2026 TLOS Price Prediction: Expert Analysis and Market Forecast for Telos Network Token Growth

Introduction: TLOS Market Position and Investment Value

Telos (TLOS), as a third-generation enterprise blockchain platform designed for hosting distributed applications, has been advancing the decentralized ecosystem since its mainnet launch in December 2018. As of 2026, TLOS maintains a market capitalization of approximately $861,790, with a circulating supply of around 51.51 million tokens, and the current price hovers near $0.01673. This asset, recognized as an innovative blockchain solution with advanced governance features and scalability capabilities, is playing an increasingly important role in providing transparent and collaborative frameworks for global organizations.

This article will comprehensively analyze TLOS price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. TLOS Price History Review and Current Market Status

TLOS Historical Price Evolution Trajectory

- 2021: TLOS was listed on Gate.com in March, marking its entry into the global trading market

- 2024: The token reached a notable price level of $0.622416 on February 29, representing a significant milestone in its trading history

- 2026: Market conditions led to price fluctuations, with the token experiencing downward pressure in early February

TLOS Current Market Situation

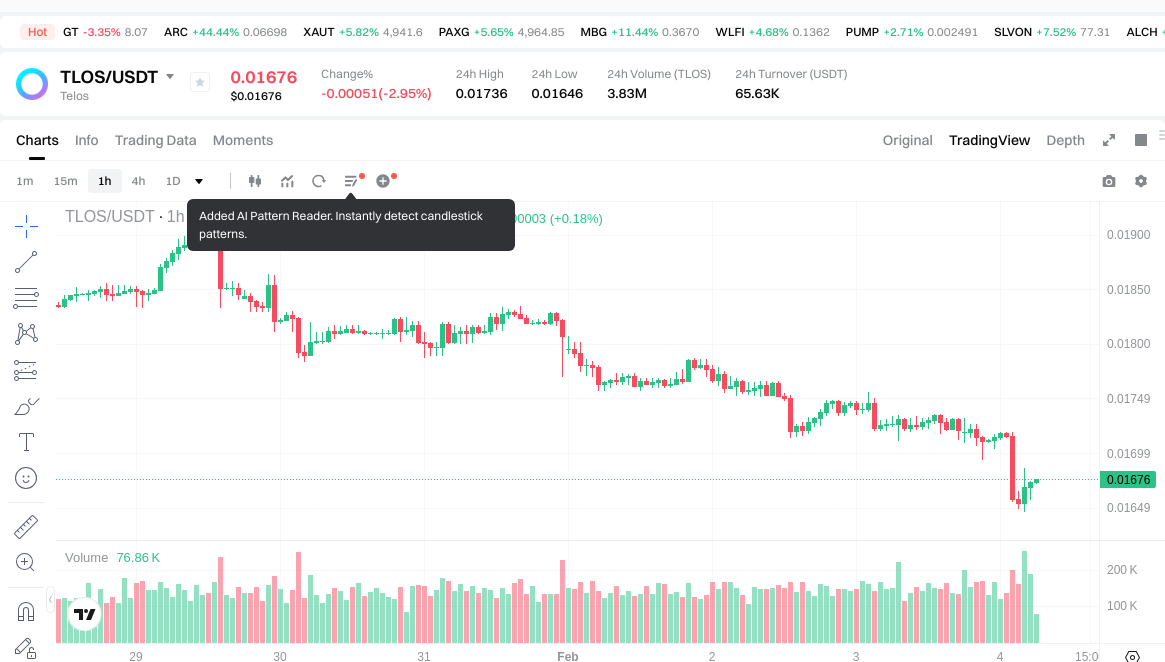

As of February 4, 2026, TLOS is trading at $0.01673, showing a 24-hour price change of -3.29%. The intraday trading range spans from $0.01646 to $0.01736, reflecting moderate volatility within the session.

The token's market capitalization stands at approximately $861,790, with a circulating supply of 51,511,682.93 TLOS tokens. This represents about 14.5% of the total supply currently in circulation. The 24-hour trading volume has reached $65,683.75, indicating ongoing market activity.

Over different time horizons, TLOS has experienced varied performance: a slight increase of 0.3% over the past hour, while showing declines of 12.04% over the past week and 6.32% over the past 30 days. The one-year performance reflects a significant contraction of 86.85% from previous levels.

