What Is Ripple (XRP)? A Global Payment Infrastructure Built on Blockchain Technology

In 2026, following regulatory clarity in the United States and the entry of spot XRP ETFs, Ripple is no longer seen merely as a challenger to traditional banking systems. It has increasingly become a central hub within the global Internet of Value.

This article introduces the definition and operating model of Ripple, its team background and institutional backing, the token economics and use cases of XRP, and examines Ripple’s future outlook through a comparison with SWIFT.

What Are Ripple and XRP?

Ripple is a global fintech company dedicated to building the Internet of Value, aiming to transform cross border payments using blockchain technology. Unlike many highly decentralized cryptocurrencies that lack enterprise compliance, Ripple adopts an enterprise focused approach, providing production grade solutions for global banks, payment institutions, and asset managers.

XRP is the native asset of the XRP Ledger (XRPL), a core component of the Ripple ecosystem. In international transfers, XRP functions as a bridge currency, significantly reducing the need for pre-funded foreign exchange accounts known as Nostro accounts.

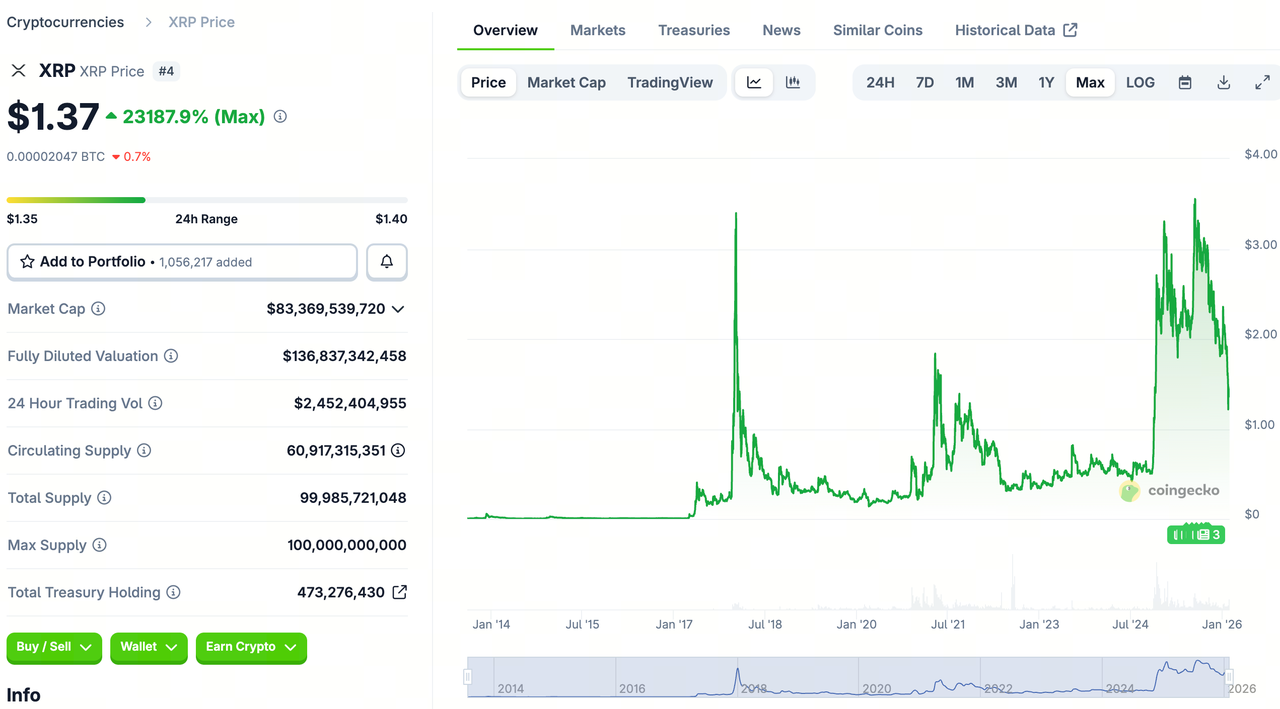

At present, XRP has a market capitalization of approximately $83 billion, ranking as the fourth largest cryptocurrency globally, behind BTC, ETH, and USDT.

The Origin and Core Vision of Ripple

Ripple was founded in 2013 in response to inefficiencies in traditional cross border payment systems. The global cross border payments market exceeds $100 trillion, yet the SWIFT system suffers from slow settlement times of two to five days, high costs, and limited transparency.

