TANSSI vs GRT: A Comprehensive Comparison of Two Leading Blockchain Infrastructure Solutions

Introduction: TANSSI vs. GRT Investment Comparison

In the cryptocurrency market, the comparison between TANSSI and GRT has become an increasingly relevant topic for investors. Both assets exhibit notable differences in market capitalization ranking, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape.

TANSSI: Launched in 2026, this project has gained attention for its ability to enable teams to deploy appchains within minutes rather than months, backed by Ethereum-grade security and fast finality. The protocol is particularly focused on serving RWA (Real World Assets) and PayFi verticals, providing decentralized infrastructure with full control over execution logic.

The Graph (GRT): Since its launch in December 2020, GRT has established itself as a decentralized protocol for indexing and querying blockchain data, primarily on Ethereum. The protocol simplifies data querying through open APIs (subgraphs), enabling efficient access to blockchain information. GRT serves essential roles through indexer staking and curator signaling mechanisms.

This article will comprehensively analyze the investment value comparison between TANSSI and GRT across multiple dimensions, including historical price trends, supply mechanisms, technical ecosystems, and market positioning. The analysis aims to address investors' most pressing question:

"Which asset presents a more compelling investment opportunity at this time?"

By examining these aspects objectively, we seek to provide readers with data-driven insights for their investment considerations in these two distinct crypto assets.

I. Historical Price Comparison and Current Market Status

TANSSI and GRT Historical Price Trends

- 2025: TANSSI experienced notable volatility during its initial trading period, with price movements influenced by its launch on multiple exchanges. The token reached a peak of $0.08848 in early August 2025 before declining significantly.

- 2021: GRT was affected by the broader crypto market rally, with its price reaching an all-time high of $2.84 in February 2021 during the DeFi boom period.

- Comparative Analysis: During the recent market cycle, TANSSI declined from its high of $0.08848 to a low of $0.00006, representing a substantial correction, while GRT experienced a similar downward trajectory from its historical peak of $2.84 to current levels near $0.02551, reflecting broader market trends.

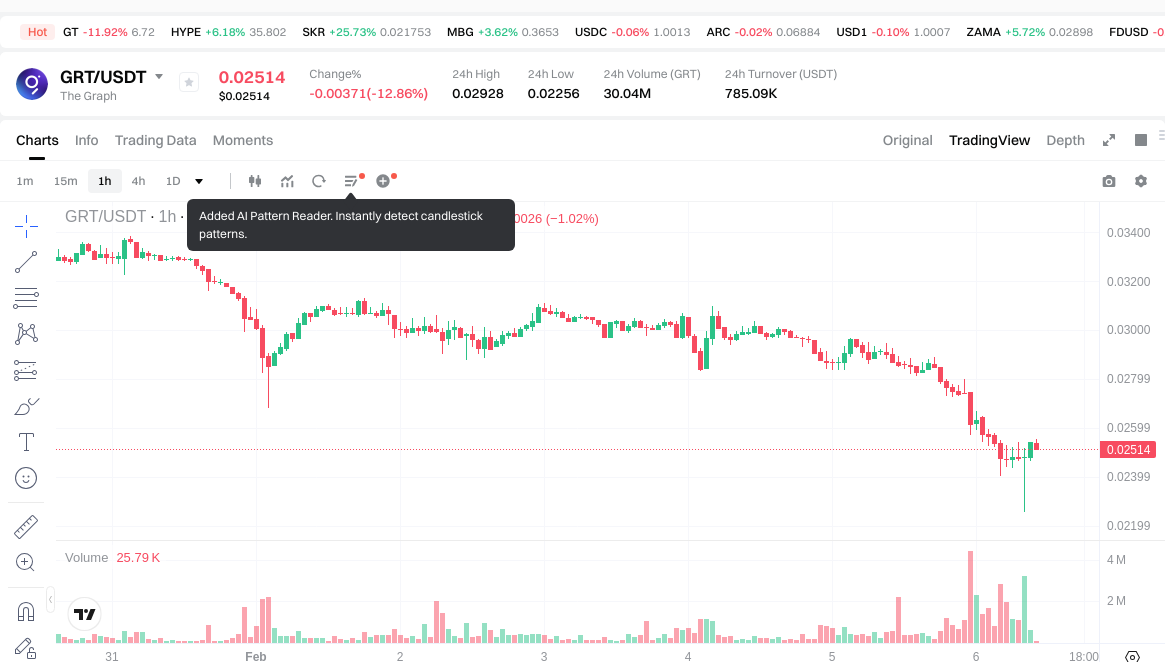

Current Market Status (February 6, 2026)