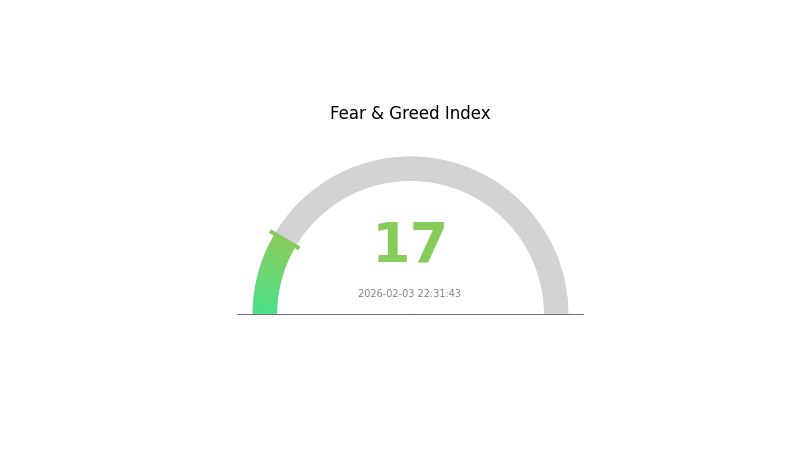

The token holder count currently stands at 2,343 addresses, suggesting a distributed ownership structure. TLOS maintains a market dominance of 0.000032% within the broader cryptocurrency ecosystem. The current market sentiment indicator shows a reading of 17, corresponding to a cautious market environment.

Click to view current TLOS market price

TLOS Market Sentiment Indicator

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The TLOS market is currently experiencing extreme fear sentiment, with the Fear and Greed Index at 17. This historically low reading suggests significant market pessimism and potential capitulation among investors. Extreme fear periods often present contrarian opportunities, as panic-driven selling may create attractive entry points for long-term investors. However, exercise caution as downward momentum could continue. Monitor key support levels and market fundamentals closely. Such sentiment extremes typically precede market reversals, making this a critical period for strategic decision-making in the TLOS market.

TLOS Holding Distribution

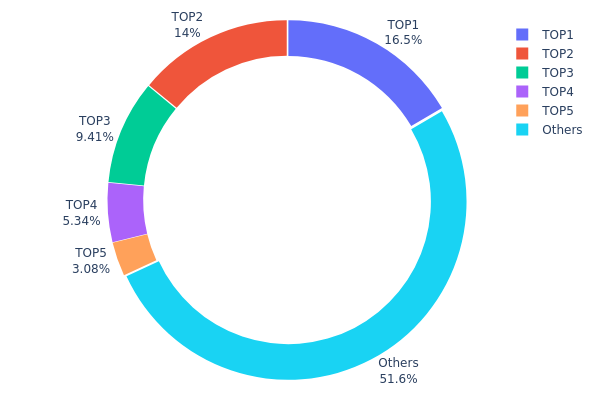

The holding distribution chart illustrates the concentration of TLOS tokens across different wallet addresses, revealing the degree of decentralization within the network. This metric serves as a critical indicator of market structure, as excessive concentration in a few addresses may signal potential centralization risks and vulnerability to large-scale market manipulation.

Current data reveals a moderate concentration pattern in TLOS holdings. The top address controls 16.53% of the supply (1.91M tokens), while the second and third-largest holders possess 14.04% and 9.41% respectively. Collectively, the top five addresses account for 48.39% of total holdings, with the remaining 51.61% distributed among other participants. This distribution suggests a relatively balanced ecosystem where no single entity dominates the network, though the top three addresses collectively hold approximately 40% of the supply, which warrants monitoring.

From a market structure perspective, this holding pattern indicates reasonable decentralization with acceptable risk levels. The distribution mitigates the likelihood of coordinated price manipulation, as the majority of tokens remain dispersed among numerous holders. However, the significant holdings of top addresses could potentially influence short-term price volatility if these whales decide to liquidate positions. The current structure demonstrates a mature on-chain architecture with sufficient distribution to support organic price discovery, while maintaining enough large stakeholders to provide market stability and liquidity depth.

Click to view current TLOS Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xad01...eb5cbf | 1910.00K | 16.53% |

| 2 | 0x69e4...c75673 | 1622.32K | 14.04% |

| 3 | 0xa851...0c1f5c | 1087.22K | 9.41% |

| 4 | 0x32f9...c296df | 616.88K | 5.33% |

| 5 | 0xfe6f...61dd28 | 356.42K | 3.08% |

| - | Others | 5960.89K | 51.61% |

II. Core Factors Influencing TLOS Future Price

Supply Mechanism

- Inflation Rate Control: Telos targets an annual inflation rate of 2.5%, which is lower than many other blockchain projects. This controlled supply expansion helps maintain token scarcity and potentially supports price stability.

