Is GHO (GHO) a good investment?: Analyzing the Aave Governance Token's Potential Returns and Market Risks

Introduction: GHO's Investment Position and Market Outlook

GHO is an important asset in the cryptocurrency space. As of December 16, 2025, GHO maintains a market capitalization of USD 352,574,343.08, with a circulating supply of approximately 352,821,318 tokens and a current price of USD 0.9993. Positioned as a "decentralized, over-collateralized stablecoin," GHO has gradually become a focal point when investors discuss the investment potential of stablecoins in the Aave Protocol ecosystem. The token is fully backed by assets, maintains transparency, and is native to the Aave Protocol, designed to maintain peg stability with the U.S. dollar through market efficiencies and over-collateralization mechanisms.

Currently ranking 161st by market capitalization with a market dominance of 0.011%, GHO presents an interesting case study for investors evaluating stablecoin investments within the decentralized finance landscape. With price movements showing a 24-hour change of -0.01%, a 7-day change of -0.06%, and a year-to-date performance of +0.12%, the token has demonstrated relative price stability around its intended USD peg.

This report provides a comprehensive analysis of GHO's investment value, historical price movements, future price forecasts, and investment risks to serve as a reference for investors considering exposure to this asset.

GHO Cryptocurrency Research Report

I. GHO Price History Review and Current Investment Market Status

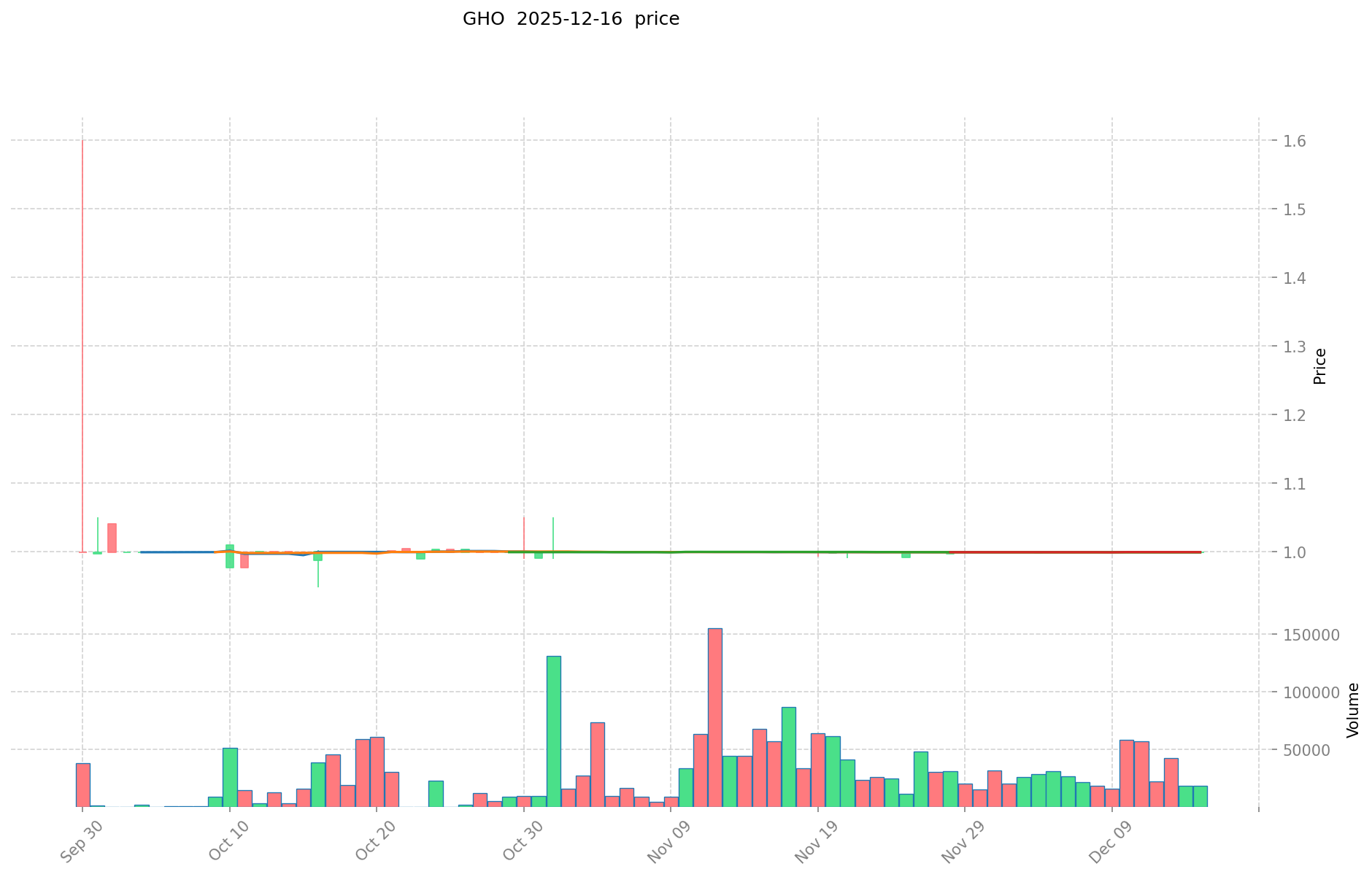

GHO Historical Price Performance

Based on available data as of December 16, 2025:

- All-time High (ATH): $1.60 reached on September 30, 2025

- All-time Low (ATL): $0.9478 reached on October 16, 2025

- Historical Price Range: $0.9478 - $1.60, representing a volatility span of approximately 69%

Current GHO Investment Market Status (December 16, 2025)

Price Metrics:

- Current Price: $0.9993

- Market Capitalization: $352,574,343.08

- Circulating Supply: 352,821,318 GHO

- Total Supply: 352,821,318 GHO

- Maximum Supply: Unlimited (∞)

Price Performance Indicators:

- 1-hour change: -0.01%

- 24-hour change: -0.01%

- 7-day change: -0.06%

- 30-day change: +0.04%

- 1-year change: +0.12%

Market Activity:

- 24-hour trading volume: $16,247.81

- Number of holders: 6,523

- Market dominance: 0.011%

- Fully Diluted Valuation (FDV): $352,574,343.08

- Market Cap to FDV ratio: 100%

GHO maintains near-perfect peg stability to the U.S. dollar, with current price oscillating tightly around $1.00.

