Is 3KDS (3KDS) a good investment?: A Comprehensive Analysis of Price Potential, Market Trends, and Risk Factors in 2024

Introduction: 3KDS Investment Position and Market Outlook

3KDS is a digital asset in the cryptocurrency space that has emerged as an IP-driven transmedia entertainment ecosystem. As of February 07, 2026, 3KDS maintains a market capitalization of approximately $319,352 with a circulating supply of 152,000,000 tokens, currently trading at around $0.002101. The project positions itself as a bridge between Web2 mass users and Web3 ownership, integrating games, AI-powered virtual idols, and digital collectibles into a unified fan-driven ecosystem inspired by Three Kingdoms characters.

Backed by strategic investors including b2en, rolling-stone, COSNINE, Gate Labs, DWF Labs, Castrum Capital, Genesis Ventures, and SeasideArden, 3KDS emphasizes content quality and sustainable user onboarding. With 4,723 token holders and deployment on the BSC chain using the BEP-20 standard, the project aims to convert existing IP fandom into long-term Web3 participation. This article will comprehensively analyze 3KDS's investment characteristics, historical price movements, future price outlook, and associated risks to provide reference information for those considering "Is 3KDS a good investment?"

I. 3KDS Price History Review and Current Investment Value

3KDS Historical Price Trends and Investment Performance

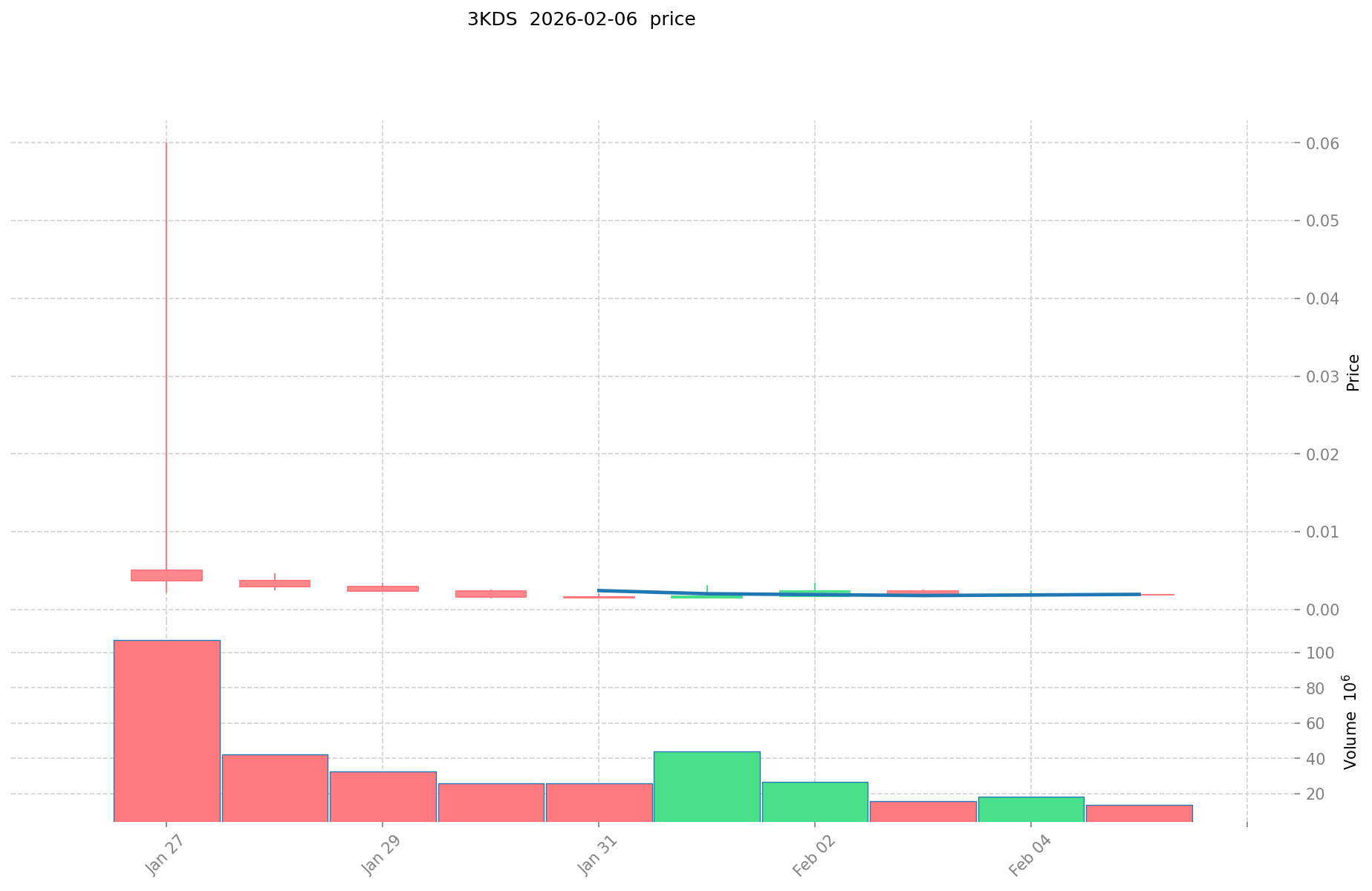

- January 2026: Token deployment on BSC mainnet → Price fluctuations between $0.001413 and $0.06

- January 27, 2026: Price reached $0.06 → Followed by correction phase

- January 30, 2026: Price touched $0.001413 → Market volatility observed during early trading period

Current 3KDS Investment Market Status (February 2026)

- 3KDS current price: $0.002101

- 24-hour trading volume: $30,568.19

- Circulating supply: 152,000,000 tokens (15.2% of total supply)

- Market capitalization: $319,352

- Total supply: 1,000,000,000 tokens

- Contract standard: BEP-20 (deployed on BSC)

- Number of holders: 4,723

- Exchange availability: Listed on 2 exchanges

Click to view real-time 3KDS market price

II. Core Factors Influencing Whether 3KDS is a Good Investment

Supply Mechanism and Scarcity (3KDS investment scarcity)

- Total Supply and Circulating Supply → Impact on Price and Investment Value

Based on available data, 3KDS has a maximum supply of 1,000,000,000 tokens, with a current circulating supply of 152,000,000 tokens, representing approximately 15.2% of the total supply. The token operates on the BSC (Binance Smart Chain) using the BEP-20 standard.

- Historical Pattern: Supply dynamics and price volatility trends

Historical price data indicates that 3KDS reached a notable price level of $0.06 on January 27, 2026, and subsequently declined to $0.001413 on January 30, 2026. As of February 7, 2026, the token is trading at approximately $0.002101, showing a 30-day decline of 95.73%.

