2026 TURBOS Price Prediction: Expert Analysis and Market Forecast for the Coming Year

Introduction: TURBOS Market Position and Investment Value

Turbos (TURBOS), positioned as a non-custodial DEX on the Sui blockchain with horizontal scalability and digital asset ownership, has been establishing its presence since its launch in 2023. Backed by Jump Crypto and Mysten Labs, Turbos bridges the gap between the Sui ecosystem and broader market participants. As of February 2026, TURBOS maintains a market capitalization of approximately $864,572, with a circulating supply of around 6.62 billion tokens and a price hovering near $0.0001306. This asset, serving as a key infrastructure component within the Sui DeFi ecosystem, plays an increasingly relevant role in facilitating liquidity provision and efficient trading.

This article will comprehensively analyze TURBOS price movements from 2026 through 2031, combining historical patterns, market supply-demand dynamics, ecosystem developments, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. TURBOS Price History Review and Market Status

TURBOS Historical Price Evolution Trajectory

- 2023: TURBOS launched in May with an initial offering price of $0.005, experiencing significant price movements during its first year of trading

- 2023: Reached price peak at $0.024 on May 15, 2023, shortly after launch, followed by a subsequent market correction phase

- 2023-2024: Market cycle adjustment period, with price declining from $0.024 high to $0.0000707 low recorded on December 17, 2023

TURBOS Current Market Situation

As of February 4, 2026, TURBOS is trading at $0.0001306, with 24-hour trading volume reaching $25,106.17. The token has shown a slight positive movement of 0.22% over the past 24 hours, with intraday price ranging between $0.0001271 and $0.0001353.

TURBOS maintains a circulating supply of 6.62 billion tokens, representing 66.2% of the maximum supply of 10 billion tokens. The current market capitalization stands at approximately $864,572, with a fully diluted market cap of $1.306 million. The token holds a market share of 0.000048% within the broader cryptocurrency market.

Over different time horizons, TURBOS has experienced varied price performance: a decline of 0.3% in the past hour, a decrease of 14.06% over the past week, and a drop of 22.1% over the past month. From its initial offering price of $0.005, the token has seen a change of approximately -97.39%.

The token is currently listed on 2 exchanges and has 6,208 holders. TURBOS operates on the Sui blockchain ecosystem as a non-custodial DEX platform.

Click to view current TURBOS market price

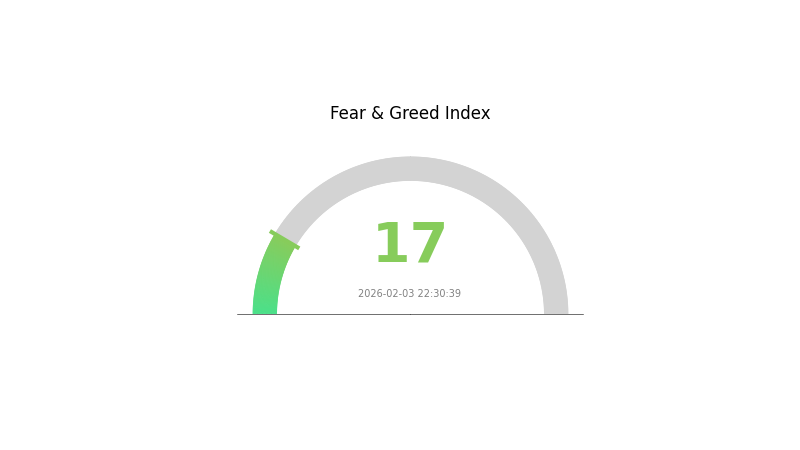

TURBOS Market Sentiment Indicator

2026-02-03 Fear and Greed Index: 17 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear, with the Fear and Greed Index at 17. This indicates significant market anxiety and pessimistic sentiment among investors. When fear reaches such extreme levels, it often signals potential oversold conditions and may present buying opportunities for contrarian traders. Market participants should remain cautious while monitoring key support levels. Risk management and careful position sizing remain essential during periods of heightened fear. Consider diversifying your portfolio and conducting thorough due diligence before making any trading decisions.