II. Project Overview

GHO is a decentralised, over-collateralised stablecoin that is fully backed, transparent, and native to the Aave Protocol. Key characteristics include:

Core Features:

- Designed to maintain a value pegged to the U.S. dollar

- Users mint GHO on demand, subject to mint cap limitations set by Aave governance

- Stability maintained through market efficiencies and over-collateralisation mechanisms inherent in the Aave Protocol

- ERC-20 token standard deployed on Ethereum blockchain

Technical Specifications:

- Contract Address (Ethereum): 0x40d16fc0246ad3160ccc09b8d0d3a2cd28ae6c2f

- Chain: Ethereum (ETH)

- Protocol: Aave Protocol

III. Market Position and Network Statistics

- Global Market Ranking: #161

- Exchange Listings: 2 exchanges

- Token Holders: 6,523 addresses

- Market Share: 0.011% of total cryptocurrency market

IV. Official Resources

Primary Sources:

- Official Website: https://gho.xyz/

- Technical Documentation: GHO Technical Paper

- Blockchain Explorer: Etherscan Token Page

- Official Twitter/X: https://x.com/aave

Report Date: December 16, 2025

Data Source: Gate.com Cryptocurrency Database

GHO (GHO) Investment Analysis Report

Report Date: December 16, 2025

Data Source: Gate.com Crypto Data Platform

I. Executive Summary

GHO is a decentralized, over-collateralized stablecoin native to the Aave Protocol, designed to maintain a value pegged to the U.S. dollar. As of December 16, 2025, GHO trades at $0.9993 with a market capitalization of $352.57 million and a circulating supply of 352.82 million tokens. The asset ranks 161st among cryptocurrencies by market cap, with a market dominance of 0.011%.

II. Core Factors Influencing GHO as an Investment

Supply Mechanism and Scarcity (GHO Investment Supply Dynamics)

GHO operates under a demand-driven minting model where users can mint tokens by locking collateral in Aave markets and paying a protocol-defined borrow rate. The total supply is subject to mint cap limitations set by Aave's governance.

Key Supply Metrics:

- Current circulating supply: 352,821,318 GHO

- Circulating supply ratio: 100.0% (fully diluted)

- Maximum supply: Unlimited (∞)

- Supply growth: GHO supply experienced a 10x expansion in 2024, reaching over 200 million tokens borrowed within the Aave protocol

Investment Significance: The unlimited maximum supply distinguishes GHO from scarce cryptocurrencies, positioning it as a stablecoin rather than a value-accrual asset. However, the governance-controlled mint cap provides supply management mechanisms that prevent hyperinflation while allowing growth aligned with protocol demand.

