2026 PVU Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Utility Tokens

Introduction: PVU's Market Position and Investment Value

PlantVsUndead (PVU), as a blockchain-based defense game platform combining NFT technology with gaming mechanics, has been developing its ecosystem since its launch in 2021. As of February 2026, PVU maintains a market capitalization of approximately $177,070, with a circulating supply of around 285 million tokens, and the price hovering around $0.0006213. This asset, positioned at the intersection of GameFi and NFT sectors, is exploring its role in the play-to-earn gaming landscape.

This article will comprehensively analyze PVU's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. PVU Price History Review and Market Status

PVU Historical Price Evolution Trajectory

- 2021: PlantVsUndead launched and reached a peak price level, with the token price experiencing significant growth momentum during the early development phase

- 2021-2025: The token entered a prolonged adjustment period, with price declining from elevated levels as market dynamics shifted

- 2025: Price reached a lower range as the token continued to navigate through market cycles and evolving project developments

PVU Current Market Situation

As of February 9, 2026, PVU is trading at $0.0006213, with a 24-hour trading volume of $9,538.37. The token demonstrates relatively modest trading activity in the current market environment.

The circulating supply stands at 285 million PVU tokens, representing 95% of the maximum supply of 300 million tokens. The current market capitalization is approximately $177,070, while the fully diluted market cap reaches $186,390. The token's market dominance remains minimal at 0.0000073% of the total cryptocurrency market.

Recent price performance shows mixed short-term trends, with a marginal increase of 0.0043% over the past hour, while the 7-day and 30-day periods reflect declines of 0.88% and 3.19% respectively. The one-year performance indicates a 44.1% decrease, reflecting broader market adjustments.

The token holder base comprises 747,071 addresses, suggesting a distributed ownership structure. PVU operates on the BSC (BNB Smart Chain) network, with its contract address verified on BscScan. The project combines tower defense gaming mechanics with NFT technology, positioning plants as digital assets within its ecosystem.

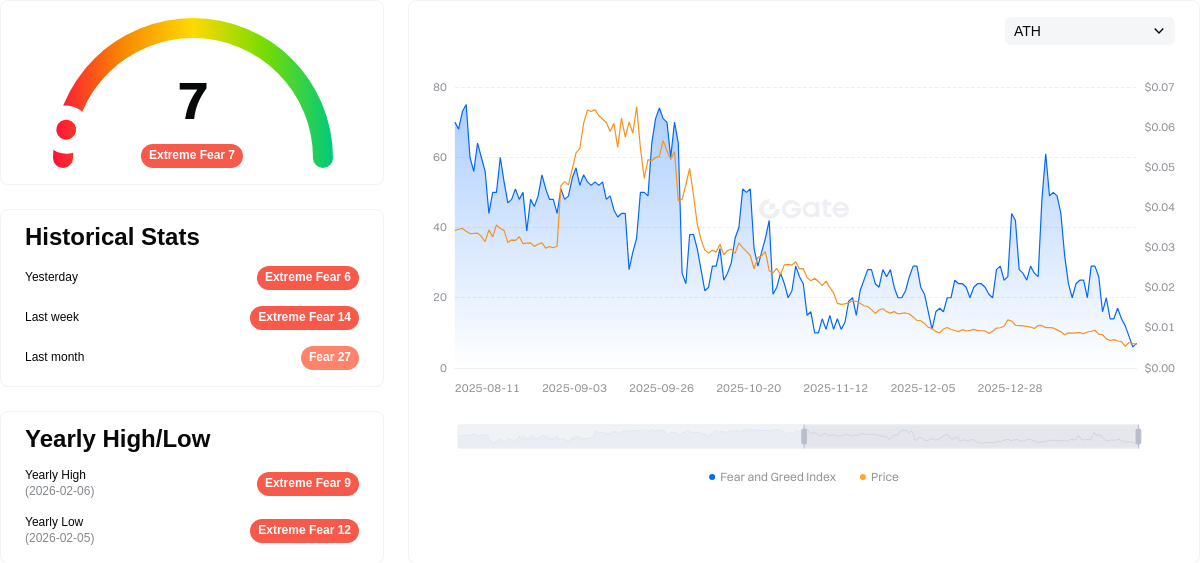

Current market sentiment indicators show an index reading of 7, corresponding to an extreme fear level in the broader cryptocurrency market environment.

