2026 PAI Price Prediction: Expert Analysis and Market Forecast for the Next Three Years

Introduction: PAI's Market Position and Investment Value

ParallelAI (PAI), as a decentralized AI computational infrastructure project, has been dedicated to solving GPU bottlenecks through innovative parallel processing solutions since its launch in 2024. As of 2026, PAI has a market capitalization of approximately $1.27 million, with a circulating supply of 100 million tokens, and the price hovering around $0.01266. This asset, known as a "democratized AI computation platform," is playing an increasingly important role in optimizing global GPU utilization and reducing AI development costs.

This article will comprehensively analyze PAI's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. PAI Price History Review and Market Status

PAI Historical Price Evolution Trajectory

- 2024: Token launched on September 28, 2024 at $0.193, experiencing significant volatility in early trading phases

- December 2024: Price reached peak level of $1.518 on December 12, 2024, representing substantial appreciation from launch price

- 2025-2026: Market underwent correction phase, with price declining from peak levels toward lower price ranges

PAI Current Market Situation

As of February 3, 2026, PAI is trading at $0.01266, reflecting a decline of 6.56% over the past 24 hours. The token has experienced notable price movements across different timeframes, with a 1.95% decrease in the last hour and a 35.010% decline over the past week. Monthly performance shows a 60.67% reduction, while the annual change indicates a 94.76% decrease from prior levels.

The 24-hour trading range spans from $0.01189 to $0.01389, with total trading volume reaching $36,571.79. The token maintains a circulating supply of 100,000,000 PAI, which represents 100% of the maximum supply, resulting in a market capitalization of $1,266,000. The fully diluted market cap matches the current market capitalization at $1,266,000.

ParallelAI holds the market position of 2,355 with a market dominance of 0.000045%. The project has attracted 10,724 holders and is listed on 3 exchanges. The token recorded its lowest price point at $0.01189 on February 2, 2026. Current market sentiment indicators reflect cautious positioning among participants.

Click to view current PAI market price

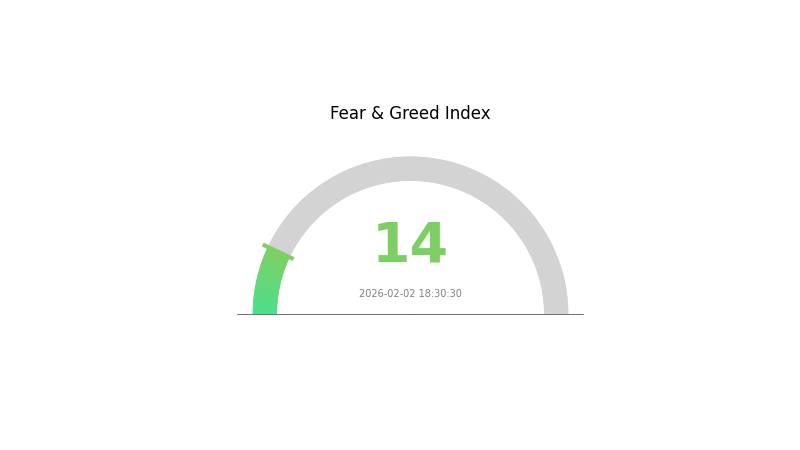

PAI Market Sentiment Index

2026-02-02 Fear and Greed Index: 14 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at just 14 points. This indicates widespread pessimism and risk aversion among investors. When fear reaches such extreme levels, it often presents contrarian opportunities for long-term investors who believe in the market's recovery potential. However, caution is advised as volatile price movements may continue. Monitor market developments closely and consider your risk tolerance before making investment decisions on Gate.com.

