TLOS vs OP: A Comprehensive Comparison of Two Leading Layer-2 Solutions in the Blockchain Ecosystem

Introduction: TLOS vs OP Investment Comparison

In the cryptocurrency market, the comparison between TLOS and OP has consistently been a topic of interest for investors. Both assets exhibit notable differences in market cap rankings, application scenarios, and price performance, representing distinct positioning within the crypto asset landscape. Telos (TLOS): Launched in December 2018, this third-generation blockchain platform has gained market recognition through its focus on building fast, scalable distributed applications with advanced governance features and enterprise-grade capabilities. Optimism (OP): Introduced in May 2022, this Ethereum Layer 2 solution has established itself as a low-cost, high-speed blockchain infrastructure, primarily serving as a governance token within the Optimism ecosystem. This article will provide a comprehensive analysis of TLOS vs OP investment value comparison, examining historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future projections, attempting to address investors' most pressing question:

"Which is the better buy right now?"

I. Historical Price Comparison and Current Market Status

TLOS (Coin A) and OP (Coin B) Historical Price Trends

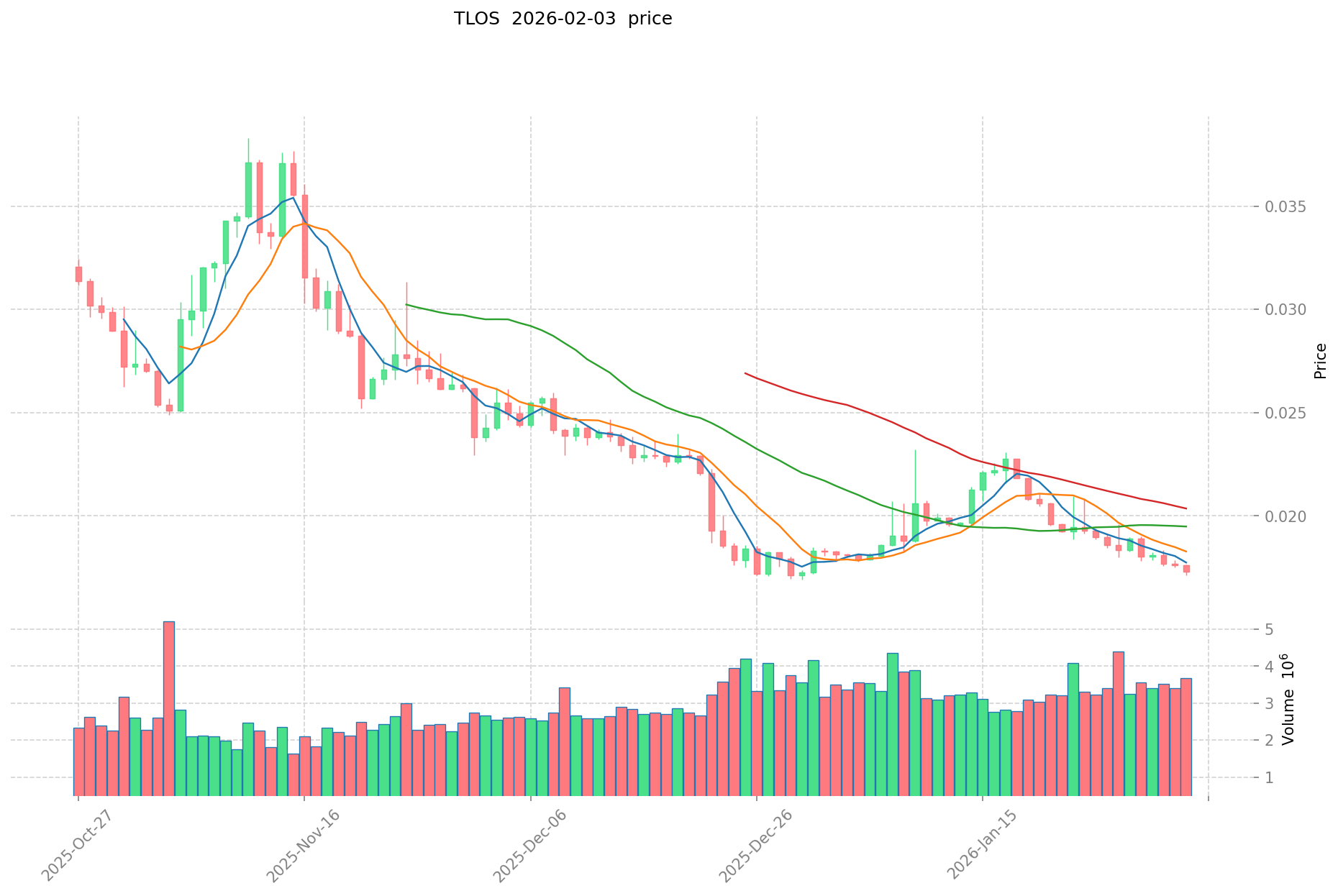

- 2024: TLOS experienced a notable price fluctuation, reaching an all-time high of $0.622416 on February 29, 2024. During this period, the token demonstrated significant volatility within the broader crypto market cycle.

- 2024: OP reached its all-time high of $4.84 on March 6, 2024, reflecting strong market momentum during the same period. The token benefited from increased activity in the Ethereum Layer 2 ecosystem.

- Comparative Analysis: During the 2024-2026 market cycle, TLOS declined from its peak of $0.622416 to a low of $0.01628696 (recorded on February 4, 2026), representing a substantial decrease. In contrast, OP fell from $4.84 to $0.207182 (also on February 4, 2026), showing a similar downward trend across both assets during this period.

Current Market Status (February 4, 2026)

- TLOS Current Price: $0.01658

- OP Current Price: $0.2126

- 24-Hour Trading Volume: TLOS $63,747.95 vs OP $1,644,886.72

- Market Sentiment Index (Fear & Greed Index): 17 (Extreme Fear)

