2026 WSI Price Prediction: Expert Analysis and Market Forecast for the Next Bull Run

Introduction: WSI's Market Position and Investment Value

WeSendit (WSI) serves as a decentralized data transmission and storage solution, designed to protect users' data and personal information since its inception. As of 2026, WSI maintains a market capitalization of approximately $613,345, with a circulating supply of around 826.72 million tokens, and the price hovering around $0.0007419. This asset, operating within the decentralized file transfer and storage sector, is gradually establishing its presence in the Web3 data protection landscape.

This article will comprehensively analyze WSI's price trends from 2026 to 2031, combining historical patterns, market supply and demand dynamics, ecosystem development, and macroeconomic conditions to provide investors with professional price forecasts and practical investment strategies.

I. WSI Price Historical Review and Market Status

WSI Historical Price Evolution Trajectory

- 2023: WSI reached a peak price level of $0.312782 on January 7, marking a significant milestone in its early market performance

- 2025: The token experienced substantial downward pressure, with prices declining to a low of $0.00071733 on November 21

- 2025-2026: The cryptocurrency entered a period of continued price compression, with values remaining near historical lows

WSI Current Market Situation

As of February 5, 2026, WSI is trading at $0.0007419, showing notable volatility across multiple timeframes. The token has declined by 4.47% over the past hour and 12.38% in the last 24 hours, with the 24-hour trading range spanning from $0.0007195 to $0.0008488.

Broader timeframe analysis reveals more pronounced negative trends, with WSI declining 23.87% over the past week and 32.14% over the last 30 days. The annual performance shows a decline of 75.64%, reflecting challenging market conditions throughout the period.

The project maintains a market capitalization of approximately $613,345, with 826,722,363 tokens in circulation representing 55.11% of the total supply. The fully diluted market cap stands at $1,103,947, based on a maximum supply of 1,500,000,000 tokens. Daily trading volume amounts to $12,863.77, indicating relatively limited liquidity.

WSI operates as a BEP-20 token on the BSC (Binance Smart Chain) network, with the contract address 0x837A130aED114300Bab4f9f1F4f500682f7efd48. The project has accumulated approximately 12,849 token holders.

The broader cryptocurrency market sentiment index currently registers at 14, indicating an "Extreme Fear" environment, which may be contributing to the downward pressure on WSI and similar assets.

WSI focuses on providing decentralized transmission and storage solutions while emphasizing data and personal information protection.

Click to view current WSI market price

WSI Market Sentiment Indicator

2026-02-04 Fear and Greed Index: 14 (Extreme Fear)

Click to view current Fear & Greed Index

The crypto market is currently experiencing extreme fear with an index reading of 14, indicating strong bearish sentiment among investors. This level suggests significant market pessimism and potential capitulation. When fear reaches such extremes, contrarian investors often view it as a potential buying opportunity, as markets tend to recover from these lows. However, caution is advised as further downside movement remains possible. Traders should monitor key support levels and market indicators closely during this volatile period.

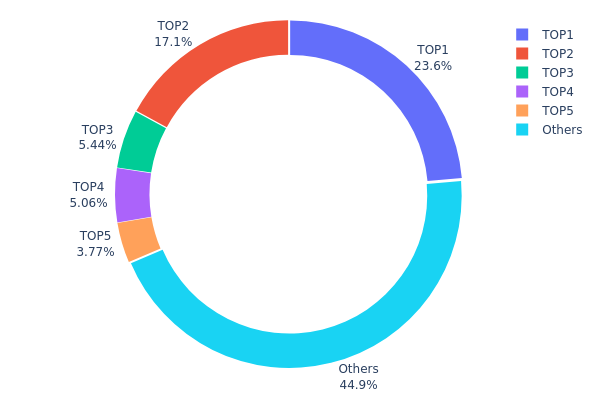

WSI Holding Distribution

The holding distribution chart reflects the concentration of token ownership across different addresses on the blockchain. By analyzing the proportion of tokens held by top addresses versus the broader community, this metric provides insights into the degree of decentralization and potential market manipulation risks.