- TANSSI current price: $0.001156

- GRT current price: $0.02551

- 24-hour trading volume: TANSSI $52,307.28 vs GRT $785,598.99

- Market Sentiment Index (Fear & Greed Index): 9 (Extreme Fear)

View real-time prices:

- Check TANSSI current price Market Price

- Check GRT current price Market Price

II. Core Factors Influencing TANSSI vs GRT Investment Value

Supply Mechanism Comparison (Tokenomics)

- TANSSI: Based on available information, TANSSI operates within a tokenized ecosystem focused on real-world asset (RWA) integration. The project has launched its sovereign L1 on the Tanssi mainnet, connecting over 300 tokenized real-world assets including private equity funds and U.S. stocks, primarily serving Latin American markets.

- GRT: Market observations indicate that GRT experienced intraday fluctuations, with reported prices around $0.0406 USD showing a decline of approximately 2.91% within certain trading periods. The token participates in decentralized governance mechanisms.

- 📌 Historical Pattern: Supply mechanisms influence price cycles through token distribution models, staking requirements, and ecosystem incentive structures, though specific details for both projects require further technical documentation.

Institutional Adoption and Market Application

- Institutional Holdings: The materials reference investment considerations emphasizing the importance of understanding underlying business models, suggesting that institutional preferences depend on project fundamentals and risk-return profiles.

- Enterprise Adoption: TANSSI demonstrates application in connecting tokenized financial instruments across Latin American markets, focusing on bridging traditional finance with decentralized systems. GRT's application relates to decentralized data indexing and query protocols.

- Regulatory Landscape: Cross-border transaction demands and regional policy variations affect both projects differently, with TANSSI's focus on regulated financial instruments potentially facing different compliance considerations compared to GRT's infrastructure-oriented services.

Technical Development and Ecosystem Building

- TANSSI Technical Framework: The project has established a sovereign L1 infrastructure on Tanssi mainnet, enabling integration of diverse asset classes including private funds and equity securities, with particular emphasis on serving emerging market financial needs.

- GRT Technical Evolution: Functions within decentralized data infrastructure, supporting query protocols and governance participation across blockchain networks.

- Ecosystem Comparison: TANSSI concentrates on real-world asset tokenization and traditional finance integration, while GRT operates in data infrastructure layer. Their DeFi, NFT, payment, and smart contract implementations serve different functional purposes within the broader blockchain ecosystem.

Macroeconomic Context and Market Cycles

- Performance in Inflationary Environments: Asset-backed tokens like those in TANSSI's ecosystem may exhibit different correlations with inflation compared to infrastructure tokens like GRT, depending on the underlying asset characteristics and market demand dynamics.

- Macroeconomic Monetary Policy: Interest rate adjustments and dollar index movements influence both projects through different transmission mechanisms - TANSSI through its connection to traditional financial instruments, and GRT through its role in decentralized infrastructure value flows.

- Geopolitical Considerations: Cross-border transaction requirements and international developments affect adoption patterns, with TANSSI's focus on Latin American markets and cross-border asset integration potentially responding to regional economic conditions and capital flow regulations.

III. 2026-2031 Price Prediction: TANSSI vs GRT

Short-term Forecast (2026)

- TANSSI: Conservative $0.000657 - $0.001153 | Optimistic $0.001153 - $0.001499

- GRT: Conservative $0.01292 - $0.02534 | Optimistic $0.02534 - $0.02939

Medium-term Forecast (2028-2029)

- TANSSI may enter a gradual growth phase, with projected prices ranging from $0.001228 to $0.001572 in 2028, potentially reaching $0.001033 to $0.001682 by 2029

- GRT may enter an expansion phase, with projected prices ranging from $0.02222 to $0.04410 in 2028, potentially reaching $0.02760 to $0.05093 by 2029

- Key drivers: institutional capital inflows, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- TANSSI: Baseline scenario $0.001295 - $0.001579 (2030) | Optimistic scenario $0.001436 - $0.001700 (2031)