Ripple’s core vision is to rebuild global payment infrastructure through blockchain technology by achieving the following goals:

- Real time settlement with confirmation times of three to five seconds

- Significant cost reduction of 40% to 70% compared to traditional methods

- Improved transparency with end to end transaction tracking

- Liquidity optimization by reducing the need for pre-funded intermediary accounts

How Does Ripple Work?

In traditional financial systems, cross border transfers often pass through multiple intermediary banks, resulting in long settlement times and high fees.

Through its blockchain-based architecture, Ripple aims to fundamentally change how assets and value are transmitted globally. This is achieved through the combined operation of three core components: the XRP Ledger, RippleNet, and the XRP token.

XRP Ledger (XRPL): The Decentralized Base Ledger

The XRP Ledger is an open source distributed ledger that serves as the underlying platform for all transactions. Unlike Bitcoin, it does not rely on energy intensive proof of work, but instead uses a unique consensus mechanism.

- High performance with support for over 1,500 transactions per second

- Near instant settlement with confirmation times of three to five seconds

- Extremely low costs with average transaction fees of approximately 0.0002 XRP

RippleNet: A Global Network for Financial Institutions

RippleNet is an institutional grade payment network built on XRPL, currently connecting more than 300 financial institutions worldwide, including banks and payment service providers.

- Standardized integration through unified APIs and connectivity protocols, enabling institutions to send money as easily as sending email

- Compliance and security designed to meet strict regulatory requirements, ensuring transparency and safety for each cross border transfer

XRP Token: Fuel and Bridge of the Ecosystem

As the native digital asset, XRP plays multiple roles within the ecosystem:

- Bridge currency enabling efficient exchange between less liquid currency pairs

- On demand liquidity allowing institutions to avoid holding large foreign currency reserves by using XRP for instant settlement

- Network protection through the burning of a small amount of XRP as transaction fees

Based on these components, Ripple enables an on demand liquidity process that facilitates global value transfer. A typical cross border payment using Ripple follows these steps:

- Initiation: An institution in country A sends local currency A through RippleNet

- Instant bridging: The system converts currency A into XRP, eliminating the need for pre-funded capital

- On chain transfer: XRP is transferred across the XRP Ledger to the destination gateway within seconds

- Final conversion: XRP is immediately converted into local currency B

- Settlement: Funds are delivered to the receiving institution in country B

Through the integration of XRPL, RippleNet, and XRP, Ripple has significantly reshaped global payments.

Ripple vs SWIFT: An Evolving Landscape

In the global financial environment of 2026, the competition between Ripple and SWIFT has entered a new phase.

While SWIFT still controls approximately 80% of global B2B payments, Ripple is increasingly demonstrating advantages in speed, cost efficiency, and penetration into emerging markets. Morgan Stanley previously noted that Ripple is considered a leading international payment alternative to SWIFT.

Below is a comparison of Ripple and SWIFT across settlement speed, average cost, transaction transparency, and technical architecture:

| Comparison Dimension | Ripple (XRP Ledger) | SWIFT (Traditional Network / gpi) |

|---|---|---|

| Settlement Time | 3–5 seconds (Near-instant finality) | ~24 hours (gpi); Traditional can take 2–5 days |

| Average Cost | ~$0.0002 per transaction (Fixed, minimal) | $10–$50 (Depends on intermediaries & FX spreads) |

| Transaction Transparency | End-to-end on-chain tracking; immediate confirmation | gpi supports tracking, but settlement is not real-time |

| Liquidity Requirement | On-Demand Liquidity (ODL); no pre-funding needed | Requires pre-funded Nostro/Vostro accounts globally |

| Error / Failure Rate | Below 0.001% (Automated verification) | ~2%–3% (Due to manual processing or compliance stops) |

| Technical Architecture | Decentralized Ledger (Blockchain / DLT) | Centralized Messaging + Correspondent Banking |

It is worth noting that in regions such as Southeast Asia, Latin America, and Africa, traditional SWIFT routes are complex and costly. Ripple has collaborated with local regulators and central banks, including CBDC pilot programs launched in 2026, to provide near zero cost clearing channels, making it a preferred option for cross border remittances in these regions.

XRP Token Economics and Utility

XRP’s token model differs significantly from Bitcoin’s halving mechanism and Ethereum’s proof of stake model. Its core logic is based on fixed supply, controlled release, and transaction based burning.

The maximum supply of XRP is 100 billion tokens. The initial allocation consisted of 20% to the founding team and 80% to Ripple Labs, intended to support technical development, infrastructure, and XRPL operations. This structure has also raised concerns within the community regarding decentralization and market control.

