2026 SUDO Price Prediction: Expert Analysis and Market Forecast for the Next Generation of Blockchain Governance Tokens

Introduction: SUDO's Market Position and Investment Value

Sudoswap (SUDO), as a governance token for a centralized liquidity AMM protocol designed specifically for NFTs, has been navigating the evolving digital asset landscape since its launch. As of February 2026, SUDO maintains a market capitalization of approximately $338,323, with a circulating supply of about 25.4 million tokens, trading at around $0.01332. This asset, positioned at the intersection of DeFi and NFT infrastructure, plays a role in enabling decentralized governance for NFT liquidity solutions.

This article will comprehensively analyze SUDO's price trajectory from 2026 to 2031, combining historical patterns, market supply-demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. SUDO Price History Review and Market Status

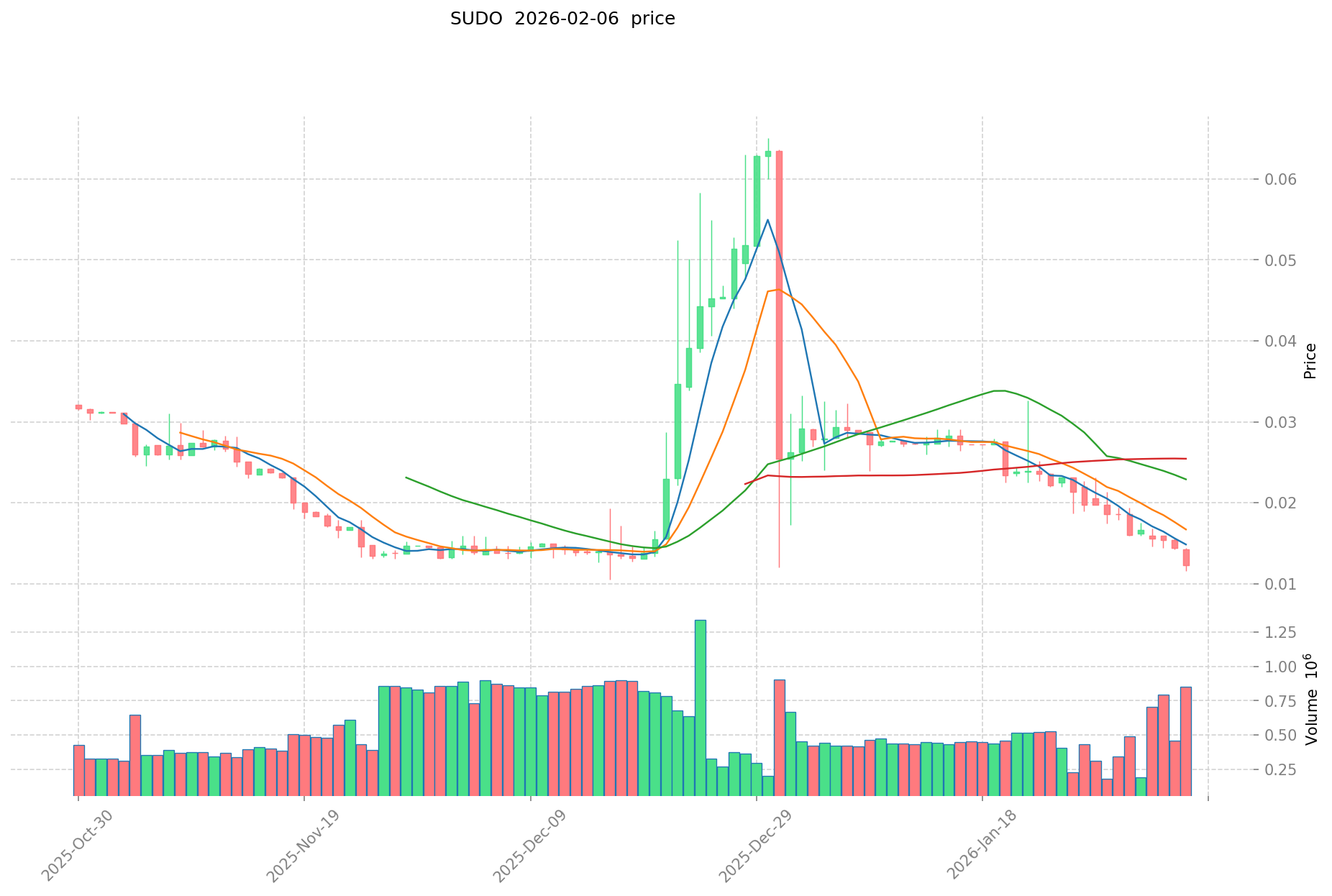

SUDO Historical Price Evolution Trajectory

- 2023: SUDO reached its all-time high of $4.16 on February 19, demonstrating strong initial market performance during the token's early trading period

