2026 PSTAKE Price Prediction: Expert Analysis, Market Trends, and Future Outlook for Persistence's Native Token

Introduction: PSTAKE's Market Position and Investment Value

pSTAKE Finance (PSTAKE), as a liquid staking protocol for Proof-of-Stake (PoS) assets, has been facilitating liquidity solutions for staked assets since its launch in 2022. As of February 2026, PSTAKE maintains a market capitalization of approximately $172,300, with a circulating supply of 500,000,000 tokens, and the current price hovering around $0.0003446. This asset, recognized for its role in unlocking liquidity for staked PoS tokens, is playing an increasingly important role in bridging Cosmos ecosystem growth while enhancing liquidity and composability of Ethereum ecosystem assets.

This article will comprehensively analyze PSTAKE's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. PSTAKE Price History Review and Market Status

PSTAKE Historical Price Evolution Trajectory

- 2022: PSTAKE reached its peak price on March 7, with the price climbing to $1.21

- 2026: The token experienced significant downward pressure, with the price dropping to a historical low of $0.00027458 on February 3

PSTAKE Current Market Situation

As of February 9, 2026, PSTAKE is trading at $0.0003446, representing a decline of 3.27% over the past 24 hours. The token has experienced notable price fluctuations in recent periods, with a 2.35% decrease over the past 7 days and a substantial 69.01% decline over the past 30 days. The annual performance shows a significant decrease of 98.63% compared to one year ago.

The 24-hour trading volume stands at $23,177.69, with the price fluctuating between $0.0003026 and $0.000391 during this period. PSTAKE maintains a market capitalization of $172,300, with all 500 million tokens currently in circulation, representing 100% of the total supply. The fully diluted market cap equals the current market capitalization at $172,300. The token holds a market dominance of 0.0000068%.

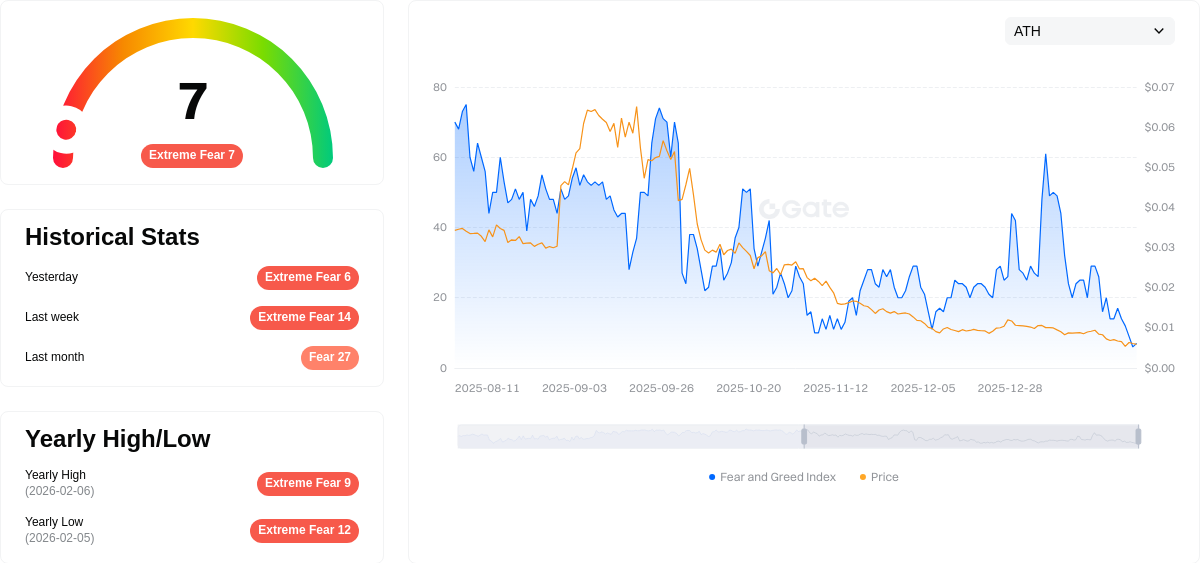

PSTAKE is currently listed on 4 exchanges and has approximately 14,205 token holders. According to market sentiment indicators, the current fear and greed index stands at 7, indicating an "Extreme Fear" sentiment in the market.