Based on current data, WSI exhibits a moderate to high concentration pattern. The top address holds approximately 23.64% of total supply (354,717.99K tokens), while the second-largest address (likely a burn address indicated by "0x0000...00dead") accounts for 17.14%. The top five addresses collectively control 55.03% of the circulating supply, leaving 44.97% distributed among other holders. This concentration level suggests that a relatively small number of entities possess significant influence over the token's market dynamics.

Such distribution patterns present both opportunities and risks for market participants. On one hand, the substantial burn address allocation demonstrates a deflationary mechanism that could support long-term value appreciation. On the other hand, the concentrated ownership among top addresses increases vulnerability to large-scale selling pressure and potential price manipulation. Any significant movement from these major holders could trigger sharp volatility, particularly in less liquid market conditions. The relatively balanced distribution between top holders and the remaining community (approximately 55:45 ratio) indicates a developing ecosystem that has achieved partial decentralization, though continued monitoring of whale activity remains essential for risk assessment.

Click to view current WSI Holding Distribution

| Top | Address | Holding Qty | Holding (%) |

|---|---|---|---|

| 1 | 0x0529...c553b7 | 354717.99K | 23.64% |

| 2 | 0x0000...00dead | 257124.94K | 17.14% |

| 3 | 0x8477...32db4f | 81638.35K | 5.44% |

| 4 | 0x2787...70887f | 75832.50K | 5.05% |

| 5 | 0x4f32...efc017 | 56543.23K | 3.76% |

| - | Others | 674142.99K | 44.97% |

II. Core Factors Influencing WSI's Future Price

Supply Mechanism

- Circulating Supply: As of November 2025, WSI has a circulating supply of approximately 818,367,741 tokens with a market capitalization of $698,476.87. The current price stands at $0.0008535.

- Supply Scarcity: The token's limited circulation may create scarcity pressure as market adoption increases, potentially supporting price appreciation over time.

- Current Impact: The relatively low trading volume of $10,371.31 within 24 hours suggests limited liquidity, which could amplify price volatility in response to supply-demand imbalances.

Institutional and Major Holder Dynamics

- Institutional Participation: Market sentiment indicators show an extreme fear index of 1, reflecting minimal institutional confidence at present. Enhanced institutional involvement could provide crucial support for future price stability.

- Enterprise Adoption: Broader acceptance of WSI within file transfer and data sharing sectors may drive fundamental value, though specific enterprise partnerships require further development.

- Regulatory Environment: Regulatory changes and policy developments in cryptocurrency markets remain key external factors that could significantly impact WSI's adoption trajectory and market positioning.

Macroeconomic Environment

- Market Sentiment: The cryptocurrency market's overall sentiment, including fear and greed indicators, continues to influence WSI's price movements. Current extreme fear levels suggest potential upside once market confidence recovers.

- Economic Cycles: Broader macroeconomic changes, including inflation trends and monetary policy shifts, may affect investor appetite for digital assets like WSI.

- Market Demand: Growing demand for decentralized file transfer solutions could support WSI's long-term value proposition, particularly as data privacy concerns increase globally.

Technology Development and Ecosystem Building

- Platform Innovation: Technological advancements in WeSendit's file transfer infrastructure may enhance user experience and drive adoption, supporting price appreciation through increased utility.

- Ecosystem Expansion: Development of complementary applications and integration with other platforms could broaden WSI's use cases, creating additional demand drivers.

- Network Effects: As the user base grows, network effects may strengthen WSI's competitive position within the file transfer market, potentially translating into sustained price support over the 2026-2031 forecast period.