Click to view current PVU market price

PVU Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of just 7. This exceptionally low sentiment indicates severe market pessimism and heightened investor anxiety. When fear reaches such extreme levels, it often signals potential capitulation among traders. Historical patterns suggest that periods of extreme fear can occasionally present contrarian opportunities for long-term investors, though caution remains essential. Market participants should closely monitor developments and maintain disciplined risk management strategies during this volatile period.

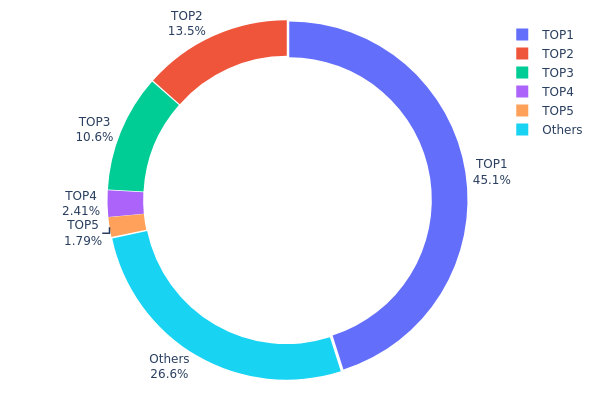

PVU Holding Distribution

The holding distribution chart visually represents the concentration of PVU tokens across different wallet addresses, providing crucial insights into the token's decentralization level and potential market risks. By analyzing the proportion of tokens held by top addresses versus smaller holders, investors can assess whether the asset is vulnerable to price manipulation or exhibits a healthier, more distributed ownership structure.

According to the latest on-chain data, PVU demonstrates a highly concentrated holding pattern. The top address controls 135,252.23K tokens, accounting for 45.08% of the total supply, while the second and third largest holders possess 13.50% and 10.61% respectively. Collectively, the top three addresses control approximately 69.19% of all circulating tokens, indicating significant centralization. The top five addresses combined hold 73.37% of the supply, leaving only 26.63% distributed among all other holders. This concentration level raises concerns about the token's vulnerability to large-scale sell-offs and potential price manipulation by major stakeholders.

Such a concentrated holding structure presents notable implications for market dynamics. The dominance of a few large addresses means that price movements could be heavily influenced by the trading decisions of these major holders, potentially resulting in increased volatility and reduced market stability. Additionally, this concentration level may discourage institutional investors and retail traders who prefer assets with more balanced distribution patterns. From a decentralization perspective, PVU's current holding structure deviates significantly from the ideal of broad token distribution, suggesting that governance decisions and market liquidity could be disproportionately controlled by a small group of participants.

Click to view the current PVU Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x7b16...6e5f5c | 135252.23K | 45.08% |

| 2 | 0x5107...dc0165 | 40516.19K | 13.50% |

| 3 | 0x0d07...b492fe | 31847.48K | 10.61% |

| 4 | 0xbcd7...f04057 | 7221.24K | 2.40% |

| 5 | 0x5fa6...b03238 | 5359.13K | 1.78% |

| - | Others | 79803.72K | 26.63% |

II. Core Factors Influencing PVU's Future Price

Supply Mechanism

- Market Demand and Competition Dynamics: PVU's price trajectory is significantly shaped by evolving market demand patterns and the competitive landscape within the Play-to-Earn gaming sector. The token's valuation responds to shifts in player engagement, competing project launches, and overall gaming industry trends.

- Historical Patterns: Historical price movements have demonstrated sensitivity to broader cryptocurrency market cycles and sector-specific developments. Past volatility reflects the interplay between speculative trading activity and fundamental project adoption metrics.

- Current Impact: Present market conditions suggest that supply-demand equilibrium remains a critical determinant, with price discovery influenced by active user growth rates and tokenomics adjustments.

Macro-Economic Environment

- Monetary Policy Influence: Global monetary policy shifts, particularly decisions by major central banks regarding interest rates and liquidity conditions, create ripple effects across risk asset classes including cryptocurrencies. Changes in the broader financial environment can alter investor appetite for tokens like PVU.

- Inflation Hedge Characteristics: While cryptocurrency assets are sometimes positioned as inflation hedges, PVU's performance in inflationary environments depends on multiple variables including its utility within the gaming ecosystem and broader market sentiment toward digital assets.

