2026 SCF Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Blockchain Adoption

Introduction: SCF's Market Position and Investment Value

Smoking Chicken Fish (SCF), as a meme token on the Solana blockchain, has established its presence in the cryptocurrency market since its launch in July 2024. As of February 2026, SCF maintains a market capitalization of approximately $1.11 million, with a circulating supply of around 999.79 million tokens, and its price hovering around $0.001115. This Solana-based community-driven asset is gradually building its niche within the broader meme token ecosystem.

This article provides a comprehensive analysis of SCF's price trajectory from 2026 to 2031, examining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic factors to offer professional price forecasts and practical investment strategies for investors. With current 24-hour trading volume at approximately $2,390 and over 21,000 holders, SCF represents an interesting case study in the evolving landscape of Solana-based meme tokens. The token has experienced significant price volatility since reaching a peak of $0.50 in October 2024, currently trading at a substantial discount from its historical high, which presents both challenges and potential opportunities for market participants.

I. SCF Price History Review and Current Market Status

SCF Historical Price Evolution Trajectory

- 2024: SCF launched on July 24, 2024, with an initial price of $0.1198. On October 7, 2024, the token reached a notable high of $0.5, representing substantial growth from its launch price.

- 2025: The market entered a correction phase, with the price declining significantly throughout the year. On December 19, 2025, SCF recorded a low of $0.000655, marking a considerable retracement from its previous high.

- 2026: As of early February 2026, the token has shown some recovery from its December 2025 low, though it remains significantly below its historical peak.

SCF Current Market Status

As of February 3, 2026, SCF is trading at $0.001115, representing a 24-hour decrease of 4.49%. The token has experienced notable volatility in recent periods, with a 7-day decline of 58.52% and a 30-day decrease of 35.97%. Over the past year, the price has fallen by 84.27% from its previous levels.

The token's 24-hour trading range shows a high of $0.0012339 and a low of $0.0010924, with total trading volume reaching $2,390.33. SCF maintains a circulating supply of approximately 999.79 million tokens out of a maximum supply of 999.95 million tokens, representing a circulation ratio of 99.98%.

The current market capitalization stands at approximately $1.11 million, with the fully diluted market cap closely aligned at $1.11 million due to the near-complete circulation of tokens. SCF holds a market dominance of 0.000040% and ranks at position 2445 in the broader cryptocurrency market. The token has attracted a holder base of 21,388 participants.

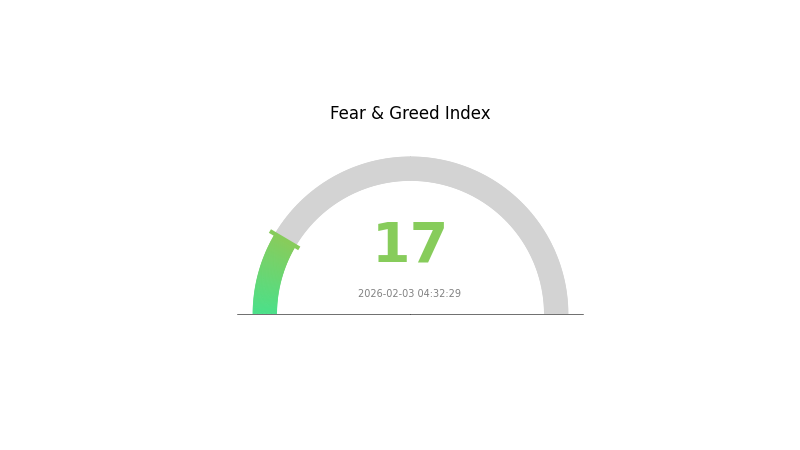

The current market sentiment index reflects extreme fear at 17, indicating heightened caution among market participants in the broader crypto ecosystem.

Click to view current SCF market price

SCF Market Sentiment Index

2026-02-03 Fear & Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is experiencing extreme fear with an SCF index reading of 17. This exceptionally low sentiment indicates investors are highly risk-averse, reflecting significant market anxiety and pessimistic outlook. Such extreme fear periods often present contrarian opportunities for long-term investors, as excessive pessimism may signal potential oversold conditions. However, caution remains warranted as market uncertainties persist. Traders should maintain disciplined risk management and avoid emotional decision-making during high volatility periods.

