2026 SKYA Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: SKYA's Market Position and Investment Value

Sekuya (SKYA), positioned as a community-driven gaming ecosystem within the anime epic fantasy universe, has been navigating the blockchain gaming sector since its launch in May 2024. As of February 05, 2026, SKYA maintains a market capitalization of approximately $552,804 with a circulating supply of around 403.21 million tokens, and the current price hovering near $0.001371. This gaming-focused digital asset, emerging from a Singapore-based video game company, is exploring its potential role in the evolving Web3 gaming landscape.

Despite experiencing notable price volatility since its all-time high of $0.085964 in December 2024, with a year-over-year decline of approximately 82.64%, SKYA continues to attract attention within the gaming and blockchain communities. The token's 24-hour trading volume of around $12,958 and presence on 2 exchanges reflect ongoing market interest, while its holder base of approximately 1,650 addresses demonstrates a developing community foundation.

This article provides a comprehensive analysis of SKYA's price trajectory from 2026 through 2031, examining historical patterns, market supply-demand dynamics, ecosystem development milestones, and broader macroeconomic conditions. Our research aims to equip investors with professional price forecasts and practical investment strategies for navigating the opportunities and risks associated with this gaming-sector digital asset. Given the project's early stage and the inherent volatility of blockchain gaming tokens, understanding these multifaceted factors becomes essential for informed decision-making in this emerging market segment.

I. SKYA Price History Review and Market Status

SKYA Historical Price Evolution Trajectory

- 2024: Token launched in May with an initial offering price of $0.02, experiencing significant volatility throughout the year. Price reached an all-time high of $0.085964 in December.

- 2025: Market entered a correction phase with substantial price decline from previous year's peak levels.

- 2026: Price continued downward movement, reaching a historical low of $0.0013 on February 4th.