- 2024-2025: The token experienced a sustained downward trend, reflecting broader market corrections and shifts in NFT trading dynamics

- 2026: SUDO recorded its all-time low of $0.01122368 on January 1, marking a significant price decline from its historical peak

SUDO Current Market Status

As of February 7, 2026, SUDO is trading at $0.01332, showing a 2.06% increase over the past 24 hours with a trading volume of $11,932.46. The token has demonstrated notable short-term volatility, with a 5.74% gain in the past hour and a 24-hour trading range between $0.01161 and $0.0141.

The broader price trends reveal challenging market conditions, with SUDO declining 28.38% over the past week and 53.49% over the past month. The one-year performance shows an 85.74% decrease, indicating sustained downward pressure on the token's valuation.

With a circulating supply of 25,399,632.77 SUDO tokens representing approximately 42.33% of the maximum supply of 60 million tokens, the current market capitalization stands at $338,323.11. The fully diluted market cap is calculated at $773,311.50. SUDO maintains a market dominance of 0.000030% and is held by 2,424 addresses. The token is deployed on the Ethereum blockchain as an ERC-20 token.

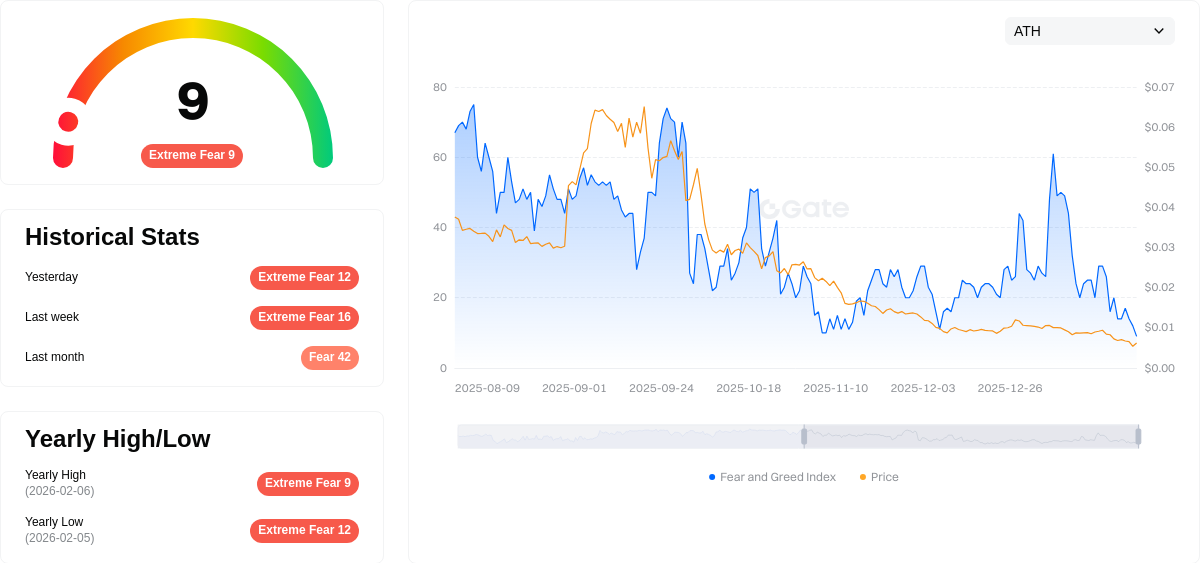

The crypto market sentiment index currently registers at 9, indicating extreme fear conditions, which may influence trading behavior and price movements across digital assets including SUDO.