View real-time prices:

- View TLOS current price Market Price

- View OP current price Market Price

II. Core Factors Influencing TLOS vs OP Investment Value

Supply Mechanism Comparison (Tokenomics)

-

TLOS: Telos operates with an unlimited maximum supply model. Current circulation stands at approximately 50.13 million tokens, with total supply around 50.12 million tokens. This distinguishes it from fixed-supply cryptocurrencies, as the unlimited supply structure may impact long-term scarcity dynamics.

-

OP: Supply mechanism information for OP is not provided in the reference materials.

-

📌 Historical Pattern: Supply mechanisms play a significant role in shaping price cycles. Unlimited supply models may face different market perception challenges compared to deflationary or fixed-supply assets, potentially affecting long-term value accumulation patterns.

Institutional Adoption and Market Application

-

Institutional Holdings: Information regarding institutional preference between TLOS and OP is not available in the provided materials.

-

Enterprise Adoption: Specific applications of TLOS or OP in cross-border payments, settlement systems, or investment portfolios are not detailed in the reference materials.

-

Regulatory Landscape: Information about different countries' regulatory stances toward TLOS and OP is not provided in the available data.

Technological Development and Ecosystem Building

-

TLOS Technical Progress: The Telos blockchain platform's potential is linked to its technical infrastructure, though specific recent upgrades are not detailed in the reference materials.

-

OP Technical Development: Technical advancement details for OP are not available in the provided materials.

-

Ecosystem Comparison: Information regarding DeFi integration, NFT implementation, payment solutions, or smart contract deployment for either TLOS or OP is not covered in the reference data.

Macroeconomic Environment and Market Cycles

-

Performance in Inflationary Environments: Comparative analysis of which asset demonstrates stronger inflation-hedging characteristics is not available in the reference materials.

-

Macroeconomic Monetary Policy: The impact of interest rate changes and U.S. Dollar Index fluctuations on both assets is not specifically addressed in the provided data.

