2026 TICO Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: TICO's Market Position and Investment Value

Funtico (TICO), as a pioneering Web3 gaming platform integrating fintech solutions, has been developing its GameFi ecosystem since its launch in 2025. As of February 8, 2026, TICO maintains a market capitalization of approximately $219,208, with a circulating supply of around 1.88 billion tokens, and its price currently stands at $0.0001166. This asset, positioned as a comprehensive crypto gaming platform, is playing an increasingly significant role in bridging traditional gaming with blockchain technology.

Despite experiencing considerable volatility since its debut—with prices ranging from an all-time high of $0.0315 in January 2025 to an all-time low of $0.00005358 in January 2026—TICO has demonstrated notable short-term recovery, showing a 22.12% increase over the past 24 hours and a 66.41% gain over the past week. The platform's SDK ecosystem, featuring NFT marketplace integration, AI tools, and analytics within a secure and compliant environment, represents its core value proposition for publishers, creators, and gamers.

This article will comprehensively analyze TICO's potential price trajectory from 2026 through 2031, combining historical patterns, market supply-demand dynamics, ecosystem development milestones, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. TICO Price History Review and Current Market Status

TICO Historical Price Evolution Trajectory

- 2025: Token launched on January 27 at a publishing price of $0.0025, price surged to historical peak of $0.0315 on the same day

- 2026: Market experienced significant correction, price declined to historical low of $0.00005358 on January 25

TICO Current Market Situation

As of February 8, 2026, TICO is trading at $0.0001166, representing a 22.12% increase over the past 24 hours. The token has shown notable short-term volatility, with a 66.41% gain over the past 7 days. However, the 30-day performance reflects a decline of 76.2%, and the one-year performance shows a decrease of 98.72%.

The current market capitalization stands at $219,208, with a circulating supply of 1.88 billion tokens, representing 100% of the total supply. The 24-hour trading volume reaches $19,929.11. The token's intraday range spans from $0.0000799 to $0.00013798.

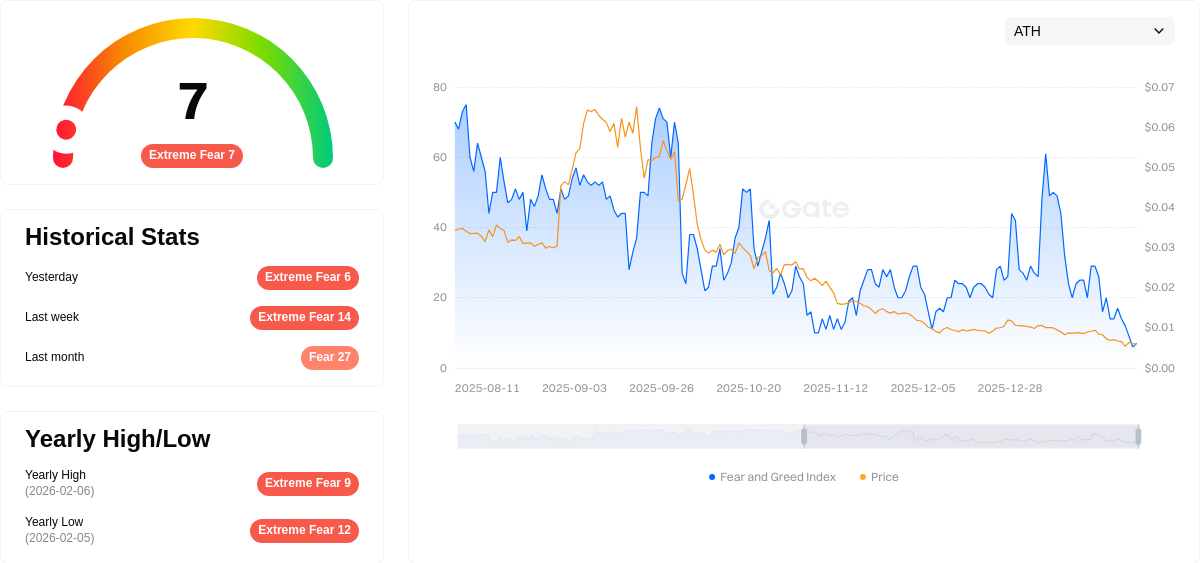

The broader crypto market sentiment indicator shows a reading of 7, reflecting an extreme fear environment, which may be influencing TICO's price movements alongside sector-specific factors.