Click to view current SUDO market price

SUDO Market Sentiment Indicator

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is experiencing extreme fear with an index reading of just 9. This exceptionally low level indicates severe market pessimism and heightened investor anxiety. During such periods, market volatility typically increases as traders reassess positions and risk exposure. Extreme fear often presents contrarian opportunities for experienced investors, as markets tend to overshoot downside moves. However, caution remains warranted as negative sentiment can persist. Traders should monitor key support levels and market catalysts closely to identify potential reversal signals or further downside risks.

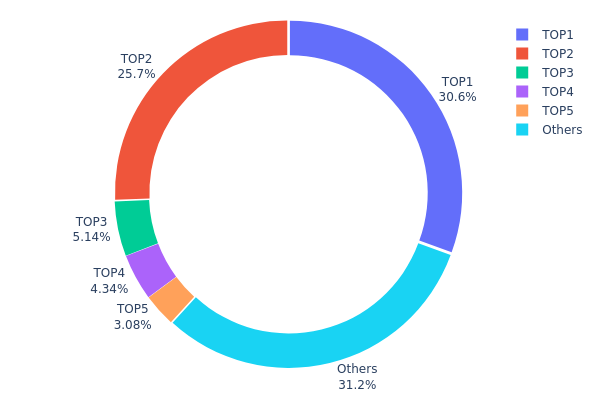

SUDO Holdings Distribution

The holdings distribution chart reveals the allocation of SUDO tokens across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. This metric provides insights into whether token supply is concentrated among a few large holders or distributed more evenly across the broader community.

Based on current on-chain data, SUDO exhibits a moderately high concentration pattern. The top holder (0xca41...07a251) controls 17,764.29K tokens, representing 30.59% of total supply, while the second-largest address (0x6853...b7eeb0) holds 25.65%. Combined, the top two addresses control over 56% of circulating supply. When expanding to the top five addresses, this concentration reaches approximately 69%, with the remaining 31.23% distributed among other participants. This distribution structure suggests that a relatively small number of entities maintain significant influence over token supply.

Such concentrated holdings present both risks and opportunities for market participants. On one hand, large holders possess substantial price influence capabilities, potentially triggering significant volatility through coordinated actions or large-scale liquidations. This concentration may amplify downside risk during adverse market conditions. On the other hand, if these major holders represent project treasury wallets, ecosystem funds, or long-term strategic investors, this structure could indicate stable backing and reduced circulating supply pressure. The current distribution reflects a relatively centralized on-chain structure, requiring investors to carefully monitor major address activities and their potential impact on secondary market dynamics.

Click to view current SUDO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xca41...07a251 | 17764.29K | 30.59% |

| 2 | 0x6853...b7eeb0 | 14892.50K | 25.65% |

| 3 | 0xa023...fc947e | 2981.90K | 5.13% |

| 4 | 0xcffa...290703 | 2518.31K | 4.33% |

| 5 | 0x75d4...6d346f | 1786.16K | 3.07% |

| - | Others | 18113.27K | 31.23% |

II. Core Factors Influencing SUDO's Future Price

Supply Mechanism

- Fixed Supply Cap: SUDO has established a total supply ceiling, which may generate scarcity as demand grows, potentially driving price appreciation.

- Historical Patterns: Crypto assets with limited supply have historically experienced upward price pressure when demand remains stable or increases.

- Current Impact: The fixed supply structure positions SUDO to benefit from increased adoption in the NFT trading infrastructure sector.

Market Position and Adoption

- Market Share: SUDO currently holds a 0.000083% market share, occupying a niche position within the crypto space, particularly in the NFT trading infrastructure segment.

- NFT Trading Sector: SUDO's adoption and utility within NFT trading platforms represent a key driver for potential demand growth.

- Community Support: Active community engagement and ecosystem development play crucial roles in driving long-term value.

Ecosystem Development

- NFT Infrastructure: SUDO's position as an NFT trading platform token ties its value proposition to the broader NFT market dynamics and trading volume trends.

- Platform Utility: The token's functional utility within the Sudoswap ecosystem influences demand patterns and holder behavior.

- Ecosystem Growth: Expansion of use cases and integration with complementary protocols could enhance SUDO's value proposition over time.

III. 2026-2031 SUDO Price Forecast

2026 Outlook

- Conservative Prediction: $0.01159 - $0.01332

- Neutral Prediction: Around $0.01332

- Optimistic Prediction: Up to $0.01545 (requiring favorable market sentiment)

The 2026 forecast suggests a relatively modest price range for SUDO, with the token potentially experiencing a slight decline of approximately 5% compared to previous levels. The predicted average price of $0.01332 reflects market consolidation, while the high of $0.01545 remains achievable under supportive conditions.