Click to view the current PSTAKE market price

PSTAKE Market Sentiment Indicator

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of just 7. This exceptionally low sentiment indicates widespread panic and pessimism among investors. When fear levels reach such extremes, it often signals potential market capitulation, presenting contrarian opportunities for risk-tolerant traders. Historical data suggests that markets tend to recover from such extreme fear conditions. However, investors should exercise caution and conduct thorough research before making investment decisions during volatile periods.

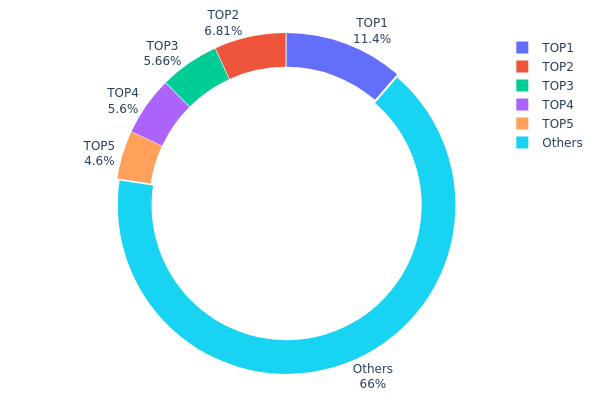

PSTAKE Token Holdings Distribution

According to the latest on-chain data, PSTAKE's token holdings distribution exhibits moderate concentration characteristics. The top five addresses collectively hold approximately 34.03% of the total circulating supply, with the largest holder at address 0x0d07...b492fe controlling 11.36% (56.83 million tokens). The second through fifth largest holders maintain relatively balanced positions ranging from 4.60% to 6.81%, demonstrating a relatively dispersed structure within the top-tier holders. Meanwhile, the remaining addresses collectively account for 65.97% of the supply, indicating a broad base of token distribution across the network.

This distribution pattern suggests PSTAKE maintains a moderately decentralized holding structure. While no single entity commands overwhelming market control, the combined influence of top holders remains significant enough to potentially impact short-term price movements during periods of coordinated selling or accumulation. The substantial portion held by smaller addresses (65.97%) provides a cushion against extreme volatility and indicates healthy community participation in the token ecosystem.

From a market structure perspective, this holdings distribution reflects a relatively stable on-chain architecture. The absence of extreme concentration (with the largest holder below 12%) reduces the risk of market manipulation, while the diverse holder base supports liquidity and trading depth. This balanced distribution typically correlates with more organic price discovery mechanisms and reduced susceptibility to single-entity driven price swings, contributing to a more mature and resilient market infrastructure for PSTAKE.

Click to view the current PSTAKE Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0d07...b492fe | 56831.33K | 11.36% |

| 2 | 0x9642...2f5d4e | 34051.53K | 6.81% |

| 3 | 0x91d4...c8debe | 28322.05K | 5.66% |

| 4 | 0xf89d...5eaa40 | 28014.89K | 5.60% |

| 5 | 0x5bdf...03f7ef | 23004.43K | 4.60% |

| - | Others | 329775.77K | 65.97% |

II. Core Factors Influencing PSTAKE's Future Price

Supply and Demand Dynamics

- Market Supply-Demand Balance: The price movement of PSTAKE is fundamentally driven by supply and demand dynamics in the cryptocurrency market. When demand increases relative to available supply, upward price pressure may emerge.

- Token Distribution: The allocation and distribution mechanisms of PSTAKE tokens can impact market liquidity and price stability.

- Current Market Phase: According to available data, PSTAKE experienced notable price movement, rising from a low point of 0.038 to 0.17 within 20 days, representing significant growth, and is currently in a consolidation phase.

Market Sentiment and Investor Confidence

- Social Media Influence: News coverage, social media discussions, and overall investor confidence collectively shape market sentiment, which plays a significant role in price predictions.

- Risk Appetite: During periods of widespread optimism, bullish sentiment may support price appreciation, while fear or negative news can lead to bearish trends.

- Sentiment Analysis: Market sentiment analysis, combined with on-chain indicators, remains an important tool for understanding price movements in both the near and long term.

Regulatory Environment

- Policy Developments: Regulatory dynamics, including ETF approvals and government policies, can significantly influence price trajectories.

- Institutional Framework: Changes in regulatory frameworks may affect institutional participation and overall market structure.

- Compliance Requirements: Evolving compliance standards in different jurisdictions can impact project operations and market accessibility.

Macroeconomic Trends

- Inflation and Interest Rates: Broader macroeconomic trends, such as inflation levels and interest rate movements, can affect investor appetite for digital assets.