Click to view current TICO market price

TICO Market Sentiment Index

2026-02-08 Fear and Greed Index: 7 (Extreme Fear)

Click to view the current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index plunging to just 7 points. This exceptionally low reading indicates severe market pessimism and panic selling pressure among investors. Such extreme fear levels historically present potential opportunities for contrarian investors, as excessive pessimism often precedes market recoveries. However, traders should remain cautious and conduct thorough risk assessment before entering positions. Monitor market developments closely on Gate.com to stay informed of sentiment shifts and emerging opportunities during this volatile period.

TICO Holdings Distribution

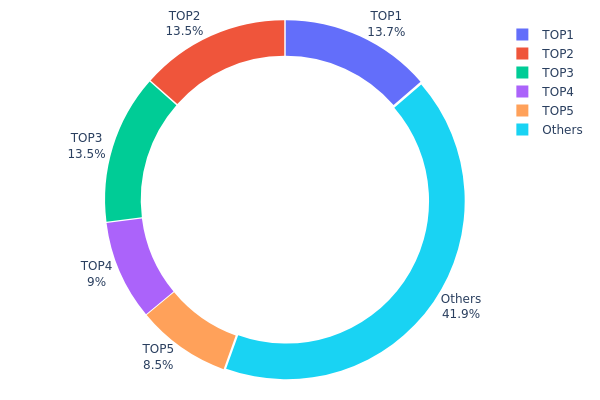

The holdings distribution chart reveals the concentration level of token ownership across different wallet addresses, serving as a critical indicator of decentralization and potential market manipulation risks. In TICO's current structure, the top 5 addresses collectively hold approximately 58.15% of the total token supply, with the largest single address controlling 13.65% (1.365 billion tokens), followed closely by two addresses each holding 13.50%. This concentration pattern suggests a moderately centralized distribution model, where major holders maintain significant influence over circulating supply dynamics.

From a market structure perspective, this concentration level presents both opportunities and concerns. While the remaining 41.85% distributed among other addresses indicates some degree of broader participation, the substantial holdings by top addresses could amplify price volatility during large-scale transactions or coordinated selling pressure. The relatively balanced distribution among the top three holders (ranging from 13.50% to 13.65%) may indicate strategic allocation among institutional investors, project treasury reserves, or founding team vesting schedules, which could provide stability if these entities maintain long-term commitment to the project's development.

The current holdings structure reflects a semi-decentralized ecosystem where decision-making power and market influence remain concentrated among key stakeholders. This concentration level, while higher than optimal for complete decentralization, is not uncommon for projects in early development stages or those with significant institutional backing. Investors should monitor potential wallet movements from these major addresses, as their trading activities could significantly impact short-term price action and overall market sentiment.

Click to view current TICO Holdings Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xf768...5d9311 | 1365000.00K | 13.65% |

| 2 | 0x8fee...b2661b | 1350000.00K | 13.50% |

| 3 | 0x20af...c01c87 | 1350000.00K | 13.50% |

| 4 | 0x3c53...e4c579 | 900000.00K | 9.00% |

| 5 | 0x5ef6...387b87 | 850000.00K | 8.50% |

| - | Others | 4185000.00K | 41.85% |

II. Core Factors Affecting TICO's Future Price

Market Demand and Adoption Trends

- Market Demand Dynamics: TICO's price outlook is influenced by market demand, adoption trends, institutional participation, and broader economic factors. The token's value reflects market sentiment and user adoption patterns.

- Trading Activity: Daily trading volume stands at $10,337.19, reflecting network activity levels and market engagement with the token.

- Price Behavior: Price fluctuations demonstrate market sentiment, user adoption trends, and external influencing factors that shape the token's valuation trajectory.

Institutional and Market Participation

- Broader Economic Factors: The token's performance is tied to wider economic conditions that affect cryptocurrency markets, including macroeconomic trends and investor sentiment shifts.

- Adoption Growth Trajectory: Industry observers note that cryptocurrency adoption continues to grow, with expectations of more users and institutions entering the market over time, which may positively influence tokens like TICO.

External Market Influences

- Market Sentiment Impact: External factors play a significant role in shaping TICO's price movements, as reflected in the token's volatility patterns and trading behavior.

- Growth Rate Projections: Some market analyses have explored potential growth scenarios using estimated annual growth rates to project future price ranges, though actual performance depends on multiple variable factors.