2027-2029 Mid-term Outlook

- Market Stage Expectation: Gradual recovery and growth phase

- Price Range Predictions:

- 2027: $0.01165 - $0.01928

- 2028: $0.01027 - $0.02272

- 2029: $0.01681 - $0.02789

- Key Catalysts: Market adoption expansion, ecosystem development, and broader crypto market trends

During this mid-term period, SUDO is projected to show progressive growth, with 2029 potentially marking a significant upward movement of 40% price change. The widening price ranges reflect increasing market participation and volatility as the token matures.

2030-2031 Long-term Outlook

- Base Scenario: $0.02312 - $0.02383 (assuming steady market development)

- Optimistic Scenario: $0.02788 - $0.03193 (with enhanced adoption and favorable regulations)

- Transformative Scenario: Up to $0.03597 (under exceptional market conditions)

The long-term projections indicate substantial growth potential, with 2030 showing a possible 69% increase and 2031 potentially reaching 97% growth. These forecasts assume continued ecosystem expansion and sustained interest in the SUDO token, though actual outcomes will depend on various market dynamics and technological developments.

- February 7, 2026: SUDO trading within initial forecast range ($0.01159 - $0.01545)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01545 | 0.01332 | 0.01159 | -5 |

| 2027 | 0.01928 | 0.01439 | 0.01165 | 2 |

| 2028 | 0.02272 | 0.01683 | 0.01027 | 19 |

| 2029 | 0.02789 | 0.01978 | 0.01681 | 40 |

| 2030 | 0.03193 | 0.02383 | 0.02312 | 69 |

| 2031 | 0.03597 | 0.02788 | 0.01673 | 97 |

IV. SUDO Professional Investment Strategy and Risk Management

SUDO Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors seeking exposure to the NFT infrastructure sector with a medium to high risk tolerance

- Operation recommendations:

- Consider dollar-cost averaging to mitigate the impact of SUDO's significant price volatility, particularly given its -28.38% decline over the past 7 days

- Monitor the protocol's development progress and governance proposals before making investment decisions

- Storage solution: Use Gate Web3 Wallet for secure storage with multi-signature functionality to protect holdings

(2) Active Trading Strategy

- Technical analysis tools:

- Support and resistance levels: Monitor the current 24-hour range between $0.01161 (low) and $0.0141 (high) for potential entry and exit points

- Volume analysis: Track the 24-hour trading volume of approximately $11,932 to assess market participation and liquidity

- Swing trading considerations:

- Be aware of the token's short-term volatility with a 5.74% increase in the past hour but -28.38% decline over 7 days

- Exercise caution with position sizing given the relatively low market capitalization of approximately $338,323

SUDO Risk Management Framework

(1) Asset Allocation Principles

- Conservative investors: Maximum 1-2% of crypto portfolio allocation

- Aggressive investors: Consider 3-5% of crypto portfolio allocation

- Professional investors: Up to 5-8% allocation with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Position sizing: Limit exposure to no more than recommended percentages given the token's high volatility

- Stop-loss implementation: Consider setting stop-loss orders to protect against further downside risk, particularly relevant given the -53.49% decline over 30 days

(3) Secure Storage Solutions

- Hot wallet recommendation: Gate Web3 Wallet for convenient access and trading

- Cold storage option: Hardware wallet solutions for long-term holdings exceeding short-term trading needs

- Security considerations: Enable two-factor authentication, never share private keys, and verify contract addresses (0x3446dd70b2d52a6bf4a5a192d9b0a161295ab7f9 on Ethereum) before transactions

V. SUDO Potential Risks and Challenges

SUDO Market Risks

- High volatility: The token has experienced an 85.74% decline over the past year and trades near its historical low of $0.01122368 recorded on January 1, 2026

- Limited liquidity: With a 24-hour trading volume of approximately $11,932 and relatively low market capitalization, large orders may significantly impact price

- Low market capitalization: The circulating market cap of approximately $338,323 presents higher risk compared to established cryptocurrencies