- Geopolitical Factors: International regulatory developments, cross-border payment dynamics, and regional policy stances toward blockchain gaming can introduce both opportunities and constraints for PVU's market performance.

Technical Development and Ecosystem Construction

- Innovation and Upgrades: Ongoing technological enhancements to the PlantVsUndead platform, including gameplay mechanics improvements and blockchain infrastructure optimizations, contribute to long-term value proposition. The pace and quality of development updates influence investor confidence and user retention.

- Ecosystem Applications: The expansion of use cases within the gaming environment, integration with decentralized finance protocols, and partnerships with complementary platforms shape PVU's utility and adoption potential. A robust ecosystem with diverse applications typically supports more resilient price fundamentals.

III. 2026-2031 PVU Price Forecast

2026 Outlook

- Conservative estimate: $0.00043 - $0.00062

- Neutral estimate: $0.00062 (average predicted price)

- Optimistic estimate: $0.00084 (requiring favorable market conditions and increased adoption)

2027-2029 Mid-term Outlook

- Market stage expectation: The token is anticipated to enter a gradual growth phase, with potential price appreciation driven by ecosystem development and broader market recovery

- Price range forecast:

- 2027: $0.00049 - $0.00099, representing approximately 17% growth

- 2028: $0.00078 - $0.00103, showing around 38% cumulative increase

- 2029: $0.00054 - $0.0011, with projected growth reaching 52%

- Key catalysts: Platform upgrades, user base expansion, and general cryptocurrency market sentiment improvements

2030-2031 Long-term Outlook

- Baseline scenario: $0.00056 - $0.00118 by 2030 (assuming steady ecosystem growth and stable market conditions)

- Optimistic scenario: $0.00076 - $0.00138 by 2031 (contingent on significant adoption milestones and favorable regulatory developments)

- Transformative scenario: Potential to exceed $0.00138 (requiring exceptional market conditions, mass adoption, and major partnership announcements)

- 2026-02-09: PVU trading within predicted range of $0.00043 - $0.00084 (establishing baseline for multi-year growth trajectory)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00084 | 0.00062 | 0.00043 | 0 |

| 2027 | 0.00099 | 0.00073 | 0.00049 | 17 |

| 2028 | 0.00103 | 0.00086 | 0.00078 | 38 |

| 2029 | 0.0011 | 0.00095 | 0.00054 | 52 |

| 2030 | 0.00118 | 0.00102 | 0.00056 | 64 |

| 2031 | 0.00138 | 0.0011 | 0.00076 | 77 |

IV. PVU Professional Investment Strategy and Risk Management

PVU Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Investors who believe in blockchain gaming ecosystems and NFT-based gaming models, with moderate to high risk tolerance

- Operational Recommendations:

- Consider PVU as a speculative gaming token allocation, limiting exposure to 1-3% of total crypto portfolio

- Monitor the project's game development progress and community engagement metrics regularly

- Gate Web3 Wallet offers secure storage solution with multi-chain support for BSC-based tokens like PVU

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: With 24-hour trading volume around $9,538, traders should monitor volume spikes that may indicate price movements

- Support and Resistance Levels: Current price around $0.0006213 is near historical lows, requiring careful position sizing

- Swing Trading Considerations:

- Given the low liquidity and high volatility, implement strict stop-loss orders

- Consider the 95% circulating supply ratio when evaluating potential dilution risks

PVU Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 0.5-1% of crypto portfolio

- Active Investors: 1-2% of crypto portfolio

- Professional Investors: 2-5% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Diversification: Avoid concentration in gaming tokens; maintain exposure across multiple sectors

- Position Sizing: Given PVU's ranking at 4100 and minimal market dominance (0.0000073%), limit individual position size

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet provides convenient access for active traders with BSC chain support

- Cold Storage Option: For long-term holdings, consider hardware wallet solutions with proper backup procedures

- Security Precautions: Never share private keys, enable two-factor authentication, and verify contract addresses (0x31471e0791fcdbe82fbf4c44943255e923f1b794 on BSC) before transactions

V. PVU Potential Risks and Challenges

PVU Market Risks

- Extreme Volatility: With a 44.1% decline over the past year and trading near all-time lows, PVU exhibits significant price instability