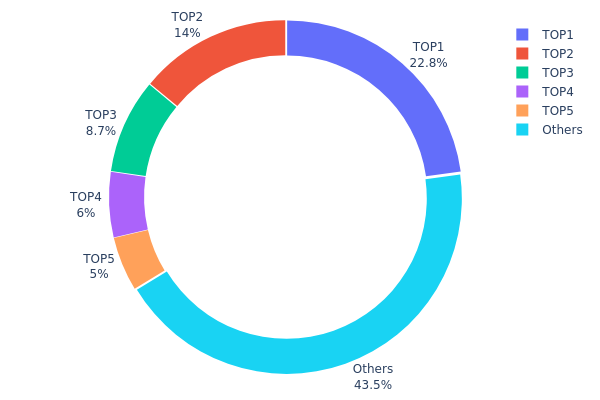

TURBOS Holding Distribution

The holding distribution chart reflects the concentration of TURBOS tokens across different wallet addresses, serving as a crucial metric to assess the level of decentralization and potential market manipulation risks. By analyzing the proportion of tokens held by top addresses versus smaller holders, we can evaluate whether the token supply is broadly distributed or concentrated in the hands of a few entities, which directly impacts market stability and price volatility.

Based on current on-chain data, TURBOS exhibits a moderate to high concentration pattern. The top holder controls 22.80% (2,280,000K tokens), followed by the second-largest address holding 14.00% (1,400,000K tokens). The top five addresses collectively account for 56.50% of the total supply, while the remaining 43.50% is distributed among other addresses. This concentration level suggests that a significant portion of TURBOS supply remains in the hands of major stakeholders, potentially including early investors, team members, or institutional participants.

From a market structure perspective, this concentration level presents both opportunities and risks. On one hand, large holders may provide liquidity stability and long-term confidence in the project. On the other hand, the significant holdings of top addresses introduce heightened risks of price manipulation and elevated volatility, as coordinated selling by major holders could trigger substantial price fluctuations. The relatively dispersed nature of the remaining 43.50% among other addresses indicates some degree of community participation, but the dominance of top holders means that decentralization remains limited, and on-chain governance could be influenced by a small number of entities.

Click to view current TURBOS Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0xc43b...beb1f7 | 2280000.00K | 22.80% |

| 2 | 0xd6f2...bf4ba2 | 1400000.00K | 14.00% |

| 3 | 0xfd5b...90e8f7 | 870031.08K | 8.70% |

| 4 | 0x6e55...50d86a | 600000.00K | 6.00% |

| 5 | 0x15a4...1ea230 | 500000.00K | 5.00% |

| - | Others | 4349968.92K | 43.5% |

II. Core Factors Influencing TURBOS Future Price

Market Trends and Sentiment

- Market Volatility: TURBOS exhibits significant price fluctuations, with high volatility presenting both opportunities and risks for traders. The overall cryptocurrency market sentiment directly impacts TURBOS price movements, making it sensitive to broader market conditions.

- Trading Liquidity: Limited trading volume may affect transaction efficiency, potentially leading to wider bid-ask spreads and increased price sensitivity to large orders.

- Investor Sentiment: Market psychology and emotional responses to news events can create substantial short-term price movements, influencing both buying and selling pressure.

Technical Development and Innovation

- Continuous Technical Innovation: The future performance of TURBOS depends heavily on ongoing technological improvements and updates to its underlying infrastructure. Technical advancements can enhance network efficiency and expand use cases.

- Ecosystem Expansion: The development and adoption of applications within the TURBOS ecosystem play a crucial role in driving long-term value. Increased utility and real-world applications can support price appreciation.

- Platform Integration: Collaboration with influential figures and platforms in the cryptocurrency space has accelerated TURBOS visibility and adoption, potentially expanding its user base.

Regulatory Environment

- Regulatory Changes: Shifts in cryptocurrency regulations across different jurisdictions can significantly impact TURBOS price trajectory. Favorable regulatory developments may boost confidence, while restrictive policies could dampen market enthusiasm.

- Compliance Requirements: Evolving compliance standards and legal frameworks affect how TURBOS operates within various markets, influencing investor confidence and institutional participation.

Market Dynamics

- Supply and Demand Balance: The interaction between available supply and market demand creates fundamental pricing pressure. Changes in either factor can lead to notable price adjustments.

- Competitive Landscape: The broader cryptocurrency market competition and the emergence of alternative projects may influence TURBOS market position and valuation.

- Adoption Rate: The speed and scale at which users and projects adopt TURBOS technology will be a key determinant of its future market performance.