- Economic Conditions: Overall economic conditions and monetary policy decisions by major central banks may influence capital flows into cryptocurrency markets.

- Investment Environment: The general investment climate and risk-on versus risk-off sentiment in traditional markets can have spillover effects on crypto asset prices.

Technology and Ecosystem Development

- Staking Infrastructure: As a staking-focused platform, pSTAKE Finance's technological capabilities and staking services represent core value propositions.

- Liquidity Expansion: The platform has expanded liquidity offerings, including opening DYDX liquidity, which may enhance ecosystem utility.

- DeFi Integration: The project's integration within the broader DeFi ecosystem and partnerships with other protocols can influence long-term value proposition.

- Platform Innovation: Continuous technological improvements and feature additions may contribute to user adoption and platform competitiveness.

III. 2026-2031 PSTAKE Price Forecast

2026 Outlook

- Conservative prediction: $0.00023 - $0.00035

- Neutral prediction: $0.00035 (average scenario)

- Optimistic prediction: $0.00046 (requires favorable market conditions and increased adoption)

2027-2029 Outlook

- Market stage expectation: Gradual growth phase with potential volatility as the project matures and expands its liquid staking ecosystem

- Price range forecast:

- 2027: $0.00026 - $0.00052, representing approximately 16% growth

- 2028: $0.00036 - $0.00062, showing continued upward momentum with 34% growth

- 2029: $0.0005 - $0.00056, maintaining stability with 57% cumulative growth

- Key catalysts: Enhanced protocol adoption, strategic partnerships within the liquid staking sector, and broader DeFi integration

2030-2031 Long-term Outlook

- Baseline scenario: $0.00045 - $0.00055 (assuming steady market development and consistent protocol utility)

- Optimistic scenario: $0.00056 - $0.00073 (contingent on accelerated ecosystem expansion and favorable regulatory environment)

- Transformative scenario: $0.0008 (under exceptional market conditions with significant institutional adoption and liquid staking sector expansion)

- 2026-02-09: PSTAKE trading within the $0.00023 - $0.00046 range (early stage of projected growth cycle)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00046 | 0.00035 | 0.00023 | 0 |

| 2027 | 0.00052 | 0.0004 | 0.00026 | 16 |

| 2028 | 0.00062 | 0.00046 | 0.00036 | 34 |

| 2029 | 0.00056 | 0.00054 | 0.0005 | 57 |

| 2030 | 0.0008 | 0.00055 | 0.00045 | 59 |

| 2031 | 0.00073 | 0.00068 | 0.00056 | 96 |

IV. PSTAKE Professional Investment Strategy and Risk Management

PSTAKE Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors interested in liquid staking solutions within the Cosmos and Ethereum ecosystems

- Operational Recommendations:

- Consider gradual accumulation during market downturns, given the significant 30-day decline of 69.01%

- Monitor the development progress of pSTAKE's cross-chain bridge technology and ecosystem partnerships

- Store assets using Gate Web3 Wallet for secure ERC-20 token management

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of $23,177.69 to identify potential trend reversals

- Support and Resistance Levels: Track the 24-hour range between $0.0003026 (low) and $0.000391 (high)

- Swing Trading Considerations:

- Exercise caution given the high volatility, with a 1-year decline of 98.63%

- Set tight stop-loss orders due to limited market depth and lower exchange availability (4 exchanges)

PSTAKE Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% allocation maximum

- Aggressive Investors: 2-3% allocation maximum

- Professional Investors: Up to 5% with active monitoring

(2) Risk Hedging Approaches

- Diversification: Balance PSTAKE holdings with other liquid staking tokens across different blockchain ecosystems

- Position Sizing: Limit exposure given the low market cap of $172,300 and minimal market dominance of 0.0000068%

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking operations

- Multi-signature Approach: Consider using multi-signature wallets for larger holdings

- Security Precautions: Verify contract address (0xfB5c6815cA3AC72Ce9F5006869AE67f18bF77006) on Etherscan before any transactions; be aware of potential smart contract risks in liquid staking protocols

V. PSTAKE Potential Risks and Challenges

PSTAKE Market Risks

- High Volatility: The token has experienced substantial declines, including a 69.01% drop over 30 days and 98.63% decline over one year

- Low Liquidity: With a market cap of only $172,300 and trading on 4 exchanges, liquidity constraints may impact larger transactions

- Price Proximity to All-Time Low: Current price of $0.0003446 is close to the all-time low of $0.00027458 recorded on February 3, 2026

