2026 WING Price Prediction: Expert Analysis and Market Outlook for the Upcoming Year

Introduction: WING's Market Position and Investment Value

Wing (WING), as a decentralized lending platform based on credit scoring and supporting cross-chain asset interactions, has been developing its unique position in the DeFi ecosystem since its launch in 2020. As of 2026, WING maintains a market capitalization of approximately $409,873, with a circulating supply of around 5.46 million tokens, and the price hovering near $0.075. This asset, recognized as an innovative credit-based lending solution, is playing an increasingly important role in the decentralized finance sector.

This article will comprehensively analyze WING's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic environment factors to provide investors with professional price forecasts and practical investment strategies.

I. WING Price History Review and Market Status

WING Historical Price Evolution Trajectory

- 2020: Wing launched on September 16, 2020, experiencing significant volatility in its early days. On September 17, 2020, the token reached its all-time high of $140.81, representing an exceptional surge shortly after its market debut.

- 2021-2024: The token entered a prolonged consolidation phase, with price movements reflecting broader DeFi market cycles and adjustments in the lending protocol landscape.

- 2025: Wing experienced substantial downward pressure, with the price declining to its all-time low of $0.071 on June 5, 2025, marking a significant correction from historical peaks.

WING Current Market Status

As of February 6, 2026, Wing is trading at $0.075, reflecting challenging market conditions across short and medium-term timeframes. The token has declined 1.81% over the past hour and 14.04% in the last 24 hours, with the 24-hour trading range spanning between $0.075 and $0.096. The weekly performance shows a 10.6% decrease, while the monthly chart indicates an 18.5% decline. The annual performance reveals a substantial 97.87% decrease, highlighting the prolonged bearish pressure on the asset.

The token's market capitalization stands at approximately $409,874, with a circulating supply of 5,464,984 WING tokens representing 54.65% of the maximum supply of 10,000,000 tokens. The fully diluted market cap is calculated at $572,859. Trading volume over the past 24 hours reached $221,265, suggesting moderate liquidity levels. Wing currently holds a market dominance of 0.000024% and ranks at position 3173 in the cryptocurrency market.

The token is held by approximately 4,817 addresses and is listed on 2 exchanges. Market sentiment indicators show an extreme fear reading of 9 on the volatility index, reflecting cautious positioning among market participants. The substantial gap between the current price and the all-time high demonstrates the significant retracement experienced over the project's lifecycle.

Click to view current WING market price

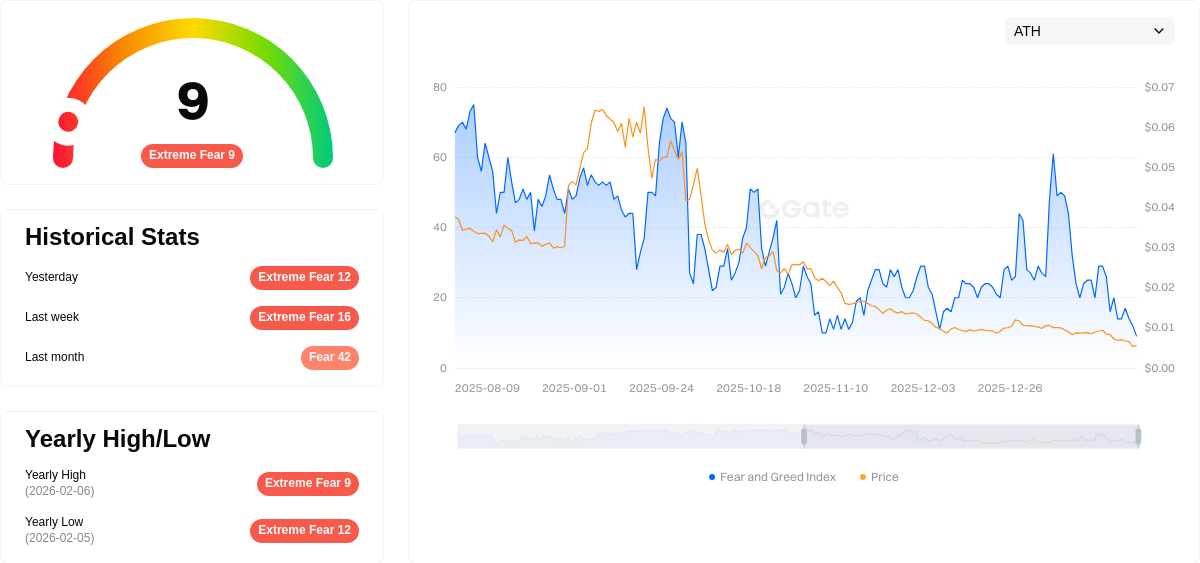

WING Market Sentiment Index

2026-02-06 Fear and Greed Index: 9 (Extreme Fear)