- Investment Significance: Scarcity as a key factor in long-term investment considerations

With only 15.2% of tokens currently in circulation, the remaining supply distribution timeline and release schedule may influence future price dynamics. The low market capitalization of approximately $319,352 and fully diluted valuation of $2,101,000 suggest limited liquidity, which presents both opportunities and risks for potential investors.

Institutional Investment and Mainstream Adoption (Institutional investment in 3KDS)

- Institutional Holding Trends: Strategic Investor Base

According to project information, 3KDS is supported by several strategic investors and partners with experience in Web3 infrastructure, trading, and venture investment. These include b2en, rolling-stone, COSNINE, Gate Labs, DWF Labs, Castrum Capital, Genesis Ventures, and SeasideArden.

- Adoption by Notable Entities → Enhancement of Investment Value

The project focuses on bridging Web2 mass users with Web3 ownership through an IP-driven transmedia entertainment ecosystem. Built around original characters inspired by the Three Kingdoms, 3KDS integrates games, AI-powered virtual idols, and digital collectibles into a unified fan-driven ecosystem. The project emphasizes content quality and sustainable user onboarding, aiming to convert existing IP fandom into long-term Web3 participation.

- Policy Impact on Investment Prospects

As of February 2026, no specific regulatory developments or policy announcements directly affecting 3KDS have been identified in the available materials.

Macroeconomic Environment's Impact on 3KDS Investment

- Monetary Policy and Interest Rate Changes → Altering Investment Attractiveness

The broader cryptocurrency market environment and macroeconomic conditions may influence investor sentiment toward smaller-cap tokens like 3KDS. Current market share stands at approximately 0.000083%, indicating limited market presence.

- Role as Inflation Hedge → Digital Asset Positioning

The positioning of 3KDS as an entertainment and gaming ecosystem token differs from traditional store-of-value narratives. Its investment thesis centers on user adoption and ecosystem growth rather than inflation hedging characteristics.

- Geopolitical Uncertainty → Enhanced Investment Demand

No specific geopolitical factors directly impacting 3KDS investment demand have been identified in the available materials as of February 2026.

Technology and Ecosystem Development (Technology & Ecosystem for 3KDS investment)

- Integration of Games, AI-Powered Virtual Idols, and Digital Collectibles → Enhancement of Investment Appeal

The 3KDS ecosystem combines multiple entertainment verticals, including gaming applications, AI-driven virtual idol experiences, and digital collectible offerings. This multi-faceted approach aims to create diverse utility and engagement opportunities for token holders.