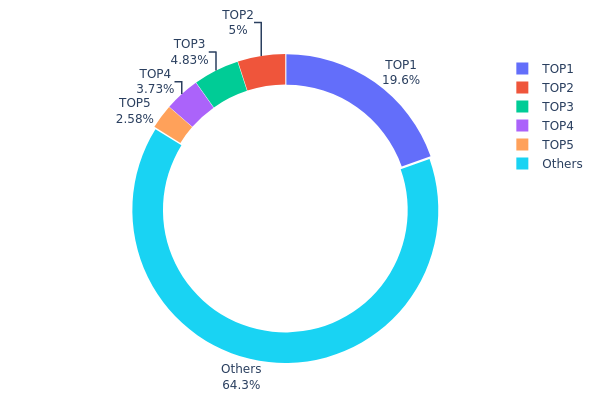

SCF Holding Distribution

The holding distribution chart reflects the concentration of token holdings across different wallet addresses on the blockchain, serving as a key indicator of market structure and decentralization levels. By analyzing the distribution patterns of top holders versus smaller participants, investors can assess potential risks related to price manipulation, market liquidity, and the overall health of the token ecosystem.

Based on the current data, SCF exhibits a moderately concentrated holding structure. The top address holds approximately 195.76 million tokens, accounting for 19.58% of the total supply, while the top five addresses collectively control 35.71% of all circulating tokens. This concentration level suggests that while no single entity exercises overwhelming dominance, a small group of major holders maintains significant influence over market dynamics. The remaining 64.29% distributed among other addresses indicates a relatively healthy level of decentralization, though the substantial holdings of top participants cannot be overlooked.

This distribution pattern carries notable implications for market behavior. The presence of large holders introduces potential volatility risks, as coordinated selling pressure from top addresses could trigger significant price movements. However, the relatively dispersed nature of the remaining 64.29% provides a stabilizing foundation that may absorb sudden shocks. From a structural perspective, SCF demonstrates characteristics of an emerging token transitioning toward broader distribution, though it has not yet achieved the fully decentralized profile typical of mature cryptocurrencies. Market participants should monitor any significant shifts in top holder positions, as redistribution trends could signal changing market sentiment or strategic repositioning by institutional players.

Click to view current SCF Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 5Q544f...pge4j1 | 195760.59K | 19.58% |

| 2 | DQRcqA...wdzN4c | 50032.92K | 5.00% |

| 3 | ASTyfS...g7iaJZ | 48311.02K | 4.83% |

| 4 | FDrWFx...as2aMK | 37296.79K | 3.73% |

| 5 | 5PAhQi...cnPRj5 | 25745.34K | 2.57% |

| - | Others | 642639.82K | 64.29% |

II. Core Factors Influencing SCF's Future Price

Supply Mechanism

- Supply Chain Finance Adoption: The expansion of supply chain finance (SCF) mechanisms directly impacts market liquidity and pricing dynamics. As more small and medium-sized enterprises (SMEs) gain access to financing through SCF platforms, demand for related financial instruments increases.

- Historical Patterns: Research indicates that supply chain finance implementation has historically improved operational efficiency and reduced financing constraints for participating enterprises, creating positive feedback loops in related markets.

- Current Impact: Growing institutional adoption of SCF frameworks is expected to enhance market depth and potentially stabilize price volatility through improved liquidity provision.

Institutional and Major Holder Dynamics

- Institutional Holdings: Financial institutions are increasingly integrating supply chain finance solutions into their service portfolios, with evidence showing enhanced total factor productivity for enterprises engaging in SCF activities.

- Enterprise Adoption: Companies implementing SCF mechanisms demonstrate improved investment rates and stronger supply chain relationships, according to empirical studies showing statistically significant positive effects on enterprise efficiency.

- National Policies: Regulatory frameworks continue evolving to support supply chain finance development, with governments exploring hybrid mechanisms that combine compliance and project-based approaches.

Macroeconomic Environment

- Monetary Policy Impact: Central bank policies regarding interest rates and credit availability significantly influence SCF market conditions. The current environment shows mixed signals, with some advanced economies maintaining cautious monetary stances.

- Inflation Hedge Attributes: Supply chain finance mechanisms demonstrate resilience during inflationary periods by facilitating continued business operations and maintaining liquidity flows within supply chains.

- Geopolitical Factors: International trade dynamics and supply chain restructuring efforts, particularly in response to global economic shifts, continue shaping the SCF landscape and associated market valuations.