Institutional Investment and Mainstream Adoption (Institutional Investment in GHO)

Revenue Generation and Protocol Integration: GHO has demonstrated rapid adoption within the Aave ecosystem. Despite representing only 200+ million tokens borrowed in Aave's multi-billion dollar borrowing volume, GHO already accounts for approximately 10% of the protocol's revenue. This disproportionate revenue contribution indicates strong adoption momentum relative to supply size.

DAO Treasury and Buyback Mechanisms: GHO-related revenue flows to the Aave DAO treasury, funding a permanent $50 million yearly buyback program and Safety Module rewards. This structural support mechanism provides institutional backing through the Aave governance framework.

Cross-Chain Expansion: GHO is expanding beyond Ethereum to other blockchain networks, increasing its utility and addressable market. Broader circulation across chains and DeFi protocols is expected to stabilize and increase the protocol's revenue base over time.

Macroeconomic Environment Impact on GHO Investment

Stablecoin Market Positioning: As a stablecoin, GHO's investment thesis differs from volatile cryptocurrencies. Its value proposition centers on capital preservation and efficient DeFi mechanics rather than speculative appreciation. In uncertain macroeconomic environments, stablecoins serve critical functions as reliable mediums of exchange and collateral within decentralized finance ecosystems.

Interest Rate Environment: Staking mechanism (stkGHO) launched in October 2025 offers approximately 8.4% APY, funded by borrower interest redirected to the DAO. This yield structure positions GHO as an alternative yield-bearing asset in low-rate environments, though primarily for sophisticated DeFi users.

III. Market Performance Analysis

Price Dynamics and Volatility

| Metric | Value |

|---|---|

| Current Price (Dec 16, 2025) | $0.9993 |

| 24-Hour Change | -0.01% |

| 7-Day Change | -0.06% |

| 30-Day Change | +0.04% |

| 1-Year Change | +0.12% |

| All-Time High | $1.6000 (Sept 30, 2025) |

| All-Time Low | $0.9478 (Oct 16, 2025) |

| High-Low Range | $0.6522 (40.8% spread) |

Price Stability Assessment: GHO maintains a relatively tight price band around its $1.00 peg, with recent volatility constrained to -0.06% (7-day) and +0.04% (30-day) movements. The all-time high of $1.60 represents a 60% premium to peg, while the all-time low of $0.9478 reflects a 5.22% discount. This modest deviation range indicates functional peg maintenance mechanisms.

Trading Activity

- 24-Hour Trading Volume: $16,247.81

- Exchange Listings: 2 exchanges

- Holder Count: 6,523 addresses

- Market Cap to Circulating Supply Ratio: 1.0 (indicating peg stability)

IV. Technology and Ecosystem Development

Blockchain Infrastructure

Contract Specification:

- Standard: ERC-20

- Chain: Ethereum

- Contract Address: 0x40d16fc0246ad3160ccc09b8d0d3a2cd28ae6c2f

- Verification: Etherscan integration available

Ecosystem Integration

Aave Protocol Native Integration: GHO's native status within Aave provides direct integration into the largest decentralized lending protocol. Users accessing Aave's collateralized borrowing mechanisms can directly mint and utilize GHO without intermediaries.

DeFi Application Development: GHO's expansion into DeFi applications beyond Aave demonstrates ecosystem breadth. Cross-protocol integration increases utility as a liquidity layer and collateral asset across multiple DeFi protocols.

Governance and Transparency:

- Technical documentation available via GitHub (GHO Technical Paper)

- Aave governance controls protocol parameters

- Over-collateralization mechanisms ensure stability through market-enforced capital requirements

V. Risk Factors

Concentration and Liquidity Risks

- Limited exchange listings (2 exchanges) may constrain liquidity during market stress

- Relatively small holder base (6,523 addresses) increases concentration risk

- Thin 24-hour trading volume ($16,247.81) suggests limited depth

Protocol Dependency

GHO's value and functionality depend entirely on Aave Protocol's continued operation and governance decisions. Changes in Aave's parameter settings, mint caps, or economic model directly impact GHO's utility and adoption.