- GRT: Baseline scenario $0.04356 - $0.04491 (2030) | Optimistic scenario $0.03201 - $0.04850 (2031)

Disclaimer

TANSSI:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.00149916 | 0.0011532 | 0.000657324 | 0 |

| 2027 | 0.0014322744 | 0.00132618 | 0.0008752788 | 15 |

| 2028 | 0.001572319008 | 0.0013792272 | 0.001227512208 | 20 |

| 2029 | 0.00168238133856 | 0.001475773104 | 0.0010330411728 | 28 |

| 2030 | 0.001721194171195 | 0.00157907722128 | 0.001294843321449 | 37 |

| 2031 | 0.001699639767124 | 0.001650135696237 | 0.001435618055726 | 44 |

GRT:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0293944 | 0.02534 | 0.0129234 | 0 |

| 2027 | 0.039956112 | 0.0273672 | 0.01778868 | 8 |

| 2028 | 0.04409676936 | 0.033661656 | 0.02221669296 | 33 |

| 2029 | 0.0509317686108 | 0.03887921268 | 0.0276042410028 | 53 |

| 2030 | 0.052090369148664 | 0.0449054906454 | 0.043558325926038 | 77 |

| 2031 | 0.050437847092913 | 0.048497929897032 | 0.032008633732041 | 91 |

IV. Investment Strategy Comparison: TANSSI vs GRT

Long-term vs Short-term Investment Strategies

-

TANSSI: May appeal to investors focused on emerging real-world asset tokenization, particularly those interested in Latin American market exposure and infrastructure development for traditional finance integration. The asset's positioning in RWA and PayFi verticals suggests potential relevance for those monitoring appchain deployment efficiency and cross-border asset connectivity.

-

GRT: May suit investors seeking exposure to established decentralized data infrastructure, particularly those valuing protocol maturity and network effects in blockchain indexing services. The token's operational history since 2020 provides a longer track record for evaluation compared to newer entrants.

Risk Management and Asset Allocation

-

Conservative Investors: TANSSI 20-30% vs GRT 70-80% - This allocation reflects GRT's longer operational history and established market presence, while maintaining measured exposure to TANSSI's emerging infrastructure.

-

Aggressive Investors: TANSSI 40-50% vs GRT 50-60% - Higher allocation to TANSSI acknowledges potential growth opportunities in RWA tokenization, balanced with GRT's infrastructure positioning.

-

Hedging Tools: Stablecoin reserves for market volatility management, consideration of options strategies where available, and diversified exposure across different protocol categories to mitigate concentration risk.

V. Potential Risk Comparison

Market Risk

-

TANSSI: Faces heightened volatility characteristic of newer market entrants, with price movements showing substantial corrections from early peaks. Trading volume of $52,307.28 indicates developing liquidity conditions that may amplify price fluctuations during market stress periods.

-

GRT: Experiences correlation with broader cryptocurrency market cycles, as evidenced by historical price movements from peaks in 2021. Current trading volume of $785,598.99 suggests relatively more established liquidity, though still subject to sector-wide sentiment shifts reflected in market fear indices.

Technical Risk

-

TANSSI: Operational considerations include the execution of its sovereign L1 infrastructure and the integration complexity of connecting diverse tokenized assets. Network stability during scaling phases and the maintenance of security standards while enabling rapid appchain deployment present ongoing technical challenges.

-

GRT: Infrastructure dependencies relate to maintaining decentralized indexing capabilities across multiple blockchain networks. Protocol upgrades and the coordination of indexer and curator mechanisms involve technical considerations for sustained network operation.

Regulatory Risk

- Global regulatory developments affect both projects through different channels. TANSSI's focus on tokenized financial instruments, including private equity funds and securities, may face evolving compliance frameworks for digital asset representations of traditional investments. GRT's data infrastructure role encounters regulatory considerations surrounding decentralized protocol operations and cross-border data flows. Regional policy variations, particularly in markets where TANSSI concentrates operations, introduce jurisdiction-specific compliance considerations.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

TANSSI Characteristics: Positions in emerging real-world asset tokenization infrastructure, demonstrates focus on Latin American market integration, offers exposure to appchain deployment technology with rapid finalization capabilities. The project addresses specific verticals (RWA and PayFi) with developing ecosystem connections.