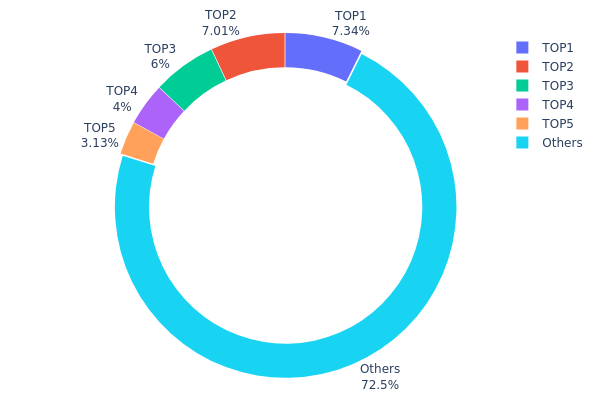

PAI Holding Distribution

According to the current on-chain data, PAI's holding distribution exhibits moderate concentration characteristics. The top 5 addresses collectively hold approximately 27.45% of the total supply, with the largest holder controlling 7.33% (7.337M tokens), followed by 7.00% and 6.00% respectively. The remaining 72.55% is distributed among other addresses, indicating a relatively decentralized ownership structure compared to many emerging tokens.

From a market structure perspective, this distribution pattern suggests a balanced ecosystem. While the top holders possess significant positions, none exceeds 10% of the total supply, which reduces the risk of single-entity manipulation. The gradual decline in holding percentages from top addresses (7.33% → 7.00% → 6.00% → 4.00% → 3.12%) demonstrates a healthy distribution curve rather than extreme concentration in a few wallets. This structure typically indicates strong community participation and reduces the potential impact of large-scale sell-offs on price stability.

The current holding distribution reflects PAI's relatively mature on-chain structure, with institutional investors, early participants, and retail holders maintaining a reasonable balance. This diversified ownership model enhances market liquidity while limiting excessive volatility caused by concentrated holdings. The majority stake held by "Others" (72.55%) further confirms the token's broad distribution base, which is generally favorable for long-term project development and price discovery mechanisms.

Click to view the current PAI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x24b8...320817 | 7337.36K | 7.33% |

| 2 | 0x3cc9...aecf18 | 7008.23K | 7.00% |

| 3 | 0xe94e...11e717 | 6000.00K | 6.00% |

| 4 | 0x39f6...a86a47 | 4000.00K | 4.00% |

| 5 | 0x9642...2f5d4e | 3128.71K | 3.12% |

| - | Others | 72525.70K | 72.55% |

II. Core Factors Influencing PAI's Future Price

Supply Mechanism

- Token Distribution and Circulation: The future price trajectory of PAI depends significantly on whether the project can deliver on its core commitments and continuously advance ecosystem development. The supply dynamics and token release schedule play a crucial role in determining market availability and potential price pressure.

- Historical Patterns: Supply-side elasticity has traditionally influenced price movements in similar projects, with controlled token releases generally supporting price stability during growth phases.

- Current Impact: The pace of ecosystem expansion and token circulation will be key determinants of near-term price action, as increased utility drives organic demand.

Institutional and Major Holder Dynamics

- Community Engagement: Community activity level remains a critical factor in PAI's valuation. Active participation in governance, development contributions, and social engagement directly correlate with sustained interest and adoption rates.

- User Adoption Rate: The growth trajectory of actual users engaging with PAI's ecosystem services will be instrumental in establishing fundamental value beyond speculative interest.

Macroeconomic Environment

- Overall Cryptocurrency Market Cycle: PAI's price movements will inevitably be influenced by broader crypto market sentiment and cyclical trends. Bull and bear market phases in the wider digital asset space create tailwinds or headwinds for individual tokens.

- Market Sentiment: Investor confidence, regulatory developments, and global economic conditions affecting risk appetite will impact PAI's performance relative to other digital assets.

Technical Development and Ecosystem Building

- Project Development Progress: The ability to fulfill technological roadmap milestones and deliver promised features will be essential for maintaining investor confidence and attracting new participants to the ecosystem.

- Market Competition: PAI's competitive positioning relative to similar projects will influence its market share and long-term viability. Differentiation through unique features or superior execution will be critical for sustained growth.