Click to view current Fear & Greed Index

The cryptocurrency market is currently experiencing extreme fear, with the Fear and Greed Index reaching 9. This exceptionally low reading indicates severe market pessimism and panic selling. When the index enters extreme fear territory, it often presents contrarian opportunities for long-term investors, as markets typically rebound from such extreme conditions. However, caution is warranted as further downside remains possible. Monitor key support levels and market fundamentals closely during this period of heightened uncertainty and volatility.

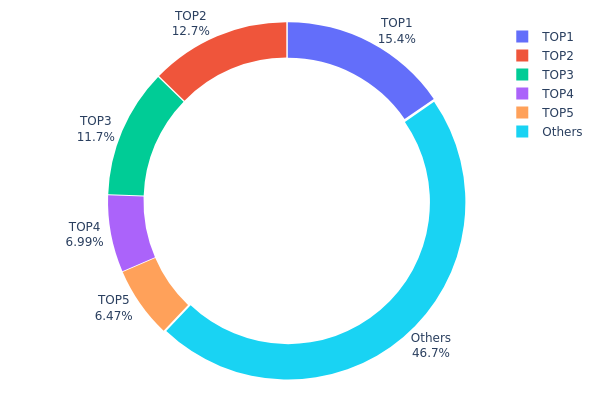

WING Holding Distribution

The holding distribution chart illustrates the concentration of WING tokens across different wallet addresses, providing crucial insights into the token's ownership structure and potential market dynamics. This metric serves as a key indicator of decentralization level and helps assess the risk of concentrated selling pressure or potential market manipulation.

Based on the current data, WING exhibits a relatively concentrated holding pattern. The top address holds approximately 1.36 million tokens, representing 15.40% of the total supply, while the top five addresses collectively control 46.32% of all circulating tokens. This concentration level suggests a moderate centralization risk, as nearly half of the token supply is controlled by just five entities. The remaining 46.68% is distributed among other holders, indicating some degree of broader community participation, though the concentration in top addresses remains noteworthy.

This holding structure presents both opportunities and risks for market participants. The significant concentration in top addresses could lead to increased price volatility, as large holders possess substantial influence over market movements. Any decision by these major holders to liquidate positions could trigger sharp price fluctuations. However, the presence of 46.68% held by other addresses provides some buffer against complete market control by a few entities. For potential investors, understanding this distribution is essential for risk assessment and position sizing decisions.

Click to view current WING Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | AJN2SZ...j1fNdf | 1358.81K | 15.40% |

| 2 | AUKZ3K...mqL8Wo | 1125.00K | 12.75% |

| 3 | AXTCgk...qEh8Fb | 1033.47K | 11.71% |

| 4 | ATVQ3A...oXbk3c | 617.19K | 6.99% |

| 5 | AGp3rJ...jcsuhB | 570.89K | 6.47% |

| - | Others | 4118.44K | 46.68% |

II. Core Factors Influencing WING's Future Price

Market Demand and Volatility

- Price Volatility: Cryptocurrency prices are highly volatile and may be influenced by external factors such as financial, regulatory, or political events. This volatility reflects market trends and should be considered when evaluating investment opportunities.

- Market Sentiment: External events, including policy changes and broader market trends, play a significant role in shaping demand for WING. Investors should monitor these developments closely to understand potential price movements.

- Risk Awareness: The indicative nature of cryptocurrency pricing suggests that prices reflect market dynamics rather than serving as definitive trading benchmarks. This characteristic requires investors to maintain awareness of market conditions.

Regulatory Environment

- Policy Impact: Regulatory developments can substantially affect cryptocurrency valuations. Changes in financial regulations or government policies may create both opportunities and challenges for WING's market performance.

- Compliance Considerations: As regulatory frameworks evolve, compliance requirements may influence how WING operates within different jurisdictions, potentially affecting investor confidence and market accessibility.

Technical Development

- Technology Evolution: The ongoing development of underlying technology represents a key factor in determining WING's long-term value proposition. Technical improvements may enhance functionality and user adoption.