SKYA Current Market Situation

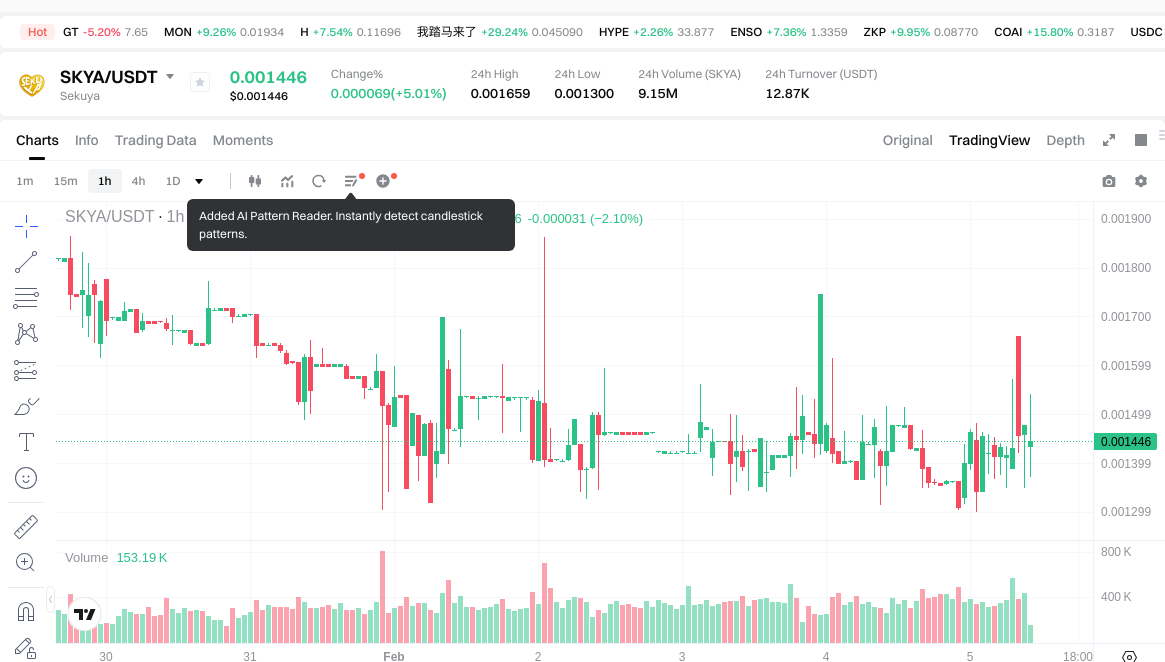

As of February 5th, 2026, SKYA is trading at $0.001371, representing a 12.05% increase over the past 24 hours with a trading volume of $12,958.50. The 24-hour price range spans from $0.0013 to $0.001659.

The token's market capitalization stands at $552,804.66 with a circulating supply of 403,212,732.75 SKYA tokens, representing 40.32% of the maximum supply of 1 billion tokens. The fully diluted market cap is $1,371,000.

Recent price trends show mixed performance across different timeframes: a 1.55% gain over the past hour, contrasted with declines of 15.67% over the past week, 28.12% over the past month, and 82.64% over the past year. The current price represents a 98.41% decline from the December 2024 peak.

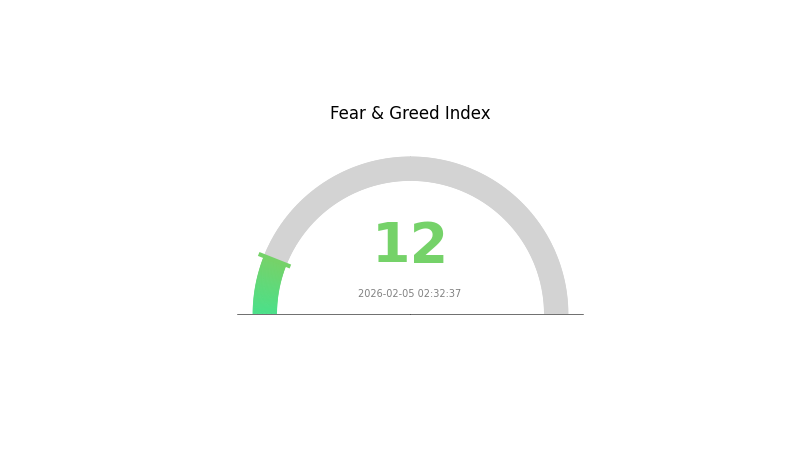

The cryptocurrency market sentiment index currently registers at 12, indicating extreme fear among market participants. SKYA holds a market dominance of 0.000053% and ranks 2969 among tracked cryptocurrencies.

Click to view current SKYA market price

SKYA Market Sentiment Indicator

2026-02-05 Fear and Greed Index: 12 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear conditions, with the index dropping to 12. This exceptionally low reading indicates severe market pessimism and heightened risk aversion among investors. Such extreme fear typically creates capitulation opportunities for contrarian investors who believe assets are oversold. Historically, these periods have preceded significant market recoveries. However, caution remains essential as fear-driven markets can persist. Traders should consider portfolio rebalancing opportunities while maintaining strict risk management protocols during this volatile period.

SKYA Holding Distribution

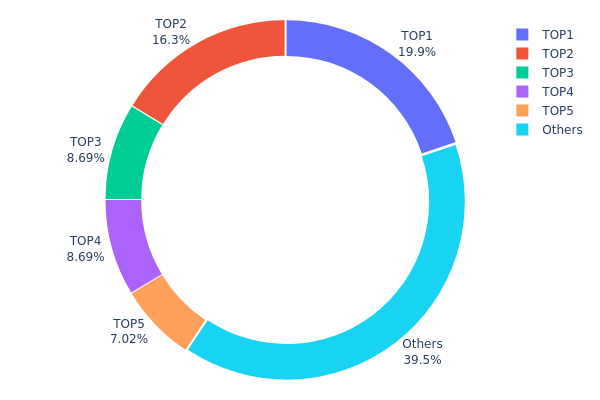

The holding distribution chart reveals the allocation of SKYA tokens across different wallet addresses, serving as a crucial indicator of decentralization and market structure. By analyzing the concentration of tokens among top holders, investors can assess potential risks related to price manipulation, liquidity depth, and overall market health. A more dispersed distribution typically signals healthier market dynamics, while excessive concentration may indicate vulnerability to large-scale sell-offs or coordinated market movements.