- Historical Pattern: Lower inflation rates compared to similar projects have historically contributed to better price performance during market uptrends.

- Current Impact: The maintained 2.5% annual inflation rate continues to provide predictable supply growth, which may support long-term price appreciation as demand increases.

Institutional and Major Holder Dynamics

- Market Sentiment: Investor confidence and sentiment have direct influence on TLOS price movements. Positive news regarding widespread adoption or technical breakthroughs can drive significant price action.

- Adoption Trends: Market demand and adoption patterns remain key drivers for TLOS valuation, with growing ecosystem participation potentially supporting price growth.

Macroeconomic Environment

- Market Conditions: Broader cryptocurrency market trends and economic factors continue to influence TLOS price dynamics, with overall digital asset sentiment playing a significant role.

- Economic Factors: General economic conditions, including liquidity in crypto markets and risk appetite among investors, affect TLOS price performance.

Technology Development and Ecosystem Building

- Diverse DApp Support: Telos supports various decentralized applications across multiple sectors, including decentralized exchanges, NFT marketplaces, and other ecosystem projects. This diversification strengthens the platform's utility and potential for adoption.

- Ecosystem Expansion: The continuous development of applications and projects within the Telos ecosystem serves as a fundamental driver for long-term value appreciation.

- Technical Innovation: Ongoing technical developments and improvements to the Telos network infrastructure contribute to enhanced functionality and user experience, supporting ecosystem growth.

III. 2026-2031 TLOS Price Prediction

2026 Outlook

- Conservative Prediction: $0.01173 - $0.01676

- Neutral Prediction: $0.01676

- Optimistic Prediction: $0.01961 (contingent on favorable market conditions)

2027-2029 Outlook

- Market Stage Expectation: The market may enter a phase of moderate growth as TLOS seeks to establish broader adoption and ecosystem development.

- Price Range Prediction:

- 2027: $0.01000 - $0.02109

- 2028: $0.01277 - $0.02887

- 2029: $0.01722 - $0.03250

- Key Catalysts: Potential drivers include technological advancements within the Telos ecosystem, strategic partnerships, and increased utility of TLOS tokens.

2030-2031 Long-term Outlook

- Baseline Scenario: $0.02440 - $0.03349 (assuming steady ecosystem growth and stable market conditions)

- Optimistic Scenario: $0.02838 - $0.03349 (contingent on significant adoption milestones and favorable regulatory developments)

- Transformative Scenario: Up to $0.03349 (under exceptionally favorable conditions such as mass adoption and major platform integrations)

- 2026-02-04: TLOS price projections suggest a range between $0.01173 and $0.01961 for the year, reflecting cautious market sentiment in the near term.

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.01961 | 0.01676 | 0.01173 | 0 |

| 2027 | 0.02109 | 0.01818 | 0.01 | 8 |

| 2028 | 0.02887 | 0.01964 | 0.01277 | 17 |

| 2029 | 0.0325 | 0.02425 | 0.01722 | 44 |

| 2030 | 0.03349 | 0.02838 | 0.0244 | 69 |

| 2031 | 0.03248 | 0.03093 | 0.02815 | 84 |

IV. TLOS Professional Investment Strategy and Risk Management

TLOS Investment Methodology

(1) Long-Term Holding Strategy

- Suitable for: Investors who believe in blockchain infrastructure development and seek medium to long-term returns

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) approach to build positions gradually, reducing impact of short-term volatility

- Monitor Telos ecosystem development and adoption metrics as key indicators

- Store assets securely using Gate Web3 Wallet for enhanced security and convenient access

(2) Active Trading Strategy

- Technical Analysis Tools:

- Support and Resistance Levels: Monitor the $0.01628 recent low and $0.01736 24-hour high as key reference points

- Volume Analysis: Track the current 24-hour trading volume of $65,683.75 to assess market liquidity and participation

- Swing Trading Key Points:

- Consider the high volatility evidenced by 12.04% weekly decline when setting position sizes

- Implement stop-loss orders to protect against sudden downward movements

TLOS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio

- Aggressive Investors: 3-5% of crypto portfolio

- Professional Investors: Up to 10% of crypto portfolio based on comprehensive due diligence

(2) Risk Hedging Solutions

- Diversification Strategy: Combine TLOS with other blockchain infrastructure tokens to spread sector-specific risks

- Position Sizing: Limit individual trade exposure to avoid significant losses from volatility