Peg Maintenance

While GHO has maintained approximate peg stability historically, sustained periods above or below $1.00 create potential for arbitrage-induced volatility during governance adjustments or market stress scenarios.

VI. Key Information Resources

| Category | Reference |

|---|---|

| Official Website | https://gho.xyz/ |

| Technical Documentation | https://github.com/aave/gho-core/blob/main/techpaper/GHO_Technical_Paper.pdf |

| Blockchain Explorer | https://etherscan.io/token/0x40d16fc0246ad3160ccc09b8d0d3a2cd28ae6c2f |

| Project Twitter | https://x.com/aave |

VII. Conclusion

GHO represents a functional stablecoin infrastructure component within the Aave ecosystem rather than a speculative investment asset. Its investment case rests on:

- Protocol Economics: Strong revenue generation (10% of Aave protocol revenue) despite limited supply relative to borrowing volumes

- Structural Support: Permanent buyback program and DAO treasury allocation provide institutional backing

- Ecosystem Growth: 10x supply expansion in 2024 demonstrates adoption momentum

- DeFi Integration: Expanding cross-chain presence increases utility and revenue stability

However, investors should recognize that GHO's design prioritizes capital stability and DeFi utility over price appreciation potential. Its unlimited supply cap and governance-controlled minting distinguish it from scarce cryptocurrency assets. Assessment of GHO as an investment requires evaluation based on stablecoin utility metrics and DeFi protocol participation rather than traditional appreciation-focused investment frameworks.

III. GHO Future Investment Predictions and Price Outlook (Is GHO(GHO) worth investing in 2025-2030)

Short-term Investment Prediction (2025, short-term GHO investment outlook)

- Conservative Forecast: USD 0.66 - 0.99

- Neutral Forecast: USD 0.99 - 1.33

- Optimistic Forecast: USD 1.33 - 1.84

Mid-term Investment Outlook (2026-2028, mid-term GHO(GHO) investment forecast)

-

Market Stage Expectations: GHO continues to establish itself as a decentralized, over-collateralized stablecoin within the Aave ecosystem. Adoption may gradually expand through increased facilitator integrations and broader DeFi protocol adoption.

-

Investment Return Predictions:

- 2026: USD 0.76 - 1.34

- 2027: USD 0.98 - 1.85

- 2028: USD 1.37 - 2.20

-

Key Catalysts: Enhanced liquidity mechanisms, increased institutional adoption of Aave Protocol, expansion of GHO use cases across DeFi platforms, improvement in peg stability through market efficiency refinements, and broader market sentiment toward decentralized stablecoins.

Long-term Investment Outlook (Is GHO a good long-term investment?)

-

Base Case Scenario: USD 1.97 - 3.01 by 2030 (assuming steady growth in Aave Protocol adoption and stable market conditions for decentralized stablecoins)

-

Optimistic Scenario: USD 2.50 - 3.50 by 2030 (corresponding to significant mainstream adoption and favorable macroeconomic environment for crypto assets)

-

Risk Scenario: USD 0.66 - 1.50 by 2030 (under regulatory pressures, competitive threats from centralized stablecoins, or reduced demand for over-collateralized mechanisms)

View GHO long-term investment and price forecasts: Price Prediction

2025-12-16 to 2030 Long-term Outlook

- Base Case: USD 1.97 - 3.01 (corresponding to steady protocol growth and stable market conditions)

- Optimistic Case: USD 2.50 - 3.50 (corresponding to widespread adoption and favorable market environment)

- Transformative Case: USD 3.50+ (if breakthrough ecosystem developments and mainstream adoption are achieved)

- 2030-12-31 Predicted High: USD 3.01 (based on optimistic development assumptions)

Disclaimer: This analysis is based on available market data and historical trends. Cryptocurrency markets are highly volatile and subject to rapid changes. Past performance does not guarantee future results. Investors should conduct their own research and consult financial advisors before making investment decisions. This material is for informational purposes only and does not constitute investment advice.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.329202 | 0.9994 | 0.659604 | 0 |

| 2026 | 1.33894615 | 1.164301 | 0.75679565 | 16 |

| 2027 | 1.852402891 | 1.251623575 | 0.9762663885 | 25 |

| 2028 | 2.20385879086 | 1.552013233 | 1.36577164504 | 55 |

| 2029 | 2.2723025744353 | 1.87793601193 | 1.4084520089475 | 87 |

| 2030 | 3.008922975114842 | 2.07511929318265 | 1.971363328523517 | 107 |

GHO Stablecoin Research Report

Report Date: December 16, 2025

I. Executive Summary

GHO (pronounced "go") is a decentralized, over-collateralized stablecoin native to the Aave Protocol. As of December 16, 2025, GHO trades at $0.9993, maintaining close parity with the U.S. dollar. With a market capitalization of $352.57 million and a circulation supply of 352,821,318 tokens, GHO ranks 161st among all cryptocurrencies by market cap, representing 0.011% of the total crypto market.