Technology Development and Ecosystem Building

- Digital Platform Integration: Technology platforms utilizing blockchain and digital verification systems are enhancing transparency and traceability in SCF operations, improving efficiency and investor confidence.

- Automation and AI Applications: Advanced technologies are being deployed to streamline SCF processes, with automated verification and real-time tracking capabilities reducing operational friction and costs.

- Ecosystem Applications: The SCF ecosystem encompasses diverse participants including core enterprises, suppliers, clients, and financial institutions, creating network effects that strengthen as adoption increases. Research demonstrates that enterprises with more extensive SCF engagement and higher levels of supply chain relationship embedding achieve superior productivity outcomes.

III. 2026-2031 SCF Price Forecast

2026 Outlook

- Conservative forecast: $0.00059 - $0.00112

- Neutral forecast: $0.00112

- Optimistic forecast: $0.00127 (subject to favorable market conditions)

2027-2029 Outlook

- Market stage expectation: Progressive growth phase with gradual price appreciation as the project gains traction

- Price range forecast:

- 2027: $0.0008 - $0.00135

- 2028: $0.00075 - $0.00158

- 2029: $0.00138 - $0.00154

- Key catalysts: Steady market adoption, potential ecosystem developments, and increasing trading volume on platforms like Gate.com

2030-2031 Long-term Outlook

- Baseline scenario: $0.00139 - $0.00212 (assuming moderate market growth and sustained project development)

- Optimistic scenario: $0.00156 - $0.00216 (contingent on expanded utility and broader market acceptance)

- Transformational scenario: Prices may reach upper forecast levels if the project achieves significant milestones and benefits from favorable crypto market cycles

- 2026-02-03: SCF trading remains in early price discovery phase with potential for gradual appreciation over the forecast period

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00127 | 0.00112 | 0.00059 | 0 |

| 2027 | 0.00135 | 0.00119 | 0.0008 | 7 |

| 2028 | 0.00158 | 0.00127 | 0.00075 | 13 |

| 2029 | 0.00154 | 0.00142 | 0.00138 | 27 |

| 2030 | 0.00212 | 0.00148 | 0.00139 | 32 |

| 2031 | 0.00216 | 0.0018 | 0.00156 | 61 |

IV. SCF Professional Investment Strategy and Risk Management

SCF Investment Methodology

(I) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance who understand meme token volatility and can withstand significant price fluctuations

- Operational Recommendations:

- Consider dollar-cost averaging to mitigate entry timing risk, as SCF has demonstrated substantial volatility with a 58.52% decline over 7 days

- Establish clear exit thresholds based on your risk tolerance, considering the token's historical price range between $0.000655 and $0.5

- Storage Solution: Gate Web3 Wallet offers secure storage for Solana-based tokens with user-friendly interface and integrated security features

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume ($2,390) relative to market cap ($1.11M) to identify liquidity trends and potential breakout signals

- Price Action Analysis: Track key support levels around $0.0010924 (24H low) and resistance near $0.0012339 (24H high) for short-term positioning

- Swing Trading Key Points:

- Given the high volatility (4.49% daily decline, 58.52% weekly decline), establish strict stop-loss orders at 5-10% below entry points

- Monitor holder count (21,388) and on-chain activity for early signals of trend reversals or momentum shifts

SCF Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 0.5-1% of total crypto portfolio

- Aggressive Investors: 2-5% of total crypto portfolio

- Professional Investors: May allocate up to 5-10% with active hedging strategies

(II) Risk Hedging Solutions

- Diversification Strategy: Balance SCF allocation with more established cryptocurrencies and stablecoins to offset meme token volatility

- Position Sizing: Given the 84.27% decline over one year, limit individual position exposure and avoid concentration risk

(III) Secure Storage Solutions

- Non-Custodial Wallet Recommendation: Gate Web3 Wallet provides self-custody for Solana tokens with multi-layer security architecture

- Cold Storage Solution: For larger holdings, consider hardware wallet integration to minimize online exposure

- Security Precautions: Enable two-factor authentication, verify contract address (GiG7Hr61RVm4CSUxJmgiCoySFQtdiwxtqf64MsRppump) before transactions, and never share private keys or seed phrases

V. SCF Potential Risks and Challenges

SCF Market Risks

- Extreme Volatility: SCF has declined 58.52% over 7 days and 84.27% over one year, indicating substantial price instability characteristic of meme tokens