- Ecosystem Growth: The expansion of applications and use cases within the WING ecosystem could contribute to increased utility and demand over time.

III. 2026-2031 WING Price Prediction

2026 Outlook

- Conservative Prediction: $0.0495 - $0.075

- Neutral Prediction: Around $0.075

- Optimistic Prediction: Up to $0.11025 (requires favorable market conditions and ecosystem expansion)

2027-2029 Outlook

- Market Stage Expectation: WING may enter a gradual growth phase, with price volatility influenced by broader cryptocurrency market trends and DeFi sector developments

- Price Range Predictions:

- 2027: $0.04724 - $0.13431, with an average around $0.09263

- 2028: $0.06694 - $0.15318, with an average around $0.11347

- 2029: $0.07199 - $0.13999, with an average around $0.13332

- Key Catalysts: Platform adoption rates, technological upgrades, and overall DeFi market sentiment could serve as primary drivers for price movements

2030-2031 Long-term Outlook

- Baseline Scenario: $0.11889 - $0.15169 in 2030 (assuming steady platform growth and stable market conditions)

- Optimistic Scenario: $0.11678 - $0.1658 in 2031 (contingent on significant ecosystem expansion and increased institutional adoption)

- Transformative Scenario: Potential to exceed $0.1658 (under exceptionally favorable conditions including major partnerships and widespread DeFi adoption)

- February 6, 2026: WING trading within the predicted range of $0.0495 - $0.11025 (early-stage price discovery phase)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.11025 | 0.075 | 0.0495 | 0 |

| 2027 | 0.13431 | 0.09263 | 0.04724 | 23 |

| 2028 | 0.15318 | 0.11347 | 0.06694 | 51 |

| 2029 | 0.13999 | 0.13332 | 0.07199 | 77 |

| 2030 | 0.15169 | 0.13666 | 0.11889 | 82 |

| 2031 | 0.1658 | 0.14417 | 0.11678 | 92 |

IV. WING Professional Investment Strategy and Risk Management

WING Investment Methodology

(1) Long-term Holding Strategy

- Target Investors: Risk-tolerant investors who believe in decentralized lending protocols and credit-based DeFi innovation

- Operational Recommendations:

- Consider accumulating positions during significant market corrections, given WING's current price volatility

- Monitor the platform's total value locked (TVL) and borrowing activity as indicators of protocol health

- Storage Solution: Gate Web3 Wallet offers secure storage for WING tokens with multi-signature support and cross-chain compatibility

(2) Active Trading Strategy

- Technical Analysis Tools:

- Volume Analysis: Track the 24-hour trading volume ($221,265) relative to market cap to identify liquidity patterns

- Moving Averages: Use 7-day and 30-day moving averages to identify trend reversals, noting the recent -10.6% (7D) and -18.5% (30D) declines

- Swing Trading Considerations:

- Set tight stop-loss orders due to high volatility, as evidenced by the 24-hour range of $0.075 to $0.09574

- Monitor cross-chain lending activity and OScore credit system adoption for fundamental momentum signals

WING Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-3% of crypto portfolio allocation

- Aggressive Investors: 5-10% of crypto portfolio allocation

- Professional Investors: Up to 15% with active hedging strategies

(2) Risk Hedging Solutions

- Stablecoin Pairing: Maintain partial positions in stablecoins to capture rebound opportunities during volatility

- Portfolio Diversification: Balance WING exposure with established DeFi blue-chips to mitigate protocol-specific risks

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for active trading and staking participation

- Cold Storage Solution: Hardware wallet integration for long-term holdings exceeding $1,000

- Security Precautions: Enable two-factor authentication, regularly update wallet software, and never share private keys or seed phrases

V. WING Potential Risks and Challenges

WING Market Risks

- Extreme Volatility: The token has declined 97.87% over the past year, indicating severe market pressure and potential liquidity concerns

- Limited Exchange Presence: With only 2 exchanges listing WING, liquidity constraints may amplify price swings during market stress

- Low Market Capitalization: At approximately $410,000 circulating market cap, WING faces risks from whale manipulation and thin order books

WING Regulatory Risks

- DeFi Lending Scrutiny: Credit-based lending protocols may face increased regulatory attention as authorities worldwide develop frameworks for decentralized finance

- Cross-chain Compliance: The platform's cross-chain asset support could encounter regulatory challenges in jurisdictions with strict crypto transfer rules

- Token Classification Uncertainty: Governance and utility tokens like WING operate in evolving legal landscapes with potential reclassification risks