-

Geopolitical Factors: Information about how cross-border transaction demand and international situations affect TLOS and OP is not included in the reference materials.

III. 2026-2031 Price Prediction: TLOS vs OP

Short-term Forecast (2026)

- TLOS: Conservative $0.0091 - $0.0165 | Optimistic $0.0165 - $0.022

- OP: Conservative $0.193 - $0.212 | Optimistic $0.212 - $0.310

Mid-term Forecast (2028-2029)

- TLOS may enter a consolidation phase with projected price range of $0.011 - $0.028 in 2028, potentially expanding to $0.017 - $0.034 by 2029

- OP may experience gradual growth trajectory with estimated range of $0.226 - $0.420 in 2028, followed by $0.266 - $0.384 in 2029

- Key drivers: institutional capital flow, ETF developments, ecosystem expansion

Long-term Forecast (2030-2031)

- TLOS: Baseline scenario $0.021 - $0.029 (2030), $0.021 - $0.032 (2031) | Optimistic scenario $0.024 - $0.035 (2031)

- OP: Baseline scenario $0.354 - $0.376 (2030), $0.243 - $0.450 (2031) | Optimistic scenario $0.523 - $0.630 (2031)

Disclaimer: Price predictions are subject to market volatility and various external factors. Historical performance does not guarantee future results. This analysis is for informational purposes only and should not be considered investment advice.

TLOS:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.0219849 | 0.01653 | 0.0090915 | 0 |

| 2027 | 0.022723791 | 0.01925745 | 0.015020811 | 16 |

| 2028 | 0.028337337675 | 0.0209906205 | 0.01133493507 | 26 |

| 2029 | 0.03403629114075 | 0.0246639790875 | 0.017018145570375 | 48 |

| 2030 | 0.034046156732385 | 0.029350135114125 | 0.023773609442441 | 77 |

| 2031 | 0.034550979056347 | 0.031698145923255 | 0.020603794850115 | 91 |

OP:

| Year | Predicted High Price | Predicted Average Price | Predicted Low Price | Price Change |

|---|---|---|---|---|

| 2026 | 0.30952 | 0.212 | 0.19292 | 0 |

| 2027 | 0.3754944 | 0.26076 | 0.1877472 | 22 |

| 2028 | 0.419927904 | 0.3181272 | 0.225870312 | 49 |

| 2029 | 0.38378865408 | 0.369027552 | 0.26569983744 | 73 |

| 2030 | 0.5232072632256 | 0.37640810304 | 0.3538236168576 | 77 |

| 2031 | 0.62973075638592 | 0.4498076831328 | 0.242896148891712 | 111 |

IV. Investment Strategy Comparison: TLOS vs OP

Long-term vs Short-term Investment Strategies

-

TLOS: May appeal to investors interested in blockchain platforms focused on distributed application development and governance innovation. The platform's enterprise-grade capabilities and scalability features position it as a potential choice for those exploring third-generation blockchain infrastructure investments.

-

OP: May suit investors seeking exposure to Ethereum Layer 2 scaling solutions and DeFi ecosystem growth. As a governance token within the Optimism network, it represents participation in Ethereum's scaling infrastructure development.

Risk Management and Asset Allocation

-

Conservative Investors: Consider balanced exposure with careful position sizing - potential allocation frameworks might include lower percentages of total portfolio in higher-volatility assets, with emphasis on diversification across multiple blockchain ecosystems.

-

Aggressive Investors: May explore higher allocation percentages in growth-oriented positions, while maintaining awareness of volatility risks inherent in emerging blockchain platforms.

-

Hedging Tools: Stablecoin reserves for liquidity management, options strategies for downside protection, and cross-asset diversification across different blockchain categories.