II. Market Overview and Current Status

II.1 Price Performance

| Metric | Value |

|---|---|

| Current Price | $0.9993 |

| 24-Hour Change | -0.01% |

| 7-Day Change | -0.06% |

| 30-Day Change | +0.04% |

| 1-Year Change | +0.12% |

| All-Time High | $1.60 (September 30, 2025) |

| All-Time Low | $0.9478 (October 16, 2025) |

The price stability demonstrates GHO's core function as a stablecoin, with minimal deviation from its $1.00 USD peg across all measured timeframes.

II.2 Market Metrics

| Indicator | Value |

|---|---|

| Market Capitalization | $352,574,343.08 |

| 24-Hour Trading Volume | $16,247.81 |

| Circulating Supply | 352,821,318 GHO |

| Total Supply | 352,821,318 GHO |

| Maximum Supply | Unlimited (∞) |

| Market Share | 0.011% |

| Total Holders | 6,523 |

II.3 Distribution and Availability

GHO is primarily available on Ethereum (ERC-20 standard) and is listed on 2 exchanges. The token's supply is managed through governance-controlled mint caps, allowing the Aave community to regulate circulating volume while maintaining price stability.

III. Core Technology and Mechanism

III.1 Protocol Architecture

GHO operates as a native stablecoin within the Aave Protocol ecosystem, leveraging Aave's established infrastructure and governance mechanisms. The stablecoin is:

- Decentralized: Controlled by Aave governance rather than a centralized entity

- Over-collateralized: Users must deposit collateral exceeding the GHO value they mint

- Fully Backed: All circulating GHO is supported by collateral assets held within the Aave Protocol

- Transparent: All transactions and collateral holdings are verifiable on-chain

III.2 Stability Mechanism

GHO's stability is maintained through:

- Market Efficiency: Aave Protocol's established liquidity pools and market mechanisms

- Over-collateralization Requirements: Users must post excess collateral to mint GHO

- Governance Controls: Mint cap limitations set by Aave governance prevent excessive supply expansion

- Incentive Structures: Economic incentives encourage price maintenance at the $1.00 peg

III.3 Technical Specifications

| Technical Detail | Specification |

|---|---|

| Blockchain | Ethereum (ETH) |

| Token Standard | ERC-20 |

| Contract Address | 0x40d16fc0246ad3160ccc09b8d0d3a2cd28ae6c2f |

| Block Explorer | Etherscan |

IV. GHO Investment Strategy and Risk Management

IV.1 Investment Considerations for Stablecoin Positions

Investors should recognize that GHO serves a fundamentally different purpose than volatile cryptocurrencies:

- Reserve Asset Function: GHO is designed for use as a medium of exchange and store of value within the Aave ecosystem, not primarily as an investment vehicle for price appreciation

- Peg Maintenance Strategy: The modest trading volume ($16,247.81 in 24 hours) reflects its use case as a utility token rather than a speculative asset

- Portfolio Allocation: GHO functions as a cash equivalent or liquidity vehicle rather than a growth component

IV.2 Risk Management Considerations

For Users Requiring USD-Equivalent Assets:

- Use GHO for liquidity management within Aave Protocol operations

- Maintain direct stablecoin position only if participating in Aave's governance or yield strategies

Security Recommendations:

- For significant holdings: Hardware wallet storage (Ledger, Trezor)

- For active protocol participation: Secure software wallets with multi-signature support

- Enable withdrawal whitelisting and address verification features

V. Investment Risks and Challenges

V.1 Market Risks

- Stablecoin Depegging: While GHO maintains strong collateralization, extreme market stress could challenge peg stability

- Liquidity Risk: Limited trading volume (only $16,247.81 in 24-hour volume) across 2 exchanges creates potential liquidity constraints

- Market Concentration: Small holder base (6,523 addresses) may indicate concentrated ownership