- Ecosystem Applications: The development and adoption of practical use cases within PAI's ecosystem will provide fundamental support for token demand, moving beyond purely speculative value propositions.

III. 2026-2031 PAI Price Forecast

2026 Outlook

- Conservative forecast: $0.00941 - $0.01255

- Neutral forecast: $0.01255 average price level

- Optimistic forecast: up to $0.01795 (contingent on favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market stage expectation: transitional phase with gradual price appreciation, characterized by moderate volatility and expanding use cases

- Price range forecast:

- 2027: $0.01174 - $0.01647, representing approximately 20% growth

- 2028: $0.01459 - $0.02157, with an expected 25% increase

- 2029: $0.00954 - $0.02751, projecting 47% growth potential

- Key catalysts: ecosystem development, strategic partnerships, and broader market recovery trends

2030-2031 Long-term Outlook

- Baseline scenario: $0.01618 - $0.03351 (assuming steady adoption and stable market conditions)

- Optimistic scenario: $0.02208 - $0.02944 range by 2031 (contingent on accelerated ecosystem growth)

- Transformative scenario: potential to reach $0.03351 by 2030 (under highly favorable regulatory environment and mass adoption)

- February 3, 2026: PAI trading within $0.00941 - $0.01795 range (early stage of projected growth trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01795 | 0.01255 | 0.00941 | 0 |

| 2027 | 0.01647 | 0.01525 | 0.01174 | 20 |

| 2028 | 0.02157 | 0.01586 | 0.01459 | 25 |

| 2029 | 0.02751 | 0.01871 | 0.00954 | 47 |

| 2030 | 0.03351 | 0.02311 | 0.01618 | 82 |

| 2031 | 0.02944 | 0.02831 | 0.02208 | 123 |

IV. PAI Professional Investment Strategies and Risk Management

PAI Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors who believe in the long-term potential of decentralized AI infrastructure and GPU resource optimization

- Operational Recommendations:

- Consider accumulating positions during market corrections when PAI trades significantly below its initial launch price

- Monitor the development progress of Parallel AI's parallel processing solutions and GPU optimization platform

- Store assets using Gate Web3 Wallet for secure long-term custody with multi-signature protection

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume which currently stands at approximately $36,571, identifying potential breakout opportunities

- Support and Resistance Levels: Track the 24-hour low at $0.01189 and high at $0.01389 for short-term trading ranges

- Swing Trading Key Points:

- Consider the significant price volatility, with PAI showing a 7-day decline of approximately 35% and 30-day decline of approximately 60%

- Implement strict stop-loss mechanisms given the substantial price fluctuations from the initial listing price of $0.193

PAI Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-10% of crypto portfolio allocation

- Professional Investors: Up to 15% with active hedging strategies

(II) Risk Hedging Solutions

- Position Sizing: Limit individual trade exposure to no more than 2-5% of total portfolio value

- Dollar-Cost Averaging: Implement systematic purchase plans to mitigate timing risks in volatile markets

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading access and integrated DeFi functionality

- Cold Storage Solution: Hardware wallet for long-term holdings exceeding $10,000 in value

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (0x13e4b8cffe704d3de6f19e52b201d92c21ec18bd on Ethereum) before transactions

V. PAI Potential Risks and Challenges

PAI Market Risks

- High Volatility: PAI has experienced substantial price declines, with a 1-year change showing a significant decrease, indicating elevated market volatility

- Limited Liquidity: With trading currently available on 3 exchanges and daily volume around $36,571, liquidity constraints may impact large transactions

- Market Sentiment Dependency: As an AI and blockchain integration project, PAI's price may be highly sensitive to broader AI sector trends and crypto market cycles

PAI Regulatory Risks

- AI Regulation Uncertainty: Evolving global regulations regarding artificial intelligence applications may impact decentralized AI platforms

- Securities Classification Concerns: Token-based AI infrastructure projects may face scrutiny regarding their classification as utility or security tokens