V. Potential Risk Comparison

Market Risks

-

TLOS: The token has demonstrated significant price volatility, declining substantially from its February 2024 peak of $0.622416 to current levels around $0.01658 as of February 4, 2026. The unlimited supply mechanism may present different scarcity dynamics compared to fixed-supply assets. Lower trading volume ($63,747.95 in 24 hours) may indicate reduced market liquidity.

-

OP: While benefiting from association with Ethereum's Layer 2 ecosystem, the token has also experienced considerable price fluctuation, declining from its March 2024 high of $4.84 to approximately $0.2126. Market sentiment indicators show "Extreme Fear" levels (17 on Fear & Greed Index), suggesting broader market uncertainty affects both assets.

Technical Risks

-

TLOS: As a third-generation blockchain platform, technical execution risks include maintaining network stability, achieving scalability targets, and demonstrating competitive advantages in an increasingly crowded blockchain platform landscape.

-

OP: Layer 2 solution risks include dependency on Ethereum mainnet security, potential technical vulnerabilities in rollup mechanisms, and competition from alternative Layer 2 solutions. Network adoption and transaction throughput maintenance present ongoing technical considerations.

Regulatory Risks

Both TLOS and OP operate in an evolving regulatory environment where government policies toward cryptocurrency assets continue to develop. Changes in regulatory frameworks across different jurisdictions may impact token utility, trading accessibility, and overall market dynamics. Governance token classifications and blockchain platform regulations remain areas of potential regulatory attention.

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

-

TLOS Characteristics: Represents exposure to a blockchain platform emphasizing distributed application development, governance features, and enterprise-grade infrastructure. The project's focus on third-generation blockchain technology may appeal to those interested in alternative smart contract platforms beyond dominant ecosystems.

-

OP Characteristics: Offers participation in Ethereum's Layer 2 scaling infrastructure through a governance token model. Benefits from association with the broader Ethereum ecosystem and ongoing development in Layer 2 solutions addressing scalability challenges.

✅ Investment Considerations:

-

Newer Investors: Should approach both assets with careful research and risk assessment. The current "Extreme Fear" market sentiment (index: 17) and substantial price declines from 2024 peaks suggest exercising caution. Starting with smaller position sizes while building understanding of blockchain technology fundamentals may be prudent.

-

Experienced Investors: May evaluate both assets within broader portfolio strategies, considering exposure to different blockchain categories (alternative Layer 1 platforms vs Ethereum Layer 2 solutions). Position sizing should account for high volatility and liquidity considerations, particularly given TLOS's lower trading volume.

-

Institutional Investors: Should conduct comprehensive due diligence on technical infrastructure, team capabilities, ecosystem development, and regulatory compliance frameworks. Both assets represent emerging blockchain technologies with associated execution risks and market uncertainties.

⚠️ Risk Disclosure: The cryptocurrency market exhibits extreme volatility. Price predictions are subject to numerous variables and uncertainties. This analysis is provided for informational purposes only and does not constitute investment advice. Investors should conduct independent research and consult qualified financial advisors before making investment decisions.

VII. FAQ

Q1: What are the main differences between TLOS and OP in terms of their core use cases?

TLOS is a third-generation blockchain platform focused on distributed application development with enterprise-grade capabilities, while OP is an Ethereum Layer 2 governance token designed for scaling solutions. TLOS emphasizes building fast, scalable dApps with advanced governance features as a standalone blockchain infrastructure. In contrast, OP operates within the Ethereum ecosystem, serving primarily as a governance mechanism for the Optimism Layer 2 network that aims to reduce transaction costs and increase throughput on Ethereum.

Q2: How does the supply mechanism differ between TLOS and OP, and what implications does this have?

TLOS operates with an unlimited maximum supply model, currently having approximately 50.13 million tokens in circulation. This unlimited supply structure differs fundamentally from fixed-supply cryptocurrencies and may impact long-term scarcity dynamics and price appreciation potential. Unfortunately, detailed supply mechanism information for OP is not available in the reference materials, making direct tokenomics comparison challenging for investors evaluating supply-side factors.