III. 2026-2031 WSI Price Prediction

2026 Outlook

- Conservative forecast: $0.0005 - $0.00074

- Neutral forecast: $0.00074 (average)

- Optimistic forecast: $0.00079 (requires favorable market conditions and increased adoption)

2027-2029 Medium-term Outlook

- Market stage expectation: The token is anticipated to enter a gradual growth phase, with steady price appreciation as market recognition potentially improves

- Price range forecast:

- 2027: $0.00053 - $0.00105 (approximately 3% change)

- 2028: $0.00071 - $0.0012 (approximately 22% change)

- 2029: $0.00072 - $0.00127 (approximately 42% change)

- Key catalysts: Market adoption trends, broader cryptocurrency market sentiment, and potential technological developments within the WSI ecosystem

2030-2031 Long-term Outlook

- Baseline scenario: $0.00068 - $0.0014 (assuming stable market conditions and moderate growth trajectory)

- Optimistic scenario: $0.00116 - $0.0014 in 2030 (contingent on enhanced utility and ecosystem expansion)

- Progressive scenario: $0.00099 - $0.00151 in 2031 (subject to significant market evolution and increased platform integration)

- 2026-02-05: WSI trading within $0.0005 - $0.00079 range (establishing baseline for future growth projections)

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00079 | 0.00074 | 0.0005 | 0 |

| 2027 | 0.00105 | 0.00076 | 0.00053 | 3 |

| 2028 | 0.0012 | 0.00091 | 0.00071 | 22 |

| 2029 | 0.00127 | 0.00106 | 0.00072 | 42 |

| 2030 | 0.0014 | 0.00116 | 0.00068 | 56 |

| 2031 | 0.00151 | 0.00128 | 0.00099 | 72 |

IV. WSI Professional Investment Strategy and Risk Management

WSI Investment Methodology

(1) Long-term Holding Strategy

- Suitable for: Investors with high risk tolerance and belief in decentralized data storage solutions

- Operational Recommendations:

- Consider dollar-cost averaging (DCA) approach to mitigate volatility impact given the token's significant price fluctuations

- Monitor project development progress and adoption metrics for the decentralized transmission and storage solution

- Storage Solution: Use Gate Web3 Wallet for secure storage of WSI tokens, ensuring proper backup of recovery phrases

(2) Active Trading Strategy

- Technical Analysis Tools:

- Moving Averages: Utilize 20-day and 50-day moving averages to identify trend reversals, particularly relevant given WSI's 23.87% decline over 7 days

- Volume Analysis: Monitor the 24-hour trading volume of approximately $12,864 to assess liquidity and market interest

- Swing Trading Points:

- Set stop-loss orders below recent support levels, considering the 24-hour low of $0.0007195

- Take profit targets should account for resistance levels near the 24-hour high of $0.0008488

WSI Risk Management Framework

(1) Asset Allocation Principles

- Conservative Investors: 1-2% of crypto portfolio allocation

- Aggressive Investors: 3-5% of crypto portfolio allocation

- Professional Investors: 5-8% with active risk hedging strategies

(2) Risk Hedging Solutions

- Portfolio Diversification: Combine WSI with established cryptocurrencies and stable assets to balance risk exposure

- Position Sizing: Limit individual position size based on the token's market cap of approximately $613,345 and relatively low liquidity

(3) Secure Storage Solutions

- Hot Wallet Recommendation: Gate Web3 Wallet for convenient trading and staking accessibility

- Cold Storage Solution: Transfer long-term holdings to hardware wallets for enhanced security

- Security Precautions: Enable two-factor authentication, verify contract address (0x837A130aED114300Bab4f9f1F4f500682f7efd48 on BSC), and never share private keys

V. WSI Potential Risks and Challenges

WSI Market Risks

- High Volatility: The token has experienced a 75.64% decline over the past year, indicating substantial price instability

- Limited Liquidity: With a 24-hour trading volume of approximately $12,864 and market cap of $613,345, liquidity constraints may impact execution prices

- Market Cap Position: Ranked at #2873 with only 0.000042% market dominance, suggesting limited market recognition and adoption

WSI Regulatory Risks

- Data Storage Compliance: Decentralized storage solutions may face evolving regulatory frameworks regarding data sovereignty and privacy laws

- Securities Classification: Token classification as utility or security may vary across jurisdictions, potentially affecting trading availability

- Cross-border Data Regulations: International data transfer regulations could impact the project's operational model

WSI Technical Risks

- Smart Contract Vulnerabilities: BSC-based token contracts may be subject to exploits or bugs affecting token functionality

- Project Development Risk: Limited public information about technical roadmap and development progress may indicate execution challenges