Based on the current data, SKYA exhibits a moderately concentrated holding pattern. The top holder controls 160,000K tokens (19.87%), followed by the second-largest address with 130,935.50K tokens (16.26%). The top five addresses collectively hold approximately 60.52% of the total supply, leaving 39.48% distributed among other participants. This concentration level, while not extreme, suggests that a relatively small group of entities maintains significant control over the token's circulating supply. Such distribution creates potential vulnerabilities, as coordinated actions by these major holders could substantially impact market liquidity and price stability.

From a market structure perspective, this holding pattern presents both opportunities and risks. The concentration among top addresses may provide price stability during volatile periods if these holders adopt long-term strategies. However, it simultaneously introduces heightened volatility risk should any major holder decide to liquidate their position. The 39.48% held by smaller addresses indicates some degree of retail participation and decentralization, which is positive for market resilience. Nevertheless, investors should remain cognizant that approximately three-fifths of the supply rests with a limited number of addresses, potentially affecting trading dynamics and susceptibility to whale-driven price movements.

Click to view current SKYA Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x277b...e5186c | 160000.00K | 19.87% |

| 2 | 0x7c90...288a40 | 130935.50K | 16.26% |

| 3 | 0x3dc9...0fa240 | 70000.00K | 8.69% |

| 4 | 0x6486...6fd8d8 | 70000.00K | 8.69% |

| 5 | 0x91dc...20dc92 | 56486.74K | 7.01% |

| - | Others | 317768.24K | 39.48% |

II. Core Factors Influencing SKYA's Future Price

Market Demand and Adoption Trends

- Demand Dynamics: SKYA's price outlook is significantly shaped by market demand levels. As adoption trends evolve, increased interest from both retail and institutional participants could provide upward momentum for the token's valuation.

- Historical Patterns: Cryptocurrency markets have demonstrated that tokens with growing user bases and expanding use cases tend to experience sustained price appreciation over time.

- Current Impact: The current market environment suggests that tokens capable of demonstrating real-world utility and attracting consistent trading volume are better positioned for potential price growth.

Market Structure and Liquidity

- Liquidity Considerations: The overall cryptocurrency market trend plays a crucial role in SKYA's performance. Sufficient liquidity across trading platforms is essential for maintaining stable price action and reducing the risk of excessive volatility.

- Exchange Order Book Depth: Projects that cannot absorb token supply through exchange order books without disrupting price movements may face challenges in maintaining investor confidence.

- Market Maturity: As the crypto market continues to evolve, tokens with deeper liquidity pools and stronger market infrastructure tend to exhibit more sustainable price trajectories.

Regulatory Environment

- Policy Framework: The regulatory landscape surrounding cryptocurrencies continues to develop globally. Changes in regulatory policies can have immediate and significant impacts on market sentiment and token valuations.

- Compliance Considerations: Projects that proactively address regulatory requirements and maintain transparent operations may be better positioned to navigate evolving compliance standards.

- Regional Variations: Different jurisdictions adopt varying approaches to cryptocurrency regulation, creating a complex environment that can influence both institutional participation and retail adoption.

Broader Economic Factors

- Macroeconomic Conditions: Wider economic factors, including global financial market trends, interest rate policies, and economic growth indicators, can indirectly affect cryptocurrency market dynamics.

- Risk Sentiment: Shifts in overall market risk appetite often correlate with cryptocurrency price movements, as digital assets are frequently viewed as higher-risk investments.