- Expansion of Ecosystem Applications → Long-term Value Support

With approximately 4,723 token holders as of February 7, 2026, the project demonstrates early-stage community formation. The focus on converting Web2 audiences to Web3 participants represents a growth strategy dependent on content quality and user experience.

- DeFi, NFT, and Payment Applications Driving Investment Value

The project's integration of digital collectibles (NFTs) and entertainment content positions it within broader Web3 trends. Trading activity shows a 24-hour volume of approximately $30,568, with the token listed on 2 exchanges as of February 2026.

III. 3KDS Future Investment Forecast and Price Outlook (Is 3KDS(3KDS) worth investing in 2026-2031)

Short-term Investment Forecast (2026, short-term 3KDS investment outlook)

Based on available market data as of February 7, 2026, 3KDS is trading at approximately $0.002101. The token has demonstrated notable volatility since its recent listing, with 24-hour price fluctuations ranging between $0.0017 and $0.0022. According to prediction models, several scenarios may emerge for the remainder of 2026:

- Conservative forecast: $0.0018 - $0.0022

- Neutral forecast: $0.0021 - $0.0024

- Optimistic forecast: $0.0025 - $0.0028

The short-term trajectory may be influenced by market acceptance of its Web3 gaming ecosystem and overall sentiment in the blockchain gaming sector. With a current market cap of approximately $319,352 and circulating supply of 152 million tokens (15.2% of total supply), the project remains in its early price discovery phase.

Mid-term Investment Outlook (2027-2028, mid-term 3KDS(3KDS) investment forecast)

The mid-term period may represent a critical phase for 3KDS as its gaming platform and digital collectibles ecosystem continue development. According to predictive models:

-

Market stage expectation: Transition from initial listing volatility toward establishing baseline value support, contingent upon ecosystem development milestones and user adoption metrics.

-

Investment return forecast:

- 2027: $0.0019 - $0.0029, representing potential growth of approximately 16% from 2026 average predictions

- 2028: $0.0018 - $0.0038, with potential expansion of approximately 27% relative to 2026 baseline

-

Key catalysts: Platform user activity metrics, content release schedule for games and digital assets, strategic partnership announcements, and broader Web3 gaming market conditions. The project's backing from entities including Gate Labs, DWF Labs, and other strategic investors may influence development trajectory.

Long-term Investment Outlook (Is 3KDS a good long-term investment?)

Long-term value potential for 3KDS appears closely tied to the broader blockchain gaming market evolution and the project's ability to convert its IP-driven entertainment concept into sustained user engagement. Industry projections suggest the blockchain gaming market may reach significant scale by 2026, which could provide tailwinds for well-positioned projects.

- Base scenario: $0.0026 - $0.0033 (2029-2030 range, corresponding to steady ecosystem maturation and sustained user base growth)

- Optimistic scenario: $0.0035 - $0.0046 (2030-2031 range, assuming accelerated adoption of Web3 gaming platforms and favorable market conditions)

- Risk scenario: $0.0014 - $0.0020 (reflecting potential challenges in user acquisition, market downturn, or delayed development milestones)

For detailed 3KDS long-term investment and price prediction analysis: Price Prediction

2026-2031 Long-term Perspective

- Base scenario: $0.0026 - $0.0041 (corresponding to steady progress and incremental mainstream application expansion)

- Optimistic scenario: $0.0035 - $0.0046 (corresponding to large-scale adoption and favorable market environment)

- Transformational scenario: Above $0.0046 (contingent upon breakthrough ecosystem developments and mainstream popularization)

- December 31, 2031 predicted high: $0.0043 (based on optimistic development assumptions)

Disclaimer: These forecasts are derived from historical data patterns, prediction models, and market analysis. Cryptocurrency markets involve substantial risk and high volatility. Price predictions should not be construed as investment advice, and actual outcomes may differ significantly from projections. The information presented is for research purposes only, and individuals should conduct thorough due diligence and consult financial professionals before making any investment decisions.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00278916 | 0.002113 | 0.00179605 | 0 |

| 2027 | 0.0028922744 | 0.00245108 | 0.0018628208 | 16 |

| 2028 | 0.003847215168 | 0.0026716772 | 0.001790023724 | 27 |

| 2029 | 0.00384614649712 | 0.003259446184 | 0.00257496248536 | 55 |

| 2030 | 0.004618635242728 | 0.00355279634056 | 0.003126460779692 | 69 |

| 2031 | 0.004290001581226 | 0.004085715791644 | 0.002778286738317 | 94 |

IV. 3KDS Investment Strategy and Risk Management (How to invest in crypto assets)

Investment Methodology (3KDS investment strategy)

-

Long-term Holding (HODL 3KDS): Suitable for conservative investors

- Long-term holding strategy may be considered for investors who believe in the project's transmedia entertainment ecosystem and Web3 onboarding model. Given the token's circulating supply of 152,000,000 (15.2% of total supply), understanding tokenomics and release schedules is important.