III. 2026-2031 TICO Price Prediction

2026 Outlook

- Conservative Prediction: $0.0001

- Neutral Prediction: $0.00012

- Optimistic Prediction: $0.00015 (contingent on favorable market conditions and increased adoption)

2027-2029 Outlook

- Market Stage Expectation: TICO is anticipated to enter a gradual growth phase, potentially benefiting from broader cryptocurrency market recovery and enhanced project development milestones.

- Price Range Prediction:

- 2027: $0.00012 - $0.00019

- 2028: $0.00014 - $0.00022

- 2029: $0.00015 - $0.00026

- Key Catalysts: Market sentiment improvement, technological upgrades, expanded use cases, and growing community engagement may serve as primary drivers for price appreciation during this period.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.00012 - $0.00031 (assuming steady ecosystem development and maintained market interest)

- Optimistic Scenario: $0.00023 - $0.00036 (contingent on successful partnerships, widespread adoption, and favorable regulatory environment)

- Transformative Scenario: Potential to exceed $0.00036 (under exceptional conditions including major platform integrations, institutional adoption, or breakthrough technological innovations)

- 2026-02-08: TICO trading within the range of $0.0001 - $0.00015, reflecting early-stage market positioning and investor sentiment

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00015 | 0.00012 | 0.0001 | 0 |

| 2027 | 0.00019 | 0.00013 | 0.00012 | 14 |

| 2028 | 0.00022 | 0.00016 | 0.00014 | 40 |

| 2029 | 0.00026 | 0.00019 | 0.00015 | 65 |

| 2030 | 0.00031 | 0.00023 | 0.00012 | 96 |

| 2031 | 0.00036 | 0.00027 | 0.00014 | 132 |

IV. TICO Professional Investment Strategy and Risk Management

TICO Investment Methodology

(I) Long-term Holding Strategy

- Target Investors: Investors interested in GameFi ecosystem growth and Web3 gaming platform development

- Operational Recommendations:

- Consider accumulating positions during market corrections when the price approaches support levels

- Monitor platform development milestones including SDK adoption, NFT marketplace activity, and user growth metrics

- Storage Solution: Gate Web3 Wallet provides secure storage with multi-chain support for TICO tokens on Avalanche C-Chain

(II) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor 24-hour trading volume patterns; current volume of approximately $19,929 indicates moderate liquidity conditions

- Support and Resistance Levels: Track key price levels with attention to the all-time low of $0.00005358 as a potential support zone

- Swing Trading Considerations:

- The token has shown significant volatility with a 7-day change of 66.41%, presenting potential short-term trading opportunities

- Consider the 30-day decline of 76.2% when evaluating entry points and risk-reward ratios

TICO Risk Management Framework

(I) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: Up to 10% with active monitoring and rebalancing strategies

(II) Risk Hedging Solutions

- Position Sizing: Implement strict position limits based on individual risk tolerance and portfolio size

- Stop-Loss Orders: Consider setting stop-loss levels 15-20% below entry points to limit downside exposure

(III) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking activities with multi-layer security features

- Cold Storage Option: Consider hardware wallet solutions for long-term holdings exceeding trading needs

- Security Precautions: Enable two-factor authentication, verify contract addresses (0xedf647326007e64d94b0ee69743350f3736e392c on Avalanche C-Chain), and never share private keys or seed phrases

V. TICO Potential Risks and Challenges

TICO Market Risks

- High Volatility: The token has experienced a substantial 98.72% decline over the past year, indicating significant price volatility that may continue

- Limited Trading Venues: Currently available on only 2 exchanges, which may constrain liquidity and increase price volatility

- Market Cap Positioning: Ranked at #3827 with a market cap of approximately $219,208, indicating early-stage status with associated risks

TICO Regulatory Risks

- Gaming and NFT Regulation: Evolving regulatory frameworks for blockchain gaming and NFT marketplaces may impact platform operations

- Cross-Border Compliance: As a global Web3 gaming platform, TICO may face varying regulatory requirements across different jurisdictions

- Token Classification Uncertainty: Potential regulatory changes regarding token classification could affect trading availability and compliance requirements

TICO Technical Risks

- Platform Development Risk: Success depends on continued development and adoption of the SDK and gaming ecosystem by publishers and creators

- Competitive Landscape: The Web3 gaming sector faces intense competition from established platforms and new entrants

