decline from historical highs, low market capitalization, and early-stage development risks. The 18.3% monthly gain suggests some renewed interest, but the limited liquidity and low circulation ratio present substantial volatility risks.

OWN Investment Recommendations

✅ Beginners: Consider waiting for clearer project milestones and increased market stability before entering; if interested, allocate only minimal portfolio percentage (under 1%) as a speculative position ✅ Experienced Investors: May consider small positions during price dips as a high-risk, high-reward opportunity, while closely monitoring project development and partnership announcements ✅ Institutional Investors: Conduct thorough due diligence on IP licensing agreements and platform user metrics; consider strategic positions aligned with broader Web3 social protocol investment thesis

OWN Trading Participation Methods

- Spot Trading: Available on Gate.com with OWN trading pairs for direct purchase and sale

- Research and Monitoring: Follow project updates through official channels (https://otherworld.network/) and social media (https://x.com/own_protocol)

- Secure Storage: Transfer holdings to Gate Web3 Wallet for secure asset management after purchase

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is OWN token? What are its uses and application scenarios?

OWN is an innovative cryptocurrency with broad market potential and unique application scenarios. It supports blockchain platform functionality and services, featuring distinctive characteristics that attract specific communities and drive ecosystem growth.

What are the main factors affecting OWN price?

OWN price is primarily influenced by market demand and supply dynamics, ecosystem adoption rates, trading volume, Bitcoin market trends, and overall crypto market sentiment. Regulatory developments and project developments also significantly impact price movements.

How to forecast OWN token price? What are the analysis methods?

Analyze OWN price through technical analysis(support/resistance levels,trend indicators),fundamental analysis(project developments,adoption metrics),and market sentiment analysis(social media,community activity). Combine on-chain metrics with trading volume trends for comprehensive forecasting.

What is the historical price performance of OWN tokens?

OWN tokens have experienced significant price retracement of -98.69% from their all-time high. Based on current market trends, the price is predicted to reach $0.1259 by 2027, offering potential recovery opportunities for long-term holders.

What are the risks to be aware of when investing in OWN tokens?

OWN token investments carry market volatility risks, regulatory uncertainty, and project execution risks. Crypto markets are highly speculative with rapid price fluctuations. Additionally, regulatory frameworks remain evolving, which could impact token value and usability in different jurisdictions.

What are the advantages and disadvantages of OWN token compared to similar tokens?

OWN token's advantages include customization capabilities and leveraging existing blockchain security. Disadvantages include limited full control and dependency on platform stability. Its unique positioning offers differentiated value in the competitive token market.

How to Make Money on TikTok: 10 Real Ways to Earn in 2025

How does SocialFi empower creators: monetization, tokens, and community governance

What is SocialFi? Explore the future of decentralized social media in the field of crypto assets

Top 5 SocialFi projects to watch in 2025: the intersection of crypto assets and social interaction

What Is the Correlation Between Bitcoin's Social Media Followers and Its Environmental Impact?

DDD Token: Challenging medical insurance injustice with blockchain technology

What Is an Airdrop? Which Airdrop Opportunities Should You Target?

How to Get Free NFTs (5 Simple Methods)

7 Essential Indicators for Beginner Traders

FOMC and Bitcoin Prices: How U.S. Monetary Policy Influences BTC

Best Graphics Card for Mining: Top Next-Generation GPUs