- This approach requires patience through market volatility cycles and confidence in the project's execution of its IP-driven ecosystem integrating games, AI-powered virtual idols, and digital collectibles.

-

Active Trading: Based on technical analysis and swing operations

- With a 24-hour price change of 16.81% and 7-day change of 28.59%, 3KDS has shown notable short-term volatility, which may present opportunities for experienced traders.

- Technical traders should monitor key support levels around the recent low of $0.0017 and resistance levels near $0.0022, while considering the 24-hour trading volume of approximately $30,568.

Risk Management (Risk management for 3KDS investment)

-

Asset Allocation Ratio: Conservative / Aggressive / Professional investors

- Conservative investors: Consider allocating 1-3% of crypto portfolio to emerging entertainment-focused tokens

- Aggressive investors: May consider 5-10% allocation while maintaining diversification

- Professional investors: Can employ more sophisticated allocation strategies based on risk tolerance and market analysis

-

Risk Hedging Solutions: Multi-asset portfolio + hedging tools

- Diversification across different crypto categories (e.g., established cryptocurrencies, DeFi tokens, and entertainment tokens)

- Consider correlation with broader crypto market movements

- Use of stop-loss orders to limit downside exposure in volatile conditions

-

Secure Storage: Hot/cold wallets + hardware wallet recommendations

- For BEP-20 tokens like 3KDS (contract address: 0x490153b338c2469e21c55e4ff88bdcfadac68141 on BSC), ensure wallet compatibility

- Hardware wallets supporting BSC network recommended for long-term holdings

- Hot wallets suitable for active trading positions, while cold storage preferred for larger allocations

- Always verify contract addresses through official sources before transactions

V. 3KDS Investment Risks and Challenges (Risks of investing in crypto assets)

-

Market Risks: High volatility, price manipulation concerns

- The token experienced a 30-day decline of 95.73%, demonstrating substantial downside volatility

- With a market ranking of 3457 and relatively limited exchange listings (2 exchanges), liquidity may be constrained

- Market capitalization of approximately $319,352 indicates a micro-cap asset with associated risks

- Limited holder base of 4,723 may contribute to price volatility

-

Regulatory Risks: Policy uncertainty across different jurisdictions

- Entertainment and gaming tokens may face evolving regulatory scrutiny in various jurisdictions

- NFT and digital collectible components may be subject to changing regulatory frameworks

- Cross-border entertainment IP projects may encounter different compliance requirements in key markets

-

Technical Risks: Network security vulnerabilities, upgrade failures

- As a BEP-20 token on BSC, 3KDS relies on the underlying blockchain's security and performance

- Smart contract risks associated with token contracts and ecosystem integrations

- Technology integration challenges in combining games, AI-powered features, and digital collectibles

- Execution risk in delivering promised features across the transmedia entertainment ecosystem

VI. Conclusion: Is crypto assets a Good Investment?

-

Investment Value Summary: 3KDS presents a specialized approach to bridging Web2 entertainment audiences with Web3 ownership through its Three Kingdoms-inspired IP ecosystem. The project benefits from backing by strategic partners including Gate Labs, DWF Labs, and others with Web3 infrastructure experience. However, the token has experienced significant price volatility, with a 95.73% decline over 30 days, and maintains a micro-cap market position with limited liquidity.

-

Investor Recommendations:

- ✅ Beginners: Exercise caution with micro-cap entertainment tokens. If interested, consider minimal allocation, dollar-cost averaging, and secure wallet storage (hardware wallet supporting BSC network)

- ✅ Experienced Investors: May explore swing trading opportunities given volatility patterns, while maintaining strict position sizing and risk management. Consider the project's execution capability and ecosystem development progress

- ✅ Institutional Investors: Conduct thorough due diligence on team, partnerships, and roadmap execution. Assess competitive positioning in the entertainment-crypto intersection before any strategic allocation

⚠️ Disclaimer: Cryptocurrency investment carries substantial risk. This content is for informational purposes only and does not constitute investment advice. 3KDS has experienced significant price volatility and operates in a developing sector. Investors should conduct independent research, understand the risks, and only invest capital they can afford to lose.