WING Technical Risks

- Smart Contract Vulnerabilities: Lending protocols are frequent targets for exploits; users should monitor security audits and bug bounty programs

- Credit Scoring Mechanism: The OScore system represents novel technology that requires extensive real-world testing to validate reliability

- Ontology Network Dependency: As WING operates on Ontology (based on contract address 00c59fcd27a562d6397883eab1f2fff56e58ef80), any network disruptions could impact protocol functionality

VI. Conclusion and Action Recommendations

WING Investment Value Assessment

WING presents a high-risk, speculative opportunity within the decentralized lending sector. The project's innovative credit-scoring approach and cross-chain ambitions offer theoretical long-term value for the DeFi ecosystem. However, the token's 97.87% annual decline, minimal exchange listings, and sub-$500,000 market cap signal severe challenges. The circulating supply represents only 54.65% of fully diluted valuation, indicating potential future dilution pressure. Short-term risks include continued price deterioration and liquidity concerns, while long-term viability depends on successful protocol adoption and ecosystem growth.

WING Investment Recommendations

✅ Beginners: Avoid WING until demonstrating consistent understanding of DeFi lending mechanics and risk management. If interested, limit exposure to less than 1% of total portfolio ✅ Experienced Investors: Consider small speculative positions (2-5% of crypto allocation) only after thorough due diligence on protocol security and market dynamics ✅ Institutional Investors: Conduct comprehensive technical audits and regulatory risk assessments before any allocation; consider WING only as part of diversified DeFi lending basket

WING Trading Participation Methods

- Spot Trading on Gate.com: Access WING trading pairs with competitive fees and liquidity pooling options

- Gate Web3 Wallet Integration: Securely store and manage WING tokens while maintaining full custody control

- DeFi Protocol Participation: Engage directly with Wing Finance lending pools to earn WING rewards through supplying or borrowing assets (note: requires separate protocol interaction beyond exchange trading)

Cryptocurrency investments carry extremely high risks. This article does not constitute investment advice. Investors should make cautious decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What is WING token and what are its uses?

WING is a decentralized finance token built on blockchain technology, providing lending, trading, and borrowing services. It features cross-chain interoperability and governance functionality, enabling users to participate in decentralized financial ecosystems.

How has WING's price performed historically? What was the price change over the past year?

WING has maintained relatively stable performance over the past year with minimal price fluctuation. The current price stands at $0.002872, showing a flat trend with virtually no significant gains or losses during this period.

What are the main factors affecting WING price?

WING price is primarily driven by market demand, adoption rate growth, and platform ecosystem expansion. Trading volume, market sentiment, and DeFi sector performance also significantly influence its valuation.

What are WING's advantages compared to other DeFi governance tokens?

WING provides enhanced privacy and reduces front-running risks through its private transaction pool, offering superior protection compared to traditional DeFi governance tokens in the market.

What is the WING price prediction for 2024-2025?

Based on market analysis, WING demonstrated a growth trend during 2024-2025. As of late 2025, WING price reached approximately $0.09125, with positive momentum indicators suggesting continued upward potential in the coming period.

What risks should I pay attention to when investing in WING?

WING investment involves market volatility and price fluctuations. Conduct thorough research before investing. Understanding blockchain technology and market dynamics is essential for informed decision-making in crypto investments.

What is Wing Finance's development prospects and roadmap?

Wing Finance focuses on continuous platform enhancements and ecosystem expansion. The roadmap includes advancing DeFi features, improving user experience, scaling infrastructure, and integrating emerging technologies. The project commits to regular updates and innovation to strengthen market competitiveness and deliver sustainable value.

How is WING's liquidity and trading volume? Which exchanges can trade it?

WING demonstrates moderate liquidity with solid trading volume on major platforms. The token has a circulating supply of 5,464,694 WING and is actively traded across multiple exchanges, ensuring accessibility and market depth for traders seeking exposure to this DeFi asset.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

How do Fed policy and inflation data impact crypto prices in the macroeconomic landscape?

GZONE vs BAT: Which Tech Giant Dominates China's Digital Economy in 2024?

What is the current market overview of Dogecoin (DOGE) with $15.29B market cap and $4.06B 24-hour trading volume?

NODL vs FLOW: A Comprehensive Comparison of Two Leading Blockchain Development Platforms

NC vs ETH: A Comprehensive Comparison of Network Capabilities and Transaction Efficiency in Blockchain Technology