- Adoption Barriers: Competition in the decentralized storage sector from established players may hinder user acquisition

VI. Conclusion and Action Recommendations

WSI Investment Value Assessment

WSI presents a high-risk, high-volatility investment opportunity in the decentralized data storage and transmission sector. With a current price of $0.0007419 and significant decline of 75.64% over the past year, the token demonstrates substantial downside risk. The project's focus on data protection and decentralized solutions addresses growing privacy concerns, potentially offering long-term value. However, limited liquidity, low market capitalization, and uncertain development trajectory present considerable challenges. The circulating supply of 826.72 million tokens (55.11% of maximum supply) suggests potential future supply pressure.

WSI Investment Recommendations

✅ Beginners: Avoid or allocate only minimal amounts (under 1% of portfolio) due to extreme volatility and limited track record. Focus on understanding fundamental blockchain concepts before considering speculative assets like WSI.

✅ Experienced Investors: Consider small speculative position (2-3% maximum) with strict stop-loss parameters. Monitor project development milestones and adoption metrics closely before increasing exposure.

✅ Institutional Investors: Conduct comprehensive due diligence on project fundamentals, team credentials, and competitive positioning. Consider waiting for clear adoption signals or technical improvements before significant capital allocation.

WSI Trading Participation Methods

- Spot Trading: Purchase WSI directly on Gate.com with USDT or other trading pairs, suitable for long-term holding strategies

- Grid Trading: Utilize automated grid trading strategies to capture price fluctuations within the established range between $0.0007195 and $0.0008488

- Portfolio Integration: Include WSI as a small-cap speculative component within a diversified cryptocurrency portfolio focused on data storage and privacy sectors

Cryptocurrency investment carries extremely high risks, and this article does not constitute investment advice. Investors should make prudent decisions based on their own risk tolerance and are advised to consult professional financial advisors. Never invest more than you can afford to lose.

FAQ

What are the main factors influencing WSI price predictions?

WSI price is primarily influenced by supply scarcity, institutional participation, and macroeconomic changes. Technology development, ecosystem expansion, and market adoption rates are key drivers. Community engagement and regulatory environment also significantly impact price movements.

How to use technical analysis methods to predict WSI price trends?

Analyze WSI using moving averages, RSI, and trading volume patterns. Current price is $0.0008362. Technical indicators suggest potential upside to $0.0008363 tomorrow with consistent bullish momentum indicators.

WSI price predictions involve several risks and limitations including data accuracy constraints, volatile market conditions, regulatory uncertainties, and unforeseen geopolitical events. Historical patterns may not guarantee future performance. Limited trading volume and technical analysis gaps can affect prediction reliability.

WSI price predictions face risks from market volatility, regulatory changes, and limited trading volume data. Technical analysis limitations and unpredictable geopolitical factors can affect accuracy. Historical trends may not reflect future performance. Economic shifts and sentiment changes significantly impact price movements unpredictably.

What is the historical accuracy rate of WSI price predictions?

WSI price prediction accuracy varies significantly due to market volatility. Recent data shows 16.70% growth in 7 days, though WSI remains 99.94% below its all-time high. Historical performance cannot guarantee future results.

What are professional institutions' predictions for WSI's future price?

According to institutional analysis, WSI price predictions for 2026 range from $0.00051054 to $0.001. By 2030, base case scenarios project $0.001409 to $0.001890, with optimistic scenarios reaching $0.002. Long-term growth depends on ecosystem adoption and market expansion.

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Newbie Must Read: How to Formulate Investment Strategies When Nasdaq Turns Positive in 2025

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

How to Mine Ethereum in 2025: A Complete Guide for Beginners

Best Crypto Wallets 2025: How to Choose and Secure Your Digital Assets

TapSwap Listing Date: What Investors Need to Know in 2025

Top 5 Tokens to Consider for DeFi Investment

Tax Planning for Bitcoin Investors Who Have Achieved Millionaire Status

FUD and FOMO in Crypto: Key Concepts Explained with Practical Examples

OpenSea NFT Exchange: Reviews, Advantages and Disadvantages

Top 10 Metaverse Platforms: An In-Depth Overview