VII. FAQ

Q1: What is the current price and market capitalization of 3KDS?

As of February 7, 2026, 3KDS is trading at approximately $0.002101 with a market capitalization of around $319,352. The token has a circulating supply of 152,000,000 tokens (15.2% of total supply) and a 24-hour trading volume of approximately $30,568. It is currently ranked #3457 in the cryptocurrency market with 4,723 token holders and is listed on 2 exchanges.

Q2: Has 3KDS demonstrated significant price volatility since launch?

Yes, 3KDS has experienced substantial price volatility. The token reached a notable high of $0.06 on January 27, 2026, followed by a sharp decline to $0.001413 on January 30, 2026. Over the past 30 days, the token has declined by 95.73%, demonstrating the high-risk nature characteristic of micro-cap entertainment tokens in the early trading phase.

Q3: What factors differentiate 3KDS from other cryptocurrency projects?

3KDS positions itself as an IP-driven transmedia entertainment ecosystem that bridges Web2 mass users with Web3 ownership. The project integrates games, AI-powered virtual idols, and digital collectibles centered around original characters inspired by the Three Kingdoms. It is backed by strategic investors including Gate Labs, DWF Labs, Castrum Capital, and others, emphasizing content quality and sustainable user onboarding rather than traditional cryptocurrency use cases.

Q4: What are the predicted price ranges for 3KDS through 2031?

Based on prediction models, conservative forecasts suggest the following ranges: 2026 ($0.0018-$0.0028), 2027 ($0.0019-$0.0029), 2028 ($0.0018-$0.0038), 2029 ($0.0026-$0.0038), 2030 ($0.0031-$0.0046), and 2031 ($0.0028-$0.0043). These projections assume steady ecosystem development, user adoption growth, and favorable market conditions. However, actual outcomes may differ significantly due to market volatility and execution risks.

Q5: What investment allocation is appropriate for different investor types?

Conservative investors should consider allocating 1-3% of their crypto portfolio to emerging entertainment-focused tokens like 3KDS. Aggressive investors may consider 5-10% allocation while maintaining diversification across asset categories. Professional investors can employ more sophisticated strategies based on risk tolerance and market analysis. All investors should use hardware wallets supporting BSC network for secure storage and maintain strict risk management protocols.

Q6: What are the primary risks associated with investing in 3KDS?

Key risks include extreme price volatility (95.73% decline over 30 days), limited liquidity due to micro-cap status ($319,352 market cap), constrained exchange listings (2 exchanges), regulatory uncertainty affecting entertainment and gaming tokens, smart contract vulnerabilities on BSC, and execution risk in delivering the transmedia entertainment ecosystem. The limited holder base of 4,723 may contribute to price manipulation concerns and liquidity constraints.

Q7: How can investors securely store and manage their 3KDS tokens?

3KDS operates as a BEP-20 token on Binance Smart Chain with contract address 0x490153b338c2469e21c55e4ff88bdcfadac68141. Investors should use hardware wallets supporting BSC network for long-term holdings and secure storage. Hot wallets may be suitable for active trading positions, but cold storage is preferred for larger allocations. Always verify contract addresses through official sources before transactions, and employ stop-loss orders to limit downside exposure in volatile market conditions.

Q8: Is 3KDS suitable for beginner cryptocurrency investors?

Beginners should exercise significant caution with 3KDS due to its micro-cap status, extreme volatility, and limited liquidity. If interested in exposure, beginners should consider only minimal allocation (1-2% of portfolio), employ dollar-cost averaging to mitigate timing risk, use secure wallet storage, and conduct thorough research on the project's roadmap and team execution capability. This token carries substantially higher risk than established cryptocurrencies and may not be appropriate for risk-averse investors.

2025 Vertus daily combo code: Web3 gamers rewards guide

Today's Vertus Daily Combo Code: Boost Your Web3 Gaming Rewards (April 29, 2025)

GALA Coin (GALA) – Web3 Gaming Token Overview, Price Prediction & Trading on Gate.com

What is Gaming Crypto?How Gaming Crypto Works?

Detailed analysis of the top ten encryption game coins to be launched in 2025

Top 6 Best Gaming Currencies

Comprehensive Guide to Free Bitcoin Earning Methods

Everything You Need To Know About Bull Flag Patterns

Top 10 Crypto Podcasts for Investors and Enthusiasts

What is blockchain in plain language

What does the Metaverse or the digital world of the future mean?