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and ecosystem interaction

- Security Best Practices: Enable two-factor authentication, never share private keys, regularly review account activity

V. TLOS Potential Risks and Challenges

TLOS Market Risk

- Price Volatility: The token has experienced an 86.85% decline over the past year, indicating substantial volatility

- Liquidity Concerns: With a 24-hour trading volume of approximately $65,683, liquidity may be limited compared to major cryptocurrencies

- Market Ranking: Currently ranked #2626, the token faces strong competition from more established blockchain platforms

TLOS Regulatory Risk

- Jurisdictional Uncertainty: Evolving global regulations on blockchain platforms may impact Telos operations and token utility

- Compliance Requirements: Increasing regulatory scrutiny on crypto assets could affect trading availability

- Governance Framework: Changes in regulatory approaches to decentralized governance models may influence platform development

TLOS Technical Risk

- Network Security: As with any blockchain platform, potential vulnerabilities in smart contracts or infrastructure exist

- Competition Risk: Telos faces competition from numerous other layer-1 blockchain platforms with similar value propositions

- Adoption Challenges: Limited circulating supply (approximately 14.5% of total supply) may affect network effects and ecosystem growth

VI. Conclusion and Action Recommendations

TLOS Investment Value Assessment

Telos represents a third-generation blockchain platform focused on speed, governance, and scalability for decentralized applications. While the project demonstrates technical innovation in enterprise blockchain solutions, investors should carefully weigh the substantial price volatility, limited market liquidity, and competitive landscape. The significant year-over-year decline suggests current market conditions remain challenging. Long-term value depends on successful ecosystem development, increased adoption of dApps on the platform, and broader market recovery.

TLOS Investment Recommendations

✅ Beginners: Start with very small allocations (under 1% of crypto portfolio) and focus on learning about blockchain fundamentals before committing larger amounts ✅ Experienced Investors: Consider limited position sizes (2-5% of crypto portfolio) with clear stop-loss levels and regular portfolio rebalancing ✅ Institutional Investors: Conduct thorough due diligence on Telos governance structure, technical roadmap, and ecosystem metrics before any allocation

TLOS Trading Participation Methods

- Spot Trading: Purchase and hold TLOS on Gate.com with secure storage in Gate Web3 Wallet

- Dollar-Cost Averaging: Implement systematic periodic purchases to reduce timing risk

- Portfolio Integration: Include TLOS as part of a diversified blockchain infrastructure allocation strategy

Cryptocurrency investment carries extremely high risk. This article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TLOS token and what is its purpose?

TLOS is a utility token of the Telos blockchain network. It functions as a medium of exchange, governance token for voting on network direction, and enables resource allocation for computation and throughput rental to developers.

What is the historical price trend of TLOS? What were the all-time high and low prices?

TLOS reached an all-time high of $1.43 and an all-time low of $0.001193. As of February 3, 2026, the price remains significantly below its peak but substantially above its lowest point.

What are the main factors affecting TLOS price?

TLOS price is influenced by market sentiment, regulatory policies, trading volume, technology developments, and macroeconomic conditions. Market news and investor confidence play crucial roles in price fluctuations.

2024-2025 year TLOS price prediction is how?

TLOS price during 2024-2025 showed volatility influenced by market conditions and cryptocurrency trends. Historical data suggests potential growth drivers include network adoption and ecosystem development, though future performance depends on multiple market factors.

What is the relationship between TLOS and other mainstream cryptocurrencies such as ETH and BTC?

TLOS operates as an independent blockchain project competing in the market alongside BTC and ETH. While these mainstream cryptocurrencies dominate market capitalization and adoption, TLOS differentiates itself through its unique protocol design and ecosystem. Each serves distinct use cases within the broader blockchain landscape.

What risks should I be aware of when investing in TLOS?

TLOS investments carry market volatility risk, with prices subject to significant fluctuations. Technology and smart contract risks exist within the Telos network. Regulatory changes and low liquidity periods could impact value. Conduct thorough research before investing.

What is the current development status of Telos ecosystem? How does this impact TLOS price?

Telos ecosystem currently shows declining activity, with trading volume down 1.00% recently. This negative momentum may exert downward pressure on TLOS price as market activity remains sluggish.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Top 3 Cryptocurrency Exchanges for Buying Bitcoin in the UK

Who Is Vitalik Buterin? An In-Depth Look at the Co-Founder of Ethereum

What is Demand Supply Zone and How to Use It in Trading

Trading Indicators: What They Are and How They Work

How to Get Started with DeFi Investing and Key Strategies for Maximizing Returns