- Smart Contract Risk: As with all blockchain projects, smart contract vulnerabilities could pose security concerns despite operating on Avalanche C-Chain

VI. Conclusion and Action Recommendations

TICO Investment Value Assessment

FUNTICO presents itself as a comprehensive Web3 gaming platform combining proprietary games with fintech solutions, NFT marketplace, and creator tools. The platform addresses identified challenges in Web3 gaming adoption, including monetization effectiveness and user experience. However, the token's significant price decline of 98.72% year-over-year and relatively small market cap of $219,208 reflect early-stage risks. The recent 7-day surge of 66.41% suggests renewed interest, but investors should consider the limited liquidity with only 2 exchange listings and the 30-day decline of 76.2% when evaluating timing and position sizing.

TICO Investment Recommendations

✅ Newcomers: Begin with minimal exposure (1-2% of crypto portfolio) and focus on understanding the Web3 gaming ecosystem and platform development progress before increasing positions ✅ Experienced Investors: Consider dollar-cost averaging with 3-5% allocation while monitoring SDK adoption rates, user growth metrics, and partnership announcements for validation of the platform's value proposition ✅ Institutional Investors: Conduct thorough due diligence on platform traction, team background, and competitive positioning; consider strategic allocation of 5-8% with clear milestone-based assessment criteria

TICO Trading Participation Methods

- Spot Trading: Purchase TICO tokens directly on Gate.com with support for Avalanche C-Chain, allowing for straightforward entry and exit

- Storage and Holding: Utilize Gate Web3 Wallet for secure storage with access to potential platform features and ecosystem participation

- Active Monitoring: Track platform announcements regarding game launches, publisher partnerships, and SDK adoption to inform position adjustments

Cryptocurrency investments carry extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TICO? What are its uses and value?

TICO is an innovative Web3 gaming platform launched in 2025, designed to enhance blockchain game monetization efficiency and user experience. It improves gaming profitability through cutting-edge technology and better player interaction mechanisms.

How has TICO's historical price performed? What were the past trends?

TICO surged 67.70% over the past 7 days. Historical high reached $0.03007, while the low was $0.00005349. Current trading volume is $79,099.76 daily, showing strong market momentum and bullish momentum.

What is the TICO price prediction for 2024? What do experts think?

Based on current market analysis, TICO is expected to show strong growth trajectory through 2024. Industry experts remain optimistic about TICO's long-term potential, with predicted price appreciation driven by increased adoption and ecosystem development.

What are the main factors affecting TICO price?

TICO price is primarily influenced by market demand, trading volume, user adoption trends, and market sentiment. External economic factors and network activity also play key roles in price fluctuations.

What are the differences between TICO and other mainstream cryptocurrencies?

TICO distinguishes itself through focused application-specific utility rather than broad market appeal. It features lower price volatility compared to mainstream cryptocurrencies and operates with relatively specialized market liquidity, offering unique value positioning within its niche ecosystem.

What are the risks of investing in TICO? What should I pay attention to?

TICO investment involves market volatility, liquidity risks, and regulatory uncertainties. Monitor price fluctuations, diversify your portfolio, and only invest capital you can afford to lose. Stay informed about project developments and market conditions.

How is TICO's liquidity and trading volume? On which exchanges can it be traded?

TICO maintains moderate liquidity with 24-hour trading volume around $79,000. It is available on select major exchanges, providing decent market accessibility for traders interested in this token.

What is TICO's team background and project progress?

TICO was founded in 2025 by Funtico, focusing on Web3 gaming technology. The team has successfully launched multiple blockchain games and is actively developing new features to address challenges in decentralized gaming and finance.

Detailed Analysis of the Best 10 GameFi Projects to Play and Earn in 2025

Popular GameFi Games in 2025

What Are the Key On-Chain Metrics Revealing About Litecoin's Whale Activity in 2025?

What is GameFi and How Does It Work?

What is DeFi: Understanding Decentralized Finance in 2025

How Will Virtuals Protocol's AI Agent Economy Evolve by 2030?

How do competing cryptocurrencies compare in market cap, performance, and user adoption in 2026?

What is WARD Crypto Market Overview: Price, Market Cap, Trading Volume, and Liquidity in 2026

What is token economy: understanding token allocation, inflation mechanisms, and governance rights in crypto projects?

What is NFT minting and what are the costs associated with token minting

What are the major security risks and vulnerabilities in BEAM's smart contracts and exchange custody systems?