V.2 Protocol and Governance Risks

- Aave Protocol Dependency: GHO's stability depends entirely on Aave Protocol's operational integrity and governance decisions

- Governance Changes: Mint cap adjustments or protocol modifications could impact GHO utility and supply dynamics

- Smart Contract Risk: Potential vulnerabilities in protocol code, despite established track record

V.3 Regulatory Risks

- Stablecoin Regulation: Evolving global stablecoin regulations may impose reserve requirements or operational constraints

- Jurisdiction-Specific Restrictions: Different countries implement varying regulatory frameworks for stablecoin issuance and trading

- Compliance Requirements: Future regulatory changes may necessitate protocol modifications

V.4 Systemic Risks

- Collateral Risk: If assets backing GHO experience significant value decline, stablecoin stability could be threatened

- Aave Protocol Risks: Security incidents, governance failures, or protocol obsolescence directly impact GHO viability

VI. Conclusion: Is GHO a Good Investment?

VI.1 Investment Value Assessment

GHO functions fundamentally as a stablecoin utility token rather than a traditional investment asset. Its design prioritizes stability and protocol functionality over price appreciation potential. The $0.9993 price point with minimal volatility confirms successful peg maintenance but indicates limited capital gains opportunity.

Key Distinction: Unlike volatile cryptocurrencies, GHO's value proposition centers on:

- Reliable USD equivalent function within Aave Protocol

- Participation in decentralized finance strategies

- Access to Aave ecosystem yield opportunities

VI.2 Investor Recommendations

For Different Investor Types:

✅ DeFi Protocol Participants: GHO is appropriate for users actively engaging with Aave Protocol, requiring USD-equivalent liquidity for yield farming or collateral management

✅ Conservative Investors Seeking Stablecoin Alternatives: GHO offers decentralized stablecoin exposure compared to centralized alternatives, though trading liquidity remains limited

✅ Risk-Averse Portfolio Managers: GHO serves as a cash equivalent reserve in multi-asset portfolios, not as a growth or speculative position

⚠️ Not Suitable For:

- Investors seeking price appreciation or capital gains

- Short-term traders (limited trading volume)

- Investors requiring high liquidity across multiple exchanges

VI.3 Important Disclaimer

⚠️ Critical Notice: Cryptocurrency and decentralized finance investments carry substantial risks including but not limited to: smart contract vulnerabilities, regulatory changes, market volatility, and loss of funds. GHO, as a decentralized protocol product, carries additional risks including governance-related changes and protocol dependency risks. This report is purely informational and does not constitute investment advice. Conduct thorough due diligence and consult qualified financial advisors before making investment decisions. Past performance does not guarantee future results.

References

- Official Website: https://gho.xyz/

- Technical Documentation: https://github.com/aave/gho-core/blob/main/techpaper/GHO_Technical_Paper.pdf

- Block Explorer: https://etherscan.io/token/0x40d16fc0246ad3160ccc09b8d0d3a2cd28ae6c2f

- Governance: https://x.com/aave

Data as of December 16, 2025. Market data subject to change. For real-time information, refer to primary sources and official channels.

GHO Cryptocurrency Research Report - Frequently Asked Questions

FAQ

Q1: What is GHO and how does it differ from other stablecoins?

A: GHO is a decentralized, over-collateralized stablecoin native to the Aave Protocol, designed to maintain a value pegged to the U.S. dollar. Unlike centralized stablecoins (such as USDC or USDT), GHO is governed by Aave's decentralized community through governance voting. Users mint GHO by depositing collateral in Aave markets, and the supply is controlled through governance-set mint caps. This structure provides transparency and decentralized control, though it introduces governance-related risks that centralized stablecoins do not carry.

Q2: Is GHO a good investment for price appreciation?

A: No. GHO is fundamentally designed as a stablecoin utility token, not as an investment vehicle for capital gains. As of December 16, 2025, GHO trades at $0.9993 with minimal volatility (-0.06% over seven days), which confirms successful peg maintenance but indicates limited appreciation potential. The token's design prioritizes stability and DeFi functionality over price growth. Investors seeking speculative returns should consider other cryptocurrency assets rather than stablecoins.

Q3: What are the main risks associated with holding GHO?