Q3: Which asset has shown better price resilience during the 2024-2026 market downturn?

Both assets experienced significant declines from their 2024 peaks, but the percentage drops differ substantially. TLOS fell from $0.622416 (February 2024) to $0.01658 (February 2026), representing approximately a 97% decline. OP decreased from $4.84 (March 2024) to $0.2126 (February 2026), approximately a 96% decline. While both assets demonstrated similar downward trajectories during this period, neither showed exceptional resilience, reflecting broader cryptocurrency market conditions during this cycle.

Q4: What are the projected price ranges for TLOS and OP by 2031?

Based on current analysis, TLOS projections for 2031 range from $0.021-$0.032 in the baseline scenario, with an optimistic scenario reaching $0.024-$0.035. OP's 2031 projections show a baseline scenario of $0.243-$0.450, with an optimistic scenario of $0.523-$0.630. These predictions suggest OP may have higher absolute price targets, though investors should recognize that price predictions are subject to significant uncertainty and numerous market variables that can substantially alter outcomes.

Q5: How do trading volumes compare between TLOS and OP, and why does this matter?

As of February 4, 2026, TLOS recorded a 24-hour trading volume of $63,747.95, while OP showed $1,644,886.72 in the same period—approximately 26 times higher. This substantial difference in trading volume matters because higher liquidity generally allows for easier entry and exit positions with less price slippage. Lower liquidity assets like TLOS may experience greater price volatility during large trades and could pose challenges for investors seeking to execute sizeable positions without impacting market price.

Q6: Which investment strategy is more suitable for conservative versus aggressive investors?

Conservative investors may consider balanced exposure with lower portfolio allocation percentages in these higher-volatility assets, emphasizing diversification across multiple blockchain ecosystems and maintaining substantial stablecoin reserves for liquidity. Aggressive investors might explore higher allocation percentages in growth-oriented positions, potentially favoring OP for its Ethereum ecosystem association or TLOS for alternative Layer 1 exposure. However, both investor types should implement hedging tools such as options strategies for downside protection and maintain awareness of the extreme volatility inherent in emerging blockchain platforms.

Q7: What are the primary technical risks specific to each asset?

TLOS faces technical execution risks related to maintaining network stability, achieving scalability targets, and demonstrating competitive advantages in a crowded blockchain platform landscape as a third-generation blockchain. OP's technical risks center on its dependency on Ethereum mainnet security, potential vulnerabilities in rollup mechanisms, and competition from alternative Layer 2 solutions. Additionally, OP must maintain transaction throughput and network adoption while navigating the evolving Layer 2 ecosystem where multiple competing solutions are emerging.

Q8: Given the current "Extreme Fear" market sentiment, is now an appropriate time to invest in either asset?

The current Fear & Greed Index reading of 17 indicates "Extreme Fear" in the cryptocurrency market, which historically has sometimes presented contrarian buying opportunities, though timing market bottoms remains exceptionally difficult. Both TLOS and OP have declined substantially from their 2024 peaks, and market sentiment suggests continued uncertainty. Newer investors should exercise particular caution during extreme fear periods, potentially starting with smaller position sizes while building understanding. Experienced investors may view such periods as potential accumulation opportunities, but should carefully assess whether fundamental factors support long-term recovery prospects before committing capital.

2025 SUI coin: price, buying guide, and Staking rewards

How to Buy Crypto: A Step-by-Step Guide with Gate.com

HNT Price in 2025: Helium Network Token Value and Market Analysis

What is SwissCheese (SWCH) and How Does It Democratize Investment?

Cardano (ADA) Price Analysis and Outlook for 2025

How to Invest in Metaverse Crypto

Ultimate Guide to Free NFT Minting

Investigating the True Identity of Bitcoin Founder Satoshi Nakamoto

How to Participate in Cryptocurrency Airdrops and Essential Security Measures

Top 7 Hardware Picks for Cryptocurrency Mining

What Does DYOR Mean in Crypto?