-

GRT Characteristics: Provides established decentralized data indexing infrastructure, maintains operational history since 2020, serves foundational protocol functions across blockchain networks. The token participates in governance mechanisms and staking systems within a more mature ecosystem framework.

✅ Investment Considerations:

-

Beginning Investors: May find GRT's longer operational track record and established market presence more suitable for initial cryptocurrency infrastructure exposure. The protocol's fundamental role in blockchain data accessibility offers clearer use case understanding for those developing familiarity with decentralized systems.

-

Experienced Investors: Might evaluate both assets based on specific portfolio objectives - TANSSI for exposure to RWA tokenization trends and emerging market infrastructure, GRT for established data protocol positioning. Allocation decisions would depend on individual risk tolerance and sector preference within blockchain infrastructure categories.

-

Institutional Participants: Assessment factors include regulatory compliance frameworks relevant to each project's operational focus, liquidity conditions for position management, and strategic alignment with institutional investment mandates regarding infrastructure exposure versus emerging technology adoption.

⚠️ Risk Disclosure: Cryptocurrency markets demonstrate significant volatility characteristics. This analysis presents informational content and does not constitute investment recommendations. Market conditions, regulatory developments, and project-specific factors may materially affect asset performance. Individuals should conduct independent evaluation and consider professional consultation appropriate to their circumstances before making investment decisions.

VII. FAQ

Q1: What is the primary difference between TANSSI and GRT in terms of their blockchain infrastructure roles?

TANSSI focuses on enabling rapid appchain deployment for real-world asset (RWA) tokenization and PayFi applications, while GRT provides decentralized data indexing and querying infrastructure across blockchain networks. TANSSI's infrastructure launched in 2026 emphasizes sovereign L1 capabilities that allow teams to deploy application-specific chains within minutes, particularly serving Latin American markets with connections to over 300 tokenized assets including private equity funds and securities. In contrast, GRT has operated since December 2020 as an established protocol for indexing blockchain data, primarily on Ethereum, through open APIs (subgraphs) that enable efficient data access. The fundamental distinction lies in TANSSI's focus on asset tokenization infrastructure versus GRT's concentration on data accessibility infrastructure.

Q2: How do the trading volumes and liquidity conditions compare between TANSSI and GRT?

GRT demonstrates significantly higher liquidity with a 24-hour trading volume of $785,598.99 compared to TANSSI's $52,307.28 as of February 6, 2026. This substantial difference reflects GRT's longer market presence and more established trading ecosystem since its December 2020 launch. The higher trading volume for GRT suggests more robust liquidity conditions, which typically translates to reduced slippage and improved execution for larger position sizes. TANSSI's lower trading volume indicates developing liquidity that may result in wider bid-ask spreads and potentially greater price impact during transaction execution, particularly during periods of market stress when liquidity tends to contract further.

Q3: What are the key risk factors specific to TANSSI's investment profile?

TANSSI faces elevated volatility risk as a newer market entrant, having experienced a significant correction from its peak of $0.08848 in August 2025 to its current price of $0.001156. The project's concentration in real-world asset tokenization, particularly within Latin American markets, introduces regulatory complexity regarding digital representations of traditional financial instruments such as private equity funds and securities. Technical execution risks include maintaining network stability during scaling phases while enabling rapid appchain deployment capabilities. Additionally, the developing liquidity environment with relatively low trading volume ($52,307.28) may amplify price fluctuations during market downturns. The project's success depends on continued adoption within its targeted RWA and PayFi verticals, market segments still in early development stages.

Q4: How have TANSSI and GRT performed during historical market cycles?

GRT experienced its peak performance during the February 2021 DeFi boom, reaching an all-time high of $2.84 before declining to current levels near $0.02551, representing correlation with broader cryptocurrency market cycles. TANSSI, launching in 2026, reached an early peak of $0.08848 in August 2025 before declining substantially to a low of $0.00006, demonstrating high volatility characteristic of new market entrants. Both assets have experienced significant corrections from their respective peaks, though GRT's longer operational history provides more data points for evaluating behavior across multiple market phases. The current market sentiment index of 9 (Extreme Fear) affects both assets, though their response mechanisms differ based on their distinct infrastructure roles and market positioning.