A: Key risks include: (1) Protocol dependency—GHO's stability depends entirely on Aave Protocol's operational integrity and governance decisions; (2) Liquidity constraints—limited trading volume ($16,247.81 in 24-hour volume) across only 2 exchanges may restrict exit opportunities; (3) Peg stability challenges—although GHO maintains approximate peg stability, sustained deviations during market stress could create arbitrage-induced volatility; (4) Regulatory uncertainty—evolving global stablecoin regulations may impose operational or reserve requirements; (5) Collateral risk—if assets backing GHO decline significantly, stablecoin stability could be threatened.

Q4: How does GHO maintain its USD peg?

A: GHO maintains its peg through multiple mechanisms: (1) Over-collateralization—users must deposit collateral exceeding the GHO value they mint, creating automatic stability incentives; (2) Market efficiency—Aave Protocol's established liquidity pools and market mechanisms facilitate price discovery; (3) Governance controls—Aave governance sets mint caps to prevent excessive supply expansion; (4) Arbitrage incentives—economic incentives encourage traders to restore price to $1.00 if deviations occur. These combined mechanisms have successfully maintained GHO's price within a tight band, with historical deviation range of approximately 5-60% from peg.

Q5: What is GHO's market position and adoption status as of December 2025?

A: GHO ranks 161st by market capitalization with $352.57 million in total market cap and represents 0.011% of the total cryptocurrency market. The token has a circulating supply of 352.82 million GHO with 6,523 token holders. GHO demonstrated significant adoption momentum in 2024 with a 10x supply expansion. Despite representing only a portion of Aave's borrowing volume, GHO already accounts for approximately 10% of the Aave Protocol's total revenue, indicating strong adoption momentum relative to supply size.

Q6: Who should consider holding GHO and for what purposes?

A: GHO is appropriate for: (1) Aave Protocol participants requiring USD-equivalent liquidity for yield farming, collateral management, or protocol participation; (2) Investors seeking decentralized stablecoin exposure compared to centralized alternatives; (3) Conservative portfolio managers using GHO as a cash equivalent reserve asset; (4) Users participating in Aave's governance structures who require protocol-native assets. GHO is not suitable for investors seeking price appreciation, short-term traders requiring high liquidity, or those requiring immediate access across multiple exchange platforms.

Q7: What are the long-term price forecasts for GHO through 2030?

A: Based on available projections, GHO price forecasts through 2030 include: Base case scenario of USD 1.97-3.01 (assuming steady Aave Protocol adoption and stable market conditions); Optimistic scenario of USD 2.50-3.50 (corresponding to mainstream adoption and favorable market environment); Risk scenario of USD 0.66-1.50 (under regulatory pressures or reduced demand). However, these forecasts are speculative and should not be interpreted as investment recommendations. GHO's stablecoin design prioritizes stability over appreciation, so significant price movement above or below peg would indicate dysfunction rather than investment success.

Q8: Where can GHO be purchased and what are the technical specifications?

A: GHO is listed on 2 exchanges and can be purchased by minting directly through the Aave Protocol via collateral deposit. Technical specifications include: Blockchain—Ethereum (ETH); Token Standard—ERC-20; Contract Address—0x40d16fc0246ad3160ccc09b8d0d3a2cd28ae6c2f; Verifiable through—Etherscan block explorer. Users can verify holdings through Etherscan using the contract address. For significant holdings, hardware wallet storage (Ledger, Trezor) is recommended for security. Additional resources include the official website (https://gho.xyz/), technical documentation (available on GitHub), and Aave's official channels (https://x.com/aave).

XZXX: A Comprehensive Guide to the BRC-20 Meme Token in 2025

Bitcoin Fear and Greed Index: Market Sentiment Analysis for 2025

Top Crypto ETFs to Watch in 2025: Navigating the Digital Asset Boom

5 ways to get Bitcoin for free in 2025: Newbie Guide

Bitcoin Market Cap in 2025: Analysis and Trends for Investors

2025 Bitcoin Price Prediction: Trump's Tariffs' Impact on BTC

Is Undeads Games (UDS) a good investment?: A Comprehensive Analysis of Risk, Potential Returns, and Market Viability

Is BUILDon (B) a good investment?: A Comprehensive Analysis of Performance, Risks, and Future Prospects

Is Vision (VSN) a good investment?: A Comprehensive Analysis of Token Performance, Market Potential, and Risk Factors for 2024

Is Arweave (AR) a good investment?: A Comprehensive Analysis of Risks, Opportunities, and Market Potential in 2024

Is Sonic (S) a good investment?: A Comprehensive Analysis of Price Predictions and Market Potential in 2024