III. 2026-2031 TURBOS Price Prediction

2026 Outlook

- Conservative Prediction: $0.00011 - $0.00013

- Neutral Prediction: $0.00013

- Optimistic Prediction: $0.00014 (subject to favorable market conditions and adoption growth)

2027-2029 Outlook

- Market Stage Expectation: The market may enter a gradual recovery phase with increasing institutional interest and broader crypto adoption.

- Price Range Predictions:

- 2027: $0.00009 - $0.00017

- 2028: $0.00009 - $0.00016

- 2029: $0.0001 - $0.00023

- Key Catalysts: Enhanced platform utility, expanding DeFi ecosystem participation, and potential partnerships could serve as primary drivers for price appreciation.

2030-2031 Long-term Outlook

- Base Scenario: $0.00012 - $0.00028 (assuming steady market growth and moderate adoption rates)

- Optimistic Scenario: $0.00019 - $0.00029 (assuming accelerated ecosystem development and increased trading volume)

- Transformative Scenario: Potential to reach upper price boundaries if significant technological breakthroughs and widespread institutional adoption materialize

- 2026-02-04: TURBOS trading within established ranges as market participants assess long-term value propositions

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00014 | 0.00013 | 0.00011 | 0 |

| 2027 | 0.00017 | 0.00014 | 0.00009 | 5 |

| 2028 | 0.00016 | 0.00015 | 0.00009 | 17 |

| 2029 | 0.00023 | 0.00016 | 0.0001 | 21 |

| 2030 | 0.00028 | 0.0002 | 0.00012 | 50 |

| 2031 | 0.00029 | 0.00024 | 0.00019 | 81 |

IV. TURBOS Professional Investment Strategy and Risk Management

TURBOS Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Long-term DeFi believers and Sui ecosystem supporters

- Operational Recommendations:

- Consider accumulating positions during market downturns, given the current price is significantly below its historical peak

- Monitor Turbos Finance's protocol development and partnership announcements with Jump Crypto and Mysten Labs

- Utilize secure storage solutions such as Gate Web3 Wallet for long-term holdings

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Monitor the 24-hour trading volume of $25,106 to identify liquidity trends

- Support and Resistance Levels: Current 24H range between $0.0001271 (low) and $0.0001353 (high) provides key trading boundaries

- Swing Trading Considerations:

- Be aware of recent volatility, with 7-day decline of 14.06% and 30-day decline of 22.1%

- Set appropriate stop-loss levels given the token's substantial distance from its all-time high

TURBOS Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-8% of crypto portfolio allocation

- Professional Investors: Up to 10% with active monitoring and hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Balance TURBOS holdings with other Sui ecosystem tokens and major cryptocurrencies

- Position Sizing: Limit initial exposure given the token's 94.44% decline over the past year

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking

- Cold Storage Approach: For long-term holdings exceeding trading needs

- Security Precautions: Enable two-factor authentication, verify contract addresses (0x5d1f47ea69bb0de31c313d7acf89b890dbb8991ea8e03c6c355171f84bb1ba4a::turbos::TURBOS on Sui), and never share private keys

V. TURBOS Potential Risks and Challenges

TURBOS Market Risks

- High Volatility: The token has experienced substantial price fluctuations, declining 94.44% from its peak of $0.024 in May 2023

- Limited Liquidity: With only 2 exchanges listing TURBOS and relatively modest 24-hour trading volume, liquidity constraints may impact large transactions

- Market Cap Ranking: Currently ranked 2625 with a market capitalization of approximately $864,572, indicating limited market presence

TURBOS Regulatory Risks

- DeFi Regulatory Uncertainty: As a decentralized exchange protocol, Turbos Finance may face evolving regulatory frameworks affecting DeFi platforms

- Jurisdictional Compliance: Potential regulatory changes in key markets could impact protocol operations and token utility

- Smart Contract Oversight: Increased regulatory scrutiny on DeFi protocols may require additional compliance measures

TURBOS Technical Risks

- Smart Contract Vulnerabilities: As with any DeFi protocol, potential bugs or exploits in smart contracts pose security risks

- Sui Network Dependency: Protocol performance and security are tied to the underlying Sui blockchain infrastructure

- Competition Risk: The DEX space on Sui remains competitive, with potential new entrants affecting market share

VI. Conclusion and Action Recommendations

TURBOS Investment Value Assessment

Turbos Finance represents a specialized investment opportunity within the Sui ecosystem, backed by notable investors Jump Crypto and Mysten Labs. The protocol aims to provide non-custodial DEX services with horizontal scalability. However, the significant decline from historical peaks and current low market capitalization present considerable risks. The project's long-term value proposition depends on successful execution of its DeFi expansion strategy and continued ecosystem development. Short-term risks include high volatility, limited liquidity, and competitive pressures within the Sui DeFi landscape.