- Capital Flow Patterns: The direction of institutional and retail capital flows within the crypto ecosystem can signal changing preferences and potentially forecast price trends across different token categories.

III. 2026-2031 SKYA Price Forecast

2026 Outlook

- Conservative Prediction: $0.00085 - $0.00145

- Neutral Prediction: Around $0.00145

- Optimistic Prediction: Up to $0.00161 (requiring favorable market conditions)

Based on the forecast data, SKYA is expected to demonstrate modest growth potential in 2026, with an estimated price increase of approximately 5%. The token's price range reflects early-stage market positioning, with the average price projected around $0.00145. Market participants should note the relatively wide spread between conservative and optimistic scenarios, indicating potential volatility during this initial forecast period.

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual accumulation phase with progressive value appreciation

- Price Range Forecast:

- 2027: $0.00116 - $0.00185, with anticipated 11% growth

- 2028: $0.00096 - $0.00211, projecting 22% increase

- 2029: $0.00131 - $0.00279, targeting 38% expansion

- Key Catalysts: Progressive market adoption and ecosystem development

The mid-term trajectory suggests accelerating momentum, with year-over-year growth rates increasing from 11% to 38%. This progressive expansion pattern indicates potential strengthening of market fundamentals. The widening price ranges in later years reflect both increased opportunity and heightened uncertainty as the project matures.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00178 - $0.00234 by 2030 (assuming steady ecosystem growth)

- Optimistic Scenario: Reaching $0.00321 in 2030 (with accelerated adoption and favorable market conditions)

- Transformative Scenario: $0.00219 - $0.00297 by 2031 (sustained ecosystem expansion with potential price consolidation at higher levels)

The long-term forecast indicates substantial growth potential, with 2030 projecting a 70% increase and 2031 potentially achieving 102% gains from current levels. The 2031 projections show a narrowing spread between high and low estimates ($0.00219 - $0.00297), suggesting potential market stabilization at elevated price levels. However, investors should recognize that long-range forecasts carry inherent uncertainties and actual performance may vary significantly based on market dynamics, technological developments, and broader cryptocurrency sector trends.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00161 | 0.00145 | 0.00085 | 5 |

| 2027 | 0.00185 | 0.00153 | 0.00116 | 11 |

| 2028 | 0.00211 | 0.00169 | 0.00096 | 22 |

| 2029 | 0.00279 | 0.0019 | 0.00131 | 38 |

| 2030 | 0.00321 | 0.00234 | 0.00178 | 70 |

| 2031 | 0.00297 | 0.00278 | 0.00219 | 102 |

IV. SKYA Professional Investment Strategy and Risk Management

SKYA Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Community-driven gaming enthusiasts and anime fantasy universe believers who understand the gaming industry's long-term potential

- Operational Recommendations:

- Consider accumulating during market downturns, given the current price near historical lows

- Monitor project development milestones and community engagement metrics

- Utilize Gate Web3 Wallet for secure storage with multi-layer protection

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Track the recent 12.05% 24-hour price increase against the -15.67% weekly decline to identify potential reversal patterns

- Volume Analysis: Monitor the $12,958 daily trading volume for liquidity assessment

- Swing Trading Key Points:

- Observe the 24-hour price range between $0.0013 and $0.001659 for entry and exit opportunities

- Set stop-loss orders considering the significant volatility indicated by the -82.64% annual decline

SKYA Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: Up to 10% with active management and hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance SKYA exposure with established gaming and metaverse tokens

- Position Sizing: Limit individual position risk given the low market dominance of 0.000053%

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading access

- Cold Storage Solution: Hardware wallet for long-term holdings exceeding trading needs

- Security Precautions: Enable two-factor authentication, verify contract address (0x623cd3a3edf080057892aaf8d773bbb7a5c9b6e9), and never share private keys