PSTAKE Regulatory Risks

- Staking Service Oversight: Liquid staking protocols may face increased regulatory scrutiny as authorities examine DeFi staking services

- Cross-chain Operations: The protocol's cross-chain bridge functionality between Cosmos and Ethereum may attract regulatory attention

- Evolving Compliance Standards: Changes in cryptocurrency regulations across jurisdictions could impact protocol operations

PSTAKE Technical Risks

- Smart Contract Vulnerabilities: As an ERC-20 token operating across multiple chains, potential security flaws in smart contracts could pose risks

- Bridge Security: Cross-chain bridge mechanisms represent potential attack vectors that have historically been exploited in DeFi

- Competition: The liquid staking space is becoming increasingly competitive, which may impact PSTAKE's market position

VI. Conclusion and Action Recommendations

PSTAKE Investment Value Assessment

PSTAKE Finance operates in the growing liquid staking sector, offering solutions for Cosmos ecosystem assets. However, the significant price decline of 98.63% over the past year and proximity to all-time lows present considerable short-term risks. The protocol's limited market presence, with only $172,300 in market capitalization and 0.0000068% market dominance, indicates early-stage development. While the liquid staking narrative holds long-term potential as blockchain ecosystems mature, investors should approach PSTAKE with caution given current market conditions.

PSTAKE Investment Recommendations

✅ Beginners: Consider avoiding PSTAKE until establishing experience with more established cryptocurrencies; if interested, limit exposure to less than 1% of portfolio ✅ Experienced Investors: May allocate 1-3% for speculative purposes, focusing on liquid staking sector diversification rather than concentrated positions ✅ Institutional Investors: Conduct thorough due diligence on protocol security, team background, and competitive positioning before considering any allocation

PSTAKE Trading Participation Methods

- Spot Trading: Trade PSTAKE on Gate.com and verify availability across the 4 supporting exchanges

- DeFi Participation: Engage with pSTAKE protocol directly for liquid staking operations on supported networks

- Portfolio Integration: Consider PSTAKE as part of a diversified liquid staking strategy alongside other established protocols

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is PSTAKE? What are its uses and value?

PSTAKE is an ERC-20 token enabling holders to participate in protocol governance and network security through staking. It drives pSTAKE protocol development and provides decision-making power in ecosystem direction.

What is the historical price performance of PSTAKE?

PSTAKE reached an all-time high of $1.21 on March 6, 2022, and hit a low of $0.0006608 on January 28, 2026. As of February 8, 2026, it trades between $0.0006608 and $0.0008424.

What is the PSTAKE price prediction for 2024-2025?

Based on available data, pSTAKE Finance price predictions for 2024-2025 show potential upside with estimated 5% annual growth trajectory. Long-term outlook suggests gradual appreciation driven by ecosystem adoption, institutional interest, and broader market dynamics, though exact figures remain subject to market volatility and regulatory developments.

What is the difference between PSTAKE and other staking-related tokens?

PSTAKE enables institutions to earn on Bitcoin while maintaining full custody of assets, unlike other staking tokens requiring relinquished control. PSTAKE tokens drive governance and incentives within the protocol, emphasizing institutional trust and asset control.

What are the risks of buying and holding PSTAKE?

PSTAKE faces market volatility and potential price fluctuations. As a crypto asset, it's subject to regulatory changes, liquidity risks, and technology risks. Conduct thorough research before investing.

What is the future development prospect and roadmap of PSTAKE?

pSTAKE Finance aims to enhance Bitcoin staking through cross-chain solutions, delivering high yields via BTCFi strategies. Its roadmap focuses on expanding staking solutions, strengthening partnerships, and driving mainstream adoption in the crypto ecosystem.

How is the liquidity and trading volume of PSTAKE?

PSTAKE demonstrates solid market activity with a 24-hour trading volume of $354,599 and a circulating supply of 440 million tokens. The token maintains healthy liquidity across multiple platforms, supporting consistent price discovery and efficient order execution for traders.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

What is AIX9: A Comprehensive Guide to the Next Generation of Enterprise Computing Solutions

What is KLINK: A Comprehensive Guide to Understanding the Revolutionary Communication Platform

What is ART: A Comprehensive Guide to Understanding Assisted Reproductive Technology and Its Impact on Modern Fertility Treatment

What is KAR: A Comprehensive Guide to Knowledge and Reasoning Systems in Modern Technology

What is MART: A Comprehensive Guide to Multi-Agent Reinforcement Learning Through Time