To address concerns about large scale sell offs, Ripple locked 55 billion XRP into escrow in 2017, releasing 1 billion XRP monthly. Historically, 60% to 80% of released tokens are returned to escrow.

Originally used primarily as a bridge currency, XRP’s utility has expanded to include:

- Transaction fees for all XRPL operations

- Account reserves require 20 XRP to create an account

- DeFi base asset for lending and trading on XRPL

- Stablecoin settlement supporting RLUSD

In December 2024, Ripple introduced the compliant stablecoin RLUSD, forming a dual engine model with XRP:

- RLUSD provides price stability for daily settlement and risk management

- XRP provides liquidity as transaction fees and a universal exchange medium

- Synergy exists as all RLUSD transfers, swaps, and staking activities on XRPL consume XRP, increasing demand and burn rates

Ripple’s Core Leadership Team

Ripple’s success is supported by a leadership team combining Silicon Valley innovation and Wall Street experience:

Brad Garlinghouse (CEO) is a former Yahoo executive known for the “Peanut Butter Manifesto” and led Ripple’s regulatory strategy and institutional expansion.

Chris Larsen (Executive Chairman) is a blockchain pioneer and founder of E LOAN and Prosper, shaping Ripple’s emphasis on trust and technology.

David Schwartz (CTO) is a core architect of the XRP Ledger, responsible for decentralization, smart contract hooks, and real world asset integration.

Monica Long (President) led Ripple’s strategic expansion into stablecoins and custody services during 2025 and 2026.

Funding History and Institutional Backing

Ripple’s funding history reflects traditional finance entering blockchain infrastructure.

Early investment came from blockchain focused capital. In 2016, Ripple received funding from SBI Investment, strengthening its presence in Japan and Southeast Asia.

By late 2025, Ripple secured strategic investment from major Wall Street market makers including Citadel Securities and Fortress Investment, accelerating XRP liquidity development.

Institutions invested in Ripple primarily due to regulatory clarity, acquisition strategy, and XRPL’s role in real world asset tokenization.

How to Buy and Trade XRP?

As the fourth largest cryptocurrency by market capitalization, XRP is listed on major centralized and decentralized exchanges.

Taking Gate as an example, as of February 13, 2026, XRP was priced at $1.368 with a 24 hour trading volume of $56 million.

To buy or trade XRP on Gate, users can follow these steps:

- Open Gate and log into your account or complete registration and security setup

- Search for XRP on the trading page and enter the project page

- Review Ripple’s project information, official disclosures, announcements, and risk notices

- View market data including price trends, volume, and historical performance

- Gate supports XRP spot trading, perpetual contracts, and ETF products

Compliance and Risk Considerations

After 5 years of legal proceedings, Ripple reached a decisive regulatory turning point in 2026.

On August 7, 2025, the SEC lawsuit concluded with Ripple paying a civil penalty of $125 million. The court ruled that XRP itself and secondary market trading do not constitute securities, and under res judicata principles, the SEC cannot refile the case.

On January 27, 2026, the Ninth Circuit Court dismissed investor class action lawsuits against Ripple, citing expired statutes of limitation, removing long standing legal uncertainty.

Despite regulatory clarity, Ripple still faces challenges. Deep integration with traditional banking systems requires time and technical adaptation. Competition from CBDCs and alternative networks such as Stellar remains significant. As a bridge asset, XRP also requires continued market depth to minimize price slippage during large settlements.

Conclusion

Since its inception, Ripple has demonstrated resilience through legal challenges and continuous technological and compliance focused iteration. It has built a bridge between traditional finance and decentralized systems.

For developers, XRPL opens new opportunities for DeFi. For institutions, RLUSD provides a compliant settlement option. For investors, XRP has evolved from a speculative token into an asset supporting global cross border clearing. As global payments continue to digitize, Ripple’s position in this trillion dollar market is likely to remain significant.

FAQs

Is XRP a security?

No. US courts have ruled that XRP itself is not a security and the SEC case has formally ended.

What is the relationship between Ripple and XRP?

Ripple is the company that develops and maintains XRPL and RippleNet. XRP is the native token of XRPL. Ripple holds a large amount of XRP but does not fully control it.

What is RLUSD?

RLUSD is a US dollar stablecoin issued by Ripple and fully backed one to one by US dollar assets for compliant stablecoin payments.

How can Ripple’s future prospects be evaluated?

Key indicators include bank partnerships, cross border transaction volume growth, and regulatory developments.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

What Are Altcoins?

What is Blum? All You Need to Know About BLUM in 2025

What Is Dogecoin?