- Limited Liquidity: With 24-hour trading volume of approximately $2,390 against a market cap of $1.11 million, sudden price movements may occur during large trades

- Market Sentiment Dependency: As a meme token without fundamental utility drivers, price movements are heavily influenced by social media trends and community sentiment rather than intrinsic value

SCF Regulatory Risks

- Meme Token Classification: Regulatory frameworks for meme tokens remain unclear in many jurisdictions, potentially leading to trading restrictions or delisting requirements

- Market Manipulation Concerns: Lower liquidity meme tokens may face increased scrutiny regarding pump-and-dump schemes and coordinated trading activities

- Exchange Compliance: Changes in exchange listing policies could impact token accessibility and trading volume

SCF Technical Risks

- Smart Contract Vulnerability: While running on Solana blockchain, smart contract bugs or exploits could impact token functionality or holder balances

- Network Dependency: Token performance is tied to Solana network stability; any network outages or congestion could affect transaction processing

- Centralization Concerns: With a circulating supply of 99.98% of max supply, examine token distribution patterns to assess concentration risk among large holders

VI. Conclusion and Action Recommendations

SCF Investment Value Assessment

SCF represents a high-risk, speculative meme token running on the Solana blockchain with significant volatility characteristics. The token has experienced substantial price declines of 58.52% over 7 days and 84.27% over one year, indicating considerable downside risk. With a market cap of approximately $1.11 million and relatively low trading volume, liquidity constraints may amplify price movements. While the token maintains a holder base of 21,388 participants, investment should be approached with extreme caution given the lack of fundamental utility drivers and dependence on community sentiment. Long-term value proposition remains speculative, while short-term risks include continued volatility and potential further price erosion.

SCF Investment Recommendations

✅ Beginners: Avoid or allocate only minimal "educational" capital (less than 0.5% of portfolio) to understand meme token dynamics without significant financial exposure ✅ Experienced Investors: Consider small speculative positions (1-3% of crypto portfolio) only if comfortable with potential total loss and capable of active monitoring ✅ Institutional Investors: Exercise extreme caution; meme tokens typically fall outside institutional risk parameters due to volatility, limited liquidity, and regulatory uncertainty

SCF Trading Participation Methods

- Spot Trading: Purchase SCF through Gate.com spot markets with limit orders to control entry prices during volatile conditions

- Dollar-Cost Averaging: Spread purchases over multiple time periods to mitigate timing risk, though this does not eliminate downside exposure

- Risk-Defined Strategies: Set predetermined exit points both for profit-taking and loss limitation before entering positions

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What are the main factors influencing SCF price prediction?

SCF price is primarily influenced by community engagement, exchange expansion, and trading volume. Liquidity withdrawal, concentrated holdings, regulatory risks, and market demand are key factors affecting price movements.

How to use technical analysis methods to predict SCF price trends?

Technical analysis for SCF involves studying historical price patterns and trading volume. Key indicators include moving averages, RSI, and support/resistance levels. Monitor trend direction and breakout points to identify potential price movements.

What are the risks and limitations in SCF price prediction?

SCF price prediction faces credibility risks, regulatory uncertainties, and commodity price volatility. Market data limitations and model accuracy constraints also affect prediction reliability and outcomes.

How do market sentiment and news events affect SCF's price?

Market sentiment and news events significantly influence SCF pricing. Positive news increases investor demand, driving prices higher, while negative news typically causes price declines. Investor confidence and broader market trends are key factors determining SCF's price movement.

What are professional institutions' predictions for SCF's future price?

Professional institutions predict SCF's price will be influenced by supply dynamics, adoption trends, and market sentiment. While specific forecasts vary, analysts suggest monitoring tokenomics and broader market conditions for informed expectations.

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Top 5 Meme Coins to Invest in 2025: Risks and Rewards

Meme Coin Price Predictions for 2025:Factors Influencing Meme Coin Prices

Solana (SOL) : Low Fees, Memecoins, and the way to moon

Pepe Unchained: Pepe Meme Coin evolves into a Layer-2 ecosystem

MemeBox Price and Airdrop Guide 2025: What You Need to Know

What Is an Airdrop? Which Airdrop Opportunities Should You Target?

How to Get Free NFTs (5 Simple Methods)

7 Essential Indicators for Beginner Traders

FOMC and Bitcoin Prices: How U.S. Monetary Policy Influences BTC

Best Graphics Card for Mining: Top Next-Generation GPUs