- Liquidity Concerns: Limited trading volume of approximately $9,538 in 24 hours may result in substantial slippage during large transactions

- Market Cap Concentration: With a circulating market cap of only $177,070, the token is susceptible to manipulation and rapid price swings

PVU Regulatory Risks

- Gaming Token Classification: Evolving regulations regarding blockchain-based gaming tokens may impact PVU's operational framework

- NFT Regulatory Uncertainty: As PVU combines gaming with NFT technology, changing legal frameworks around digital collectibles could affect the project

- Regional Restrictions: Certain jurisdictions may impose limitations on play-to-earn models, potentially reducing user base

PVU Technical Risks

- Smart Contract Vulnerabilities: As a BSC-based token, PVU relies on smart contract security; any exploits could result in significant losses

- Blockchain Dependency: The project's reliance on Binance Smart Chain means network congestion or technical issues could affect functionality

- Game Development Risks: The project's value proposition depends on continuous game development and user engagement maintenance

VI. Conclusion and Action Recommendations

PVU Investment Value Assessment

PVU presents as a highly speculative gaming token with significant challenges. Trading near historical lows ($0.0006213 vs. ATH of $24.73) with minimal market presence, the token carries substantial downside risks. While the blockchain gaming sector shows long-term potential, PVU's current metrics—including limited liquidity, declining price trends, and minimal market dominance—suggest investors should approach with extreme caution. The project's viability depends heavily on successful game development and community retention.

PVU Investment Recommendations

✅ Beginners: Avoid investment until demonstrable project progress and improved market metrics emerge; focus on established cryptocurrencies for initial portfolio building ✅ Experienced Investors: If considering exposure, limit allocation to under 1% of crypto portfolio as a speculative position; implement strict stop-losses ✅ Institutional Investors: Current risk-reward profile does not align with institutional investment criteria; monitor for fundamental improvements before consideration

PVU Trading Participation Methods

- Spot Trading: Available on Gate.com with PVU trading pairs; verify liquidity depth before executing large orders

- Wallet Storage: Utilize Gate Web3 Wallet for secure BSC token management with integrated trading capabilities

- Research and Monitoring: Follow official channels at https://plantvsundead.com/ and https://twitter.com/vs_nft for project updates before making investment decisions

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is PVU token and what are its uses?

PVU is the native utility token of Plant Vs Undead game ecosystem. It serves as in-game currency for purchasing resources, NFT assets, and conducting transactions within the game platform. PVU holders can stake tokens, participate in governance, and earn rewards through gameplay activities.

What is the historical price trend of PVU?

PVU has declined 52.75% over the past three months and 25.17% over six months. However, it showed a modest recovery of 0.31% in the last 30 days, indicating potential stabilization in recent trading activity.

What price is PVU expected to reach in 2024?

PVU is projected to experience significant growth in 2024 driven by increased demand in the chemical industry. However, future gains may face headwinds from policy controls and the adoption of new green technologies in the sector.

What are the main factors affecting PVU price?

PVU price is primarily driven by supply and demand dynamics, market sentiment, trading volume, adoption rate, macroeconomic conditions, and regulatory developments. These factors collectively determine price movements in the cryptocurrency market.

Is PVU a high-risk investment? What should I pay attention to?

PVU offers growth potential in the gaming crypto space. Monitor market volatility, diversify your portfolio, and invest only what you can afford to lose. Stay updated on project developments and community sentiment for informed decisions.

What advantages does PVU have compared to other gaming tokens?

PVU features limited total supply with distribution completed over 3 years, offering superior long-term investment value versus other gaming tokens. Its scarcity and allocation strategy provide significant market advantages.

How to predict PVU price trends through technical analysis?

Analyze PVU price trends using moving averages, RSI, and MACD indicators on historical data. Identify support and resistance levels, chart patterns, and volume trends to forecast price movements and trading signals.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

What is AIX9: A Comprehensive Guide to the Next Generation of Enterprise Computing Solutions

What is KLINK: A Comprehensive Guide to Understanding the Revolutionary Communication Platform

What is ART: A Comprehensive Guide to Understanding Assisted Reproductive Technology and Its Impact on Modern Fertility Treatment

What is KAR: A Comprehensive Guide to Knowledge and Reasoning Systems in Modern Technology

What is MART: A Comprehensive Guide to Multi-Agent Reinforcement Learning Through Time