TURBOS Investment Recommendations

✅ Beginners: Approach with caution; consider starting with minimal allocation (under 1% of portfolio) and focus on understanding DeFi mechanics before investing ✅ Experienced Investors: May consider small speculative positions (2-5% allocation) with strict risk management, monitoring protocol developments and Sui ecosystem growth ✅ Institutional Investors: Conduct thorough due diligence on smart contract audits, team credentials, and liquidity depth before considering any exposure

TURBOS Trading Participation Methods

- Spot Trading on Gate.com: Direct purchase and sale of TURBOS tokens with transparent pricing

- Liquidity Provision: Participate in Turbos Finance DEX liquidity pools on the Sui network for potential yield generation

- DCA Strategy: Dollar-cost averaging to mitigate timing risk given current price volatility

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is TURBOS? What are its main uses and functions?

TURBOS is a cryptocurrency designed for trading and yield generation on Sui network. Its main functions include Concentrated Liquidity Market Maker(CLMM), perpetual AMM trading, and TurbosBoost Camp for enhanced trading returns.

How to conduct TURBOS price prediction? What analysis methods and tools are available?

Analyze TURBOS prices using technical analysis with moving averages and trading volume trends, combined with fundamental analysis monitoring market news and ecosystem development. Track on-chain metrics and sentiment indicators for comprehensive prediction.

What are the main factors affecting TURBOS price?

TURBOS price is primarily driven by market supply and demand, trading volume, investor sentiment, and broader cryptocurrency market trends. Network adoption on Sui ecosystem and community activity also significantly influence price movements.

What is the historical price performance of TURBOS?

TURBOS has declined 7.10% over the past week, underperforming the broader crypto market which fell 4.80%. As of February 2026, the token continues to show weak market performance compared to similar cryptocurrencies.

What are the risks and limitations in TURBOS price predictions?

TURBOS price predictions face market volatility, regulatory uncertainties, and technological development risks. Predictions rely on current data and historical patterns, which may not guarantee future performance. Market conditions can shift significantly, affecting actual price movements unpredictably.

What are the differences in price movements between TURBOS and similar tokens?

TURBOS exhibits higher volatility compared to similar tokens, with significant price fluctuations driven by active trading activity. Its price movements are influenced by market sentiment and on-chain dynamics, offering distinct trading opportunities for investors seeking exposure to emerging DeFi protocols.

What are professional analysts' price predictions for TURBOS in the future?

Professional analysts predict TURBOS price range between $0.0017 and $0.0032 in 2025. Predictions vary based on market trends, community sentiment, and trading volume. Most analysts expect the price to fluctuate within this range throughout the year.

How to develop an investment strategy based on TURBOS price prediction?

Analyze market trends, technical indicators, and fundamental data. Set stop-loss and take-profit levels. Backtest strategies using historical data, optimize trading frequency and position sizing. Implement robust risk management to maximize returns on TURBOS investments.

What will be the market capitalization of USDC in 2025? Analysis of the stablecoin market landscape.

How is DeFi different from Bitcoin?

What is DeFi: Understanding Decentralized Finance in 2025

USDC stablecoin 2025 Latest Analysis: Principles, Advantages, and Web3 Eco-Applications

Development of Decentralized Finance Ecosystem in 2025: Integration of Decentralized Finance Applications with Web3

2025 USDT USD Complete Guide: A Must-Read for Newbie Investors

Comprehensive Guide to Take Profit and Stop Loss in Trading

Top Cryptocurrencies to Watch in 2025: Investment Opportunities

NFT: What Is Digital Art and How Does It Differ from Traditional Artworks?

Top 7 Bitcoin Mining Machines for Cryptocurrency Mining Operations

What is LOOKS: A Comprehensive Guide to Understanding Modern Visual Communication Standards