Q5: What allocation strategies are suggested for conservative versus aggressive investors?

Conservative investors may consider a 70-80% allocation to GRT versus 20-30% to TANSSI, reflecting GRT's longer operational track record and more established market presence with higher liquidity conditions. This allocation approach prioritizes the stability associated with mature infrastructure protocols while maintaining measured exposure to emerging RWA tokenization trends. Aggressive investors might evaluate a more balanced 50-60% GRT versus 40-50% TANSSI allocation, acknowledging higher growth potential in real-world asset infrastructure while maintaining substantial exposure to established data protocol positioning. Both strategies should incorporate stablecoin reserves for volatility management and consider diversification across different protocol categories to mitigate concentration risk. The appropriate allocation ultimately depends on individual risk tolerance, investment timeline, and portfolio objectives within blockchain infrastructure categories.

Q6: What technical capabilities differentiate TANSSI's infrastructure approach?

TANSSI enables teams to deploy appchains within minutes rather than months, providing Ethereum-grade security with fast finality through its sovereign L1 infrastructure on the Tanssi mainnet. This rapid deployment capability addresses a specific pain point in blockchain development where traditional infrastructure deployment requires extensive time and resources. The platform maintains full control over execution logic while delivering decentralized infrastructure, particularly serving RWA and PayFi verticals. The technical framework supports integration of diverse asset classes including private equity funds and equity securities, with current connections to over 300 tokenized real-world assets. This infrastructure approach contrasts with GRT's focus on data indexing efficiency, representing different value propositions within blockchain infrastructure—TANSSI emphasizing deployment speed and asset integration versus GRT prioritizing data accessibility and query optimization.

Q7: How might regulatory developments affect TANSSI and GRT differently?

TANSSI's focus on tokenizing traditional financial instruments, including private equity funds and securities, subjects it to evolving compliance frameworks governing digital asset representations of regulated investments. The project's concentration in Latin American markets introduces jurisdiction-specific regulatory considerations related to cross-border asset integration and regional capital flow regulations. Regulatory changes affecting securities tokenization, custody requirements, or cross-border transactions could materially impact TANSSI's operational model. GRT faces different regulatory considerations centered on decentralized protocol operations and cross-border data flows, with less direct exposure to securities regulation but subject to infrastructure-related compliance requirements. Both projects encounter general cryptocurrency regulatory developments, though transmission mechanisms differ—TANSSI through its connection to traditional finance regulation, GRT through data infrastructure and protocol governance frameworks.

Q8: What factors should institutional participants evaluate when comparing these assets?

Institutional participants should assess regulatory compliance frameworks relevant to each project's operational focus, considering TANSSI's exposure to securities tokenization regulation versus GRT's infrastructure protocol positioning. Liquidity conditions become critical for institutions requiring efficient position management—GRT's trading volume of $785,598.99 provides substantially more robust liquidity than TANSSI's $52,307.28. Strategic alignment with institutional mandates requires evaluation of whether infrastructure exposure priorities favor established data protocols (GRT) or emerging RWA tokenization technology (TANSSI). Additional considerations include custody solutions availability, counterparty risk assessment, track record evaluation (GRT's operational history since 2020 versus TANSSI's recent launch), and integration capabilities with existing institutional systems. The decision framework should incorporate risk management protocols appropriate to each asset's volatility profile and market maturity level.

Detailed Analysis of the Top 10 RWA Cryptocurrencies in 2025

Benefits of RWAs in Crypto

How to Earn with The RWA DePin Protocol in 2025

Detailed Analysis of RWA in Crypto Assets

Rexas Finance: A Blockchain-Powered Real-World Asset Tokenization Ecosystem

SIX Token (SIX): Core Logic, Use Cases and 2025 Roadmap Analysis

What is PHIL: A Comprehensive Guide to Philosophy and Its Impact on Modern Society

What is MOONPIG: A Comprehensive Guide to the Popular Online Greeting Card and Gift Platform

What is Hop Protocol? Understanding HOP Token and Cross-Chain Bridge Technology

What is AM: A Comprehensive Guide to Amplitude Modulation in Modern Communications

What is NC: A Comprehensive Guide to Numerical Control Technology and Its Applications in Modern Manufacturing