- Cross-border Compliance: Decentralized GPU resource networks may encounter varying regulatory requirements across different jurisdictions

PAI Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token, PAI relies on smart contract security, which could be subject to potential exploits or bugs

- Platform Development Risk: The success of PAI depends on the continued development and adoption of Parallel AI's parallel processing solutions

- Competition Risk: The decentralized computing and AI infrastructure space is becoming increasingly competitive, with multiple projects targeting GPU optimization

VI. Conclusion and Action Recommendations

PAI Investment Value Assessment

ParallelAI presents an innovative approach to addressing GPU bottlenecks in AI development through decentralized parallel processing solutions. The project's focus on optimizing GPU utilization for global developers addresses a genuine market need in the expanding AI sector. However, investors should carefully consider the substantial price volatility, with PAI trading significantly below its initial listing price, alongside the relatively limited liquidity and early-stage development status. The long-term value proposition hinges on successful platform development, ecosystem adoption, and the ability to effectively integrate AI and blockchain technologies. Short-term risks include continued price pressure, market volatility, and execution challenges inherent in building decentralized AI infrastructure.

PAI Investment Recommendations

✅ Beginners: Limit exposure to 1-2% of total crypto holdings, prioritize learning about the project fundamentals, and avoid trading during high volatility periods ✅ Experienced Investors: Consider strategic accumulation during market corrections, employ technical analysis for entry and exit points, and maintain disciplined risk management protocols ✅ Institutional Investors: Conduct thorough due diligence on platform development milestones, evaluate token economics and unlock schedules, and implement hedging strategies for volatility management

PAI Trading Participation Methods

- Spot Trading: Purchase PAI directly on Gate.com with fiat or cryptocurrency pairs for straightforward exposure

- Dollar-Cost Averaging: Establish systematic purchase schedules to reduce timing risk and average entry costs over extended periods

- Portfolio Integration: Include PAI as part of a diversified AI and decentralized infrastructure theme allocation, balancing with established projects

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is PAI coin? What are its uses and value?

PAI is a decentralized digital asset designed for mobile-based mining and peer-to-peer transactions. It functions as a medium of exchange within its ecosystem, with value driven by community adoption and network utility. The coin enables users to participate in a distributed financial network through accessible mobile applications.

How to predict PAI token price? What analysis methods are available?

Analyze PAI price through technical analysis (charts, indicators), fundamental analysis (project developments, adoption), market sentiment, trading volume trends, and blockchain metrics. Monitor ecosystem updates and compare with similar projects for comprehensive prediction insights.

What are the main factors affecting PAI price?

PAI price is primarily influenced by market sentiment, trading volume, ecosystem development, regulatory changes, and correlation with broader crypto market trends. Supply dynamics and institutional adoption also play significant roles in price movements.

What are the risks and uncertainties in PAI price prediction?

PAI price prediction faces market volatility, regulatory changes, and sentiment shifts. Prediction models rely on historical data which may not reflect future conditions. Network adoption rates, technology developments, and macro economic factors significantly impact accuracy. Always conduct thorough research before making decisions.

What are the differences between PAI and other cryptocurrencies?

PAI features mobile-based mining without specialized hardware, uses an efficient consensus mechanism, and offers broader accessibility compared to traditional cryptocurrencies. It provides lower energy consumption and faster transaction processing, making it more inclusive for everyday users seeking decentralized participation.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

What is SLAY: Understanding the Modern Slang Term and Its Cultural Impact

What is CAPS: A Comprehensive Guide to Capital Letters and Their Usage in Modern Communication

What is P00LS: A Comprehensive Guide to Decentralized Liquidity Pools and DeFi Innovation

What is FLT: A Comprehensive Guide to Fermat's Last Theorem and Its Revolutionary Impact on Mathematics

What is MAN: A Comprehensive Guide to Metropolitan Area Networks and Their Applications in Modern Business Infrastructure