V. SKYA Potential Risks and Challenges

SKYA Market Risks

- Extreme Volatility: The token has experienced an 82.64% decline over the past year, reflecting significant market uncertainty

- Low Liquidity: With only 2 exchanges listing and a daily volume of approximately $12,958, liquidity constraints may impact price execution

- Market Capitalization: The relatively small market cap of $552,804 indicates higher susceptibility to market manipulation

SKYA Regulatory Risks

- Gaming Token Classification: Evolving regulations regarding gaming tokens and virtual assets may impact token utility

- Geographic Restrictions: Regulatory frameworks in different jurisdictions may limit token accessibility

- Compliance Requirements: Future regulatory compliance costs may affect project development resources

SKYA Technical Risks

- Smart Contract Risks: As an ERC-20 token, vulnerabilities in the underlying smart contract could pose security threats

- Platform Dependency: Reliance on Ethereum network exposes the token to network congestion and gas fee fluctuations

- Project Execution: The success depends on the team's ability to deliver on the anime epic fantasy universe vision

VI. Conclusion and Action Recommendations

SKYA Investment Value Assessment

SKYA represents a speculative opportunity in the gaming and anime fusion sector with significant potential upside but considerable downside risks. The project's community-driven approach and unique positioning in the anime epic fantasy universe offer long-term value proposition for believers in the gaming metaverse narrative. However, the current price near historical lows, limited exchange listings, and substantial annual decline require careful consideration. The 40.32% circulating supply suggests potential future selling pressure as more tokens enter circulation.

SKYA Investment Recommendations

✅ Beginners: Start with minimal exposure (under 1% of total portfolio) to understand market dynamics; use Gate.com for regulated trading access ✅ Experienced Investors: Consider strategic accumulation during favorable market conditions while maintaining strict position limits of 3-5% ✅ Institutional Investors: Conduct thorough due diligence on team capabilities, roadmap execution, and community metrics before any allocation

SKYA Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale with transparent order books

- Dollar-Cost Averaging: Regular small purchases to mitigate timing risks in volatile markets

- Community Engagement: Monitor official channels on Twitter and website updates for project developments

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SKYA? What are its uses and value?

SKYA is a cryptocurrency token designed for decentralized applications and trading. It serves as a utility token within its ecosystem, enabling transactions and governance. Its value is driven by market demand, adoption rate, and utility within the network, with strong potential for growth as the ecosystem expands.

How to predict SKYA token price? What are the main factors affecting the price?

SKYA price prediction relies on analyzing market sentiment, trading volume, and investor confidence. Key factors include historical price trends, technical analysis patterns, and overall market momentum. Monitor these indicators for informed price forecasting.

What are the risks of investing in SKYA and what should I pay attention to?

SKYA investment involves market volatility, regulatory changes, and liquidity risks. Monitor price fluctuations, regulatory developments, and project updates. Diversify your portfolio and invest only what you can afford to lose.

What are the advantages and disadvantages of SKYA compared to other mainstream cryptocurrencies?

SKYA offers high transparency and decentralization with strong censorship resistance. However, it may lack market liquidity and widespread adoption, while its collateral mechanism could face regulatory challenges.

How is SKYA's price outlook for 2024? What do experts think?

SKYA's 2024 price outlook remains uncertain with limited expert consensus. Current market analysis focuses on 2025 and beyond. Key factors include technological developments, market adoption, and overall crypto market conditions driving potential growth.

Where can I buy and trade SKYA?

SKYA tokens are available on decentralized and centralized exchanges. The most popular trading platform is Uniswap V3 on Ethereum network. You can also find SKYA on other DEX and CEX platforms for trading and purchasing.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

What Is EIP-4488?

Comprehensive Guide to Recession Preparation

How to Choose a Cryptocurrency Exchange: Top 5 Recommended Platforms for International Users

Profitability Analysis of Cryptocurrency Mining: Miner and Altcoin Selection in Recent Years

Top 7 Most Popular NFT Games