SUDO Regulatory Risks

- NFT-related regulation: Evolving regulatory frameworks for NFT marketplaces and AMM protocols may impact the project's operations

- Governance token classification: Potential regulatory scrutiny regarding the classification and treatment of governance tokens

- Cross-border compliance: Operating across multiple jurisdictions may expose the protocol to varying regulatory requirements

SUDO Technical Risks

- Smart contract vulnerabilities: As with all DeFi protocols, there exists potential risk of smart contract exploits or bugs

- Protocol dependency: The token's value is closely tied to the success and adoption of the Sudoswap NFT AMM protocol

- Competition risk: The NFT marketplace sector faces increasing competition from established and emerging platforms

VI. Conclusion and Action Recommendations

SUDO Investment Value Assessment

SUDO presents as a specialized governance token for an NFT-focused AMM protocol operating in a niche but evolving sector. While the protocol addresses liquidity needs in the NFT market, investors should carefully consider the token's significant recent price decline of 85.74% over the past year and current price of $0.01332, which remains substantially below its all-time high of $4.16 recorded in February 2023. The limited circulating supply of approximately 25.4 million tokens (42.33% of maximum supply) and low holder count of 2,424 suggest concentrated ownership risk. Long-term value depends heavily on increased NFT trading activity and protocol adoption.

SUDO Investment Recommendations

✅ Beginners: Consider waiting for clearer market stabilization signals before entry, as the recent 30-day decline of 53.49% suggests ongoing price discovery; if participating, limit allocation to less than 1% of total crypto portfolio ✅ Experienced investors: May consider opportunistic positions at current levels with strict risk management protocols, including defined stop-loss levels and position sizing aligned with high-risk asset classification ✅ Institutional investors: Conduct thorough due diligence on the Sudoswap protocol's technical infrastructure, governance mechanisms, and competitive positioning before considering allocation

SUDO Trading Participation Methods

- Spot trading: Available on Gate.com with SUDO trading pairs for direct purchase and sale

- Decentralized exchanges: Trade directly using Ethereum-based DEX platforms by connecting Gate Web3 Wallet

- Governance participation: Token holders can engage in protocol governance by reviewing proposals at the official documentation portal

Cryptocurrency investment carries extremely high risk, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is SUDO token? What are its main uses and value?

SUDO token enables decentralized governance, allowing holders to vote on proposals and participate in network decisions. Its value derives from governance rights, network participation demand, and token scarcity within the ecosystem.

What are the main factors affecting SUDO price?

SUDO price is primarily influenced by its fixed supply mechanism, which creates scarcity as demand increases. Market demand, investor confidence, and trading volume are key drivers. Additionally, market trends and adoption rate significantly impact price movements.

What is the historical price trend of SUDO token?

SUDO token's price reached ¥0.1219 at its peak and ¥0.1105 at its low point. As of February 6, 2026, SUDO is trading at ¥0.1105, down 8.52% daily with 24-hour trading volume of 2.566 million yuan.

What are professional analysts' predictions for SUDO's future price?

Professional analysts predict SUDO will experience significant growth from 2025 to 2030 based on market trends and ecosystem development. The long-term outlook appears positive, though specific price targets vary by analyst.

What risks should I be aware of when investing in SUDO tokens?

SUDO token investment carries market volatility risks with potential value depreciation. Key risks include market uncertainty, liquidity constraints, and regulatory changes. Assess your risk tolerance before investing.

What are the advantages and disadvantages of SUDO compared to other mainstream cryptocurrencies?

SUDO's main advantage lies in its innovative technology and unique ecosystem. However, its disadvantage includes highly concentrated token distribution, with the top five addresses holding 69.92% of supply, creating potential market manipulation risks and price volatility.

What are the circulating supply and total supply of SUDO tokens?

SUDO token has a circulating supply of 58,056,418. The total supply has not been clearly defined. These figures are current as of February 6, 2026.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Is Taxa Network (TXT) a good investment?: A Comprehensive Analysis of Market Potential, Risk Factors, and Future Prospects

Is 3KDS (3KDS) a good investment?: A Comprehensive Analysis of Price Potential, Market Trends, and Risk Factors in 2024

Digital Rupee: A Comprehensive Guide to India's CBDC

Bitcoin Dominance Chart: What Is It and Why Is It Important?

What Is a Crypto Paper Wallet?